Nifty Analysis EOD – July 30, 2025 – Wednesday🟢 Nifty Analysis EOD – July 30, 2025 – Wednesday 🔴

Trapped in Illusion – A Day of Decoy Moves

Nifty moved 130 points today, falling short of the 2-week average range of 196 points. It formed its IB by 11:40 AM, marking the day's high and low early. For the rest of the session, it hovered between the IB high and the previous day high, eventually closing near the mean.

Despite a close below the open, Nifty managed a green close vs. the previous day—making it a classic "moboroshi candle" day, where visuals deceive sentiment.

📉 Intraday 5 Min Time Frame Chart

🪜 Intraday Walk

IB formed by 11:40 AM

False breakout on both sides trapped traders badly

Nifty stayed stuck between IB high and PDH

Closed slightly above the previous close, but below open

Eyes on breakout of 24,910 for targets of 24,995 and 25,090–25,110

🔄 Trend & Zone Update

📈 Resistance Zone Shifted To: 25,110 ~ 25,090

📉 Support Zone Shifted To: 24,520 ~ 24,480

🕯 Daily Time Frame Chart with Intraday Levels

🕯️ Daily Candle Breakdown

Candle Type: Small Red Hammer‑Like Candle (Decoy / Moboroshi)

Today’s OHLC:

🟢 Open: 24,890.40

🔺 High: 24,902.30

🔻 Low: 24,771.95

🔴 Close: 24,855.05

📈 Change: +33.95 (+0.14%)

📌 Candle Structure:

Real Body: 35.35 pts (Small bearish body)

Upper Wick: 11.90 pts (Very small)

Lower Wick: 83.10 pts (Long)

📌 Key Observations:

Buyers stepped in near 24,770 zone

Closed near open but slightly lower → mild net selling

Long lower wick indicates dip buying support

📌 Implication:

Buyers defended 24,770–24,780 zone

A reclaim of 24,900–24,920 may resume bullish move

A close below 24,770 weakens support

🛡 5 Min Intraday Chart

🛡️ Gladiator Strategy Update

ATR: 195.72

IB Range: 78.15 → Medium

Market Structure: Balanced

💥 Trades Triggered:

🕙 10:25 AM – Short Entry → SL Hit

📌 Trade Summary:

False IB breakouts on both sides led to a stop loss hit—typical trap in a tight consolidation phase.

📌 Support & Resistance Levels

📈 Resistance Zones:

24,880 ~ 24,890

24,910

24,995

25,090 ~ 25,110

📉 Support Zones:

24,830 ~ 24,820

24,780

24,725 ~ 24,715

24,660 ~ 24,650

🔮 What’s Next? / Bias Direction

Awaiting breakout above 24,910 for potential targets of 24,995 and 25,090–25,110. Consolidation may reward patient breakout players in upcoming sessions.

🧠 Final Thoughts

“Structure is key. When levels work, respect them. When they break, adapt.”

Today's range was narrow, but traps show signs of buildup. Be ready when the market unwinds.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Support and Resistance

USDJPY - 30/7/25 - BoS to a bearish pull backI dont normally trade USDJPY but i see a setup based on my strategy. The price was climbing to take out a previous high on the 4H and Daily TF. But on the hourly there is a clear BoS which suggests that there may be a pull back even though the HTF bias is still bullish.

+ve:

1. there is a BoS on the 1 hour chart

2. Equal low liquidity just below which will draw price to this zone

3. Big imbalance below the equal low liquidity

-ve:

1. Fed news today may push the market against my trade idea

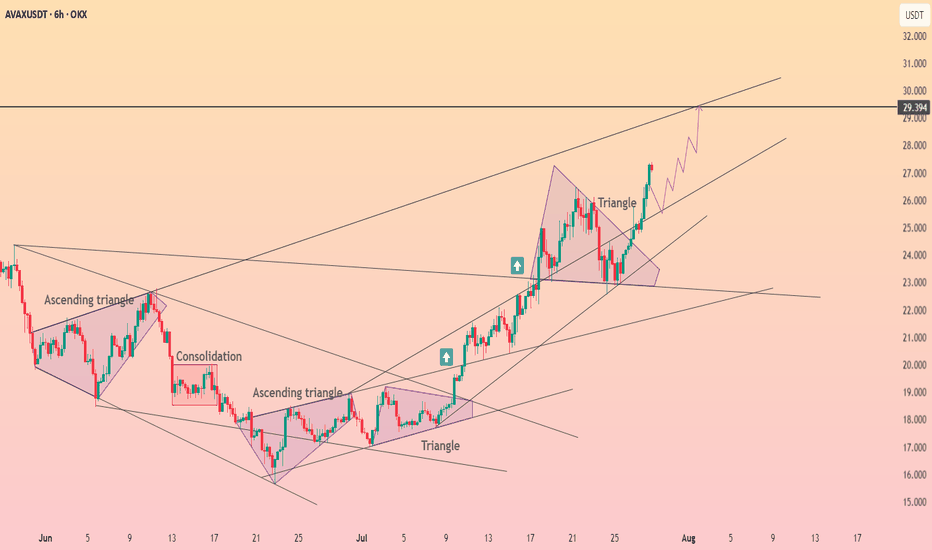

Avalanche broke through the $26 level ┆ HolderStatBINANCE:AVAXUSDT is consolidating just beneath the $33 resistance after reclaiming a prior range high. Price action is forming a classic bull flag while higher lows continue to support the structure. A breakout above $33 could confirm bullish continuation toward $35 and $36. Momentum remains strong as long as the $31.5 support holds, making AVAX one of the key watchlists this week.

USD/CAD Eyes Breakout Above 1.38 as Weekly MACD Flashes BullishUSD/CAD Eyes Breakout Above 1.38 as Weekly MACD Flashes Bullish Signal

USD/CAD Weekly Technical Outlook

The pair is approaching a key resistance zone around 1.3800 . A weekly close above this level could signal a push toward the 1.4000 handle, opening the door for a longer-term bullish breakout and potential buy-and-hold scenario.

From the downside, a break below 1.3500 would likely trigger Canadian dollar strength, possibly driving the pair much lower.

MACD Confirmation:

The weekly MACD is crossing above the histogram from below, which is typically a bullish momentum signal. This supports the idea of a developing uptrend and could mark the beginning of a sustained move higher—especially if accompanied by strong volume.

Fundamental Backdrop:

The recent surge in U.S. Treasury demand reflects heightened risk-off sentiment and USD strength, which may continue to support the upside in USD/CAD in the near term.

GOLD Range-Bound Before Fed – Breakout Above 3349 Unlocks 3374GOLD | Bullish Momentum Builds Ahead of Fed Decision – Key Range Between 3349 and 3312

Fundamental Insight:

Gold is slightly higher as the U.S. dollar weakens ahead of the Fed’s rate decision. Markets await signals on future policy, which could drive sharp moves in gold.

Technical Outlook:

Gold remains bullish while above 3320, with upside potential toward 3349.

A 1H close above 3349 confirms breakout momentum, opening the path toward 3374, and potentially 3401.

A break below 3320, especially below 3312, would invalidate the bullish setup and trigger downside toward 3285, then 3256.

Currently range-bound between 3349 and 3312 — watch for breakout confirmation to determine the next trend direction.

Key Levels:

• Support: 3320 – 3285 – 3256

• Resistance: 3349, 3374 – 3401

Bias: Bullish above 3320

📍 Watch Fed volatility – breakout expected soon

Good turnaround by market as expected from the channel bottom.We had given a message that the market was nearing the bottom and there can be a turnaround sooner than later and market turned around today. This bounce can be currently seen as a technical bounce but it can become a full fledged fightback by bulls if it crosses key resistance levels of Mother line, Father line and Mid-channel resistance. These are the 3 key resistances in front of us currently. All eyes on the important trade deal announcements and with US and China which are on going any news on that from can disrupt the market proceedings in either way. Support and resistance levels for Nifty are as under:

Key Nifty Resistances: 24849 (Trend line resistance), 24922 (Motherline Resistance of hourly chart), 25028, 25070 (Father line resistance), 25189 (Mid-channel resistance), 25243 (Very important resistance for Bulls to conquer). Above 25243 Bulls can gain control of Nifty.

