Structuretrading

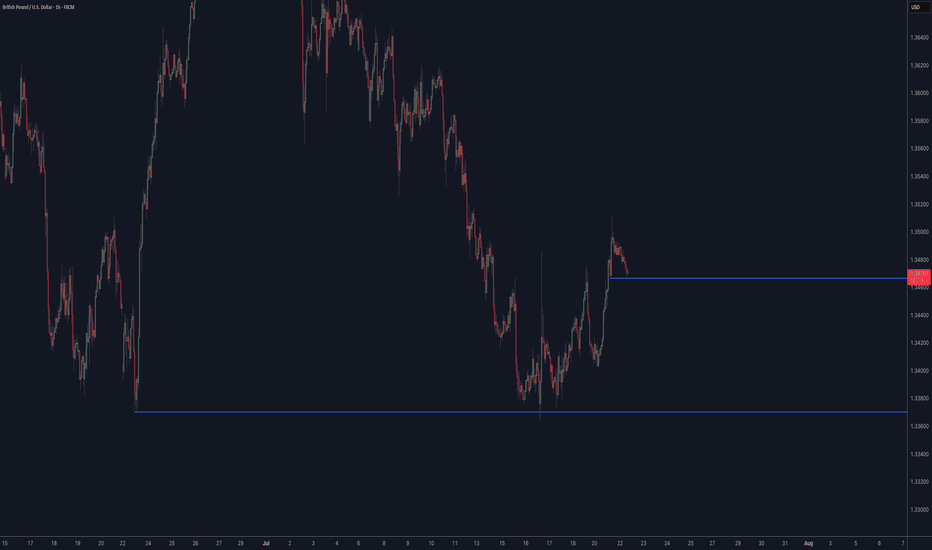

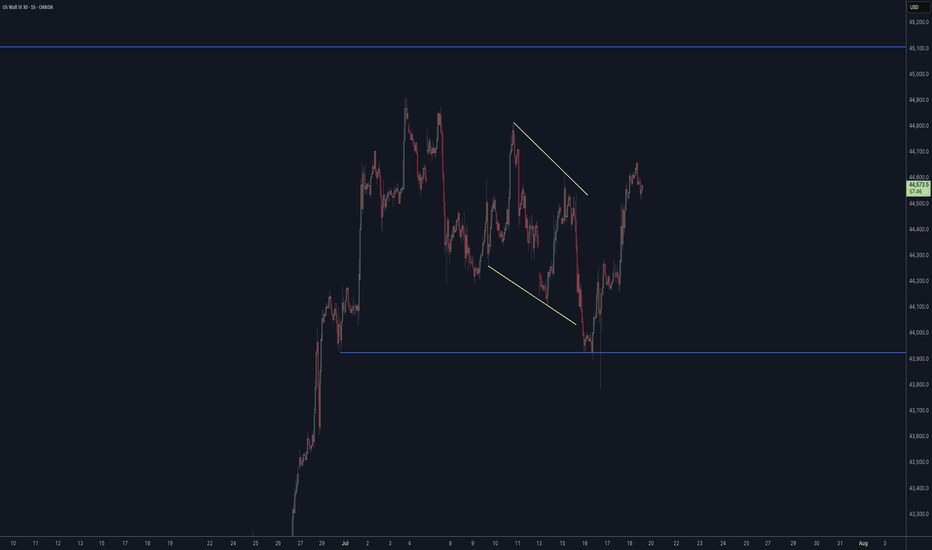

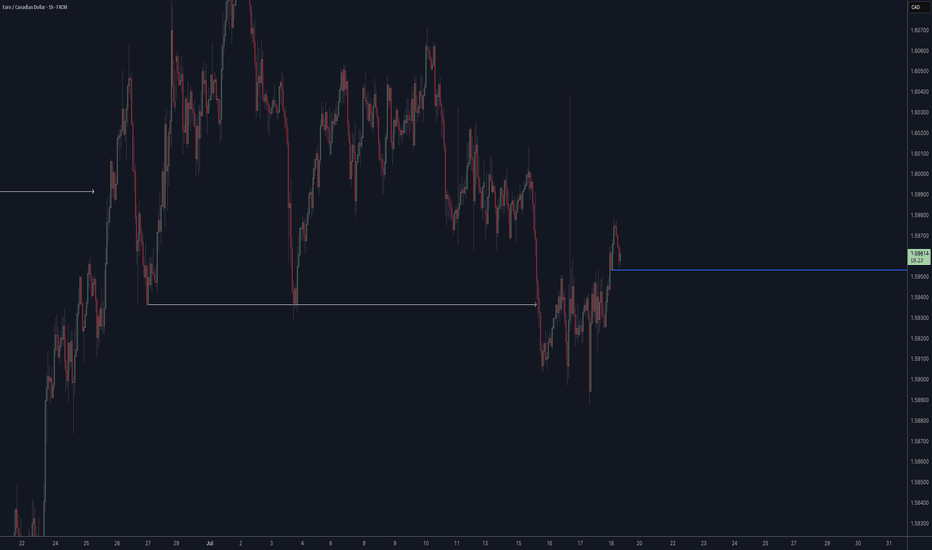

EURUSD & US30 Trade Recaps 18.07.25A long position taken on FX:EURUSD for a breakeven, slightly higher in risk due to the reasons explained in the breakdown. Followed by a long on OANDA:US30USD that resulted in a loss due to the volatility spike that came in from Trump.

