S&P Up 6% Since Major Breakout!The S&P started off 2021 with a strong first week of trading and the current trend forming appears linear and strong.

We can identify a linear trend as price has just been using the 20 simple moving average as support since the

consolidation breakout when price moved above $3588 in November 2020.

We also have an indicator called the LTI which is our proprietary tool and only available to our Phoenix members

which helps to confirm linear trends and this tool confirms that the S&P is trending strong.

The move since price broke above $3588 has risen by 6% and we have positions in stocks which have moved up over

triple that percentage and more.

The markets are looking strong overall and we are taking advantage of the profits being handed out but we want

to be mindful that earnings season is coming up and the earnings figures could push price in any direction.

As a result, we need to remain ready to manage our positions if we see major levels of support and resistance

being taken out.

With the S&P trending, we want to see how price interacts with the $4000 psychological round number.

If that level is broken as well then we should see a continuation of the overall bull trend.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

Sublimetrading

Gold's Bond With The 200SMA!Since the beginning of 2020, Gold has been favouring the daily 200 simple moving average

as a comfortable level of support.

The first contact we can see was in March 2020 which was during the peak of the global

pandemic last year. Price created a low at $1451 before returning back above the 200sma.

Following the bounce off support, we saw price climb 42% over the next 5 months, smashing

its way above the $2000 psychological round number and reaching its current all-time high

of $2075.

Price has been moving sideways to down since reaching its current top and found support

at the 200sma again at the end of November and formed a low at $1764.

Gold started to find strength once again and climbed up to a high of $1959 on January 6th

and suffered a sharp fall which was cushioned by the 200sma once again.

The candle from January 12th is bullish and price is trying to climb up once again.

If we see a move to the upside, the 200sma may continue to come in as support and help

to push price higher.

We now want to see price take out the $2000 round number and then the all-time high at $2075.

Our position in Gold is still running and we are still waiting for an opportunity to add more positions

once price starts to create new record highs once again.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

Gold Bouncing Back!Gold is acting as expected following its bounce off the weely 50 simple moving average zonal support area.

During that period, price did drop below the daily 200 simple moving average and that move could have

influenced traders to panic and exit positions prematurely.

Looking at the higher timeframe, which in this case is the weekly chart, allows us to look at the market

more objectively. Once we become objective, we are in a position to make sound investment decisions

that should over time result in healthy consistent returns.

Price is looking strong so far this week and is now fast approaching the $2000 round number which may

act as strong resistance again.

If price is able to break this resistance zone, then it has the all-time high at $2075 to contest with.

The recent deep pullback is part and parcel of the behaviour of Gold and if price is to repeat itself

then we should see new record highs created in the coming weeks/months.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

First Trading Day Of 2021 Bearish!As we have now entered a new year we want to see if the momentum from 2020 will seep over and

continue to flood us with further profits for our portfolio.

During November, the S&P 500 started creating new record highs once again following its breakout

of consolidation. On the last trading day of 2020, price tagged the current all-time high but was not

able to close above that level at $3756.

When the markets opened for the first trading day of 2021, the candle opened above the all-time high

but we soon started to see bearish moves and price was even trading below the 20 simple moving average

during market hours.

By the time the market closed, price ended the day sat just above the 20sma which is being used as support.

This is why we are always informing our members that the closing price is important, not the price we see

during market hours, because the closing price provides us with a clearer picture.

What we need to see going forward is a bounce off the 20sma and for price to move towards the $4000

round number and beyond.

If price continues to use the 20sma as support then that will indicate a linear trend is in play and this is

what we usually experience in strong bullish markets.

We continue to remain long and will do so as long as the bullish trend remains in play.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

Bitcoin On Fire!Bitcoin broke the previous all-time high and the $20,000 round number on December 16th and created

a new record high on December 20th at $24,298. It took 3 years for price to revisit this level and we may

see price move on up towards the $30,000 round number or we may even see another sharp decline.

Cryptos are very volatile and very hard to get an idea of where price may be heading next but price does

tend to respect major levels of support and resistance.

After seeing some strong moves last week, this week is looking bearish so far and we may even see price

move down to retest the $20,000 round number or the previous all-time high.

