Support and Resistance

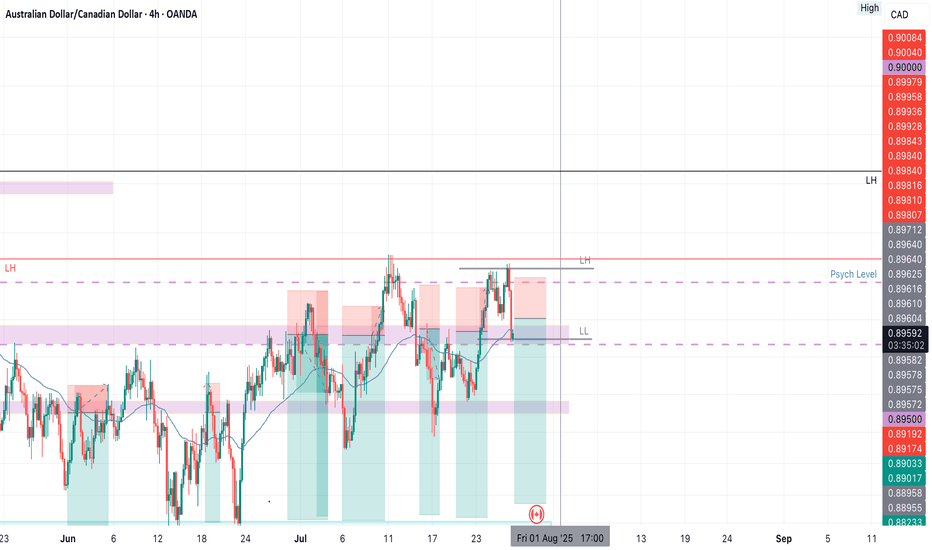

AUDCAD SHORT Market structure bearish on HTFs 3

Entry at both Daily and Weekly AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Structure point Daily

Around Psych Level 0.90000

H4 EMA retest

H4 Candlestick rejection

Rejection from Previous structure

Levels 4.51

Entry 120%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

GOLD → Retest of resistance within a bearish runFX:XAUUSD breaks through the upward trend support amid a rallying dollar. Since the opening of the session, the price has been testing the zone of interest, but bears are quite aggressive...

Gold is partially recovering after falling to $3,268, a monthly low caused by the Fed's hawkish tone. The Central Bank kept its rate at 4.25–4.5% (9 votes to 2), highlighting uncertainty due to Trump's tariffs. Markets now estimate the probability of the rate remaining unchanged in September at 58% (previously 35%). The dollar's rise slowed amid concerns about the extension of the US-China trade truce and profit-taking ahead of key US employment data (after strong ADP and GDP reports). The nearest drivers are labor market statistics and trade news, while the technical picture for gold remains bearish.

Technically, on D1, the price is breaking key support zones, including the trend line, which overall only increases selling pressure on the metals market...

Resistance levels: 3310, 3320, 3334

Support levels: 3287, 3267, 3255

As part of the correction, the price has exhausted the entire daily ATR, forming a retest of the liquidity and interest zone. If the bears keep the price below 3320-3310, gold may head towards support...

Best regards, R. Linda!

USDCADSupport Zone: Price has retested a strong support area

Price Action: The retest held — buyers defended it, showing rejection wicks / bullish candles.

Bias: Bullish while support holds → look for continuation to next resistance.

Invalidation: Bias weakens if support breaks and closes below the zone.

So as long as price stays above the retested support, USD/CAD remains bullish.

GBPCAD: The Hunt for the Previous Month's LowLike a predator stalking its prey, the market often moves with a clear objective. For GBPCAD, the primary target is now the massive pool of liquidity resting below the Previous Month's Low. This isn't a random drop; it's a calculated hunt. This analysis lays out the plan to join the reversal after the hunt is complete.

The price of GBPCAD is approaching a large pool of liquidity in the form of the Previous Month's Low (PML) , with the May 5th low located just below it. There is a high probability that this liquidity will be swept in the near future, because with only a few days left until the end of the month, the PML will no longer act as such a strong magnet for the price as it does now.

