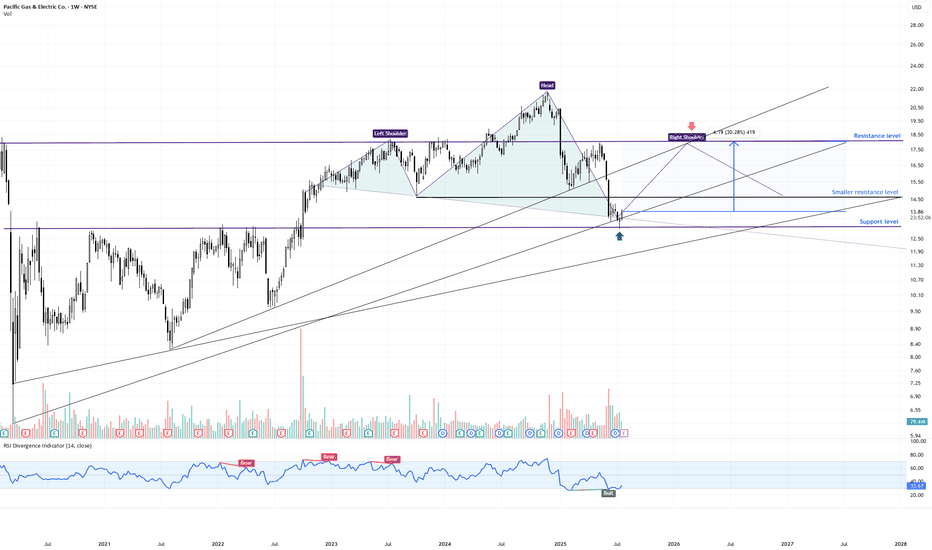

PCG Weekly Swing Trade | High-Probability Reversal Zone📍 Ticker: PCG (Pacific Gas & Electric Co.)

📆 Timeframe: 1W (Weekly)

💡 Pattern: Head & Shoulders Formation – Testing Neckline & Long-Term Support

📉 Price: $13.87 (current weekly level)

📊 Volume: 78M

📉 RSI: 33.7 → oversold zone brewing

🔍 What the Chart is Showing

PCG is in the late stages of a Head & Shoulders pattern, but the right shoulder is still developing. Price is now pressing into a critical confluence area where multiple factors intersect:

✅ Neckline zone from the potential H&S structure

✅ Multi-year ascending trendline support (2020 origin)

✅ Horizontal support cluster from 2022–2023 consolidation

✅ Weekly RSI hovering near oversold, hinting at possible bullish divergence

Importantly, the H&S is not yet confirmed – it would require a decisive weekly close below the neckline to trigger a textbook breakdown.

🧠 Swing Trade Scenarios

➡️ Bullish Reversal Scenario (Failed Breakdown)

🟢 Entry Zone: $13.60–$14.00

🎯 Target 1: $14.62 (initial resistance pivot) - close 30-70% of the position

🎯 Target 2: $17.80–$18.50 (major resistance) - close the another 30-70% of the position.

⛔️ Stop-Loss 1: Close below $13.20 (neckline break confirmation)

➡️ Bearish Breakdown Scenario (Pattern Confirmation)

❌ If PCG closes below $13.20 on the weekly, it confirms the H&S → opens downside toward $11.50 (the lowest trendline support)

⚠️ What Makes This Week Critical

📌 A hammer-like candle is forming – but needs a strong weekly close to indicate buyer absorption

📌 A close above $14.00 would weaken the H&S formation, hinting at a failed pattern

📌 A close below $13.20 would confirm the bearish continuation

This is a decision zone: either the right shoulder fails, triggering a deeper swing lower, or buyers defend and negate the pattern.

💬 Will PCG confirm the weekly H&S breakdown or trap bears with a failed pattern bounce?

✅ This week’s close will define the next major swing move!

LIKE & FOLLOW for more professional swing setups with clean risk/reward.

