SUI ready to provide structure? Be prepared for downside.SUI is at a good level, to get some support. There are further levels to get support below. However, a pivot structure can be built here. Momentum has room to get further oversold, but some downsides could still happen. DCA is the best strategy.

Full TA: Link in the BIO

Suiusdt

CFXUSDT UPDATECFXUSDT is a cryptocurrency trading at $0.0788, with a target price of $0.1400. This represents a potential gain of over 80%. The technical pattern observed is a Bullish Falling Wedge, indicating a possible trend reversal. This pattern suggests that the downward trend may be coming to an end. A breakout from the wedge could lead to a significant upward movement in price. The Bullish Falling Wedge is a positive indicator, signaling a potential price surge. Investors are showing optimism about CFXUSDT's future performance. The current price may present a buying opportunity. Reaching the target price would result in substantial returns for investors. CFXUSDT is positioned for a potential breakout and significant gains.

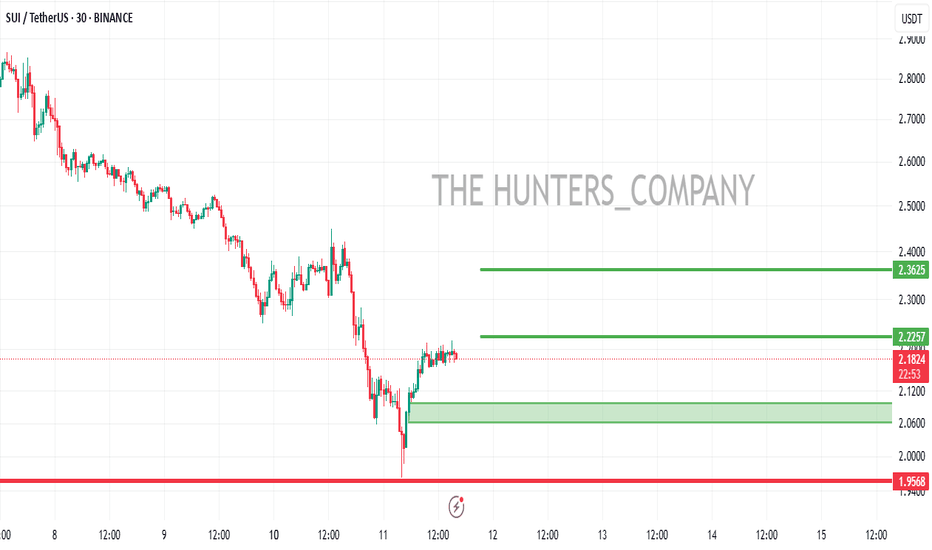

SUI/USDT:BUY LIMITHello friends

Due to the heavy price drop, it can be seen that the buyers have supported the price well at the specified support and by hitting higher ceilings and floors, they are giving us a sign that they have good strength. Now we can buy in steps with capital and risk management and move to the specified targets.

Don't forget to save profit on each target.

*Trade safely with us*

SuiUsdt Trade setup 12-15% upside ??recent impluse momentum with a formation of HL on 1h could be a sign of trend change

trade entry at2.300 to 2.350 demand zone further up at 2.5 can be the potential pullback area and could then face resistance at 2.65

and considering the down side risk at 2.200 can be the stop loss as it is recent low that bulls will try to defend

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame and is expected to continue lower.

We have a trend to stabilize below the 100 moving average once again.

We have a downtrend on the RSI indicator, supporting the upward move with a break above it.

We have a resistance area at the upper limit of the channel at 2.55.

Entry price: 2.52

First target: 2.40

Second target: 2.32

Third target: 2.20

SUI - Falling Wedge - Confirmed BreakoutBINANCE:SUIUSDT (1D CHART) Technical Analysis Update

SUI is currently trading at $2.77 and showing overall bullish sentiment

Price has formed nice falling wedge and we see a clear breakout from the falling wedge pattern. I'm expecting this trend to hold and read the resistance level around $5.3

Entry level: $2.7

Stop Loss Level: $1.8

TakeProfit 1: $3.1

TakeProfit 2: $4

TakeProfit 3: $5.3

Max Leverage: 2x

Position Size: 1% of capital

Remember to set your stop loss.

Follow our TradingView account for more technical analysis updates. | Like, share, and comment your thoughts.

Cheers

GreenCrypto

SUI ANALYSIS🚀#SUI Analysis :

🔮As we can see in the chart of #SUI that there is a formation of "Falling Wedge Pattern". In a daily timeframe #SUI broke out the pattern. Expecting a bullish move in few days if #SUI retest the levels

⚡️What to do ?