The capture of this liquidity would be accompanied by the mitigation of a daily order block in conjunction with a daily FVG . This confluence of factors could act as strong support for a potential price bounce, with a minimum target of a liquidity sweep of the Previous Week's High (PWH) .

SETUP CONDITIONS

The condition for the long setup to form would be a sharp downside liquidity sweep with a candle wick, which mitigates the upper part of the daily order block, followed by the start of a bullish order flow on a lower timeframe .

► Invalidation: Invalidation of the long scenario would be a daily candle body closing below the May 5th low, or a sharp drop to the middle of the daily order block.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

The principles and conditions for forming the manipulation zones I show in this trade idea are detailed in my educational publication, which was chosen by TradingView for the "Editor's Picks" category and received a huge amount of positive feedback from this insightful trading community. To better understand the logic I've used here and the general principles of price movement in most markets from the perspective of institutional capital, I highly recommend checking out this guide if you haven't already. 👇

P.S. This is not a prediction of the exact price direction. It is a description of high-probability setup that become valid only if specific conditions are met when the price reaches the marked POI. If the conditions are not met, the setup are invalid. No setup has a 100% success rate, so if you decide to use this trade idea, always apply a stop-loss and proper risk management. Trade smart.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If you found this analysis helpful, support it with a Boost! 🚀

Have a question or your own view on this idea? Share it in the comments. 💬

► Follow me on TradingView to get real-time updates on THIS idea (entry, targets & live trade management) and not to miss my next detailed breakdown.

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

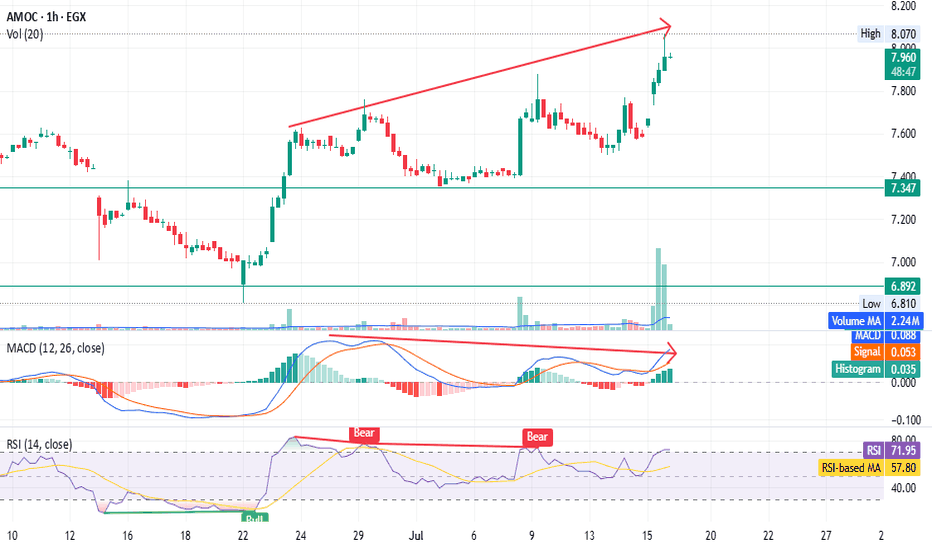

AMOC - Beware of the bear trap - only for shareholders EGX:AMOC timeframe: 1 hour

Prices continue to rise, forming a higher top than the previous one,

but MACD shows a negative divergence.

RSI indicates bearish dominance despite the price increase.

High volume with a gap, unsupported by other indicators, suggests possible distribution.

Stop loss (profit-saving) at 7.62.

This is not financial advice, just our analysis based on chart data. Consult your account manager before investing.

Thanks and good luck!

XAUUSD Update – Down Continuation to 3250?1. What Happened Yesterday

After an anemic correction that formed a bearish flag, Gold finally broke below 3300 and even dipped under the 3280 support zone — which was my primary downside target. While the move during the day didn’t have enough momentum to reach my second sell limit, I was already in a low-volume short position, so I didn’t miss the move entirely.

2. The Key Question

Has the drop ended, or are we looking at further downside?

3. Why I Expect More Downside

• The overall structure remains bearish.

• The newly formed resistance (previous support) is now the new sell zone.