#PCG #SwingTrade #Utilities #TargetTraders #TechnicalAnalysis #HeadAndShoulders

Support and Resistance

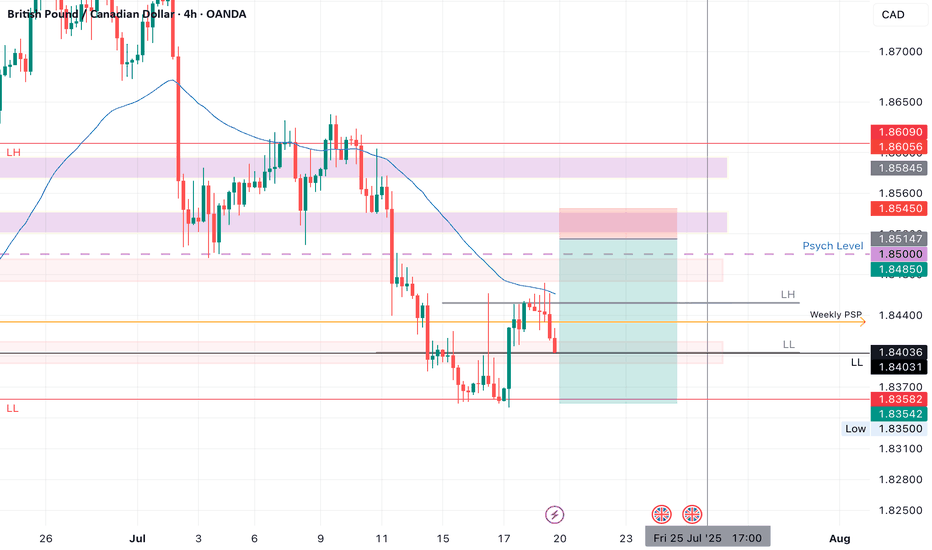

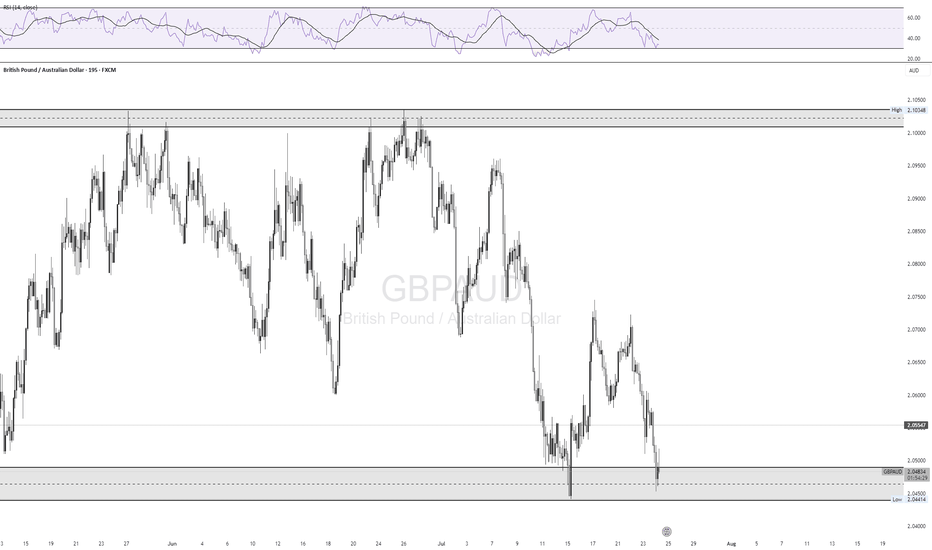

GBPCAD SHORTMarket structure bearish on HTFs DW

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Daily EMA retest

Around Psychological Level 1.85000

H4 Candlestick rejection

Levels 5.3

Entry 90%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

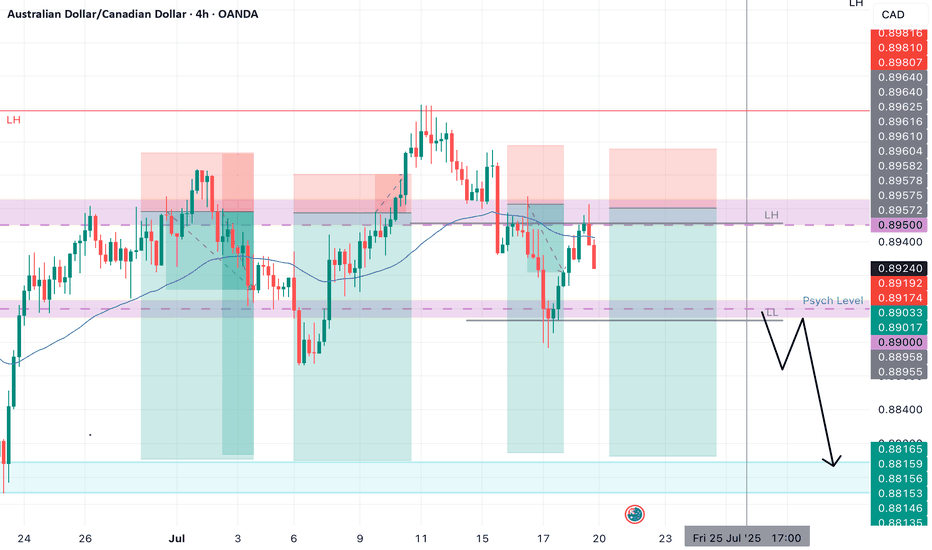

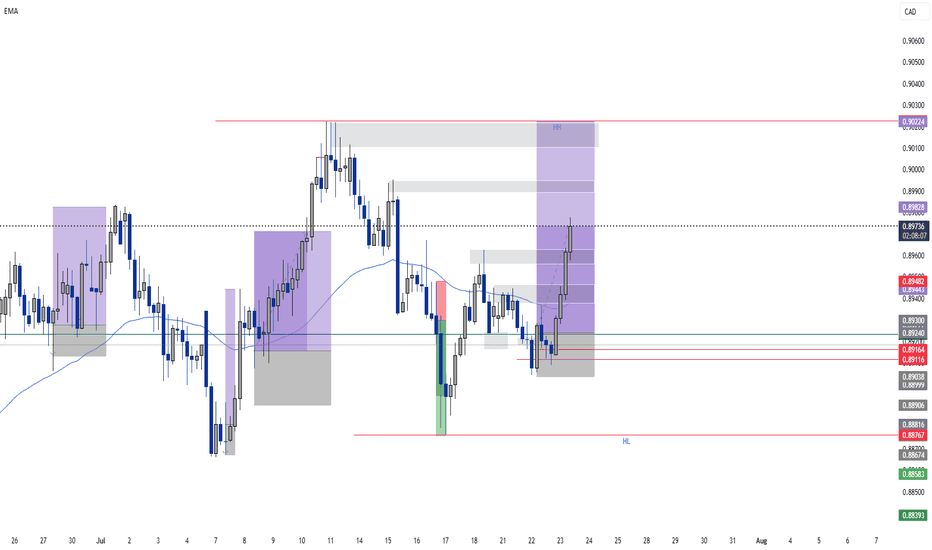

AUDCAD SHORTMarket structure bearish on HTFs DW

Entry at both Weekly and Daily AOi

Weekly Rejection at AOi

Weekly Previous Structure Point

Weekly Rejection at AOi

Daily Rejection at AOi

Daily Previous Structure Point

Around Psychological Level 0.89500

H4 EMA retest

H4 Candlestick rejection

Levels 4.17

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

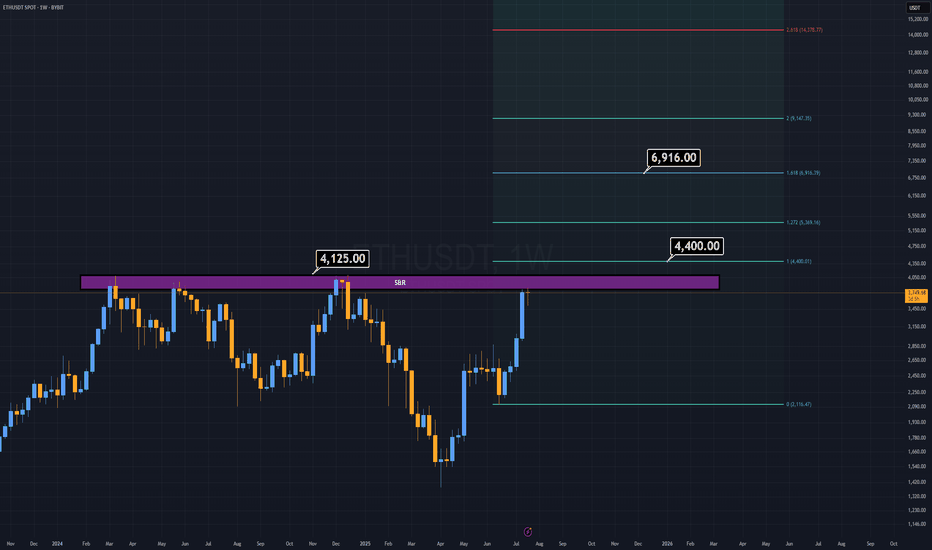

ETH Analysis (1W)Here I am, presenting the asset I personally dislike the most — ETH.

But the chart doesn’t care about feelings. ETH looks ultra bullish, but only if it breaks above the $4,125 level.

Why this level?

The $3,800–$4,100 range has historically acted as a major distribution zone — a place where market participants have consistently taken profit for years.

If this resistance is finally broken, we could see ETH rally toward $6,900 as a minimum target.

This level is based on the breakout projection of the long-standing macro structure.

Honestly, the target looks even better than the asset itself :)

Good Luck.

