Supply_and_demand

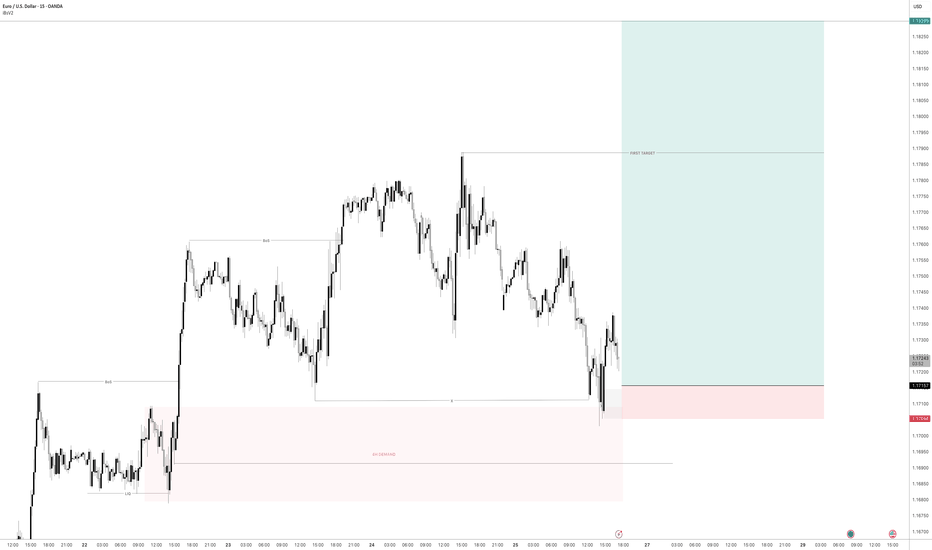

SILVER Analysis - Can buyers push toward 4,100$?TRADENATION:XAGUSD is trading within a clear ascending channel, with price action consistently respecting both the upper and lower boundaries. The recent bullish momentum indicates that buyers are in control, suggesting there's chances for potential continuation on the upside.

The price has recently broken above a key resistance zone and now came back for a retest. If this level holds as support, it would reinforce the bullish structure and increase the likelihood of a move toward the 4,100 target, which aligns with the channel’s upper boundary.

As long as the price remains above this support zone, the bullish outlook stays intact. However, a failure to hold above this level could invalidate the bullish scenario and increase the likelihood of a deeper pullback.

Remember, always confirm your setups and use proper risk management.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

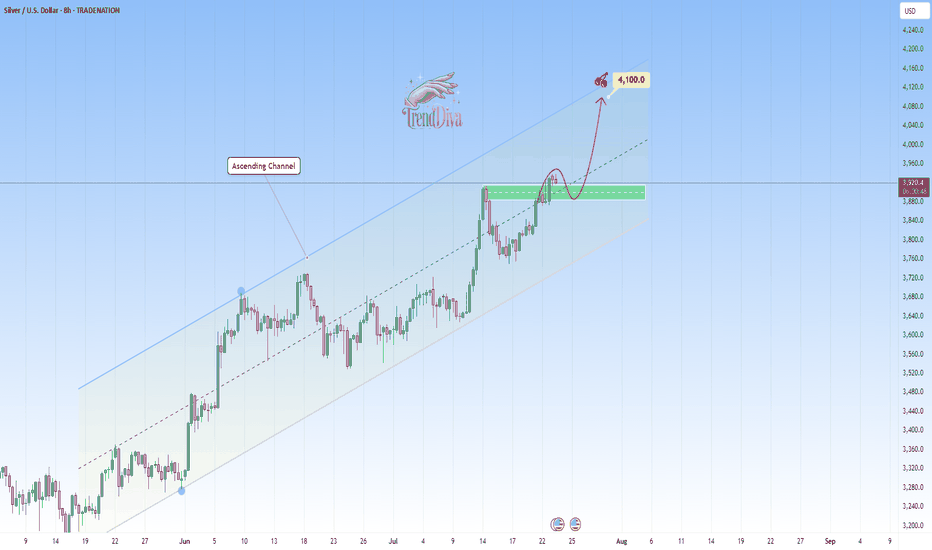

"XAU/USD Hits Major Demand – Is a Relief Rally Brewing?"🟡 XAU/USD (Gold) – Demand Zone Rejection in Play | Bullish Correction Ahead?

Timeframe: 30-Minute | Date: July 25, 2025

Created by: AllyPipsExpert

Indicators: Ichimoku Cloud, BOS (Break of Structure), Dynamic S/R, Trendlines

---

🔍 Technical Analysis & Key Insights:

🔸 1. Market Recap – Distribution & Downtrend Confirmation:

After the Break of Structure (BOS) near 3385, gold confirmed a bearish reversal following the distribution phase at the top resistance zone around 3445–3460.

Bearish momentum was sustained by a descending trendline, paired with a bearish Kumo (Ichimoku cloud) crossover.

🔸 2. Major Zone Tagged – Key Demand Area Tested:

Price has now reached the critical demand block at 3320–3340, a zone that previously initiated bullish impulse on July 18–19.

The current bullish projection (in blue) reflects potential short-term recovery or correction phase, following oversold conditions and historical support strength.

🔸 3. Bullish Reversal Potential – Short-Term Retracement?

The blue arrow reflects a likely bullish retracement toward 3360–3380, aligning with trendline retest and potential Kumo rejection.

Expect sellers to re-enter if price retests former BOS/imbalance zone, creating scalp or swing sell setups on confirmation.