• If the price drops towards 3280 again, continuation to 3250 becomes very probable.

4. Trading Plan

Selling rallies remains the preferred strategy, especially on spikes into resistance. As long as the price stays below 3335-3340 zone, the bearish outlook remains intact.

5. Conclusion

Sell the rallies. The technical picture still favors downside continuation — no need to overcomplicate it. 🚀

Disclosure: I am part of TradeNation's Influencer program and receive a monthly fee for using their TradingView charts in my analyses and educational articles.

META watch $779 then 798: Dual Golden fib barrier to 800 round META earnings blew away the analyst expectations.

Surged into dual Golden fibs at $779.61 then 797.90

This "high gravity" zone will likely hold price for a bit.

.

See "Recent Publications" for previous charts ------------>>>>>>>>>

Such as this one that caught an HUGE BREAKOUT

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.

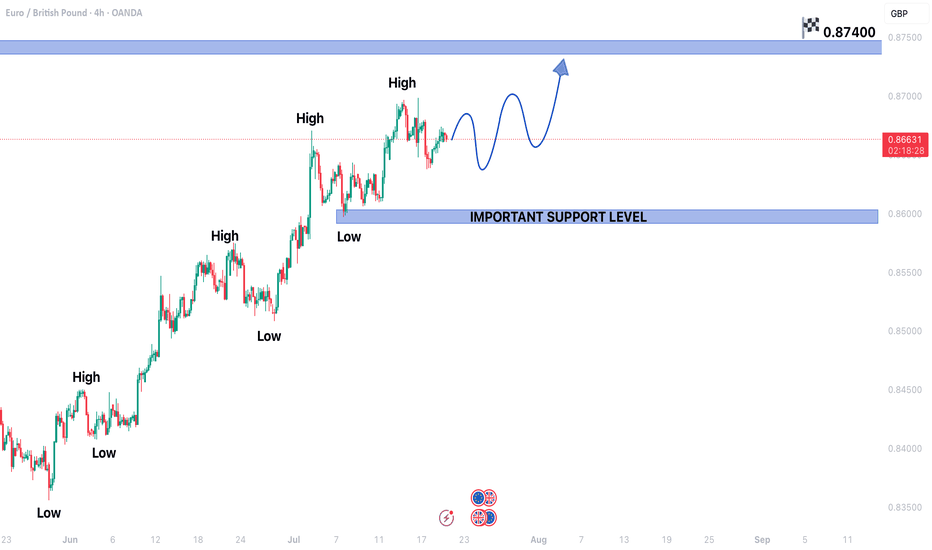

EURGBP CONTINUING BULLISH TREND STRUCTUREEURGBP CONTINUING BULLISH TREND STRUCTURE IN 4H TIME FRAME.

Price is currently in a secondary trend.

Price is expected to end the secondary trend and start primary trend again.

On higher side market may hit the targets of 0.87400

On lower side 0.85950 may act as a key support level.

WDC eyes on $78: Double Golden fib zone should slow the surge WDC earnings report caused a break out from consolidation.

Price spiked into a Double Golden fib zone at $77.81-78.18

This "very high gravity" confluence should hold price for a bit.

Previous analysis that caught HUGE BREAKOUT

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.

What’s Really Going on with CRSP — And What You Need to KnowIt’s Thursday morning. The stock has been dropping.

You’re asking yourself: What the hell is going on?

You’re seeing red in your portfolio, the option chain bleeding. Retail’s getting nervous. But here’s the thing you need to understand — and I want you to sit with this:

The drop is the setup. Not the end.

This is exactly how squeezes begin

CRSP is down today — not because of bad news, but because the market makers are doing their job.

Implied volatility is elevated ahead of earnings on Monday.

Shorts are trying to apply pressure to shake loose retail hands.

Option dealers are reducing exposure by selling stock — delta neutral hedging.

It’s Thursday before earnings.

This is when they suppress the price on purpose to cheapen contracts, reset expectations, and trap anyone not looking deep enough.

And that’s where the opportunity lies.

The mechanics you’re not being told

Let’s break this down in raw numbers.

CRSP short interest is 29.15 million shares.

