Structure-trade

XLMUSDT Moon mission 🦐 🌘XLMUSDT After broke weekly structure , XLM seems very bullish

According to Plancton's strategy, we can set a nice order

–––––

Follow the Shrimp 🦐

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

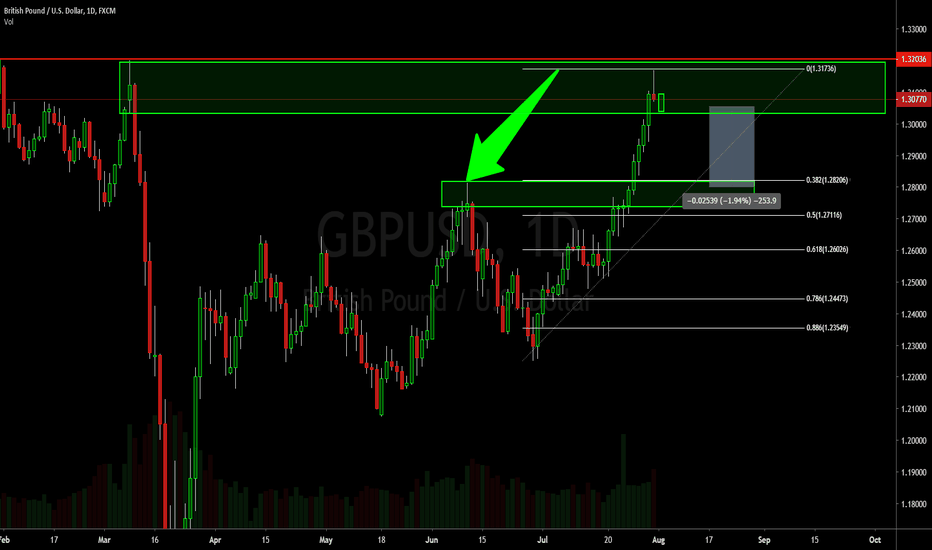

GBPUSD - DAILY - STRUCTURE TRADE IDEAThe GBPUSD has finally rallied to the previous level of structure resistance that we had on our radar. Now although we had a nice candle to close the week, we must remember that not only is it the close of a week but also the close of the month.

A good sign of confirmation for a little relief lower would be a lower low, lower close candle.

- Akil

US500 3223.4 + 0.53% LONG IDEA * CONTINUATION & FUNDAMENTALS Good Day Everyone

A look at US500 starting from the monthly perspective we remain in a bullish rally for third month in a row hitting ( HH ).

Coming down to the weekly we broke level 3191.3 support level we could see a retest of this level before we see a continuation to the upside this week but on a larger scale we are still net long on the index.

On the daily we broke out of a descending channel rallied up and we are now at level 3236.1 which saw a couple of rejections.

S&P500 is still range bound within structure for now bound in a symetrical triangle on the 4H chart waiting for a breakout of structure to confirm and determine direction amongst other things as we are still net long on higher timeframes the sentiment is still net long.

lets see how it goes.

Good luck and happy trading everyone

_________________________________________________________________________________________________________________________

ENTRY & SL - FOLLOW YOUR RULES ON PENDING ODER & SO FORTH

RISK-MANAGEMENT

PERIOD - SWING TRADE

__________________________________________________________________________________________________________________________

If you like the idea kindly leave a like and a follow will definitely follow back and leave your idea & Comment on the pair in the comment section.

US30 26633 - 0.21% SHORT IDEA * STRUCTURE BOUND PATTNSGood Day Everyone

A look at the US30 INDEX currently trading inside a symmetrical triangle range bound in a ascending triangle and we currently have a bullish flag on the index looking to see a push up as we are overbought on most indicators respect the symmetrical structure and see continuation to the down side with the bears...

Good luck and happy trading everyone

_________________________________________________________________________________________________________________________

ENTRY & SL - FOLLOW YOUR RULES ON PENDING ODER & SO FORTH

RISK-MANAGEMENT

PERIOD - SWING TRADE

__________________________________________________________________________________________________________________________

If you like the idea kindly leave a like and a follow will definitely follow back and leave your idea & Comment on the pair in the comment section.

NZDUSD 0.66141 + 0.57 % LONG IDEA * BREAKOUT PATTERNS Good Day Everyone

A look at the NZDUSD pair which is currently trading in a descending channel looking for a push up to retest the structures roof since the pair just broke out of a pennant formation. broke above looking maybe for a retest of this structure then continuation to the upside. any reversal pattens and significant moves to the downside will change the whole trading plan lets see how it goes...

