80% Of Time - A Trading Edge You Don't Want To MissDo you want to know why trading with median lines, also known as pitchforks, can be so successful? It’s simple:

Prices swing from one extreme back to the middle.

From the middle, they often swing to the other extreme.

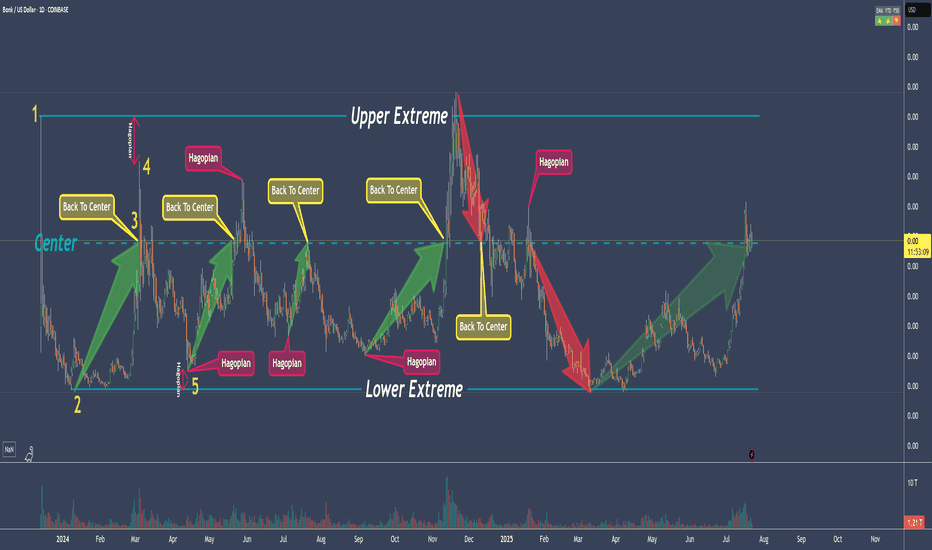

What do we see on the chart?

- The upper extreme

- The center

- The lower extreme

So far, so good.

Now let’s follow the price and learn a few important rules that belong to the rulebook of median lines/pitchforks, and with which you can make great trades.

Point 1

The price starts and is sold off down to…

Point 2

...and from there starts to rise again, up to…

Point 3

...which is the center. And here we have a rule that is very important and one that you need to be aware of in trading to be successful:

THE PRICE RETURNS TO THE CENTER IN ABOUT 80% OF ALL CASES

If we know this, then we can stay in a trade with confidence.

Point 4

The price climbed even higher but missed the upper extreme.

This is the “Hagopian Rule” (named after the man who discovered it).

And the rule goes: If the price does not reach the next line (upper extreme, lower extreme, or center), then the price will continue moving in the opposite direction from where it originally came.

Phew...that’s a mouthful ;-)

But yes, we actually see that the price does exactly this.

From point 4, where the price missed the upper extreme, the price not only goes back to the center but continues and almost reaches the lower extreme!

Now if that isn’t cool, I don’t know what is!

And what do we have at point 5?

A "HAGOPIAN"!

What did we just learn?

The price should go higher than the center line.

Does it do that?

Oh yes!

But wait!

Not only does the Hagopian Rule apply. Remember?

"The price returns to the center line in about 80% of the cases."

HA!

Interesting or interesting?

So, that’s it.

That’s enough for now.

Now follow the price yourself and always consider which rule applies and whether it’s being followed.

How exactly do you trade all this, and what are the setups?

...one step at a time.

Don’t miss the next lesson and follow me here on TradingView.

Wishing you lots of success and fun!

Success

123 Quick Learn Trading Tips - Tip #7 - The Dual Power of Math123 Quick Learn Trading Tips - Tip #7

The Dual Power of Math: Logic for Analysis, Willpower for Victory

✅ An ideal trader is a mix of a sharp analyst and a tough fighter .

To succeed in the financial markets, you need both logical decision-making and the willpower to stay on track.

Mathematics is the perfect gym to develop both of these key skills at the same time.

From a logical standpoint, math turns your mind into a powerful analysis tool. It teaches you how to break down complex problems into smaller parts, recognize patterns, and build your trading strategies with step-by-step thinking.

This is the exact skill you need to deeply understand probabilities and accurately calculate risk-to-reward ratios. 🧠

But the power of math doesn't end with logic. Wrestling with a difficult problem and not giving up builds a steel-like fighting spirit. This mental strength helps you stay calm during drawdowns and stick to your trading plan.

"Analyze with the precision of a mathematician and trade with the fighting spirit of a mathematician 👨🏻🎓,

not with the excitement of a gambler 🎲. "

Navid Jafarian

Every tip is a step towards becoming a more disciplined trader.

Look forward to the next one! 🌟

123 Quick Learn Trading Tips - Tip #6 - Defensive or Aggressive?123 Quick Learn Trading Tips - Tip #6 - Defensive or Aggressive?

To make money in trading, you need to control your emotions.