As the consolidation period lasted for 3 years and we finally have a breakout, we can expect to see a strong

continuation in the direction of the breakout but as I have mentioned above, cryptos can be volatile so we

need to tread with caution here.

As Bitcoin is looking bullish, we should see the other Cryptocurrencies follow suit.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

S&P Creating Record Highs and Flying!Following on from the breakout of $3588 on November 24th, price appears to be forming a linear bullish

trend. We can identify this when price uses the 20sma as support/resistance as this indicates that the

pullbacks are shallow and short in length of time.

The most recent consolidation period (shaded area) lasted from September 2nd to November 24th and

this occurred following price making a record high. Now that price is creating record highs again,

we want to be mindful that price could consolidate once again.

This does not mean that we stand aside but it does mean we have to tread with caution and enter into

positions gradually so that a lot of our capital does not get tied up in losing positions.

As long as price goes on to create higher highs and higher lows then we should see price move towards

the $4000 round number. We then need to see if this psychological level will act as a strong level of resistance.

We are pretty much bullish in our portfolio and we will continue to look for high probability opportunities and

compound on the profitable assets that we have running.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

Gold Holding Above The Weekly 50SMAGold has created a pattern on the weekly timeframe where it has been using the 50 simple moving

average as support and appears to have done so again last week.

Price did not exactly touch the 50sma but came close and used that zone as a support level. A bounce

off this area does not confirm that we will see a continuation to the upside but it prepares us in case

price does continue to climb.

The all-time high at $2075 at the beginning of August saw the start of a decline which turned into

consolidation and then price broke down through the consolidation support level. It was then that the

weekly 50sma was used as support.

If price does start to resume the uptrend then we have the $2000 round number above price and the

all-time high for price to break. These are strong levels of S/R that may prove difficult to break the first time.

Gold has the tendency to trend long-term but with periods of consolidation and deep pullbacks along the way up.

Gold just needs some patience while it gathers momentum.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

S&P Is Up And Away!The S&P is off to a flying end of the year and if the momentum continues to push price skywards,

then we may even see a bull trend through 2021.

Price went into consolidation from September 2nd and created a fake breakout on November 9th

as it attempted to break out for the first time.

Then again on November 16th, price gapped up and broke out of consolidation and because of the

momentum, price appeared to be on its way up and remain out of consolidation. This optimism was

shortlived when price reentered back into the consolidation zone.

On the third attempt on November 24th, price broke out once again and has since remained out of

that zone and appears to be forming a linear move to the upside so far.

We now want to see a pullback to a level of support and a break and close above a previous high to

confirm we are in a bull market and this should give us the confidence that the trend will continue.

The 20 simple moving average is just below price and if that can hold as support then we should

see a linear trend develop.

We are long in both UK and US stocks and will remain that way unless the S&P indicates the trend is over.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

What's Going To Stop This Bitcoin Rally?Bitcoin is on the move again and we are seeing impulsive moves similar to what we witnessed back

in 2017 where price almost reached $20,000.

Following the decline in December 2017, price came down to the weekly 200 simple moving average

where it found support before starting another bullish rally.

Price didn’t travel as far as the previous trend and only reach a high of $13,880 before starting a

slow decline to the weekly 200 simple moving average once again.

From March 2020, price has been gaining strength and has surpassed the prior resistance at $13,880

and now looks set to visit the all-time high at $19,666 set back in December 2017.

The current trend looks strong and the buyers are in control at the moment. If price does break

through the major resistance then we should see Bitcoin create record highs but the $20,000

round number is a strong level to break.

Other cryptocurrencies should start to follow suit and we are already seeing strong moves in Ethereum.

As Bitcoin is already too expensive, we want to look for lower priced cryptos that are trending strong.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

Dow Jones First To Create A New All-Time HighLeading the way in the Indices is the Dow jones which broke out yesterday to create a new all-time high.

The breakout was only by 17 points so this could potentially be a fake breakout but if we see another bullish

candle that clears the current high then we should continue to see a bullish rally.

Not too far above where price is sat at the moment is the $30,000 round number which could act as a strong

level of resistance so we have to let the days unfold to see what the outcome will be.

