SUIUSDT: Breakout + Retest = Lift-Off Soon!BINANCE:SUIUSDT has shown impressive strength, bouncing back with solid volume after hitting a major weekly support level. This bullish reaction suggests a potential move toward higher highs, making it an attractive opportunity for long-term investors. Entering a position in the spot market and holding for the long term could yield significant gains.

On the 4-hour chart, SUI is forming an ascending triangle pattern. After breaking out, it has successfully retraced and is now gearing up for a strong swing move. Traders can consider entering at this level and look to book profits as the price climbs higher. As always, managing risk with a proper stop loss is crucial.

BINANCE:SUIUSDT Currently trading at $2.4

Buy level : Above $2.4

Stop loss : Below $2.15

Target : $3.5

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

SUI

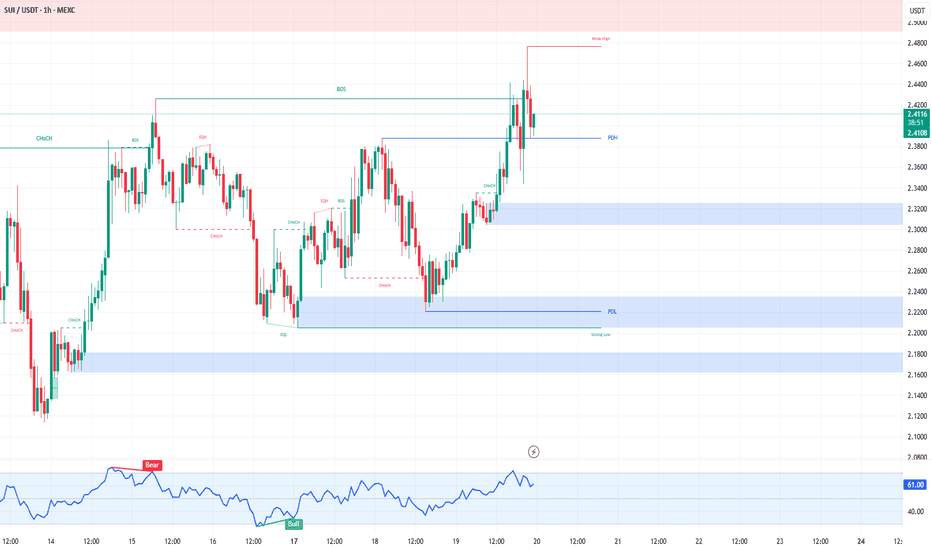

SUI/USDT 1H: Bullish Breakout Confirmed – Can $2.65 Be ReachedSUI/USDT 1H: Bullish Breakout Confirmed – Can $2.65 Be Reached?

Current Market Conditions (Confidence: 8/10):

Price at $2.40, showing a strong breakout from the accumulation zone.

RSI at 60.41, indicating bullish momentum with room to run higher.

Clean break above $2.35 resistance with strong volume confirms bullish intent.

Hidden bullish divergence forming on RSI, reinforcing continuation potential.

LONG Trade Setup:

Entry: $2.38 - $2.42 zone.

Targets:

T1: $2.50 (first resistance).

T2: $2.65 (major liquidity zone).

Stop Loss: $2.30 (below recent support).

Risk Score:

7/10 – Favorable risk-to-reward, but watch for temporary resistance at $2.50.

Market Maker Activity:

Accumulation is evident with minimal selling pressure above $2.35.

The clean break of resistance suggests a continuation of the uptrend.

Strong support is established at $2.30, with clear order blocks reinforcing demand.

Bull flag pattern forming, signaling an imminent move higher.

Recommendation:

Long positions remain favorable in the $2.38 - $2.42 range.

Monitor price action at $2.50, as this level may provide temporary resistance.

If volume continues to increase, expect a move toward $2.65.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

SUI/USDTHello friends

Given that the price has reached a good support and buyers have entered and supported the price, you can now buy in stages at the specified levels with capital and risk management and move towards the specified goals.

If you would like to be with us in the Alt Season, send us a message.