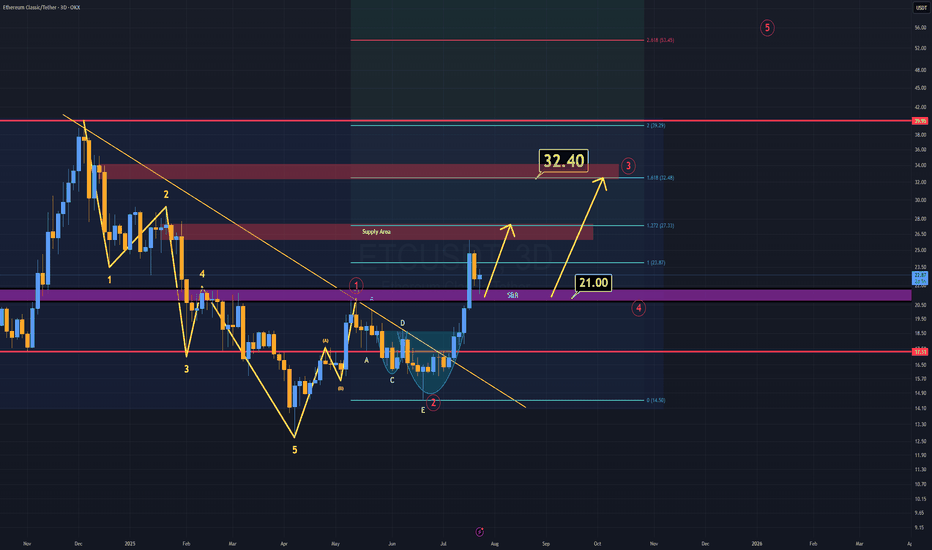

ETC Analysis (3D)ETC is showing a strong bullish structure, just like many other altcoins.

The key difference? ETC has already confirmed its breakout.

As long as ETC holds above the $21 level, I believe the minimum target sits at $32 in the coming weeks.

According to Elliott Wave Theory, that $32 region also marks the end of wave 3, which perfectly aligns with a daily supply block, a strong technical confluence.

Recently, ETC tapped the rebuy zone, highlighted in purple (S/R zone) on the chart.

Lower timeframes also support this bullish continuation scenario.

Momentum is on the side of the bulls.

S wishes you the best of luck!

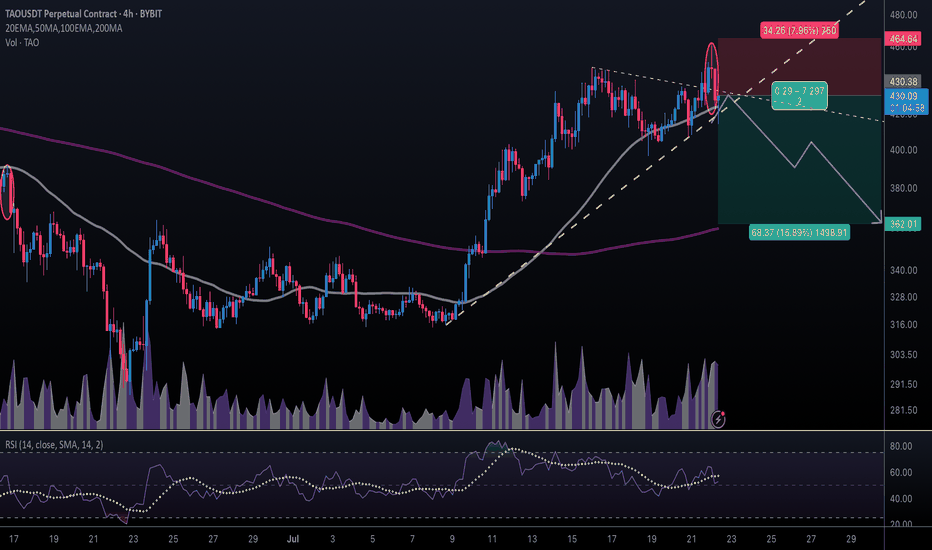

#TAOUSDT #4h (ByBit) Ascending trendline near breakdownBittensor printed an evening doji star deviation, a retracement down to 200 MA support seems next.

⚡️⚡️ #TAO/USDT ⚡️⚡️

Exchanges: ByBit USDT

Signal Type: Regular (Short)

Leverage: Isolated (5.0X)

Amount: 5.0%

Entry Targets:

1) 430.38

Take-Profit Targets:

1) 362.01

Stop Targets:

1) 464.64

Published By: @Zblaba

GETTEX:TAO BYBIT:TAOUSDT.P #4h #Bittensor #AI #DePIN bittensor.com

Risk/Reward= 1:2.0

Expected Profit= +79.4%

Possible Loss= -39.8%

Estimated Gaintime= 1 week

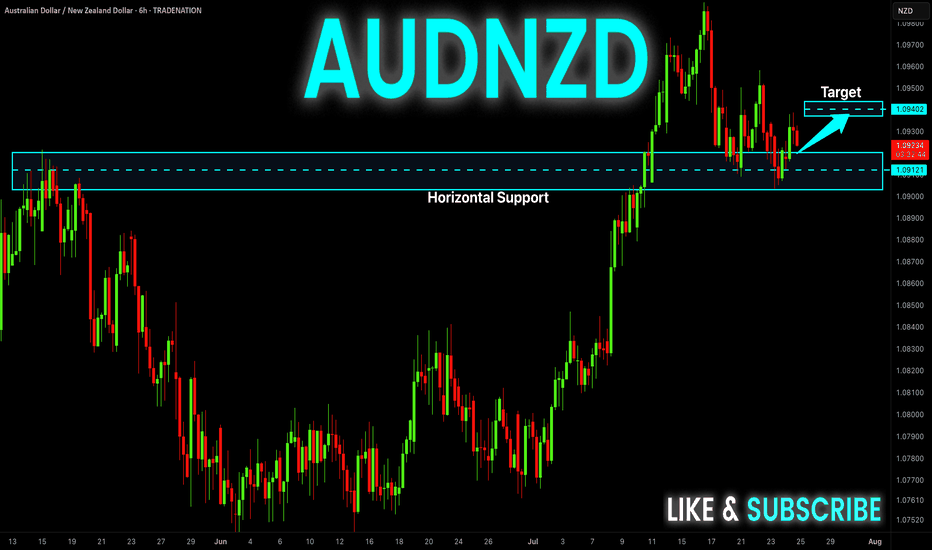

AUD-NZD Local Long! Buy!

Hello,Traders!

