Tactical BTCUSDT Swing: Persistent Risk On, Key Stop at 103,000__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Strong bullish sectoral momentum (Risk On / Risk Off Indicator on strong buy across all timeframes), but momentum is fading just below key resistances.

Supports/resistances: Key 104,179–103,086 area tested on every timeframe, consolidating a major price floor. Upside targets: 109,588 then 111,980.

Volume: Stable liquidity, no anomaly spike or structural rupture. Volumes consistent with trend; moderate pickup in activity near supports, no climax.

Market behavior: Investor Satisfaction Indicator is neutral on all timeframes except 1H (behavioral buy signal to monitor). No euphoria or panic, no aggressive accumulation.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global bias: Cautiously bullish as long as 104,179–103,086 pivot support holds. Risk On / Risk Off Indicator gives a strong bullish sector signal. Macro backdrop neutral, low volatility.

Opportunities: Swing timing on pullback to support confirmed on 1H/4H, targets 109,500/111,980. Wait for daily/4H confirmation before full allocation.

Risk zones: Strong invalidation under 103,086, alert under 104,179. Suggested technical stop-loss below 103,000 USDT.

Macro catalysts: Watch ECB and Fed (8:30–9:45 UTC, Thursday). Expect possible volatility spike, adjust sizing and stop accordingly.

Action plan: Active swing trading off support, dynamic stops, partial exposure ahead of major events. Active risk/reward management (>2.5), upside targets on technical pivots, liquidity is normal.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

: Global uptrend but fading momentum below ATH. Major support 104,179–103,086, no clear behavioral signals. Risk On / Risk Off Indicator strong buy, volumes stable.

: Strong tech sector bias (Risk On / Risk Off Indicator strong buy), support at 104,179. ISPD DIV neutral, volumes normal.

: Pause/consolidation above multidimensional support (104,179). Healthy but cautious structure.

: Consolidation >104,179, long positioning remains valid as long as support holds; no clear short-term behavioral inflow.

: Testing key support, first signs of indecision. Increased watchfulness recommended.

: First short-term behavioral buy signal (ISPD DIV/mason's), optimal tactical allocation timing if 104,179 support is defended.

: Intraday range on support, no emotional spike or break volume.

: Local flush, defensive rebound off support, short-term range scenario; potential technical bounce.

Cross-timeframe summary:

- 104,179 is the key defensive multi-support area, tested across all TFs.

- Risk On / Risk Off Indicator is bullish across the board, except behavioral divergence (ISPD DIV Buy on 1H only).

- No panic or rupture volumes detected.

- Immediate risk if breakdown below 104,179 and/or 103,086: opens door to intraday bearish extension toward 93,377.

__________________________________________________________________________________

STRATEGIC OUTLOOK – Final Summary

__________________________________________________________________________________

Technical setup: Solid consolidation above 104,179/103,086 supports, sectoral buying confirmed. No major deterioration unless a clear breakdown occurs.

Opportunity: Short-term swing entry on 1H/4H signal, target 109,500–111,980. Stop-loss below 103,000 advised.

Risk: Downside acceleration if support breaks, especially if LTH profit taking continues or spot demand fades.

Macro: Calm backdrop, ECB and Fed decisive for short-term volatility. Watch post-announcement market action.

On-chain: Significant profit-taking near highs, no euphoria, positive risk/reward if stops are respected.

Operational summary:

Cautiously bullish while 104,179/103,086 hold.

Tactical swing entry possible on pullback and confirmed signal (1H or 4H).

Strict stop management below 103,000, reduced exposure before key ECB/Fed events.

Upside targets: 109,588 – 111,980.

Monitor volumes and behavioral signals post-news.

Key levels to watch:

Supports: 104,179, 103,086

Resistances: 109,588, 111,980

Macro alerts: ECB/Fed (Thursday morning, 8:30–9:45 UTC)

Behavioral ISPD DIV signal after news

Suggested stop-loss : < 103,000 USDT (as of 01/06/2025, 22:56 CEST)

Comprehensive analysis based on multi-timeframe technical structure, Risk On / Risk Off Indicator and ISPD DIV behavioral/mason's confirmations. Remain disciplined and flexible in risk management.