The S&P 500 is not too far behind and should create a new all-time high as long as the momentum continues.

The Nasdaq lags further behind but should slowly follow suit sooner or later and when all three Indices are

making record highs, this will signal the start of a long-term overall bullish trend for stocks.

We continue to look for high probability opportunities that are outperforming the Indices.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

USDTRY Supported By The 20sma Again!The USDTRY has consistently been using the 20 simple moving as support since breaking out of consolidation

in August and has risen by 11.7% in that time.

Catching this trend near the start would have positioned you well to add compounds along the way.

Recently price experienced a steep fall which would have raised concerns for many traders out there.

But looking at the bigger picture of a bullish trend and identifying the 20sma as a potential support level,

would have reduced the chances of allowing fear to creep in.

The bearish candle we saw on the 9th November closed below the 20sma but found support at the

8.0000 round number.

Now that a potential support zone has been established. We need to see a bounce from this level and

eventually a break and close above the current high at 8.5777.

In the meantime, we will continue to manage our positions which are running in profit.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

COVID Vaccination Or US Election - What Pushed The S&P?With news of a new vaccine and the election of a new US president, it is unclear what actually pushed

the S&P 500 to new all-time highs. However, what is clear is that we are seeing the potential for the

beginning of long-term bullish trends.

Prior to gapping up on Monday, price was in consolidation so we were waiting for a breakout to confirm

where price is likely to go next.

Despite breaking out on Monday, price failed to close outside of the consolidation zone. This fake breakout

may be followed by price moving sideways for some time.

What we want to see next is a bounce from a support level then a retest of resistance. We want the

momentum to eventually push price above the current all-time high at $3645.

Below price we have the 20sma, 50sma and a previous all-time high at $3393 around the same zone.

This cluster of support may be strong enough to hold price from declining further if it does come to this level.

The markets are still bullish so we will continue to look for opportunities in strong trending stocks so keep

an eye on our posts for all the latest breakouts.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

USDTRY Up another 4%!The USDTRY has gone under the radar for many investors who stick to investing in only one market.

This forex pair reminds us of why we need to diversify our investment pot.

Since the last post, price has moved up another 4% bringing the price rise since breaking out

to 20.2% and counting.

Trends in the forex market usually lasts only a few months so we may see the trend here come

to an end soon, but for now we will continue to ride the wave until we see signs of a trend reversal.

We will update our community if and when we need to tighten our stops but as for now, our compounds

are working for us and bringing us in some healthy profits as price continues to climb.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

S&P 500 Up 6.5% During US Election Count!The US election vote counting has been going on for a number of days now but the market seems unfazed

as the S&P 500 continues to rise, with stocks breaking out to reach new all-time highs this week.

September and October displayed pullbacks across the board but November is showing bullish momentum

and if these moves are sustained then we should see breakouts in the coming weeks/months.

Price has been in consolidation since the beginning of September and has been crossing above and below

the previous all-time high at $3393 while the market finds its footing.

With a move of 6.5% this week in the S&P, we have seen some stocks making record highs and setting up

for opportunities once all the election dust settles.

As we are around the period of the year where trends begin to emerge, we are technically due to start

seeing some long-term trends. If this historic cycle plays out then prepare yourselves for the opportunities

that may appear over the coming weeks.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

USDTRY Is Flying High While Other Markets Remain Stagnant!The USDTRY is climbing fast while other markets remain stagnant. This is why we always want to have

a strategy that works in all markets as our money will always be working for us.

In early August 2020, price broke through a major level of resistance and is not looking back.

The trend that has been established is moving better than we could have imagined and this usually

happens when investing.

Assets will tend to trigger a position and then over time, the movement speeds up unexpectedly.

This is why we want to remain in a trend unless there is a good reason to exit.

The main reason we would exit would be if the trend has come to an end and this should be

stated in your Trading Plan.

Price has climbed 16.62% since breaking above resistance and we are seeing an extra thrust this week.

Momentum is good but we have to remember that it will not last so we need to be prepared to collect profit

and not give it all back to the market.