AUD-NZD is about to retest

A strong horizontal support

Level of 1.0912 and as we are

Bullish biased we will be expecting

A local bullish rebound

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

SELL ETH 25.7.2025Reversal trade order: SELL at H1~M15

Type of entry: Limit order

Reason:

- Candle creates reverse number 1 model

- The bottom hasn't touched any peak yet (meaning it hasn't reached a strong reversal zone)

Note:

- Management of money carefully at the price of bottom of M5 (3,716)

Set up entry:

- Entry sell at 3,751

- SL at 3,776

- TP1: 3,716

- TP2: 3,670

Trading Method: Price action (No indicator, only trend and candles)

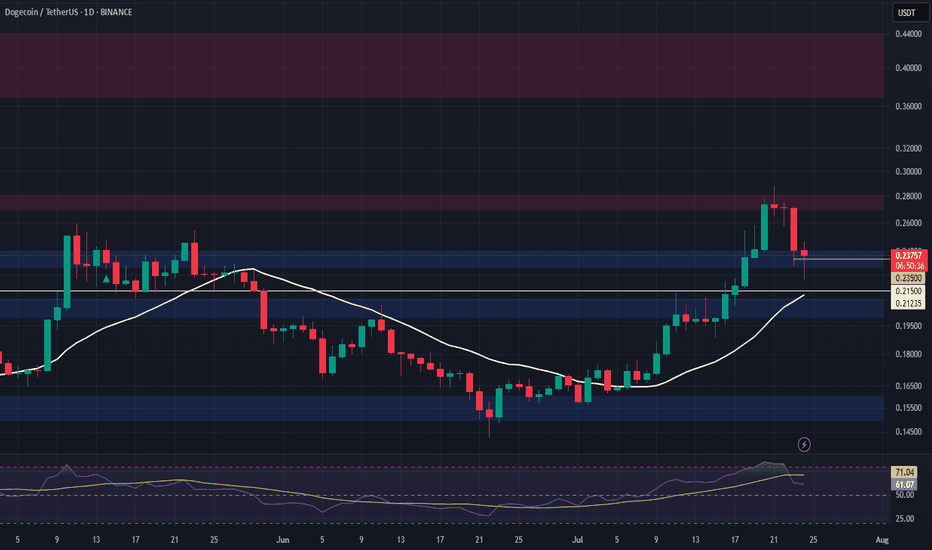

DOGE Swing Trade – Key Support in PlayDOGE is currently holding a major support zone, offering a strong risk-reward opportunity for a long swing position. With bullish sentiment and meme coin narratives returning, this level is worth watching for upside continuation.

📌 Trade Setup:

• Entry Zone: $0.23 – $0.24

• Take Profit Targets:

o 🥇 $0.27 – $0.28

o 🥈 $0.37 – $0.44

• Stop Loss: Just below $0.215

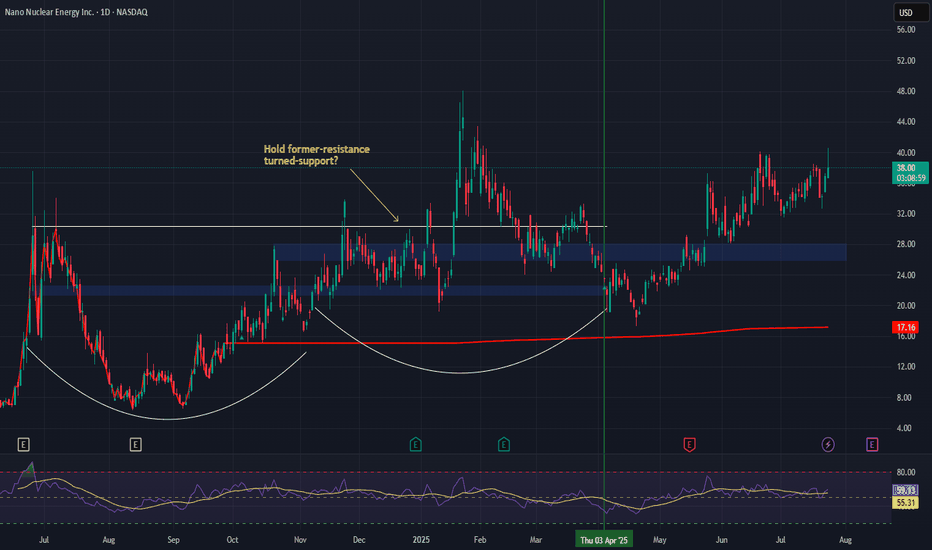

Nano Nuclear (NNE) –Powering the Future of Clean U.S. Energy 🇺sCompany Snapshot:

Nano Nuclear Energy NASDAQ:NNE is a pioneering U.S.-based microreactor company developing compact, modular nuclear power solutions for defense, medical, and national grid applications.

Key Catalysts:

Nuclear Innovation Meets Energy Independence 🔌

NNE is at the forefront of advanced nuclear tech, supporting America’s push toward energy resilience and decarbonization.

Its microreactors are designed for fast deployment, critical for defense bases, hospitals, and remote power needs.

Strong Market Momentum 📈

Since our initial entry on April 3rd, NNE has surged 74%, reflecting rising investor interest in nuclear solutions.

After printing a higher high, the stock is pulling back toward a key support zone.

Policy & Investor Tailwinds 📊

U.S. energy policy is increasingly focused on nuclear as a clean base-load source, giving NNE a strategic edge.

Growing institutional attention on microreactors as scalable, next-gen energy infrastructure.

Investment Outlook:

Bullish Entry Zone: $26.00–$27.00

Upside Target: $58.00–$60.00, supported by innovation, policy alignment, and long-term energy demand.

🔆 NNE is shaping up as a high-conviction play on America’s nuclear energy future.

#NNE #NuclearEnergy #Microreactor #CleanEnergy #EnergySecurity #DefenseTech #GridStability #Innovation #GreenEnergy #NextGenPower #EnergyIndependence

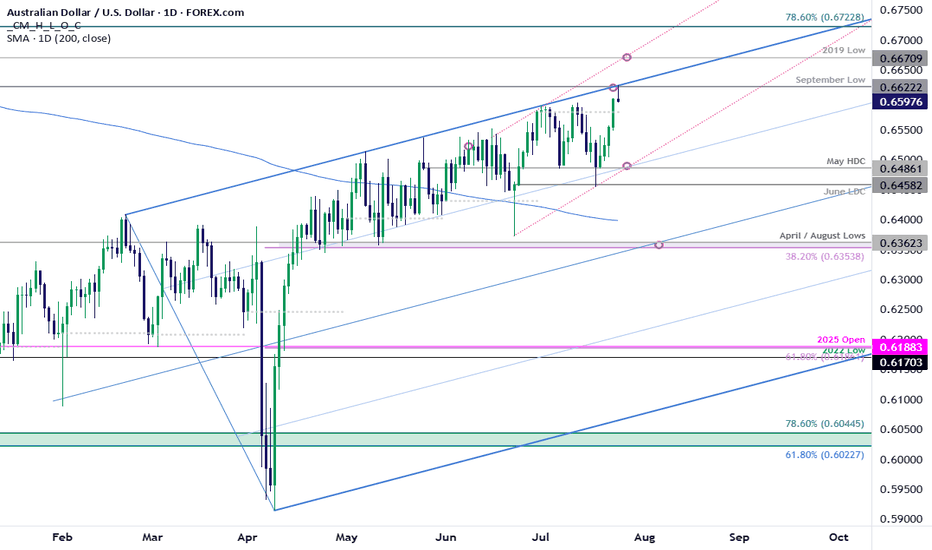

AUD/USD Bulls Eye BreakoutThe Australian Dollar surged more than 1.8% this week with AUD/USD now testing multi-month uptrend resistance at fresh yearly highs. A four-day rally takes price into confluent resistance at the September low / upper parallel at 6622- The focus is on today’s close with the immediate advance vulnerable while below this key slope. Subsequent resistance objectives eyed at the 2019 low at 6671 and the 78.6% retracement of the broader 2024 decline at 6723.

