Gold (XAU/USD) Breaks Ascending Channel – Bearish Move Ahead?📉 Market Structure:

Gold was moving in an ascending channel, but price has now broken below the support trendline.

This suggests a possible trend reversal or correction.

📌 Key Levels:

Resistance : $3,125 - $3,170

Support: $3,054 - $3,035

Target: $3,000 - $2,995

📊 Trade Idea:

A pullback to support-turned-resistance could give a short entry.

Bearish target: $3,000 if rejection holds.

Invalidation: If price reclaims $3,125.

🔍 Watch for:

Price reaction at the former channel support.

Possible retest before further drop.

Let me know if you need any modifications! 🚀

Supportresistancelevels

"Bitcoin Breakout Setup: Potential Rally Towards $94K!"Key Observations:

Support Zone: A crucial support level is marked below the broken channel, indicating a potential area for a price reversal.

Bullish Projection: A breakout above this support level could push BTC higher towards the target price of 94,101.24 USD.

Technical Patterns: The price initially showed a strong downtrend, followed by a recovery forming an ascending channel, and now a potential bullish breakout is expected.

Trading Plan:

Bullish Scenario: If BTC holds above the support level, a strong move upwards toward 94,101.24 USD could be expected.

Bearish Scenario: A failure to hold support could result in further downside toward lower key levels.

Conclusion:

Traders might look for buying opportunities near the support zone with a potential upside target of 94,101.24 USD while managing risk in case of further breakdown.

Would you like to refine this further or add specific indicators? 🚀

Is This the Calm Before the Storm on AUD/USD?The AUD/USD pair is currently consolidating within a sideways range, indicating indecision in the market. Price is fluctuating between key horizontal support near 0.6150 and resistance around 0.6450.

A rising trendline is providing strong dynamic support, keeping the pair from breaking lower, while a descending resistance line continues to limit upside momentum. As long as the pair remains within this range, no clear trend is confirmed.

A breakout above resistance could signal a bullish shift, while a breakdown below the trendline may open the door for further downside.

If you find our analysis helpful, don’t forget to like and follow us.

THANK YOU

DYOR, NFA

EUR/USD Chart Analysis - Bearish Breakdown Towards Target📉 Pattern & Market Structure:

The chart shows an ascending channel that was previously supporting price action. However, the price has broken below the lower trendline, confirming a bearish breakdown.

The recent price action suggests a shift from bullish momentum to bearish sentiment.

📉 Price Action & Target:

A breakdown from the channel suggests further downside movement.

The price is currently around 1.07556, with a potential target of 1.05089 based on the measured move from the broken channel.

This target aligns with a key support level.

📌 Trading Plan:

Bears may look for sell opportunities below 1.07602.

Confirmation of further downside can be seen if the price stays below previous support-turned-resistance levels.

Bulls might wait for a potential reversal near the target zone.

⚠️ Risk Management:

Watch for pullbacks or retests of the broken support before entering a short position.

A break back above 1.08765 could invalidate the bearish setup.

USD/JPY 4H Analysis – Potential Bearish RetestThe USD/JPY pair has been in a clear downtrend, trading within a descending channel for an extended period. Recently, price action has broken above the channel, but it is now facing resistance around the 150.35 level.

Retest Zone: The pair is currently retesting the broken trendline, and if it fails to sustain above this level, a rejection could lead to further downside.

Bearish Expectation: If the price fails to reclaim 150.35, a move towards the 147.00 support zone is likely.

Confirmation: A strong bearish candle from this level could indicate a reversal, confirming the downward move.

Traders should watch for price action signals at the retest level before making decisions.

GBP/USD Breakdown – Support Under Pressure, Bearish Target AheadChart Analysis:

The GBP/USD pair is currently trading around 1.29578, facing resistance near 1.30366.

A support zone has been identified around 1.29000, which the price is testing.

If this support level breaks, we could see a bearish move toward the next target near 1.26970.

Strong support is positioned lower, which may act as a key reversal point if the decline continues.

Trading Outlook:

Bearish Scenario: If the price breaks below the current support, a drop toward 1.26970 seems likely.

Bullish Scenario: If GBP/USD holds above support, we may see a retest of resistance at 1.30366.

Conclusion:

Traders should watch for a confirmed breakout or rejection at support before taking positions. A clean break below could trigger a stronger bearish move. 🚨

(XAU/USD) Sell Setup |Bearish Move Expected Towards Key SupportAnalysis:

The price has experienced a strong uptrend but is now showing signs of resistance near the 3,054.161 level.

