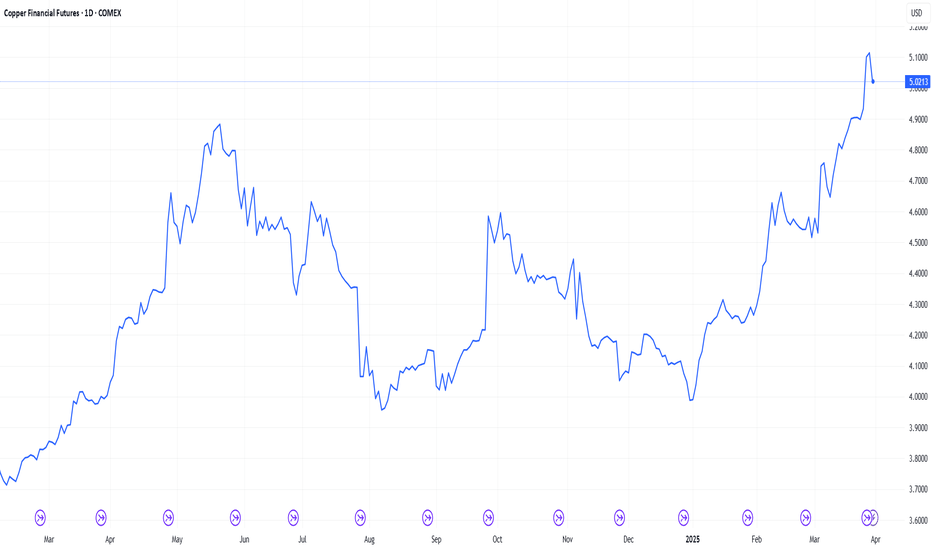

Copper is red hot right now. Here’s whyCopper’s COMEX price hit a new high on 26th March making the red metal red hot right now. The first three months of 2025 have seen industrial metals make noticeable gains with the Bloomberg Industrial Metals Subindex up 10.55% year to date1. Copper’s gains, however, stand out for numerous reasons.

Tariffs

The additional premium of COMEX prices over the London Metal Exchange (LME) prices reflects aggressive buying by US traders importing copper in anticipation of a possible 25% tariff on copper imports. This speculation has been fuelled by President Trump last month ordering a probe into the threat to national security from the imports of copper. As aluminium imports were also recently subjected to tariffs, markets are speculating that copper might be next.

This rush has triggered a shift in global flows, with metal moving out of LME warehouses and into US Comex facilities, where copper is held on a “duty paid” basis to avoid future levies. As traders front-run potential policy changes, this behaviour is tightening global supply and fuelling price gains, adding to a market already under pressure from rising demand and a looming supply squeeze.

Demand

China has given an additional boost to copper prices having announced a new action plan to boost domestic consumption by raising household incomes. The stimulus is seen as a positive signal for copper demand, especially as retail sales have already shown stronger-than-expected growth early in the year. China has also set itself a GDP growth target of 5% for 2025, and so far this year, its manufacturing Purchasing Managers' Index (PMI) has remained in expansionary territory — a sign that the economy is holding steady. With momentum building across consumption and manufacturing, copper is getting a fresh tailwind despite lingering weakness in the property sector.

Further support for industrial metals, including copper, has come from Germany’s recently unveiled €1 trillion infrastructure and defence spending plan — a move that will inevitably drive greater demand for base metals.

Supply

Supply tightness in the copper market is being driven by several structural and emerging challenges. Exceptionally low processing fees—caused by an oversupply of smelting capacity, particularly in China—have placed financial strain on global smelters, prompting companies like Glencore to halt operations at its facility in the Philippines. Looking ahead, Indonesia’s proposal to shift from a flat 5% copper mining royalty to a progressive rate of 10–17% risks discouraging future production growth. These supply-side pressures come as the International Copper Study Group reported a slight global copper deficit in January 2025. While a similar shortfall at the start of 2024 eventually turned into a surplus, this time the combination of weakening smelting economics, policy headwinds, and solid demand could make the current deficit more persistent and impactful.

Several major copper miners have recently downgraded their production estimates for 2025, adding further pressure to an already tight market. Glencore suspended output at its Altonorte smelter in Chile2, while Freeport-McMoRan delayed refined copper sales from its Manyar smelter in Indonesia due to a fire3. Anglo American expects lower output from its Chilean operations amid maintenance and water challenges, and First Quantum Minerals faces reduced grades and scheduled downtime4. These disruptions are likely to tighten global copper concentrate supply, potentially widening the market’s supply-demand imbalance just as demand continues to strengthen.