Full explanation as to why I executed on these positions and the management plan with both.

Any questions you have just drop them below 👇

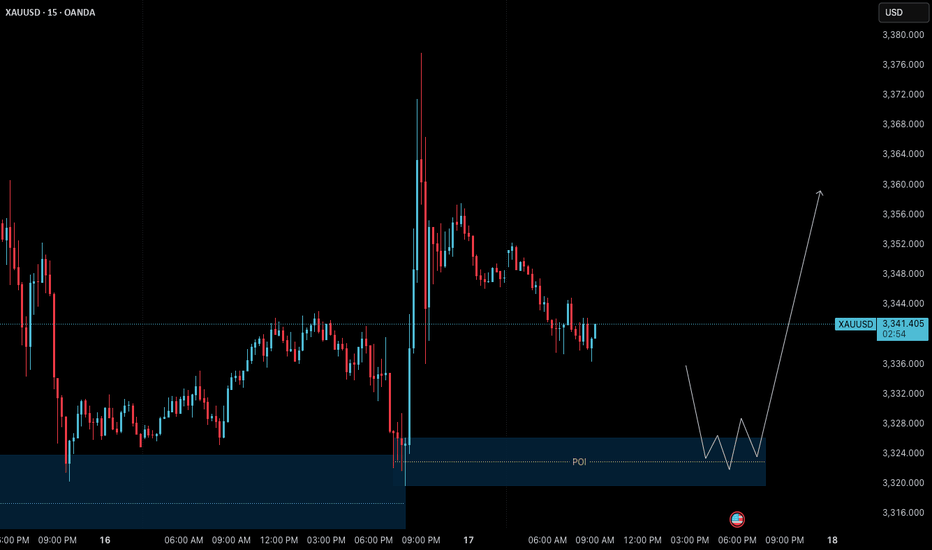

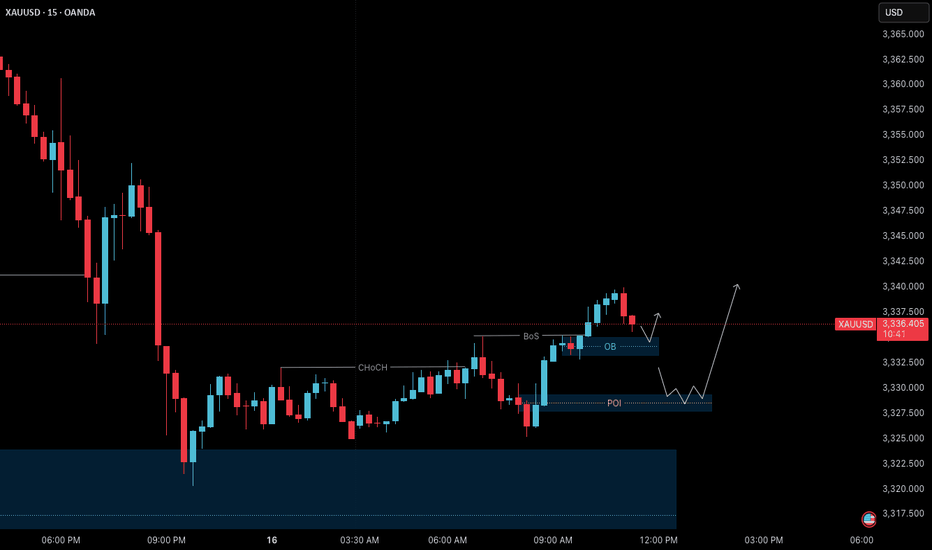

Gold (XAUUSD) – 17 July Analysis | Demand Zone in Play🟢 Gold (XAUUSD) – 17 July Analysis | Demand Zone in Play

