Thermax : Stage 1 Breakout (1-3 Months)#Thermax #stage1nreakout #ascendingtrianglepattern #patternbreakout #trendingstock #swingTrading

Thermax : Swing Trading

>> Stage 1 Breakout + Retest done

>> Ascending Triangle @ bottom of Downtrend

>> Trending setup in stock

>> Good strength & Recent Volume Buildup

>> Low Risk High Reward Trade

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, comment & Follow for more Analysis

Disc : Charts Shared are for Learning Purpose & not a Trade recommendation. Pls consult a SEBI Registered Advisor before taking position in it

Swingtradesetup

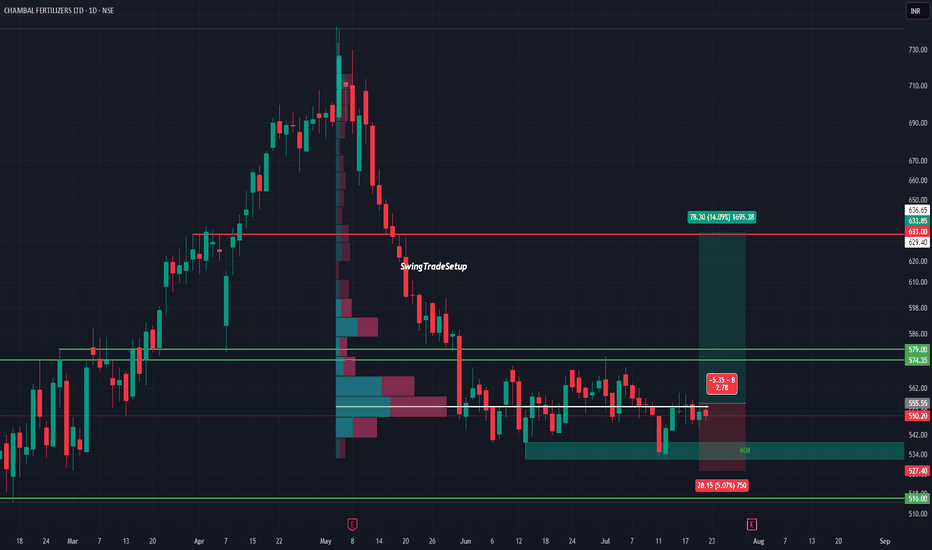

CHAMBAL FERTILISERS LTD – Potential Bottoming Out‽CHAMBAL at Demand Zone | Volumes story

After a steep fall from 730 to 516, Chambal is now consolidating in a critical demand zone backed by visible volume activity. This range has previously triggered price reversals, and now history might repeat.

The stock is respecting the support between 527–516, forming a potential base. On the upside, a clean breakout above ₹555.55 can unlock a near-term target of 633+, a move of over 14%.

The risk-to-reward ratio remains attractive with a tight invalidation below ₹527, while the volume profile suggests accumulation in this range.

Technical View :

• Major support: ₹516–527

• Breakout trigger: ₹555.55

• Upside target: ₹633–636

• Risk below: ₹527

• Volume profile: Dense node suggests buyer interest

Valuation :

• PE: ~10.3 (undervalued vs peers)

• Dividend Yield: ~6.5% (steady income potential)

• Promoter Holding: 60.62% (strong & stable)

• No recent equity dilution

• DII/FII: Activity neutral, could turn if technical align

A good mix of fundamentals, attractive valuation, and technical structure makes this a stock to keep an eye on. If it crosses ₹560 with volume, it may kick off a short-term trend reversal.

This chart is for educational use only and not a buy/sell recommendation.

EURUSD Analysis : Eyes on Bullish Breakout Setup + Target🧭 Current Market Context:

The EURUSD pair is currently trading near 1.16765 on the 4H timeframe, displaying classic accumulation behavior at a key Support-Resistance Interchange Zone (SR Flip). After an extended bearish correction from the previous swing high, price has started compressing in a descending structure underneath a well-respected trendline. This tightening range near a historic support zone suggests that a major breakout could be on the horizon.

🧠 Technical Confluences:

🔹 1. Descending Trendline - Bearish Control Line:

The trendline drawn from the July highs has acted as a clear resistance line, rejecting multiple bullish attempts to break higher.