Initial support rests with the July open at 6581 and is backed by the May high-day close (HDC) / weekly open at 6486-6506. Losses would need to be limited to this region for the late-June advance to remain viable (near-term bullish invalidation). Subsequent support seen at the June low-day close (LDC) at 6458 with a break below 6350 ultimately needed to suggest a more significant high is in place / larger reversal is underway.

Bottom line: A breakout of the July opening-range takes AUD/USD into confluent uptrend resistance- risk for topside exhaustion / price inflection here. From a trading standpoint, a good zone to reduce portions of long-exposure / raise protective stops – losses shudl be limited to 6486 IF price is heading higher on this stretch with a close above this slope needed to fuel the next leg of the advance.

Keep in mind the FOMC interest rate decision is on tap next week with Core Personal Consumption Expenditures (PCE) and Non-Farm Payrolls (NFPs) slated into the monthly cross. Stay nimble into the releases and watch the weekly closes here.

-MB

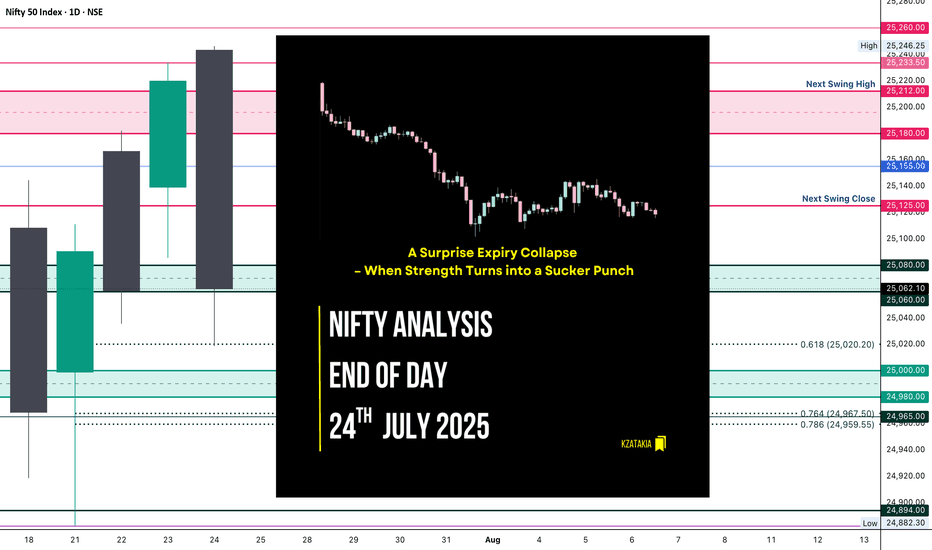

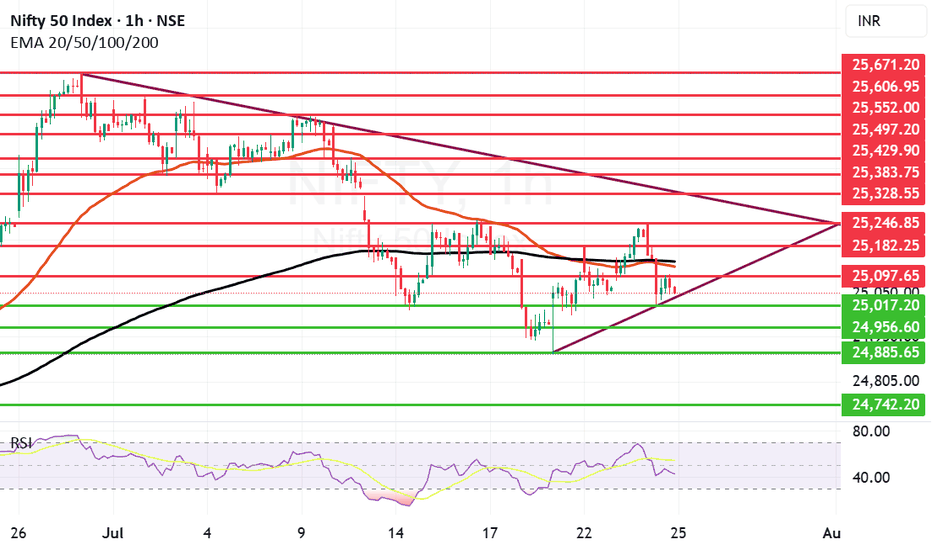

Nifty Analysis EOD – July 24, 2025 – Thursday 🟢 Nifty Analysis EOD – July 24, 2025 – Thursday 🔴

📉 A Surprise Expiry Collapse – When Strength Turns into a Sucker Punch

Today’s session was an unexpected twist.

Nifty opened above the previous day’s high, giving early hope to the bulls—but within the first hour, it slipped to 25,155 and formed its IB. What followed was a sharp 136-point fall, breaking not just yesterday’s low, but also the July 22nd low. This sudden bearish momentum was completely news-driven, and expiry-day long unwinding only added fuel to the fire.

Despite a strong close yesterday, today’s fall erased all of July 23rd’s gains and brought us right back to July 22nd’s close—neutralizing the recent upward effort.

The day closed at 25,062, marginally above key support. Technically, today’s low respected the 0.618 Fib retracement level drawn from July 21st’s low to July 23rd’s high—so a dead cat bounce is possible if no further bad news hits. But if we open below 25,050 tomorrow, expect more downside pressure toward 24,960–24,890 zones.

🕯 5 Min Time Frame Chart with Intraday Levels

🕯 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 25,243.30

High: 25,246.25

Low: 25,018.70

Close: 25,062.10

Change: −157.80 (−0.63%)

Candle Structure Analysis:

🔴 Body: Large red body (181.2 pts) shows strong intraday selling.

☁️ Upper Wick: Tiny (2.95 pts) → sellers dominated from the start.

🌊 Lower Wick: Moderate (43.4 pts) → small recovery near close.

Candle Type:

Almost a bearish Marubozu — clear domination by sellers with barely any upper shadow, signaling intense sell pressure.

Key Insight:

Bulls lost control after open.

Bears took charge below 25,155.

Close near support, but bias cautious.

Bulls must reclaim 25,150+ for recovery, else 25,000 may give way.

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 185.97

IB Range: 83.55 → Medium

Market Structure: Balanced

Trades Triggered:

⏰ 10:05 AM – Short Entry → SL Hit

⏰ 11:10 AM – Short Entry → Target Hit (1:3.6 Risk:Reward)

📊 Support & Resistance Levels

Resistance Zones:

25,125

25,155

25,180 ~ 25,212

25,233

Support Zones:

25,080 ~ 25,060

25,020

25,000 ~ 24,980

24,967 ~ 24,959

24,882

🔮 What’s Next?