Gold continues to follow the bullish structure we’ve been tracking in our recent posts. Yesterday's news-driven price action pushed the market to a new swing high near 3377.600 , confirming strength in higher timeframes. Now, price is currently in a retracement/pullback phase , pulling back toward a key intraday demand zone at 3326–3320 — offering potential opportunity for the next leg upward.

🔍 Where Are We Now?

The market is currently pulling back toward a key M15 demand zone: 3326–3320 . This level also aligns with a higher timeframe order block on the H4, making it a critical confluence area for structure-based traders.

This 3326–3320 zone is crucial because:

→ It’s a fresh M15 demand zone inside a higher timeframe bullish structure

→ It aligns with the H4 OB that previously acted as a launchpad

→ The overall trend remains bullish unless this zone is decisively broken

If the zone holds and we get LTF confirmation (such as M1 internal structure shift + micro-BoS), it may present a high-probability long setup.

⚙️ Structure Summary:

✅ H4: Bullish continuation structure with recent higher high

✅ M15: Pullback within bullish order flow

✅ M1 (for entry): Awaiting ChoCH + BoS as entry trigger inside POI

📌 Trade Setup Plan (upon confirmation):

→ Entry: From 3326–3320 demand zone

→ Stop Loss: 40 pips below entry

→ Take Profit: 120 pips (targeting new HH based on H4 projection)

→ Risk-to-Reward Ratio: 1:3

🧠 Key Trading Insight:

We never predict — we prepare .

We don’t chase price — we position with confirmation .

Discipline means waiting for price to invite us in , not entering just because a level looks attractive.

📈 Summary & Expectations:

➡️ Price is retracing into a structurally significant demand zone

➡️ Market bias remains bullish unless this zone fails

➡️ If the zone holds with valid M1 confirmation, we’ll consider a long setup targeting a new high

➡️ No confirmation = no trade. Patience > prediction.

📘 Shared by @ChartIsMirror

This analysis is part of our ongoing structure-based approach to trading Gold. All entries are derived from pure price action, multi-timeframe structure alignment, and trader discipline — as taught in our book:

“The Chart Is the Mirror: Mastering Gold with Structure, Stillness, and Price Action”

Gold – Bullish Structure Confirmed | July 16 Outlook🟢 Gold (XAUUSD) – July 16 Analysis | Uptrend Resumed After H4 OB Test

As outlined in our previous post — Gold – H4 Structure at Key Decision Point | July 14 Outlook , price has now tested the H4 order block near 3320, which we marked as a high-probability reversal zone.

Following this, the market has shown clear signs of strength — with both internal structure shift and a Break of Structure (BoS) on M15, confirming that the uptrend has resumed.

🔍 Structure Alignment:

✅ H4: Bullish continuation after OB test

✅ M15: ChoCH + BoS → confirms trend alignment with H4

📌 Key Intraday Levels to Watch:

🟩 3335–3333 (M15 Order Block & Breaker Level):

→ A short-term OB just before our main POI

→ If price respects this zone with LTF confirmation (M1 Micro-ChoCH + BoS), we may plan an early long entry

🟩 3327.7–3329.4 (Main M15 POI Zone):

→ High-probability continuation zone

→ On retest + LTF confirmation → plan for long setup

📈 Trade Plan:

→ Watch 3335–3333 OB first

→ If respected with M1 confirmation, early entry is valid

→ If that zone fails, wait for price to revisit 3327–3329 POI

→ Same confirmation rules apply

In both cases, target new HH, in line with current trend momentum

📖 When price respects structure and confirms behavior, don’t second-guess — follow the process.