👀Keep an eye on #SUI price action. We can trade according to the chart and make some profits⚡️⚡️

#SUI #Cryptocurrency #TechnicalAnalysis #DYOR

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading towards a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.20.

We are experiencing a downtrend on the RSI indicator that is about to be broken and retested, supporting the upward trend.

We are heading towards stability above the 100 Moving Average.

Entry price: 2.26

First target: 2.32

Second target: 2.40

Third target: 2.47

SUI/USDTHello friends

You can see that after the price fell in the specified support area, the price was supported by buyers and caused the resistance to break, and now, when the price returns to the specified ranges, you can buy in steps and move with it to the specified targets, of course, with capital and risk management...

*Trade safely with us*

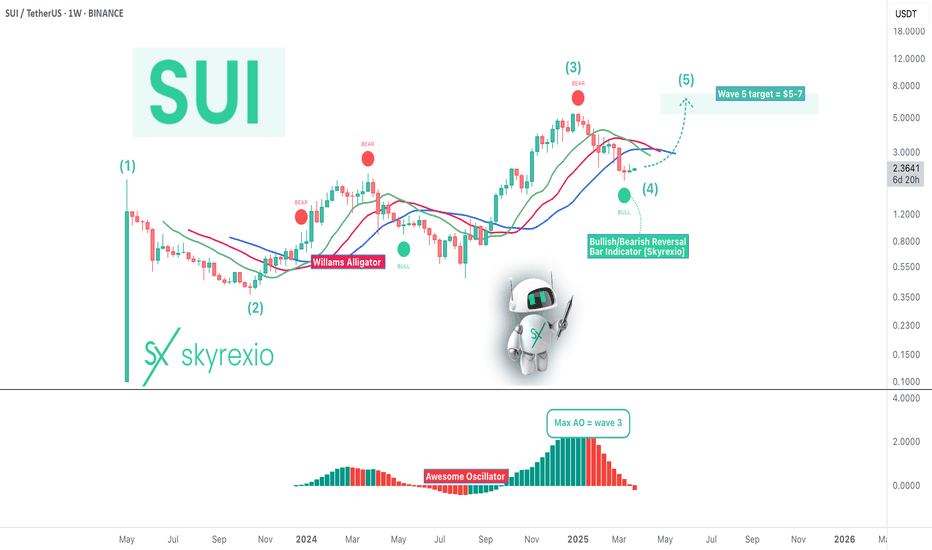

SUI - Last Growth Ahead Before Bear MarketHello, Skyrexians!

It's time to update BINANCE:SUIUSDT idea. Last time we pointed out that wave 3 has been finished and correction incoming. Now we are seeing this correction. Today we got the indicating that correction is over and we can see the great growth soon.

Let's look at the weekly chart. Here we can see the Elliott waves structure. Wave 3 has been finished at the recent top. Awesome oscillator gives us the hint that bull run will continue, but now that much because we have only wave 5 ahead which has a target $5-7 in the next 3-6 months. The strong confirmation that correction is over is the green dot on the Bullish/Bearish Reversal Bar Indicator below the alligator's lines.

Best regards,

Skyrexio Team

___________________________________________________________

Please, boost this article and subscribe our page if you like analysis!

Breaking: $SUI Dips 8% Today Down to $2.28Sui the layer 2 layer-blockchain platform designed to support the needs of global adoption by offering a secure, powerful, and scalable development platform, leveraging a novel object-centric data model and the secure Move programming language to address inefficiencies prevalent in existing blockchain architectures has dip 8% today amidst a broader market condition.

As of the time of writing, CRYPTOCAP:SUI is down 4.2% trading below key Moving Averages (MA) with the Relative Strength Index (RSI) currently oversold at 39 hinting at a move breaking below the support point to the 1-month low axis.

Sui Price Live Data

The live Sui price today is $2.25 USD with a 24-hour trading volume of $627,615,661 USD. Sui is down 7.77% in the last 24 hours. The current CoinMarketCap ranking is #18, with a live market cap of $7,119,977,067 USD. It has a circulating supply of 3,169,845,047 SUI coins and a max. supply of 10,000,000,000 SUI coins.

SUIUSDT: Breakout + Retest = Lift-Off Soon!BINANCE:SUIUSDT has shown impressive strength, bouncing back with solid volume after hitting a major weekly support level. This bullish reaction suggests a potential move toward higher highs, making it an attractive opportunity for long-term investors. Entering a position in the spot market and holding for the long term could yield significant gains.

On the 4-hour chart, SUI is forming an ascending triangle pattern. After breaking out, it has successfully retraced and is now gearing up for a strong swing move. Traders can consider entering at this level and look to book profits as the price climbs higher. As always, managing risk with a proper stop loss is crucial.

