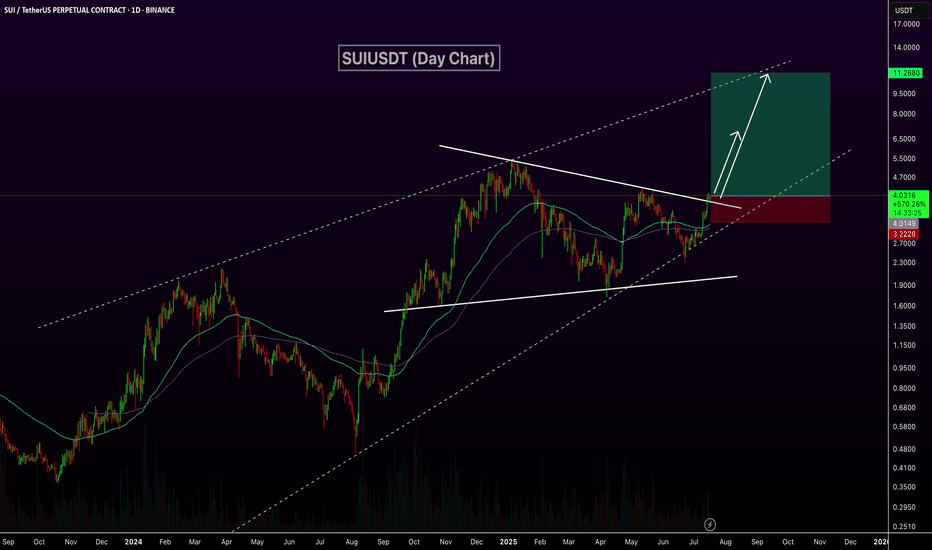

SUIUSDT Cup & Handle Breakout SUI has formed a classic Cup and Handle pattern on the daily chart and has now successfully broken above the neckline resistance around $4.30. This breakout could trigger a strong bullish continuation if volume sustains and retests hold.

Key Points:

Pattern: Cup and Handle

Breakout Level: ~$4.30 (neck resistance)

Potential Upside Target: $5.50 – $6.00+ based on pattern projection

Support Zone: $3.50

Confirmation: Sustained volume and close above neckline

Cheers

Hexa

Suiusdtperp

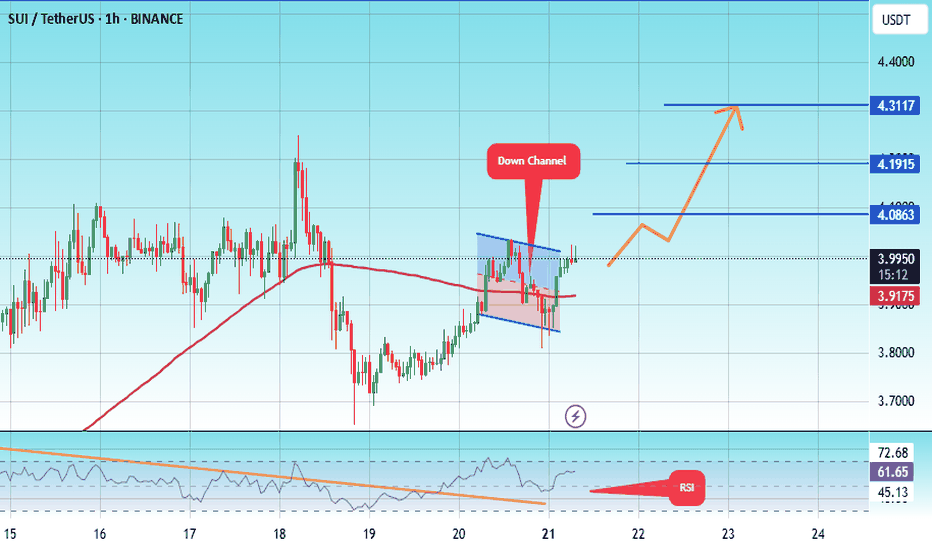

#SUI/USDT potentail to 4.30 $#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking strongly upwards and retesting it.

We have support from the lower boundary of the descending channel, at 3.85.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 3.80, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the Moving Average 100.

Entry price: 3.99.

First target: 4.08.

Second target: 4.19.

Third target: 4.30.

Don't forget a simple thing: ease and capital.

