SUGARUSD LongSugar has just broken out of a falling wedge pattern which could also be bullish flag. Nothing too complex, but I marked out where any divergences have played out coupled with the RSI > 65 signalling intermediate tops. I think sugar has anywhere from 5 to 10 percent to go up before marking another intermediate top.

For this trade, use the CANE ETF. I would suggest a stop below today's open and to just let this trade run.

SUGAR

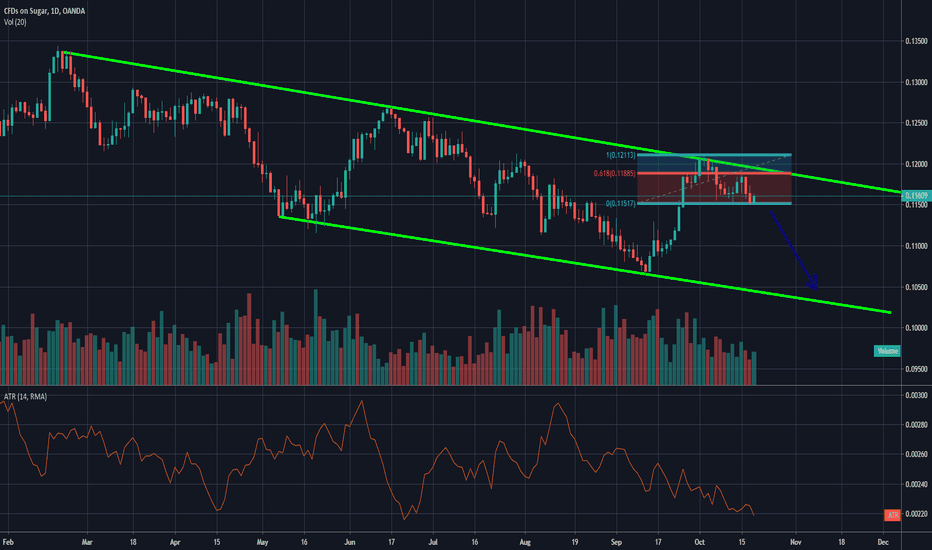

SUGAR SHORT D1 UPDATE - DOUBLE TOP REVERSAL COMING?Hey traders, this is the update for the Sugar trade that I am still currently in.

Looks like price has come back up to the green trend line before reversing.

Looking left we see that price reached this exact area before, creating a potential double top pattern.

If you did not enter before, now would be a great time with a risk to reward of 3.

If price can break the neckline bears will be in full control.

The moving averages are also looking like a bearish cross soon on the MACD.

Daily trade analysis and ideas:

Telegram: t.me

Facebook: www.facebook.com

Twitter: forex_dojo

Instagram: www.instagram.com

Website: www.forexshinobi.com

Tiktok: @forexshinobi

ForexShinobi

SUGAR DAILY ANALYSIS - TL TOUCH AND 61.8% FIB RETRACE SHORT?Sugar came up to test the upper green trendline before price reversed.

Price then retraced to the 61.8 Fib Level before moving back down.

It looks like the bears are in control for now, and Sugar should continue to push lower as October comes to an end.

Daily trade analysis and ideas:

Telegram: t.me

Facebook: www.facebook.com

Twitter: forex_dojo

Instagram: Jaylen.Forex

Website: www.forexshinobi.com

ForexShinobi

SugarUS LongSugar weekly candle just closed above the 20 ma and the 21 ema. Looking left when that occurred in the past we had at least one additional full body weekly candle close above those moving averages before trend reversal OR start of a further uptrend , especially in those cases that 21 ema crossed over the 20 ma to the upside.

Linking this idea with my previous long position on Sugar.

Hello Traders, SUGAR/USD 0.12052 VS 0.12668. Trade SetupsHello Traders, SUGAR/USD 0.12052 VS 0.12668.

Looking for Yellow: a Break and continuation / corrective / Consolidation Pattern at 0.12546 / 0.12668

To Continue the upside movent towards 0.13120 / 0.3372.

Or Blue: Possible Completion Consolidation /Continuation / Corrective Pattern 0.12546

to Retest / Break previous Lows once more 0.12052 / 0.12080 towards 0.11827 / 0.11742.

sugar/usd short term setupOn the weekly I see a strong down trend and on the daily, I see support turning into resistance as well so that indicates bearish movement.

On the 4hr chart, I see price get towards that resistance line and I drew up a resistance zone from the previous high and noticed it might make a double top. I am looking to go short at that moment in time.

Entry, Stop loss and Take profit are all added.

POSSIBLE SHORT SETUP?Sugar looks to be forming a short setup due to double-top and indecision around ichimoku cloud. Short setup is not yet confirmed as market has not given a clear direction as of yet but this is one to keep a close eye on for drop to targets identified by yellow lines in chart.

HELPFUL VIDEOS TO TEACH YOU:

www.youtube.com

www.youtube.com

DISCLAIMER;

Do set stop losses when trading but be generous with how much room you allow for this due to candle wicks and there is also the possibility to hedge yourself, for more confident traders.

All comments and questions welcome, if curious about indicators I use then feel free to inquire.

IF YOU SUPPORT IDEAS, DO LIKE, FOLLOW & SHARE. ~ THANKS! ~