A support level is identified around 3,000, which has been tested multiple times.

A potential sell setup is indicated after the price retested a resistance-turned-support zone around 3,027.737.

The target for the downside move is marked at 2,942.844, aligning with a previous support level.

If bearish momentum continues, a further decline toward 2,915.859 is possible.

Trading Idea:

Sell Entry: Around 3,027-3,030 after confirmation of rejection.

Stop Loss: Above 3,054 (recent resistance).

Take Profit Targets:

TP1: 2,942

TP2: 2,915

Market Sentiment:

The price is reacting to key levels, and if it breaks below 3,000, it could accelerate the bearish move.

A break above 3,054 would invalidate the short setup and could push the price higher.

ETH/USD – Bullish Breakout & Buying OpportunityEthereum has broken out of a descending channel and is consolidating near a key support zone. The price action suggests a potential bullish continuation, with a buying opportunity forming above the $2,000 - $2,100 support level.

Key Levels to Watch:

Support: ~$2,000, ~$1,800

Resistance Zone: ~$2,250

Target: ~$2,530

Trading Plan:

Buy Entry: On breakout and retest above $2,250

Stop-Loss: Below $2,000

Take-Profit: $2,530

If Ethereum successfully breaks resistance with volume confirmation, it could rally toward $2,500+, making this a strong bullish setup. Keep an eye on price action for confirmation. 🚀

EUR/USD | Bearish Breakdown & Retest | Short Setup EUR/USD VIP Short Setup | Smart Money Move 🔥📉"

Chart Analysis:

Ascending Channel Breakdown: EUR/USD broke below a well-respected bullish channel, signaling a potential downtrend.

Retest & Resistance: Price is currently retesting the broken structure near 1.08565, a key resistance zone.

Sell Confirmation: The rejection at this level suggests bearish momentum.

Target: The next major support lies at 1.06513, aligning with previous price action levels.

Trading Plan:

✅ Entry: Around 1.08155 - 1.08565 (after rejection confirmation)

✅ Take Profit: 1.06513

✅ Stop-Loss: Above resistance for risk management

Summary: Smart money is eyeing this short trade after a strong bearish breakout. A retest of resistance gives a prime entry for sellers. 📉🔥

GBP/USD – Potential Pullback from ResistanceChart Overview:

The 4-hour GBP/USD chart shows a strong uptrend contained within a rising channel.

The price has recently reached the upper boundary of the channel and is showing signs of rejection, indicating a possible pullback.

A downside move towards 1.27736 is anticipated, which aligns with a key support level.

Technical Outlook:

If the price respects the resistance zone, a retracement toward the 1.27736 target could be expected.

A confirmed break below this level could open the door for further downside.

However, if bullish momentum resumes, the price may attempt to break above the 1.3000 psychological level.

Trading Plan:

Short-term traders may look for selling opportunities targeting 1.27736.

Long-term traders may wait for a bullish reaction at support for potential continuation of the uptrend.

Key Levels:

Current Price: 1.29574

Support Target: 1.27736

Resistance: 1.3000

Would you like to add further details or modify the description

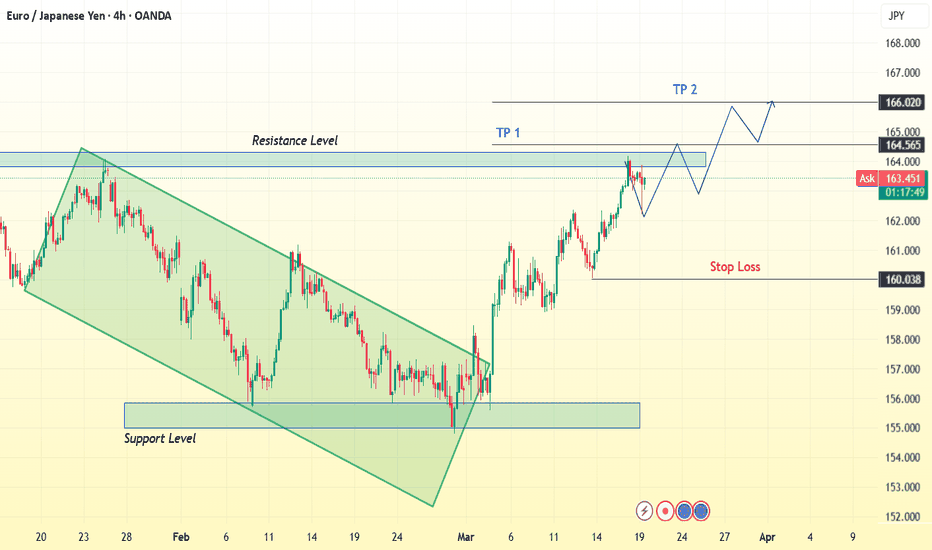

EURJPY 4H | Bullish Breakout & Retest – Next Big Move?The EUR/JPY 4-hour chart presents a compelling bullish breakout setup following a structured downtrend. The market recently broke through a significant resistance zone, indicating potential further upside movement. This analysis outlines key price levels, market structure, and an actionable trading plan.

📊 Market Structure Overview

🔸 Downtrend Reversal: The price was previously trading within a descending channel (highlighted in green), forming lower highs and lower lows.

🔸 Support Confirmation : The price bounced from a strong support zone around 158.500 - 160.000, confirming buyers' interest in this region.

🔸 Breakout & Retest : A strong bullish impulse broke through the 164.500 - 165.000 resistance zone, suggesting a shift in market sentiment.

📌 Key Trading Levels

🔹 Support Zone: 158.500 - 160.000

This area previously acted as a demand zone where buyers aggressively pushed the price higher.

It now serves as a safety net for long positions.

🔹 Resistance Zone (Now Potential Support): 164.500 - 165.000

Price has broken above this level, but a retest could provide an ideal entry for confirmation.

🔹 Next Major Resistance (Target Levels):

TP1: 165.000 → A psychological level and previous resistance.

TP2: 166.020 → A higher resistance zone where price may struggle to break through.

📈 Trading Plan – Long Setup

✅ Entry Confirmation:

Wait for price to pull back to the 164.500 - 165.000 zone.

Look for bullish candlestick patterns (e.g., pin bars, engulfing candles) to confirm buyers stepping in.

🎯 Take Profit Targets:

TP1: 165.000 (Initial resistance level)

TP2: 166.020 (Potential extended bullish move)

🛑 Stop Loss Strategy:

Below 160.038 (Previous structure low & key support level)

Ensures protection against potential fakeouts or trend reversals.

📢 Risk-Reward Ratio:

Aiming for 2:1 or better risk-reward ratio for an optimal trade setup.

📝 Market Outlook & Conclusion

📌 The recent breakout above resistance suggests bullish momentum is strong. However, traders should be patient and wait for a pullback to enter at a better risk-reward level. If price successfully retests and holds above 164.500, there is a high probability of continuation towards 166.020.

🚀 Trading Bias: Bullish – Until market structure shifts or a major rejection occurs at resistance.

📢 Final Trading Tip

🔹 Patience is key! Don’t rush into a trade immediately after a breakout. Wait for confirmation, as false breakouts are common in volatile markets. A successful retest of the broken resistance will provide a low-risk, high-reward entry opportunity.

EUR/GBP Bearish Trading Setup | Resistance Rejection & BreakdownMarket Context & Overview

The EUR/GBP currency pair is currently showing signs of bearish momentum, as illustrated in this 1-hour trading chart. The price is facing a strong resistance zone while forming a descending trendline, indicating that sellers are gaining control over the market. Given this technical setup, traders can anticipate a potential breakdown leading to further downside movement.

This analysis highlights key price levels, technical indicators, and potential trade opportunities based on current price action. The bearish outlook is supported by the market structure, which is displaying signs of a potential trend reversal from the resistance zone.

🔹 Key Technical Levels

1️⃣ Resistance Zone (0.84200 - 0.84300)

This area has acted as a strong selling zone in previous price action.

Multiple rejection points indicate that buyers are struggling to push beyond this level.

This resistance aligns with the descending trendline, further strengthening the bearish bias.

2️⃣ Support Level (0.84000)

The current support level has provided temporary demand, preventing immediate downside movement.

If the price breaks below this support, it will confirm a bearish continuation.

3️⃣ Major Resistance Zone (0.84495)

This is the all-time high resistance zone in the short-term structure.

A break above this level would invalidate the bearish setup and could lead to bullish momentum.

4️⃣ Target Level (0.83735)

If the price successfully breaks below 0.84000, the next target would be 0.83735.