---

🔧 Confluences & Technical Highlights:

Confluence Point Description

Demand Zone Strong previous accumulation at 3320–3340

BOS Retest Area Key liquidity level now acting as resistance

Ichimoku Cloud Price below cloud = bearish bias maintained

Descending Trendline Reinforces bearish structure unless broken

Price Action Rejection wick at demand + potential short squeeze

---

🎯 Trade Outlook:

🧭 Bias: Short-Term Bullish Rebound → Long-Term Bearish Continuation

🟩 Support: 3320 – 3340

🟥 Resistance: 3360 – 3385 (BOS & Trendline zone)

🔁 Scenario: Bounce → Retest → Continuation lower (unless breakout confirmed)

---

📘 Why This Chart Could Be Featured:

✅ Multi-layered Analysis: BOS, zones, cloud, price action, and psychological zones used together.

✅ Forward-Looking: Projects the next logical market reaction instead of just explaining the past.

✅ Clean, Structured, Educational: Layout and visuals guide the viewer through logical trade steps.

✅ Value-Packed: Provides actionable levels and flexible scenarios — helpful to traders of all levels.

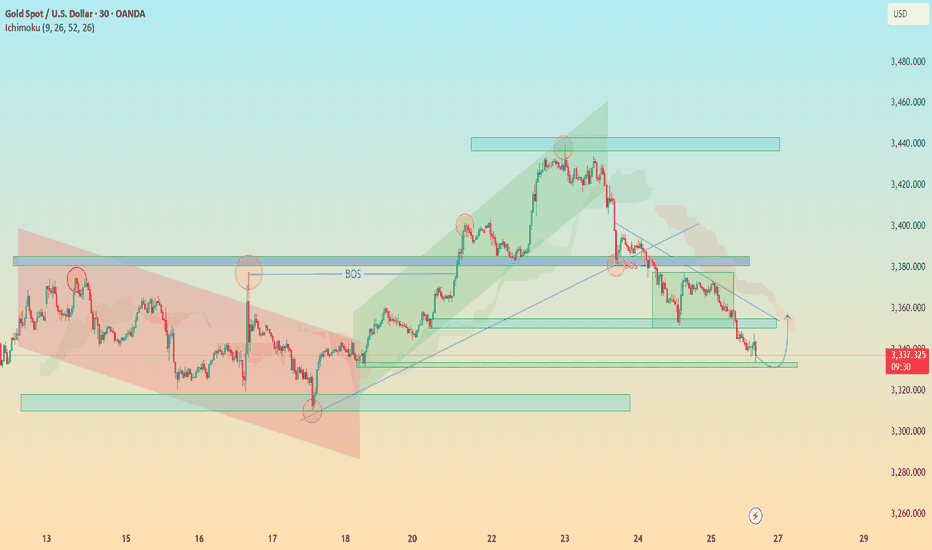

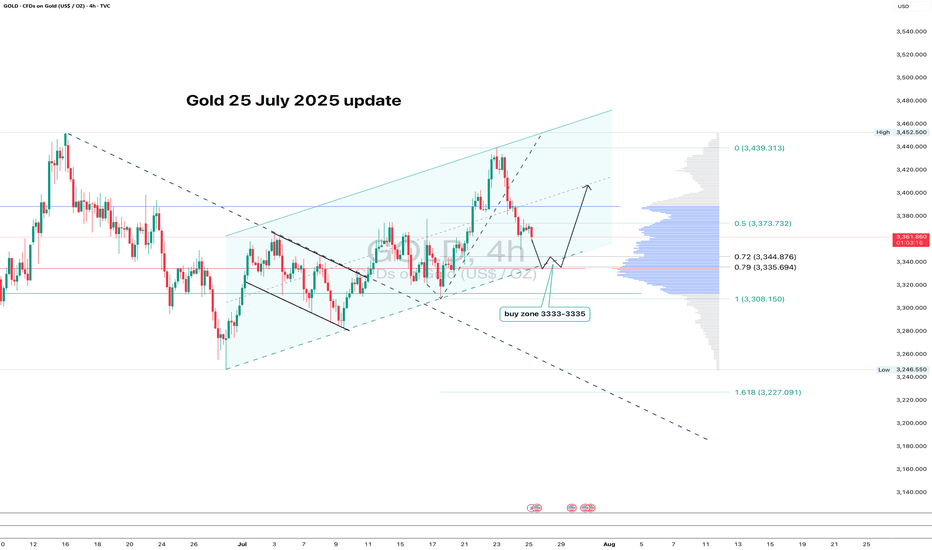

GOLD: clean pullback - now let’s see if support holdsGold continues to trade within an ascending channel on the 4H chart. After a local high, the price pulled back and is now approaching the key zone at 3333–3335. This area lines up with the 0.79 Fib retracement, the lower channel boundary, and a major volume cluster — a classic confluence zone.

If buyers show up here and we get a bullish reversal candle, this becomes a valid long setup with a tight stop just below the level. First target is 3373 (0.5 Fib), followed by a potential retest of the high near 3439.

The structure remains intact, the pullback is orderly, and volume supports the move. As long as the channel holds - the bias stays bullish.

DXY 1D – Tipping Point: News or Price Action?Hey Guys,

The DXY index is currently moving within a downtrend. This trend is unlikely to reverse unless it breaks above the 98.950 level.

Sure, key fundamental data could shift the trend, but without those news catalysts, a reversal at this point doesn’t seem realistic.

Don’t forget—98.950 is a critical threshold for the DXY.

I meticulously prepare these analyses for you, and I sincerely appreciate your support through likes. Every like from you is my biggest motivation to continue sharing my analyses.