📘 Shared by @ChartIsMirror

Gold – M15 Downtrend in Play | July 15 Analysis🔻 Gold (XAUUSD) – July 15 Analysis | Bearish Bias Until Proven Otherwise

The market has entered a pullback phase on H4, and we’re expecting a potential retest of the 3320 Order Block before any continuation of the broader uptrend resumes.

🔍 M15 Market Structure:

✅ ChoCH followed by BoS confirms a downtrend on M15

🎯 Current short-term objective: Retest of H4 OB (3320)

📍 Price Action Context:

Price is now revisiting the same M15 POI where yesterday’s short setup originated.

Last session, this POI was respected, but instead of creating a new Lower Low, price is trading inside the same zone again.

This signals indecision — so we let price reveal its intent

🧭 Trade Planning Scenarios:

Scenario 1 – Bearish Continuation:

→ If the POI is respected again with clear M1 confirmation ( Micro-ChoCH + BoS ), we will plan for a short setup toward 3320

Scenario 2 – POI Breaks:

→ If price breaks above this POI zone, the next key level to observe is the 3355–3359 supply zone

→ We’ll reassess from there based on new confirmation

📌 Bias for Today:

🔻 Bearish bias remains intact as long as M15 structure does not shift back to bullish.

All setups must align with structure — we are short-biased only until the market proves otherwise

📖 Structure before emotion. Let the market invite you — not the other way around.

📘 Shared by @ChartIsMirror

Gold – H4 Structure at Key Decision Point | July 14 Outlook🟡 Gold (XAUUSD) – July 14 Outlook | Key Reaction Ahead at 3366

Gold closed Friday at 3355.665 , after facing resistance from the H4 swing high (3366) .

While price failed to break that level during the session, the last H4 candle closed as a bullish spinning top , signaling indecision — but with slight bullish pressure.

As we head into Monday’s open, the next move could be pivotal in determining the direction of the upcoming H4 trend leg.

🔮 Key Scenarios to Watch

1️⃣ Bullish Scenario (Preferred Bias):

If the market opens above 3366 , creating a clean Break of Structure (BoS) , it would confirm the continuation of the H4 uptrend.

→ In this case, we will watch for a retest of the 3320 Order Block (OB) — a potential long setup zone.

→ If price gives another BoS after the first, it may also present a continuation entry opportunity, depending on structure.

2️⃣ Rejection / Bearish Case:

If the market fails to break 3366 , we’ll step back and observe how M15 reacts.

→ Consolidation could follow before any significant BoS.

→ In this scenario, patience is key — we’ll wait for either confirmation of a deeper pullback or a structure shift on lower timeframes.

3️⃣ Consolidation Possibility:

There’s also a strong possibility that price consolidates between the H4 swing high (3366) and the 3320 OB before making a structural decision.

→ A tight range can trap both buyers and sellers — so it’s crucial not to act prematurely.

🧭 Trade Bias Summary

✅ If BoS (above 3366):

→ Bullish bias confirmed

→ Look for long on OB retest (e.g., 3320 zone) or next M15 structure break

⚠️ If No BoS:

→ Step back, observe M15

→ Wait for structure clarity before forming bias

🔁 If Range Forms (3366–3320):

→ Stay out until market resolves direction

→ Let breakout + retest guide the next setup

🧠 Final Thoughts

This analysis is shared for educational and structural observation purposes only — not as trade advice or recommendation.

The goal is to track price behavior around key zones and adapt based on how structure confirms or invalidates bias.

📖 Let the market reveal its intention — not with emotion, but through structure.

We don’t predict the breakout — we prepare for both outcomes.

