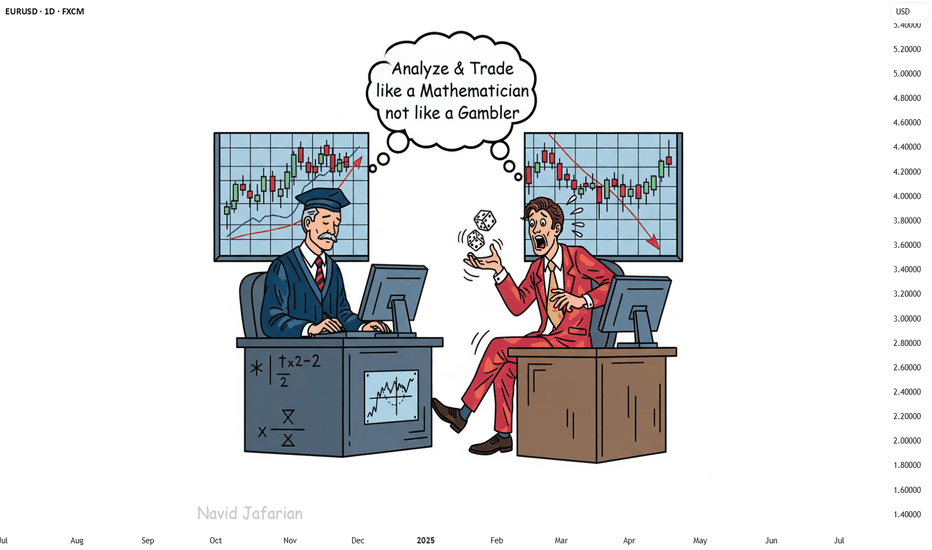

123 Quick Learn Trading Tips - Tip #7 - The Dual Power of Math123 Quick Learn Trading Tips - Tip #7

The Dual Power of Math: Logic for Analysis, Willpower for Victory

✅ An ideal trader is a mix of a sharp analyst and a tough fighter .

To succeed in the financial markets, you need both logical decision-making and the willpower to stay on track.

Mathematics is the perfect gym to develop both of these key skills at the same time.

From a logical standpoint, math turns your mind into a powerful analysis tool. It teaches you how to break down complex problems into smaller parts, recognize patterns, and build your trading strategies with step-by-step thinking.

This is the exact skill you need to deeply understand probabilities and accurately calculate risk-to-reward ratios. 🧠

But the power of math doesn't end with logic. Wrestling with a difficult problem and not giving up builds a steel-like fighting spirit. This mental strength helps you stay calm during drawdowns and stick to your trading plan.

"Analyze with the precision of a mathematician and trade with the fighting spirit of a mathematician 👨🏻🎓,

not with the excitement of a gambler 🎲. "

Navid Jafarian

Every tip is a step towards becoming a more disciplined trader.

Look forward to the next one! 🌟

Successfultrade

ATOM ANALYSIS📊 #ATOM Analysis

✅There is a formation of Falling Wedge Pattern on daily chart with a good breakout and currently retests from the major resistance zone and again trading around its major resistance zone 🧐

Pattern signals potential bullish movement incoming after a successful breakout of resistance zone

👀Current Price: $4.800

🚀 Target Price: $6.300

⚡️What to do ?

👀Keep an eye on #ATOM price action and volume. We can trade according to the chart and make some profits⚡️⚡️

#ATOM #Cryptocurrency #TechnicalAnalysis #DYOR

123 Quick Learn Trading Tips - Tip #6 - Defensive or Aggressive?123 Quick Learn Trading Tips - Tip #6 - Defensive or Aggressive?

To make money in trading, you need to control your emotions.

Traders often fall into two emotional traps:

Overly Aggressive: After several wins , a trader may become too confident. They might increase their position sizes or take on riskier trades. This can lead to significant losses if the market turns.

Overly Defensive: After several losses , a trader may become too fearful. They might hesitate to enter good trades or exit trades too early. This can lead to missed profit opportunities.

Maintaining a balance between these states is key. Learn to recognize and control your emotions. Discipline and a calm mind are essential for successful trading.

In trading, you must simultaneously be

defensive and aggressive.

