Supportzones

AUDUSDAUDUSD was in bearish trend from last few days and now has given the breakout from falling trendline with strong bullish divergence.

Currently the price is creating a support zone with some healthy green candles and it seems like bulls are getting ready to take control.

What you guys think of it ?

EDUUSDTEDUUSDT was trading in bearish parallel channel and recently has given the breakout from channel.

Currently the price is following the short term bullish trendline and also getting support from broken channel level around, 0.5855 region.

If this level holds perfectly then the next target will be 0.6325.

DISNEY Revisiting a 10 year Support LineThis Technical Analysis is on Disney (DIS), on the 2 Week timeframe.

Our Current Price action is TESTING SUPPORT on this MASSIVE Decade Long SUPPORT LINE.

The 1st time we have ever tested SUPPORT on this was September 29th, 2014.

Highlighted by the RED circles, everytime we've tested this we've had some sort of Price Bounce.

The Most massive gains were from the Bottom of the COVID Crash to the TOP @ approx. $202.00

A Gain of about 154%.

It was also a more evident time to buy as the RSI gave hints along with some other indicators.

Another one being the GOLDEN CROSS where 2 week 21 EMA CROSSED Above 2 week 50 SMA .

Whats happening now?

Currently our 2 week candle, has not yet closed. It will do so August 14th. We will give more clues then. If we maintain support thats GOOD, If we see ourselves below it, and CONFIRM BELOW that would be VERY BAD. This would mean we have broken a 10 year SUPPORT LINE.

We have also had a DEATH CROSS, which is when 21 EMA CROSS below the 50 SMA. This often times causes price to fall as we've recently seen. The moving averages currently seems like there pointing downwards, indicating that price can still drop more.

I would like to see the Moving Averages to flatten out at 180 degrees. To have this happen price needs to bounce from here.

Price is also currently in a downward channel.NOTE how the lower trend line of the channel is below the MAJOR RESISTANCE.

It can be possible that we test this.

Notice the BLACK ARROWS on the RSI and MACD. If you relate them to the lower trend line of the downward channel on Price action. This shows a BULLISH DIVERGENCE. Which is a sign of potential BULLISH MOVE UP.

Bullish Divergence = When Price action shows LOWER LOWS but the indicators show HIGHER LOWS. Usually means price is lagging behind the indicators and eventually PRICE will increase to catch up to the indicators. In normal instances, price moves in sync with indicators.

If PRICE moves BELOW the SUPPORT, its possible we touch this area indicated by the BLACK ARROW, which coincides with the horizontal black line that touches the previous candle wicks. This would put the BULLISH DIVERGENCE at play. Look to see in the upcoming weeks what happens.

Some danger signs are seen in the indicators:

RSI -> Currently our ORANGE RSI Line as moved below the BLACK Moving Average. If you look left it has always been associated with price drops. If we continue to stay below, risk of price drop remains.

MACD-> Notice how the size of the GREEN histograms have been decreasing, indicating a slow down on MOMENTUM. If we don't see bigger GREEN histograms print, next likely thing is the appearrance of RED Histograms which will indicate increased probability of PRICE going down.

ADX -> Highlighted zone shows RED LINE above GREEN. This indicates that bearish momentum is present. As long as RED line is ABOVE GREEN, likelyhood of bearish momentum and price falling is probable.

CONCLUSION:

Disney has reached the CRITICAL SUPPORT line for the 5th time in the 10 year history of this SUPPORT LINE. Everytime when it did so as seen in previous history, its been known to be decent area to BUY. Is it a good area to buy? In my opinion its hard to tell in this moment. For one, we should wait till the close of this CURRENT 2 week candle on the 14th of August. Something to note, everytime we test a trendline, support or resistance, each time it gets weaker. Keeping this in mind, with the warning signs in the indicators and a potential BULLISH DIVERGENCE, a scenario that can be possible: we break it, to test the lower trend line of the Downward channel, only to have prices MOVE BACK UP. But its important to state that this doesn't have to happen either. We need to be patient and observe what is to come in the coming weeks. Zooming into the smaller timeframes, can also give more concrete short-term clues on direction. Stay tuned for updates on other timeframes.