Key Support levels: 25741, 25627 (Channel bottom Support), 24519.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

AUDJPY - Looking To Sell Pullbacks In The Short TermM15 - Strong bearish move.

No opposite signs.

Currently it looks like a pullback is happening.

Expecting bearish continuation until the two Fibonacci resistance zones hold.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Dow Jones Futures Edge Up Ahead of Fed, GDP & Tech EarningsDow Jones Futures Edge Up Ahead of Fed, GDP & Tech Earnings – Bearish Bias Below 44,770

Dow Jones futures rose slightly overnight as investors brace for a packed session. Key events include the release of Q2 GDP data before the market opens, the Federal Reserve’s policy decision in the afternoon, and earnings reports from major tech firms later in the day.

Yesterday, the Dow Jones managed to break below the ascending channel, which technically indicates a new bearish signal for today.

The price stabilizing below 44,770, along with an attempt to break the support line at 44,610, suggests a potential downward move.

Initially today, before the opening of the New York session, the price may attempt to rise toward 44,770 as a retest. However, we anticipate a decline afterward, aiming to break and pass the support level at 44,610, and then extend the drop toward 44,360.

The bullish scenario becomes valid only if the price stabilizes above 44,770. If it can trade above this level for a longer duration, it may rise further toward 44,910.

Key Levels

• Support: 44,610 - 44,360.

• Resistance: 44,770 - 44,910 - 45,100.

SPX500 Awaits Fed – Key Support at 6388 in FocusSPX500 Awaits Fed Decision – Breakdown Below 6365 Could Deepen Correction

Following the registration of a new all-time high at the beginning of the week, the price has started to decline. Also, investors await the Federal Reserve's policy statement later today for guidance on the future path of monetary policy.

The price is currently positioned below the 6388 level, which is a key zone in conjunction with the support line at 6365. This area signals the potential for a new downward correction if the price stabilizes below 6365.

A sustained move below 6365, confirmed by a 1H or 4H candle close, would open the door to a sharper decline toward 6341, followed by 6319, both considered critical support zones.

As for the bullish scenario: if the price finds support and manages to rebound today, the first step toward recovery would be a breakout above 6388, which may lead to a climb toward 6415. Breaking above 6415 would pave the way to retest the resistance zone at 6427, with the potential to reach a new all-time high at 6454.

Key Levels

• Support: 6365 - 6341 - 6319.

• Resistance: 6388 - 6415 - 6427.

BankNfity levels - Jul 31, 2025Utilizing the support and resistance levels of BankNifty, along with the 5-minute timeframe candlesticks and VWAP, can enhance the precision of trade entries and exits on or near these levels. It is crucial to recognize that these levels are not static, and they undergo alterations as market dynamics evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We trust that this information proves valuable to you.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you successful trading endeavors!

Nifty levels - Jul 31, 2025Nifty support and resistance levels are valuable tools for making informed trading decisions, specifically when combined with the analysis of 5-minute timeframe candlesticks and VWAP. By closely monitoring these levels and observing the price movements within this timeframe, traders can enhance the accuracy of their entry and exit points. It is important to bear in mind that support and resistance levels are not fixed, and they can change over time as market conditions evolve.

The dashed lines on the chart indicate the reaction levels, serving as additional points of significance to consider. Furthermore, take note of the response at the levels of the High, Low, and Close values from the day prior.

We hope you find this information beneficial in your trading endeavors.

* If you found the idea appealing, kindly tap the Boost icon located below the chart. We encourage you to share your thoughts and comments regarding it.

Wishing you success in your trading activities!