Traders often fall into two emotional traps:

Overly Aggressive: After several wins , a trader may become too confident. They might increase their position sizes or take on riskier trades. This can lead to significant losses if the market turns.

Overly Defensive: After several losses , a trader may become too fearful. They might hesitate to enter good trades or exit trades too early. This can lead to missed profit opportunities.

Maintaining a balance between these states is key. Learn to recognize and control your emotions. Discipline and a calm mind are essential for successful trading.

In trading, you must simultaneously be

defensive and aggressive.

Balance is Key ⚖️

Navid Jafarian

Every tip is a step towards becoming a more disciplined trader. Look forward to the next one! 🌟

123 Quick Learn Trading Tips #5: To HODL, or not to HODL?123 Quick Learn Trading Tips #5:

To HODL, or not to HODL: That is the question

Alright, crypto adventurers, let's talk about HODLing! 🎢

Ever seen this meme?

It perfectly captures the reality of holding onto your Bitcoin! 😂

What newbies think HODLing is: A smooth bike ride to the finish line! 🚴♂️💨

Easy peasy, right? Just buy and wait for the moon! 🚀🌕

What HODLing actually is: A wild rollercoaster through mountains, valleys, stormy seas, and even a cloud with a face! 😱🌊🏔

It's a journey filled with dips, peaks, unexpected turns, and maybe even a few moments where you question your life choices! 😅

But here's the secret sauce: The good news is that the more you learn about Bitcoin, the easier it becomes to HODL. 🧠📈

Why? Because understanding the technology, the fundamentals, and the long-term vision of Bitcoin gives you the conviction to weather the storms. ⛈

You start to see the dips as buying opportunities, not as reasons to panic-sell! 📉➡️📈

So, dive into the world of Bitcoin! Learn about its history, its technology, and its potential! 📚💡

The more you know, the stronger your hands will be, and the smoother that HODL journey will feel! 💪💎

Remember, it's not just about getting to the finish line, it's about enjoying the crazy ride! 🎉

123 Quick Learn Trading Tips #4: Spot or Futures? Real or Fake?123 Quick Learn Trading Tips #4: Spot or Futures? Real or Fake? 🧐

News : $1.3 Billion has been liquidated 💥 from the FUTURES market within the past 24 hours, as Bitcoin plummeted to $86,000. 📉

Futures leveraged traders were forced to close their positions, realizing a collective loss of $1.3 Billion.

This shows how risky trading with leverage (borrowed money) can be. 💸 ⚠️

Traders who use leverage enter into a gambling game with exchanges, which always win the game. In other words, in the last 24 hours, several crypto exchanges made $1.3 billion in profits.

On the other hand, people who bought Bitcoin directly (spot market) only lost a small amount of profit. This shows that owning the actual asset is more stable. 💎

Traders using leverage lose their money. But for spot investors, this is a good chance to buy more Bitcoin at a low price and make their long-term position stronger. 💰

Like I always tell my students and friends:

Let's go up the spot market stairs, step by step. 🪜 Don't think about the futures elevator. 🏢 It has crashed many times, 📉 and it will crash again. ⚠️

Instead of gambling in the "fake" futures game,

invest your money in the "real" spot market. 💎

Build your investments by owning assets, not by risky leverage. 🚫

Have a nice trading journey!

Forex: from 500 to 100k: is it possible?

Hello, I am the professional trader Andrea Russo and today I want to answer a question that is frequently asked: "Can you get to 100 thousand euros starting from just 500 euros?" The answer, as we will see, depends on several factors, but above all on the strategy you choose to adopt, on risk management and on the discipline in respecting the investment rules. In this article, we will look at a specific strategy, a sort of "daydream" that, although theoretically possible, also involves a series of risks to be considered very carefully.

Imagine starting with a capital of 500 euros. The strategy that I will explain provides that each successful investment will lead to a 30% gain on the invested capital, while each wrong operation will result in a 10% loss. In essence, if the market goes in your favor, you will earn 30% on the invested capital, but if things go badly, you will lose 10%.

If applied correctly, this strategy could lead to significant earnings over time, but let's make some assessments.

The strategy of earning 30% on each positive trade is based on the "magic of compound numbers", that is, on the fact that, every time you earn, you earn on an increasingly higher basis, thus increasing the invested capital. If you maintain a good rate of winning trades, the capital will grow exponentially over time.

How many earnings do you need to get to 100 thousand euros?

To calculate how many trades it will take to get to 100,000 euros, we can use the exponential growth formula. If we start with 500 euros and want to know how many winning trades at 30% we need to get to 100,000 euros, we can do the following calculation:

500 is the initial capital.

1.30 is the multiplier for each winning trade (30% earnings).

n is the number of trades needed.

Solving the equation, we get that n is approximately 17 consecutive winning trades (approximate). Therefore, you will need to make at least 17 consecutive successful trades, without any losses, to get to 100,000 euros.

Dangers of the strategy

Although the numbers may seem promising, it is important to remember that the market is not predictable and that not all trades will be winners. Furthermore, the 30% gains and 10% losses are hypothetical and do not take into account other factors, such as trading commissions, slippage, and market volatility.

