Perfect automated detection of BlackSwan pattern - ShortA Bearish-type big BlackSwan pattern occurred.

Also on the weekly chart, Bearish-type BlackSwan pattern is occurring.

Short after seeing the rebound.

*Harmonic patterns is automatically detected using the indicators below.

- Harmonic auto-detect PRO

Swanpattern

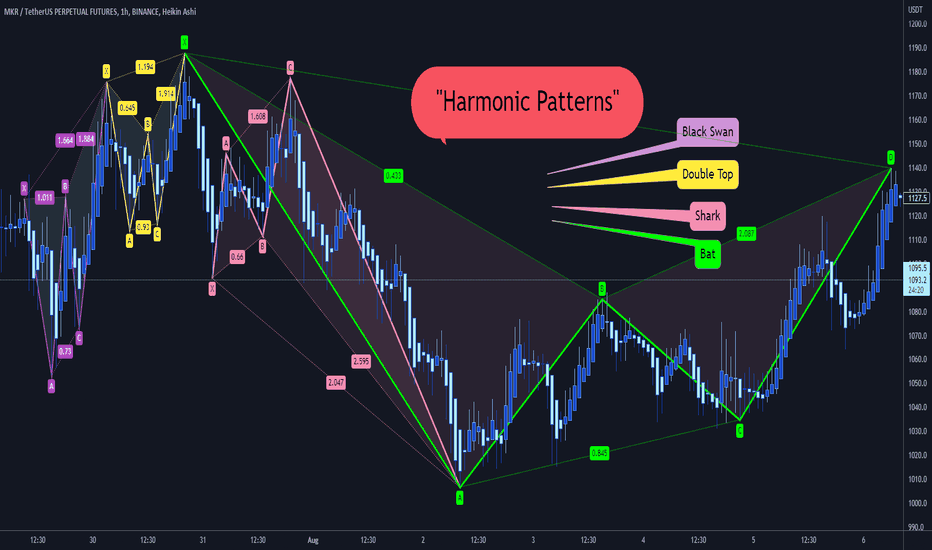

Harmonic PatternsHarmonic Patterns

we have so many kinds of “Harmonic Pattern”:

Black Swan

Bat

Crab

Butterfly

Gartly

White Swan

Shark

Zero_Five

Cypher

Double Top

Double Bottom

📚👌🏻 Each one of them has its unique Fibonacci levels.

⚡️ Do you want to know them?

😍 Happy to see what you find in the charts, please share yours with us

GreyScale BitCoin Trust (GBTC)

I have never has any interest in Bitcoin nor its derivatives. I like the technology but believe we are still in its early days.

That is not to say however I don't follow it.

One equity way to position a Bitcoin view is with GreyScale Bitcoin Trust.

So currently on a weekly basis there there are two current bullish harmonic Patterns in play ... A Gartley and a Black Swan.

Additionally there is also evidence of a bullish Wolfe Wave in play which I have marked with a time and a target.

Our final inspection shows an upsloping Andrews Pitchfork which is also has been marked.

IMHO this technical analysis evidence suggests we have formed or in the process of forming a significant bottom.

That said, I will watch an comment on its progress. BTC may have one final push down to the $23,000 so my game plan is to enter an established GTBC rally just under the $23 level with a stop at approximately $the $17 level.

My target is around the $34 level.

If it works out that's good..

This is educational investment advice. Do your own due diligence and respect market trends and conditions which as any student of the crypto space can change rapidly .

See you in September.

S.

Perfect automated detection of BlackSwan - ShortA Bearish-type BlackSwan occured within the resistance zone of 132.20-133.30.

Also on the daily chart and 4-hour chart, Bearish-type BlackSwan is occurring.

Short after seeing the rebound. At that time, be careful of re-inversion in the support zone of 125.60-126.70.

Perfect automated detection of BlackSwan pattern - ShortA Bearish-type BlackSwan pattern occured near the resistance zone of 131.60-133.20.

Short after seeing the rebound. At that time, be careful of re-inversion in the support zone of 123.60-125.20.

If it does not rebound at point D and exceeds the resistance zone of 133.20, consider Long.

Perfect automated detection of BlackSwan pattern - LongA Bullish-type BlackSwan pattern occured.

Long entry if it exceeds 1.2800.