I’m truly grateful for each of you—love to all my followers💙💙💙

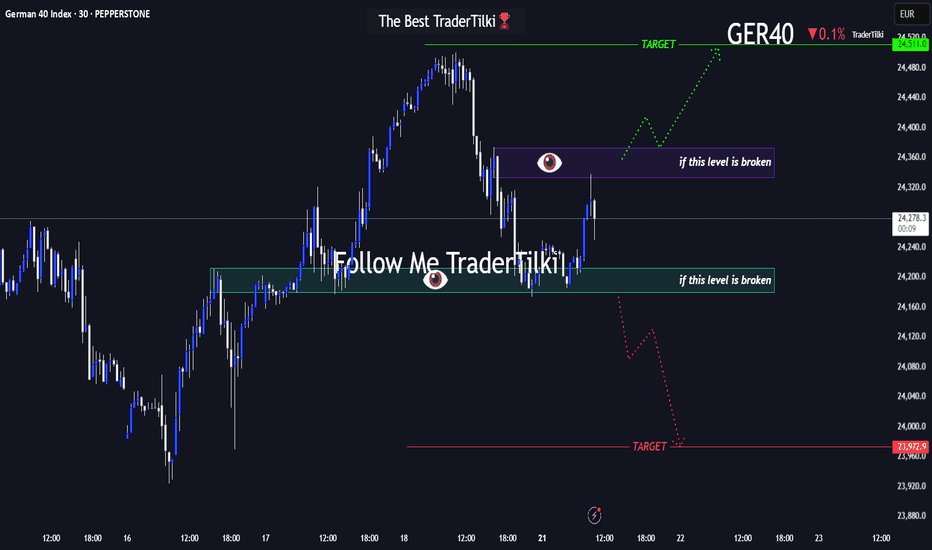

Before GER40 Roars, It WhispersHey guys👋

Here’s the latest GER40 analysis I’ve prepared for you:

🔻 If the **24,179** support level breaks, the next target is **23,972**.

🔺 If the **24,373** resistance level breaks, the next target is **24,511**.

🎯 I’ve shared two key levels with you — please monitor them carefully.

Every like from you gives me a big boost of motivation 🙏

Thanks to everyone who supports my work — truly appreciate it 💙

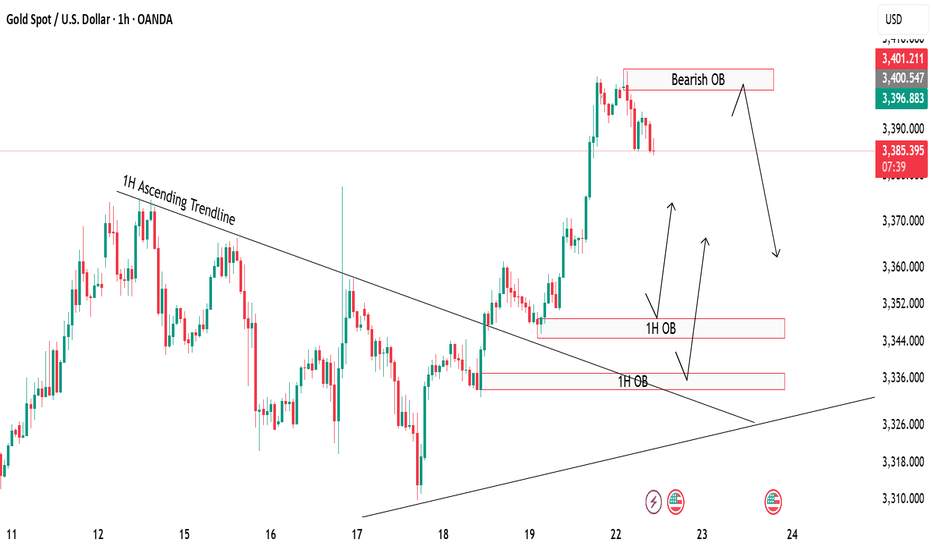

Gold Rejection & Retest Zones AnalysisGold has recently broken out of the 1H ascending trendline with a strong bullish push 🚀. After this breakout, we are now watching key supply and demand zones for the next move.

🔴 Bearish OB (3398-3404):

Price is currently hovering around the bearish order block, which could trigger some short-term rejection or pullback from this zone.

🟢 Bullish OB Zones (3350 & 3330):

If gold decides to correct lower, we have two important bullish OBs below, perfectly lining up with the previous trendline retest ✅. These zones can offer high-probability buy setups if price respects them.

🎯 Focus is on watching for possible rejections from the top OB, or waiting for a deeper retracement towards the bullish zones for buy confirmations

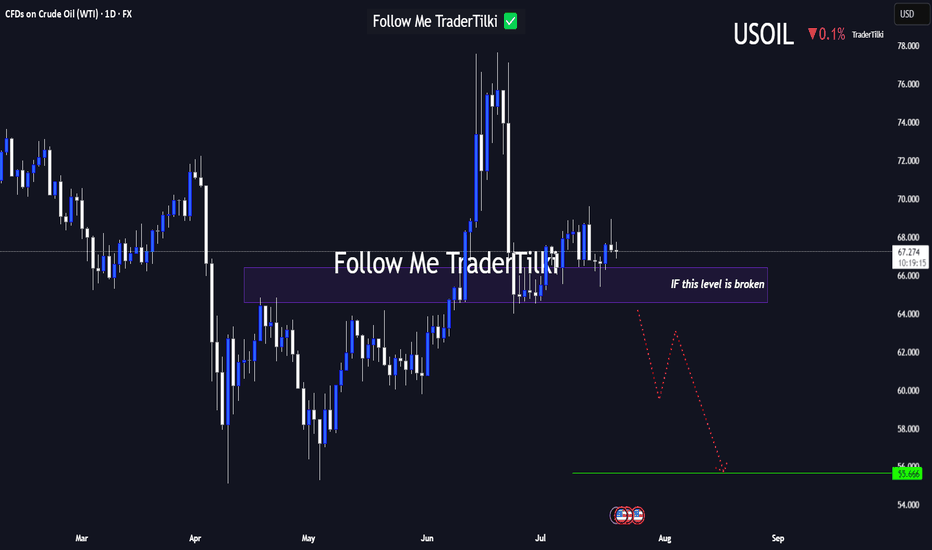

USOIL Under Technical Pressure: 1D Timeframe Breakdown Hey Guys,

The 66.584 level currently stands as the strongest support zone for USOIL. If this level breaks with a candle close, the next major target could drop to 55.666.

