A Sleeping Giant in the Energy Sector?While everyone’s chasing the next hot AI stock, a quiet opportunity might be taking shape in the energy sector; and it could be a big one.

🔋 As AI data centers explode in size and number, the demand on our power grid is rising fast. Nuclear is still years away, and renewables are struggling to scale in time. That leaves oil and gas as the most reliable players; and one U.S. company may be perfectly positioned to ride that wave.

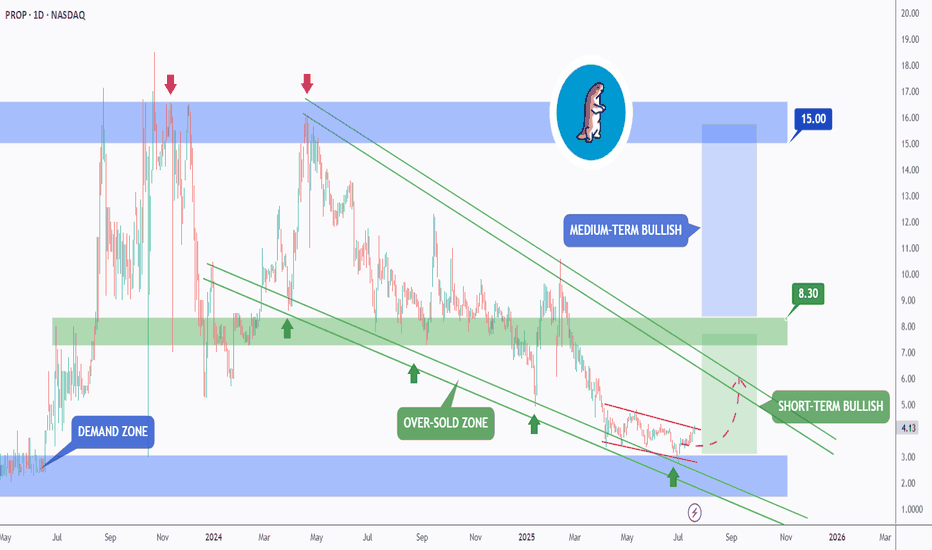

📊 Technical Analysis

NASDAQ:PROP PROP has been in a steady downtrend, moving within a falling wedge pattern (marked in green). Right now, it’s retesting the bottom of that wedge, typically where things get oversold.

Even more interesting, PROP bounced off a major monthly demand zone last week, a signal that buyers may be stepping in.

In the short term, if the blue demand zone holds, we could see a push toward the $7 mark, which lines up with the top of the wedge.

But to really confirm a medium-term reversal, we’ll need a clean break above the $8.3 resistance. If that happens, the door could open to a rally toward $15, a key level from early 2024.

🛢️ Why PROP? A Hidden Play With Room to Run

Prairie Operating Co. (NASDAQ: PROP) isn’t your typical small-cap oil stock. They own 65,000 acres in Colorado’s DJ Basin and use modern drilling tech to stay lean and efficient. That means they can still make money even when oil prices dip.

As energy demand continues to climb, PROP could be sitting in the sweet spot , especially with the world so focused on tech stocks. But behind every AI boom is a growing energy need, and companies like PROP are the ones powering it.

One well-known Wall Street firm recently gave PROP a Buy rating with a $21.75 price target; that’s a potential 281% upside from where it stands today. And that’s not even counting the potential boost from energy-friendly policies under the current administration.

📌 One to Watch in 2025

PROP might just be one of the most under-the-radar energy plays going into the new year.

The biggest moves often start quietly; and this one has all the ingredients to surprise.

➡️ As always, speak with your financial advisor and do your own research before making any investment decisions.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All strategies are good, if managed properly.