The next level we want to see price move towards is the 9.0000 round number.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

S&P Breaks Strong Support!As the US election is approaching, we are starting to see some interesting movements in the markets so far today.

Price is now trading below a major level of support which was the previous all-time high from February this year

at $3393. This level has since been acting as support and resistance.

As the markets are still open at the time of posting, we may see a shift in price by the end of the trading day.

If price does close below this level then we may see further weakness in the S&P. But if price closes above this level

then price may have established a support level and we may see a push back to the upside.

Closing (end of day) price is important to us because it gives us a lot more information and allows us to be objective

about our next steps in regards to looking at how to apply our strategy.

The S&P still remains in its 11-year bullish trend and for us to confirm further bullishness, we need to see the all-time

high broken at $3588. Should this happen, then there will be a plethora of stocks to choose from.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

FedEx Shares Soar 220% in 7 Months!This year has seen a rise in home deliveries, especially during the lockdown period and FedEx

appears to be one of a number of companies benefiting from this trend.

Over the years price has been on a steady growth, and from a low of $34 in March 2009 price grew

by 700% through to January 2018 and reached a high of $274.

A decline was underway from that point, and in just 26 months the share price dropped to $88.

Things did turn around in April this year as price started an impulsive trend back to the upside,

not only breaking above last year's high and the $200 round number, but also the previous all-time high.

As long as the demand for home deliveries remains high, we may see FedEx continue to shine.

The next hurdle in the way is the $300 round number which may act as an obstacle but seeing how

quickly price has climbed lately, the $300 psychological resistance may not cause any long-term problems.

As price has created record highs this month, this stock has moved higher on our watchlist and now we

are just waiting for a high probability setup before entering a position.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

S&P Wedged Between Support & ResistanceThe S&P 500 is showing good progress despite having a bearish start to the week. The first thing

we want to look at when we identify declines against the trend are levels of support below price.

If support is strong enough, then it should be able to stop price from declining further.

Below price we have the 20 & 50 simple moving averages as well as the previous all-time high from

February this year at $3393. When there is a cluster of support around the same zone, it gives us an

indication that the level is strong and price usually bounces off these levels.

The S&P still remains in an 11-year bull trend and although price is below the current all-time high

at $3588, the trend still looks good for a continuation as price is forming higher highs and higher lows.

The shaded area may form a consolidation zone as it lies in between major support and resistance levels.

A breakout of either of these levels would suggest a potential continuation in that direction.

The bias is for a breakout of resistance as the overall trend is bullish and this should be followed by

a strong bullish surge in the stock market.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

USDTRY Gains Another 1,390 Pips!The Turkish Lira continues to weaken which we can see in this chart where the US Dollar is displaying

dominance over the Lira.

Since the last post, price has risen by 1,390 pips which is 1.8%. Based on the weekly timeframe,

price has not yet formed a clean pullback so we may be due one. But if the trend is strong,

then we may not see a pullback for some time.

The consolidation resistance was formed around the 7.000 round number, so the next round number

at 8.000 may create some difficulty for price to make it past.

When the USDTRY is in a trend, it does tend to pick up speed so we shouldn’t be surprised if we

experience a surge in price. This happened back in 2018 when price was in an uptrend then we saw

a move of 26% in the month of August 2018 alone.

We can’t guarantee what will happen next so we just have to continue on as normal and look to

maximise profits as much as we can, so long as this trend continues to run.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

Will The S&P Bounce Off Support To New All-Time Highs?It is no secret that the stock market has recovered well following the huge declines in the markets

and the S&P is a good example of this recovery. From March, earlier this year, price has climbed 57%

from $2191 to its current price.

On August 24th, price successfully broke above the previous all-time high set at $3393. This high was

created on February 19th 2020. We expected to see price retest $3393 as it is a major level of support.

Price had other ideas and actually moved below this level, only to return above it on October 5th.

No matter what you expect price to do, it will continuously surprise you which is why we have to

be open to different outcomes.

Price is now back above $3393 but is pulling back and may come down to this level again to use as

support along with the 50 simple moving average.