When you reach your first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

SUI/USDT Massive Cup and Handle Pattern Unfolding Is a Breakout?🧠 Technical Overview:

The daily chart of SUI/USDT showcases a textbook formation of the Cup and Handle pattern — a powerful bullish continuation signal that often precedes explosive upside moves.

The “Cup” took shape between January and July 2025, reflecting a deep rounding bottom. This indicates a long-term accumulation phase where bears gradually lose control.

The “Handle” is currently forming as a downward-sloping consolidation channel, often known as a bullish flag, which is typically the final pause before a breakout.

🔍 Key Technical Levels:

Current Price: $3.9661

Support Zone: $3.96

Major Resistance Levels to Watch:

$4.10 (handle resistance & breakout trigger)

$4.40 (local structural high)

$4.77 (previous high & fib extension zone)

$5.00 (psychological level)

$5.36 (measured move target from cup breakout)

---

🟢 Bullish Scenario: Breakout Incoming

If price breaks and closes above the handle resistance around $4.10, backed by increasing volume:

This confirms the Cup and Handle breakout.

Expect a rapid move toward $4.77 – $5.36 in the short to mid term.

The height of the cup projected upward gives a target of approximately +35% gain from breakout point.

🔔 Watch for:

Bullish engulfing candles

Volume spike during breakout

Break of upper trendline from the handle

---

🔴 Bearish Scenario: Breakdown Risk

If the price fails to hold the $3.96 support and breaks down from the handle channel:

Price may retest lower support zones near $3.60 or even $3.20

However, as long as the cup’s base at ~$2.50 holds, the macro bullish structure remains valid.

⚠️ Invalidation: A daily close below $3.60 would invalidate the short-term bullish setup.

---

📊 Pattern Psychology:

The Cup and Handle pattern reflects investor accumulation, shakeout, and renewed confidence. This is often seen in strong uptrending markets — and the current structure suggests that bulls are quietly preparing for a potential breakout.

---

📅 Timing Outlook:

Handle formations typically last between 1–3 weeks. If this timeline holds, a breakout could occur before mid-August 2025.

---

✅ Conclusion:

The technical setup for SUI/USDT is extremely compelling. With a strong Cup and Handle pattern nearing completion, and key resistance just overhead, traders should prepare for potential breakout conditions. A confirmed move above $4.10 could trigger a bullish wave toward $5.00+.

📌 Set alerts. Manage risk. And don’t ignore the volume.

#SUI #SUIUSDT #CryptoBreakout #CupAndHandle #BullishSetup #CryptoChartPatterns #AltcoinAnalysis #TechnicalAnalysis #BreakoutTrade

SUIUSDT – A Setup Worth WatchingThe blue box isn't just a zone, it’s a place where value and timing intersect.

🟦 Context

If price enters this area with control:

It aligns with past volume cluster support

A clean 1H break and confirmation may unlock high R:R potential

Structure + patience = confidence

📌 Execution Plan

🧭 No need to predict.

Just observe:

✅ Does the blue box hold with absorption or slowdown?

✅ Does CDV remain constructive?

✅ Does the 1H chart break and confirm direction?

If yes, there’s asymmetry on your side.

And that’s when smart trades happen.

"It’s not about being early. It’s about being right when it matters."

— And that starts with a prepared eye and a defined plan.

📌I keep my charts clean and simple because I believe clarity leads to better decisions.

📌My approach is built on years of experience and a solid track record. I don’t claim to know it all but I’m confident in my ability to spot high-probability setups.

📌If you would like to learn how to use the heatmap, cumulative volume delta and volume footprint techniques that I use below to determine very accurate demand regions, you can send me a private message. I help anyone who wants it completely free of charge.

🔑I have a long list of my proven technique below:

🎯 ZENUSDT.P: Patience & Profitability | %230 Reaction from the Sniper Entry

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT.P: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

🐢 TURBOUSDT: Buy Zones and Buyer Presence

🌍 ICPUSDT.P: Massive Upside Potential | Check the Trade Update For Seeing Results

🟠 IDEXUSDT: Spot Buy Area | %26 Profit if You Trade with MSB

📌 USUALUSDT: Buyers Are Active + %70 Profit in Total

🌟 FORTHUSDT: Sniper Entry +%26 Reaction

🐳 QKCUSDT: Sniper Entry +%57 Reaction

📊 BTC.D: Retest of Key Area Highly Likely

📊 XNOUSDT %80 Reaction with a Simple Blue Box!

📊 BELUSDT Amazing %120 Reaction!