Sources:

1 Source: Bloomberg, based on total return index as of 28 March 2025.

2 Reuters, March 26, 2025

3 Reuters, October 16, 2024

4 Metal.com. February 14, 2025

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Structural

Will GBP/JPY Attempt to Push Higher?Due to it's failed attempts to break each Lower High and the Highest High, I believe it's time for GBP/JPY to sell further. Looking at it on the daily timeframe, I've identified areas of strong support that needs to be broken, preferably with a momentum candlestick and a close below from H4 to Daily. Target prices identified, coincide with the various structural supports as well as Fib Trend Extension levels with the final target being a possibility for price to "spike" into, reversing for a possible retracement.

View video for a full explanation and identified TPs.

Please "like" and feel free to comment with your own ideas or agreement!

Bearish Divergence| S/R Flip Retest| Long Structural Support Evening Traders,

Today’s Analysis – NZDJPY – breaking a key level where an S/R flip will confirm structural support.

Points to consider,

- Impulse bull move (breaking key level)

- Bearish Divergence evident (allowing for a retest)

- Structural Resistance (immediate target)

- RSI putting in lower highs

- Stochastics sell cross

NZDJPY broke resistance with an impulse move, currently trading at its range median with a valid bearish divergence.

A retest of structural support well let the bearish divergence play out – will also confirm the S/R flip retest.

The RSI is putting in lower highs whilst the stochastics is projecting a sell cross – putting more emphasis on the bearish divergence.

Overall, in my opinion, NZDJPY is likely to confirm support with a retest. A long trade will be valid with defined risk below structure.

What are your thoughts?

Please leave a like and comment,

And remember,

“In order to succeed, you first have to be willing to experience failure.”

― Yvan Byeajee

NZDUSD The coming weeksAs its a new Week I have been reviewing the weekly chart to get a better idea of the overall move.

On the lower time frames my Initial thoughts were short but looking here I think we could see a rise.

Short term I do think we may see a retest of 0.70000 area the fib retracement on the most recent Daily impulse leg up gives us a 618 at one of my weekly key levels of 0.68745, this is the area id be looking for Bullish signs to buy, we could see a move before this but this would give the best RR.

Longer term we have got a Bullish Flag pattern forming on the Weekly chart. Using the Fib inversion on the recent pull back it gives us the 1.618 up at previous structure, the fib extension also gives us a 1.27 at this area, one last bit of confluence is the fib retracement on the big impulse leg down gives us a 618 at this same level.

would use the lower time frames for entry and would be watching the 0.73000 level for possible resistance.

USDCAD Ideas on the lower time framesSo on the Daily I have a bearish outlook and have a few patterns Im watching,

We have seen a break below the daily trend line, how low will we continue?

Here are a couple of ideas a gartley and a Bat, presonally the bat for me offers a better rr but will watch and see

USDCAD 2618 tradeAfter the 2 targets hit on the bullish bat this has now brought us to the 618 area of retracement following the recent double top impulse leg down and retracement for a 2618 trade.

as for tragets seeing as the 1.29993 level is the most recetn bit of strucutre/reversal point will see if we continue down to this area first

gbp/usd: 2 ways we can attack the marketAfter the brexit, the GBPUSD has been consolidating, trading sideways, that is a great scenario to trade between the structures, in this case in particular we have a 115 pips wide range where we can either buy at @1.2968 or sell at @1.3084.

Depends on which gets filled first

The best opportunity for us is the short one, because it has a significantly major level of structure

EURAUD: Looking for a Bearish RunIf we end up getting a LLLC here on the EURAUD, my prediction for the next place that we'd see some buying pressure at is down at the 1.5050's-1.4950's level.

As a buyer, that's where I would look next if I'm interested in trying to catch a pullback. If I'm a seller, then I'm looking for a retest of previous structure & a chance to hop on the downward move in anticipation of the level mentioned above.

Akil Stokes

Chief Currency Analyst & Head Trading Coach

www.TradeEmpowered.com -The Premier Online Trading Education Company

YouTube goo.gl

Facebook: goo.gl

Twitter: goo.gl

@AkilStokesRTM (Instagram, Periscope, Snap Chat & StockTwits)

EURJPY Weekly Double bottom PossibleI have been watching the 4hr and Daily Time frames and felt that we had reached the bottom, the pair has pushed a bit further lower as we can see with the wick on this weeks candle

If the cande doesn't close outside of this box I feel we could see a reversal in the coming weeks

EURGBP 4hr Double Top So was a little bit early on my entry as we moved almost 55 pips higher!

But what we have seen is the pair come back up into recent highs and form a Double top. This are is well into the oversold area of the RSI

How there are 2 possible outcomes we could come back down to the 0.77743 level and bounce

or

If we break structure there is a possible 2618 set up, which given the previous lower support I see this as an area to watch