BNB/USDDT 1HInterval Review ChartHello everyone, let's take a look at the BNB to USDT chart on a one hour time frame. As you can see, the price dynamically moved lower from the local upward trend line.

When we unfold the trend based fib extension grid, we see that the price remains at the upper limit of the support zone from $214.7 to $213.6, but we can see a decline towards the support level at $210.4.

Looking the other way, we have the first resistance zone from $215.4 to $216, then the second zone from $216.7 to $217.5, and then strong resistance at $218.7.

Looking at the CHOP indicator, we see that most of the energy has been used, the RSI shows a strong recovery with room for further decline, but the STOCH indicator has exhausted the energy, which may indicate a moment of recovery.

Supportandresitance

Bulls and Bears zone for 09-08-2023Yesterday was a positive day after three straight down days. Can traders end the week with a positive day which remains to be seen.

Any test of ETH session High could provide direction for the day.

Level to watch: 4454 --- 4456

Report to watch:

US: Wholesale Inventories (Preliminary)

10:00 AM ET

ETH/USDT 4H Interval ReviewHello everyone, let's take a look at the ETH to USDT chart on the 4-hour time frame. As you can see, the price is moving below the local downtrend line.

After unfolding the Trend Based Fib Extension grid, we see that the price stays in the support zone from $ 1636 to $ 1614, then there is the second zone from $ 1597 to $ 1581, and then support at $ 1556.

Looking the other way, we see that the first support is at $1650, the second is at $1665, the third is at $1680, and then we have a support zone from $1701 to $1727.

The CHOP index indicates that most of the energy has been used, the RSI is moving around the middle of the range, while the STOCH index indicates that there is less and less energy for further price drops.

Giant Symmetrical Triangle TRACUSDI think this is the coolest chart pattern in crypto i have found. It's a weekly on the OriginTrail token TRACUSD.

Showing a giant symmetrical triangle, with a well-defined level of horizontal resistance running through the middle of the triangle.

Notice also TRACUSD loves to retrace to the 4.236 Fibonacci level after each decline.

The minimum target of this breakout is around $2.50 which is the length of the vertical side of the triangle. This also happens to coincide with the all-time high, making it an important level.

However, the ultimate price target for this would be the 4.236 extension to around $14.84!

Only time will tell if this pattern will play out, however it's a very nice looking chart. Do you agree? Comment below.

ETH/USDT 1DInterval Review ChartHello everyone, I invite you to review the chart of ETH in pair to USDT, on a one-day interval. First, we will use the yellow line to mark the downtrend from which the price has changed to an uptrend, then with the blue lines we will mark the uptrend channel, from which the price breaks out at the bottom, often leaving the channel gives a move similar in size to the channel, so you should take into account such an event.

When we look at the EMA Cross 200, we see that the price has fallen below the blue line, which indicates a return to the downtrend, it is worth watching further behavior under this line.

Moving on, we can move on to marking support areas when we start a larger correction. And here we have a visible support zone from $1667 to $1515, then there is a second strong support zone from $1367 to $1152 and then a strong support at $880

Looking the other way, we see that the price has reached an important resistance zone that it has not yet been able to overcome from $1920 to $2235. However, if we manage to get out of it higher, we still have resistance at $2,555, and then a very strong resistance at $3,008.

Please look at the CHOP index, which indicates that we have a lot of energy to make a move, the RSI indicator shows a rebound and a sideways trend, while the STOCH indicator indicates that most of the energy has been used, which may give the price a rest.

BTC/USDT Short-Term 1HInterval ReviewHello everyone, let's take a look at the BTC to USDT chart on a one hour timeframe. As you can see, the price is moving in the downtrend channel.

When we lay out the trend based fib extension grid, we can identify a support zone from $25695 to $25627 that the price is approaching, then we have a second zone from $25560 to $25465 and then a strong support at $25343.

Looking the other way, first resistance is at $25,479, then second resistance at $25,866, then we have a resistance zone from $25,960 to $26,055, then strong resistance at $26,188.

