Supply and Demand

$ETH Breakout this week?CRYPTOCAP:ETH local chart looks ready

I think were looking at a decent ETH breakout this week to the next resistance High Volume Node at $3600 minimum target.

👉 BTC is consolidating under all time high resistance after multiple tests which is usual a sign of bullish continuation. Usualy giving alts room to room.

👉 Ethereum is above the daily 200EMA, daily pivot and also consolidating under resistance once more after testing the 0.382 Fibonacci retracement and S1 daily pivot adding confluence to that being the local bottom. This appears to be Elliot wave 2, a shallow wave 2 retracement (less than 0.5) is a show of strength and investor impatience.

Analysis invalidated below the daily pivot and daily 200EMA as this will lock in 3 waves up and look corrective.

Safe trading

NAS100 - Stock market is waiting for tariffs!The index is above the EMA200 and EMA50 on the four-hour timeframe and is trading in its ascending channel. Maintaining the ascending channel will lead to the continuation of the Nasdaq's upward path to higher targets, but if it does not rise and corrects towards the demand limits, you can buy the Nasdaq index with appropriate reward and risk.

Three months ago, Donald Trump postponed the imposition of severe retaliatory tariffs, granting America’s major trading partners more time to reach new agreements that Washington views as “fairer.” Now, as the White House’s July 9 deadline approaches, only two official trade deals have been finalized—one with the United Kingdom and another with Vietnam. As for China, merely a fragile temporary truce has been reached, which has so far prevented any additional tariffs from being enforced.

Although reports suggest promising progress in negotiations with India, Japan, and South Korea, no final agreements have been secured with these countries yet. Interestingly, talks with the European Union—which had previously stalled—have suddenly taken a positive turn, and prospects for a deal with Canada in the coming days have also improved.

However, given the limited time left, it seems unlikely that trade agreements with all of America’s 18 key partners will be reached before the deadline. This situation has raised a critical question for the markets: Will Trump set a new deadline for the remaining countries, or will the suspended tariffs be reinstated?

The prevailing view is that the U.S. president will once again resort to threats before granting any extensions—this time not merely by reviving the “Liberation Day” tariffs, but also by promising even heavier tariffs to extract the last concessions from the remaining trade partners.

U.S. Treasury Secretary Scott Bassett stated that if no agreements are reached by August 1, tariffs will revert to the levels announced in April. He also emphasized that Washington’s core strategy in these trade talks is to apply maximum pressure. According to Bassett, letters will be sent to various countries, outlining the August 1 deadline for reaching deals. This news, which broke during the market’s closing hours, sparked a wave of risk appetite in the financial markets.

In a week when the U.S. economic calendar is notably devoid of major data releases, investors are focusing their attention on the minutes from the Federal Reserve’s June FOMC meeting—a document that could offer fresh insights into the trajectory of interest rates for the second half of the year.

June’s strong employment report, which exceeded market expectations, has effectively dashed hopes for an interest rate cut this month. Now, if the positive economic momentum persists, the likelihood of a rate cut in the September meeting may also gradually be priced out by the markets.

According to data from Challenger, Gray & Christmas, U.S. employers announced 47,999 job cuts in June, marking a sharp decline from 93,816 in the previous month. Compared to June of last year, layoffs have dropped by 2%. However, total job cuts in the second quarter of 2025 reached 247,256—a 39% increase from the same period last year (177,391) and the highest second-quarter layoff figure since 2020.

With no significant economic reports scheduled for the coming days, investors will be closely analyzing Wednesday night’s Fed minutes and the limited remarks from central bank officials—statements where every word has the potential to significantly move the markets.

GBP/USD Pair Analysis📈 GBP/USD Pair Analysis – Monday, July 7, 2025

1️⃣ The pair is moving within an ascending price channel, indicating a continued positive trend in the medium term.

2️⃣ Strong demand areas have been identified on the larger time frames, which are expected to support the price in the event of a decline to these areas.

3️⃣ The MACD indicator is oversold, increasing the possibility of a rebound and upward movement from the current or nearby areas.

📌 Summary and Recommendations:

🔹 General Trend: Upward

🔸 The price is currently making a temporary downward correction.

✅ We expect the pair to rise again towards the upper limit of the price channel, provided it holds above the specified demand areas.