This setup is based on the 1-day timeframe. I highly recommend keeping a close watch on that key level.

Every like from you is my biggest motivation to keep sharing these insights. Thanks so much to everyone who’s showing support!

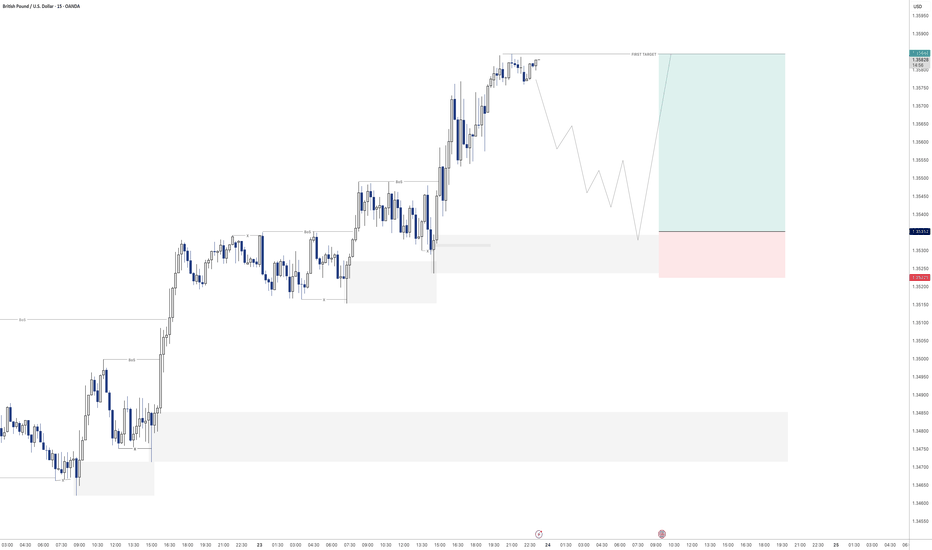

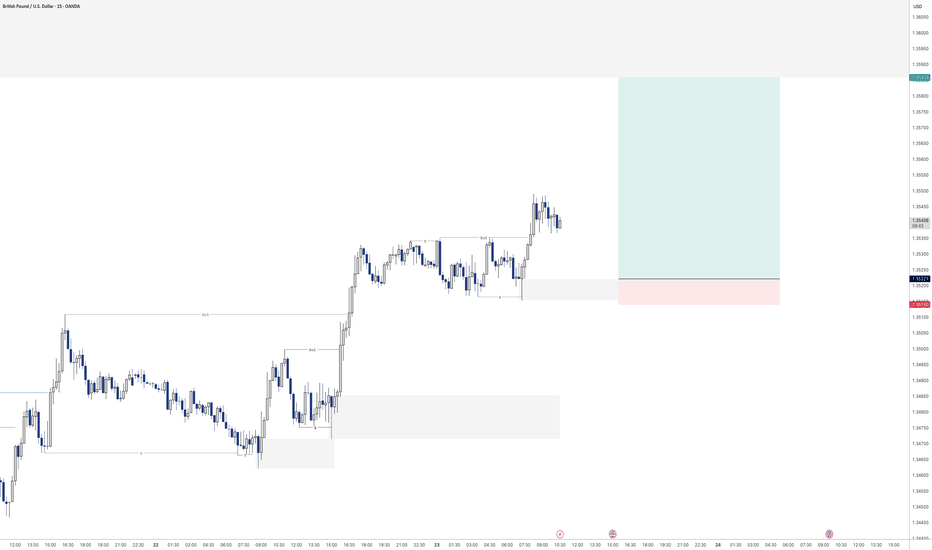

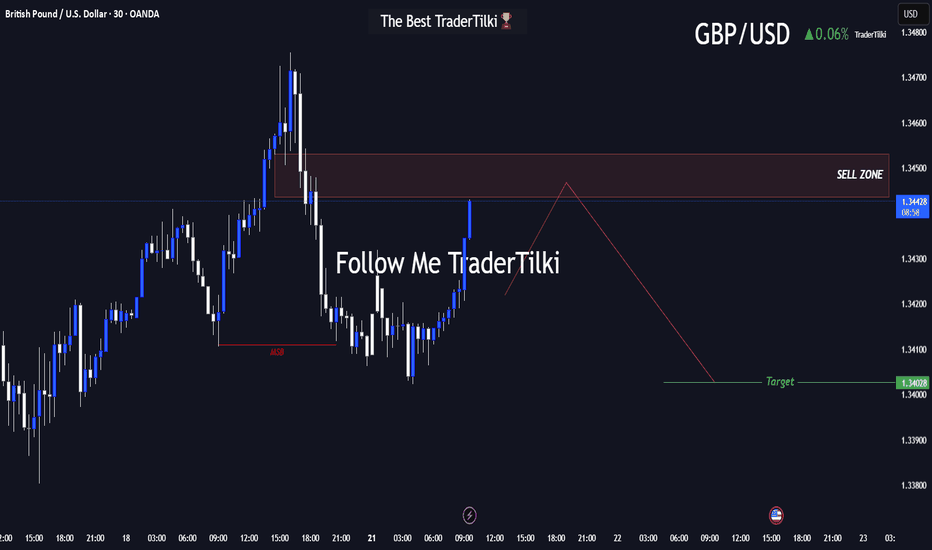

Major Levels Ahead: GBPUSD Trade Setup UnveiledHey friends, I’ve prepared a fresh GBPUSD analysis for you!

📍 Target level: 1.34028

🔻 SELL zone: Between 1.34532 and 1.34437

I expect the trade to reach its target during the London or New York session.