Balance is Key ⚖️

Navid Jafarian

Every tip is a step towards becoming a more disciplined trader. Look forward to the next one! 🌟

123 Quick Learn Trading Tips #5: To HODL, or not to HODL?123 Quick Learn Trading Tips #5:

To HODL, or not to HODL: That is the question

Alright, crypto adventurers, let's talk about HODLing! 🎢

Ever seen this meme?

It perfectly captures the reality of holding onto your Bitcoin! 😂

What newbies think HODLing is: A smooth bike ride to the finish line! 🚴♂️💨

Easy peasy, right? Just buy and wait for the moon! 🚀🌕

What HODLing actually is: A wild rollercoaster through mountains, valleys, stormy seas, and even a cloud with a face! 😱🌊🏔

It's a journey filled with dips, peaks, unexpected turns, and maybe even a few moments where you question your life choices! 😅

But here's the secret sauce: The good news is that the more you learn about Bitcoin, the easier it becomes to HODL. 🧠📈

Why? Because understanding the technology, the fundamentals, and the long-term vision of Bitcoin gives you the conviction to weather the storms. ⛈

You start to see the dips as buying opportunities, not as reasons to panic-sell! 📉➡️📈

So, dive into the world of Bitcoin! Learn about its history, its technology, and its potential! 📚💡

The more you know, the stronger your hands will be, and the smoother that HODL journey will feel! 💪💎

Remember, it's not just about getting to the finish line, it's about enjoying the crazy ride! 🎉

123 Quick Learn Trading Tips #4: Spot or Futures? Real or Fake?123 Quick Learn Trading Tips #4: Spot or Futures? Real or Fake? 🧐

News : $1.3 Billion has been liquidated 💥 from the FUTURES market within the past 24 hours, as Bitcoin plummeted to $86,000. 📉

Futures leveraged traders were forced to close their positions, realizing a collective loss of $1.3 Billion.

This shows how risky trading with leverage (borrowed money) can be. 💸 ⚠️

Traders who use leverage enter into a gambling game with exchanges, which always win the game. In other words, in the last 24 hours, several crypto exchanges made $1.3 billion in profits.

On the other hand, people who bought Bitcoin directly (spot market) only lost a small amount of profit. This shows that owning the actual asset is more stable. 💎

Traders using leverage lose their money. But for spot investors, this is a good chance to buy more Bitcoin at a low price and make their long-term position stronger. 💰

Like I always tell my students and friends:

Let's go up the spot market stairs, step by step. 🪜 Don't think about the futures elevator. 🏢 It has crashed many times, 📉 and it will crash again. ⚠️

Instead of gambling in the "fake" futures game,

invest your money in the "real" spot market. 💎

Build your investments by owning assets, not by risky leverage. 🚫

Have a nice trading journey!

123 Quick Learn Trading Tips #3: Better turn up the heat123 Quick Learn Trading Tips #3: Better turn up the heat 🔥

Ever wonder why some traders seem to have all the luck? 🤔 They're not just lucky; they've built an iceberg of hard work, discipline, and even failures beneath the surface of their "success." Don't just chase the tip – build your own solid foundation.

Here's what that iceberg looks like in trading:

Hard work: 📚 Studying markets, developing strategies, and always practicing. No shortcuts here! 🚫

Patience: ⏳ Giving up short-term gains for long-term strategies. Don't rush. Good traders wait for the best opportunities.

Risks: 🎲 Take smart trades, not reckless ones. Be brave, but not foolish.

Discipline: 🎯 Follow your trading plan. Don't let your feelings make you change it. Trust what you learned before. Trust your strategy.

Failures: 🤕 Everyone loses money sometimes. Learn from your losses. It's important to get back up and keep going.

Doubts: 😟 Managing emotions and fear is crucial. It's normal to have doubts.

Changes: 🔄 The market always changes. You need to change your strategies too. Be ready to adapt.

Helpful habits: 📈 Consistent analysis and risk management are your bread and butter. Stick to good routines.

Want to build a success iceberg? 🧊

Better turn up the heat 🔥

– it's going to be a long, cold journey beneath the surface.

👨💼 Navid Jafarian

So, stop scrolling through my TESLA pics 🚗 and get back to analyzing those charts! 📊 Your iceberg isn't going to build itself. 😉

A BIG WIN for GOOGLE Congrats 2 those who followed this analysis

A BIG WIN for GOOGLE and For You !