~ Richard Nasr

Surge

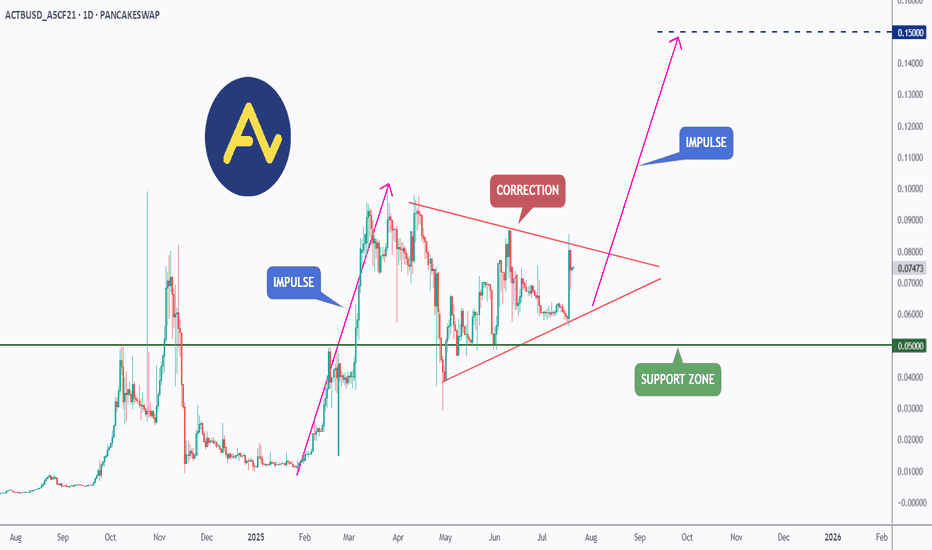

ACT (Acet) - Eyeing the Next Impulse Move?ACT has been forming a textbook bullish continuation pattern.↗️

After a strong impulse leg earlier this year, price has been consolidating within a symmetrical triangle, signaling a healthy correction phase.

🏹Today, ACT broke out of the triangle to the upside , indicating that bulls may be taking control once again.

📍If momentum continues, the next impulse move could push price toward the $0.15 resistance as a first target — a major psychological and technical level.

As long as the $0.050 support holds, ACT remains in bullish territory with upside potential in sight.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Richard Nasr

SEI - One More Bullish Impulse Soon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈After surging by over 75% last week , SEI is currently in a correction phase.

However, it is approaching the intersection of the previous high marked in orange and blue trendline acting as a non-horizontal support.

📚 As per my trading style:

As #SEI approaches the blue circle zone, I will be looking for bullish reversal setups (like a double bottom pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Tiziana (NASDAQ: TLSA) is Setting Up for a Major Move Today!Tiziana Life Sciences Ltd (NASDAQ: TLSA) has been gaining traction following our initial alert! The stock has been steadily climbing, closing Friday’s session at $0.792, up 7.03%, with volume surging from $184,039 to $346,792. Market cap has also surged from a low of $81.23M to $86.40M, signaling growing investor confidence.

With momentum steadily building and market interest growing, we anticipate further upside as the new trading week begins. TLSA continues to push forward in the biotech space, this could be a pivotal moment for the stock. With a pipeline of cutting-edge therapies targeting some of the most challenging diseases, NASDAQ: TLSA could be on the verge of a game-changing breakout.

Technical Outlook:

TLSA continues to showcase bullish momentum, backed by strong trading volume and key technical patterns. The double-bottom formation at the $0.63 range remains intact, historically a pattern associated with significant breakouts. Additionally, with RSI at 56.84 and trading below its moving average, there’s ample room for further upside. An 85% surge remains a viable target.

TLSA’s Breakthrough in Immunotherapy

TLSA stands out due to its groundbreaking work in immunology and oncology, particularly in developing next-generation immunotherapies for neurodegenerative diseases. With its lead candidate, Foralumab (TZLS-401), targeting Non-Active Secondary Progressive Multiple Sclerosis, Alzheimer’s, and ALS, the company is positioned for major breakthroughs in the biotech space.

Moreover, the company has filed a patent application for Foralumab’s potential use in enhancing CAR-T cell therapy, a move that could revolutionize cancer treatment. With a lean operational model maximizing value, TLSA remains a compelling buy.

XIAOMI (1810): Another All-Time High Surpassed!A new all-time high has been reached 🎉

XIAOMI has been surging non-stop since August 2024, with our position now up 180% since our entry back in March. We are taking our next profit here and letting the rest run.

Xiaomi experienced significant growth in 2024, bolstered by China’s economic development and government support. The Chinese government implemented subsidies to stimulate demand for electronics, heavily favoring the stock. These policies aimed to strengthen domestic consumption and accelerate technological modernization.

In March 2024, Xiaomi introduced its first EV, the SU7 sedan. By November, the company exceeded its initial targets, raising its annual delivery forecast to 130,000 vehicles.

Technically, it is safe to say that we are trading in a wave 3, but the key question remains: for how long and what price level will it target? Analyzing the chart, it makes the most sense to anticipate a very large and sharp wave 3, with the same dynamics for wave ((3)). While the possibility of even higher surges exists, historical patterns suggest the likelihood of a rounding top formation as multiple waves come to an end.

We don’t believe our entry level will ever be retested, but we remain cautious with new entries for now, closely monitoring the chart for further developments.

ADA looks fired up and ready to goIt looks as though the recent upward surge has confirmed there is more to come to the upside. This long term pattern of WXYXZ looks very likely meaning that the current upward surge is an impulse of X. It really does look great and would be confirmed with a lovely green bar in volume as shown at the bottom of the chart. Target would be a minimum of $8 within this scenario. Follow for more.

Target (TGT): A Buying Opportunity in the GapAfter three months of waiting and planning this setup on NYSE:TGT , we are finally buying shares following the recent drop into the desired breakout gap. Before this move, the stock hovered around the Point of Control (POC), making a breakout in either direction inevitable. This decline now provides a more favorable risk-to-reward ratio, setting us up to aim for the all-time highs once again.

If the level of wave (4) is breached, we will need to reassess our bullish outlook and consider a potential deeper correction. However, the setup remains promising as the 78.6% and 88.2% Fibonacci retracements align perfectly with the lower edge of the gap.

Historically, NYSE:TGT ’s oversold RSI since 2019 has led to a minimum 50% pump in four out of six cases, further solidifying our bullish view. The next critical level to watch is $180—reclaiming this resistance will be crucial for continued upward movement. Until then, we will stay patient and monitor the situation. ✅

100k might start wave 4 of 5Hi all, what an exiting time to be part of crypto. BTC is putting in all time new highs almost daily at the moment, it's incredible to watch. This chart shows that hitting 100k might end the gorgeous wave 3 of 5 we've been having of late and plunge is into a wave 4. Not to worry, if this happens this will be a lovely buy dip as wave 5 will be owed at this point. Don't forget, this 1-5 impulse is only wave ONE of FIVE of a higher degree of trend so there's plenty more up to go as yet. Follow more more.

XRP fractal, a little more detailFurther to my previous post on XRP. I realise that I was not clear enough. I am awaiting the intitial surge to 1.9, then I'm out. There may well be higher highs to come. But, if the fractal plays out there will be an equal downward surge that will take us to local lower lows and below my entry point. So, I'm going to stick it out to 1.9. Follow for more

What's next for PEPE?It looks as though there is a fractal forming with PEPE that can take it onto significant higher highs. If wave 5 completes, we'll see the same fractal playing out from the two boxes. The Hurst cycles at the bottom also infer that this upward surge can happen quite quickly given there's not a huge amount of time left before the end of the cycle, validation the 5 waves. No matter how good PEPE looks, I'm not going near it. But, it's up to you as they say. Follow for more.

NVIDIA (NVDA): Targeting $166 amid AI momentumNVIDIA continues to dominate the AI and computing landscape, with a significant development in Japan: SoftBank’s telecom unit will soon receive Nvidia’s advanced Blackwell chip design for its supercomputers. The upcoming earnings report on November 20 is critical in sustaining NVIDIA’s exceptional growth trajectory.

CEO Jensen Huang’s company has projected third-quarter revenue of approximately $32.5 billion, propelled by substantial demand for Hopper and Blackwell GPUs. These GPUs are crucial for strengthening NVIDIA’s data center segment, which currently operates with an impressive 68% margin. Priced between $30,000 and $40,000, Blackwell chips are already seeing high demand, with production scaling in Q4 2024.

From a technical perspective, NASDAQ:NVDA still has room to grow, with a targeted area of $166 or higher in the short term. We are closely monitoring the stock for either a move into this target or a shift in market structure that could change the outlook.

Stay tuned for updates as we approach the earnings call and as NVIDIA continues to set new milestones in the tech space.

Shopify (SHOP): Preparing for a Long-Term Entry at $49.62Considering Shopify, the situation is unfolding as we anticipated. We expected the beginning of 2024 to potentially mark the peak for Shopify with the completion of Wave (1), indicating a Wave 2 correction. This correction is likely to find support between the 63.8% and 78.6% retracement levels.

Currently, the pattern is showing lower lows and lower highs, suggesting that further price declines may occur, potentially closing existing gaps. Our strategy is still developing, but we plan to place a long-term entry at $49.62 with a stop-loss at $31.

Shopify (SHOP): Riding the 130% rally after the earnings surgeShopify kicked off the earnings week with a significant surge, rising 130% since our entry. We’ve taken additional profits at this level and canceled our second limit order. The stock has reached the 161.8% Fibonacci target at $111, aligning with our strategy.

In its third-quarter earnings report, Shopify reported revenue that exceeded Wall Street’s expectations, with double-digit gross merchandise volume growth. Looking ahead, the company forecasts a mid-to-high-twenties percentage growth in revenue for Q4, supported by the same factors driving its strong performance this year.

While Shopify continues its upward momentum, there’s no clear indication of when this rally might lose steam. The RSI is currently overbought, suggesting a potential pullback in the near future. If we spot a wave 4 correction, we will reassess and update the chart for a potential new entry.

Visa (V): Pullback Incoming After New All-Time HighsVisa ( NYSE:V ) has reached our anticipated wave 3 target, a significant milestone for this stock that has consistently delivered strong performance. Recently, regulators in the EU have begun probing Visa and MasterCard’s fees, assessing their impact on businesses. While this could pose some risks, Visa’s overall trajectory remains promising.

The stock has been setting new all-time highs consistently, but with the potential completion of wave ((v)) and wave 3, we are now looking for a pullback. This correction could offer a great opportunity to open new long positions. Our target range for the pullback is between $280 and $260, though the exact level remains uncertain. Before this, there could still be further upside, with a potential minor retracement between $311 and $325 that would support a bearish short-term outlook.

We are monitoring this closely and have alerts set to act when the time is right. Visa remains a long-term performer, but patience will be key to capitalizing on its next move.

Deutsche Bank (DBK): Earnings beat but loan losses double We missed the optimal entry for Deutsche Bank (DBK), but the analysis was accurate overall. The earnings report showed some resilience with a revenue increase of 5.2% year-over-year, reaching €7.50 billion, slightly above analyst expectations of €7.30 billion. The stock reacted with a modest dip, but nothing significant. However, Deutsche Bank reported a notable rise in loan losses, which doubled to €494 million in Q3 2024 compared to €245 million a year ago, aligning closely with the €482 million forecasted by analysts.

From a technical standpoint, our primary count still appears valid, though it’s a bit on the lower side. This could indicate that wave 3 might not be the longest wave in this count, which is atypical but possible as long as it’s not the shortest.

We’re targeting a potential endpoint for wave 5 within the HTF resistance zone, aligning with the 50-61.8% Fibonacci extension level, where we could look for a long position if the setup confirms. We will continue to monitor DBK closely as this potential target level nears and adjust accordingly.

Tesla (TSLA): Positioning for growth as Musk eyes record salesAs we anticipated in our last update, Tesla bounced right at the expected level following its earnings call. After posting better-than-expected earnings, TSLA shares surged up 20% on market opening. Tesla reported a 17% increase in net income for the September quarter, reaching $2.2 billion, which beat analyst expectations. Additionally, revenue grew by 8%, reaching $25.2 billion, just shy of the consensus estimate of $25.4 billion.

Most noteworthy, Elon Musk hinted at a promising future outlook. He stated Tesla aims for a record-breaking quarter in vehicle sales, with potential growth of 20% to 30% in 2025. However, there is still cautious sentiment about whether this will follow the pattern of past announcements, where major news led to temporary rallies, followed by dips if expectations weren’t met.

As we highlighted previously, a bounce here suggests a likely revisit to the range high. If the current trend continues, the next high could align with the trendline, potentially forming another lower high. For sustained upside, breaking this trendline with a solid push is critical. We’re closely watching these developments and will keep you updated on any relevant changes.

3M (MMM): Building a Bullish Case Despite HeadwindsWith 3M's earnings yesterday, it’s the perfect moment to analyze the stock and assess the upcoming opportunities. The company is expected to have benefited from its restructuring actions, such as headcount reduction, likely lowering costs and improving margins this quarter. Its disciplined spending and restructuring savings could also boost profitability.

Despite these positive factors, challenges in 3M’s packaging and expression, along with home and auto care divisions, may drag down its performance. Lower consumer retail spending on durable goods is expected to impact its Consumer segment's results.

From a technical standpoint, 3M’s surge from the support zone recently was strong enough to shift the weekly trend from bearish to bullish. Such a structural change on the weekly chart is significant, as it's not common to see such a clean trend reversal. However, as often happens with sharp upward movements, we are now seeing a bearish divergence on the RSI. This divergence doesn’t mean a pullback is imminent but suggests that one could happen eventually.

Looking at the daily chart, there may be potential for 3M to move higher if wave 1 isn’t complete. Even if earnings were positive, we should still witness a pullback. We are looking to build a position by layering bids at key levels. Our first target entry is the gap high, followed by the gap low, which aligns with the 50% Fibonacci level. If the price continues to drop, we’ll continue adding bids down to the 78.6% Fibonacci retracement level. Our stop loss will be set below wave (2) to safeguard the trade. A break below this level would invalidate the bullish outlook and could result in a drop to $56, though this scenario seems less probable for the near future.

Coinbase (COIN): Strong push ahead after Bitcoin surge!After our last analysis on NASDAQ:COIN two months ago, we saw another leg down into the golden pocket and the imbalances we were watching. These got partially filled, reaching around 50%, which provided the necessary strength for a push higher. This recent jump is largely due to Bitcoin's rise over the past weeks, as Coinbase, being a major holder of Bitcoin, has directly benefited from this positive development.

This surge was strong enough to invalidate the bearish trend on the higher time frame, confirming that a bullish sequence is now in play. The biggest and closest resistance ahead is the VAH (Volume Area High) traded since November 2023. With the RSI currently overbought and showing a bearish divergence, a pullback could be on the horizon. However, we aren't too concerned about this unless the price drops below $160.50. The bullish outlook will only be invalidated if it dips under $145.

One thing to note about NASDAQ:COIN is its heavy correlation with Bitcoin, which introduces more volatility. The crypto market is also playing a key role in the U.S. elections, with both Trump and Harris addressing the sector. This could provide some tailwinds for Coinbase in the future.

In terms of the broader outlook, the potential wave ((iii)) could see a rise toward $263-$323, though this will take time to unfold. Given the market dynamics, it's better to remain cautious, but the setup looks promising.

Overall, we continue to monitor NASDAQ:COIN closely, but we are more inclined to invest in Bitcoin itself due to the inherent correlation and volatility with the stock.

Uber (UBER): Missed the Rally? Here comes new opportunitiesIt's been a while since we last looked at Uber, and the stock has moved perfectly since then. Uber reacted exactly as expected to our desired area, but unfortunately, we didn’t buy any shares at the time. If you did, congratulations – this position is now up 60.8%!

Shares of rideshare companies Uber Technologies and Lyft surged on Friday, following Tesla's underwhelming Robotaxi reveal. Uber has shifted its focus away from developing autonomous vehicles and is instead concentrating on expanding its marketplace for riders and drivers. This shift has created a robust network effect, making it increasingly difficult for competitors to match Uber's scale, according to a recent report by Business Insider.

Uber’s asset-light business model, which doesn't involve owning or maintaining vehicles, has been financially successful, generating $1.7 billion in free cash flow in the second quarter. Now, Uber has reached a new all-time high, and if we look back at the chart, it's easy to see a clear and powerful pattern. After entering our desired area, Uber made a sharp V-shaped correction, followed by a key level retest. In a short period, NYSE:UBER turned bullish, marking a complete turnaround.

We will be closely watching Uber Technologies' upcoming earnings report, scheduled for October 31, 2024. After this event, we’ll update our chart and look for possible new opportunities.

Gilead Sciences (GILD): Pattern Still Intact—What’s the Plan?Let’s quickly review our open position in $GILD. We’ve managed to turn the whole chart around, and I hope everyone who bought in had the strength to sit it out. It was a close call with the stop loss, but now we’re up significantly, and we’ve moved our stop loss closer to $65.46. So far, we’re up 17%, and we don’t want to dictate when to take profits. If you’re in, do your own research and take profits whenever you feel comfortable—it's all up to you 👍.

If you take a closer look, you’ll see that NASDAQ:GILD has been following a nice upward pattern: a surge, then three candles down, then another surge. I’m not sure how long this pattern will hold, but as long as we don’t retrace too much, we should be fine. I also like that we’re respecting all the key levels. The RSI is about to be overbought, so we might see another three candles down, but this time it could be a deeper pullback.

We’ll see how it plays out, but we’re very pleased with this swing trade so far. Congratulations to everyone who’s been riding this wave 🍾.

Gilead Sciences (GILD): First Take Profit in a High RangeGilead Sciences is now back trading at the high end of its range, and we’ve decided to take our first profit here. It’s crucial to respect range-bound trading, and there is a strong possibility of a pullback at this point. However, we don’t expect this pullback to reach the lower end of the range again but rather settle in the middle. If NASDAQ:GILD reclaims this range high, it could provide even more upside and new opportunities.

We are also raising our stop loss to $65.80 to lock in gains. Gilead serves as our "natural hedge" against broader risk-on market conditions, and with a 40% bounce from the range low at the same time the S&P 500 is hitting new all-time highs, it’s clear that Gilead can benefit as well.

We’re keeping a close eye on this stock, and if another opportunity arises, we’ll be ready to act.

JD.com (JD): Massive 97% Rally—What's Next?We mentioned Chinese stocks a while ago, and finally, they're starting to pay off—big time. We bought shares of JD.com back in July, and after a small dip, the stock soared an impressive 97% in just 65 days.

Shares of U.S.-listed Chinese companies are gaining momentum, fueled by continued stimulus efforts. September's PMI data beat expectations despite a decline in factory activity, which has further bolstered hopes for increased stimulus. Over the past week, JD.com's stock surged following the People’s Bank of China's aggressive monetary easing measures. The central bank reduced the reserve requirement ratio (RRR) by 50 basis points, bringing it down to 9.5%. This move will inject around 1 trillion yuan (approximately $140 billion) into the financial system. The increased liquidity gives banks more capital to lend, easing financial pressures on businesses like JD.com that rely heavily on consumer spending and economic confidence.

JD.com, often considered a barometer for China’s domestic consumption, has benefited significantly from this shift in sentiment, with investors betting that further stimulus measures could lead to increased consumer spending on e-commerce platforms.

From a technical perspective, there's not much left to say—we took some profits on JD.com, as this parabolic rise could either continue or see a pullback before another leg higher. All indications point towards further gains for JD.com, as it has smashed through all resistance and trend channels with remarkable strength. Our stop loss is set at break even, and we’re letting this trade continue to run.

Xiaomi (1810): Major Gains, Next Targets and Updated StrategyThe Hang Seng Index and its constituent stocks have been surging higher, with Xiaomi leading the charge 🚀. The setup we had on Xiaomi was quite similar to the one for Alibaba, featuring a tight stop-loss and a high risk-to-reward ratio, which, just like NYSE:BABA , worked out perfectly. Although we aimed to catch the end of wave (ii), we missed the entry by just a few HKD. Despite this, the position is now up an impressive 85% since we initially sent out the entry back in March.

We have taken our first round of profits as we haven't locked in any gains yet, and we have moved our stop-loss to the break-even point. However, we are confident that Xiaomi will not revisit this level for a long time. We took profits upon reaching a key wave 3 extension level. While we expect further gains on the lower time frame, we must also respect what the higher time frame indicates. Whether it's longing wave (iv) or wave 4, the choice depends on whether we are right about the higher or also the lower time frame. On the higher time frame, we anticipate a maximum rise to 30 HKD before we see a significant correction.

We believe there is still substantial upside potential for Xiaomi – it's only a matter of time. We'll keep monitoring both scenarios closely and act accordingly 📈.