Thank you for your time! Please do support this idea and my work by boosting, following and commenting. Follow for updates and ideas on other trade-ables.

If you have any questions do reach out. Thank you again.

DISCLAIMER: This is not financial advice, i am not a financial advisor. The thoughts expressed in the posts are my opinion and for educational purposes. When trading always spend majority of your time on risk management strategy.

BTC/USDT check the description!Hello everyone, let's look at the BTC to USDT chart on a one hour time frame. As you can see, the price has moved sideways from the local downtrend line.

When we unfold the trend based fib extension tool, we can mark the first support zone from $28998 to $28830, then we mark the second strong support zone from $2855 to $28357.

Looking the other way, we will check the resistance places in the same way and here we see that the first resistance is at $29254, then the second at $29475, the third at $29656 and the fourth strong resistance at $29831.

At this point, it is worth paying attention to the CHOP Index and the RSI indicator, because we can see that when we crossed the lower limit on the CHOP indicator and the upper limit on the RSI indicator, there was a strong change in the price trend.

BTCUSDT 1H Chart ReviewHello everyone, I invite you to review the chart of BTC in pair USDT taking into account the time interval of one hour. First, we will use the blue lines to mark the local downtrend channel that btc lagged upwards, and entered the uptrend channel from which the exit was down. What's more, the exit from the first channel was close to the high of the channel, if the exit from the current channel behaves similarly, we can see a correction around $28,000.

Now we can move on to marking the places of support in the event of a correction. And here, in the first place, it is worth marking the support zone where the price is currently from $ 29,485 to $ 28,733, but when we fall below this zone, we can see a drop around the previously mentioned place of $ 27,996, and the next support is at $ 26,928.

Looking the other way, in a similar way, using the trend based fib extension tool, we can determine the places of resistance. First, the price has to break the resistance at $30,644, then we have a second resistance at $31,487, and then a third very strong resistance at $32,344.

The CHOP index indicates that there is little energy for the next move, the RSI rebounded from the upper edge and there is still room for the price to go lower, but on the STOCH indicator we see that the energy is running out at the moment, which may give a temporary sideways trend.

DOTUSDT 1DInterval ReviewHello everyone, I invite you to review the DOT chart in pair to USDT, on a one-day timeframe. First, we will use the yellow line to mark the uptrend line, from which, as you can see, the price breaks out at the bottom.

Moving on, we can move on to marking support areas when we start a larger correction. And here the price stays ahead of the first support zone from $5.16 to $4.97, then we have a second very strong support zone from $4.79 to $4.53, and when the price goes lower we have support at 4.20 $.

Looking the other way, we see price bounce off the $5.27 resistance, then $5.60 resistance, a third resistance at $5.94, then a fourth resistance at $6.39.

Please look at the CHOP index, which indicates that we have a lot of energy for the upcoming move, the RSI is moving around the middle of the range, while the STOCH indicator indicates crossing the lower limit, which can give a temporary sideways trend for the price or a rebound.

Matic/Usdt 1D ReviewHello everyone, I invite you to review SOL in pair to USDT, on a one-day interval. First, we will use the blue lines to mark the downtrend channel where the price is moving in the upper range.

Moving on, we can move on to marking support areas when we start a larger correction. And here, the first support is at $22.38, the second support is at $19.68, the third support is at $17.44, and then we have a strong support zone from $15.20 to $12.

Looking the other way, we see that the price has reached an important resistance zone from $ 27.14 to $ 32.34, which so far has no strength to break. However, if it manages to exit the descending channel upwards and break through the resistance zone, the next resistance will appear at the price of $38.89.

Please look at the CHOP index, which indicates that we have a lot of energy for the upcoming move, MACD indicates that we are in a downtrend, while the RSI has a rebound and we are moving at the downtrend line, which may indicate a larger correction.