I knew that the "Stacked Channel" was the key and that Google would make a decision sooner or later. If we look closely, the price tried to rise several times. However, the key this channel gave us was from October 7th, with that bearish volume candle. Although it was coming down strongly, it didn’t manage to break my stacked channel. This is a very clear signal from the price, telling us: I'm still strong and still in the bullish game.

one more detail to conclude is that the price is signaling with wicks that there’s a lot of buying pressure, and it’s not yet for a bear market.

Google's only hope was the earnings report, and with an excellent report and very solid numbers, we won big on this analysis!

Congratulations if you followed this analysis and entered before the report. As I had mentioned several weeks ago, I’ve always been "Bullish" on Google, and it didn’t disappoint me, either technically or fundamentally. Google remains STRONG !

Thank you for supporting my channel & Congrats to you!

Best regards

The Most Famous Traders Around the GlobeThe Most Famous Traders Around the Globe

You may have come across news articles and personal stories on social media about traders who have made huge profits and achieved early retirement. Such stories can motivate you to learn and practise to achieve your personal highs. In this FXOpen article, you will find out more about the most famous traders and their success stories.

What Makes a Trader Successful?

It’s important to realise that success is subjective, and there is no one formula for achieving it. For some people, success is earning as much as possible in a short period, while for others, it’s about gradually saving up and building capital for retirement.

Still, people who come to succeed generally share certain character and behavioural traits. Let’s consider what can positively influence trading.

Experienced and successful traders:

- are well-educated in their fields

- have a solid trading plan

- are disciplined and patient

- can control their emotions

- are flexible and adaptable

These qualities are essential for navigating the changing markets and finding profitable opportunities, and developing these characteristics could help you on your way.

Edward Arthur Seykota: an Algorithm for Success

Edward Arthur Seykota is known as a “Father of Trading Systems”. This man is a legend in the world of trading, and for good reason. Ever since beginning his career as a trader in the 1970s, he has been captivated by the concept of a mechanised system for conducting trades and performing technical analysis.

Ed Seykota developed algorithms for trading and used computer programs to execute trades. The profit made by his robot used between 1972 and 1988 was over 250,000% — the assets of his client grew from $5,000 to $15 million. He has been consistently profitable in the markets for more than four decades, and his success has inspired countless traders around the world.

Andy Krieger: How to Hack Forex Trading

One of the best day traders is Andy Krieger, a currency trader who gained notoriety in the late 1980s for his aggressive trading strategies. He worked for Bankers Trust, and he’s best known for trades against the New Zealand dollar. His primary strategy was to bet against the NZD because he believed it would be susceptible to short-selling.

Krieger enlarged his risk by combining foreign currency options with his significant trading limit, took a position, and benefited from the 1987 New York Stock Exchange crash. Andy made a profit of over $300 million for his employer in just one day.

Ingeborga Mootz: A Great Female Trader

Ingeborga Mootz is a woman from Germany who proved that there are no age or gender restrictions on trading. Having no relevant education or experience, she became a successful investor at the age of 75. Now she is almost 100 years old and a millionaire, and she keeps advising others on how to make money in the stock market.

Ingeborga Mootz used to have a humble existence, and when she married, her husband forbade her from working. Her stock market activity began after her husband’s death when she found a thousand shares of VEBA while going through his papers. She sold the shares and made a 100% profit, and trading became her point of interest. The main area that Frau Mootz looks at is banking.

Richard Dennis: How to Trade a Trend

Richard Dennis inspires traders with his ingenious and innovative approach to commodities trading. Dennis was a trend trader who preferred identifying trends and making trades in their direction with increasingly high leverage, maximising profits in good scenarios.

Richard was born into a poor Irish family in Chicago, and he made a name for himself trading on the Chicago Mercantile Exchange at the age of 17. Within ten years, he turned a borrowed $1,600 into an astounding $200 million through commodities trading.

One of his most famous experiments involved training a group of people known as “Turtles” for just two weeks. The Turtles reportedly made an impressive cumulative profit of $175 million over five years.

Bill Lipschutz: How to Learn From Mistakes and Manage Risk

Bill Lipschutz began his trading career after graduating from Cornell University in the late 1970s. During this period, he managed to turn a modest investment of $12,000 into a staggering $250,000. However, there was a setback, and one bad trading decision caused him to lose his entire stake. This experience taught him a valuable lesson in risk management that he has carried through his career.