Looking at the CHOP indicator, we see that there is energy for a further move, on the RSI we see a rebound with room for a further decrease, however, the STOCH indicator indicates that the energy in this move has been heavily consumed, which may stop further correction and give a sideways trend.

BTC/USDT 1HInterval ReviewHello everyone, let's take a look at the BTC to USDT chart on a one hour timeframe. As you can see, the price is moving below the local downtrend line.

After unfolding the trend based fib extension mesh, we see that the first support is at $25,492, then we have the second support at $25,084, and then the third support at $24,749.

Looking the other way, you can immediately see the resistance zone from $25,858 to $26,181, then we have an area that the price quickly goes back and forth, and then a strong resistance zone from $27,082 to $27,557.

Looking at the CHOP indicator, we see that there is energy to make a move, on the RSI we are moving around the middle of the range, however, looking at the STOCH indicator, we can expect an attempt to pull the price down.

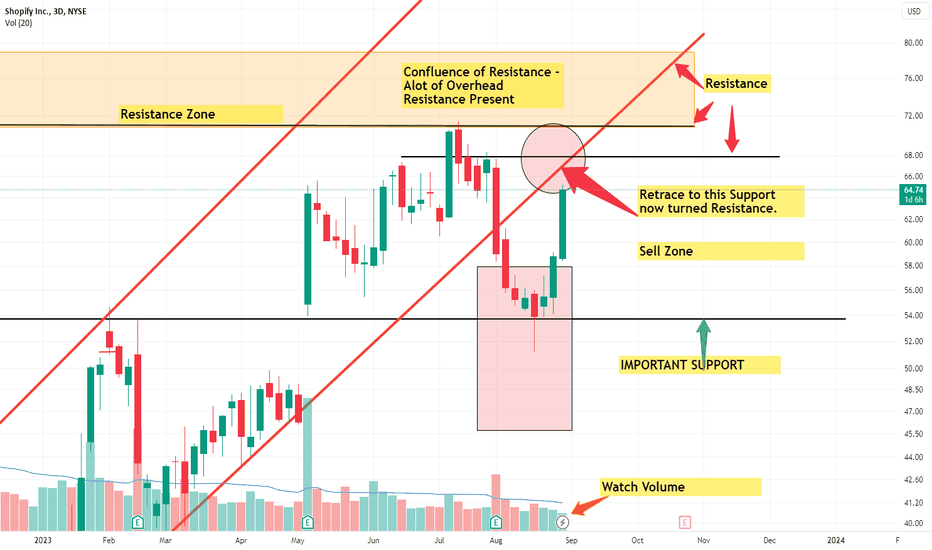

Shopify Short term Sell Target Off Major Support BounceHI guys, ive been following Shopify (SHOP), since its test of some important SUPPORT. This is a quick update from my previous idea. (Which you can find down below for more context)

We've currently bounced extremely bullish off the SUPPORT level, heading towards a SUpport turned Resistance line associated with the UPTREND channel i identified.

Normally when we break down or break above trend lines, that we have respected for some time. We tend to retrace back to that same line to Re-Test it.

Such is the case for Shopify.

Watch the Volume, an INCREASE/ SPIKE in Volume is absolutely needed to get back ABOVE, resuming our UPTREND.

But due note: we are heading into Labor day weekend, thus RISK of LOW VOLUME.

I would then consider if you were able to take positions from the SUPPORT level bounce

To think about off loading some of your position here.

If we do get back into the UPTREND channel from my previous POST. We can look to take new positions if SUPPORT is CONFIRMED.

__________________________________________________________________________________

Thank you for taking the time to read my analysis. Hope it helped keep you informed. Please do support my ideas by boosting, following me and commenting. Thanks again.

Stay tuned for more updates on SHOP in the near future.

If you have any questions, do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. Do not use my ideas for the basis of your trading strategy, make sure to work out your own strategy and when trading always spend majority of your time on risk management strategy

CSPRUSD At An Interesting Level Of Support Inside A Channel CSPRUSD / Casper token is at an interesting level of support inside a parallel channel. Seems to also be sitting at a level of horizontal support. Minimum target is around 0.07 - 0.08 which is at upper level of channel. It also coincides with a previous level of support and resistance as identified by the blue band.