Price has failed to close above it on the 4H chart, showing sellers are still in control—but momentum is fading.

A breakout of this line is a crucial confirmation of buyer strength returning.

🔹 2. SR Flip Zone - Interchange Area:

This zone previously acted as resistance, capping the rally in June.

After price broke above it, the same area now acts as support, confirming its role as an SR flip zone—a textbook demand level.

Smart money often steps in at these interchange areas to accumulate long positions.

🔹 3. Re-accumulation Phase (Smart Money Behavior):

Market structure is showing a rounded bottom formation, hinting at possible absorption of sell-side liquidity.

Price action is compressing into the support zone, reducing volatility—a signal that a reversal or breakout is near.

The previous similar move ("Same Like This") from late June led to a strong bullish impulsive wave—this historical behavior adds confidence in the current bullish outlook.

🔹 4. Potential Bullish Pattern:

Price needs to develop a bullish reversal pattern (e.g., inverse head & shoulders, bullish engulfing, or a sweep of the low with rejection).

Only then will the setup be validated. This is not a blind buy zone, but a zone of interest for high-probability longs if price confirms.

🧨 Trade Plan Scenarios:

✅ Scenario 1 - Confirmation Breakout:

Wait for a clean breakout above the descending trendline.

Enter on breakout + retest structure.

Target the next major reversal zone at 1.18500.

🐢 Scenario 2 - Early Long Entry:

Enter on bullish confirmation (engulfing, pin bar, etc.) at the SR Interchange zone.

Stop loss below the support box.

Ride early for better R:R if the breakout confirms.

❌ Invalidation:

A clean breakdown below 1.1600 with momentum will invalidate the bullish bias.

In that case, reevaluate based on new structure.

📊 Projected Path:

If the trendline breaks, expect a bullish rally toward the next major resistance zone (1.18500).

That zone has historically acted as a major reversal and profit-taking level for bulls, and we expect price to react again if tested.

🔍 Macro View (Optional Insight):

USD may show weakness due to macro data (CPI/FED talks), helping EURUSD lift.

Eurozone data stability could further fuel demand for EUR.

📌 Final Thoughts:

This EURUSD setup is forming at a high-value area, backed by technical structure, historical behavior, and smart money positioning. If the price reacts positively from this zone and breaks the descending trendline, it could trigger a bullish leg toward 1.18500, offering a rewarding risk-to-reward opportunity for both swing and short-term traders.

Stay patient. Let the market confirm the direction before execution. 📈

USDJPY Analysis : Bearish Setup from Reversal Zone + Target⚠️ Overview:

The USDJPY 4H chart reveals a smart money-driven bearish setup, unfolding precisely from a major Reversal Zone, which aligns with a key supply area. Price action is now offering high-probability short trade opportunities, supported by structural breaks, clear CHoCHs (Change of Character), and BOS (Breaks of Structure).

🔎 Detailed Technical Breakdown:

🔹 Bearish Pattern + Channel Formation:

The pair formed a bearish price pattern earlier, which initiated the previous downtrend. This move developed into a well-formed descending channel, showing controlled distribution from the institutional side. The channel break marked a liquidity grab below previous lows, trapping retail sellers before shifting structure.

🔹 Channel Insider Demand + Breakout:

After reaching the Channel Insider Demand, USDJPY made a strong bullish push, causing a Minor BOS — a sign of temporary bullish pressure. However, this move served to rebalance price into a premium zone, which is the current Reversal Zone. This zone lies near previous imbalance/fair value gaps and coincides with a supply structure, making it a high-reaction area.

🔹 Reversal Zone (Premium Area):

Price tapped the Reversal Zone and began rejecting aggressively. This reaction indicates the presence of large sellers and order blocks. The current price action now displays a Minor CHoCH, suggesting a short-term bearish shift in order flow.

This is a textbook case of premium vs. discount pricing, where price seeks liquidity above recent highs before reversing to more balanced zones.