In 1981, Lipschutz took a job as a currency trader at Salomon Brothers. At the time, forex trading was only growing in popularity. He quickly established himself as a very successful trader and, by 1985, was making the company more than $300 million a year in profits. He eventually became Salomon’s chief currency trader and held this position until his departure in 1990.

Final Thoughts

All these experienced traders who have achieved success differ from each other in biography, trading style, and strategy. The amounts they have earned are also different. It is important to remember that these are the exceptions rather than the rules, and most traders face losses while trading.

However, what you can learn from them is that they possess some specific qualities such as risk management skills, emotional control, loss acceptance, discipline, and flexibility. You can develop these skills as well, and to do this, open an FXOpen account and start your journey. To boost your performance, consider using the advanced trading tools offered on our TickTrader platform. We are sure that they will be helpful for trading, learning and skill development.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Turning point is in. Bitcoin is heading back UPSo, if Bitcoin is heading back up, it's not just riding on the whims of market sentiment or the technical analysis of a few clever humans. It's propelled by the collective belief in its scarcity, utility, and the ever-growing narrative of it being digital gold.

Remember, in the grand scheme of the universe, Bitcoin's price movements might just be the equivalent of a small blip on the radar of cosmic events, but for us earthlings, it's the financial spectacle of our times.

Keep your spacesuits on, your helmets secure, and your wallets ready; Bitcoin's trajectory might just be the most entertaining show in the galaxy right now.

Disclaimer: All predictions come with a side of cosmic uncertainty. Invest wisely, or at least with a sense of humor, knowing that in the vast expanse of space, even Bitcoin's price is just a tiny, albeit exciting, speck.

Comparing Charts to the Editors Picks (Purely for Emphasis) Ah, the age-old dance of support and resistance in the financial markets – it's like watching a soap opera where the plot twists are as predictable as they are dramatic. Today, let's draw a parallel between our beloved charts and, for the sake of emphasis, the Editor's Picks on a certain streaming service.

The Setup

Imagine your chart as the streaming service's homepage, and the Editor's Picks are your key support and resistance levels. These aren't just random selections; they're curated, highlighted, and often, where the action's at.

Support: The Show You Can't Cancel

Support in the market is like that show you keep coming back to, even when everyone says it's past its prime. It's the level where the price finds buyers, like fans who refuse to let their favorite series die. No matter how many times it gets "cancelled" (the price dips), it bounces back, because, well, there's still a fanbase (demand).

Resistance: The Show Everyone's Talking About

Resistance is akin to the new hit series everyone's raving about. It's where the price hits a ceiling, not because it's not good, but because everyone's already watching (selling). The hype is real, but can it sustain? That's the question.

The Market's Drama

Just like how shows get renewed or canceled based on viewership, our support and resistance levels are tested, broken, or reinforced by market sentiment.

Breaking Support: It's like your favorite show finally getting the axe. It hurts, but it's a sign that maybe, just maybe, the market's ready for something new.

Breaking Resistance: This is when the new show surpasses expectations, becoming the next big thing. The price breaks through, indicating a shift in market sentiment, a new trend, or perhaps, a new fan favorite.

Why This Analogy?

By comparing market levels to something as universally understood as TV show popularity, we highlight the dynamic nature of support and resistance. They're not static; they're influenced by the collective mood, news, and sometimes, sheer unpredictability.

The Takeaway

Next time you're analyzing charts, think of it like scrolling through your streaming service. Where's the support holding like a beloved series? Where's the resistance capping the price like the next big hit? Understanding these dynamics isn't just about numbers; it's about reading the market's story, its drama, and its unpredictable twists.

Stay tuned, stay amused, and remember, in the market's grand theater, every level has its moment in the spotlight. 🎬📈

Disclaimer: While this analogy is for fun, remember, markets are more complex than TV show ratings. Trade wisely, and maybe keep a sense of humor handy.

We did it again. Target hit with high accuracyLadies and gentlemen, gather 'round, for we've done it again! The market, that wild, untamed beast, has once more danced to the tune of our predictions, hitting our target with the precision of a laser-guided missile.

The Bullseye Moment

We set our sights, we aimed, and lo and behold, the market didn't just hit our target; it bullseyed it with the accuracy of a master archer. It's like we've discovered the secret formula for market prediction, or at least, we've had a stroke of genius that even the market couldn't ignore.

