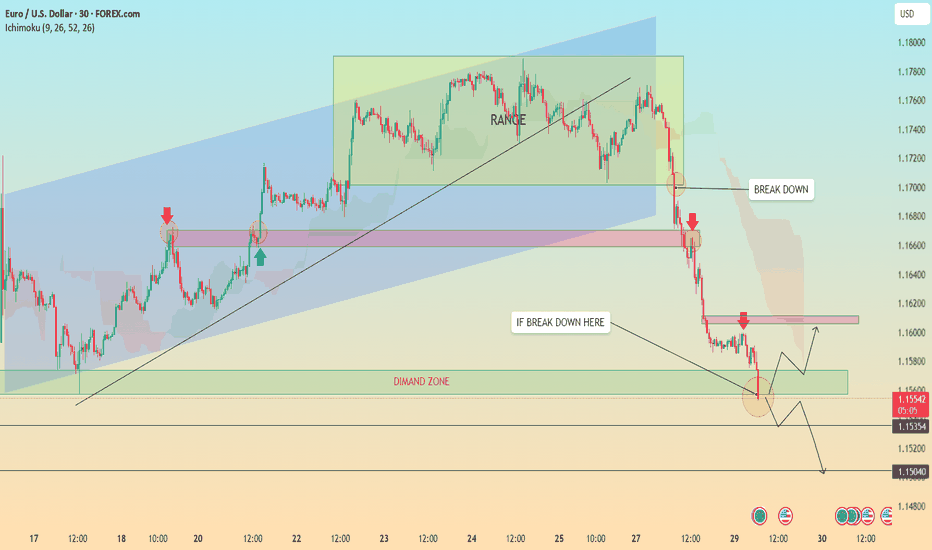

EURUSD Breakdown Bearish Trend Continues or Demand Zone Reversal🔍 Chart Breakdown: EUR/USD (30-min TF)

Trend Overview:

Previous Trend: Bullish channel structure (highlighted in blue).

Current Momentum: Strong bearish breakdown following a clear range phase.

The chart shifted from consolidation → breakdown → aggressive bearish continuation.

🧱 Key Technical Highlights:

1. Bearish Breakout:

Price broke below the ascending trendline and exited the ranging box, confirming a bearish shift.

Multiple Breakdown Retests (highlighted with red arrows) confirming structure failures and validating resistance zones.

2. Range Zone (Distribution Phase):

Price moved sideways within the green rectangle (“RANGE”), indicating accumulation/distribution before the selloff.

The breakdown from this range confirmed bearish momentum.

3. Demand Zone Test (Now in Play):

Price is approaching/hovering around a demand zone (green box) marked as a critical support.

Buyers may react here, offering two key scenarios:

Bounce back to retest resistance around 1.1600 (highlighted).

Breakdown below demand, leading to further decline toward next major support zones (1.15354 and 1.15040).

4. Price Reaction Zones:

🔴 Resistance zones are clearly marked where breakdown retests occurred.

🟢 Demand zone with bounce-or-break logic provides directional bias.

🧭 Potential Scenarios (Marked on Chart):

✅ Bullish Case:

If demand zone holds, expect:

A corrective rally toward 1.1600–1.1620.

Watch for rejection signals here (could be ideal for re-entering shorts).

❌ Bearish Case:

If breakdown below green demand zone occurs, targets:

1.1535 (local structure support)

1.1504 (next confluence level; possible long-term bounce area)

📈 Indicators:

Ichimoku Cloud: Price is well below the cloud, confirming bearish control.

Structure: Lower highs & lower lows = confirmed bearish trend.

Supportresistace

Ultimate Strategy ScreenerThis Strategy Screener is the ultimate tool which screens 40 instruments with a single strategy.

The Basic concept of using this is to create a strategy that has high win rate and screener scans for the required conditions and generate a buy or sell signals. The signals are valid for a short period. After which they disappear. Only the Strategy Entry point or Buy/Sell Signals are indicated in the screener.

The combination of Indicators used are displayed on the screener. Additionally the outcome of all unused indicators are also displayed as signals in the form of Direction Arrows below the Instrument Strategy Data.

You can get the Buy/Sell Signals Based on the settings of indicators you combine. Also you can filter out the unwanted signals using the Trend filter.

Zigzag Levels and Donchian Channel with Fibonacci Value are provided for entry and exit levels and stop loss values.

S/R levels are also provided.

The indicators that one can combine are as below.

EMA200

VWAP

Supertrend

UT Bot

SSL Hybrid

QQE

MACD

Stochastic

PSAR

Stochastic RSI

RSI

Awesome Oscillator

Linear Regression Candles

EMA Crossover

ADX

Directional Index

MACD

Momentum Oscillator

HVSA (hybrid Volume Spread Analysis)

Williams % Range

More Indicators can be added based upon requirements.

NZDUSD - Sell Stop on Break of 4-Hour SupportAnalysis

A divergence has been identified, and a rising wedge pattern has formed. The price is currently testing the 4-hour resistance level and is moving towards the 4-hour support. If the price breaks the second support level, we will enter a position, anticipating a bearish trend.

Trade Plan

Entry: 0.61284

SL: 0.61503

TP1: 0.61065

TP2: 0.60846

FIL ANALYSIS🔮 #FIL Analysis 💰💰

🌟🚀 As we can see that #FIL is trading in a symmetrical triangle and given a perfect breakout and already retest the levels. But there is an instant resistance of descending trendine. If #FIL breaks the descending trendline then we will see a good bullish move in few days . 🚀🚀

🔖 Current Price: $6.154

⏳ Target Price: $10.00

#FIL #Cryptocurrency #DYOR

INDUSIND BANK LONGNifty Bank is move upside around 2.5% in today session and in the category of top index gainers.