This level aligns with previous swing lows, making it a realistic downside target for short positions.

5️⃣ Stop Loss Placement (Above 0.84201)

A stop-loss above 0.84201 ensures protection against false breakouts.

If price breaks above this level, it could signal a shift in market structure.

🔹 Technical Insights & Market Sentiment

1️⃣ Descending Trendline: The price is respecting a descending trendline, indicating a bearish bias.

2️⃣ Multiple Resistance Rejections: Price has tested the resistance zone multiple times without breaking through.

3️⃣ Bearish Price Action: The recent candles show lower highs, reinforcing the downtrend.

4️⃣ Volume Analysis: A drop in buying pressure at resistance signals potential weakness among buyers.

5️⃣ Fundamental Factors : GBP strength due to macroeconomic factors could add further pressure on EUR/GBP.

🔹 Trade Plan & Strategy

📌 Entry Criteria

Ideal entry near 0.84150 - 0.84200 if price shows rejection at resistance.

Alternatively, enter after a confirmed breakdown below 0.84000 for safer confirmation.

🎯 Profit Target

First target: 0.83735

If bearish momentum continues, price could extend towards 0.83600 as an extended target.

🛑 Stop Loss Placement

Above 0.84201 to minimize risk.

This ensures the trade remains valid while avoiding market noise.

🔹 Risk-Reward Ratio & Trade Management

✅ Risk-Reward Ratio (RRR): Approximately 2:1, making this a favorable setup.

✅ Trade Management:

If price starts reversing before hitting the target, consider trailing stop-loss to secure profits.

If price consolidates around support, watch for breakout confirmations before entering.

🔹 Final Thoughts & Market Sentiment

This trading setup suggests a strong bearish opportunity based on price action, resistance rejection, and trendline confluence. The break below 0.84000 will be the key trigger for further downside movement. If price remains below resistance, a sell position with a stop-loss above 0.84201 and a target of 0.83735 offers a high-probability trade setup.

Explosive Polygon (MATIC) Analysis | A 1200% Profit Opportunity!🔍 End of 150-Week Correction & Start of a Major Fifth Wave

Polygon (MATIC) has reached a critical turning point on the weekly timeframe. After a lengthy three-wave correction spanning around 150 weeks, MATIC now signals the potential end of its corrective phase and the start of a new, powerful upward wave. Recent strong candles suggest that if MATIC can break key resistance levels, it may enter the fifth wave—a wave typically associated with high momentum and substantial profit potential.

📈 Suggested Entry Points:

1️⃣ First Entry: After breaking the $0.62 resistance

🔸 A break above the $0.62 level will act as an initial confirmation of an uptrend, indicating the start of a potential bullish wave. This entry is best suited for risk-tolerant investors, as it offers an earlier opportunity to join the rally with potentially higher returns. However, investors should note that entering at this point carries more risk, as short-term corrections could occur.

2️⃣ Second Entry: After breaking the $1.3 resistance

🔸 The $1.3 level is a key resistance zone, and breaking it would provide a stronger confirmation of the uptrend. This entry is ideal for more cautious investors, as it signals a clearer trend reversal and a likely continuation of the bullish wave. Entering here has relatively lower risk and could be a safer entry for those looking to mitigate risk.

🎯 Fifth Wave Target: $8

🔸 Based on technical analysis and historical patterns, the target for MATIC’s fifth wave is around the $8 mark. This translates to a potential gain of 500% to 1200%, making it one of the most exciting long-term opportunities in the spot market.

📌 Final Note:

With MATIC’s promising setup and high potential in the fifth wave, this opportunity could yield substantial returns for spot investors. By selecting a strategic entry point and managing risk effectively, you can take advantage of this promising long-term investment opportunity.

GBP/CAD Weekly Analysis - Potential Retest of Upper ChannelWelcome to our weekly GBP/CAD analysis In this post, we'll provide you with a comprehensive outlook for the GBP/CAD currency pair for the upcoming trading week, highlighting the recent upper channel breakout and the potential retest scenario.

📈 Key Weekly Analysis Points:

- Upper Channel Breakout: We'll discuss the implications of the recent breakout from the upper channel and its significance for GBP/CAD traders.

- Robust Support Zone: Explore the strong support zone that could influence price action during the anticipated retest.

- Key Resistance Levels: Assess the critical resistance levels that may present challenges for GBP/CAD bulls.