🔹 Price Flow Expectations (Downside Targets):

The first confirmation of bearish continuation will come with a clean break below the Minor CHoCH level (~144.400). Following that, momentum is expected to carry USDJPY toward:

🥇 Target 1: 144.00 – Local support / liquidity pocket

🥈 Target 2: 143.00 – Key psychological & structural support

🥉 Target 3: 142.00–142.50 Zone – Marked as the Next Reversal Zone, which could act as demand

This setup remains valid as long as the price remains below 147.200, which is the high of the Reversal Zone. A breakout above this invalidates the bearish thesis.

🧠 MMC (Mind Market Curve) Interpretation:

The chart clearly respects Mind Curve Theory structure:

CHoCH/BOS confirms internal order flow

Reversal zone is placed at a curve top (premium)

Support base (discount zone) is yet to be revisited

The curve shape guides a possible rounded rejection scenario, pushing price down into the major support, aligning with smart money liquidity grab behavior.

📊 Strategic Insight:

This is a classic smart money trap — fake bullish breakout, quick grab of early breakout traders’ stops, followed by a decisive turn from supply.

Traders should monitor:

Candle structure at current levels

Reaction to minor CHoCH zone (~144.400)

Swing Trading: Unique Features and StrategiesSwing Trading: Unique Features and Strategies

Swing trading stands out as a dynamic approach in the trading world, blending elements of both short-term and long-term strategies. In this article, we will explore the unique features of swing trading, including its reliance on technical analysis, the use of chart patterns, and the strategic timing of entries and exits. Whether you're new to trading or seeking to refine your approach, understanding the nuances of swing trading can provide valuable insights into navigating the financial markets.

The Basics of Swing Trading

Swing trading meaning refers to a style that involves holding short- and medium-term positions - usually from a couple of days to a few weeks - with the aim of capitalising on the “swings” in the market.

What is a swing trader? A swing trader’s definition is simple: swing traders are those who typically enter and exit markets at significant support and resistance levels, hoping to capture the bulk of expected moves.

These traders tend to look at hourly to weekly charts to guide their entries, although the timeframe used will depend on the swing trader’s individual approach and the asset being traded. Swing trading can be used across all asset classes, from stocks and forex to cryptocurrencies* and commodities. In the stock market, swing trading can be especially effective, as stocks tend to experience high volatility and are subject to frequent news and events that can drive prices.

Swing traders predominantly use technical analysis to determine their entries and exits, but fundamental analysis, like comparing the interest rates of two economies, can also play a significant role. It can help determine a price direction over the course of days or weeks.

Swing Trading vs Other Styles

To better understand the unique features of swing trading, let’s compare it with our styles.

Position trading involves holding trades for weeks and months, focusing on capturing long-term trends. Position traders are less concerned with short-term fluctuations and are more likely to use fundamental analysis, such as economic data and company earnings, to make their decisions. This style requires patience and a long-term perspective, with fewer trades but potentially larger returns per trade.

Swing trading involves holding trades for several days to a few weeks, aiming to capture short- and medium-term price movements within a larger trend. This style balances the need for active market participation with the flexibility to not monitor trades constantly. Swing traders primarily rely on technical analysis to identify entry and exit points, focusing on chart patterns and indicators.

Day trading requires traders to buy and sell assets within the same trading day, often holding positions for just minutes or hours. The goal is to capitalise on intraday price movements, and traders close all positions before the market closes to avoid overnight risk. This style demands constant market monitoring and quick decision-making, with a strong reliance on real-time technical analysis.

Scalping is an ultra-short-term trading style where positions are held for seconds to minutes, aiming to make small profits on numerous trades throughout the day. Scalpers rely almost entirely on technical analysis and need to act quickly, often executing dozens or hundreds of trades daily. The focus is on high-frequency trading with very tight stop-losses, requiring intense concentration.

Swing Trading: Benefits and Challenges

Although swing trading provides numerous opportunities which makes it popular among traders, it comes with a few challenges traders should be aware of.

Benefits:

- Lower Time Commitment. One of the most significant benefits for swing traders is the reduced time commitment. This style can be adapted to suit a trader’s individual schedule.

- Flexibility. It is often more flexible than other styles. Not only does it offer time flexibility, but it allows for a wider range of tools to be used to determine price swings. Also, it can be applied to many assets. The most common is swing trading in forex and swing trading in stocks.

- Technical Analysis Focus: Utilises technical indicators and chart patterns to identify entry and exit points, providing clear criteria for decision-making.

