Bitcoin/USDTBINANCE:BTCUSDT

In previous bitcoin analyzes, the range (34-31) was explained

I had given that the maximum level of trading between these two ranges is very high

And now the failure of the 34,000 area is causing a lot of growth

It will be good for bitcoin and my suggestion for heavy buying

The first step is failure and then getting confirmation and failure

The resistance of the profession ends the downward trend

Strongresistance

UDR approaching all-time-highs with tonnes of buying pressureUDR is extremely close to breaking its all-time-highs from February 2020. Not only that but it's been on an absolute tear for the past 7 months. That's 7 consecutive months it has been closing green.

Taking a look at the volume coming in, it seems like it will break in the coming week.

Not only is this setting up for a great trade, it's also a great long term hold. This REIT has proven to come out of a crash only to do even better than before.

Final thoughts:

* Strong up-trend with tonnes of volume

* Approaching February 2020 all-time-highs

* Great long term hold as REITs pay out generous dividends

Trade Idea

* This is a long term resistance so do wait for a confirmation of the breakout on the weekly time frame. A break and hold above $51.25 would be the signal.

* A rejection from here could send UDR back to around $48.90. Which, given how well it's doing, would be a great entry point

GBPNZD: Will you short it ?On GBPNZD, H1 timeframe, price is forming a trendline as it's hovering around a strong resistance level. The price had 2 rejections forming a non-typical double top as the two red dots aren't 100% parallel. Meanwhile, until the trendline is broken, this one is still bullish.

40K is the Important Zone for BTCUSDBTCUSD has an strong resistance in 39~41K USD, so after touching this resistance, should take action on it and return down.

So after touching support of 35K can rise a bit to the strong resistance, here is the important zone for taking BTC to going up or down.

Here is tow scenario that can show the future of the chart.

GBP/JPY GOOD SHORT POSITIONGBP JPY facing a strong supply zone which is respected and rejected multiple times

as per technical aspect gbp jpy will go down to retest the Fibonacci areas which are mentioned down below

look for bearish confirmation on lower time frames and enter short with your own money management

always remember that with discipline patience always pays

patience is the key

Warning to those using my trading ideas - Serious level!Dear friends, at this level you need to be extremely careful, because it is from these values that the price was lowered - and there are big sales at the top - be careful !

Moreover - I understand that growth without price rollback. Be attentive beyond these levels.

I have nothing to worry about, we are reaching goal by goal, the third take-profit has already been achieved.

But I think that we will go to close the stop losses of the average market players, where they are at the level of 33700-34300.

Perhaps I am mistaken, but it is from such values that I will try to look for a good short entry point for myself, if there is a definite confirmation for me. After all, every growth needs correction - and possibly, possibly - we will have such a large flat (I do not exclude this from my "F" PLAN

FLATTENING TO BOTTOMS - SELLERS STILL THERE - NOKIA -DAILYWe have noticed that the market price is flattening. From a long super drop, it has been evolving in a horizontal range which is still going a bit down.

The bottom black lines are showing probable bottom and potential extended bottom.

Whenever the market price finds regularity in the long direction, sellers come to push it back down.

To resume the recovery is very hard and the fall easy to engage. Very pessimistic.

The top blue line is showing a zone where sellers are stronger. Their action zone. Breaking that point would possibly announce a big movement upwards.

Positive side: The market trend is less elastic in the decrease direction and have been trying to run horizontally rather than downwards.

Investors sentiment is probably what the price reveals. Waiting maybe for a decision in the board or expecting a technological move to revive Nokia Corporation's price up.

Alert: Bitcoin is don't make this bullish movement yet!!!Hello, in this analysis so quickly. Bitcoin has difficult to find up to broke up the $10,700 USD resistance, and then, Bitcoin doesn't prepare and we are in the possible strong resistance formed betwen the $10,700 USD and $10,800 USD. The key is in H4 timeframe. The bulls don't have force to continue up and this could be a possible drop and manipulation of the price!!! Beware to put any long position, because Bitcoin could be manipulated by bears!!!

