Supplyanddemmand

Sitting Tight with Cryptocurrencies - Bitcoin AnalysisContrary to my normal technical analysis, I've added common Moving Averages used by Hedge Funds on the Daily Chart. Price is clearly below all of them, with a strong break below the most recent Support Zone, which I've labeled "Current Resistance".

My previous analysis notated that Zone as a possible support level, which we have now clearly broken through. Therefore, I don't plan to add anymore crypto to my positions until we have reached the next Potential Support Zone, which I have labeled.

Crypto & Stocks are a waiting game right now, so don't panic or FOMO any positions. Take this time to get better at your analysis process & save money to invest, so you are ready when others are faked out. -@JilianToree

#ES Futures 06.09.22 Daily Overview and Levels to WatchYesterday played out pretty much as first expected, was able to actually call the high and the low within a few points as mentioned I thought we might stay in tighter range between 4157 and our 4103-4099.75 level and we did. Today Globex attempted to break out of our Key Resistance at 4143.75-4137.50 and failed which trapped a lot of people, with that fail I will be looking for us to test the opposite side of this range and our Key Support at 4084.50-4077.25 I believe we should have enough supply to take it out but then we have to monitor how much extension we get and if we accept or come back in. On the downside if we get under 4103.25-4099.75 we can see Key Support at 4084.50-4077.25 and lower levels that I would like to see hold are 4061.50-4056.50 and especially 4046-4042.25, ideally if we will have a fail and come back in we will not break both of those but if we do we have next Key Support at 4030.75-4025.25 to keep in mind. On the upside if we again cant take Key Support which is also our T+2 low for the day then we can see rotation back up or what I will be watching for is a flush of that area and see if we can find buyers at lower levels that will bring us back into this range and that would confirm for me that most likely we are out of supply and can see higher levels of 4103.25-4099.75, 4123.75-4119.25 and Key Resistance at 4143.75-4137.50 and if that does happen today or tomorrow then we can see a run from the Key Resistance up to the next one at 4220. Have to manage expectations as we are still in tight range but today we already seen the signs of it breaking.

XAUUSD Bullish IdeaIm going for a crazy 1:40 on gold and a 1:20 if that fails. I believe it is bullish and we are going to the higher supply area above 1874.00. Now idk if price will return to any of my demand zones, being it already too the H4 imbalance and tapped into the order block but if so we shall see what happens.

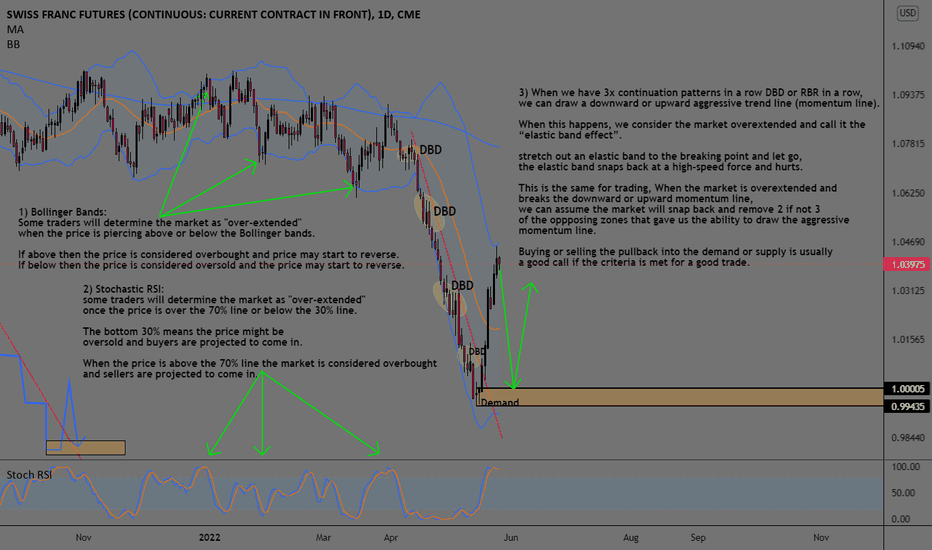

Overextended Markets (Overbought And Oversold)1) Bollinger Bands:

Some traders will determine the market as "over-extended"

when the price is piercing above or below the Bollinger bands.

If above then the price is considered overbought and price may start to reverse.

If below then the price is considered oversold and the price may start to reverse.

2) Stochastic RSI:

some traders will determine the market as "over-extended" once the price is over the 70% line or below the 30% line.

The bottom 30% means the price might be oversold and buyers are projected to come in.

When the price is above the 70% line the market is considered overbought and sellers are projected to come in.

3) Supply And demand

When we have 3x continuation patterns in a row DBD or RBR in a row, we can draw a downward or upward aggressive trend line (momentum line).

When this happens, we consider the market overextended and call it the “elastic band effect”.

stretch out an elastic band to the breaking point and let go, the elastic band snaps back at a high-speed force and hurts.

This is the same for trading, When the market is overextended and breaks the downward or upward momentum line, we can assume the market will snap back and remove 2 if not 3 of the opposing zones that gave us the ability to draw the aggressive momentum line.

Buying or selling the pullback into the demand or supply is usually a good call if the criteria are met for a good trade.

Gold daily viewGold price moved higher from a bullish pin bar which formed last week near $1782 support. XAUUSD advanced for the fourth trading day and currently is near $1856 amid US dollar weakness. Although, it is rallying, the commodity is still exposed for the selling pressure while the price remains below the recent bearish pin bar signal under $1877 - $1895 supply area. Traders, please like and comment if you like this idea. Thank you.

#ES Futures 5.17.22 Overview and Levels to WatchYesterday we had a balance day in our 4030.75-3976.50 range as were thinking it would be, in the Globex session we failed to go lower and did not even touch our 3994.50-3988.75 level which was a sign that we are out of supply. Once we got to our Key Resistance and todays T+2 high (Fridays High) we consolidated a bit and broke out, leaving single prints behind which is a short position/buyers. We reached our next Key Resistance at 4084.50-4077.25 where we found sellers and currently distributing product between that and the lower level of 4061.50-4056.50. Today we have to keep in mind that we have single prints below us where we can expect buyers to be active if we get into that area, seeing how many of them we can fill would be the tell of how much supply we have, being above T+2 with a gap again can force some buy ins today but will it be enough for us to extend higher. On the downside we have 4061.50-4056.50, 4046-4042.25 which is our first single print area where we can see buyers active, ideally if we are going to head higher we will not break both of those levels but if we do we have our gap fill of T+2 high at 4036 and Key support at 4030.75-4025.25. On the upside if we cant fill the singles and that gap to T+2 then we can rotate higher, our Key Resistance for now is 4084.50-4077.25 if that goes our upper levels are 4103.25-4099.75, 4123.75-4119.25 where we should see some sellers on the first test and our next Key Resistance at 4143.75-4137.50 where we should see a good sell response if we get there. I will be looking for long trades from single print areas and lower levels or when we get through the Key Resistance. Powell speaks at 2 so might be an interesting day, patience is KEY.