BINANCE:SUIUSDT Currently trading at $2.4

Buy level : Above $2.4

Stop loss : Below $2.15

Target : $3.5

Max leverage 3x

Always keep stop loss

Follow Our Tradingview Account for More Technical Analysis Updates, | Like, Share and Comment Your thoughts

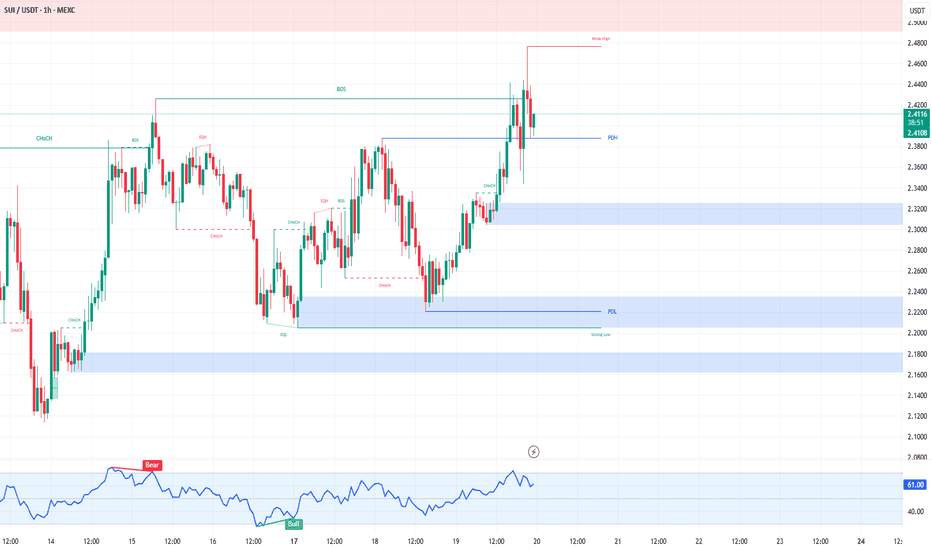

SUI/USDT 1H: Bullish Breakout Confirmed – Can $2.65 Be ReachedSUI/USDT 1H: Bullish Breakout Confirmed – Can $2.65 Be Reached?

Current Market Conditions (Confidence: 8/10):

Price at $2.40, showing a strong breakout from the accumulation zone.

RSI at 60.41, indicating bullish momentum with room to run higher.

Clean break above $2.35 resistance with strong volume confirms bullish intent.

Hidden bullish divergence forming on RSI, reinforcing continuation potential.

LONG Trade Setup:

Entry: $2.38 - $2.42 zone.

Targets:

T1: $2.50 (first resistance).

T2: $2.65 (major liquidity zone).

Stop Loss: $2.30 (below recent support).

Risk Score:

7/10 – Favorable risk-to-reward, but watch for temporary resistance at $2.50.

Market Maker Activity:

Accumulation is evident with minimal selling pressure above $2.35.

The clean break of resistance suggests a continuation of the uptrend.

Strong support is established at $2.30, with clear order blocks reinforcing demand.

Bull flag pattern forming, signaling an imminent move higher.

Recommendation:

Long positions remain favorable in the $2.38 - $2.42 range.

Monitor price action at $2.50, as this level may provide temporary resistance.

If volume continues to increase, expect a move toward $2.65.

🚀 Follow me on TradingView if you respect our charts! 📈 Daily updates!

SUI/USDTHello friends

Given that the price has reached a good support and buyers have entered and supported the price, you can now buy in stages at the specified levels with capital and risk management and move towards the specified goals.

If you would like to be with us in the Alt Season, send us a message.