Good luck and happy trading everyone

_________________________________________________________________________________________________________________________

ENTRY & SL - FOLLOW YOUR RULES ON PENDING ODER & SO FORTH

RISK-MANAGEMENT

PERIOD - DAY TRADE

__________________________________________________________________________________________________________________________

If you like the idea kindly leave a like and a follow will definitely follow back and leave your idea & Comment on the pair in the comment section.

WABIBTC had a great weekly retracement 🦐WABI bounced on 0.618 Fibonacci's level on weekly timeframe.

Now we are waiting to break a 4h structure and According to Plancton's strategy, we can set a nice order

–––––

Follow the Shrimp 🦐

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

a higher chance of long position fkli julyas you can see, the purple line indicates an uptrend going on...

current support : 1540

1st tp 1560

2nd tp 1580-84

SL : somewhere around 5-10pts below the support level of 1540...depends on ur account size...

**this is juz a trading idea, dun trade it if it is not part of your plan...trade at your own risk

if you like this content, pliz like and share...leave a comment is fine too...

trading a possible formation of "head-and-shoulder" patternthis is a fcpo trading

we can actually use the structure formation to involve in our trading...for this example, we can use the formation of the right shoulder as a structure level to short the market...the neckline is possible to be formed at 2300, the psychological and strong support level...a breakout of this level will mark a turn to the downside...

resistance : 2367-2400

support level : 2300

this is juz a trading idea, trade at your own risk...

pliz like and share...

ELFBTC seems bullishELFBTC seems bullish, the price it attempting to break weekly structure

According to Plancton's strategy, we can set a nice order

–––––

Follow the Shrimp 🦐

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

EURJPY waiting for a confirmation 🦐 EURJPY waiting for a confirmation, the price should break a 4h structure According to Plancton's strategy, we can set a nice order

–––––

Follow the Shrimp 🦐

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

USDJPY rejected from dynamic trendline 🦐USDJPY rejected from dynamic trendline, and now the price is on 4h structure.

IF the price breaks that structure we can wait a retest, according to Plancton's strategy, we can set a nice order

–––––

Follow the Shrimp 🦐

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

DREPBTC looking for a breakout in daily structure 🦐DREPBTC looking for a breakout in daily structure 🦐

According to Plancton's strategy, we can set a nice order

–––––

Follow the Shrimp 🦐

Here is the Plancton0618 technical analysis, please comment below if you have any question.

The ENTRY in the market will be taken only if the condition of Plancton0618 strategy will trigger.

XAUUSD 1769.13 -0.08 % LONG IDEAGood Day Everyone

Here's a long idea on the GOLD provided the metal holds the ascending channel we are currently trading in.

some fundamentals from DAILY FX - link attached

GOLD PRICES LONG-TERM: STILL OVERBOUGHT

Taking a step back to get some context and Gold prices remain in an overbought state on the monthly chart, largely owed the prolonged up-trend that’s helped to propel prices into this area on the chart. As discussed previously, the 1742.50 level was big, as this is the 14.4% Fibonacci retracement of the post-Financial Collapse move and, for two months, helped to set resistance in Gold. The notable exception during that two-month-range was the high set in mid-May, when Gold prices quickly broke out after the weekly open.

But, as looked previously, that bullish drive was largely emanating from an interview that FOMC Chair Jerome Powell had on the US television program 60 Minutes, in which he said that there was ‘no limit’ to what the Fed could do with the liquidity programs available to them. This breakout-fake out scenario is shown in Green on the below chart, as price action merely reverted right back into the range.

GOLD EIGHT-HOUR PRICE CHART

www.dailyfx.com

___________________________________________________________________________________________________________________________

ENTRY & SL KINDLY FOLLOW YOUR RULES

RISK-MANAGEMENT

PERIOD - DAY TRADE

TARGETS - MARKED

___________________________________________________________________________________________________________________________

If you like the idea kindly leave a like and a follow will definitely follow back and leave your idea & Comment on the pair in the comment section. APPRECIATE IT

US500 2988.4 - 0.33% LONG IDEAGOOD DAY EVERYONE

HERE'S A LONG IDEA ON THE US500 INDEX, THE S&P 500 HAS RECOVERED A GREAT DEAL TO COVER LOST GROUND IN THE LAST COUPLE OF WEEKS..

> THE MARKET IS TRADING AT + 2 MONTH HIGH OR SO THE INDEX HAS BEEN STRUGGLING TO HIT THAT 3000 MARK BUT GAINING TRACTION NONETHELESS...

> WE'VE SEEN THE FORMATION OF AN ASCENDING CHANNEL ON THE INDEX HOPING THE STRUCTURE HOLDS LOOKING FOR LONG OPPORTUNITIES IN THE INDEX

TARGET - 3100

RISK MANAGEMENT

PERIOD - DAY TRADE