Here are some of the main dangers associated with this strategy:

Volatility and risk of loss: The 10% loss per mistake, even if small, can quickly accumulate in a drawdown period. For example, after 5 losing trades, the capital could be drastically reduced.

Psychological complexity: Maintaining discipline in such a volatile trading environment is one of the most difficult challenges for any trader. There is always a temptation to “catch up” losses or make riskier trades to increase profits, which can undermine the effectiveness of the strategy.

Market Unpredictability: The market is never linear. Winning trades are not guaranteed, and even with a well-structured strategy, it is possible to find yourself in a prolonged drawdown period that puts the solidity of the plan at risk.

Capital Management: The Heart of the Strategy

The real secret of this strategy is not so much in earning 30%, but in protecting your capital and limiting losses. Capital management is essential to any type of trading, and it is what separates successful traders from those who fail.

Here are some key principles for effective capital management:

Position Size: Do not risk more than 1-2% of your capital on any one trade. This allows you to survive even a long period of consecutive losses, without compromising your capital.

Stop loss and take profit: Use stop loss to limit losses and take profit to cash in profits when the market moves in your favor. Don't expect the market to go up forever, but set clear goals.

Controlling emotions: Being able to stay calm, even when facing losses, is essential. Greed and fear are a trader's worst enemies, so keeping a clear mind is the key to long-term success.

Diversification: Don't put all your capital on a single asset or trade. Diversification helps reduce overall risk.

Conclusions

In summary, yes, it is theoretically possible to get to 100 thousand euros starting from 500 euros, but it is not easy at all. Success in trading does not only depend on the percentages of gain or loss, but also on the ability to manage capital and stay calm in difficult phases.

Happy trading.

How I am approching scaling my account to the next level💰 Introduction

I have been actively investing for over seven years. When I started in 2017, I had no idea what I was doing. My first trade was a short/mid-term win on an altcoin skyrocketing in a straight line—it felt unbelievable. But the truth was, I was completely clueless.

Still, I was hooked. I started reading everything I could and expanded my focus to stocks and Forex. Six months later, I had developed some ideas about Forex, though I was still lost when it came to stocks. I funded a Forex account with €8,000 to test my skills, using a simple 1:1 risk-to-reward 0.5% per trade system. A few months later, I was up about 15% - a solid start.

From there, my goal was clear: design a great strategy first, then scale it. But things didn’t go as planned.

I suffered a serious injury, which got progressively worse, making it impossible to hold a regular job. I spent everything I had on rent and medical bills. To make matters worse, I stubbornly clung to a terrible strategy for years - even after developing better ones. I ignored huge unrealized gains, constantly chasing the “holy grail” of investing. Ironically, today, I trade every single strategy (or a modified version to add to winners) I’ve ever designed since 2019 - except the one I stubbornly stuck with for years.

Through all this, I learned a crucial lesson:

💡 A strategy should work from day one. You backtest it to verify, then refine it, but you don’t trade it live until it’s ready.

Now, after years of experience, mistakes, and lessons learned, I have several proven strategies and a fresh perspective. The next step? Scaling up aggressively.

Of course, I can’t cover everything in one article, a full book wouldn’t even be enough. Some aspects of growing an account, like tax implications, aren’t discussed here.

But my goal is simple: to inspire investors to think creatively about scalability and strategy development. The process of building an investment strategy - including a scaling plan - is all about creativity.

💰 The Challenge of Scaling: Why Gains Lag Behind Losses

Your gains will always lag behind your losses - this is a fundamental reality in investing. If you scale too fast, your winners from months ago may not be enough to cover your new losses, even if you're performing well overall.

I am not talking about drawdowns, those makes things even worse. I am talking about how looking for asymmetric returns means the time it takes will be asymmetrical too. For mid-term strategies, traders typically risk 1 unit to gain 5, 10, or even 15. However, the time required for returns grows exponentially as reward targets increase. If you're aiming for 10x or more, your losing trades might last only 2–3 days, but your winners could take six months or longer to materialize.

I experienced this firsthand in 2024. I started the year strong, accelerating my risk after solid returns from trading the Yen. Then I hit the gas again, but things turned bad - primarily because I was experimenting with a new strategy alongside my proven ones. In November, I realized a 15x profit on gold, which could have significantly changed my situation. However, I had entered the position back in February, before I began scaling, so the gains didn’t have the impact I needed at the time.

💰 Scaling Only Works for the Few Who Are Ready

Most traders either stagnate or lose, and even the best often learn the hard way early on. You’ve probably heard the common statistic: only 10% of FX investors win, and only 10% of stock investors beat the market. But even within that elite group, only a third outperform significantly enough to consider trading as a full-time career rather than just a supplement for retirement.

From the data I've seen, only about 3% of investors should even consider aggressive scaling. Attempting to scale without a proven track record is a recipe for disaster. Even the most famous market wizards often had to learn the hard way early on.