__________________________________________________________________________________

Supportresistancetrader

BTC/USD Forming Bullish Falling Wedge – Potential Target📐 2. Technical Pattern – Falling Wedge

A falling wedge forms when the price consolidates between two converging downward-sloping trendlines. It suggests diminishing selling pressure and a likely reversal.

Key Characteristics in This Chart:

Upper Resistance Trendline: Formed by connecting the series of lower highs.

Lower Support Trendline: Formed by connecting the lower lows.

The price respects both boundaries, confirming wedge structure.

Volume generally decreases during the wedge (implied but not shown).

✅ Bullish Implication: Once price breaks above the upper resistance, it often triggers a sharp upward move due to the squeeze of supply and the build-up of demand.

🧱 3. Support and Resistance Zones

🔻 Resistance Zone:

Area: ~100,000 to ~108,000 USD

Marked as a wide horizontal band (beige-shaded area).

Previous price peaks and consolidations suggest this zone is strong supply.

Breakout above this zone could trigger momentum towards the higher target.

🔹 Support Zone:

Area: ~72,000 to ~75,000 USD

Historical reaction level where buyers previously stepped in.

Coincides with the lower wedge boundary and recent bounce points.

Repeated tests strengthen this as a reliable accumulation zone.

🎯 4. Trade Setup Strategy

💼 Entry Strategy:

Trigger: A confirmed breakout above the wedge’s upper trendline (black diagonal line).

Confirmation: A strong bullish daily close above the trendline, ideally with volume spike.

The current price (~77,130) is near the lower boundary—offering a potential early entry or low-risk setup with a tight stop.

📌 Stop-Loss Placement:

Level: 70,916 USD

Below the wedge’s lower support and beneath the broader support zone.

Ensures exit if the pattern fails or bears regain control.

🧭 Target Projection:

Target Price: 114,562 USD

Based on the height of the wedge projected from the breakout point, a standard wedge breakout measurement.

Aligns with historical highs and psychological resistance.

🧮 Risk-Reward Ratio: Assuming entry around 77,130:

Risk (Stop-Loss): ~6,200 points

Reward (Target): ~37,432 points

R:R Ratio ≈ 1:6 – Highly favorable

⚙️ 5. Market Psychology & Price Action Insight

The falling wedge pattern suggests exhaustion of sellers.

Buyers are defending the support zone aggressively—creating higher lows within the wedge.

Each bounce is slightly more aggressive, indicating growing bullish sentiment.

A breakout from the wedge could act as a catalyst for rapid price acceleration as sidelined bulls enter and shorts cover.

📊 6. Summary of the Setup

Component Detail

Pattern Falling Wedge (Bullish)

Timeframe 1-Day Chart

Entry Point Breakout above upper trendline

Stop Loss 70,916 USD

Target 114,562 USD

Support Zone 72,000–75,000 USD

Resistance Zone 100,000–108,000 USD

Risk/Reward Approx. 1:6

Bias Bullish

📌 Final Thoughts

This setup provides a technically sound opportunity with clear invalidation (stop loss) and a well-defined profit target. The risk-to-reward ratio is attractive, and the price structure suggests a bullish reversal is likely, pending a confirmed breakout.

Gold (XAU/USD) Bullish Breakout: Next Target $3,181?"Key Observations:

Current Price: Gold is trading at $3,127.450 at the time of the chart.

Trend: The chart exhibits a strong uptrend, with higher highs and higher lows.

Support Levels: Several support levels are marked in the $3,010 - $2,999 range, extending down to around $2,906.

Resistance and Target:

The immediate price range is highlighted, suggesting possible consolidation.

A breakout above this range could lead to a target around $3,181.

Chart Annotations:

A retracement (red structure) indicates a short-term correction before continuation.

A breakout structure (black lines) suggests a previous significant upward movement.