📊 Simple Red Box, Extraordinary Results

📊 TIAUSDT | Still No Buyers—Maintaining a Bearish Outlook

📊 OGNUSDT | One of Today’s Highest Volume Gainers – +32.44%

📊 TRXUSDT - I Do My Thing Again

📊 FLOKIUSDT - +%100 From Blue Box!

📊 SFP/USDT - Perfect Entry %80 Profit!

📊 AAVEUSDT - WE DID IT AGAIN!

I stopped adding to the list because it's kinda tiring to add 5-10 charts in every move but you can check my profile and see that it goes on..

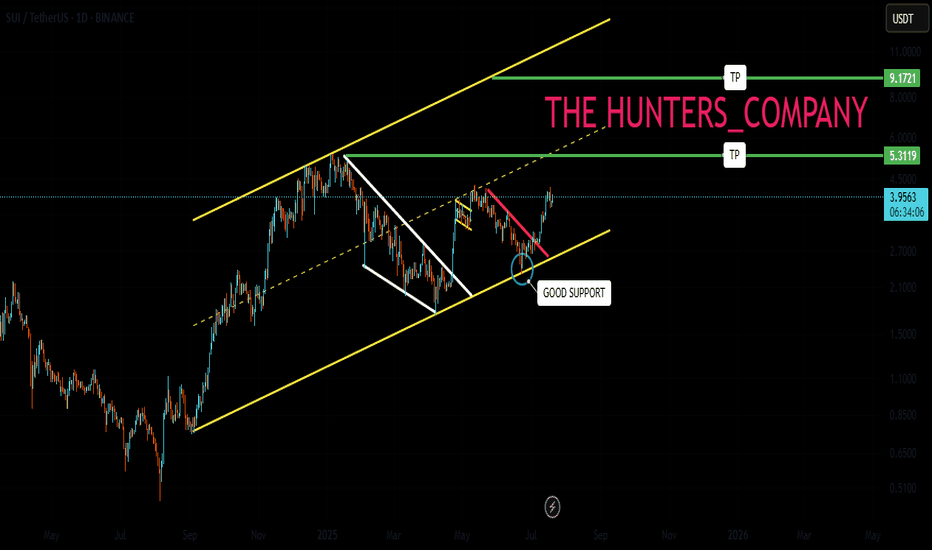

SUI : HODL BASKETHello friends🙌

🔊We have come to introduce a signal that can be a good option for your investment portfolio.

Given that the price is in the ascending channel and has good support from buyers, it is expected that this time the price will break the middle line of the channel and move to the ceiling of the channel and succeed in reaching ATH...

Don't forget about capital and risk management.⚠

🔥Follow us for more signals🔥

*Trade safely with us*

SUIUSDT Breaks Out of Triangle – Eyes on $10BINANCE:SUIUSDT daily chart has confirmed a breakout above a symmetric triangle resistance line within a larger ascending channel, signaling strong bullish momentum. Price has reclaimed the 100 and 200 EMAs, and the breakout is backed by rising volume. This setup opens the door for a potential rally toward the $10.00 level, with price currently holding above key structure support around $4.00. As long as this level holds, continuation toward the upper trendline remains likely. CRYPTOCAP:SUI

Will key support be held or broken today?Hello friends

According to the complete analysis we conducted on this currency, we concluded that the price correction can continue with the failure of the specified support and go to lower supports, but if buyers support the price in the support area, it can have a good rise.

Note that with capital and risk management, you can buy in steps in the specified support areas and move with it to the specified targets.

*Trade safely with us*

#SUI/USDT ready to surge 13% toward $3.72 target?#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We have a bounce from the lower boundary of the descending channel. This support is at 3.30.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

There is a major support area in green at 3.20, which represents a strong basis for the upside.

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

We have a trend to hold above the 100 Moving Average.

Entry price: 3.44

First target: 3.53

Second target: 3.62

Third target: 3.72

Don't forget a simple thing: ease and capital.

When you reach the first target, save some money and then change your stop-loss order to an entry order.

For inquiries, please leave a comment.

Thank you.

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 2.90.

We are experiencing a downtrend on the RSI indicator that is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 3.00

First target: 3.07

Second target: 3.15

Third target: 3.24

Will suffering be broken today?Hello friends

Given the good price rise, you can see that the price has entered a range, which indicates that it is gathering strength for its next move.

Now we can buy in steps with risk and capital management and move with it to the specified targets.

