Swedishkrona

ridethepig | SEK for the Yearly Close📌 SEK for the Yearly Close

In general the following flows are working flawlessly, sellers have recaptured the control and are bringing about a lot of pressure on the main macro targets issued at the beginning of 2020. One indication of the weakness is clearly the USD devaluation, and is represented by the attacking side rushing to SEK.

Introducing some layers to time for this just as an example for reference points using Gann, it is strategically interesting to see Feb 2022 as it is also a panic cycle in the dollar according to my models. The buyers are hanging by a thread, they are having trouble trying to pay their debts and will have to convince the creditors.

At the point when this was made, Fed was seen as a deer in the headlights via Covid capitulation / flip flop and, with what immense trouble they will have now in achieving credibility after funding the Whitehouse policies in broad daylight!! Watch for the lows next week, its not quite so easy for buyers to dispose of the momentum here: if this happens we may enter into waterfall mode.

Thanks as usual for keeping the feedback coming 👍 or 👎

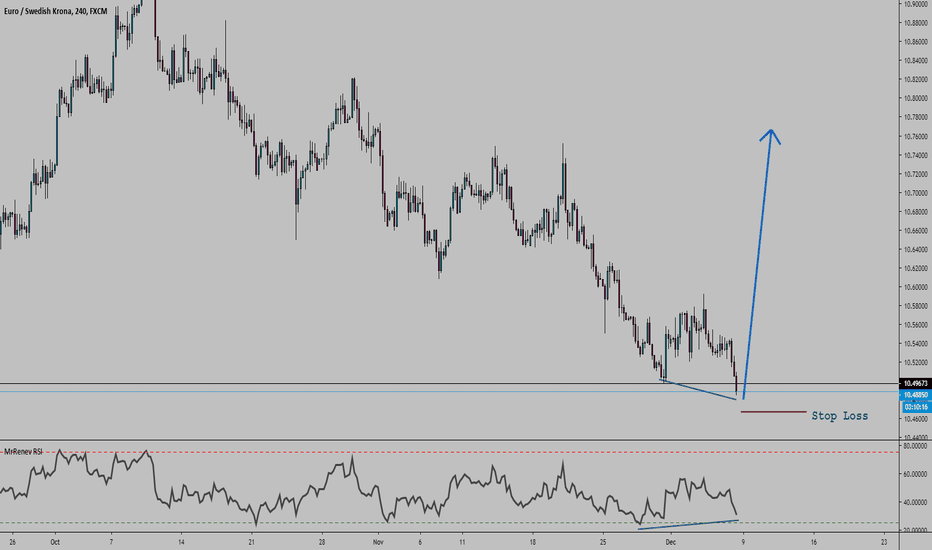

EURO_SWEDISH CRONA STRUCUTRE ANALYSIS|LONG

EUR_SEK BOKOKE THE RESISTANCE. SPIKED. RETESTED SUPPORT.

NOW BROKE OUT OF RESISTANCE.

It might move in a triangle fashion

Consolidating for an upwards move

Pick it up from the support levels outlined

___________________________________

LIKE and SUBSCRIBE for QUALITY

USD_SEK BEAUTIFUL STRUCTURE| THE DRAWING IS COOL A.F.

JUST MARVEL AT WHAT THE MKT DRAWS SOMETIMES.

LOOKS LIKE A STAR CONSTELLATION OR SMTH

But yeah, the pair will probably move the way I've drawn it too, so watch out for longz

_______________________________________

LIKE for the pretty pic, SUBSCRIBE for more COOL stuff

NOKSEK: Aiming for the Support.The pair is trading within a 1D Channel Up (RSI = 48.456, STOCH = 47.038, MACD = 0.001, ADX = 30.430) which is currently neutral as it is aiming for a new Higher Low. That can be on the 0.9585 Support, which is our current target on this pull back.

** If you like our free content follow our profile to get more daily ideas. **

Comments and likes are greatly appreciated.

GBPSEK short every chance u haveHey there!

Very simple setup explained in the chart, just keep shorting until the pair says otherwise. Simple. If the pair closes above resistance look for better opportunities.

If you have any questions please leave them in comments.

Did you like the idea?? Give us a thumbs up!!