The range and possible continuation are marked, indicating that the price may consolidate before attempting to reach the target.

Trading Perspective:

If price holds above the range, we may see bullish continuation towards $3,181.

A break below support levels could signal a deeper pullback towards $3,010 or lower.

This chart suggests a bullish outlook, with potential for more upside if momentum continues. Traders might look for confirmations before entering long positions.

Bitcoin Rejection from Resistance – Short Setup with Bullish PotBitcoin is currently testing a key resistance zone around $85,500, where previous price action showed strong selling pressure. A rejection from this level could lead to a short-term pullback towards $83,750 - $83,250 , aligning with a retest of the broken trendline before a potential bullish continuation.

🔹 Entry: $85,200 - $85,500

🔹 Stop-Loss (SL): $86,000

🔹 Take-Profit (TP): $83,750, with potential long re-entry from this zone targeting $86,000+

📊 Watch for price action confirmation within the resistance zone before entering. If BTC holds above $85,500, the bullish breakout could accelerate. 🚀

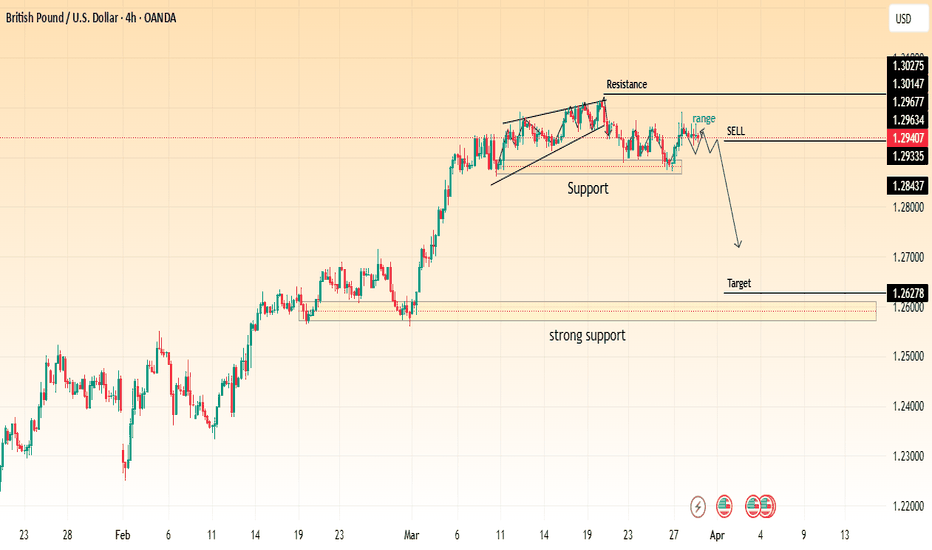

GBP/USD Breakdown: Bearish Setup with Sell Opportunity!"Key Observations:

Rising Wedge Breakdown:

The price initially formed a rising wedge near resistance.

The wedge broke down, indicating bearish momentum.

Support and Resistance Levels:

Resistance Zone: Around 1.3014 – 1.3027, marking a strong rejection area.

Support Zone: Around 1.2933 – 1.2843, where price previously bounced.

Strong Support: Around 1.2627, marked as the target area for a bearish move.

Bearish Setup:

A range-bound consolidation occurred after the breakdown.

The chart marks a sell signal, suggesting a move toward the 1.2627 target zone.

Trading Idea:

Entry: Sell after confirmation below 1.2933.

Target: 1.2627 (major support level).

Stop-Loss: Above 1.3014 (resistance level).

This setup suggests a potential bearish continuation, with price expected to decline further if support breaks. Always confirm with volume and market conditions before entering a trade.

GBP/USD Breaks Rising Channel – Bearish Target Ahead!Key Observations:

Rising Channel: The price was trading within an ascending channel, bouncing between resistance and support.

Breakout & Sell Signal: The price has broken below the channel support, indicating a potential trend reversal.

Bearish Target: The next key support level is around 1.27024, aligning with a previous demand zone.

Confirmation: If the price stays below 1.29165, further downside movement is likely.

Trading Idea:

Short Entry: After confirmation of a breakdown below support.

Target: 1.27024 (next major support level).

Stop Loss: Above 1.30127 (previous resistance).

This setup suggests bearish momentum as long as the price remains below the broken support. Traders should watch for retests and volume confirmation.

Gold/USD (XAU/USD)– Potential Bearish CorrectionKey Observations:

Uptrend & Resistance:

The price has been trending upwards within a parallel channel.

It reached a resistance level around $3,064 - $3,055, where selling pressure is evident.

Potential Pullback:

The price is showing signs of rejection at resistance and could move lower.

The first target for the pullback is around $3,013 - $2,964, which aligns with previous structure levels.

A deeper correction could test support near $2,880 - $2,878.

Trade Setup Idea:

Bearish scenario: If price fails to reclaim resistance, traders may look for short opportunities targeting lower support levels.

Bullish scenario: If price breaks above resistance, it could trigger further upside momentum.

Conclusion:

This chart suggests a possible short-term correction before determining the next move. Traders should watch price action near key levels for confirmation.

Gold (XAU/EUR) – Bearish Setup at Key Resistance LevelChart Overview:

This 4-hour chart of Gold (XAU) against the Euro (EUR) suggests a potential bearish setup as the price has reached a key resistance zone.

Key Observations:

Resistance Zone: The price has broken above a descending channel and is testing a significant resistance level around 2,790 - 2,800 EUR.

Sell Signal: A rejection from this resistance level has prompted a potential short entry.

Bearish Target: The projected price decline could reach the 2,727 EUR support zone, aligning with previous demand areas.

Risk-to-Reward: The expected decline represents a -2.08% move, indicating a strong risk-reward setup for sellers.

Trading Idea:

Sell Entry: Near 2,790 EUR (if rejection confirms).

Target: 2,727 EUR (support zone).

Invalidation: A breakout above resistance could signal further bullish continuation.

This setup suggests a short opportunity, but traders should watch price action for further confirmation before entering trades. 📉🔥

This is a 4-hour chart of Bitcoin (BTC/USD)This is a 4-hour chart of Bitcoin (BTC/USD) showing a key resistance level around $86,527 and a potential bearish move towards lower support zones.

Analysis:

Price is currently trading near the resistance zone, struggling to break above it.

A sell setup is suggested, expecting rejection from resistance.

The first target is around $78,500, with an extended downside target at $75,869 and possibly $71,580 if momentum continues.

A stop-loss level is placed above resistance at $86,527, indicating a risk management strategy.

The overall structure suggests bearish sentiment unless price breaks above resistance.

Potential Trading Plan:

📉 Bearish Scenario:

Short below resistance confirmation.

Targets at $78,500, $75,869, and $71,580.

Stop-loss above $86,527.

📈 Bullish Scenario:

A break and close above $86,527 could invalidate the bearish setup.

SLB is breaking out of a head and shoulders patternIn this chart I point to main chart pattern in the SLB prices at this moment, that is the head and shoulders. Not only that, but the prices are doing a breakout of this pattern, that I indicate step-by-step at the purple text in the chart.

I am also trying to take some advantage of this movement, and so I bought a very short term put option to try catch some profit from an eventual falling in prices. The put information is in the gray text in the chart.

CPO Extended Gains to Record HighPalm oil prices gone up higher as expected and closed at 5322 after posted record high at 5327.

Factors continue to affect palm oil prices:

1. New export permit policy in Indonesia which required exporters of vegetable oil to gain approval for their shipments and declare their domestic sales with the objective to ensure that sufficient supply of cooking oils in domestic market. New regulation may curb supplies from Indonesia and led buying spree in Malaysia. Besides, India likely to shift their imports to soybean and sunflower oils as replacement.

2. Bullish sentiment in global oil market continue to support palm oil prices.

3. Strong gains in soybean oil following latest weather forecast that turned into hot and dry weather in Argentina and Southern Brazil which may result further yield deterioration.

Technical View:

1. Market break new high and closed above 5300

2. Stochastic remains uptrend signal

Suggestion Trade:

Long if stay above 5300

Target Stop Loss (support level) 5100

Target Profit (resistance level)

TP1 5425 TP2 5525 TP3 5625

AUDUSD short - Double Top - Supply Demand - UPDATEHello Traders!

Great moves on AUDUSD yesterday. The price went down from the h4 Supply Zone. It also created a new Supply Zone. We can expect that the price will go up again to the Supply Zone. Afterwards I expect a drop down to the Demand Zone.

If we are at the Demand Zone the price could push higher, but also had the opportunity to break it. Remember we are at a daily level of supply. This levels can push the price for more pips in one direction. But we will need to watch price action and the market at that specific time for further confirmation.

But for now cheers for all who are in the trade or for the traders who scalp it. It made great moves yesterday.

That was my Idea and I hope you liked it. Please leave a LIKE if you like the content. In the comment section you can share your view and ask questions.

Also tell me who is already in shorts?

Thank you and we will see next time

- Darius.

USDCAD short - Supply Demand - h4Hello Traders!

I marked the most important Zones on the chart. We got here a nice short setup. Price pushed down from the Supply Zone. I am waiting right now for price to go a little up and then to short USDCAD with Price Action Signal. This is the Trading Idea for USDCAD

That was my Idea and I hope you liked it. Please leave a LIKE if you like the content. In the comment section you can share your view and ask questions.

Thank you and we will see next time

- Darius.

EURJPY long and short setup - Supply DemandHello Traders !

We got 2 possible setups on EURJPY. We can buy it and short it. We will need to see how the market will open and to see if we are going to push again down to the Demand Zone. If we will do so then we can buy from there. Otherwise we have the opportunity to short it from the Supply Zone. Watch Price Action in order to trade with confirmation and you are good.

That was my Idea and I hope you did like it. Please leave a LIKE if you like my Content that I share with you. In the comment section you can tell my your view and ask questions.

Thank you and we will see next time

- Darius.

DXY long, UPDATE, EXPLAINED, Market behavior, CorrelationHello Traders !

What is the DXY?

It is an index of the value of the United States dollar relative to a basket of foreign currencies. The Index goes up when the U.S. dollar gains strength (value) compared to other currencies.

Why do we need to analyze it?

Actually I like to have a look on the DXY because of the Correlation. So the DXY is nice to use when we are trading XAUUSD , EURUSD , AUDUSD , GBPUSD . Usually when the DXY goes up, the mentioned pairs will go down. Just watch for example EURUSD and XAUUSD the last week and compare it with the DXY. You will see what I am talking about.

Chart Analysis:

If we are looking at the chart we can see that we dropped now from a daily Demand. We now go 2 option.

#1 - Price going up again, down, retest and then drop

#2 - Price going higher, retest the the Demand and shot up

For the final confirmation wait for Price Action to show you signals.

That was my Idea and I hope you did like it. Please leave a LIKE if you like my Content that I share with you. In the comment section you can tell my your view and ask questions.

Thank you and we will see next time

- Darius.

USD WTI SHORTHello Guys,

In this video i breakdown what i see on oil. I view oil as being completely weak especially with the effects from corona virus that have impacted the demand side of the commodity. At the moment even though the pair is weak which could be viewed as cheap for investor to buy based of value trading most of smart money will likely stay away from the dip buy until they get a solid fundamental sign that the price has finally bottomed out. Russia a top oil producer saying no to cutting oil supply to OPEC during and the Feds cutting the rates further solidifies the idea that oil will take a while to recover from this bear trend hence for now i would rather be on the safe side of smart money and only look for short positions after pull backs to key weekly resistance levels

EURUSD long or short (Supply Demand)Hello Traders !

2 possible scenarios for EURUSD. Watch Price Action for final Confirmation.

Let me know your view on EURUSD and what you think about my Analysis.

Please leave a LIKE to support me if you like the Content I provide on Trading View

Thank you and we will see next time

- Darius.