However, there is a resistance zone at 1.2890-1.2990 near point C, so we need to be careful about repulsion in this zone during entry.

*Harmonic patterns and support/resistance zones are automatically detected using the indicators below.

- Harmonic auto-detect PRO

- Support/Resistance Zone Auto PRO

Perfect automated detection of BlackSwan pattern - ShortA Bearish-type BlackSwan pattern occured within the resistance zone of 84.90-85.10.

(In this resistance zone , there was a rebound in 25 Feb 2021)

Short after seeing the rebound. At that time, be careful of re-inversion in the support zone of 83.90-94.10.

If it rises above the resistance zone 85.10, consider Long.

*Harmonic patterns and support/resistance zones are automatically detected using the indicators below.

- Harmonic auto-detect PRO

- Support/Resistance Zone Auto PRO

Perfect automated detection of BlackSwan pattern - ShortA Bearish-type BlackSwan pattern occurred in the wide resistance zone.

If it falls below BlackSwan's B point again, a small head and shoulder is completed on the daily chart.

In that case, aim for Short. But note the resistance zone around fibonacci 38.2%.

On the other hand, if it exceeds Black Swan's D point, Long is possible, but be careful because it is still in the resistance zone.

*Harmonic patterns and support/resistance zones are automatically detected using the indicators below.

- Harmonic auto-detect PRO

- Support/Resistance Zone Auto PRO

Perfect automated detection of WhiteSwan pattern - ShortA Bearish WhiteSwan pattern occured within the resistance zone of 1.265-1.293.

And a Bearish type Bat pattern also occured on the weekly chart.

If it exceeds the resistance zone, consider Long.

However, since the Bearish Bat pattern also occurs on the weekly chart, be careful of the downward reversal after breaking through the zone.

After confirming the repulsion in the resistance zone, aim for Short.

*Harmonic patterns and support/resistance zones are automatically detected using the indicators below.

- Harmonic auto-detect PRO

- Support/Resistance Zone Auto PRO

Perfect automated detection of BlackSwan pattern - ShortA Bearish type BlackSwan pattern occured within the resistance zone of 0.794-0.809.

(In this resistance zone , there were rebounds in May 1996-Mar 1997, Feb 2004, Nov 2004, Mar 2005, Jan 2007, Aug 2007, Jun 2009, May 2010, Jan 2015, May 2015, Jul-Sep 2017, Jan 2018)

If it falls below BlackSwan's point C (0.75636), consider Short further.

If it rises above BlackSwan's point D (0.80072), consider Long. If it exceeds 0.8200, consider Long even more strongly.

If it does not exceed BlackSwan's point D, a double top will be completed around 0.8000, so consider Short.

*Harmonic patterns and support/resistance zones are automatically detected using the indicators below.

- Harmonic auto-detect PRO

- Support/Resistance Zone Auto PRO

Perfect automated detection of BlackSwan pattern - LongA Bullish BlackSwan pattern occured within the resistance zone of 1.190-1.193.

(In this resistance zone , there were multiple rebounds in Jul-Dec 2020)

Long after seeing the rebound.

If the downtrend continues, note the resistance zone of 1.175-1.178.

*Harmonic patterns and support/resistance zones are automatically detected using the following tools.

- Harmonic auto-detect

- Support/Resistance Zone Auto

Perfect automated detection of BlackSwan patternBearish type BlackSwan pattern occurs on all daily, weekly and monthly charts. It's rare case.

128.0-129.0 has Support & Resistance Zone.

If it exceeds 130.0, consider Long. But note the next resistance zone, 132.0.

If it falls below 128.0, consider Short.

Perfect automated detection of BlackSwan pattern - ShortEntry(sell) 1.36500, T/P 1.32000, S/L 1.38500

A Bearish type BlackSwan pattern occured at the timing beyond the long-term resistance zone of 1.37-1.38.

(In this resistance zone, there was a rebound in January 2009, March 2009, February 2016, February 2018, March 2018)

If it rebounds again in this zone and falls, it is a selling tendency.

Perfect automated detection of BlackSwan pattern - LongEntry(buy) 1.675000, T/P1 1.710000, T/P2 1.730000, S/L 1.665000

It rebounded against the support line of about 1.66100, which was the bottom price in December 2019 and July 2019.

Long because the Bullish type BlackSwan pattern was generated at that timing.