Do you have a different view and analysis? Let us know in the comments. I love to be proven wrong. It is the only way to become better.

Remember that trading is only part of your life. Do not spend all day in front of the screen!!

Surf, Trade, Live!!

ridethepig | Remaining Short EURSEK A timely update to the EURSEK chart with 2020 flows entering into play as widely anticipated. Lets start by reviewing the concerning Macro Map in the diagram:

In the longer term, positional swings come down to a struggle between patience on the one hand and greed tendencies on the other. In this all-encompassing battle, economic strategy, though important in itself, will always need the presence of technicals in order to strive for mobility.

I am expecting sooner or later the free-fall to begin and get rid of the early dip buyers.

Good luck all those on the sell side. As usual thanks for keeping your support coming with likes, comments and etc!

USDSEK is close to 6-Months Low!It will be a nice buy possibility near the 6-Months Low.

We should look for an entry point in the younger timeframe.

The false breakout is the best pattern for open trade.

Dear followers, the best "Thank you" will be your likes and comments!

Before to trade my ideas make your own analysis.

Thanks for your support!

Best FX pair of 2018-2020 making a nice bottomI think there is a high probability, higher than 20% I am certain, that this pair if it visits the entry area, goes up without going down too much.

It could also go a bit further before reversing, I am giving myself 2 chances on this one but no more if I lose twice I quit.

Here you have the weekly chart:

The spread is 30 points which is not very high, it's not the same as 30 points on EURUSD.

It's a pretty typical bottom (if it ends up being one).

Textbook says to wait for "confirmation" or something I guess?

Something like this?

And not even enter at neckline, they want a "confirmation" candle, they want the price to go past the neckline.

And stop losses are rarely mentionned. At the bottom (great idea), sometimes halfway through.

You don't even get 2R! Forex markets TREND.

TREND = goes in 1 direction MORE than the OTHER. THEREFORE ==> Target MORE than stop loss.

That's how the market is. It works in a high reward to risk way.

It is abstract but it's logical and pretty simple to understand right?

Hey, they want more and more confirmation, so I have a proposal:

Already made a new low as I write this, but hasn't reached the entry level yet.

Let's do this!

GBPSEK, What do you think? Blue or Yellow?The GBPSEK global trend is bullish but the local trend is bearish.

How do you think? Can the price bounce off the bottom borders of these channels?

Thanks for sharing your thoughts under my ideas!

I appreciate it!

Before to trade my ideas make your own analysis.

Thanks for your support!

USD/SEK will reverse back in the following daysThe pair will reverse back in the following days after being whipsawed, sending the pair lower toward its previous low. Sweden leaves the negative territory of interest rate in the last month of 2019. This has fueled the Swedish Krona against the US dollar. However, the greenback managed to fight the krona following the signing of the US-China trade deal. Despite this, investors are worried about the future of the US dollar as impeachment in the House of Senate begins. Under the Trump Administration, US indices hit record levels and unemployment reached 50-years low. Another concern from investors was the diminishing leadership of America in the global arena. As Europe introduces a greener economy, the US is moving away and pumping oil as much as possible. America even reached records of daily oil production as demand for the black gold continues to surge. A street in Stockholm became the first location in Sweden to ban old diesel cars.

EUR/SEK is seen to reverse back following a series of weak candl𝔹𝕖𝕗𝕠𝕣𝕖 𝕪𝕠𝕦 𝕣𝕖𝕒𝕕 𝕥𝕙𝕚𝕤 𝕚𝕕𝕖𝕒, 𝕡𝕝𝕖𝕒𝕤𝕖, 𝕔𝕝𝕚𝕔𝕜 𝕥𝕙𝕖 𝐋𝐈𝐊𝐄 𝐛𝐮𝐭𝐭𝐨𝐧 𝕥𝕠 𝕤𝕦𝕡𝕡𝕠𝕣𝕥 𝕞𝕪 𝕨𝕠𝕣𝕜.

𝕀 𝕨𝕠𝕦𝕝𝕕 𝕒𝕡𝕡𝕣𝕖𝕔𝕚𝕒𝕥𝕖 𝕚𝕥.

