GME LONG IDEA UPDATEDIn my previous post regarding the long opportunity on GME stock, I called a long signal after a break out of a downtrend line. However, price had dropped down to the demand zone, giving another long opportunity.

To take advantage of this long opportunity, you can buy at the current market price, while the exit will be at $20.30 and the targets can be at $35.70, $47.90 and the final target at $64.70.

Confluences for the long idea are as follows:

1. Weekly break of structure

2. Valid Inducement

3. Orderflow

4. Price within the discount

5. Price respecting bullish trendline

6. Hammer candlestick confirmation

7. Price at a support level

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

Supply and Demand

BTCUSDT[BITCOIN]:Price is Likely to be Heading Towards $144,000.Recently, Bitcoin has shown extreme bullish price behaviour, and there’s no sign of bearish influence in the market. After monitoring the price since May 4th, we believe there’s a high possibility of price hitting the 120k region first. This could be followed by a small correction around 105k, where a strong bullish price influence will lead the price to our final target at 140k. Both fundamental and technical factors support this view, but it doesn’t guarantee the price will follow our expectations.

Before investing or trading cryptocurrencies, do your own research as they carry significant financial risk. This chart analysis is for educational or secondary purposes only.

Good luck and trade safely.

If you want to support and encourage us, you can do the following: ❤️

-Like the idea

-Comment the idea

-Share ;)

Team Setupsfx_

#BTCUSDT(BITCOIN): Two Targets First $130,000 And Then $150,000Bitcoin is poised for significant distribution, with a potential price surge to $130,000, followed by a swing target of $150,000. The current accumulation phase is poised to transition into a substantial bullish move. We anticipate a surge in bullish volume in the coming days or weeks. Our analysis anticipates this transition to be completed by the end of the year or sooner.

It is important to note that this analysis does not guarantee a specific price movement and is provided solely for educational purposes.

We extend our best wishes for your successful trading endeavours. If our analysis has been of assistance, we would appreciate it if you could express your gratitude by liking and commenting.

For further insights, please follow our account.

Team Setupsfx_

#BTCUSDT: Major Bearish Correction?Bitcoin is currently undergoing a correction following its recent peak. While the initial price decline appeared insignificant, it has since experienced a substantial drop, suggesting a substantial volume of selling activity in the market.

We anticipate two potential areas where the price could reverse and resume its upward trajectory. These areas could lead to a price of 110,000, followed by 120,000, and ultimately reaching 150,000.

We strongly recommend that you implement rigorous risk management measures and conduct your own analysis before making any investment decisions.

Best regards,

Team Setupsfx_

AUDJPY Technical Breakout - Targeting 97.400 Next?TRADENATION:AUDJPY has recently broken decisively above a key resistance zone that had previously capped price for several months. This breakout was preceded by a period of compression and range-bound price action, where bullish momentum steadily built up, indicated by higher lows pressing against the resistance level. This type of structure typically leads to an explosive breakout, which we are now seeing unfold.

After the breakout, price came back for a clean retest of the broken resistance zone, which has now flipped into support. The retest held firmly, suggesting strong buyer interest at this level and confirming the validity of the breakout.

With this structure in place, the bullish momentum is likely to extend further toward the next target zone around 97.400, provided price remains above the current support.

As long as the price holds above the retested zone, the bullish outlook remains intact. A breakdown back below this area, however, would be a warning sign and could open the door to a deeper pullback.

Remember, always wait for confirmation before entering trades, and maintain disciplined risk management.

Dow Jones Potential DownsidesHey Traders, in the coming week we are monitoring US30 for a selling opportunity around 44,270 zone, US30 is trading in an uptrend and currently seems to be attempting to break it down, if we get dips below the trend we will be looking for a potential retrace towards further downsides.

Trade safe, Joe.

AI Looks Bullish (12H)The AI correction has started from the point marked as "start" on the chart.

It seems that wave C has completed, as its time cycle has finished and the price has reclaimed key levels.

As long as the green zone holds, the price can move toward the targets and the red box.

The targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

ASTERDM - classic VCP retest - My Pick - No AdviceASTERDM exhibited 3 shrinking pullbacks on its daily with increasingly narrow ranges and diminishing volume followed by a strong upside break. Post-breakout, the ideal setup is a retest: price pulls back to the breakout level (pivot), holding above it.

Fundamentally, Aster DM is a solid healthcare growth story: strong expansion, low debt, cash-rich, with robust ROCE/ROE. But valuation is rich, and earnings are skewed by non-core income.

Technically, VCP setup looks promising—good base, breakout, and retest in place.

PNB Housing Finance - My Pick - No advice.Robust fundamentals indicate solid upside potential. If you believe in growth in the housing finance space, this could represent a strategic buy with a medium‑term horizon. Stock undercut 50 Day moving average and closed above it. it also undercut last several days low and close above it, showing lack of selling interest. A good close with good volume above PDH will tiggger my entry. These are my views and no advice to buy.

GBPUSD: Bearish > Bullish Order FlowAlright, we are approaching some Higher Timeframe Points of Interests. We got a Potential Bullish Bat Pattern Pattern this align with this Bullish H4 Order Block, that's right in the middle of an whole number 1.34. We could expect some spikes around the area, some complex pullbacks, but we must remain steady.

SP500 TECHNICAL ANALYSIS 30 MINUTE TIME FRAME 📊 Technical Analysis – SP500 CFD (30-Minute Chart)

✅ 1. Overall Market Trend:

The market is currently in a range-bound structure after a sharp upward move toward the 6,296 level.

Price entered a clear supply zone and reversed sharply.

Multiple BOS (Break of Structure) and CHoCH (Change of Character) events indicate clear shifts in price behavior.

📌 2. Key Structure Zones:

🟩 Demand Zones:

6,240–6,250: First active demand zone — could trigger bullish reactions.

6,180–6,200: Deeper liquidity zone within the Discount area, ideal for long setups if tested.

Price is approaching equilibrium and preparing for a potential reaction.

🟥 Supply Zones:

6,290–6,300: This premium zone caused the recent rejection and is currently acting as short-term resistance.

📈 3. Price Action & Candles:

Price created a rising wedge near the highs, which broke down.

Strong bearish candles followed, breaking key short-term structure levels.

Price is now heading into the equilibrium zone and testing demand.

📌 4. Possible Scenarios:

🔻 If Price Falls:

Watch for a reaction at the 6,240–6,250 demand zone.

If this area breaks, the next downside target is 6,180–6,200 — a high-probability liquidity zone.

🔺 If Price Rebounds:

A bullish reaction from the current zone could send price back toward 6,270+.

A confirmed break of 6,296 would open the door to higher highs.

🧠 Summary Table:

Condition Analysis

Current Status In corrective phase after bullish impulse

Short-Term Trend Bearish structure active (BOS, CHoCH present)

Key Support 6,245 → 6,180

Key Resistance 6,290–6,300

Buy Opportunity Bullish confirmation at demand zones

Sell Opportunity Weak reactions or breakdowns below BOS

⚠️ Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice or a buy/sell signal.

Always trade based on your personal strategy and risk management plan.

VANTAGE:SP500

BTC 4 HR TIME FRAME ANALYSIS 4H Technical Analysis – BTCUSDT.P (Bitcoin Perpetual on Bitget)

✅ 1. Trend Overview:

Current Market Phase: Strong uptrend.

Price has broken multiple H4 BOS (Break of Structure) levels with strong bullish momentum.

The last impulse candle shows a vertical breakout, often a sign of aggressive buyers or FOMO.

🔄 2. Key Structure Zones:

🔵 Demand Zones (Highlighted in Green):

Around 113,700–114,000 → fresh demand zone after last breakout.

Around 108,000–110,000 → mid-level zone from earlier accumulation.

Deeper zone at ~96,000–98,000 → higher timeframe demand (may hold if larger correction happens).

🔴 Supply Zones (No immediate supply shown, but...)

Watch for reaction zones around 118,000–120,000 as psychological resistance.

📍 3. Price Action & Structure:

The current move is parabolic, indicating momentum exhaustion may soon follow.