- Trade Strategies: Get insights into potential trading strategies and setups for the week ahead.

If you're a trader or investor interested in GBP/CAD, this post offers valuable insights to help you navigate the markets effectively on TradingView.

Please remember to follow us for regular updates and analysis. Feel free to share your thoughts and questions in the comments section below. We value your feedback and interaction!

#GBPCADAnalysis

#ForexAnalysis

#WeeklyAnalysis

#ChannelBreakout

#SupportResistance

#TradingViewAnalysis

#ForexTrading

#CurrencyPair

#GBPvsCAD

#TradingStrategies

#TechnicalIndicators

#ForexInsights

#ForexEducation

#ChartAnalysis

#ForexOutlook

#TradingIdeas

#GBPCADRetest

#ForexStrategy

#TradingTips

#ForexMarketAnalysis

Disclaimer: This analysis is for educational purposes only and should not be considered as financial advice. Always conduct your research and consult with a financial advisor before making any trading decisions. Trading involves risks, and it's crucial to manage them wisely.

#CRUDEOIL Weekly Major Support & Resistance Levls.Providing Weekly Support and Resistance levels for next coming week based on Central Pivot Range and its major support & resistance levels of week, where price can take support and face resistance. Three black lines indicating weekly Central Pivot Range. Previous week high & low also performs as a major support and resistance levels. Can take long & short positions according to how price perfoms at particular given support & resistance levels.

#ALUMINIUM Weekly Major Support & Resistance Levels.Providing Weekly Support and Resistance levels for next coming week based on Central Pivot Range and its major support & resistance levels of week, where price can take support and face resistance. Three black lines indicating weekly Central Pivot Range. Previous week high & low also performs as a major support and resistance levels. Can take long & short positions according to how price perfoms at particular given support & resistance levels.

#ZINC Weekly Major Support & Resistance Levels.Providing Weekly Support and Resistance levels for next coming week based on Central Pivot Range and its major support & resistance levels of week, where price can take support and face resistance. Three black lines indicating weekly Central Pivot Range. Previous week high & low also performs as a major support and resistance levels. Can take long & short positions according to how price perfoms at particular given support & resistance levels.

#SILVER Weekly Major Support & Resistance levels.Providing Weekly Support and Resistance levels for next coming week based on Central Pivot Range and its major support & resistance levels of week, where price can take support and face resistance. Three black lines indicating weekly Central Pivot Range. Previous week high & low also performs as a major support and resistance levels. Can take long & short positions according to how price perfoms at particular given support & resistance levels.

#SILVER Weekly Major Support & Resistance Levls##Providing Weekly Support and Resistance levels for next coming week based on Central Pivot Range and its major support & resistance levels of week, where price can take support and face resistance. Three black lines indicating weekly Central Pivot Range. Previous week high & low also performs as a major support and resistance levels. Can take long & short positions according to how price perfoms at particular given support & resistance levels.

#GOLD Weekly Major Support & Resistance Levels.Providing Weekly Support and Resistance levels for next coming week based on Central Pivot Range and its major support & resistance levels of week, where price can take support and face resistance. Three black lines indicating weekly Central Pivot Range. Previous week high & low also performs as a major support and resistance levels. Can take long & short positions according to how price perfoms at particular given support & resistance levels.

#COPPER Weekly Major Support & Resistance Levels.Providing Weekly Support and Resistance levels for next coming week based on Central Pivot Range and its major support & resistance levels of week, where price can take support and face resistance. Three black lines indicating weekly Central Pivot Range. Previous week high & low also performs as a major support and resistance levels. Can take long & short positions according to how price perfoms at particular given support & resistance levels.

#TCS Weekly Major Support & Resistance Levels.Providing Weekly Support and Resistance levels for next coming week based on Central Pivot Range and its major support & resistance levels of week, where price can take support and face resistance. Three black lines indicating weekly Central Pivot Range. Previous week high & low also performs as a major support and resistance levels. Can take long & short positions according to how price perfoms at particular given support & resistance levels.

#APOLLOHOSP Weekly Major Support & Resistance Levels.Providing Weekly Support and Resistance levels for next coming week based on Central Pivot Range and its major support & resistance levels of week, where price can take support and face resistance. Three black lines indicating weekly Central Pivot Range. Previous week high & low also performs as a major support and resistance levels. Can take long & short positions according to how price perfoms at particular given support & resistance levels.