*Trade safely with us*

SUI: Current SituationYou asked, and we delivered:

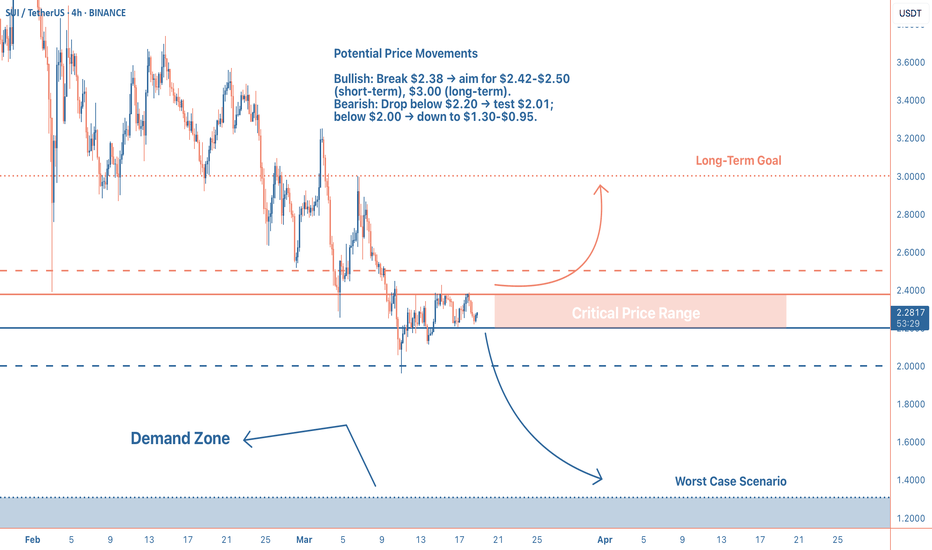

SUI is trading at $2.2616, navigating a volatile crypto market that’s down 4.4% in total market cap over the last 24 hours. As a Layer 1 blockchain, SUI stands out with its object-centric data model and Move programming language, emphasizing scalability and user accessibility. Its token serves multiple roles: staking, gas fees, utility, and governance. With a market cap of $7.51 billion and a circulating supply of 3.17 billion SUI (out of 10 billion), SUI ranks between #19 and #23 among cryptocurrencies. Recent trading volume is robust, ranging from $578.34 million to $742.90 million in 24 hours, signaling strong market activity. The price is well below its all-time high of $5.35 (January 4, 2025), with recent lows at $2.01 and highs at $2.42. Sentiment is mixed: some traders eye a breakout from a descending channel and partnerships as bullish, while others flag bearish divergence and a broken macro structure, hinting at downside risks to $1.30-$0.95.

Technical Indicators and Key Levels

Short-Term (1-Hour and Daily Charts):

Support: $2.20 (immediate), $2.01 (cycle low)

Resistance: $2.38 (24-hour high), $2.42 (cycle high), $2.50

Indicators: RSI ~50 (neutral), MACD bearish but hinting at reversal. A hold above $2.20 could spark a rally to $2.38-$2.50.

Long-Term (Weekly Chart):

Support: $2.00, $1.30-$0.95

Resistance: $2.50, $3.00, $5.35 (ATH)

The 200-day MA is falling, reflecting long-term pressure, but holding $2.00 is key for bulls.

Potential Scenarios

Bullish Case: Hold $2.20, break $2.38 with volume → target $2.42-$2.50 (short-term), $3.00 (long-term).

Bearish Case: Drop below $2.20 → test $2.01; below $2.00 risks $1.30-$0.95.

Volume is critical—watch for spikes to confirm moves.

Broader Context and Tips

SUI’s fundamentals, scalability, user-friendly features like zkLogin, and ecosystem growth, offer long-term promise, but short-term risks loom. External factors like regulatory shifts or macro events (e.g., US inflation data) could sway its path. Traders should focus on $2.20, a hold keeps bulls in play, a break signals caution. Use tight stops (e.g., below $2.20 for longs) and stay alert for news on partnerships or adoption. Long-term, $2.00 is a key floor for accumulation.

SUIUSD Can it go to $12??Sui / SUIUSD hit last week the Pivot Zone that marked the initial historic opening price, the Feb & Marhc 2024 Highs and October 2024 bottom.

So far this week is reacting with a bounce.