If we closely look the Bank Nifty chart, we can see the breakout on daily time frame with good decisive candle.

INDUSIND BANK is the top gainer in the BANK NIFTY, along with Index it give breakout.

As we can see in the chart INDUSIND BANK shrink the range from the last month with the same support zone.

It would be a good opportunity from here to TOP.

Mastering Support & Resistance This video dives into the fundamentals of support and resistance, the cornerstones of technical analysis.

We'll cover:

** Identifying trends:** Learn how to spot bullish and bearish trends using higher highs/higher lows (HH/HL) and lower highs/lower lows (LH/LL).

️** Support & Resistance Levels: Discover how to pinpoint key price levels where the market may bounce or reverse, creating potential trading opportunities.

** Fibonacci: Unlock the power of the Fibonacci retracement to identify high-probability trade entry points at the 61.8% level.

USD/BRLFOREXCOM:USDBRL price is at a major resistance zone and seems to be forming a double top on the daily time frame. Price should start heading down. Worst case it breaks the daily zone and hits the Monthly descending trendline (red). Price is currently overbought on the RSI and Bollinger Bands so there is a high probability it will go down.

NIFTY to start falling more than S&P500 from next week onwardsNIFTY/SPX chart has hit the upper trendline of ASCENDING WEDGE this week. it had hit the upper trendline 2 TIMES and the lower trendline 3 TIMES till now and has reversed every time since 2020

we can clearly see that whenever the price has reversed from the LOWER TRENDLINE , NIFTY has started performing better than S&P500 and whenever price has reversed from the UPPER TRENDLINE S&P500 has started performing better than NIFTY

Now that the REVERSAL is imminent in the WEDGE pattern and global markets are VERY BEARISH , hence we can expect that the BEAR RALLY of indian market is over and it will become MORE BEARISH than the USA market from the next week onwards

SP:SPX

NSE:NIFTY

Thanks a lot for reading...

EURCHF - Taking a chance on several daily rejectionsWhile the SNB hasn't really signals any policy change for short-medium term, considering that global inflation has started to cool down, there is quite a chance that they cannot keep hiking rate at some point. Meanwhile, the technical side of it shows a potential buying condition that hard to miss.

As you might see on the chart, based on those conditions, I prefer not to take an aggressive approach. Waiting for the price made a new high in lower timeframe, or at least a new daily high would be better before taking a long trade.

"Trading is NOT about how often you are right!! Trading is a mathematical calculation of the ratio of the results you WILL get to the risk you MAY spend!!!"

Support and Resistance Markup Here is how I markup my 4 hour chart for Bitcoin. The candlestick chart isn't used very much for marking up as it doesn't provide the same amount of data as the line chart. I also toggle between the bar chart to provide more data when it comes to seeking a specific wick.

BTCUSDT vs DXY - Pro Bitters or Dolly?DXY touching a Monthly resistance in a Rising Wedge. Bitters Weekly support in a Pennant. Bitters also in a Falling Wedge. Bias bitters (BTCUSDT) to the upside. BTC Weekly also local CC 0.618.

DXY close above Weekly 104.650 will be a Game Changer. Possibly, probably push BTC down a notch. Will be looking at the pwLow approx. 23,415 .. Monthly 23, 300.

XAUUSD My analysis for rest of day : v2So here is my 2nd analysis using a separate set of 2 main tools and a 3rd which is sometimes switched out with any indicator I might come across and feel the urge to give it a try but otherwise its mainly EngulfingCandle and Fluid Trades - SMC

Anyone else use these indicators and if you have/are, what settings and assets do you find works best for you?

BTCUSDT - Trading Range (Retest)2Hour Chart - UTC+1

My best effort attempting to draw a trading range that the price if currently retesting to enter back into the range. Will create a separate chart idea for a possible trading range should we continue to the upside.

Trading range:

Bottom 21,500 Top 24,300 and Middle 22,900. At the time of writing, possible retest of the top of the range. Not having yet hit the weekly at 24,295 could possibly be a signal for a front run however, levels between this weekly and daily levels above seem to be well respected. * The weekly was tapped. Nice reaction, lots a resistance above after recent daily action.

Fibs:

Fib Channel from low on Saturday 14 Jan at 11:00, to low Mon 13 Feb at 17:00, to higgh Thurs 2 Feb at 01:00.

Fib Retracemet from low Mon 13 Feb 2022 at 17:00 to high Thurs 16 Feb at 17:00. Interesting level is 0.618 about mid of the channel including a daily an nPoc.

Assumptions:

All monthly, weekly, daily, and nPoc Horizontal rays act as support and resistance levels. Support when price is above and resistance on price action below. Fib channel also used for indication of past and present possible support/resistance levels.

My bias:

Bullish for a break to the upside. Plenty of price discovery above should the range be broken to the upside. Although bias I'm always trading the levels as they come.

AUDUSD Long Term Predictions (4H Chart)Technical Analysis Summary

AUD/USD

TREND ANALYSIS

We have 1 Uptrend Trend in Green (Long Term)

Be careful trends need to be modified when broken to the new peaks(Downtrend) and lows (Uptrend).

FUTURE PREDICTIONS

We have many resistance and support levels that I have mentioned above.

I use thickness as an indicator of strength of levels (ONLY FOR VISUALS).

White Levels are levels that represent tight stoplosses or support and ressitance levels from the past to show old publications.

Good luck everyone, stay safe!

If you need help don't hesitate to send me a message or comment

If you find this content beneficial please don't forget to LIKE and FOLLOW

Trading Involves High Risk

Not Financial Advice

Exercise Proper Risk Management