📘 Shared by @ChartIsMirror

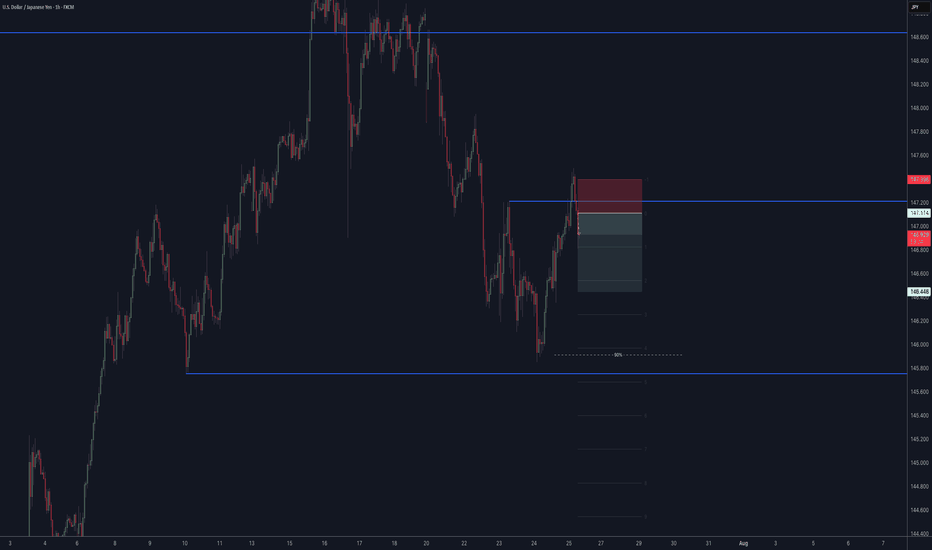

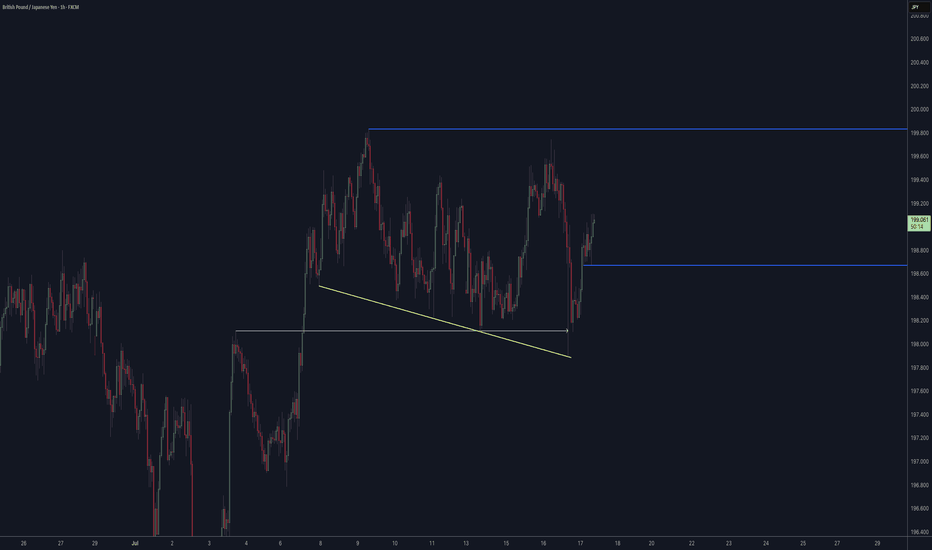

11.07.25 USDJPY Trade Recap + Re-Entry for +2.5%A long position taken on USDJPY for a breakeven, followed by a premature re-entry that I took a loss on. I also explain the true re-entry I should have taken for a 2.5% win.

Full explanation as to why I executed on these positions and also more details around the third position that I did not take.

Any questions you have just drop them below 👇

Gold – July 11 | H4 & M15 Aligned, Higher Highs in Sight🟡 Gold – Higher Highs in Sight | July 11 Analysis

As outlined in our July 10 analysis

( Gold – H4 OB Held, BoS Confirmed ),

price retested the 3313–3310.5 POI and continued upward in alignment with the broader bullish structure.

Gold is now trading around 3330–3335 , and both H4 and M15 remain in clear uptrends — forming a consistent sequence of higher highs and higher lows .

This post is intended purely for educational and structural observation —

not as trading advice or encouragement to enter trades.

Please use your own strategy, confirmation methods, and risk assessment before taking any action.

🔄 Structure Alignment

✅ H4: Bullish continuation

✅ M15: Trend aligned, forming HH–HL structure

🟢 Bias: Long-only setups (based on structure)

🔍 Key Supply & POI Zones

📌 3345–3346:

→ Strong supply zone

→ If price breaks above, we expect a new higher high

📍 If retracement occurs before breaking 3346:

→ Watch 3319.5–3321.5 (M15 POI)

→ Valid only if respected with M1 confirmation (ChoCh + BoS)

🎯 Trade Plan (Educational Observation)

🛑 No shorts — structure does not support counter-trading

🕒 Monitor: For price to revisit the 3319.5–3321.5 zone

✅ If respected + M1 confirms → structure favors long

🎯 Target: Move above 3346 , continuing the bullish sequence

🧠 Final Thoughts

Price structure remains in strong alignment — but the key is confirmation, not prediction.