Bitcoin - Will Bitcoin record a new ATH?!Bitcoin is above the EMA50 and EMA200 on the four-hour timeframe and is in its medium-term ascending channel. Maintaining the specified support area will lead to the continuation of Bitcoin’s upward path and recording a new ATH. If it is corrected, we can look for Bitcoin buying positions from the specified demand zones.

It should be noted that there is a possibility of heavy fluctuations and shadows due to the movement of whales in the market and compliance with capital management in the cryptocurrency market will be more important. If the downward trend continues, we can buy within the demand area.

In recent days, Bitcoin has been stabilizing in a price range of around $107,000, with the market simultaneously witnessing a combination of short-term volatility and massive accumulation by institutional investors. A close examination of Bitcoin’s fundamental parameters shows that the market has entered a different phase than in the past; one that is no longer driven solely by momentary excitement, and that structured capital flows and on-chain data have formed its main axis. At the forefront of this trend are Bitcoin spot investment funds (Bitcoin ETFs), which reached their highest level of capital inflows in June. Total net inflows of these funds reached more than $4.5 billion last month, and on some days even approached more than $1 billion. Funds such as BlackRock’s IBIT and Fidelity’s FBTC now have billions of dollars in assets under management, a clear sign of increasing institutional participation in the Bitcoin market. These institutional investors are accumulating Bitcoin not with a short-term view, but with a long-term view and through legal means, which has reduced selling pressure and increased market stability.

On the other hand, the data from Anchin clearly shows that the market is in a steady accumulation trend. The amount of old Bitcoins held for more than 8 years experienced a significant growth of 5% in the second quarter of 2025. This statistic shows that long-term investors are not only reluctant to sell, but are still accumulating their assets. Also, the MVRV ratio, which indicates the relative profit or loss of the market, has decreased from 2.29 to 2.20, indicating mild and controlled profit taking by some investors, rather than widespread selling pressure or general panic. This rational behavior is a sign of market maturity and investors’ intelligence in managing short-term profits.

On-chain activity data also shows a similar trend. The average daily active addresses have reached around 1.02 million, indicating a decrease in market inflammation while maintaining overall dynamism. Other indicators such as Liveliness and Whale Accumulation also confirm that the amount of old transaction traffic has decreased and whales are mainly accumulating, not supplying. This trend is very valuable, especially in a market that has been far from explosive growth. From a macro perspective, the Bitcoin market is clearly in a consolidation and accumulation phase, but this consolidation is based on much stronger foundations than in previous periods. Institutional capital inflows via ETFs have reached over $50 billion, providing a strong foundation for continued growth. Also, some very old wallets that have been inactive for nearly 14 years have recently woken up and moved around $2 billion worth of Bitcoin. Although this could be a sign of potential supply, the market has not yet seen a significant negative reaction to it in the current market conditions and the market remains cautious.

Analysts believe that Bitcoin is in the third phase of its bullish cycle after the halving, which could bring gains of more than 120%. Some forecasts suggest a price range of $200,000-250,000 by the end of this year; however, the realization of such levels is subject to stable macroeconomic data, ETF performance and the absence of severe geopolitical shocks.

Finally, it can be said that the Bitcoin market has now reached a maturity where even periods of consolidation tend to strengthen its fundamentals rather than weaken the market. High-powered institutional investors are entering, whales continue to accumulate instead of selling, and long-term investors also see a bright outlook for the coming months. In this phase, price levels of $125,000 to $140,000 are likely by the end of the summer if the current trend continues, while in the event of severe economic or political pressures, key support for Bitcoin will be in the $95,000 to $100,000 range. Overall, Bitcoin is moving slowly but steadily towards higher targets, with stronger support than at any time in its history.

EUR/USD Pair Analysis📉 EUR/USD Pair Analysis – Monday, July 7, 2025

1️⃣ A clear ascending price channel on the daily chart defines the overall trend of the pair.

2️⃣ The price is currently touching the upper boundary of the channel, indicating a potential downward correction from the designated areas (in gray).

3️⃣ Strong demand areas have emerged at lower levels, which may support a subsequent upside move.

📌 Summary and Recommendation:

🔻 In the short term:

An opportunity to quickly sell the pair using scalping from the current areas, targeting nearby points.

🔺 In the medium to long term:

We prefer to wait for a decline to the lower boundary of the price channel, as we plan to buy from there, in line with the general uptrend.