The pair is seen to reverse back following a series of weak candles. Sweden celebrated its 25th year of accession to the European Union this month, together with Finland and Austria. They became the 13th, 14th, and 15th Member States of the EU. However, the celebration was market with a rift between the Nordic countries and Brussels. The European Union wants to implement a Eurowide minimum wage, which will hurt rich countries in the Nordic with high minimum wage. The plan of the European Commission was its first step towards creating a framework for minimum wage to be adopted by all EU Member States. However, this will destroy the century-old models of collective bargaining between the Nordic countries and the labor unions. This will eventually result to a disruption among member countries with a lower or higher minimum wage requirements. The bold policy was introduced by European Commission President Ursula von der Leyen.

USDSEK: Pressure by the MA50. Buy opportunity lower.USDSEK had a strong enough rebound on the July 19, 2019 Support, managing to turn 1D bullish again (RSI = 55.827, ADX = 26.453, Highs/Lows = 0.0481) since November. We are expecting this bounce to accumulate more buyers in the process aiming at the 9.7000 Symmetrical Resistance. Conservative traders may enter a little lower as a pull back is very much possible if the 1D MA50 (blue line) holds.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

EURSEK is under the Mirror Level!I will open Sell the false breakout because:

- the price is under the Mirror Level 10.48800;

- the trend is bearish;

- potential profit will be 3 times bigger than the risk.

Push like if you think this is a useful idea!

Before to trade my ideas make your own analyze.

Write your comments and questions here!

Thanks for your support!

EURSEK SFP reaction. Still bearish on the SEK.More people in the country than there are houses. Sweden is not really socialist but they really on an inevitable course to self destruction.

Not going to go into too much details.

Good entry to short this failing currency.

I think this is my best currency this year. I have good hopes.

1/3 or more of my good trades I had to enter on friday afternoon -.-

So I don't even care anymore (also I have account protection and guarenteed stops).

USDSEK Reversal Pattern after All Time New Highs!USDSEK has been on my watchlist for quite sometime after we made new all time highs and then produced large red candles showing no momentum in the break.

You can see we tried to create another higher high, but price was rejected and reversed at 9.7280.

You can see the head and shoulders pattern which has occurred after making multiple higher lows and higher highs in an uptrend. This is ideal as we want to see an established trend before a reversal pattern.

We did break the neckline yesterday and have seemed to retest the breakout zone with todays daily candle, with the wick retesting the zone and indicating sellers stepping in.

I do not use trendlines very much, but also shows a break of the trend so adds some more confluence.

EURSEK was a trade I covered and took a few weeks back, and it can still make another lower high. Perhaps there is still ways downward for the Swedish Krona.

I am looking to take profits at the flip zone of 9.30 in the long term, although I would expect to see some reaction at 9.45.

NZDSEK: Sell opportunity within the 1W Channel Down.The pair is trading within a 1W Channel Down (RSI = 47.865, MACD = -0.019, Highs/Lows = 0.0000) since March and the neutral technical indicators suggest that the price made a Lower High within the Channel and is preparing for the next bearish leg towards a new Lower Low.

On top of that the Lower High rejection (on the inner dashed trend line) took place on the 1D MA200. We have 6.0100 - 6.0500 as the Target Zone.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.

USDSEK Buy SignalPattern: Channel Up on 1M.

Signal: Bullish as the price is near the Higher High zone. Also every time the price broke below the 1D MA50, it always stayed supported above the previous low, which delivered a rebound to a new Higher High.

Target: 10.04400 (+0.73% from last Higher High) and 10.20000 in extension (+8.00% as per the increase that the last bounce on a Double Bottom delivered).

* See how well this pattern worked last time:

GBPSEK: The short opportunity of the Golden Cross.The pair is trading within a strong long term Channel Up since October 2017 on the 1M (monthly) chart (RSI = 60.289, MACD = 0.143, Highs/Lows = 0.3378). It is currently testing the 12.6000 1W Resistance following a Golden Cross on the 1D chart.

This formation has delivered a roughly -4% drop on the past two occurences. Since the RSI topped at 80.000 which is always a sell zone on 1D, we are going short with TP = 12.2000 or once the 1D RSI touches 38.500.

** If you like our free content follow our profile (www.tradingview.com) to get more daily ideas. **

Comments and likes are greatly appreciated.