*Trade safely with us*

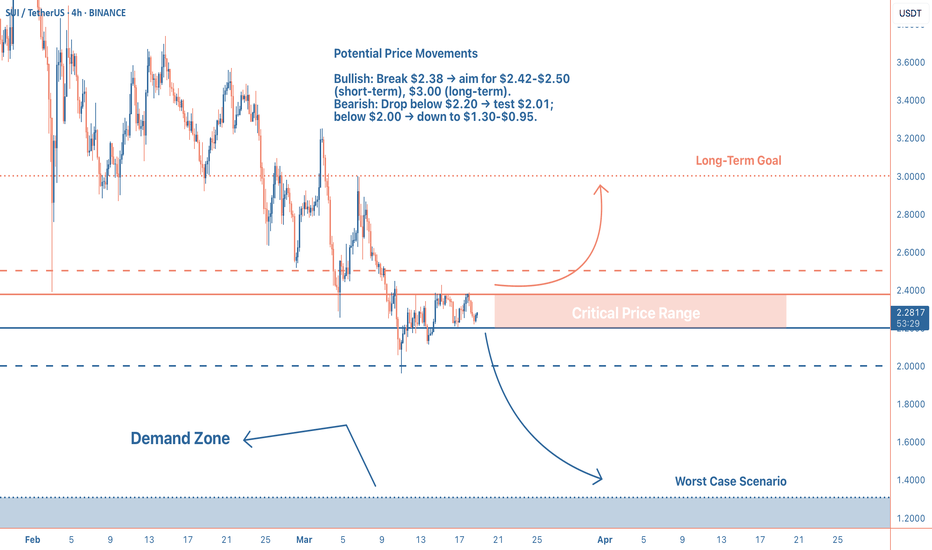

SUI: Current SituationYou asked, and we delivered:

SUI is trading at $2.2616, navigating a volatile crypto market that’s down 4.4% in total market cap over the last 24 hours. As a Layer 1 blockchain, SUI stands out with its object-centric data model and Move programming language, emphasizing scalability and user accessibility. Its token serves multiple roles: staking, gas fees, utility, and governance. With a market cap of $7.51 billion and a circulating supply of 3.17 billion SUI (out of 10 billion), SUI ranks between #19 and #23 among cryptocurrencies. Recent trading volume is robust, ranging from $578.34 million to $742.90 million in 24 hours, signaling strong market activity. The price is well below its all-time high of $5.35 (January 4, 2025), with recent lows at $2.01 and highs at $2.42. Sentiment is mixed: some traders eye a breakout from a descending channel and partnerships as bullish, while others flag bearish divergence and a broken macro structure, hinting at downside risks to $1.30-$0.95.

Technical Indicators and Key Levels

Short-Term (1-Hour and Daily Charts):

Support: $2.20 (immediate), $2.01 (cycle low)

Resistance: $2.38 (24-hour high), $2.42 (cycle high), $2.50

Indicators: RSI ~50 (neutral), MACD bearish but hinting at reversal. A hold above $2.20 could spark a rally to $2.38-$2.50.

Long-Term (Weekly Chart):

Support: $2.00, $1.30-$0.95

Resistance: $2.50, $3.00, $5.35 (ATH)

The 200-day MA is falling, reflecting long-term pressure, but holding $2.00 is key for bulls.

Potential Scenarios

Bullish Case: Hold $2.20, break $2.38 with volume → target $2.42-$2.50 (short-term), $3.00 (long-term).

Bearish Case: Drop below $2.20 → test $2.01; below $2.00 risks $1.30-$0.95.

Volume is critical—watch for spikes to confirm moves.

Broader Context and Tips

SUI’s fundamentals, scalability, user-friendly features like zkLogin, and ecosystem growth, offer long-term promise, but short-term risks loom. External factors like regulatory shifts or macro events (e.g., US inflation data) could sway its path. Traders should focus on $2.20, a hold keeps bulls in play, a break signals caution. Use tight stops (e.g., below $2.20 for longs) and stay alert for news on partnerships or adoption. Long-term, $2.00 is a key floor for accumulation.

$SUI - Breaking of the IceSUI is still trending downward as its price continues to be rejected at the VWAP.

On the daily timeframe, we can expect the price to retest its daily demand zone around $1.70 and $1.60.

We are looking to enter a long position at this level, targeting the equilibrium around $2.80 to $3 (to break through resistance, or " break the ice ").

If we encounter any rejection at that level, we’ll then look to short, targeting $0.80.

This thesis would be invalidated by a clean reclaim of $2.50.

GMXUSDT UPDATEGMXUSDT is a cryptocurrency trading at $15.52. Its target price is $30.00, indicating a potential 90%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about GMXUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. GMXUSDT is poised for a potential breakout and substantial gains.

FTTUSDT UPDATEFTTUSDT is a cryptocurrency trading at $1.3195. Its target price is $3.0000, indicating a potential 100%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about FTTUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. FTTUSDT is poised for a potential breakout and substantial gains.

LUNAUSDT UPDATELUNAUSDT is a cryptocurrency trading at $0.1946. Its target price is $0.3500, indicating a potential 85%+ gain. The pattern is a Bullish Falling Wedge, a reversal pattern signaling a trend change. This pattern suggests the downward trend may be ending. A breakout from the wedge could lead to a strong upward move. The Bullish Falling Wedge is a positive signal, indicating a potential price surge. Investors are optimistic about LUNAUSDT's future performance. The current price may be a buying opportunity. Reaching the target price would result in significant returns. LUNAUSDT is poised for a potential breakout and substantial gains.