#BTC Update #4 – July 7, 2025🟠 #BTC Update #4 – July 7, 2025

Bitcoin has been trading inside a supply zone , and its last impulsive move happened right into that area. While it tried to push higher again, I now see signs of rejection.

If this rejection holds, the first level I’m watching is $107,850 . Below that, there's a key support around $106,350 . Should this level break, we could see a deeper drop toward $102,650 , where an imbalance zone remains untested.

At the moment, short setups look more reasonable than longs but from a risk/reward perspective, I don’t see enough edge to take action yet. So for now, I’m not entering any position and will simply watch BTC’s next move .

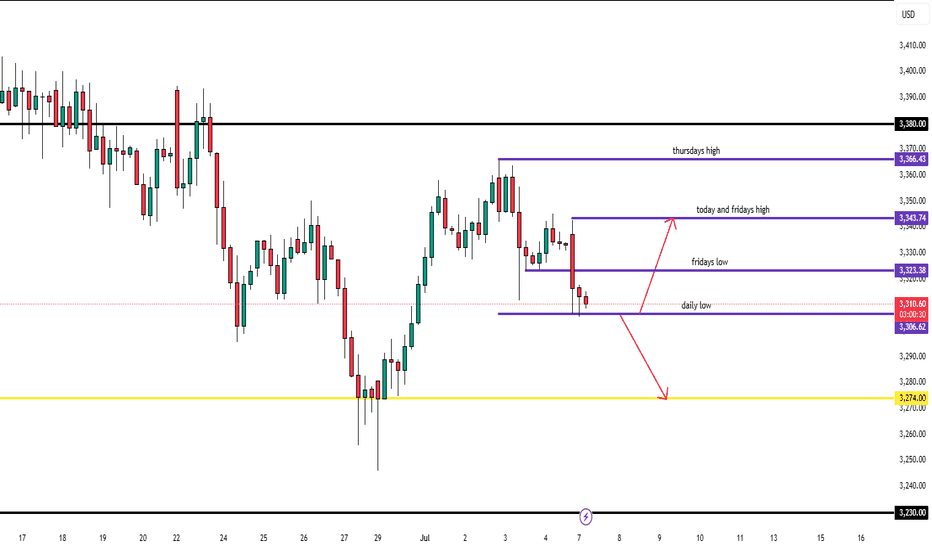

XAUUSD – Monday, July 7th AnalysisGold is sitting on a knife’s edge as we enter the NY session.

Current price action:

Rejected twice at 3307 on the 4hr

Broke Friday’s low

Now approaching today’s low

Scenario 1 – Bearish:

Clean break below current 4hr low → target: 3274 (323 pips)

This is a key higher timeframe swing level, last tested in May

Scenario 2 – Bullish:

If we reject current lows and support forms →

First target: 3307 (170 pips)

Second target: 3344 (390 pips)

📌 Risk is balanced — both directions offer 300+ pips. Monitor structure + volume closely.

NQ Power Range Report with FIB Ext - 7/7/2025 SessionCME_MINI:NQU2025

- PR High: 23028.50

- PR Low: 22943.00

- NZ Spread: 191.25

No key scheduled economic events

First full trading day following long holiday weekend

Session Open Stats (As of 12:45 AM 7/7)

- Session Open ATR: 323.71

- Volume: 33K

- Open Int: 271K

- Trend Grade: Neutral

- From BA ATH: -0.6% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 23239

- Mid: 21525

- Short: 20383

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

XAUUSD BUY 3260On the 4-hour chart, XAUUSD is currently fluctuating and falling, and the short-term market is expected to continue to fall. The current support below can be focused on around 3260, which is a potential buying position for the bullish bat pattern, and this position is also in the previous demand area.

TIA Coin: Unlock 118% Profit Potential (1D)From the point where we placed the red arrow on the chart, it appears the TIA correction has begun.

Despite the current bullish market trend, TIA has not yet experienced a pump, and it seems the price hasn't reached its bottom yet. This correction seems to follow a large, time-consuming diamond-shaped diametric pattern, and we are currently in the early or middle stages of wave G.

Recently, the price lost a minor trendline, marked with a red dotted line, indicating that wave G might continue its path.