If the bullish trend is sustained, which is also the 0.618 Fibonacci and the 1week RSI bottom like July 2024, then we expect at least a +507.35% rise towards the 1.382 Fib extension.

Buy and target $12.000.

Follow us, like the idea and leave a comment below!!

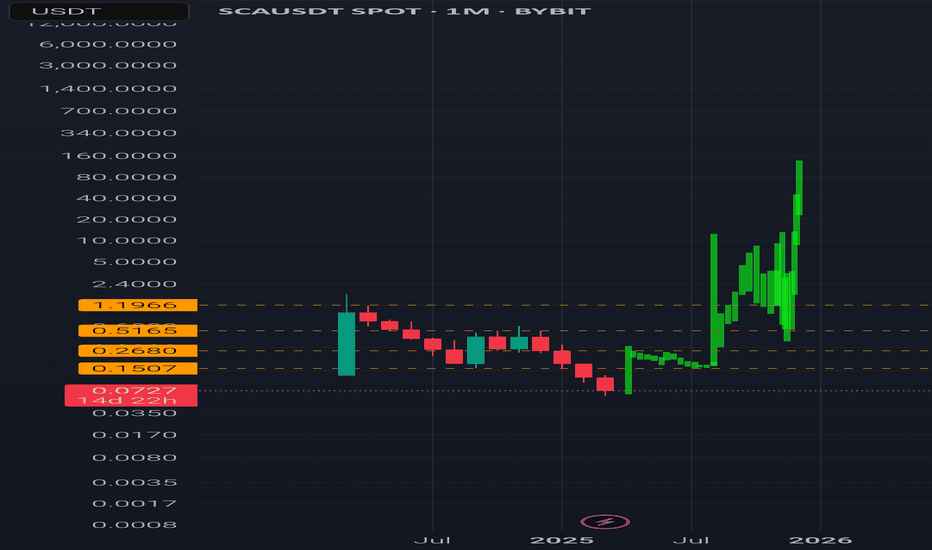

Scallop (SCA) Potential 200x Gains by next bull run

Current Market Overview:

Current Price: $0.07

Market Cap: $8M

Target Market Cap: $200M+

Potential Growth: 25x - 200x

Showing strong accumulation signals, indicating that most weak hands have already exited. With whales now in control, the price action suggests an imminent breakout in the coming bull run.

Key Observations:

✅ Deep Accumulation Phase: The price has been suppressed for a long time, suggesting all early holders have been flushed out.

✅ Whale Accumulation: With fewer retail traders, whales can now dictate price action, leading to a controlled rally.

✅ Bull Market Catalyst: If the Bitcoin cycle and altcoin season play out as expected, SCLP could experience parabolic growth.

Price Targets Based on Market Structure:

TP1: $0.25 → Initial breakout level (6.5x from current price)

TP2: $0.60 → Strong resistance (15x)

TP3: $6.00 → Major psychological level (85x)

TP4: $28.00+ → Full bull cycle potential (400x+)

Market Cap Projections:

At $1.75 (25x Growth): ~$200M market cap

At $6.00 (85x Growth): ~$700M market cap

At $28.00 (400x Growth): ~ SEED_TVCODER77_ETHBTCDATA:3B market cap

$SUI - Breaking of the IceSUI is still trending downward as its price continues to be rejected at the VWAP.

On the daily timeframe, we can expect the price to retest its daily demand zone around $1.70 and $1.60.

We are looking to enter a long position at this level, targeting the equilibrium around $2.80 to $3 (to break through resistance, or " break the ice ").

If we encounter any rejection at that level, we’ll then look to short, targeting $0.80.

This thesis would be invalidated by a clean reclaim of $2.50.