Every like and show of support fuels my motivation to share more analysis—thank you all for being part of this journey!

GBPUSD: Bearish > Bullish Order FlowAlright, we are approaching some Higher Timeframe Points of Interests. We got a Potential Bullish Bat Pattern Pattern this align with this Bullish H4 Order Block, that's right in the middle of an whole number 1.34. We could expect some spikes around the area, some complex pullbacks, but we must remain steady.

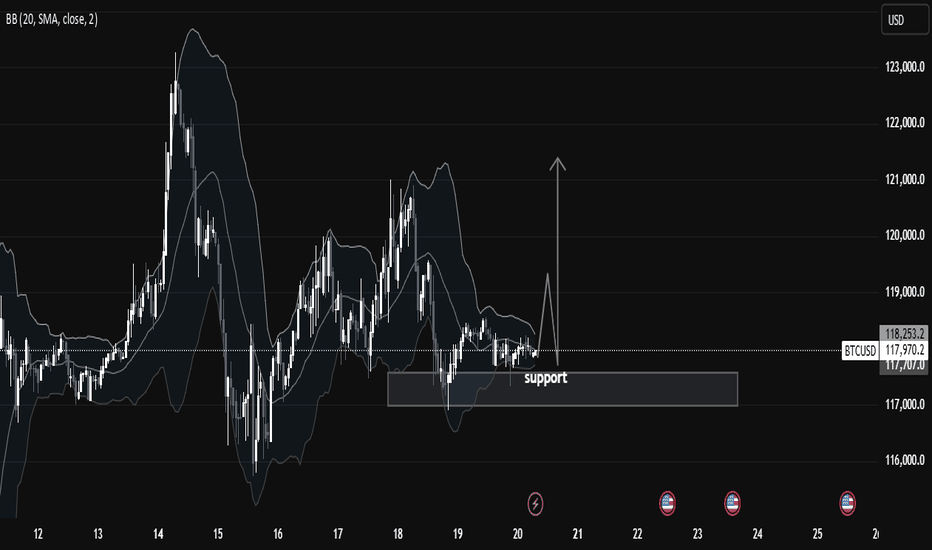

Chart Analysis: BTCUSD Consolidating at Key Support LevelIn this 1-hour BTCUSD chart, we observe that price is currently respecting a key support zone between $117,500 and $118,000, which has held strongly over the past few sessions. This region has acted as a strong demand zone, with visible buying pressure every time the price dips into it. The chart clearly shows multiple rejections from this zone, indicating that smart money participants are accumulating here.

We also see the Bollinger Bands (20 SMA) tightening around the price. This narrowing of the bands signifies low volatility and a potential expansion move. Such squeezes are often followed by impulsive breakouts or breakdowns, and traders should be alert for a decisive candle close above or below the range to confirm direction.

🧠 Market Structure & Technical Insights:

Support Holding: Price is consolidating above a major support level at $117,500–$118,000, which has been tested multiple times but not broken.

Accumulation Phase: The sideways structure after a previous impulsive move suggests that price is possibly in a re-accumulation phase before another leg up.

Liquidity Above Range: There's a visible liquidity pool above recent highs (~$118,600–$119,000), which could be targeted if bulls take control.

Volatility Squeeze: Bollinger Bands are compressing, showing signs of accumulation. Such patterns typically lead to a breakout move, especially if paired with volume.

Candle Behavior: Long wicks from below the support show aggressive buying interest, rejecting lower prices. This is a bullish signal.

🎯 Potential Scenarios:

1. Bullish Breakout:

If BTCUSD breaks and closes above the mini resistance near $118,600–$119,000, we may see a quick move toward $120,500 and $122,000.

A breakout backed by volume and momentum would confirm strength and trend continuation.

2. Bearish Breakdown:

A break below $117,500 with a strong bearish candle and increased volume would invalidate the bullish bias and may open the downside toward $116,000 and possibly $114,500.

This would indicate failure to hold support, transitioning into a distribution phase.

3. Range-Bound:

Until we get a clear break in either direction, price may continue to range between $117,500 and $118,600. Best approach is to remain patient and wait for breakout confirmation.

📚 Educational Note:

This is a textbook setup for many smart money traders—a compression near a strong support level with low volatility. Such patterns reflect market indecision, but also the potential energy build-up for a significant move. Traders should focus on risk management and confirmation instead of predicting direction blindly.

✅ Key Levels to Watch:

Support: $117,500

Resistance: $118,600 – $119,000

Breakout Target: $120,500 – $122,000

Breakdown Target: $116,000 – $114,500

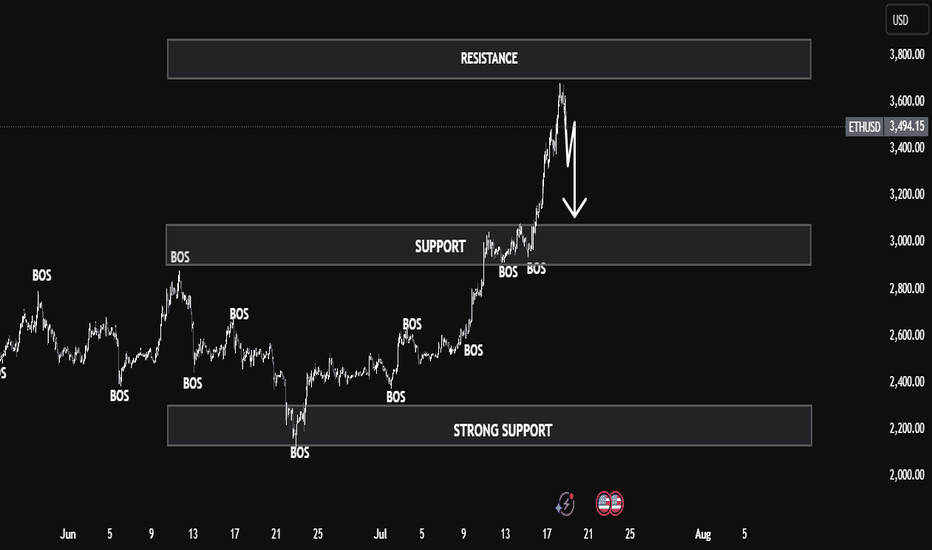

ETHUSD Smart Money Breakdown – Price Rejection from Premium ZoneEthereum has shown a strong impulsive rally after multiple Breaks of Structure (BOS) from early June, signaling a clear shift in market sentiment from bearish to bullish. Each BOS indicates that demand zones have been respected and liquidity has been efficiently used to fuel higher prices — a classic signature of institutional involvement.