What This Means

Validation: It's not just luck; it's skill, strategy, and maybe a dash of market magic. This hit isn't just about the numbers; it's about the confidence it instills in our methods.

Opportunity: With such precision, we're not just riding the wave; we're surfing it, looking for the next crest to conquer. This isn't the end; it's the beginning of the next phase.

The Cosmic Perspective

From an outside view, watching humans celebrate hitting a market target might seem like cheering for a leaf falling exactly where you pointed. Yet, here we are, reveling in the moment, because in the grand chaos of the market, these moments of precision are rare gems.

The Takeaway?

Keep those targets in sight, not because the market will always play along (it's as fickle as the wind), but because when it does, it's like the universe is giving us a nod. Here's to hitting targets, celebrating victories, and always, always, aiming for the next one.

Stay sharp, stay amused, and remember, in this cosmic game of darts, we're all just throwing at the board, hoping for that perfect score. 🎯🚀

Disclaimer: Markets can decide to swerve at the last second. Trade with caution, humor, and maybe a bit of skepticism.

Market Obedience: Price Chasing Targets Like a Dog After a BoneAh, the market, that unpredictable beast, has once again proven to be as trainable as a well-bred retriever. Here we are, watching price action follow our nominated target zones with the enthusiasm of a puppy chasing its favorite toy.

The Market's Leash

You've set the target zones, and lo and behold, the market's not just following; it's sprinting towards them like there's a treat at the end. It's like watching a perfectly executed fetch command, where instead of a ball, we're throwing out price targets, and the market, in all its chaotic glory, is fetching them with surprising precision.

What This Means for Us

Trader's Delight: When the market behaves like this, it's like we've unlocked the secret to canine training for financial markets. The predictability, while fleeting, gives us a moment to bask in the glory of being right.

A Setup for More: Whether it's setting up for another bounce or preparing for a deeper dive, this adherence to our target zones is laying the groundwork for our next moves.

The Cosmic Perspective

From a galaxy far, far away, watching humans get excited over a market following a line we've drawn must look quite amusing. It's like celebrating because your pet finally learned to sit on command, except here, the pet is a vast, complex financial ecosystem.

The Takeaway?

Keep those target zones marked, not because the market will always play fetch (it's as unpredictable as a cat sometimes), but because when it does, it's giving us a rare glimpse into its playbook. Here's to setting targets, watching them hit, and occasionally, just occasionally, being right about where the market's going next.

Stay amused, stay alert, and remember, in this cosmic game of fetch, we're all just throwing sticks into the void, hoping something brings it back. 🐶🚀

Disclaimer: Markets can decide to ignore the fetch command at any moment. Trade with caution, humor, and maybe a bit of skepticism.

Ultimate Trading Strategy: Reaction to Supply and Demand Levels!🔍 Identifying Potential Buy or Sell Zones: In this step, you need to identify the zones that are likely to react and wait for the price to potentially reach them. ⏳📊

🌟 With the reaction to the first area, a buy trade is activated. 🌟

📝 Confirmations:

📉 Reaction to the expected area – Watch for a price movement hitting our anticipated zone!

🛠️ Formation of a combined hammer pattern – Look out for this powerful reversal signal!

📈 Formation of a bullish engulfing pattern – A strong indicator of upward momentum!

🔍 Trading Tips:

💡 High-risk stop-loss location:

👉 Place it below the candlestick pattern. At least twice the spread to ensure you're covered! 📏🔒

💡 Lower-risk stop-loss location:

👉 Place it below the expected area. Again, at least twice the spread for extra safety! 📏🔒

💰 Take-profit strategy:

👉 Base it on risk management mathematics, such as risk-reward ratios of 2, 4, and 6.

👉 Alternatively, observe reactions to past market areas, especially near important market highs and lows. 📊📈

🎯 Entry point strategies:

👉 Enter at the close of the confirmation candle.