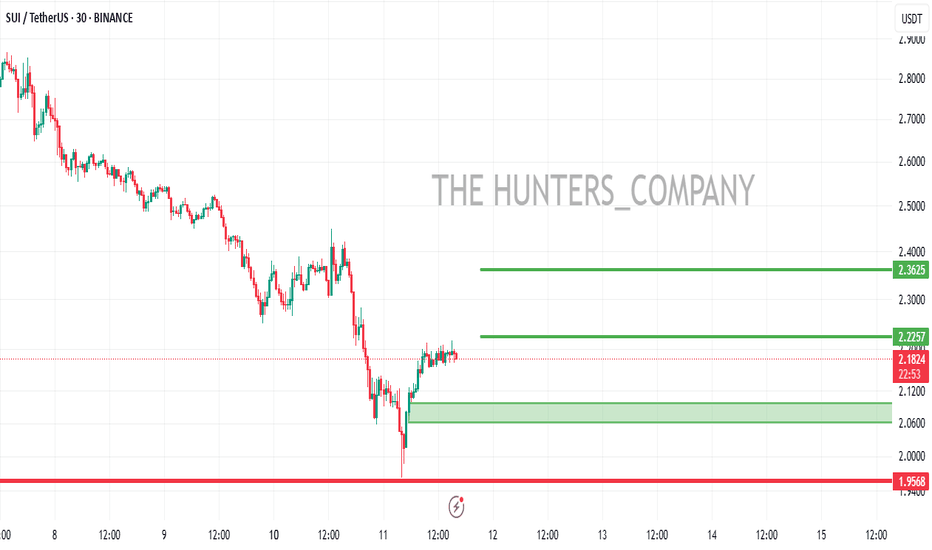

SUI/USDT 1H: Bullish Reversal Confirmed – Targeting $2.55?SUI/USDT 1H: Bullish Reversal Confirmed – Targeting $2.55?

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

Market Structure (Confidence Level: 8/10):

Bullish reversal confirmed after breaking $2.20 resistance with strong volume.

RSI shows hidden bullish divergence, supporting continued upside momentum.

Smart Money Analysis:

Major order block formed at $2.05-$2.10, confirming institutional accumulation.

Break of bearish market structure at $2.28, shifting momentum to the upside.

Clear accumulation pattern visible, indicating Smart Money positioning for a move higher.

Trade Setup:

Entry: $2.28 - $2.31 (current retest).

Targets:

T1: $2.45 (Fair Value Gap).

T2: $2.55 (major resistance).

Stop Loss: $2.05 (below recent swing low).

Risk Score:

8/10 – Strong risk-to-reward setup, but market volatility requires tight risk management.

Market Maker Activity:

Currently engineering liquidity build above $2.40, likely before the next leg up.

Volume profile supports bullish continuation, with Smart Money accumulating.

Recommendation:

Long positions remain favorable in the $2.28 - $2.31 range.

Monitor price action near $2.40 for signs of a breakout.

Use tight stops, given recent volatility, to protect against unexpected pullbacks.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

SUI - Short or Long? The Ultimate SUI Trade BlueprintHere’s an update to the analysis I did one month ago on February 10. Since then, SUI has continued to show its bearish tendencies—making lower highs and lower lows. After that dramatic 30% drop from a golden pocket short opportunity, the price started inching up on low volume. This weak rally suggests that while buyers are testing the ceiling, the overall trend remains down. That sets the stage for two possible plays: a short trade if the price reaches the resistance zone, and a long trade if it bounces off a strong support level.

1. Identification of Support and Resistance Zones

Resistance Zone (for the Short Trade):

Daily Resistance: ~2.7888

Point of Control (POC): Around 2.8035

Monthly Open: 2.83

0.618 Fibonacci Retracement: 2.8711

All these levels combine to create a robust resistance area where sellers are likely to step in.

Support Zone (for the Long Trade):

$2 Psychological Level: A key round number that attracts attention.

0.7 Fibonacci Retracement: Derived from the swing low of $0.4625 to the high of $5.3687, this places an important level at 1.9344 (just below $2).

Monthly Bullish Order Block: At 1.9137, indicating buying interest.

Fib Speed Fan (0.786): Points to support near the $2 mark.

POC: 2.0225

Anchored VWAP: Calculated from the deep low at $0.362, which again aligns around $2.

These multiple layers of confluence make the $2 area a strong support zone and an attractive entry point for a long trade.

2. Short Trade Setup

The Plan:

Building a short position gradually using a laddering strategy. With a $15,000 allocation from a $100,000 account, scale in at different levels to keep risk in check.