Will be interesting if this channel holds as support.

DOT/USDT 1D Interwal ReviewHello everyone, I invite you to review the DOT chart in pair to USDT, on a one-day interval. First, we will use the blue lines to mark the downtrend channel in which the price is currently moving.

At this point, it is worth including EMA Cross 10 and 30, which indicate the place of transition into a downtrend in which the price is still maintained.

Moving on, we can move on to marking support areas when we start a larger correction. And here the first support is at the price of $4.24, where the price remains, while further we have a strong support zone from $4.06 to $3.88.

Looking the other way, we see that the price needs to break through the resistance zone from $4.49 to $4.72, then we have a second visible zone from $4.90 to $5.09, then resistance at $5.35, and another resistance at $5.68.

On the CHOP index, we see that most of the energy is used, on the RSI we are moving at the lower end of the range, while the STOCH indicator is also moving at the lower end, which may indicate an imminent change in price direction.

BNB/USDT 4HInterval Review ChartHello everyone, I invite you to review the BNB chart on a four-hour interval. First, we will use the yellow line to mark the uptrend from which the price went down, then we have a visible downtrend, from which we observe the sideways exit and currently we can mark the local channel of the sideways trend with the blue lines.

Now let's move on to marking the places of support. We will use the Fib Retracement tool to mark the support, and here we can see that the price is at the upper border of the support zone from $215 to $210, however, when we fall below this zone, we still have support at $203, and then we can see a strong drop to the support area at $184.

Looking the other way, we can also mark the places where the price should meet resistance. And here, a slight price movement will enter the resistance zone from $216 to $220, then we have the second zone from $223 to $225, then resistance at $229, and then resistance at $234.

The CHOP index indicates that there is a lot of energy to be used in the upcoming move, on the RSI we are in the middle of the range, which makes it difficult to determine the direction, but the STOCH indicator indicates a rebound, which may push the price towards the resistance zone.

DAILY BTC Chart Review 4HIntervalHello everyone, I invite you to check the current situation on BTC in pair to USDT, taking into account the four-hour interval. First, we will use the blue lines to mark the sideways trend channel in which the price is moving. Despite an attempt to exit the indicated channel upwards, the price quickly returned to its previous level. Locally, using the yellow line, we can mark a downtrend under which the price remains.

Now we can move on to marking support areas when the price starts a major correction. For this purpose, we will use the trend based fib extension tool and after unfolding the grid, we can see that the first support is at $ 25,462, then we have support at $ 25,054, and then we can mark support zone from $24,712 to $24,385.

Looking the other way, we can determine the places of resistance in a similar way. Here we can see that the price is fighting a resistance at $25986 which it has no strength to break yet, then there is a resistance at $26393, a third resistance at $26721, then the price needs to break the resistance zone from $27055 to $27536 to go further towards the resistance at $28,125.

Please pay attention to the CHOP index, which indicates that a lot of energy has been accumulated for the upcoming move, the RSI indicator is moving in the lower part of the range with a place for the price to go a little lower, while the STOCH indicator, despite a significant rebound, is still there so that we can see the price drop .

ETH/USDT 1HInteral ReviewHello everyone, let's take a look at the ETH to USDT one hour chart. As you can see, the price is staying below the local uptrend line.

When we unfold the trend based fib extension tool, we see that the price stays at the support zone from $1632 to $1623, then we have support at $1616, third support at $1608, and then support at $1598.

Looking the other way, we see that the price needs to break the resistance zone by $1639 to $1645, then there is resistance at $1650, next at $1656 and then resistance at $1664.

Looking at the CHOP indicator, we see that the energy is used to move the price down, on the RSI we are moving around the middle with a slight rebound, while the STOCH indicator indicates that we may see a rebound in the coming hours.

BTC/USDT 1H Interval ReviewHello everyone, let's take a look at the BTC to USDT chart on a one hour timeframe. As you can see, the price is moving below the local downtrend line.