USDCHF Potential DownsidesHey Traders, in today's trading session we are monitoring USDCHF for a selling opportunity around 0.81000 zone, USDCHF is trading in a downtrend and currently is in a correction phase in which it is approaching the trend at 0.81000 support and resistance area.

Trade safe, Joe.

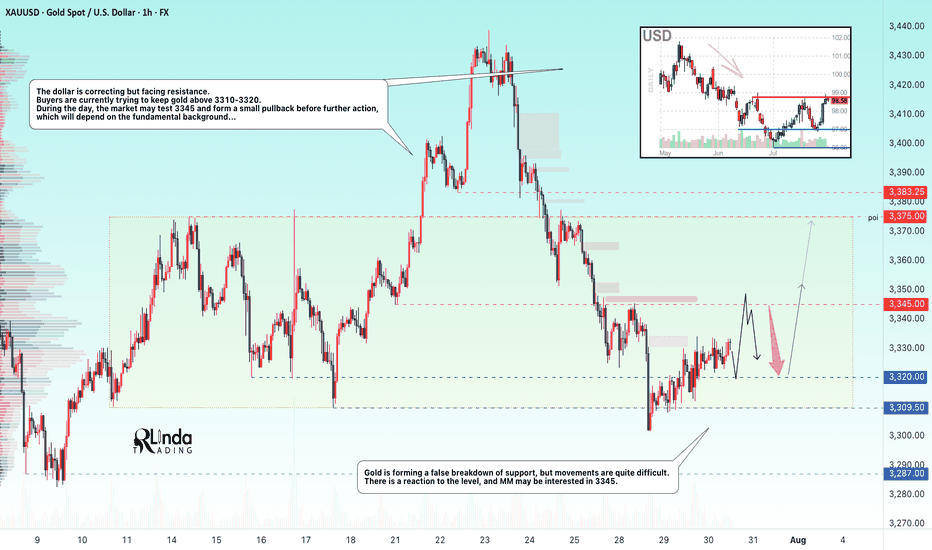

GOLD → False breakdown 3310. Consolidation ahead of news...FX:XAUUSD is forming a false breakdown of support at 3310, thereby confirming the boundaries of the trading range. The dollar is testing strong resistance within the global downtrend. And in the near future, we can expect more economic news...

Gold is trading below the key resistance level of $3345, remaining in a narrow range ahead of the Fed's decision and US GDP data for Q2. Weak data could reinforce expectations of a rate cut and support gold, while strong data would strengthen the dollar. The Fed is likely to keep rates at 4.25–4.5%, with markets pricing in a 64% chance of a 25 bps cut in September. Investors are waiting for signals from Jerome Powell, with a possible split within the Fed: some members may support calls for easing, which would be a driver for gold.

Technically, the situation on D1 is quite interesting. Gold is still below the previously broken trend resistance, but there is no continuation of the momentum. Buyers are reacting to support at 3310, but the market is stagnating due to uncertainty ahead of the news...

Resistance levels: 3345, 3375

Support levels: 3320, 3310, 3287

Thus, from a technical analysis perspective, I expect a retest of 3345, followed by a pullback to support at 3320, from which gold could move higher (if the bulls take the initiative), but if 3320 breaks and 3310 comes under pressure, gold could test 3287. Again, the emphasis is on trend support (the upward line) in the 3335-33450 zone. If the price can consolidate in this zone, we will have confirmation that the price has returned to the boundaries of the upward trend.

Best regards, R. Linda!