A gap-up or stable open may trigger a dead cat bounce toward 25,150–25,180.

A gap-down below 25,050 confirms bearish continuation → next targets: 24,960 / 24,890.

Watch price action around the 25,020–25,060 zone closely.

🧠 Final Thoughts

“Markets are never wrong – opinions often are.”

— Jesse Livermore

Today was a reminder of how expiry day surprises and news flows can flip the narrative. Stay flexible, and keep a bias—but not a blind one.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

Bitcoin Bullish Structure Holds: Focus on Support Entries & Brea__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Uptrend synchronization on all timeframes (MTFTI Strong Up). Risk On / Risk Off Indicator: strong buy on larger TF, neutral intraday.

Supports/resistances: Main HTF supports well below current price (115,736–117,000, 111,980). Key resistances to break: 120,998.7 and 122,318.

Volumes: Normal to moderate, no climax, no distribution detected.

Multi-TF behaviour: No behavioural excess, no sell signal, intraday phases are consolidative just below resistance, which is normal.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Overall bias: Strong bullish, no end-of-trend alert. Buying retracement towards the Pivot Lows is preferred.

Opportunities: Entries on dips to 115,700–117,000 (2H/4H); breakout above 120,250/122,300.

Risk zones: Return below 115,700 or 111,980 = structural alert. Increased vigilance for macro releases (ECB/PMI/Jobless Claims).

Macro drivers: Fed in focus (no move expected), volatility risk around July 29–30 (FOMC).

Action plan: Entry on retracement, dynamic management. Stop-loss under 115,736 then 111,980. Partial exits on excess or confirmed breakout.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Resistances 122,318, 120,998.7; supports 115,736.9, 105,100.2. Risk On / Risk Off Indicator: strong buy, all synchronized bullish, no exhaustion. Daily bias: robust uptrend.

12H/6H/4H: Bullish confluence. Strong momentum, stable volume, validated supports. No ISPD excess, sectoral strength intact.

2H/1H: Consolidation below resistance; healthy structure. Supports to be favored for swing/intraday positioning. Minor intraday hesitation, no reversal.

30min/15min: Behavioural neutrality, lateral movement. Volume normal to mildly elevated, no overheating. Structural risk absent.

Additional indicators:

Risk On / Risk Off Indicator: Strong buy up to 2H; neutral on short TF.

ISPD DIV: Neutral, healthy market, no excess detected.

Volume: No climax or distribution, multi-TF structural support.

Cross-timeframe synthesis: Multi-timeframe bullish alignment, no structural weakness. Opportunities on retracement, breakout plays above all-time highs.

__________________________________________________________________________________

Synthesis & Strategic Bias

__________________________________________________________________________________

BTC trend and momentum remain aligned, sector leadership (Risk On / Risk Off Indicator) intact.

Strong HTF support, major resistances must break for extension.

External risk: macroeconomic catalysts (Fed, ECB, US PMI).

Premium opportunities on dips to supports, dynamic management essential around macro events.

Final bias: as long as supports and indicator alignment hold, bull run continues. Partial exit at resistance; stops below validated pivots.

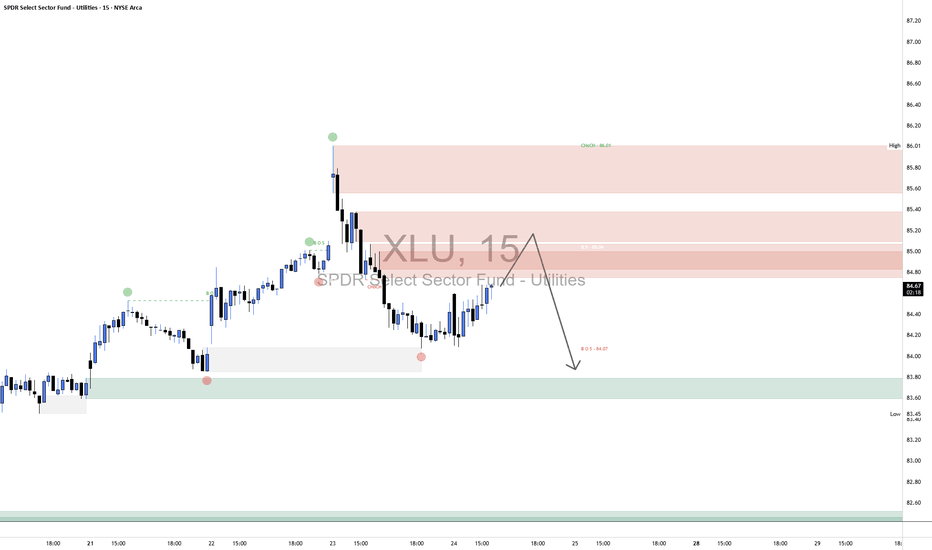

XLU Short1. Market Structure Overview

1.1 Change of Character (CHoCH) – 86.01

Marked a bearish shift after price broke below a significant higher low.

Suggests that the prior bullish trend has lost strength.

1.2 Break of Structure (BOS) – 84.07

Confirmed a bearish continuation, breaking below the previous support level.

Validates the downtrend structure following the CHoCH.

2. Supply & Demand Zones

2.1 Supply Zones (Resistance)

Zone A: 85.40–86.01

Major Supply zone created by distribution before the sharp sell-off.

Acts as strong resistance; sellers aggressively entered at this level.

Zone B: 84.80–85.20 (0.5 Level)

Intermediate Supply—likely a reaction zone for institutional sell limits.

Price could stall or reverse from this level before testing Zone A.

2.2 Demand Zones (Support)

Zone C: 83.45–83.80

First Major Demand—price reacted here previously with a strong bounce.

A break below could expose lower demand.

Zone D: 82.50–82.90

Deeper Demand—represents a high-probability buying area if Zone C fails.

3. Price Action in Bordered Region

Current Price (~84.69): Price is climbing toward supply after a local low.

Expected Move: Price is likely to:

Reach into Zone B (84.80–85.20).

Potentially reject from supply and continue downward.

If rejection occurs, price is expected to revisit Zone C (~83.50–83.80).

Bullish Scenario: If price breaks above 85.20 and sustains above 86.01, bullish continuation becomes likely.

Bearish Scenario: Rejection from current supply areas confirms continuation of the downtrend.

4. Structure & Momentum Outlook

Bias: Bearish, unless 86.01 is broken and flipped into support.

Momentum: Price is currently retracing with moderate strength. If supply absorbs buyers in Zone B, momentum will likely reverse to the downside.

Key Level to Watch: 85.00–85.20 area for reversal confirmation.

5. Supporting Financial Context

Sector Rotation: The Utilities sector (XLU) has seen recent inflows and outflows tied to market volatility and interest rate speculation.

Rate Sensitivity: Utilities are interest-rate sensitive, and the market is pricing in uncertainty around Fed cuts, adding pressure to the sector.