When we unfold the trend based fib extension grid, we see that the first support is at $25,393, then the second support is at $24,987, and then the third support is at $24,645.

Looking the other way, we see price holding a resistance zone from $25,851 to $26,193, then resistance at $26,476, another resistance at $26,747, and then a strong resistance zone from $27,140 to $27,643.

Looking at the CHOP indicator, we see that the energy is rising all the time, the RSI shows a confirmation of the sideways trend, while the STOCH indicator shows that there is a lot of energy that can be used to pull the price down.

USOIL UPDATEhi all

Oil tested daily support for three consecutive days last week, but it was unable to make a new low and bounce.

So long as the wave doesn't break high (wave B), I think USOIL is making wave B and the next direction is C.

Let me know what you think In the comments!

**My trading strategy is not intended to be a signal. It's a process of learning about market structure and sharpening my trading skills**

Thanks a lot for your support

MATIC/USDT 1D Interval ReviewHello everyone, I invite you to review the MATIC chart in pair to USDT, on a one-day interval. Let's start by marking with blue lines the strong downtrend channel in which we are currently moving. At this point, it is worth checking the EMA Cross 200 right away, where you can see the place where the price was rejected while remaining in a strong downtrend.

Going further, we will check where the price should meet support, but for this purpose we will use the Fib Retracement and Trend based fib extension tools, after spreading the grids, we can mark a strong support zone in which the price is currently from $ 0.64 to $ 0.49 , however, when this zone is broken, we can see a drop around the second equally strong zone from $0.36 to $0.24.

Looking the other way, we see that the price has been rejected in the first resistance zone from $0.76 to $0.91, only when we exit it upside price moves towards the second zone from $1.03 to $1.16 to continue make an attack at $1.34 and then resistance at $1.56.

When we look at the CHOP index, we can see that there is still energy for the current move, on the RSI we have a rebound with room for a further downward move, but on the STOCH indicator we can see that we are approaching the lower limit again, which can stop the decline and give a sideways move .

1D Review ATOM/USDTI invite you to review the ATOM chart in pair to USDT on a one-day interval. Using the blue lines, we can mark the downtrend channel in which the price is moving and we can see that we are approaching the lower border of the indicated channel.

Let's start by marking the price support spots and we see that we first have a $7.05 to $6.03 support zone, however if the price goes lower we have a very strong $5.03 to $3.60 zone and then when this zone is broken, we can see a drop to the $1.77 support area.

Looking the other way, we can similarly determine the places of resistance that the price has to face. And here we see that the price has rejected the first zone which goes from $8.39 to $9.41, when we get out of it the price has to go through the second zone from $10.24 to $11.10 and then move towards very strong resistance zone from $12.23 to $13.73.

The CHOP index indicates that there is still energy for the ongoing downward movement, we are in constant rebound on the RSI and we see that each increase gives a quick return to the lower limit of the range, while the STOCH indicator is heavily exhausted, which may give a temporary price rebound.

ETH/USDT 4HInterval Review ChartHello everyone, I invite you to review the chart of ETH in pair to USDT, also on a four-hour interval. First of all, with the help of blue lines, we can mark the downtrend channel, and locally, with the yellow line, the uptrend on which the price is currently based.

At this point, it is worth mentioning that the upper limit of the downward channel is also the EMA cross 200 line, the attempt to exit upwards is rejected, and thus we remain in a downward trend.

Now let's move on to marking the places of support. We will use the Trend based fib extension tool to mark the support, and as you can see, the price is in front of the strong support zone from $ 1633 to $ 1563, however, when we fall below this zone, we can see a drop around the $ 1506 support, and further to the support at 1449 $.

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. There is a resistance zone from $1705 to $1753, which has so far pushed the price down, only when we break it we have a second zone from $1800 to $1868, and then we will move in the direction of resistance at $1956.

The CHOP index indicates that the energy has been used. We have a strong rebound on the RSI, however, with a place we would go a little lower, while the STOCH indicator indicates crossing the lower limit, which may give a moment of rebound and a temporary sideways trend.