Scaling In (Entry Levels):

Entry # Entry Price % of Position Amount Invested ($)

1 2.6808 5% $750

2 2.7070 5% $750

3 2.7314 10% $1,500

4 2.7552 10% $1,500

5 2.7755 10% $1,500

6 2.7990 15% $2,250

7 2.8242 20% $3,000

8 2.8485 25% $3,750

Total: Avg. ~2.7924 $15,000

Stop Loss: Set at $3.07, limiting the risk to about $1,506 (roughly 10% of the trade allocation or 1.51% of the account).

Scaling Out (Exit Levels):

Exit Cover Price % of Position Amount Paid to Cover ($)

1 2.7925 5% $750.02

2 2.1715 5% $583.23

3 2.1365 10% $1,147.66

4 2.0981 20% $2,254.07

5 2.0630 20% $2,216.36

6 2.0257 10% $1,088.14

7 1.9930 15% $1,605.87

8 1.9625 15% $1,581.29

Outcome:

Total: Avg. ~2.09 $11,226.65

Net Profit: $15,000 (initial proceeds) – $11,226.65 (cost to cover) = $3,773.35

Profit % on Trade: +25.16%

Risk-to-Reward Ratio (R:R): Approximately 2.51

This laddering approach helps to secure profits at various levels while managing the risk effectively.

3. Long Trade Setup

The $2 support zone is a magnet, backed by multiple confluences. When SUI tests this area and shows signs of a rebound, it sets up a great opportunity to go long.

Key Support Details:

$2 Psychological Level: A well-watched price point.

0.7 Fibonacci Retracement: Places a key level at 1.9344 from the low ($0.4625) to the high ($5.3687).

Monthly Bullish Order Block: At 1.9137, adding to the support.

Fib Speed Fan (0.786): Confirms support near $2.

POC & Anchored VWAP: Both clustering around $2 (POC at 2.0225 and VWAP from a low of $0.362).

Trade Details:

Entry: Buy at $2.00

Target: Sell at $2.337 for an approximate 20%+ gain

Stop Loss: Set just below $1.80 to protect against further downside

Risk-to-Reward Ratio: About 2.44 or better

Wrapping It Up

In this dual-setup strategy, we're well-prepared for different market outcomes:

Short Trade: If SUI rallies into the tightly clustered resistance zone, scale into a short with defined entries, exits, and a stop loss that caps our risk at about 1.51% of the account. Exit ladder aims for an average cover price of around $2.09, netting a neat profit of approximately $3,773 (or +25.16% on the trade).

Long Trade: Conversely, if SUI finds strong footing at the confluence-rich $2 support zone, we can flip to a long position. Entering at $2.00, with a target of $2.337 and a stop loss below $1.80, gives an attractive risk-to-reward ratio of roughly 2.44.

This approach lets us capitalise on both sides of the market. Keep an eye on volume and price action. Happy trading! P.S. If you have any coin requests, feel free to share them in the comments. I will be selecting one or two for the next TA.

SUI’s Wild Ride – Finding the Next Long Trade SetupSUI had an incredible 2024, skyrocketing +1060% in just 154 days. The price peaked at the psychological $5 mark, where multiple rejections signaled a momentum shift. By the end of January 2025, the trend turned bearish, leading to a sharp correction.

Trend Shift & Momentum Analysis

I've been working on a new trend identifier indicator that helps spot trends, allowing traders to identify swing trade opportunities and manage their positions effectively. This indicator clearly highlighted the momentum shift, confirming the bearish turn and the sharp price drop that followed.

Key Support Zones & Confluences

Now that the bearish trend is in play, the focus is on identifying a solid long opportunity:

Point of Control (POC) from Previous Trading Range (~$2) – A major psychological level that many traders are watching

Trend-Based Fibonacci Extension (1:1) at $2.0373 – Adding confluence to this critical support area

Fib Speed Fan (0.75 Level) – Aligns with the $2 region, reinforcing support

Anchored VWAP (~$1.885) – From the 2023 lows, acting as an additional support zone

What’s Next for SUI?

The market is in search of a strong support level where bulls can regain control. Let’s see if we find support at the $3 mark. The $2 zone stands out as a prime area for a potential long entry, given the multiple technical confluences. If price reaches this level, we’ll be watching closely for confirmation of a bullish reversal.