*Trade safely with us*

SUIUSDT Forming Falling WedgeSUIUSDT is currently showing a very strong bullish technical setup as it forms a classic falling wedge pattern, which is widely known in crypto trading for its high probability of signaling a reversal to the upside. The pattern, combined with increasing volume, is suggesting that buyers are stepping in to absorb the remaining supply. With an expecting gain projection of 90% to 100%+, this crypto pair is gaining a lot of attention from traders looking for high-reward opportunities in the altcoin market.

SUI is an emerging project that has been gaining momentum thanks to its innovative technology and scalable blockchain infrastructure. The community around SUI continues to grow, fueled by new partnerships, ecosystem development, and increased investor confidence. This fundamental growth aligns well with the technical breakout setup, making the current price action even more interesting for swing traders and long-term holders alike.

The support zone that has formed around the base of the wedge pattern appears to be holding firmly, providing a solid foundation for a potential rally. If SUIUSDT manages to confirm its breakout and attract further buying volume, traders could see a strong move toward the next resistance levels. Monitoring on-chain activity, sentiment, and overall market conditions will be key to navigating this move efficiently.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is You opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

#SUI Ready to Grow up?#SUI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator that supports the upward break.

We have a support area at the lower boundary of the channel at 2.83, acting as strong support from which the price can rebound.

We have a major support area in green that pushed the price higher at 2.75.

Entry price: 2.87.

First target: 2.95.

Second target: 3.04.

Third target: 3.14.

To manage risk, don't forget stop loss and capital management.

When you reach the first target, save some profits and then change your stop order to an entry order.

For inquiries, please comment.

Thank you.

Sweep. Reaction. Shift. That’s not noise — that’s the model inBINANCE:SUIUSDT just tapped the lower boundary of its STB 5M, and the market responded instantly.

This wasn’t support. This was engineered liquidity — and it triggered precisely where Smart Money waits.

Here’s the structure:

Price ran the range low and tagged the STB, aligning with 0.618 at 3.1833

This reaction builds into a reclaim of the 1H OB — the same inefficiency that broke structure last time

Next draw is the 0.382 retracement at 3.2631, then 3.3124 — both short-term targets

If volume and structure align, the full reprice to 3.3922 becomes the higher-timeframe objective

Anything below 3.1265 breaks the current long bias — invalidation is clear.

Execution map:

Longs are valid as long as price holds above 3.183

TP1: 3.2631

TP2: 3.3124

Full target: 3.3922

Invalidation: Close below 3.1265

Price isn’t turning because of hope. It’s rotating because it fulfilled its algorithmic sweep.

More setups like this — clean, intentional, and early — are in the profile description.

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 3.10.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 3.30

First target: 3.34

Second target: 3.57

Third target: 3.76

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading toward a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 3.10.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are heading toward stability above the 100 Moving Average.

Entry price: 3.30

First target: 3.34

Second target: 3.57

Third target: 3.76

#SUI/USDT#SUI

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is heading for a strong breakout and retest.

We are experiencing a rebound from the lower boundary of the descending channel, which is support at 3.40.

We are experiencing a downtrend on the RSI indicator, which is about to break and retest, supporting the upward trend.

We are looking for stability above the 100 Moving Average.

Entry price: 3.70

First target: 3.81

Second target: 3.91

Third target: 4.09

SUI📈 SUI/USDT 4H Analysis

SUI is moving strong in an ascending channel, now testing key resistance at 3.71 🚀

🟢 Support Levels:

🔹 3.47 – recent pullback

🔹 3.15 – channel bottom

🔴 Resistance Levels:

🔹 3.71 – under pressure

🔹 4.27 – next target

🔹 4.64 – strong resistance

🔹 4.83 – major zone

📊 Bulls holding the ground as long as the trend stays intact!

#SUI #SUIUSD #SUIUSDT #Analysis #Eddy#SUI #SUIUSD #SUIUSDT #Analysis #Eddy

As the chart shows, the coin has a choch & an intact, high-potential daily order block inside weekly order block that needs to be mitigation.

I have identified the important supply and demand zones of the higher timeframe for you.

This analysis is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this analysis to enter the trade.

Don't forget about risk and capital management.

The responsibility for the transaction is yours and I have no responsibility for your failure to comply with your risk and capital management.

💬 Note: Important liquidity is marked on the chart. Be careful of liquidity hunting. In my opinion, the important entry point for buying spot and long futures is at 2.1693$, and it will most likely be a sniper entry. The first target from the specified point will be $5.5 and the second target will be $8.

Be successful and profitable.