BTC analysis on a four-hour intervalHello everyone, I invite you to update the current situation on the BTC pair to USDT, taking into account the interval of four hours. First, we will use the blue lines to mark the downtrend channel from which the price dynamically went down, then with the yellow line we will mark the downtrend line under which we are moving.

At this point, it is worth turning on the EMA Cross 200, because we can see an attempt to break the blue line of the trailing 200, which ended in failure, and when the re-attempt to return to the uptrend was rejected, we could see a rapid drop in the price.

Next, we will move on to marking support, for this we will use the trend based fib extension tool and after unfolding the grid, we can see a strong support zone from $ 26,169 to $ 25,574, where the price is currently holding. However, when we fall from this zone, we can see a drop to the second support zone from $24944 to $24068.

Looking the other way, we can determine the places of resistance in a similar way. However, here you can immediately see that the first two resistances have been overcome with a dynamic movement only the price has been rejected in the strong resistance zone from $ 27259 to $ 28170, only when we exit this zone upwards and then positively test it we will be able to see an increase towards the resistance at 28844 $, then an upward move to strong resistance at $30,799.

Please pay attention to the CHOP index where we can see that the collected energy was quickly used to re-dump the price, on the RSI indicator we have a strong rebound but at this point you should mark the area where there is still room for the price to go a little lower, while the STOCH indicator exceeded the lower limit which indicates a temporary sell-out, which can give a moment of rest and sideways movement.

We have just entered against the news! would you dare to?!

We have just short kiwi by half of normal risk.

We believe these are the places that technical levels works better than news! News just helped us to see NZDUSD reached our entry!

NOTE: We mostly consider news as an important factor to move the market! This time was an exception.

ETH/USDT 4H Interwal Review ChartHello everyone, I invite you to review the chart of ETH in pair to USDT, also on a four-hour interval. We will start by marking the place where the price rebounded above the EMA Cross 200 blue line, remaining in the ongoing downtrend. Further, using the yellow line, we can determine the downtrend line under which the price is currently located and from which it rebounded during yesterday's upward move.

Now let's move on to marking the places of support. We will use the Fib Retracement tool to mark the support, and here we will first mark the strong support zone from $1700 to $1648, then we can mark the second zone from $1625 to $1592, when the price goes lower we can see a drop around the $1549 support .

Looking the other way, we can also mark the places where the price should encounter resistance on the way to increases. And here we can see that the price failed to break the resistance zone from $1714 to $1752, it turned around at the upper border of the zone, only when it breaks it will move towards the resistance at $1807.

The CHOP index indicates that the energy has been used, the RSI has entered a downtrend, what's more, you can see that there is a lot of room for further decline, while the STOCH index also confirms that there is energy for the price to fall to a lower level.

BTC 4H Review Chart (price adjustment)Hello everyone, I invite you to check the current situation on the BTC pair to USDT, taking into account the four-hour interval. First of all, we will use the yellow line to mark the downtrend, which the price could not overcome, while at this point you can mark the triangle in which we are currently moving. Moreover, locally, it is worth marking the sideways trend channel from which the price went up by the height of the indicated channel.

When we turn on the EMA Cross 200, we see that the price broke the blue line and wanted to return to the uptrend, but the attempt failed and we saw a quick reversal of the price.

Now we can move on to marking support areas in case of deepening correction. And here in the first place it is worth marking the support zone from $26968 to $26599, however, when we fall below this zone, we can see a drop around the second zone from $26299 to $25684, and then we have a strong support at $25012.

Looking the other way, in a similar way using the Fib Retracement tool, we can determine the places of resistance. First, we will mark the resistance zone from $27,640 to $28,253, where we lack the energy to go up, only when this happens, the price will move towards the second very strong resistance zone from $29,129 to $30,238.

Please pay attention to the CHOP index which indicates that the energy has been used and there is currently an accumulation visible, on the RSI we crossed the upper limit which indicated overheating and a trend reversal where there is still room for the price to go lower, also the STOCH indicator confirms that there is room for us to they went a little lower in this reaction.