POPCAT/USDT – Tight Range = Engineered Liquidity Grab IncomingPOPCAT is currently consolidating in an unusually tight daily range, with candles compressing into a low-volatility coil. When structure becomes this tight, it often signals that market makers are engineering stop hunts—setting the stage for a larger move.

Thesis:

The current range is likely to break with a local liquidity sweep to the downside, followed by a bullish continuation in alignment with:

The macro HTF trend, which remains bullish

Ongoing Bitcoin dominance, which has a strong influence on meme-cap altcoins like POPCAT

This play anticipates the stop-loss liquidity below the range to be grabbed, triggering momentum to the upside once weak hands are flushed.

Setup Summary:

Price compression = manipulation phase

Looking for a sweep of recent lows (range bottom)

Entry after confirmation of trap / bullish reclaim

Target: $0.64+ range highs

Invalidation: Break and acceptance below the red zone

Key Point:

Tight ranges = traps being set. Be patient, let the sweep happen, and position with trend.

Supply and Demand

XAU/USD 09 July 2025 Intraday AnalysisH4 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

You will note that price has targeted weak internal high on two separate occasions forming a double top which is a bearish reversal pattern. This is in-line with HTF bearish pullback phase.

Remainder of analysis and bias remains the same as analysis dated 23 April 2025.

Price has now printed a bearish CHoCH according to my analysis yesterday.

Price is now trading within an established internal range.

Intraday Expectation:

Price to trade down to either discount of internal 50% EQ, or H4 demand zone before targeting weak internal high priced at 3,500.200.

Note:

The Federal Reserve’s sustained dovish stance, coupled with ongoing geopolitical uncertainties, is likely to prolong heightened volatility in the gold market. Given this elevated risk environment, traders should exercise caution and recalibrate risk management strategies to navigate potential price fluctuations effectively.

Additionally, gold pricing remains sensitive to broader macroeconomic developments, including policy decisions under President Trump. Shifts in geopolitical strategy and economic directives could further amplify uncertainty, contributing to market repricing dynamics.

H4 Chart:

M15 Analysis:

-> Swing: Bullish.

-> Internal: Bullish.

H4 Timeframe - Price has failed to target weak internal high, therefore, it would not be unrealistic if price printed a bearish iBOS.

The remainder of my analysis shall remain the same as analysis dated 13 June 2025, apart from target price.

As per my analysis dated 22 May 2025 whereby I mentioned price can be seen to be reacting at discount of 50% EQ on H4 timeframe, therefore, it is a viable alternative that price could potentially print a bullish iBOS on M15 timeframe despite internal structure being bearish.

Price has printed a bullish iBOS followed by a bearish CHoCH, which indicates, but does not confirm, bearish pullback phase initiation. I will however continue to monitor, with respect to depth of pullback.

Intraday Expectation:

Price to continue bearish, react at either M15 supply zone, or discount of 50% internal EQ before targeting weak internal high priced at 3,451.375.

Note:

Gold remains highly volatile amid the Federal Reserve's continued dovish stance, persistent and escalating geopolitical uncertainties. Traders should implement robust risk management strategies and remain vigilant, as price swings may become more pronounced in this elevated volatility environment.

Additionally, President Trump’s recent tariff announcements are expected to further amplify market turbulence, potentially triggering sharp price fluctuations and whipsaws.

M15 Chart:

$SUI Gearing Up to Break Triple Resistance?CRYPTOCAP:SUI is consolidating under resistance which often leads to a breakthrough but can take some time.

Price is sat above the daily pivot after breaking the downward trend resistance, but still under the daily 200 EMA and High Volume Node resistance. A pop above $3.09 swing high would be a bullish signal to long towards a first target of $4.2 High Volume Node.

Analysis is invalidated with a move below $2.7, leaving heavy resistance still ahead.

Safe trading

🇪🇺 EURUSD – July 9 | Multiple Buy Scenarios Based on StyleThe 4H trendline held again yesterday, and today’s daily candle continues to form within a bullish flag, giving added confluence to our overall bullish bias.

I no longer expect a deeper pullback to 1.16299 — price action suggests momentum is building.

Here’s the game plan:

🔹 For Scalpers:

Break of current high → 1.17500 (~20 pips)

Break of 1.17500 → 1.17657 (Tuesday high, ~16 pips)

Break of 1.17657 → 1.17815 (~15 pips)

Break of 1.17815 → 1.18093 (~42 pips)

🔸 For Swing Traders:

→ Main setup = break of 1.18093 for clean move into 1.18791 (~70 pips)

🔻 Bearish Only If:

→ Break of 1.16824 = potential retest of trendline

📌 Structure + HTF bias still say bullish.

Choose the setup that fits your style and manage risk accordingly.