Now, technicaly in H4 timeframe we see that Bitcoin could be to experiment a reversal of the price, so we need to be cautelous of htis chartist pattern called a bearish flag hide, because this chartist pattern it's happen when the price doesn't have force and then, make a stopped of the trend becase the price doesn't have the force to continue up. I mark in the blue zone that Bitcoin show a possible reversal, becuase it's could be to turn in short position to find down. Because we found out a 2 doji indecision of hte market and the price it's could be manipulated, and we see a series of candlestick of indecision, also the previously past candlestick was formed a bearish signal of this kind of doji libelula, that turn that bought dont't have demand yet.

So, I closed up the long position in Litecoin and Ethereum right now and I beleive that this crypto needs a updated!!!

EURNZD OUTLOOK FOR NEXT WEEKStrong horizontal and trendline support at 1.76120. We gotta be patient with this pair, and wait for the price to test the support area, and if it holds and shows signs of bullishness it's a great trade to enter.

If you have any questions, comment below. Will post an update next week.

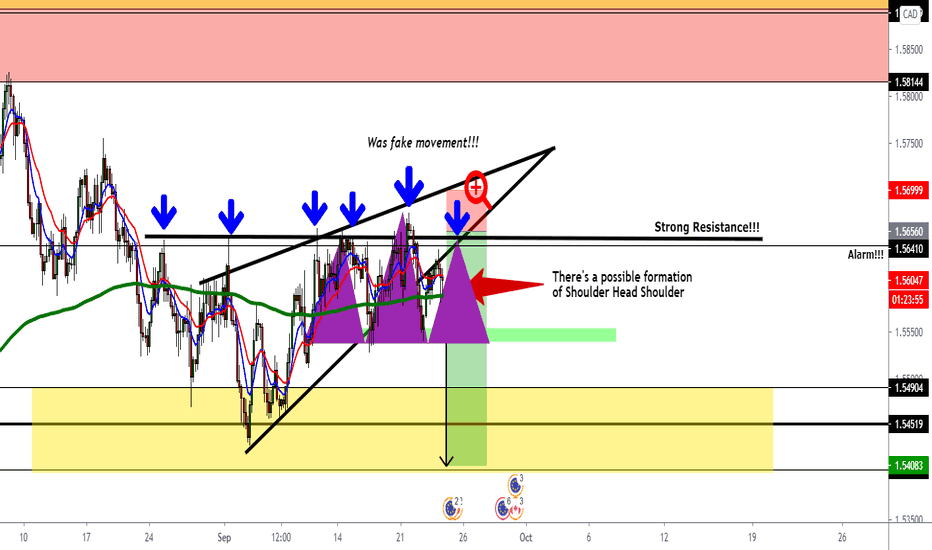

Euro/ Canadian Dollar is turn in bear singal!!!In H4 timeframe, we see a lot chartist in formation, but the most chartist in the bearish rising wedge. Also, we have formed a bullish channel or simetric triangle too both, Now, in Daily is the key:

3 days ago, EUR/CAD show a bearish, and yesterday the green candlestick grew by 50% of the big red candlestick, and then, we could see another short opportunity to find down 247 pips. Because we see a Shoulder Head Shoulder bearish pattern and we could see for the eyes this opportunity to take in notice it.

Now, in H4 timeframe we see a nice shoulde head shoulder. Also as theory, let's me explain these 6 blue arrow. These blue arrow are forming a strog resistance and we could see in H4 timeframe a drop!!!

So, I'm still alert on this par because for the next week, we see a possible nice opportunity in Forex!!!

If you like this, give me a like and share it with your friends or traders.

Not put any short or long position in this par until this par leave in this strong resistance at $1.5656 CAD, it's my psycological point to take my decision, my own decision is short becuase we see a strong resistance, I reccomend for you to put an alart approximately at $1.5638 CAD, and then, when the price leave at this price, I am still pending of possible short position at $1.5656, this is an alert to know it!!!.

XBTUSD | Strong Resistance Ahead Again | Decision TimeHello World again,

I have posted the XBTUSD weekly analysis, that what i am thinking for now about the market. if we look ALT coins for past 2 weeks so all ALT's are showing their strong upward movements except major ALT's and if we look XBTUSD so it is also continuously moving upward side few weeks without any strong correction yet. And now BTCUSD is trading below it's strong resistance of Oct-2019 ($10500) and third failed to break and currently trying to break but there are some others bearish points that i would like to share with you also.