We have identified a low-risk buy zone on the chart for catching the next bullish wave in TIA. We are targeting buy/long positions in this zone.

Price targets are clearly indicated on the chart.

A daily candle close below the invalidation level will invalidate this analysis and suggest a potential reversal.

invalidation level: 1.089$

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

XAUUSD – Gold at a Key AreaGold is now in a crucial zone with short potential.

If the market provides a valid bearish signal, I’ll take the short.

But if this zone breaks and confirms with a pullback, I’ll switch bias and go long.

💡 Remember:

We don’t control the market — we just try to profit using structure, setups, and solid risk management.

📌 Always risk max 1% per trade.

If the market goes against your bias, you only lose 1% — not your whole account.

🧠 One trade won’t make you rich,

But one reckless trade can destroy everything.

No gambling.

Just discipline, structure, and smart execution.

GBPAUD M15 - Bearish Setup Based on Divergence & Structure Break📉 GBPAUD M15 - Bearish Setup Based on Divergence & Structure Break 📉

Pair: GBPAUD

Timeframe: 15M

Strategy: Wave Analysis + Supply Zone + AO Divergence + Structure Break

⸻

🔍 Market Overview:

The current price action on GBP/AUD M15 reveals a 5-wave impulsive structure with clear signs of exhaustion at the top. Price recently tapped into a well-defined supply zone (2.08858 - 2.08710), showing bearish divergence on the Awesome Oscillator (AO) between Wave 3 and Wave 5, signaling potential reversal.

⸻

📌 Key Confluences for the Sell Setup:

1️⃣ Supply Zone (2.08858 - 2.08710):

Price has entered a strong area of previous rejection. Watch how price reacts here.

2️⃣ Bearish Divergence (AO):

• AO Histogram shows lower highs while price makes higher highs between Wave 3 and Wave 5.

• This is a classic bearish divergence—a potential early sign of trend reversal or deeper correction.

3️⃣ Break of Structure (2.08658):

A clean break below the minor structure support at 2.08658 will confirm weakness in bullish momentum and open the door for short opportunities.

4️⃣ Entry Confirmation:

• Wait for a clear M15 bearish candle close below 2.08658.

• Ideal confirmation would be a break-retest scenario, or a rejection wick back into the supply zone followed by bearish continuation.

⸻

🔽 Trade Plan (Sell Bias):

Entry Trigger: Break of 2.08658 structure

SL (Stop Loss): Above 2.08858 (Above Supply Zone / Wave 5 high)

TP1: 2.08250 (Recent minor support)

TP2: 2.07800 (Deeper correction area)

TP3: 2.07500 (Previous demand zone)

⸻

⚠️ Risk Management & Notes:

• Risk-reward ratio: Aim for at least 1:2 to 1:3 depending on entry.

• Avoid premature entries before structure is broken.

• Be cautious of news impact around AUD/GBP (as marked on chart).

⸻

📎 Conclusion:

A clean divergence setup has formed near a supply zone, with signs of bullish momentum fading. If structure breaks, this could be a high-probability short setup. Always wait for confirmation and manage risk properly.

⸻

💬 Feel free to like, comment, or share your views below. Good luck and safe trading! 🚀

#GBPAUD #PriceAction #WaveAnalysis #SupplyZone #Divergence #AO #BearishSetup #StructureBreak #ForexAnalysis #M15Setup #TradingView

BAC – Building the Base for a Breakout?Bank of America (BAC) has been consolidating quietly, attracting attention as it sits near a key mid-range level. With a 52-week low of $33.06 and a 52-week high of $48.08, the stock currently trades around $36.92 – roughly 11% above its low and 23% below its high.

This setup could be the calm before the move.

💥 Technical Outlook & Strategy

With financials holding steady and macro headwinds softening, BAC might offer a solid swing trade or medium-term positioning opportunity.

📌 Entry Points to Watch

$36.90 – Market price, if volume picks up near support

$33.30 – Prior breakout area and potential pullback support

$30.50 – Strong support and near the 52-week low for aggressive buyers

🎯 Target Levels

$39.80 – Short-term resistance; previous rejection zone

$43.50 – Fib retracement from the high, medium-term target

$47.50–48.00 – 52-week high retest, bullish scenario

🧠 Narrative to Watch

With potential Fed pauses on rate hikes, improving margins, and relative stability in U.S. banks, BAC could be positioning for a slow grind higher. Watch for earnings momentum and bond yield trends.

