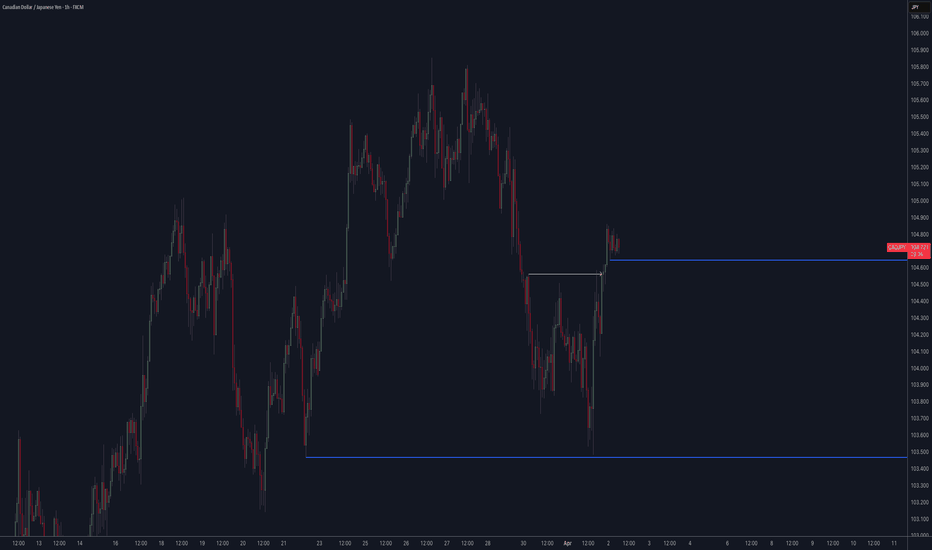

Structureanalysis

+20% During The Holidays - Who Said December Was Slow? In this video I break down multiple positions on FX:CADCHF through just the first week of December 2024. I hope this acts as a reminder to never switch off, you cannot afford to. Entering the holiday season early and dropping your guard can cost you a lot of money and potential scale-ups on capital.