That’s about 38 percent of the float — nearly one in every two tradable shares is bet against this company.

Cost to borrow is over 25 percent at peak, averaging 17.2 percent.

Days to cover is 5.3 — meaning if every short had to cover at once, it would take over a full trading week of volume.

Dark pool activity is now over 56 percent of daily volume.

This isn’t retail playing games.

This is big money loading the spring in silence.

And the trap door is earnings.

Why CRISPR Therapeutics is so misunderstood

This isn’t a meme stock. It’s not a pipe dream.

Co-founded by a Nobel Prize winner.

First ever FDA-approved CRISPR gene therapy, exa-cel.

Strategic partnerships with Vertex, Bayer, ViaCyte.

Over 2.1 billion dollars in cash on hand.

Pipelines in sickle cell, beta-thalassemia, solid tumors, diabetes, and early Alzheimer’s.

This is the Tesla of gene editing, but the market still treats it like it’s in the garage.

Why?

Because legacy investors don’t understand how fast biotech is changing.

Because analysts can’t model curing disease.

Because the old guard is still trying to value a revolution using 1990s Excel sheets.

Why the price is falling right now

Let’s be honest.

Shorts want you to sell.

Dealers need to de-risk into earnings.

IV crush is a real threat post-call.

But here’s what they don’t expect.

That retail is watching. Calculating. Waiting.

This dip isn’t about failure — it’s about strategy.

They want cheaper entries. They want to make the breakout more violent. They want to buy your shares at a discount before what could be one of the most important earnings calls in the company's history — this Monday, August 5th.

The setup is unlike anything else on the market

If the stock closes Friday anywhere near 64 to 66 dollars, and Monday earnings beat or hint at expanded trials, we get:

Gamma exposure flipping from neutral to positive

Dealers forced to hedge upward

Shorts squeezed from multiple levels

Price targeting 75 to 90 to 110 in a matter of weeks

And every dollar higher costs shorts tens of millions in floating losses.

They’re already down over 500 million since mid-June.

A move above 75 brings many of those positions to 50 percent losses — the exact pain point where margin calls trigger.

And when that starts? There’s no graceful exit.

Final thoughts

The world is sleeping on CRSP.

But you’re not.

You’re watching. You see the setup. You understand the math. You feel the potential.

This is not financial advice.

This is a call to wake up — to learn, to dig, to question what they want you to believe.

Because just like with Tesla at 30 dollars… Apple in the garage… Amazon when it only sold books…

The next generation of wealth won’t come from playing it safe. It comes from understanding the moment before it arrives.

And this is one of those moments.

Seed

LONG ON EUR/USDEUR/USD is currently at a major demand level after sweeping sell side liquidity.

The Dxy (Dollar) is overall bearish. I expect the dollar to fall and EUR/USD to rise to the previous high / supply level for over 200-300 pips.

News most likely will affect this pair in terms of volatility.

USNAS100 New ATH, looks a Correction...Wall Street Indices Hit Record Highs as AI Momentum Builds

Indices tied to the S&P 500 and Nasdaq reached fresh all-time highs on Thursday, driven by strong earnings reports from Meta and Microsoft. The results reinforced investor optimism that AI investments are delivering tangible returns and fueling future growth.

Meanwhile, Fed Chair Jerome Powell noted it's still too early to predict a rate cut in September, emphasizing that current monetary policy is not constraining economic activity. His comments followed a stronger-than-expected Q2 GDP reading, further supporting the Fed’s cautious stance.

Technical Outlook – USNAS100

After reaching recent highs, the index appears to be entering a corrective phase. A pullback toward 23470 is likely, with bullish momentum expected to resume if the price stabilizes above 23440. A sustained move above that level would target a new ATH near 23870.

However, a break below 23440 could trigger a deeper correction toward 23295.

Support: 23540 • 23440 • 23295

Resistance: 23870 • 24040

USDCHF - Looking To Buy Pullbacks In The Short TermH1 - We have a clean bullish trend with the price creating a series of higher highs, higher lows structure.

This strong bullish momentum is followed by a pullback.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

Nifty Analysis EOD – August 1, 2025 – Thursday🟢 Nifty Analysis EOD – August 1, 2025 – Thursday 🔴

🎢 Illusion Rally: What You See, Isn’t What It Was!