🧠 Smart Money Insight

As price aggressively rallied into the resistance zone ($3,600–$3,800), the market entered a premium pricing area, where smart money typically offloads positions and hunts liquidity from late buyers. This area has historically been a high reaction zone — and as seen on the chart, ETH shows signs of buyer exhaustion, suggesting a possible short-term reversal.

🔁 Anticipated Market Behavior

A corrective move is likely from this resistance, and the first target for retracement lies in the support zone around $3,000–$3,200. This level aligns with:

Previous BOS retest area

Fair value imbalance fill

Mid-range equilibrium

If momentum continues downward, the next zone of interest will be the strong support region at $2,200–$2,400, which served as a major accumulation zone. That’s where large orders previously entered the market — and a strong reaction is expected again.

📊 Market Structure Summary:

BOS Confirmations: Validated bullish structure

Liquidity Grab: At resistance – potential sweep and reversal

Premium Zone Rejection: Smart money short opportunity

Discount Zone Targets: Support & strong support zones

✅ Conclusion

ETH is at a critical decision point. If price holds below resistance with continued bearish pressure, a retracement is not only healthy — it's expected. Traders should wait for confirmation of lower timeframe structure breaks before entering shorts, and target the $3,000 zone first, with eyes on $2,200 if momentum persists.

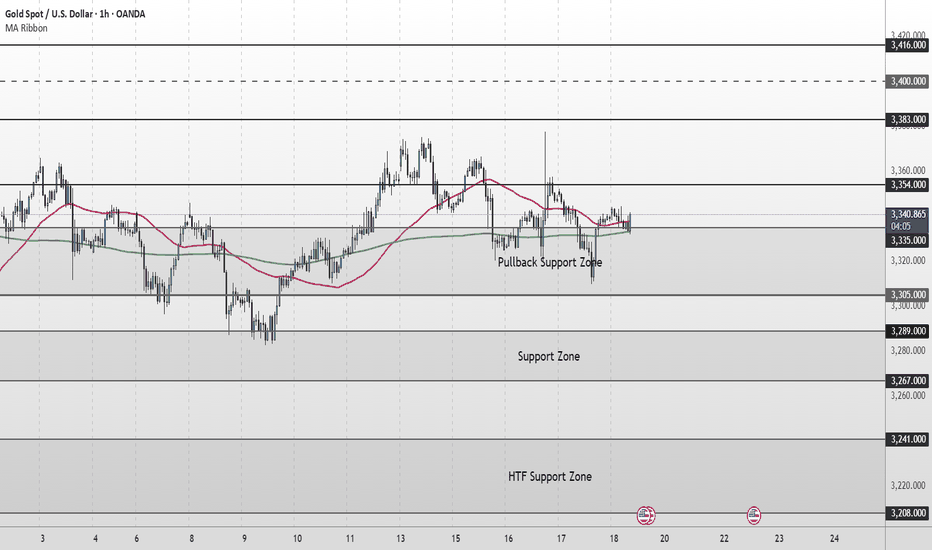

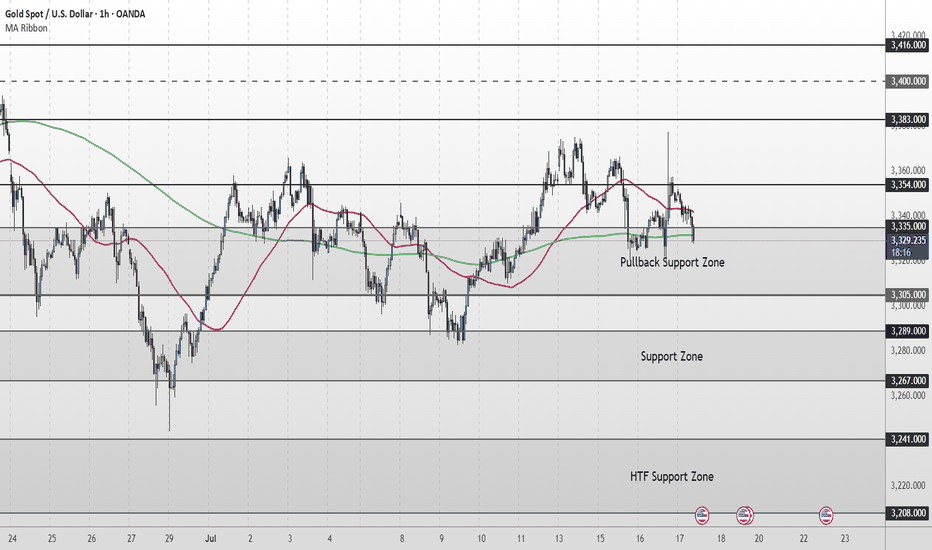

Gold Short Term Outlook Gold has held above the Pullback Support Zone (3,335–3,305) after yesterday’s volatility, with buyers stepping in to defend the zone.

Price is now trading around 3,338, caught between the 50MA and the 200MA.

Despite the recent dip, the structure remains supportive as long as price holds above 3,335.