Final Thoughts

SUI has had an extraordinary run, but corrections are natural in strong trends. The key now is to see where price stabilises and if the bulls can make a strong comeback. Time will tell how this plays out, but for now, $2 is a level to keep an eye on for a potential long setup.

BTW: I've just launched a FREE TradingView indicator – Multi Timeframe 8x MA Support & Resistance Zones. It helps visualise key support and resistance levels across different timeframes. Check it out and let me know your thoughts!

#SUI/USDT#SUI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.36

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the Moving Average 100

Entry price 2.44

First target 2.51

Second target 2.64

Third target 2.78

#SUI/USDT#SUI

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 2.40

We have a downtrend on the RSI indicator that is about to be broken and retested, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 2.48

First target 2.59

Second target 2.76

Third target 2.90

$SUI: SUI Blockchain’s Token – Poised for Growth or Overhyped?(1/9)

Good morning, crypto enthusiasts! ☀️ CRYPTOCAP:SUI : SUI Blockchain’s Token – Poised for Growth or Overhyped?

With SUI at $2.70 , is this Layer 1 blockchain’s token set to dominate the crypto market or just another flash in the pan? Let’s dive into the digital realm and find out! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Current Price: $ 2.70 as of Mar 7, 2025 💰

• Historical Context: Launched May 3, 2023, with significant growth in 2024 📏

• Sector Trend: Blockchain gaming and NFTs driving demand 🌟

It’s a hot commodity in the crypto space! ⚙️

(3/9) – MARKET POSITION 📈

• Market Cap: Approx $1.2B (based on 1B tokens) 🏆

• Operations: Layer 1 blockchain with focus on speed and scalability ⏰

• Trend: Partnerships with gaming studios, NFT platforms boosting adoption 🎯

Solid, with a clear path to utility and growth! 🚀

(4/9) – KEY DEVELOPMENTS 🔑

• Recent Partnerships: Collaborations with gaming firms like Mythical Games 🔄

• NFT Sales: Robust growth in NFT transactions on SUI blockchain 🌍

• Market Reaction: Positive sentiment post-launch and recent updates 📋

Thriving, with a focus on real-world applications! 💡

(5/9) – RISKS IN FOCUS ⚡

• Competition: Strong rivals like Solana, Avalanche in the L1 space 🔍

• Regulatory Challenges: Crypto regulations could impact growth 📉

• Volatility: Crypto market’s inherent swings affect price ❄️

Navigating these choppy waters is key! 🛑

(6/9) – SWOT: STRENGTHS 💪

• Performance: High-speed transactions, ideal for gaming and more 🥇

• Partnerships: Growing ecosystem with gaming and NFT projects 📊

• Scalability: Designed for mass adoption, per developers’ claims 🔧

Got the goods to stand out in the blockchain race! 🏦

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: New project, unproven in long-term stability 📉

• Opportunities: Expanding into metaverse, AI integration 📈

Can it scale and secure its position or get lost in the noise? 🤔

(8/9) –📢SUI at $2.70—your take? 🗳️

• Bullish: $5+ by end of 2025, gaming boom drives growth 🐂

• Neutral: Steady growth, risks balanced ⚖️

• Bearish: $0.50 by year-end, competition overtakes 🐻

Chime in below! 👇

(9/9) – FINAL TAKEAWAY 🎯

SUI’s at $2.70, with a promising future in blockchain gaming and NFTs. Volatility’s a given, but its strengths could lead to significant gains. DCA on dips, ride the wave! Gem or bust?

Sui: Mixed Signals With A Hard Chart (Bullish Later)I don't like it when there is too much empty space below the active candles, you what I mean? Below support here on the chart, there is just too much room for prices to move lower. But, when we are looking at a strong project things can be different but I still don't like it.

SUIUSDT. The level that worked as resistance in October 2024 is now working as support, March 2025. This is a good signal.

The action is still weak and there can be lower prices but, I bet there is some bullishness coming from the RSI and this indicator is what we will consider next.

The RSI bottomed 7-Feb. while SUIUSDT hit its lowest price 4-March. So we have a small bullish divergence, an early bullish signal.

The down-wave first bounced perfectly off 0.618 Fib. retracement, on a wick. Now there was a wick below this level but two close above. This is another positive signal but still early and still weak. So it is mixed.