👉 Or, set a limit order around 50% of the confirmation candle for a bigger volume opportunity! 📉📈

🌟 Buying in Two Phases: A Smart and Exciting Strategy! 🌟

🔹 Phase One:

When you reach a profit of twice the risk, exit the trade. Why? Because the Asian high has been hunted and the candlestick formed has a long upper shadow. 🌄💹

💡 Analysis:

The price hasn’t reached other zones yet and has risen in reaction to the first expected zone. Therefore, we expect a pullback and continued upward movement. 💪📈 So, I’ll place a second buy trade. 🚀💵

🔍 Confirmations for the Second Buy Trade:

A double bottom has formed, marked with an X. ❌❌

A small hammer candlestick has swept the double bottom. 🔨

A long positive shadow candlestick has swept the bottom and reacted to a small order block on the left. 🌟

💡 Tips for the Second Buy Trade:

Enter at the close of the long-shadowed doji candlestick or place a stop limit order above the long-shadowed doji candlestick. 📉📈

The stop loss should be below this candlestick. 📏🔒

🔹 Phase Two:

Next, the price has reached an expected reaction zone from where we expected a price drop. 🌐💡

🔍 Confirmations for the Sell Trade:

Reaction to the expected zone. 🔍

An inverse hammer candlestick reacting to the zone. 🔨

💡 Tips for the Sell Trade:

The entry point should be in a candlestick with a negative signal indicating a price drop. This hammer candlestick can indicate a decline. 📉🔻

The target can be a reward of 2 or the last price bottom. 🎯💰

The stop loss should preferably be behind the expected zone. 📏🔒

🔥 Important Points!!:

Since the price hasn’t deeply penetrated the zones, there’s a chance it might go higher or even mitigate this zone twice, ultimately turning it into a pullback for a further price rise. 🚀📈

Continuing on, the price reached the upper zone area.

We expected a price drop from this zone, but it reached at 03:15,

which is outside our trading session. However, we could have traded on it.

🔍 Sell Confirmations:

The price has reached the expected zone.

An inverse hammer candlestick pattern.

💡 Interesting Fact:

If you had placed a limit order around the midpoint of the previous two zones,

you would have profited by now. So, for this zone, you can also place

a limit order around 50% of it.

Continuing further, other zones have formed below that could be useful

for new trades.

✨ Successful Sell Trade Achieved, Reaching a Reward of 4 Times the Risk.

📉 During the session continuation, the trend line was broken, triggering an upward price pullback.

🔹 Now, at the beginning of the session, we have a new zone, likely a selling order placement area. We're taking the risk on this zone. This time, we can place the trade around 50% of it. 🚀💼

🔥 Alright, what's your take now? 🔥

🌟 Is the price reacting to this level or not? 🌟

🚀📈 or 📉💥

Where are the upper zones located?

What do you think? 🤔💬

Starting The Market Open RightThe start of this week has been very profitable. I am managing to stick to my trading plan consistently. A lesson I have learned is to allow price to breathe, and when price gets into a even zone, Move my stop loss in profit! Another lesson I have learned is to apply more than 1 strategy to my trades. Yes, It is good to stick to one you are comfortable with, but there is no silver bullet strategy, changes in our strategy, can be as fluent as the changes in the market, as long as the strategy matches the market conditions! The month of May has been a large toss up! PEPPERSTONE:GBPUSD , & FX:GBPJPY GBPJPY, ended last week with bearish momentum, but price on both pairs were at my set support zones. my first confluence. Second, Price was in consolidation, near a retest of my 4H bearish trendline. Lastly, price was set to retest my Monthly Resistance, PEPPERSTONE:USDX helped me monitor the trade this morning, as the price of the dollar fell around market open USA, giving the Pound more momentum for a potential bull run into the afternoon. This is my first trade where I managed to close 1:4. I look forward to more potential setups like these to share in the future.

In conclusion, I'd like to share my trading journal entry..

DID I FOLLOW MY PLAN?

Yes. I exercised Support & Resistance

Followed the trend, its my friend!

Set my stop loss according to my risk reward ratio

WHAT DID I DO WELL?

1. Identified Trend in New Session.

2. Leveraged other pairs as a resource..

3. Exercised good risk management, by setting a stop loss.

WHAT CAN I DO BETTER?

1. Set Higher Lot Size.

2. Set Stop Loss In Higher Timeframe

WHAT DID I LEARN?

1. Following A Plan Is Profitable

2. Using Different Strategies Is Okay To Increase My Success

3. How To Set My Risk Reward Ratio Properly

DID I PREPARE PROPERLY?

YES, I entered a trade in a new session with confidence with several my confluences in my technical analysis.

This time I set my price, doubled down, and wait for a confirmation.