A clean break and hold above 3,354 would confirm renewed bullish momentum, opening the path toward 3,383 and 3,400, with 3,416 as a higher‑timeframe target.

If price fails to clear 3,354 and turns lower again, watch for signs of exhaustion back into the Pullback Support Zone (3,335–3,305).

A decisive break below 3,305 would shift focus to the Support Zone (3,289–3,267), with further downside exposing the HTF Support Zone (3,241–3,208).

📌 Key Levels to Watch

Resistance:

‣ 3,354 ‣ 3,383 ‣ 3,400 ‣ 3,416

Support:

‣ 3,335 ‣ 3,305 ‣ 3,289 ‣ 3,267 ‣ 3,241

🔎Fundamental Focus

📌 4:00pm: UoM Sentiment & Inflation Expectations – can spark sharp USD/gold moves.

➡️ Expect volatility around releases.

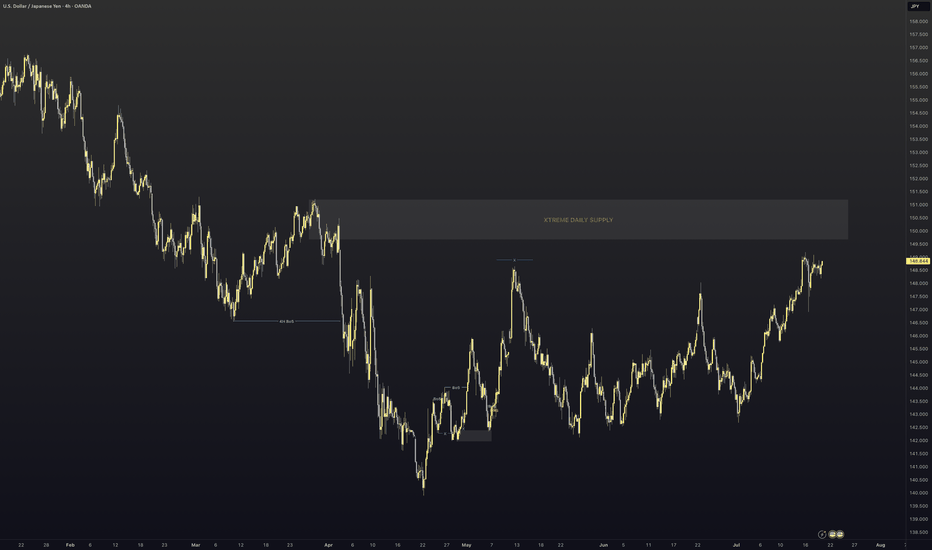

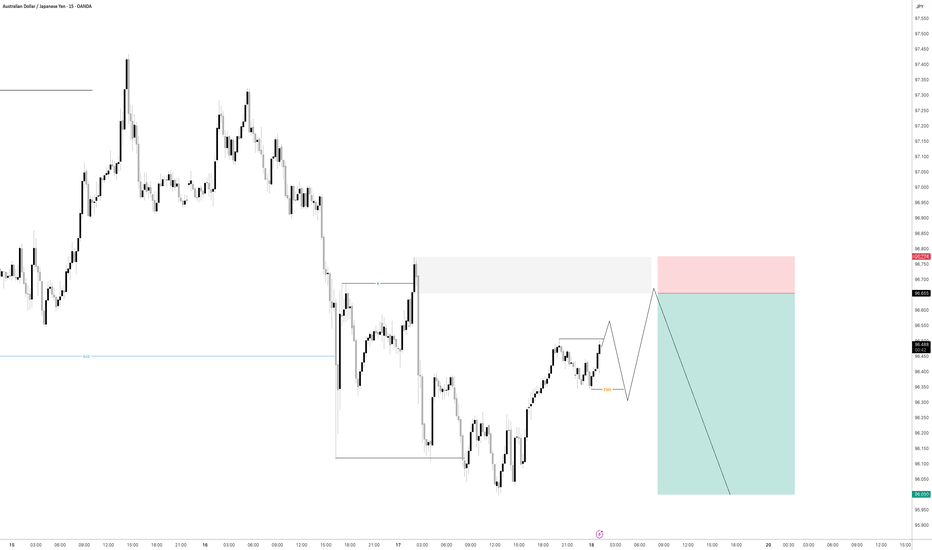

AUDJPY - POTENTIAL?USDJPY is getting super interesting.

If we can get some bearish intent to try and induce the early sellers to the downside creating some buyside liquidity then i will be all over this for a trade.

Lets see how price has moved by the morning as it does need a bit more development before we can consider entering for a short position