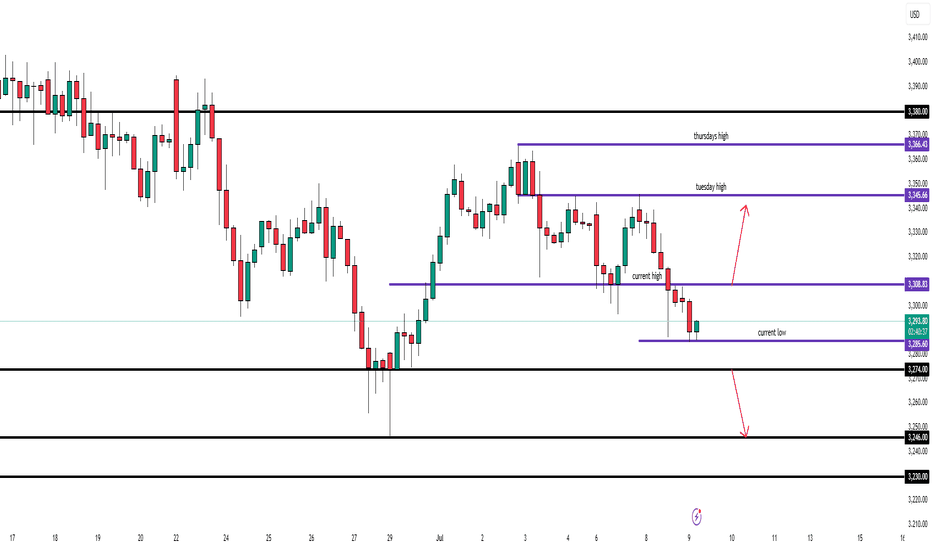

🇺🇸 XAUUSD – July 9 | Structure Testing Key Levels AgainYesterday’s clean rejection from 3328.76 gave us a profitable 300+ pip move down to 3298. Today, we’re seeing a potential double bottom near 3284.61 — the same level price held during yesterday’s drop.

📌 What I’m Watching:

🔼 Buy Setup:

Break above today’s high → bullish continuation to 3345.66

➤ Estimated 300+ pips upside

🔽 Sell Setup:

Break of today’s low = move to 3274.00

➤ If 3274 breaks, extension to 3246.00 opens up another 180 pips

Overall bias remains bullish (daily & weekly trendlines still respected), but I’ll trade what price confirms — not what I expect

AUDUSD STARTED FORMING BEARISH TREND STRUCTUREThe AUD/USD pair has recently begun forming a bearish trend structure, signaling a potential continuation of downward momentum in the coming trading sessions. This shift in market sentiment is evident as the price has started printing lower lows, a key characteristic of a bearish trend. Lower lows indicate that sellers are gaining control, pushing the exchange rate downward with each successive decline. Traders and investors should remain cautious, as this pattern suggests further downside potential unless a significant reversal occurs.

On the lower side, the market is expected to test key support levels at 0.64500 and 0.63800. These levels may act as critical zones where buyers could attempt to step in, but if selling pressure persists, a breakdown could lead to an extended decline. A breach below these supports may open the door for deeper losses, reinforcing the bearish outlook. Conversely, if the pair finds stability near these levels, a short-term bounce or consolidation could occur before the next directional move.

On the upside, 0.65900 stands as a crucial resistance level. Any bullish retracement towards this zone could attract fresh selling interest, capping upward movements. A sustained break above this resistance would be necessary to invalidate the current bearish structure, potentially shifting the trend towards neutrality or even bullish reversal. Until then, rallies towards this resistance may present selling opportunities for traders aligning with the prevailing downtrend.

In summary, the AUD/USD pair is exhibiting bearish tendencies, with lower lows confirming seller dominance. The immediate targets lie at 0.64500 and 0.63800, while 0.65900 serves as a key resistance to watch. Traders should monitor price action around these levels for potential bearish continuation or signs of a trend reversal. Risk management remains essential, as unexpected macroeconomic developments or shifts in market sentiment could alter the current trajectory.

NQ Power Range Report with FIB Ext - 7/9/2025 SessionCME_MINI:NQU2025

- PR High: 22923.00

- PR Low: 22900.50

- NZ Spread: 50.5

Key scheduled economic events:

10:30 | Crude Oil Inventories

13:00 | 10-Year Note Auction

14:00 | FOMC Meeting Minutes

Session Open Stats (As of 12:25 AM 7/9)

- Session Open ATR: 303.33

- Volume: 16K

- Open Int: 270K

- Trend Grade: Neutral

- From BA ATH: -0.8% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

Nifty 50 Maybe Face RejectionCurrently, Nifty 50 appears to be experiencing rejection on its chart. An upside movement should be anticipated only if Nifty 50 remains above this observed level. Conversely, it would be advisable to avoid purchasing options premiums, as they are likely to depreciate if the market consolidates within its current range.