A good analogy is chess - not everyone is a young prodigy, and even for those who are, it often takes 7–8 years to reach master level. The same applies to investing: skill and experience take time to develop, and rushing the process can lead to avoidable mistakes.

💰 No shortcut but there are ways to increase scalability

A path one might follow is the investment fund. However these are very restrictive, George Soros once said to make money you had to take risk. No matter how good you are you are still subject to the same laws and I know no one that has 100% win rate. If your max drawdown is 5% how much can you realistically risk per operation? Perhaps 0.25% So your 10X winner will be 2.5%. We know the returns, drawdowns and Sharpe ratios of the biggest (and supposedly best) funds, I never heard of a fund with a tiny max drawdown and huge returns except Medallion fund you got me.

The problem I personally have, or shall I say had, is that I can sometimes go 6-12 months without a winner, or with just 1-2. It is spread very non-homogeneously. In the last 3 months I have (finally!) designed a short term strategy that will smooth the curve, I risk 1 to make 5 and have opportunities in all market conditions. I was not even trying to, I just randomly felt creative and went "Eureka".

I am currently running my proven strategies on my main accounts, and the new one on a smaller account - of course I keep winning on these small amounts. This short term strategy might not be my best one, although it might be the second best, however it was exactly what I needed to help smooth the drawdowns and more boring market conditions.

💰 Balancing Creativity and Risk in Scaling Strategies

I believe designing a successful scaling strategy requires a combination of creativity and pessimism. From my experience, it's essential to explore different ways to scale while always keeping the worst-case scenario in mind.

To illustrate this, let’s consider an example - not necessarily the exact approach I will take, but a concept that reflects my thinking. Suppose I allocate €25,000 to a brokerage account and divide it into 25 "tokens" of €1,000 each. Every time the account grows, I would redistribute the balance into 25 equal parts, each representing 4% of the total.

This setup ensures that I always have capital available for new opportunities. Even if I lose 10 times in a row and have 5 tokens tied up in winning trades (or disappointing breakevens), I would still have 10 tokens left to reinvest. Based on my calculations, 25 is the minimum number required for this method to work efficiently. That said, 4% risk per trade is significantly higher than what I have ever risked, and I may adjust it downward.

💰 Risk Management and Personal Goals

If someone were able to triple a €25,000 account each year, they could theoretically reach €2 million in just four years. However, such exponential growth is rare and unsustainable over the long term. Jesse Livermore achieved extraordinary gains - but ultimately lost everything and took his own life. This is a stark reminder that extreme financial risk can have devastating consequences.

I would never attempt this kind of aggressive scaling with essential funds - certainly not with rent money, without a financial cushion, with large amounts, or without a clear Plan B.

My personal objectives:

If investing my own money: My goal is to build a €2M–€3M account while continuing my regular job - possibly reducing to part-time work.

If managing investor funds: I would aim to start with €10M AUM, with at least €500K of my own capital in the fund. My ultimate target is to grow AUM to €100M.

💰 The Crypto Factor : A Different Beast

The extreme volatility combined with long term aspect of crypto makes for a very different experience. In the past it has shown incredible returns, I know this first hand my brother started mining Ethereum I think in 2019 when the price was below $150 I guess and then he has been buying cryptos on the way up, in euros I might add, with the crypto/euro charts looking much better than the USD ones.

But there is no reason why it cannot all go to zero, or crash 95% and remain here for years. And even if the whole crypto market does not crash, several of them die each year. I am not a perma bear I do not wish my younger brother to lose everything, this is all he has, he got no diploma not interesting career.

For crypto to fit in a structured investment strategy I personally would only put small amounts. So it sort of follows the idea of a separate account with huge risk. An amount that one can afford to lose.

💰 Final words

I believe I have the experience, the rigor and the strategies to increase my risk and invest more aggressively. In a near future - maybe starting 2026 - I want to really grow my account.

My scaling will be gradual, I won't jump from an amount to 3 times that in 3 months, I will manage my risk strategically; And before even starting the battle I will have clearly defined objectives.

123 Quick Learn Trading Tips #3: Better turn up the heat123 Quick Learn Trading Tips #3: Better turn up the heat 🔥

Ever wonder why some traders seem to have all the luck? 🤔 They're not just lucky; they've built an iceberg of hard work, discipline, and even failures beneath the surface of their "success." Don't just chase the tip – build your own solid foundation.

Here's what that iceberg looks like in trading:

Hard work: 📚 Studying markets, developing strategies, and always practicing. No shortcuts here! 🚫

Patience: ⏳ Giving up short-term gains for long-term strategies. Don't rush. Good traders wait for the best opportunities.

Risks: 🎲 Take smart trades, not reckless ones. Be brave, but not foolish.

Discipline: 🎯 Follow your trading plan. Don't let your feelings make you change it. Trust what you learned before. Trust your strategy.

Failures: 🤕 Everyone loses money sometimes. Learn from your losses. It's important to get back up and keep going.

Doubts: 😟 Managing emotions and fear is crucial. It's normal to have doubts.

Changes: 🔄 The market always changes. You need to change your strategies too. Be ready to adapt.

Helpful habits: 📈 Consistent analysis and risk management are your bread and butter. Stick to good routines.

Want to build a success iceberg? 🧊

Better turn up the heat 🔥

– it's going to be a long, cold journey beneath the surface.

👨💼 Navid Jafarian

So, stop scrolling through my TESLA pics 🚗 and get back to analyzing those charts! 📊 Your iceberg isn't going to build itself. 😉

Today's Market Overview and for Tomorrow Today's Market Overview:

General Trend:

The market seems to be consolidating after breaking key structural levels (BOS and CHoCH). The price is hovering near resistance zones (Premium and EQH) and shows potential for a move toward lower support zones (Discount and Equilibrium).

Key Support and Resistance Levels:

Support Zones (Fibonacci Levels):

The range of $2,690 to $2,684 serves as a critical support area.

Resistance Zones:

The area around $2,718 to $2,725 acts as a strong resistance zone, likely to impede further upward movement.

Scenarios for Tomorrow (January 21, 2025):

If the price breaks above the $2,718 level and sustains, it may target the next resistance at $2,725 or higher.

If the price drops below $2,698, it could retest the support zone between $2,690 and $2,684.

Fibonacci Insights:

Key Retracement Levels:

Based on the chart, critical Fibonacci retracement levels seem to align near $2,705 (0.382) and $2,690 (0.618), making these levels important for potential reversals.

Recommendations for Tomorrow:

For Bullish Traders:

Wait for the price to stabilize above $2,718 and look for buy (long) opportunities targeting $2,725 or beyond.

For Bearish Traders:

If the price breaks below $2,698, short positions targeting the $2,684 support zone could be profitable.

Morning Routines of Successful Day Traders: It’s Not Just CoffeeIt's pretty busy right now in the market , so we figured why not pull you in for a breather and spin up an evergreen piece that’ll lay out some practical advice to our absolutely magnificent audience. This time we’re talking about routine, morning routine.

The time of day when the majority of us fall into two buckets: those who rise and those who hit snooze until their phone falls off the nightstand. Day traders? They’re a different breed.

Successful day traders aren’t rolling out of bed, rubbing their eyes, and clicking buy before their first sip of coffee. If you think trading is all instinct and luck, you’re in for a wake-up call.

The best in the game have morning routines that look more like pre-game rituals – calculated, precise, and yes, sometimes superstitious.

🧐 Scanning the Ground Before Dawn

Before the market bell even thinks about ringing, day traders are already glued to their screens. Futures markets? Checked. Pre-market movers? Analyzed. Global news ? Scanned twice, just in case something wild happened overnight to the Japanese yen .

The market isn’t an isolated entity; it reacts to everything and the effects are widespread, spilling over from one asset class to another. Inflation data, gold prices, tech earnings, even the tweet that Elon Musk fired off at 3 AM (especially now with his unhinged political disruption).

📒 The Power of the Trading Journal

A tried-and-tested trader’s morning doesn’t start with the news only. They crack open the sacred document – the trading journal . A quick review of yesterday’s trades is non-negotiable. What worked? What didn’t? Was there a panic sell at 10:05 that didn’t age well?

Documenting trades might feel like high school homework, but the elite money spinners swear by it. It’s not about reliving the glory or shame of past trades – it’s about patterns. Spot the patterns, and you’re already ahead of 90% of the market.

🙏 Stretch, Meditate, and Keep Emotions at Bay

Trading isn’t just charts and numbers. It’s a mental game. One bad trade can spiral into a revenge trade, and next thing you know, you’re shorting Tesla at market open because it "felt right." This is why the best day traders center themselves before the chaos begins.

Some meditate. Others hit the gym. A few just sit quietly with their thoughts, which honestly might be the most terrifying option. Regardless of the method, the goal is the same: shake off the stress, start the day calm. Because calm traders make rational decisions. Anxious traders blow up their accounts.

🤖 Tech Check: The Ritual of Rebooting

Imagine missing a perfect trade because your Wi-Fi blinked out or your trading platform decided to update at the worst possible time. For a day trader, technology isn’t just a tool – it’s the lifeline.

A tech check is part of every serious morning routine (or at least weekly). Charts must load fast, platforms need to run smoother than a Swiss watch, and backup systems stand ready for action.

Most traders have backups of their backups, in the cloud and on their hard drives. If their primary PC goes down, there’s a laptop on standby. If that dies, they have their phone. And if the phone crashes? Well, let’s just say there might be a tablet lurking somewhere nearby.

🛒 Watchlists: The Trader’s Grocery List

Top dogs curate their watchlists daily, especially when it’s still the quiet of the day. It’s not just the usual suspects like Apple AAPL or Nvidia NVDA – it’s a finely tuned selection of stocks primed for movement. It could be big tech, auto stocks and even gold-linked stocks .

Earnings reports , unusual volume, or a sudden spike in options activity – all of these feed the list. The goal is to narrow the focus. Because staring at 200 charts at once is a surefire way to miss everything important.