🧾 Nifty Summary

As we all expected, a negative gap-down opening occurred due to external news. Nifty opened 183 points lower, tested the 24,660–24,675 support zone, then rebounded sharply after a symmetrical triangle + VWAP breakout. The rally pierced through all key levels like a hot knife through butter, topping at 24,950, only to reverse with equal intensity. Closed at 24,765.

📌 Despite the technical structure, today’s move had no clear technical reasoning — more likely triggered by a mix of tariff news, confidence in Modi, weekly + monthly expiry, and manipulation.

📌 in spite of a bullish candle, strong upper rejection from 24,950 hints weakness. Candle appears bullish on colour, but bears dominated intraday close — forming a bearish Moboroshi Candle (illusion of strength).

📌 Bearish Moboroshi Candle Structure : close > open and close < Previous Close

🔍 Intraday Walk

📉 Gap down of 183 pts

🟢 Support held at 24,660–24,675

🔺 Symmetrical triangle + VWAP breakout

🚀 Sharp upmove to 24,950 zone

🔁 Reversal with same intensity

📉 Closed at 24,765 — below prior close

🖼 5 Min Time Frame Chart with Intraday Levels

📉 Daily Time Frame Chart with Intraday Levels

🕯 Daily Candle Breakdown

Open: 24,642.25

High: 24,956.50

Low: 24,635.00

Close: 24,768.35

Change: −86.70 (−0.35%)

Candle Structure:

✅ Green Candle (Close > Open) → +126.10 pts real body

⬆️ Upper Wick → 188.15 pts (Very Long)

⬇️ Lower Wick → 7.25 pts (Tiny)

Interpretation:

Opened near yesterday's low

Intraday sharp rally towards 24,950+

Faced strong selling at highs

Closed above open, but way below high — signals clear rejection

Candle Type:

📌 Bearish Moboroshi Candle — Appears bullish but hides weakness

🧠 Buyers strong initially, but sellers took control at the top

Key Insight:

Bulls need decisive close above 24,880–24,910

Else, expect drift back toward 24,660–24,675

🛡 5 Min Intraday Chart

⚔️ Gladiator Strategy Update

ATR: 208.29

IB Range: 93.95 → Medium

Market Structure: Unbalanced

Trades Triggered:

✅ 10:40 AM – Long Entry → Trailing Target Hit (R:R – 1:6.25)

📌 Trade Summary: Big R:R win today on breakout with trailing logic execution!

🧱 Support & Resistance Levels

🔺 Resistance Zones:

24,820 ~ 24,830

24,850

24,880 ~ 24,890

24,910

🔻 Support Zones:

24,780

24,725 ~ 24,715

24,660 ~ 24,650

24,620 ~ 24,600

💭 Final Thoughts

"When the move can’t be explained, the best position is caution."

Today's market behavior reinforces the idea that not all moves are technical. Keep your tools sharp, but don’t ignore contextual chaos.

✏️ Disclaimer

This is just my personal viewpoint. Always consult your financial advisor before taking any action.

AUDUSD: Dropping To the Weekly FVG, As Expected!In this video, we will analyze the following FX market for July 31 - Aug 1st.

AUDUSD

Been waiting and watching for this move, and we've tracked it for weeks! It's happening now!

Look for it to continue until we reach the +FVG!

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

XAUUSD – Bearish Outlook Ahead of FOMCGold is currently under bearish pressure as markets await the highly anticipated FOMC meeting, scheduled to begin in less than an hour. Investors are closely watching the Fed's interest rate decision and the release of the meeting minutes, which could trigger sharp volatility across the forex and commodities markets.

Technical Outlook:

From a technical perspective, the price action suggests a potential continuation of the bearish trend. If the FOMC event leads to a stronger U.S. dollar or a hawkish tone from the Fed, gold prices may decline further.

Resistance Zone; 3315 / 3330

Support Levels: 3282 / 3260

You May find more details in the Chart.

Trade wisely Best Of Luck Buddies.

Ps: Support with like and comments for better insights Thanks for understand.