Sell the EURO vs USD?Welcome back to the Mid-Week Analysis for Wed, July 8th.

In this video, we will analyze the following FX markets:

EURO and USD Index.

The USD is seeing some strength off the tariffs Trump is declaring... and extending the grace period again on. This dragging down the EURO a bit, as it is printing bearish candles for Mond and Tues.

Will Wed print another bearish candle? Are we heading for a full retracement in the EURUSD?

This could be the scenario forming that I eluded to in my Weekly Forecast video: Buy The Dips and Sell The Rips.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Smart Money Concept Sell to Buy via Quasimodo EntriesPrice has swept upside liquidity above a key level and tapped perfectly into our supply zone (Discount) for a sell on the higher timeframe. When price gets to the demand zone (Discount), where we have a sweep (SWE) of sell-side liquidity, A break of structure (BOS) confirming bullish momentum and Price rallying into the supply zone, grabbing liquidity, then our buy will trigger.

Trade Ideas:

Look for confirmation to enter the sell or wait for the buy entry.

Take a buy from the order block marked on my POI.

XAUUSD:Sharing of the Latest Trading StrategyAll the trading signals this week have resulted in profits!!! Check it!!!👉👉👉

Gold Market Analysis:

Overnight Dynamics: Following Trump’s reinstatement of tariffs, gold’s safe-haven demand drove another rally, but it still pulled back after facing pressure at the 3345 level. The decline extended today, requiring attention to the sustainability of safe-haven flows—recently, safe-haven-driven rallies have often been followed by pullbacks, so caution remains warranted for further gold corrections.

Technical Trends:

On the daily chart, gold continues to trade in a narrow range, with short-term moving averages essentially converging and flattening, suggesting a high probability of continued sideways movement in the near term.

The current range is temporarily compressed between 3285–3345, with the market bias leaning toward a "range-bound bearish" trend.

Trading Bias: Maintain a bearish stance on rebounds!

Trading Strategy:

Sell@3330-3320

TP:3300-3280

GBPUSD - 2 potential selling opportunitiesLooking at GBPUSD

We have 2 potential selling POI's.

The first one being a point in which we will need to sit on our hands for a little bit to see what price does at there is no inducement in the push down in the impulse leg. With that being the case we will need to see some sort of inducement built before we enter that POI

IF we clear the first POI I think I will take a more aggressive entry on the secondary POI that sits a little bit higher. This is due to us having already put in some sort of liquidity in and around that POI before pushing lower.

Will wait and see what happens.

Tomorrow could be a very good trading day

DOGE Long Swing Setup – Musk-Fueled Hype & Political BuzzElon Musk’s launch of the “America Party” is reigniting interest in his potential impact on crypto—especially Dogecoin. With his history of moving DOGE’s price, this political pivot could stir volatility and renewed upside. We’re watching for a dip into the $0.15–$0.16 zone for a possible long entry.

📌 Trade Setup:

• Entry Zone: $0.15 – $0.16

• Take Profit Targets:

o 🥇 $0.19 - $0.20

o 🥈 $0.23 – $0.24

• Stop Loss: Daily close below $0.13

ETH Long Swing Setup – Sideways Hold with Dip-Buy OpportunityETH continues to hold above the key $2,300 support, showing resilience and consolidating within range. We’re watching for one more dip into the $2,300–$2,375 zone to trigger a long entry, with momentum building for a potential breakout.

📌 Trade Setup:

• Entry Zone: $2,300 – $2,375

• Take Profit Targets:

o 🥇 $2,900 – $3,000

o 🥈 $3,300 – $3,400

o 🥉 $4,000 – $4,200

• Stop Loss: Daily close below $2,000

O'Reilly Automotive Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set Up

3. Break & Retest Set Up

Notes On Session

# Oreilly Automotive Quote

- Double Formation

* (A+ SIgnal)) At 65.00 USD | Completed Survey

* (Zone Feature)) At 99.00 USD | Subdivision 1

- Triple Formation

* (P1)) / (P2)) & (P3)) | Subdivision 2

* (TP1) = a / Long Consecutive Range

* (TP2) = b / Short Consecutive Pullback | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Regular Settings

- Position On A 1.5RR

* Stop Loss At 85.00 USD

* Entry At 91.00 USD

* Take Profit At 100.00 USD

* (Uptrend Argument)) & No Pattern Confirmation

- Continuation Pattern | Not Valid

- Reversal Pattern | Not Valid

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

Watch me trade NQ LIVE!This is a just a quick video showing what I look for in order to take a trade.

I entered a short on NQ minutes ago, looking for 2.44 RR!

Apologies for this rough cut video. It was spur of the moment, and I wanted to share with my followers and viewers!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.