📅 Economic Calendar: The Absolute Mainstay

Pro traders live by the economic calendar and are more likely to miss the birthday of a loved one than the Fed making an announcement. Is there a jobs report dropping ? The latest consumer prices are in ? These events are market movers, and day traders plan their sessions around them.

Big data dumps can trigger wild volatility, and the last thing any trader wants is to be blindsided by a sudden spike in price out of nowhere. Think of the economic calendar as the market’s version of a weather forecast.

You wouldn’t plan a picnic during a thunderstorm, and you shouldn’t casually load up on the British pound ahead of an expected interest rate decision.

🚀 It's Go Time: Visualization and Execution

There’s a quiet intensity in the room as you prepare for the opening bell (unless you trade forex or crypto). The screens are glowing, the watchlist is set, and the coffee is (hopefully) still hot.

But before the first trade, there’s visualization. Successful traders run through potential scenarios in their heads. “If stock X hits this level, I’ll enter. If it drops below Y, I’m out.”

It’s like rehearsing lines for a play. When the market finally opens, there’s no hesitation – just execution.

🏁 Final Thought: It’s Not Magic, It’s Routine

Day trading might look glamorous from the outside, but at its core, it’s a grind full of decisions, decisions, and decisions again. The traders who consistently win aren’t lucky; they’re disciplined. And it all starts with the morning routine.

So, next time you see all those financial gurus, mentors and course-selling forex influencers on Instagram, picture this instead: a dimly lit room, a couple screens, a watchlist, and a trader calmly sipping their third cup of coffee. Because in this game, the calmest minds – not the flashiest – take home the prize.

Discipline Over Motivation – The Key to Success in TradingMotivation gets you started, but discipline keeps you going. In trading, the difference between success and failure is often your ability to stay consistent, even when things get tough.

Always remember:

➡️ Losses are temporary, but quitting is permanent.

➡️ Small, consistent progress beats impulsive big wins.

Discipline is the bridge between your goals and your results. Stay disciplined, and success will follow!

Feel free to share your thoughts or your favorite trading mindset tips in the comments!

Unlock Your Full Potential with our Trading Psychology CourseSuccess in trading goes far beyond technical analysis and market knowledge. True mastery in the financial markets requires a deep understanding of the psychological traits that drive consistent performance and resilience. To help traders of all levels strengthen their mental game, I’m excited to announce the Hercules Trading Psychology Course – a comprehensive, 13-lesson journey into the mind of a successful trader.

What You Can Expect:

For this course I am going to provide multiple lessons, each delving into key psychological principles that separate the top traders from the rest. Whether you're a beginner looking to establish a strong foundation or an experienced trader seeking to refine your mental approach, this course will provide you with essential tools to:

Master Initiative, Discipline, and Patience – the 3 core traits every successful trader needs.

Build emotional resilience to handle losing streaks, market volatility, and avoid costly psychological traps like FOMO.

Develop a structured mindset that supports consistent profitability across any market or timeframe.

Why is Psychology So Important in Trading?

The mental aspect of trading often gets overlooked, but it’s the difference between making rational decisions and being driven by emotions like fear, greed, or desperation. This course will help you strengthen your trading mindset and equip you with practical strategies to stay disciplined, focused, and confident in your decisions – even when the markets are unpredictable.

Course Structure :

Some of the covering topics are:

The 3 Essential Traits Every Trader Must Master

The Power of Initiative in Trading

Discipline – The Pillar of Consistent Profitability

Handling Losing Streaks with Emotional Control

Overcoming Desperation in Trading

How to Beat FOMO and much more.

Each lesson is designed to be easy to understand and filled with actionable insights you can start applying immediately to improve your trading performance.

What’s Next?

Stay tuned for Lesson 1 today, where we’ll dive into the 3 essential traits that form the foundation of successful trading: Initiative, Discipline, and Patience. By mastering these traits, you’ll build the psychological resilience needed to navigate the ups and downs of the financial markets.

Make sure to follow me to catch every lesson as it’s released. I’m looking forward to sharing this journey with you and helping you take your trading to the next level!

Master the Trading Mindset: Lessons from Trading in the ZoneTrading in the Zone by Mark Douglas is widely regarded as one of the most important books for traders seeking long-term success. The book emphasizes that consistent profitability in trading is not only about mastering strategies or market knowledge but, more importantly, about trading mindset, mastering your own mind. Many traders focus purely on technical or fundamental analysis, but Douglas insists that psychological discipline is what separates successful traders from the rest.

By understanding the emotional and mental aspects of trading, you can turn potential obstacles into strengths.

Why Most Traders Struggle: The Illusion of Market Control

One of the core ideas in Trading in the Zone is that many traders enter the market under the false assumption that they can control outcomes if they make the right predictions. This mindset is deeply flawed. The financial markets are inherently unpredictable. Even with the best analysis, there are countless factors influencing price movements that are beyond any trader’s control.

Key Lesson: Embrace Uncertainty

Douglas emphasizes that successful traders must understand that the market is governed by probabilities, not certainties. You will never be able to predict the market with 100% accuracy, and that’s okay. The goal isn’t to be right every time, but to develop an approach that gives you a statistical edge—one that ensures you come out profitable over time, even when some trades fail.

Think of the market as a casino: while the house doesn’t win every game, its edge ensures that over time, it’s consistently profitable. Similarly, traders need to focus on building a system that works across a large number of trades, rather than getting caught up in trying to control individual outcomes.

Building a Winning Attitude: The Process vs. The Outcome

A major theme in Trading in the Zone is the need to shift your mindset from being outcome-driven to being process-driven. Most traders make the mistake of evaluating their performance based on whether they won or lost an individual trade. This creates a dangerous emotional cycle, where wins create overconfidence and losses spark fear or frustration.

Key Lesson: Detach from Individual Results

Douglas teaches that trading is a marathon, not a sprint. Consistent success comes from focusing on the process, not individual trades. You must follow your plan and rules consistently, regardless of the outcome of a single trade. Winning trades don’t always mean you followed your plan, and losing trades don’t necessarily indicate failure. Instead, long-term success comes from disciplined execution of your edge.

By focusing on process over profits, traders can eliminate the emotional highs and lows that lead to inconsistency. This mental shift helps you stay level-headed, even when things don’t go your way.

The Role of Beliefs in Trading: How Your Mindset Shapes Your Actions

Our beliefs influence how we behave in the market. If you have subconscious fears about losing money, or if you believe that being wrong is a sign of failure, these beliefs will manifest in your trading actions. You might hesitate to pull the trigger on a trade, cut winners too early, or hold onto losing positions because you’re afraid to admit defeat.

Key Lesson: Reprogram Your Mindset

In Trading in the Zone, Douglas explains that you must reprogram your mindset to align with the realities of trading. Accept that losses are part of the game. Successful traders understand that losses are inevitable, and they don’t let individual losses affect their confidence. Trading success comes from building a set of beliefs that supports objective decision-making.

For example:

Limiting belief: “I can’t afford to lose money.”

Empowering belief: “Losses are a natural part of trading; my edge will prevail over time.”

By changing these internal beliefs, traders can reduce emotional interference and make rational decisions in line with their strategy.

Thinking in Probabilities: Shifting to a Casino Mindset

Douglas spends considerable time explaining the concept of thinking in probabilities. He uses the metaphor of a casino to illustrate how successful traders operate. A casino doesn’t win every bet, but its edge ensures that over thousands of games, it consistently comes out ahead. Similarly, traders need to think of their trades in terms of probabilities.

Key Lesson: Your Edge is Everything

Your edge is your winning probability over a series of trades, not your ability to predict individual outcomes. Once you accept that losses are part of the game, the emotional attachment to individual trades fades. What matters is sticking to your system and letting the edge play out over time.

In practical terms, this means:

Don’t let a losing trade shake your confidence.

Don’t get overly excited about a winning trade.

Stay committed to your system, knowing that it will be profitable over time if you consistently apply it.

Overcoming the Fear of Losing

One of the biggest challenges traders face is the fear of losing. Fear of losing can cause you to avoid entering trades altogether or exit winning trades too soon. This fear stems from not fully accepting the risks of trading.

Key Lesson: Accept the Risk Before Entering a Trade

Before placing any trade, you must be at peace with the potential loss. Douglas emphasizes that you should only trade when you are completely comfortable with the risk. If you can’t emotionally handle the thought of losing a certain amount of money, you’re risking too much. By accepting the risk upfront, you free yourself from fear and allow yourself to trade objectively.

Douglas advises using smaller position sizes or setting tighter stop-losses until you feel confident about the level of risk you’re taking. Once you accept the risk, you can approach the market with less emotional interference and more discipline.

Consistency is Key: The Power of Discipline

Many traders struggle with inconsistency. They might have periods of great success, followed by periods of undisciplined trading that wipe out their profits. Douglas explains that the secret to long-term success in the markets is consistency—not in your results, but in your actions.

Key Lesson: Follow Your Rules

The most important trait of successful traders is that they follow their trading rules every single time. When you deviate from your rules because of fear, greed, or frustration, you open yourself up to unnecessary risk and losses. On the other hand, by consistently following your edge and your system, you guarantee that you will capitalize on your strategy’s strengths over time.

Consistency in following your plan leads to consistent results. Discipline becomes the foundation of a successful trading career.

The Psychological Barriers in Trading: Recognizing and Managing Emotions

Emotions such as fear, greed, impatience, and overconfidence are often the biggest roadblocks to successful trading. Douglas emphasizes that the key to overcoming these barriers is self-awareness. Traders must learn to recognize when their emotions are influencing their decisions and develop strategies for managing these emotions.

Key Lesson: Mindfulness and Emotional Control

By practicing mindfulness, traders can learn to separate their emotional responses from their actions. For example, when the market moves against you, instead of reacting impulsively, take a moment to assess the situation objectively. Is this a market move you’ve anticipated in your plan, or is it an emotional reaction to an unexpected event?