Wait, observe, and only act within your own defined process.

📖 Trade the structure, not the emotion.

When the trend aligns, hesitation costs more than waiting.

📘 Shared by @ChartIsMirror

Gold – July 10 | H4 OB Held, BoS Confirmed, Watching 3310🟡 Gold (XAUUSD) – July 10 Analysis | H4 Pullback Over, M15 Aligned for Bullish Continuation

The H4 order block around 3280 (3288–3275) was tested, and the market responded strongly — just as anticipated .

Following that, M15 structure gave a clear ChoCh + BoS , signaling that the H4 pullback is now complete .

The market has likely resumed its bullish continuation trend.

🔁 Current Market Structure

✅ H4 Trend: Resumed upward after OB reaction

✅ M15 Trend: Now aligned with H4 (ChoCh + BoS confirmed)

Bias: Bullish

→ We are only looking for long setups , in sync with both timeframes

📍 Key Levels to Watch

1️⃣ 3322–3326 → M15 OB zone

→ Currently acting as rejection zone

→ Already reacted — price is pulling back

2️⃣ 3313–3310.5 → Next potential M15 POI

→ If respected with M1 confirmation (ChoCh + BoS), long setups become valid

🎯 Target: 3345

→ Based on structure projection and intraday range

📌 If 3313–3310.5 fails:

→ Watch next zone at 3296–3298 for fresh demand/support

🧭 Execution Plan

• Wait for price to enter 3313–3310.5 zone

• Look for M1 confirmation (ChoCh + BoS)

• If confirmed:

→ Enter long

→ Target = +120 pips (as per fixed RR model)

→ SL based on M1 structure

• If zone breaks:

→ Reassess near 3296–3298

🧠 Final Thoughts

The H4 pullback is over — structure confirms bullish continuation

M15 is aligned — we now prepare , not predict

Wait for the chart to call you in — not your bias.

📖 We don’t predict reversal — we confirm structure.

We don’t chase price — we prepare for it.

📘 Shared by @ChartIsMirror

Gold (XAUUSD) – July 9 | M15 Bearish Pullback After H4 OB Tap🟡 Gold (XAUUSD) – July 9 Analysis | H4 OB Tapped, M15 Still Bearish

The market has just tapped into the H4 order block near 3280 (3288–3275) — a level we’ve been tracking closely.

However, price action shows that the H4 pullback is still active and not yet complete.

Yesterday, Gold respected the H4 supply zone (3342–3345) exactly as anticipated.

Since then, price broke below the M15 low at 3296 , confirming that bearish momentum remains valid on the lower timeframe.

🔍 Structure Breakdown

• H4: Pullback ongoing

• H4 OB: 3288–3275 (just tapped)

• M15: Broke below 3296 → Bearish trend continuation confirmed

• Current M15 State: In pullback phase

⚠️ Key Consideration:

While we are looking at bearish opportunities, keep in mind that the H4 OB (3288–3275) is a significant demand zone.

If the market begins to reclaim structure and breaks the Lower High(H4 supply zone), this could signal resumption of the H4 uptrend .

Until that happens, we remain cautiously short — but prepared to adapt.

📌 What We’re Watching

Despite the H4 OB tap, M15 remains bearish until proven otherwise.

So the focus stays on short opportunities — no longs unless structure shifts.

📍 Key M15 POI for Rejection:

→ 3322–3326 (Order Block)

→ If price pulls into this zone and gives M1 confirmation (ChoCh + micro BoS)

→ We’ll plan short setups aligned with current trend

If this zone fails, or structure flips bullish, we’ll wait patiently for a potential revisit of the H4 supply zone (3342–3345) — which remains a valid short area for high-probability setups.

🧠 Summary:

✅ H4 OB (3288–3275) tapped

❌ No bullish reversal yet — M15 still bearish

🔍 Watching 3322–3326 for possible short

📉 Bias: Bearish until structure shifts

But be flexible — if LH breaks, the game changes.

📖 Respect the structure.

The chart doesn’t reverse because you want it to —

It reverses when the market is done moving the other way.

📘 Shared by @ChartIsMirror