It is possible that SUIUSDT can start to reverse, but the fact is that it is moving lower and there is now volume, yet, to support a bullish wave.

It will recover soon enough near support. It will recover very soon... That's for sure.

Allow for some swings but it won't be too long. The Cryptocurrency market as a whole will grow.

I am betting up.

Namaste.

SUIUSD: 1W MA50 holding. Excellent long term buy opportunity.SUI is bearish on its 1D technical outlook (RSI = 43.481, MACD = -0.255, ADX = 17.753) as it is on a decline since the early January top. This is technically the bearish wave of the cyclical Channel Up and the Jan top was its HH. This is so far a -58% decline that almost tested the 1W MA50. This is same kind of decline after the previous HH of late March 2024. The July break under the Channel Up was a market overreaction but now since we are in the final year of the Bull Cycle, it is very unlikely to see another one. Quite possibly, as long as the 1W MA50 holds, it is more probable to gradually initiate the 3rd bullish wave of the Channel Up. Aim for a similar +500% rise, TP = 12.000.

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

President Trump's World Liberty Financial partners with SUIPresident Trump's World Liberty Financial partners with SUI to launch a Strategic SUI Reserve a move that saw SUI surged 13% today with a speculated 100% surge in the short term should CRYPTOCAP:SUI break the $4 resistant zone, a 100% surge is inevitable.

The layer-1 blockchain platform designed to support the needs of global adoption by offering a secure, powerful, and scalable development platform had a great start of the year as it broke out surging to $5 early the start of the year.

Sui Price Live Data

The live Sui price today is $2.96 USD with a 24-hour trading volume of $1,481,325,553 USD. We update our SUI to USD price in real-time. Sui is up 18.74% in the last 24 hours, with a live market cap of $9,373,175,223 USD. It has a circulating supply of 3,169,845,047 SUI coins and a max. supply of 10,000,000,000 SUI coins.

Univers Of Signals | SUI👋 Welcome to Univers Of Signals Channel!

Let's analyze and review one of the most popular coins in the market, sui, and update our previous analysis and find new triggers

🌐 Bitcoin Overview

Before starting today's altcoin analysis, let's look at Bitcoin on the 1-hour timeframe. Since yesterday, Bitcoin experienced a correction, which was necessary for the market, and it pulled back to the 102135 range. The next trigger for a long position will be a breakout above 104714.

Yesterday's correction, coupled with an increase in Bitcoin dominance, caused noticeable declines in some altcoins. This highlights the importance of monitoring BTC pairs in your checklist these days.

📊 Weekly Timeframe

In the weekly time frame, it is one of the coins that is in good condition, it is really in the market and is still fluctuating on the high support levels.

After hitting 5.24, we made a new ceiling or ATH, and after that, due to recent market news, we experienced some drops, and this has also caused the price correction of this coin.

For re-buying, if we make a good support candle at this level 2.4, it will be a good trigger and the main trend will start again after we break 5.24. Also, after breaking 1.77, we can temporarily exit this coin and cash out!

📈 Daily Timeframe

In the daily time frame, it has been in relatively good conditions compared to other coins in the market and has experienced fewer declines and still has a lot of support to lose!

After breaking the 1.0333 level, which was our trigger spot, we made our purchase and experienced a move after its failure with the entry of momentum and recorded a new ceiling with this event!

Along with this trend, we can draw our Fibonacci levels, which are currently involved in the important level of 0.382, and after it rises and breaks the ceiling of 5.24, we can experience a powerful move!

If this level is broken, we can also hit the support levels of 1.7702 and 1.3859 and we need to form a structure to buy now, but after breaking the trend line and the 3.65 trigger, it can be a good point! For selling, I will continue to hold for now!

📝 Final Thoughts

Stay calm, trade wisely, and let's capture the market's best opportunities!

This analysis reflects our opinions and is not financial advice.

Share your thoughts in the comments, and don’t forget to share this analysis with your friends! ❤️

SUI looks Bearish (12H)It seems that SUI is completing a large structure.

A diametric pattern appears to be forming at the end of wave G.

By maintaining the red descending trendline, it could drop toward the two specified TP levels marked on the chart.

Note that TP 1 is a strong support level.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You