Douglas encourages traders to develop emotional control strategies, such as:

Journaling your trades to reflect on your emotional state during each trade.

Setting clear, predefined exit strategies to avoid emotional decision-making.

Practicing visualization and breathing techniques to stay calm during high-stress moments.

Developing a Rules-Based Trading System

Another crucial concept in Trading in the Zone is the importance of having a rules-based trading system. Many traders enter the market without a clear plan or rules, relying on gut feeling or market sentiment. This lack of structure leads to inconsistent results and poor decision-making.

Key Lesson: Create and Follow a Solid Trading Plan

To achieve success, Douglas emphasizes the need to create a trading plan that outlines:

Your entry and exit criteria.

How much you are willing to risk per trade.

The market conditions under which you will or won’t trade.

Having a plan allows you to remove emotion from your decision-making process. When you have clear rules in place, you don’t have to guess or second-guess your actions. Instead, you follow your plan with discipline and consistency, leading to more predictable results.

Trusting Yourself and Your System

One of the final messages in Trading in the Zone is the need to trust yourself and your system. Many traders fall into the trap of doubting their strategy after a few losses, even if the strategy has worked well over time. This lack of trust leads to system hopping, where traders jump from one strategy to the next, never giving any single approach enough time to prove its worth.

Key Lesson: Confidence and Commitment

Douglas emphasizes that once you’ve developed a solid trading system, you must commit to it fully. Trust that your system will work over a large number of trades, and resist the temptation to abandon it after a few losing trades. Confidence in yourself and your strategy is essential for long-term success.

The Zone: Peak Performance in Trading

Douglas describes the ultimate goal of every trader as achieving “the zone.” This is a mental state of peak performance, where you are fully in tune with the market, your emotions are under control, and you are executing your trades with clarity and confidence. Traders in the zone are not fixated on individual outcomes but are fully present and focused on following their process.

Key Lesson: Reaching “The Zone” in Trading: Achieving Peak Performance

In Trading in the Zone, Douglas introduces the idea of “the zone” — a state of peak performance where a trader is completely in sync with the market. In this mindset, emotional distractions are minimized, allowing you to make clear, confident, and unbiased decisions. When traders enter the zone, they’re fully focused on their process and not concerned with individual wins or losses.

Key Lesson: How to Achieve the Zone

Getting into the zone requires practice, emotional control, and mental discipline. By focusing on your trading process and minimizing emotional responses, you will begin to trade with precision and without hesitation. Some key steps include:

Mastering Emotional Control: Remove attachment to individual outcomes.

Focusing on the Process: Commit fully to your strategy and trading plan.

Trusting Your System: Develop unwavering confidence in your edge over time.

When you’ve trained your mind to operate in the zone, trading becomes a fluid experience, and you are better equipped to handle the challenges of the market.

Final Thoughts: The Psychology Behind Trading Success

Trading in the Zone offers profound insights into how the mind shapes success in the financial markets. The key takeaway from Douglas’ work is that mastering the mental game is essential for consistent, long-term profitability. Successful traders learn to think in probabilities, accept risk, and develop the discipline to follow their edge consistently.

Key Takeaways:

Embrace Uncertainty: Focus on probabilities rather than certainties.

Reprogram Limiting Beliefs: Accept that losses are part of trading.

Focus on Process Over Outcome: Build and trust your trading system, and don’t be swayed by short-term results.

Master Emotional Discipline: Be aware of how emotions like fear and greed impact your trading decisions.

Strive for Consistency: Following your rules consistently will lead to consistent profits over time.

By focusing on mindset and emotional control, traders can overcome common pitfalls and achieve the level of discipline required to succeed in the highly competitive world of trading. Through Trading in the Zone, Mark Douglas offers a blueprint for developing the mental resilience needed to thrive in any market environment.

If you’re looking to elevate your trading performance, internalize these lessons and put them into practice. The market may be unpredictable, but with the right mindset, you can navigate it with confidence and discipline.

NASDAQ100US100 has been ranging since last week, I would like to see it drop before it rallies to new highs, though it is simple for nas100 to reach our SL because our entry is exposed and in sync with 97% of retail traders who sold simply because resistance zone, we are part of liquidity into this trade and market algo price machine is mostly likely to take us out.Use low lots and proper risk management. Lets Download Success

NASDAQ100US100 has been ranging since last week, I would like to see it drop before it rallies to new highs, though it is simple for nas100 to reach our SL because our entry is exposed and in sync with 97% of retail traders who sold simply because resistance zone, we are part of liquidity into this trade and market algo price machine is mostly likely to take us out.Use low lots and proper risk management. Lets Download Success

xauusdwhat a weekend gold fly once again all time high 2508 as my previous analysis i was explained that gold will fly. well as i draw simple line to understand the 1D chart prediction and i have

a: plan

b: plan

concider that gold has over bought so it may have the gap down open opportunity or fly above .

let me know what you all think, leave a comment . happy weekend.