Super X AI Technology Ltd AI Infrastructure Stock 100% upside🔋 1. AI Infrastructure Pivot & Platform Build-out

Strength: 8/10 → 8.5/10

SUPX has made a major pivot in 2025, transitioning from a legacy business into next-gen AI infrastructure. The new focus includes AI servers, liquid cooling systems, HVDC power, and full-stack data center offerings targeting the rapidly growing demand for AI compute in Asia. This shift positions SUPX as a differentiated player in a high-growth market, opening doors to larger contract values and broader verticals.

________________________________________

🤖 2. Technical Leadership Appointment

Strength: 7/10 → 8/10

A major recent step forward is the hiring of a seasoned CTO with deep data center and AI hardware experience. This upgrade significantly enhances SUPX’s execution ability and credibility in enterprise infrastructure. Institutional investors and potential partners will see this as a sign SUPX can deliver on its technical roadmap and close major deals.

________________________________________

📈 3. Asia Institutional Partnerships Pipeline

Strength: 6.5/10 → 7/10

SUPX is developing a solid pipeline of institutional AI infrastructure projects across Asia, especially with established banks and tech companies. While many projects are still in proof-of-concept or pilot stages, these early relationships can drive high-margin, recurring business if successfully converted to long-term contracts.

________________________________________

💰 4. Capital Structure & Financial Health

Strength: 6/10 → 6.5/10

The company’s cash position has improved after new equity raises, giving SUPX a runway for continued R&D and expansion. While the business is still operating at a loss and share dilution remains a factor, debt levels are manageable and financial flexibility should support continued transformation and growth.

________________________________________

________________________________________

⚠️ Negative Catalysts

🛠️ 5. Transformation Execution Risk

Strength: 6/10 → 6/10

Transitioning from a legacy model to a complex, capital-intensive AI infrastructure business brings substantial execution risk. SUPX must navigate operational scale-up, talent integration, and supply chain challenges, with no guarantee of seamless delivery. Any delays or setbacks could erode investor confidence.

________________________________________

🌐 6. Revenue Visibility & Monetization Lag

Strength: 5.5/10 → 5.5/10

Most current revenue is still pilot-based, with few long-term or recurring contracts secured. The business model relies on successful conversion of its pipeline and faster ramp-up in recognized sales. Investors will need to see evidence of stable, recurring revenue before the stock is re-rated.

________________________________________

🔁 7. Macro / Sector Sentiment Sensitivity

Strength: 5/10 → 5/10

As a small-cap AI/infra play, SUPX is highly exposed to swings in broader market sentiment. Any downturn in tech or risk-off moves in global markets could lead to outsized stock volatility, regardless of execution progress.

________________________________________

________________________________________

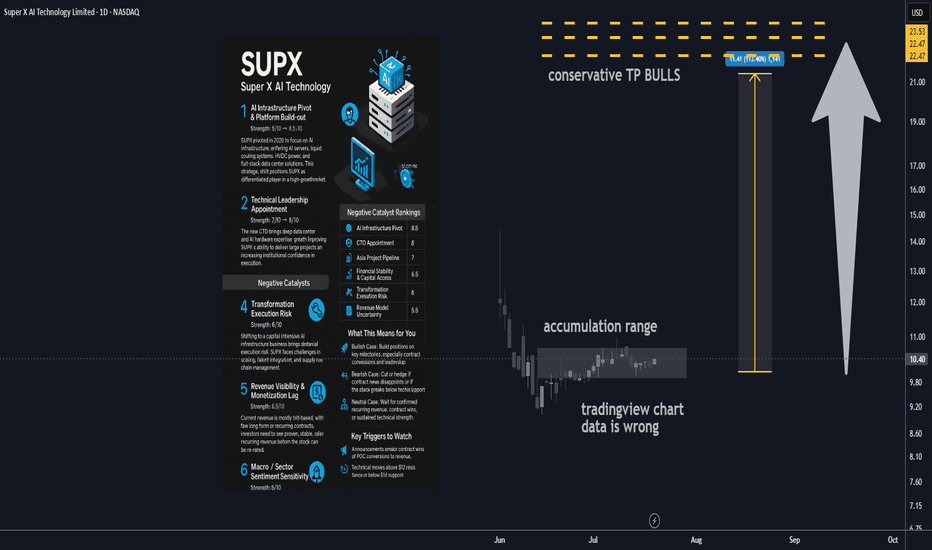

🚀 Refreshed Catalyst Rankings

Rank Driver Score

1 AI Infrastructure Pivot 8.5

2 CTO Appointment (Execution) 8

3 Asia Project Pipeline 7

4 Financial Stability & Capital Access 6.5

5 Transformation Execution Risk 6

6 Revenue Model Uncertainty 5.5

7 Macro / Sector Volatility 5

________________________________________

📊 Analyst Ratings & Price Outlook

• No major Wall Street coverage; visibility remains driven by news flow and early institutional/retail adoption.

• Technicals: The stock has established higher lows since its business model pivot. Resistance sits near $11.50–12, with support at $9.80–10.00.

• Price target: A $20 target remains plausible if SUPX delivers on growth milestones and secures new capital or contracts, representing a potential doubling from current levels.

________________________________________

🗞️ Recent Developments

• Hired a proven CTO to drive the new AI/data center focus.

• Company rebranded and fully pivoted its business model in 2025, shifting all resources to AI infrastructure.

• Implemented a new equity incentive plan to attract and retain top tech talent.

• Announced a robust pipeline of institutional projects across Asia, although most are not yet recognized as revenue.

________________________________________

🔍 Summary Outlook

SUPX is an emerging transformation play, now fully aligned with surging demand for AI infrastructure. Its success depends on management’s ability to scale, close institutional contracts, and prove out recurring revenue. While the story is compelling and early traction is positive, the company remains high-risk and execution-dependent at this stage.

Bull Case:

If SUPX converts pilots into revenue, delivers operationally, and continues to attract top talent, the stock could re-rate to the $15–20+ range as its business model is validated.

Bear Case:

Stumbles in execution, monetization, or funding could send the stock back to $7–8 support.

Neutral:

Many investors may choose to wait for confirmation of contract wins, recurring revenue, or sustained technical strength before committing.

Technical Levels to Watch:

• Bullish breakout if it clears and holds $11.50–12.00.

• Bearish risk if it fails to hold $9.80–10.00, with possible drop toward $8.

________________________________________

✅ What This Means for You

• Bullish: Build positions into execution milestones, focusing on contract conversions and leadership updates. Upside potential to $20 if catalysts align.

• Bearish: Cut or hedge exposure on failed contract news or technical breakdown.

• Neutral: Stay on the sidelines until more evidence of recurring revenue, confirmed contract wins, or positive sector momentum.