ETH/USDT 1HInterval ReviewHello everyone, let's look at the ETH to USDT chart on a one hour timeframe. As you can see, the price is staying above the local uptrend line.

When we unfold the trend based fib extension grid, we see that the price is in the support zone from $ 1873 to $ 1853, while we can mark the second zone from $ 1822 to $ 1799.

Looking the other way, we see that the price is before a strong resistance at $1888, and then we have a very strong resistance at $1927.

The CHOP index indicates that there is energy to move, the MACD indicates that we remain in a local downtrend, while the RSI has rebounded to the lower part of the range, which should give room for price growth.

CASTROLIND-DAILY/WEEKLY/MONTHLY-BREAKOUTNSE:CASTROLIND

Stock is consolidating in a channel from past 8 years. From last year it’s started to making higher low in weekly/Monthly Chart.

Monthly : As per monthly analysis stock has shown a bullish engulfing at bottom levels.

Weekly:

• June 2nd week we can see a big green candle engulfing past multiple weeks.

• June 3rd week there is rejection candle (Inverted Hammer). Things get interesting over here. The rejection candle didn’t get follow through.

• If we look carefully whole week the stock was trading between the range. July first week we can see a boom!

Daily: We can see buying from 122-123 levels from last few days and on Friday (7th July) We can see a big green candle with good volume.

It’s good time to go long for 155-160 targets.

SL: 117

I have already taken this trade.

This is only for educational purpose, please manage your risk accordingly.

Semiconductors in Focus: Top or Not?NASDAQ:NVDA has shifted sideways since the huge earnings breakaway gap, a pattern that tends to provide strong support for profit-taking. Unlike NASDAQ:AMD , the trend doesn't appear to be at risk of shifting into a downtrend at this time.

While there has been some negative news pertaining to China for NVidia, the chart patterns don't indicate any concern from the largest Buy Side Institutions yet.

NVDA reports again near the end of August. By the end of this month, the big Buy Sides will have made adjustments to their holdings depending on their expectations for earnings, a time to watch for any shift in the technical patterns.

AMD reports early August. This short-term M top is at risk of testing support level highs below.

VEDL-HOURLY/DAILY-AT SUPPORT LEVELSNSE:VEDL

Stock is consolidating between 275-285 from past a month. From past few days (Last week of June) The stock is getting seller pressure however it is not able to close below 275. It’s a sign of strength that buyers are defending this level.

Today Stock has shown a bullish hammer around the support level. It’s good time to go long with Small SL.

SL 273-274 , Target would be as per the risk reward.

This is only for educational purpose, please manage your risk accordingly.

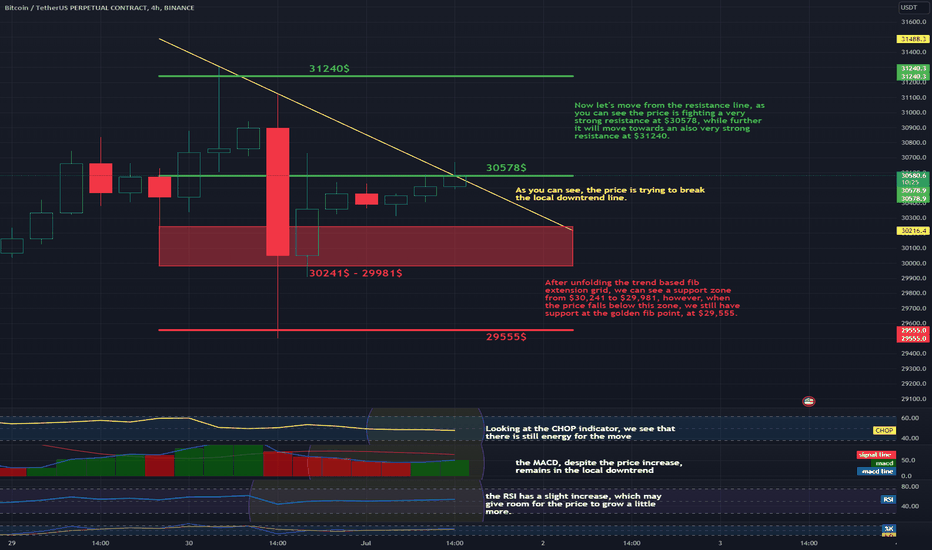

BTCUSDT 4H Interval ReviewHello everyone, let's look at the BTC to USDT chart on a 4-hour timeframe. As you can see, the price is trying to break the local downtrend line.

After unfolding the trend based fib extension grid, we can see a support zone from $30,241 to $29,981, however, when the price falls below this zone, we still have support at the golden fib point, at $29,555.

Now let's move from the resistance line, as you can see the price is fighting a very strong resistance at $30578, while further it will move towards an also very strong resistance at $31240.

Looking at the CHOP indicator, we see that there is still energy for the move, the MACD, despite the price increase, remains in the local downtrend, and the RSI has a slight increase, which may give room for the price to grow a little more.

MGL-LONG DAILY TIMEFRAME NSE:MGL

Stock is consolidating in Descending triangle pattern from past few days.

It is taking support on previous Break out level which is 1015-1020.

On 22nd June we can see a clear rejection from top. Following to the rejection there is a big red candle which is closed near support levels. Now here comes the interesting part the red candle did not got the follow through.

The stock has opened slight gap down on Monday (27th June) and it has been sharply pushed up by buyers. This is a good opportunity to go long and with low SL (approx. 2%)

Please wait for the bullish price action if it opens gap down on Tuesday (28th June)

SL: 1010 Target: 1070

The entry is bit early as I mentioned that previously red candle did not got the follow through.

This is only for educational purpose, please manage your risk accordingly.

BTC/USDT 4HInterval ReviewHello everyone, I invite you to the Friday cryptocurrency review. Let's start by checking the current situation on the BTC pair to USDT, taking into account the four-hour interval. First, we will use the blue lines to mark the local downtrend channel, from which the price went up by the height of the indicated channel.

Now we can move on to marking the support areas when the price recovers from the current increases. And here we first have support at $29,994, then second support at $29,095, then third support at $28,342, however when the price goes lower, we have a strong support zone from $27,589 to $26,520.

Looking the other way, in a similar way, using the trend based fib extension tool, we can determine the places of resistance. And here we can immediately see that the price is in front of a strong resistance at the golden point of the fib retracement, at $31838, when it manages to break it, the second resistance is at $33,790, and when the price breaks it, it will move towards resistance at the price $36,247.

Please pay attention to the CHOP index, which indicates that the energy is gathering more and more strength, the MACD indicator indicates an attempt to maintain an uptrend, while the RSI shows a strong increase, which may bring a slight rebound or a temporary sideways trend.

Daily BTC 1DChart - resistance and supportHello everyone, let's look at the BTC to USDT chart on a single day timeframe. As you can see, the price is moving below the downtrend line.

Let's start with determining the support line and here in the first place it is worth marking the support zone from $ 26858 to $ 26357, if the support is broken then the next support is $ 25864 and $ 25170.

Now let's move on to the resistance line, as you can see the first resistance is $27494, if you manage to break it, the next resistance will be $27811, $28580 and $28129.

Looking at the CHOP indicator, we see that there is still a lot of energy for the move, MACD, despite the corrections, remains in an uptrend, while the RSI is moving around the middle of the range, which makes it difficult to clearly determine the direction of the move.

BNB/USDT SHORTTERM Resistance and Support Hello everyone, let's look at the BNB to USDT chart on a 4-hour timeframe. As you can see, the price is moving above the local uptrend line.

Let's start with the support line and as you can see the first support in the near future is $312, if the support is broken then the next support is $310, and then we have a support zone from $308 to $306.

Now let's go from the resistance line, as you can see the first resistance is $316, if you manage to break it, the next resistance will be $318 and $320.

Looking at the CHOP indicator, we see that the energy has been used, the MACD indicates the maintenance of the local uptrend, while when the RSI touched the upper limit, it gave a price correction.