Recent Sentiment: Some analysts view defensive sectors like utilities as range-bound or underperforming during growth-driven rotations (CNBC, Bloomberg).

IWM Short1. Broader Market Structure 📉

1.1 Change of Character (CHoCH)

Occurred near the top (~226.70), breaking the prior higher low—signaling a shift from bullish to bearish momentum.

1.2 Break of Structure (BOS)

Confirmed by a move below that level, validating the bearish change and underlining a downtrend in progress.

2. Supply & Demand Zones

2.1 Demand Zones (Support)

Price zones where buyers have previously stepped in, marking potential reversal points:

Zone A (~223.00–223.50) – First layer of support; price tested this zone after the BOS.

Zone B (~221.80–222.20) – Mid-range demand area with historical buyer activity.

Zone C (~220.00–220.50) – Deeper support zone; last line before structural lows.

Key Takeaway: These zones represent probable stops for a short-term pullback and are ideal for long-entry decisions.

2.2 Supply Zone (Resistance)

~226.70–226.75 – Located at the level where BOS occurred; acts as near-term resistance where sellers may reassert control.

3. Price Action Inside the Bordered Area

Current Price (~224.55): Hovering between the supply and first demand zone.

Expected Movement:

A pullback into Zone A (~223.00–223.50).

If demand holds, look for a bullish reaction—forming a higher low, potentially pushing price back toward 226.70+.

Bearish Risk: A break below Zone A increases downside risk into Zone B or C, reinforcing the bearish structure.

4. Momentum & Structure Outlook

Bullish Scenario: A bounce from demand with structure preserved (~higher low) could lead to short-term upside into resistance.

Bearish Scenario: A drop below the bordered demand zone would confirm continuation of the downtrend.

Watch: Price structure around the 224–223 area and reversal cues (e.g., rejection candles, volume spikes).

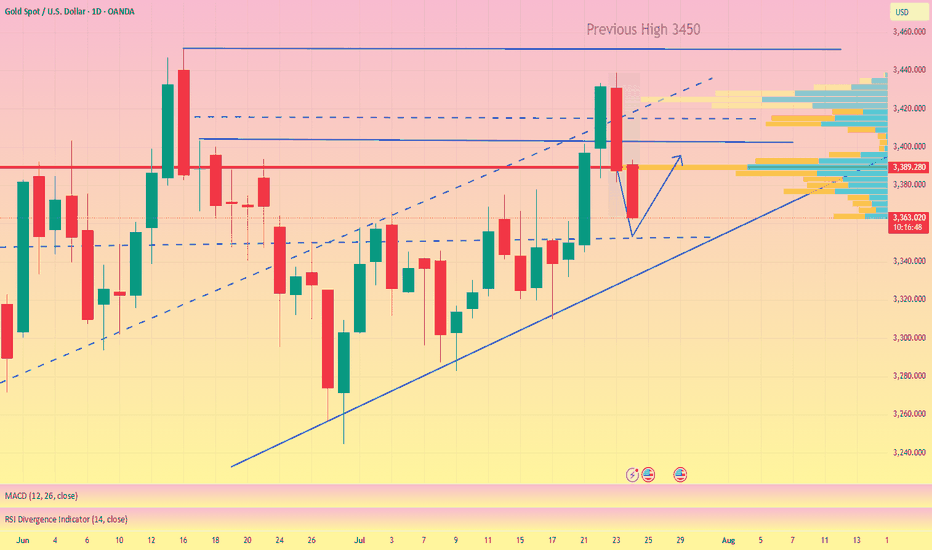

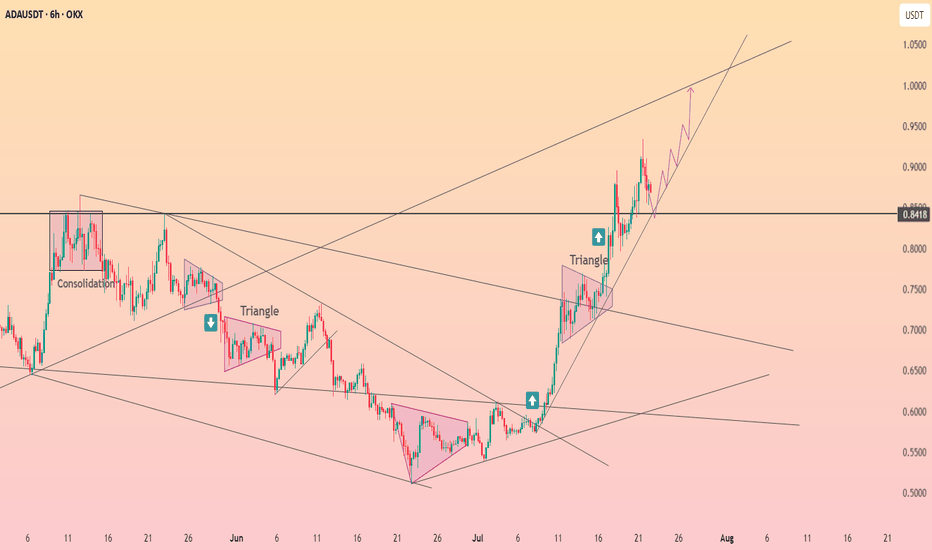

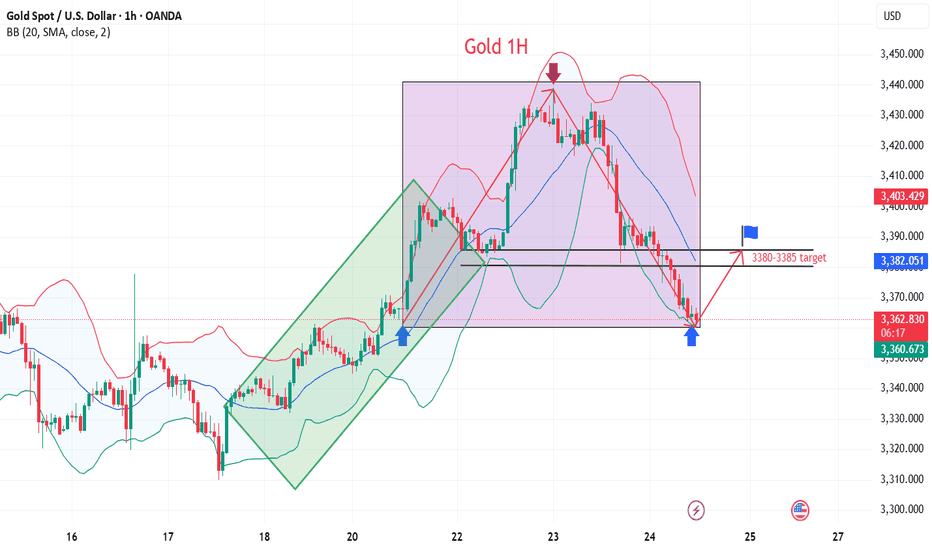

The callback is coming to an end, don't chase the short easily#XAUUSD

The long positions held last night have already left the market at a loss😔. After the Asian session opened, I continued to watch the trend of gold, but it did not effectively rebound to the ideal target area. After repeatedly testing around 3393, I chose to manually exit the market📀.