However, the last CHoCH and BOS signals are clearly bullish, and pullbacks are being aggressively bought.

Short-Term Expectation:

A correction or sideways consolidation may happen near 118,000–119,000.

Best scenario: price pulls back into the 113,700 zone, forming a bullish continuation setup.

🔍 4. Candlestick Patterns:

At the top, the last 2 candles are showing wicks, indicating possible early rejection or take-profit activity.

No confirmed reversal pattern yet (e.g., no bearish engulfing, pin bar, or evening star).

Wait for confirmation if considering a reversal trade.

📉 5. Risk Zones:

If price breaks below 113,700, then correction may deepen toward 110,000 or even 108,000.

Below 108,000 would invalidate the current short-term bullish structure and signal trend weakening.

📌 6. Key Levels to Watch:

Type Price Zone Notes

Resistance 118,500–120,000 Current high zone, psychological barrier

Demand Zone 1 113,700–114,000 Nearest fresh demand

Demand Zone 2 108,000–110,000 Mid support

HTF Demand ~96,000–98,000 Deep liquidity + structural demand

✅ Conclusion:

Market is in a strong bullish trend on the 4H chart.

Wait for a healthy pullback to demand zones before considering new longs.

Watch for bearish candlestick confirmation (like engulfing or M-structure) near highs for possible short-term reversals.

⚠️ Disclaimer:

This is not financial advice or a trading signal.

It's purely educational analysis.

Always trade based on your personal strategy and risk management. BITGET:BTCUSDT.P

USDT Dominance Is Still Bearish (1D)This index is still bearish. It could either drop from here or turn bearish again after a pullback to a higher level.

The larger structure is bearish, and the price is breaking through structures in an attempt to reach the main demand zone. This bearish trend is expected to continue.

Let’s wait and see what happens.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

Pnutusdt buy opprotunityPNUTUSDT is showing a well defined bottoming structure, completing a rounded reversal formation. Price is currently building momentum within the buy-back zone, supported by a successful break of the mid-structure line (MSL). Continuation above the IIRL neckline could trigger the next impulsive leg toward the immediate target at 0.8526, with the final setup target projected at 1.9521. Holding above 0.1831 is critical for maintaining bullish structure.

TOTAL 3 New Update (12H)This analysis is an update of the analysis you see in the "Related publications" section

TOTAL3 refers to the total crypto market cap excluding Bitcoin and Ethereum.

It pumped from the lower demand zone to the marked red box and has surged by 21%.

We now need a retracement to make the price more attractive.

If the invalidation level and the green zone hold, we could witness another bullish wave.

In this analysis, the invalidation level has been updated. A daily candle closing below this level will invalidate the setup.

Some altcoins are currently bullish, and each chart must be analyzed individually| so be cautious with your short positions.

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

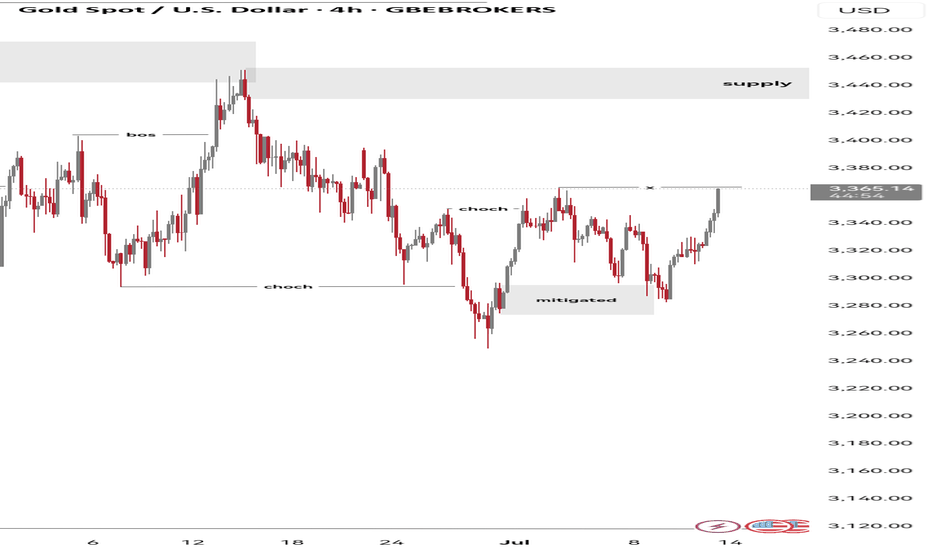

THE KOG REPORT - UpdateEnd of day update from us here at KOG:

I can't say that was a bad day or week. We got the move from 3310 into our Excalibur target level 3332 and then started looking for a potential reversal. Gold, again, had other plans and just continued to activate Excalibur after Excalibur higher combined with the red box break and close, so all we could do as mentioned in the earlier post, is call it a week early.

For now, we have support at the 3350-45 level with resistance here at 3370. I don't think they will want to leave a wick on that 4H, so let's expect a potential retest of resistance.

The week in Camelot:

RED BOX TARGETS:

Break above 3350 for 3355✅, 3360✅, 3362✅, 3365✅, 3374, 3388 and 3396 in extension of the move

Break below 3335 for 3331✅, 3324✅, 3321✅, 3310✅, 3306✅ and 3293✅ in extension of the move

Wising you all a great weekend,

As always, trade safe.

KOG

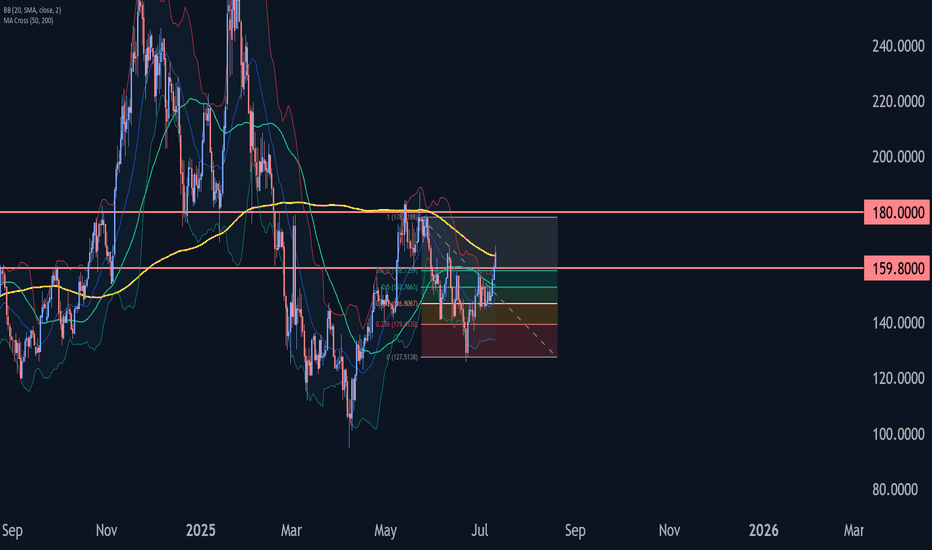

Solana Wave Analysis – 11 July 2025- Solana broke resistance zone

- Likely to rise to resistance level 180.00

Solana cryptocurrency recently broke the resistance zone between the resistance level 159.80 (which has been reversing the price from the start of June) and the 61.8% Fibonacci correction of the ABC correction (2) from May.

The breakout of this resistance zone should accelerate the active impulse waves 3 and (3).

Given the strongly bullish sentiment seen across the cryptocurrency markets today, Solana can be expected to rise to the next resistance level 180.00.

HUB24 Ltd Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# HUB24 Ltd Quote

- Double Formation

* (Area Of Value)) - (Range Structure)) *A+ | Completed Survey

* (2nd Entry Area)) - *0.5 Retracement Feature | Subdivision 1

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* (TP1) = a / Long Consecutive Range

* (TP2) = b / Short Consecutive Pullback | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Indexed To 100

- Position On A 1.5RR

* Stop Loss At 120.00 AUD

* Entry At 126.00 AUD

* Take Profit At 133.00 AUD

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy