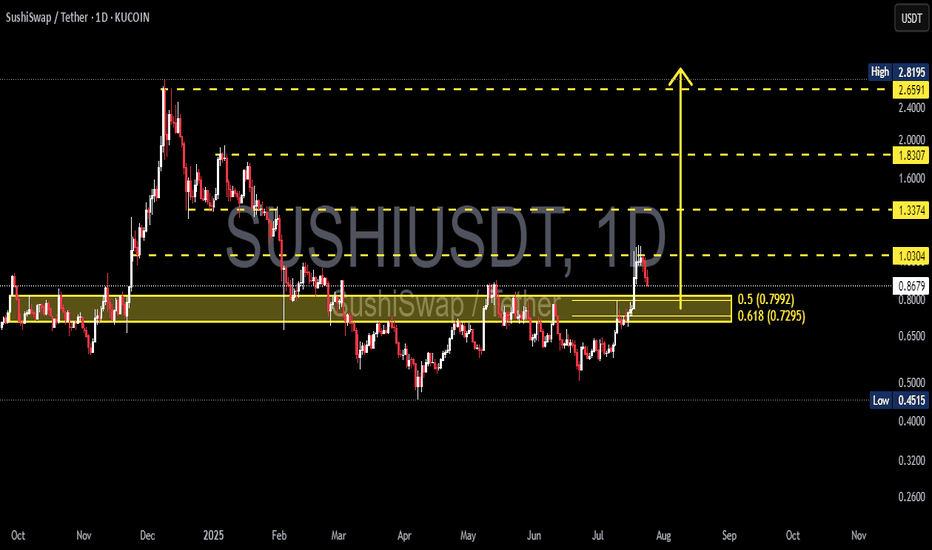

SUSHIUSDT at a Critical Pivot Golden Pocket Retest or Bull Trap?📊 Full Daily Chart Analysis (1D) — KuCoin

After months of dull sideways movement, SUSHI is finally showing signs of life! A strong breakout above a long-term consolidation range has pushed price up to the key resistance at $1.03, raising the possibility of a mid-term trend reversal.

However, the price is now entering a pullback phase. The key question:

Is this just a healthy correction before the next leg up—or the beginning of another downward move?

---

🔍 Structure & Pattern Breakdown:

Rounded Bottom Formation:

Formed from April to July 2025, this pattern signals a shift from accumulation to potential bullish expansion.

Confirmed Breakout:

A breakout above the neckline at $0.80, supported by increasing volume, suggests this move is legitimate—not a fakeout.

Golden Pocket Retest (Key Fibonacci Zone):

Price is currently pulling back into the Fibonacci Golden Pocket (0.5 at $0.7992 and 0.618 at $0.7295) — the most ideal technical zone for a bullish re-entry. This area also aligns with a strong historical demand zone.

---

📈 Bullish Scenario (Primary Case):

If daily candles hold above the $0.7295–$0.7992 zone and form a strong reversal signal (e.g. bullish engulfing or hammer):

Price is likely to retest $1.03 (minor resistance).

A successful breakout above $1.03 could lead to a rally toward:

🔸 $1.3374 – Previous horizontal resistance

🔸 $1.8307 – Key psychological level & March 2025 swing high

🔸 $2.6591 – Fibonacci extension target

🔸 $2.8195 – Major high from November 2024

This could mark the beginning of a mid-term bullish trend if volume continues to build.

---

📉 Bearish Scenario (Alternative Case):

If the price fails to hold above the Golden Pocket and breaks below $0.7295:

A deeper correction is likely, with price revisiting $0.60 or even retesting the bottom zone at $0.4515.

This would invalidate the bullish setup and confirm a bull trap.

---

🧠 Conclusion:

SUSHI is at a decisive moment. This retest of the Golden Pocket will determine whether this is simply a healthy pullback within a new uptrend, or the early sign of another bearish breakdown.

> Plan the trade, trade the plan. The $0.73–$0.80 zone is the battlefield for SUSHI’s next major move.

---

📌 Key Levels:

Level Description

$0.7295–$0.7992 Golden Pocket (Fibonacci Re-Entry Zone)

$1.03 Minor Resistance

$1.3374 Bullish Target 1

$1.8307 Bullish Target 2 (Mid Resistance)

$2.6591–$2.8195 Long-Term Bullish Targets

$0.60 / $0.4515 Bearish Supports if Breakdown Occurs

#SUSHIUSDT #CryptoBreakout #FibonacciTrading #GoldenPocket #AltcoinReversal #SushiSwap #CryptoSetup #TechnicalAnalysis #BullishScenario

Sushiswap

Massive Upside for SUSHI from Key Demand Zone!CRYPTOCAP:SUSHI is bouncing strongly from a key multi-tested weekly support zone (~$0.42–$0.55), signaling a potential bottom formation. Price action shows a bullish structure with the possibility of a trend reversal. If momentum continues, we could see a rally first toward Resistance 1 at $1.25, followed by a larger move targeting Resistance 2 at $3.75.

Stop Loss: $0.43

Resistance 1:$1.25

Resistance 2:$3.75

BINANCE:SUSHIUSDT

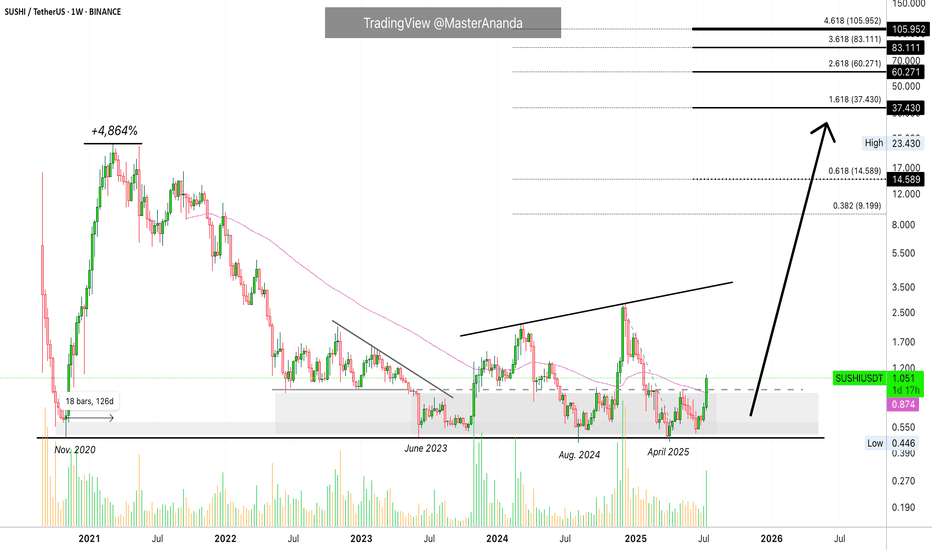

Sushi Turns Bullish, Major Support Zone Left Behind · $105 Next?A major support zone from November 2020 has been left behind. The launch pad for Sushi's previous bull market. Let me explain.

Right after SUSHIUSDT became available for trading late August 2020 it started a strong decline. This decline found support at a low point November 2020. To this day, this low remains the strongest and most important support for this pair and it has never been broken on a weekly close, not even once. The level was tested three times: In 2025, 2024 and 2023 and each time it gets tested a bullish wave develops.

From November 2020 through March 2021, 126 days, SUSHIUSDT went ultra-bullish, total growth amounting to 4,864%.

The bullish waves in late 2023 and 2024 were something minimal, whales buying nothing more as there was no continuation. The situation is different today.

Sushi has been accumulating for years and is ready for a full-blown bull market. This week it started trading above EMA55 on a full green candle, coupled with really high volume. This is it, the major bull market cycle and wave. It ends in a bull-run phase.

The November 2020 support is now being left behind. Sushi is preparing and has the possibility of hitting a new all-time high in late 2025. It can happen that the action goes beyond this year and into 2026.

Some pairs can produce an entire bull market bullish wave in 3-4 months. Other pairs can do so in 6 months exact. Some others go for longer and last 8 months while a different set can take 12 months or more. Some pairs have been in bull market territory (higher highs and higher lows) for years... Let's hope the entire market decides to produce long-term growth.

The low in June this year is a higher low compared to April. Here you can see the market variations. Some pairs produced lower lows and others, like this one, produced a higher low. Lower low or higher low makes no difference when it comes to the bigger picture, this is simply a technicality.

We are now entering a massive, marketwide bullish phase. You just need to be prepared for what is coming because this will be the opportunity of a lifetime. While there will always be new bear markets and bull markets, the prices we are seeing now will be forever gone. Crypto will grow so fast and so strong, that the next correction bottom will be really high compared to the most recent major low. Cryptocurrency is going mainstream and is here to stay for the long haul.

Namaste.

#SUSHI/USDT#SUSHI

The price is moving in a head and shoulders pattern on the 1-hour frame, adhering well to it, and is heading for a strong breakout upwards and retesting it, forming the right shoulder.

We have a bounce from the lower channel line to the right shoulder, which is support at 0.620.

We have a downtrend on the RSI indicator that is about to be broken and retested, supporting the upside.

We have a trend of consolidation above the 100 moving average.

Entry price: 0.629

First target: 0.637

Second target: 0.650

Third target: 0.666

#SUSHI/USDT#SUSHI

The price is moving within a descending channel on the 1-hour frame and is expected to break and continue upward.

We have a trend to stabilize above the 100 moving average once again.

We have a downtrend on the RSI indicator, which supports the upward move by breaking it upward.

We have a support area at the lower limit of the channel at 0.616, acting as strong support from which the price can rebound.

Entry price: 0.621

First target: 0.634

Second target: 0.643

Third target: 0.654

Sushiswap 1,2 Breakout Sequence Can Lead To New ATH (3,000% PP)On this chart and after reaching a market bottom Sushiswap produced a clear 1,2 breakout sequence. This sequence has been shown to produce a bullish wave.

You know what they say, "Third time's a charm," and we are on the third breakout from a long-term support.

1) In early June 2023 we have the first 1,2 breakout sequence which leads to a bullish wave that ended in March 204.

2) In August 2024 the same sequence again, and a new bullish wave ends December 2024 with a higher high compared to March.

3) Fast forward and bring yourself to this present day, April 2025 the same sequence starts as a higher low. "Third time's a charm." Here we are getting not only a higher high but it is possible even a new all-time high.

» Growth potential can reach 1,500%, 2,500% or even beyond 3,000%, it is still too early to say.

It is not early to know though that the market already hit bottom and is preparing to grow.

This is a good chart and a great project; an awesome opportunity. Buy and hold.

Namaste.

SushiSwap: Your Altcoin ChoiceAnother great chart. In December 2024 SushiSwap hit its highest price since December 2020 on a bullish move. In general, December 2024 produced the highest level since April 2022. Really something, a multiple years long high.

How are you doing today my friend in the law?

I hope you are having a wonderful day and weekend.

This is another classic chart setup and price action dynamic that I am about to show and analyze. SUSHIUSDT produced a triple-bottom on a wide, long-term consolidation (sideways) channel.

It is interesting to notice that shy higher highs have been present since October 2022. The bottom portion is mixed. Last week produced the lowest price ever based on candle close. On candle wick, this week is a higher low vs early August 2024. This is pretty much irrelevant.

Seeing a lower low, higher low, perfect double-bottom, etc., wouldn't change the bigger picture.

There is a strong correction after a descent but minor bullish wave. This correction ends at support and once the low is in a new bullish impulse will develop. Now, the preceding years the action was not really strong because these are transition years. A transition from bearish to bullish.

This year, everything changes. Instead of a small "descent" bullish wave, we will have a major bullish cycle, that is what comes next. The price now is absolutely awesome, the best possible, true All-Time Low. Once we are in with great timing and pricing, a bull market becomes really fun. When you manage to catch the bottom, all that follows is to see how your capital/profits grow.

Enjoy your life! And thank you for your continued support.

This is a great Top Altcoin Choice.

Namaste.

#SUSHI/USDT#SUSHI

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.850

Entry price 0.897

First target 0.924

Second target 0.947

Third target 0.980

#SUSHI Holders, Beware: A Major Move Is Brewing in the EcosystemYello Paradisers! Have you been watching #SUSHIUSDT? If not, now’s the time to pay attention. #SushiSwap is approaching a critical point that could spark a bullish breakout:

💎#SUSHI has completed a classic 5-wave impulsive structure, with Wave 5 peaking at around $2.80. What followed is an A-B-C corrective wave, bringing #SUSHI down to its current levels. Right now, we’re seeing Wave C testing the descending support near $0.92. The key question: Will this be the end of the correction, or is there more downside ahead?

💎For the bulls to regain control, #SUSHIUSD needs to break above the $1.356 resistance. A solid breakout here could trigger a rally towards $1.80, and if momentum holds, a push into the strong resistance zone between $2.60 and $2.80. However, if #SUSHI fails to clear this hurdle, expect more sideways action or even a retest of lower levels.

💎On the downside, we have strong support at $0.70. This strong support has held many times more and we believe buyers will setup in to defend this level. The next line of defense for the bulls is present at $0.60.

💎If a candle closes below this level, the bullish setup is invalidated, and we could see a sharp decline towards $0.40 or even lower. This would mark a failure of the corrective structure, leading to a deeper bearish trend.

Stay focused, patient, and disciplined, Paradisers🥂

MyCryptoParadise

iFeel the success🌴

#SUSHI/USDT Ready to go higher#SUSHI

The price is moving in a descending channel on the 1-hour frame and sticking to it well

We have a bounce from the lower limit of the descending channel, this support is at a price of 1.37

We have a downtrend on the RSI indicator that is about to be broken, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 1.45

First target 1.58

Second target 1.73

Third target 1.89

Sushi: A Plan for the Upcoming AltseasonThe SushiSwap (SUSHI) token has an interesting story heading into the next altseason. While many tokens avoided updating their historical lows, BINANCE:SUSHIUSDT stands out as one of the few that broke below its November 2020 low—proving that in crypto, never say never!

The levels we’ve outlined suggest that SUSHI is trading within a clear accumulation zone.

A continuation of the uptrend appears likely, targeting the green block region.

Market Capitalization Targets

SUSHI's previous high market capitalization reached $3.5 billion, aligning with the green block level. This could act as a mid-term target for the upcoming cycle.

If you believe in SUSHI breaking into uncharted territory, the higher targets have been marked for reference.

The largest purchases by major players were highlighted on the monthly timeframe.

This institutional activity strongly supports the potential for a significant upward movement.

Accumulation near the current levels aligns with both technical and market sentiment indicators.

Mid-term traders could consider targeting the $3.5 billion market cap level, while long-term holders can set their sights on a potential new ATH.

Hope you enjoyed the content I created! You can support this idea with your likes and comments so more people can see it.

✅ Disclaimer: Please be aware of the risks involved in trading. This idea was made for educational purposes only, not for financial investment purposes.

Check out my ideas about interesting altcoins in the related section below ↓

For more ideas, please hit "Like" and "Follow"!

Sushiswap Sushi price analysis🍣 Fresh CRYPTOCAP:SUSHI has been brought to the market, but you need to buy it at a good price and more on that later!)

Only the 4th time, for the first time in 2.5 years, OKX:SUSHIUSDT price managed to break above $2

1️⃣Now the main thing is to wait for confirmation of the breakout and the strength of buyers. That is, we need to wait for the price of the #Sushiswap token to firmly establish itself in the range of $1.50-2 and not fall below it.

2️⃣If this condition is met, the prospects for continued growth to $10 will open up, where selling one #Sushi will allow you to buy a whole roll set :)

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

SushiSwap (SUSHI)📊 SUSHI Analysis

🔹 General Overview:

SUSHI coin managed to break out of its descending channel from the top and reach its weekly timeframe resistance. This resistance could lead to a price correction. The RSI has entered the overbought zone, but another significant resistance still lies ahead.

🔹 Weekly Timeframe Analysis:

If the price manages to break the white weekly resistance zone, it could trigger a sharp move towards the Fibonacci targets:

1.618

2.618

3.618

🔹 Investment Recommendation:

✅ We recommend a laddered entry strategy for investing in this cryptocurrency:

One entry at the current market price.

Another entry if the price corrects downward.

A final entry if the weekly resistance is broken.

🔹 Long-Term Outlook:

Given SUSHI's functionality and low market cap, it has the potential to revisit its previous all-time high. However, gradual profit-taking in the red zones is essential.

🔹 Additional Notes:

1️⃣ Volume Analysis:

An increase in trading volume near the weekly resistance could indicate strong buying pressure. If the breakout is accompanied by high volume, the likelihood of a sharp move increases.

2️⃣ Price Behavior During Correction:

During a correction, observe whether the price drops slowly with low volume or quickly with high volume. A slow correction often signals accumulation by buyers.

3️⃣ Impact of Overall Market (BTC & ETH):

The general market condition, especially Bitcoin and Ethereum trends, heavily influence smaller coins like SUSHI. Ensure the overall market trend is positive.

4️⃣ Timing Investments:

Given the likelihood of a correction near resistance, avoid rushing in. The proposed laddered entry strategy can help mitigate risks.

5️⃣ Monitoring SUSHI's Fundamentals:

Stay updated on SUSHI’s protocol upgrades, new partnerships, or management changes, as these can significantly influence price trends.

💡 Conclusion:

Stay in the game with proper risk and capital management.

SUSHIUSDT Reversing from Major SupportSUSHIUSDT technical analysis update

SUSHI's price touched its major yearly support level this week, a zone it has bounced back from multiple times over the last four years. We can expect a bounce from this support level again.

Stop Loss: $0.45

Target :100%-300%

regards

Hexa

SUSHISWAP - On All Time Low SupportAnother coin that I have been keeping an eye on for some time is SUSHI, the risk reward is excellent as in very few other cases, the most important reversal point is about 20x from the current price, considering that it is one of the most important DEXs in the industry I think it is an excellent investment for the near future.

SUSHI (Crypto SUSHISWAP-USD) SELL TF H1 TP = 0.5175On the H1 chart the trend started on Aug. 27 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 0.5175

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

SUSHI (Crypto SUSHISWAP-USD) BUY TF H4 TP = 0.7142On the H4 chart the trend started on Aug. 07 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 0.7142

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am very interested in it. Thank you!

Good luck!

Regards, WeBelievelnTrading

SushiSwap Analysis & Profit TargetsSo SushiSwap is a good overall coin, also with XSushi Staking Program, the project is going the right direction at this current time.

Analysis suggests that we are at support, the reward vs the risk is very rewarding.

In the next bull run it can go up to 20$ or even more.

It's possible as long as the project and the developers go in the right direction with the project.

However, it's possible.

The profit targets are the fib levels, trailing the take profits is a good idea as well.

Do Your Own Research, This is not Financial Advice

Crypto Shadow

Alikze »» SUSHI | Complementary wave C scenario🔍 Technical analysis: Complementary wave C scenario

- In the previously presented analysis, the C wave stopped at 0.78 fibo of the previous wave.

- It is currently moving in a descending channel in the 2D time frame.

- There is an FVG gap and it is now in the middle of the channel, which is also symmetrical with the 0.78 Fibo range.

- If it faces selling pressure again after filling this gap, it can touch the specified areas in the continuation of the completion of wave C.

- Therefore, according to the current downward momentum, the pullback can be a broken structure.

💎 Alternative scenario: In addition, if it can break the neckline upwards after filling the FVG gap and exit the descending channel, it can retest the supply zone.

»»»«««»»»«««»»»«««

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support.

Best Regards,❤️

Alikze.

»»»«««»»»«««»»»«««