As long as price can find some form of support, we eventually want to see price move towards the

current all-time high at $3588 and beyond. As the overall market remains bullish, we continue to seek

high probability opportunities in the stock market.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

Nike Up Over 10%Since the last Nike post, price has moved up 10.4% and continues to demonstrate strength in the market.

Nike had its earnings release on September 22nd which had a positive effect on price as we saw a jump

from $116 to $130 overnight, adding increased profits to its shareholders.

That gap up in price was followed by a decline/pullback and price now appears to have found support

because we are seeing a continuation of the bullish momentum.

Price broke out of consolidation in early August and has trended well so far, using the 20 simple

moving average as support. When price uses the 20sma, it helps to confirm if we are seeing a linear

trend in play.

As the current pullback is showing strength, we are now anticipating a breakout above the recent high

at $130. A break and close above this level will confirm a continuation to the upside and offer us some

high probability long opportunities.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

Gold Facing Support Turned ResistanceGold made history in July of this year when it created a new all-time high. Prior to this, the last time

a new all-time high was created was 9 years beforehand. Not only was a new-all-time created, but in

the process, price moved above the major $2000 round number.

When price moves past major levels of support or resistance we tend to see price revisit that level.

This restest occurred on August 11th where price came down to the previous all-time high. This level

was then used as support through to September as price consolidated.

The support level wasn’t able to hold price up for long and we saw a decline below $1920.

What is interesting now is that the support has now become resistance.

If the ATH holds as resistance going forward then we may see further declines in Gold, moving as far

down as the 200 simple moving average.

Gold is still above the consolidation support level at $1863 so we want to see some bullish momentum

and eventually a breakout of consolidation above $2075 which is the current resistance.

If this occurs then we will look to compound or our initial position which is currently in a small profit.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.

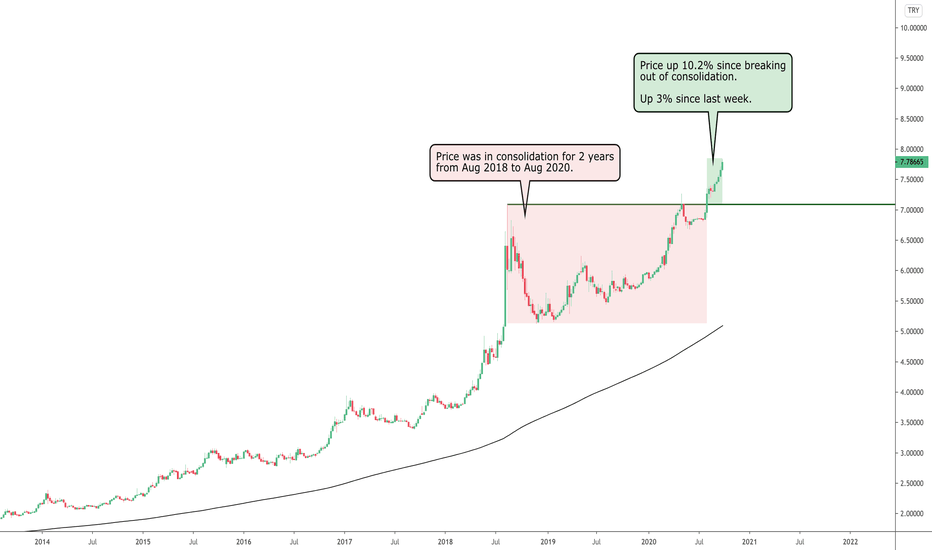

USDTRY Up 10% After Consolidating!Since posting about the USDTRY last week, price has continued to rise, handing out easy profits

so far to those investors that have added this to their portfolio.

This forex pair has been mentioned in our community leading up to our entry and as you can see,

a linear trend is starting to form.

In last week’s post, price had moved up over 7% since breaking out of consolidation. Price has since

moved up another 3% taking it to a rise of 10%.

There is still potential for further bullish moves here and the next level of resistance price may

move towards is the 8.0000 round number.

The USDTRY usually trends well and is then followed by periods of consolidation so we want to

position ourselves with compounds before the trend is over, in order to maximise our profits.

At the moment we will continue to manage our positions and lock in profits.

See below for more information on our trading techniques.

As always, keep it simple, keep it Sublime.