Gold is currently somewhat overcorrected, with the hourly line falling into severe oversold territory📉. But the market will eventually return to the bullish trend🐂. Why do I say that? First, there are less than 8 days left before the final deadline for tariffs. Second, the Federal Reserve’s interest rate cut is also approaching. In the medium and long term, there is definitely no problem with being bullish. There will be initial jobless claims data later, which will affect the trend of gold today. We need to pay some attention to it👀.

From the daily line, the current Bollinger Band middle track is near the 3343 line, and the SMA60 moving average is near the 3330 below. In the short term, the downward momentum of gold is released, and it is expected to test the 3343 mid-line support below💪.

📊Therefore, we can consider going long again at 3360-3343 below and look towards 3375-3385. Short-term losses don’t mean anything. With the recent frequent news fluctuations, we still have a good chance to turn losses into profits🚀.

🚀BUY 3360-3350

🚀TP 3375-3385

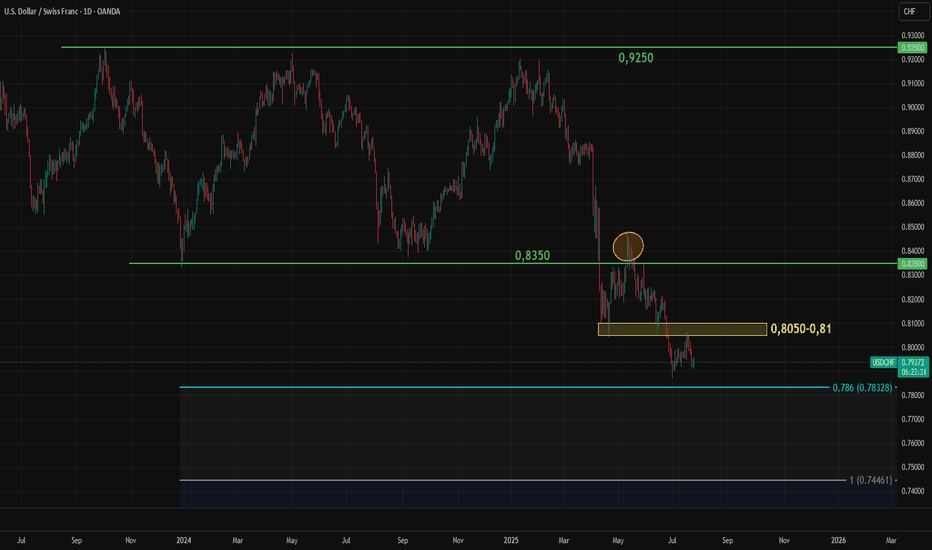

Key Levels to Watch for USDCHFAfter losing the key 0.8350 level, USDCHF attempted a re-entry but failed to hold above it. The pair is now under renewed pressure, with the price falling below 0.80.

The Swiss franc remains strong against most currencies due to solid fundamentals. USDCHF's next possible targets are 0.7830 and 0.7460, both based on Fibonacci expansion levels.

For CHF bears, the key zone to watch is between 0.8050 and 0.8100. A recovery into this zone could serve as an early signal of potential upward movement in USDCHF. However, the critical level remains at 0.8350.

AUDCAD Bullish Setup – 15min Structure Shift1. Price was trading at a discount in the context of a higher time frame bullish trend (HHs and HLs).

2. On the 15-minute chart, price attempted to break a previous lower low but failed — signaling potential exhaustion in bearish pressure.

3. This failure to break structure on the 15 min suggested sell-side liquidity was absorbed, and smart money shifted direction.

4. Price then broke short-term 15-minute structure to the upside, indicating a bullish order flow shift.

5. A bullish retracement followed into an OB, offering a high-probability entry point before continuing higher.

Nifty falls again as it can not sustain above 25240 level. Nifty again has shown some weakness as it was not able to sustain levels above 25240. The fall was lead by IT index which ended with deep cuts and fell 2.12% the other indices that saw fall were FMCG, Realty and Small Cap index. Trump's stance against Tech companies hiring from India and the deadlock in the trade deal also contributed to fall today. Index fell 157.8 points today and ended below both Mother and line on hourly chart. In the daily chart the candle we saw today was a bearish engulfing candle so further weakness can not be ruled out. The 2 major supports for nifty remain at 25017 and 24956 if these two supports are broken we may see Nifty falling towards 24885 or even 24742. Resistances for Nifty remain at 25097, 25138, 25182 and 25246. Only after we get a closing above 25246 we can see Nifty rally upwards.

Disclaimer: The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock or index. The Techno-Funda analysis is based on data that is more than 3 months old. Supports and Resistances are determined by historic past peaks and Valley in the chart. Many other indicators and patterns like EMA, RSI, MACD, Volumes, Fibonacci, parallel channel etc. use historic data which is 3 months or older cyclical points. There is no guarantee they will work in future as markets are highly volatile and swings in prices are also due to macro and micro factors based on actions taken by the company as well as region and global events. Equity investment is subject to risks. I or my clients or family members might have positions in the stocks that we mention in our educational posts. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message. Do consult your investment advisor before taking any financial decisions. Stop losses should be an important part of any investment in equity.

Las Vegas Sands | LVS | Long at $43.76Pros:

Earnings are forecast to grow 13.29% per year

Earnings grew by 18.4% over the past year

2.3% dividend yield

Cons:

Insider selling and exercising of options

Debt-to-equity ratio of 3.8x

Small price gap on the daily chart near $41 that may close prior to a move up.

If people can't buy houses, they will travel... thus, at $43.76, Las Vegas Sands NYSE:LVS is in a personal buy zone.

Targets

$50.00

$57.00

$59.00

Gold failed to break through three times, short-term bearish?

💡Message Strategy

Gold's decline today means the second consecutive day of decline as investors turn their attention to more positive trade developments since yesterday.

However, gold still received buying support earlier this week and briefly broke through $3,400. This round of gains tested key resistance levels on the gold daily chart, but ultimately the bears held their ground.

This is the third time in nearly three months that gold has tried to break through the $3,430 to $3,435 resistance area, but all failed.

📊Technical aspects

Gold’s latest decline this week has brought the price back into a range-bound trading state between key hourly moving averages. This means that the short-term trend has become more neutral.

This shows that the upward momentum has clearly weakened and buyers need to regain short-term dominance before they can hope to challenge the key resistance area mentioned earlier again.

Currently, the 200 hourly moving average near $3,365 provides support to the downside. If the price can hold this level, it will indicate that buyers are still holding on and waiting for the next upside opportunity.

Combined with the current 1H chart trend analysis, there is still a great chance of a bullish pullback in gold in the short term.

💰Strategy Package

Long Position:3360-3365,SL:3340,Target: 3380-3400