Currently everyone considering BTCUSD as in Bull trend, I also but not confirm bull yet.

Why still thinking about BEAR

* Volume on Weekly TF decreasing

* Stoch RSI oversold and can be turn bearish

* Recently rejection from ($10473)

Why BULL

* Weekly MACD Bullish turned

* Monthly MACD Bullish

* Some Major ALT's starts to move up already Like: NEO, ADA, ETC etc.

I shared what i am currently thinking about the market. If you thinking something different so please tell me about your opinion in the comment.

Hit LIKE,

Thank You.

SILVER | Strong Resistance | Fibonacci Extension Targets Todays analysis – SILVER - Consolidating within a long term descending triangle as it nears apex.

Points to consider:

- Strong resistance

- 2.272 Fibonacci extension target

- RSI above 50

- Stochastics overextended

- Low volume

SILVER unable to break structural resistance with multiple failed re-tests, however, price is quickly bought up as it retraces from resistance indicative of buyers being present, setting a slightly bullish bias in the market.

A bullish break of this formation validates the next Fibonacci extension target of 2.272; also in confluence with structural resistance. Whereas a bearish break of this formation, price is likely to find local support at the 1 Fibonacci extension target.

RSI is currently testing 50, recovering from overbought conditions. A bullish break requires the RSI to range above 50, signifying strength in the market.

The stochastic RSI recovering from oversold conditions with ample space for an increase in momentum.

Volume is clearly declining and remaining below average. This is usually an indication of an influx being imminent, likely to coincide with the breakout.

Overall, in my opinion, a break and candle close above resistance validate next immediate target of 2.272 Fibonacci extension. The break needs to be backed with increasing volume to avoid any false breaks.

What are your thoughts? Let me know in the comments below!

And if you’ve read this far - thank you for following my work and development as a trader!

As always,

Focus on you, and the money will too!

EURJPY and SELL AREA After Target ReachedHappy we are, today our target just hit by Mr Price.

Mr Price is still in an UP TREND moving, and has consolidating in STRONG RESISTANCE AREA.

How about BUY NOW..? I do not recommend, bro..

I think Mr Price will have two scenarios.

Climbing up into our SELL AREA and then falling down. Like usual, I like to create a trap:

SELL LIMIT with SL at 121.260 and TP 115.300.

OR..falling down and break our pivot line.

Lets see..

Thank you.

New Yorkarto City

Negeri di atas awan.

EURUSD : APPROACHING 1.10 LEVEL FOR THE FOURTH TIME !According to Eurusd technical analysis: There is no change in my view towards the EUR/USD pair, as the general trend is still bearish and the recent attempt for a bullish correction has been unsuccessful as long as it did not hold above the 1.1000/ 1.11500 psychological resistance. Approaching the psychological support level of 1.0800 - 1.075 continues to support the bear's control.

Risk Warning : The risk of loss in trading Foreign Exchange (FOREX) can be substantial.

You should therefore carefully consider whether trading is suitable for you in the light of your financial condition.

Goodluck !

WAIT PULLBACK ON RESISTANCE - 6J1! JAPANESE YEN TRAPPED IN RANGEThank you for your likes! Really appreciated! Thank you to share with everyone in the community.

___________________________________________________________________________

The market is trapped in a range . Wait for a break of the support/resistance.

The resistance has been tested several times . this has increased the probability of seeing a pullback

happening again at that price level.

Solution:

- Wait for pullback on resistance or break of support before entry.

-If you are already in, take your profits when possible and wait strong signal to enter again.

THE RESISTANCE IS TOO STRONG! - TVIX - CREDIT SUISSE- 30MN- IDEAThe market has been rejected several times along the bearish resistance line.

It seems like buyers are not strong enough and the sellers look like accumulating profits by consolidating positions.

Beware of the resistance which could be tested again.

To lookup:

- Volumes confirming that we are in a long run down.

- Pullback on the resistance blue line .Nice entry point for a short position.

Timing next week:

-Open movements and midday to close movements

Have an amazing weekend!