⚠️ Disclaimer

This analysis is for informational and educational purposes only and does not constitute financial advice. Always do your own research or consult with a licensed financial advisor before making trading decisions.

Is Citigroup (C) the Most Undervalued Big Bank Right Now?🔥Let’s talk numbers:

🧮 P/E: 9.78x

💸 P/S: 0.66x

That’s deep value — Wall Street’s sleeping on this one. While everyone's chasing AI, Citigroup is trading at garage sale prices.

🧠 The Setup:

If you're into swing plays with strong R/R and macro upside, C is worth a look.

🔑 Entry Zones: 1️⃣ Market price — for early bulls

2️⃣ $55 — breakout confirmation

3️⃣ $48 — bargain bin steal

🎯 Targets:

TP1: $70 🟢

TP2: $78 🚀

TP3: $84 💰

💬 Why it matters:

Citi has been lagging behind peers like JPM, but it’s still a beast. If the Fed holds or cuts, banks could catch a serious bid — and this one’s ready to pop from a value base.

📌 Watching volume at $55 and any macro shifts as catalysts.

👀 Don’t ignore this one just because it’s not trending. That’s where smart money hides.

📢 Disclaimer:

This is not financial advice. Just sharing ideas and setups I’m watching. Always do your own research and manage your risk.

#Citigroup #C #Undervalu

#Citigroup #C #UndervaluedStocks #SwingTrade #TradingSetup #DeepValue #Banking #PEratio #SmartMoneyMoves #StockMarket #Financials #Watchlist

TSLA – Calm Before the Storm or Just Another Dip Buy?Tesla (TSLA) is trading around $315, bouncing off recent lows, but this isn’t just a clean technical setup. With Elon Musk’s political drama escalating (hello, “America Party”) and ongoing tension with Trump, TSLA is becoming a battleground stock with serious volatility.

As swing traders, that’s exactly where we thrive.

📍 Entry Plan

✅ Entry #1 – $315

✅ Entry #2 – $300

• Previous breakout zone — ideal for dip buyers

✅ Entry #3 – $265

• Strong macro support; only activated if market correction deepens.

🎯 Profit Targets

• TP1: $335

• TP2: $355

• TP3: 400+ – if sentiment + volume align with narrative momentum (think: Robotaxi or AI catalyst)

If $265 gets hit, I’m not panicking, I’m preparing for high-reward setups.

⚠️ Disclaimer: This is not financial advice. I’m just sharing my plan and technical zones. Always do your own research and manage your risk.

📌 Follow for more ideas based on price, narrative, and timing. Trade smart — not loud. 🧭📈

chart shows a Long setup on AUD/JPY based on multi-timeframeThis chart shows a **buy setup on AUD/JPY** based on multi-timeframe bullish confluence and a key structure level. Here's a breakdown of the idea:

---

### 🟢 **Trade Type:** Buy

### 📈 Pair: AUD/JPY (1H Chart)

---

### ✅ **Technical Confluences:**

* **Trend Bias:**

* **Weekly (W): Bullish**

* **Daily (D): Bullish**

* **12H: Bullish**

* **Structure:**

* Price retraced into a **Weekly Area of Interest (AOI)** marked in blue and red zone.

* It bounced off the lower trendline of the ascending channel.

* Price is currently forming higher lows near the support of the AOI.

* **Indicators:**

* The **50 EMA (blue)** and **200 EMA (red)** are holding as dynamic support, especially the 200 EMA just below current price.

* EMAs show bullish alignment (short-term EMA above long-term EMA).

* **Candle Action:**

* Price rejected the AOI and is trying to push higher.

* The bullish engulfing near the EMA zone confirms buy interest.

---

### 🟦 **Entry Zone:**

* Around **94.70–94.72**, aligned with the Weekly AOI and just above 200 EMA.

### 📍 Stop Loss:

* Below the red support zone, around **94.50–94.53**, under 200 EMA and key rejection wick.

### 🎯 Take Profit:

* Around **95.30–95.32**, targeting the previous swing high for a favorable risk-reward ratio.

---

### 📊 Summary:

This is a bullish continuation trade, buying from a retracement into a strong support zone with higher timeframe bullish structure and clear confirmation through price action and EMA alignment.