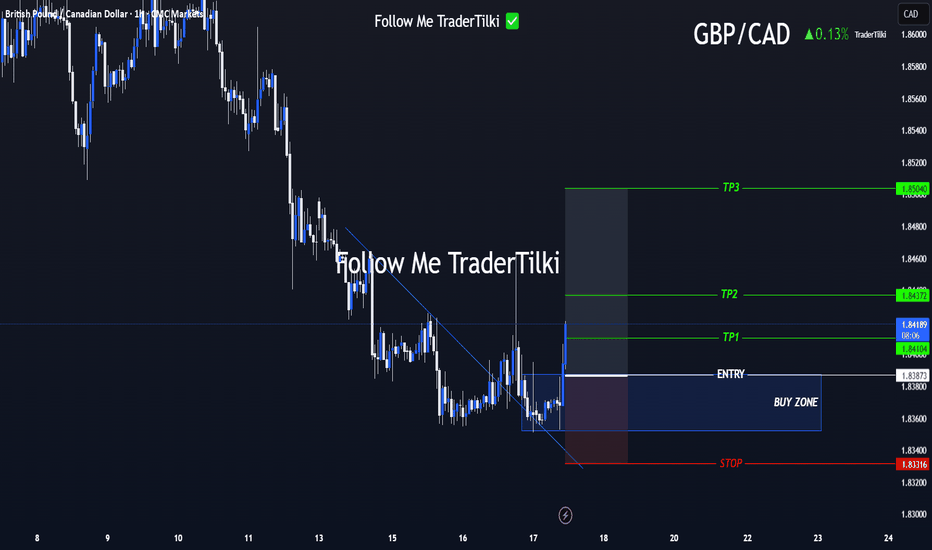

GBP/CAD Clarity in Motion! Levels Are Locked In Hey everyone 👋

📌 BUY LIMIT ORDER / GBP/CAD Key Levels

🟢 Entry: 1,83873

🎯 Target 1: 1,84104

🎯 Target 2: 1,84372

🎯 Target 3: 1,85040

🔴 Stop: 1,83316

📈 Risk/Reward Ratio: 2.18

I double-checked the levels and put together a clean, focused analysis just for you. Every single like seriously boosts my motivation to keep sharing 📈 Your support means the world to me!

Huge thanks to everyone who likes and backs this work 💙 Our goals are crystal clear, our strategy is solid. Let’s keep moving forward with confidence and smart execution!

Gold Short Term OutlookYesterday, gold staged a strong rally, pushing up toward 3,377, which was followed by a strong rejection. Price has pulled back sharply and is now testing the Pullback Zone once again.

Currently trading around 3,329, price is caught between the 50MA overhead acting as dynamic resistance and the 200MA below offering dynamic support.

For the bullish structure to regain momentum, we need to see a clean break and hold back above 3,354. This would reopen the path toward 3,383 and 3,400, with 3,416 as a higher‑timeframe target.

If buyers fail to defend the Pullback Support Zone, and price breaks decisively below 3,305, attention shifts to the Support Zone (3,289–3,267). A deeper selloff could then expose the HTF Support Zone (3,241–3,208).

📌 Key Levels to Watch

Resistance:

‣ 3,354

‣ 3,383

‣ 3,400

‣ 3,416

Support:

‣ 3,335

‣ 3,305

‣ 3,289

‣ 3,267

‣ 3,241

🔎 Fundamental Focus – High‑Impact U.S. Data Today

A packed U.S. calendar could drive volatility:

📌Core Retail Sales m/m and Retail Sales m/m

📌Unemployment Claims

📌Philly Fed Manufacturing Index

These red‑folder releases can create sharp intraday swings.

Additionally, multiple FOMC member speeches later in the session could add headline‑driven moves.

HOOD - Get Great PricingNASDAQ:HOOD and I have had a mixed relationship over the years. I have had my biggest win on the HOOD brokerage (5,000% options trade, $1200 into 60k) and at the same time I was present for the Derogatory removal of the GME button (of which I had sold before they took that button).

After many years and brokerages, I find myself returning to HOOD but this time much more experience... To my surprise, I love the platform, and I still recommend it for new traders for the ease and UI. Honestly, unless you are dealing with BIG Volume or Hot-Keying out of Low float Penny stocks, It will suit you just fine.

Now Let's Talk HOOD.

In this MASSIVE range we are looking at High $67, and a Low of $35. Thats a 47% drop!

Although we have recovered a bit, Many are eager to find a way to get in the range. Here I have put together 2 scenarios to help you play your position with confidence.

Better Price = Better psychology

Whether we are shopping at grocery store, or if we are buying a car. Getting a good deal feels better. But how do you feel when you know you overpaid?

TLDR: The best deals are the lowest purple zone "Extreme Demand" if you are Long, "Reinforced Supply" (at the top) if you are looking to get short or take profit.

Under the HOOD

Currently Robinghood is running into a little bit of a supply zone labelled "Weak Supply"

This is a new player, and we don't yet know how just how big this player is. So far they have absorbed some of that buying pressure coming in, but I would not be surprised if they we overtaken or even gapped above come Monday. This brings us to our first Scenario

Scenario 1: Blue line

With the break above "weak supply", there is headroom all the way until 51.74. This is where we will see some supply initially and maybe a small rejection.

Why would it not reject back down to a demand area like 41? Great question.

If this overtakes that "Weak Supply" zone, this will make a strong case that there is momentum behind the wheels here. I think there will be a new player reinforcing this buying if this happens all the way to the Finale at $58.01. From here I would consider taking some profits, maybe partials, or looking for some Puts.

Scenario 2: Red line

Getting Rejected by "Weak supply" would be evidence that this move was fluff. Those two demand zones may try to hold a bit, but with the lack of buying interest in the

$45 area, this won't make those buyers feel confident.

This is different story when comparing to the "Extreme Demand" zone (lowest purple zone). Buyers here have PROVEN that this is something they are very interested and they are not done accumulating yet. So from this location buyers feel confident that they are getting a good price*( see fn. )

From here this should drive demand up again, crushing shorts, and sending another nice squeeze to test that supply at 51.71

WHEW! if you made it this far, I appreciate your time!

Upvote/Follow if you enjoyed this idea, there are many more to come!

Happy trading!

* (This is a good price, because buyers are showing that it is. Although, if it did come down here, this would be the 4th test of this area. I still think there will be strong demand here, but this isn't the best tests. 2nd and 3rd were stronger.)

US30 (Dow Jones) Is On My Radar — The Moment’s Getting Close!Hey Guys,

I've marked my sell zone on the Dow Jones (US30) chart.

Once price reaches my entry range, I’ll be jumping into this high-probability trade setup.

🚪 Entry Levels: 44,551 – 44,632 – 44,677

🛑 Stop Loss: 44,725

🎯 Targets:

• TP1: 44,468

• TP2: 44,359

• TP3: 44,126

📐 Risk-to-Reward Ratio: Approximately 2.41 from the 44,551 entry

Your likes and support are what keep me motivated to share these analyses consistently.

Huge thanks to everyone who shows love and appreciation! 🙏