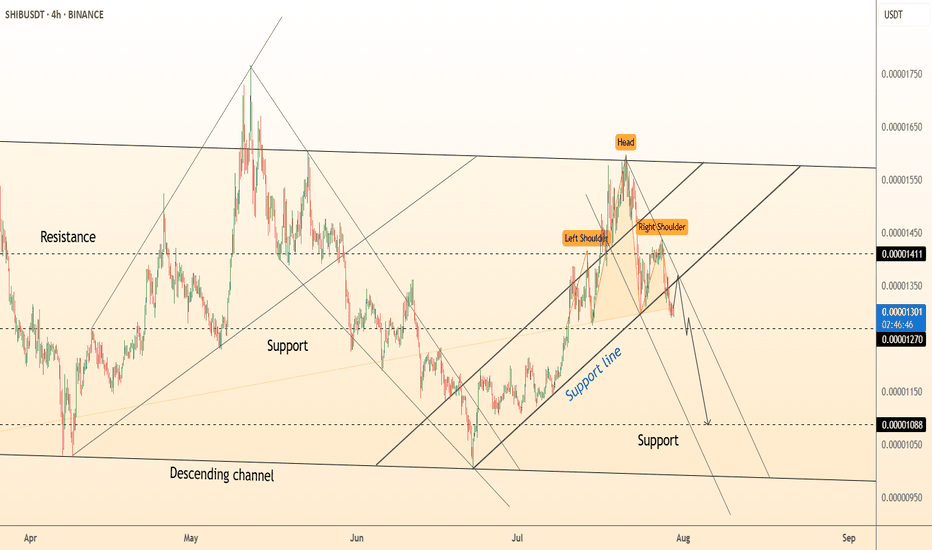

DeGRAM | SHIBUSD fell below the support line📊 Technical Analysis

● A classic Head and Shoulders pattern has formed below resistance at 0.00001411, confirming a bearish reversal with neckline break.

● Price is descending inside a bearish flag and is testing prior support at 0.00001270, with the next major level near 0.00001088.

💡 Fundamental Analysis

● Risk sentiment weakened after latest FOMC minutes signaled persistent inflation risk, fueling a defensive tilt in crypto.

● Whale outflows from SHIB wallets and declining DEX volumes suggest bearish positioning and fading demand.

✨ Summary

Bearish reversal confirmed below 0.00001411. Break of 0.00001270 opens path to 0.00001088. Watch neckline retests for renewed selling pressure.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

DeGRAM | GBPUSD reached the lower boundary of the channel📊 Technical Analysis

● GBPUSD has broken out of a falling wedge within a descending channel, reclaiming the lower boundary of the broader structure.

● Price is consolidating just above 1.33160 support and appears ready to retest the 1.34650 resistance, aided by a series of higher lows and a bullish break of short-term trendlines.

💡 Fundamental Analysis

● Weakening USD sentiment continues after Friday’s softer core PCE and downward revision of Michigan inflation expectations.

● UK economic sentiment improved after recent wage growth and mortgage approval data exceeded forecasts, bolstering GBP.

✨ Summary

Breakout from wedge confirms bullish bias. Support at 1.33160; target 1.34650 short-term. Watch for rally continuation while holding above 1.33625.

-------------------

Share your opinion in the comments and support the idea with a like. Thanks for your support!

NAS100 MAY FORM THE BEARISH HEAD AND SHOULDERS.NAS100 MAY FORM THE BEARISH HEAD AND SHOULDERS.

NAS100 has been trading sideways since the beginning of the week, forming local highs with lows staying at same price for the most part. The price seem to form the Head and Shoulders reversal pattern

What is a Head and Shoulders?

A Head and Shoulders pattern is a reversal chart pattern signaling a potential trend change. It consists of three peaks: two lower "shoulders" and a higher "head" in the middle, connected by a "neckline" (support level). A bullish (inverse) Head and Shoulders forms at a downtrend's end, signaling an uptrend; a bearish Head and Shoulders forms at an uptrend's end, signaling a downtrend.

Currently the SMA50 is pushing on NAS100 from above, while SMA200 is supporting the price. In case the SMA200 on 30-m minutes timeframe gets broken, we may see the decline towards 23,200.00 support level.

SHIBUSDT major weekly support of 0.000010$ is strong!!Two weekly supports which are 0.000010$ & 0.000007$ are strong enough to hold price like past years and i think soon those weekly +100% candles will surprise us here on BINANCE:SHIBUSDT too.

all major supports and resistances are all also mentioned on the chart too.

DISCLAIMER: ((trade based on your own decision))

<<press like👍 if you enjoy💚