- More Opportunities Compared to Long-Term Techniques. Because swing traders usually hold positions for a few days to a few weeks, they have the ability to take advantage of shorter-term market movements that might not be reflected in longer-term price trends.

Challenges:

- Exposure to Overnight Risk. Positions held overnight or over weekends can be affected by unexpected news or events, leading to potential gaps or adverse price movements.

- Requires Patience: Effective swing trading requires waiting for trades to develop over days or weeks, which may test a trader's patience.

- Market Volatility: Performance can be impacted by periods of low volatility or choppy markets, where price movements may not align with your expectations.

Popular Tools to Use When Swing Trading

The effectiveness of a swing traders’ strategies will ultimately depend on their ability to correctly identify price movements. For this, traders use different chart patterns and technical indicators. Here are three common tools that can be used as part of a swing trading strategy.

Channels

Traders can use channels to take advantage of well-identified price trends that play out over days and weeks. To plot a channel, you first need to identify a trending asset that’s moving in a relative zig-zag pattern rather than one with large jumps in price. Traders will often use the channel to open a swing trade in the direction of the trend; in the example above, they might look to buy when the price tests the lower line and take profit when the price touches the upper line of the channel.

Moving Averages

Moving averages (MAs) are one of the commonly used indicators and they can help swing traders determine the direction of the trend at a glance. The options here are endless:

- You could pair fast and slow moving averages and wait for the two to cross; this is known as a moving average crossover. When a shorter MA crosses above a longer one, the price is expected to rise. Conversely, when a shorter MA breaks below a longer one, the price is supposed to decline.

- You could stick with one and observe whether the price is above or below its average to gauge the trend. When the price is above the MA, it’s an uptrend; when it’s below the MA, it’s a downtrend.

- You could use an MA as a support or resistance level, placing a buy order when the price falls to the MA in an uptrend and a sell order when it rises to the MA in a downtrend.

Fibonacci Retracements

Lastly, many swing traders look to enter pullbacks in a larger trend. One of the most popular ways to identify entry levels during these pullbacks is the Fibonacci Retracement tool. Traders typically wait for a shift in price direction, then apply the tool to a swing high and swing low. Then, they enter at a pullback, usually to the 0.5 or 0.618 levels, to take advantage of the continuation of the trend. As seen above, this strategy can offer entry points for those looking to get in early before a trend continues.

The Bottom Line

Swing trading stands out for its ability to balance the demands of active trading with the flexibility of longer-term investing. The unique features of swing trading, such as its moderate holding periods and strategic use of technical indicators, allow traders to potentially manage risk and adapt to various market conditions. Embracing swing trading strategies can help traders refine their approach. As with any trading style, continued learning and disciplined execution are key to achieving consistent results.

FAQ

What Is Swing Trading?

Swing trading is a style that involves holding positions over a period of several days to weeks to take advantage of price movements within a trend. Swing traders use technical analysis, including chart patterns and indicators, to identify potential entry and exit points, balancing the need for active participation with a longer-term perspective.

What Is Swing Trading vs Day Trading?

Swing trading and day trading are distinct methods. The former focuses on capturing price movements over several days to weeks, allowing for less frequent trading and requiring less constant market monitoring. In contrast, the latter involves buying and selling assets within the same trading day, often holding positions for minutes or hours, and requires continuous market observation and quick decision-making.

What Is the Downside of Swing Trading?

The downsides of swing trading include exposure to overnight and weekend risks, as positions held outside market hours can be affected by unexpected news or events. Additionally, this method requires patience and discipline, as trades may take time to develop, and performance can be impacted by periods of low volatility or choppy markets.

*Important: At FXOpen UK, Cryptocurrency trading via CFDs is only available to our Professional clients. They are not available for trading by Retail clients. To find out more information about how this may affect you, please get in touch with our team.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

USD/JPY Premium Trade Setup | High-Probability Short OpportunityKey Elements in the Chart:

Uptrend Channel: The price was moving inside an ascending channel but recently broke downward.

Resistance Zone: Marked near the 150.000 level, indicating a key rejection area where sellers are strong.

Sell Zone: A potential short-selling opportunity is identified around 149.300 after a breakdown from the channel.

Support Zone: Located around 148.500, where the price may find temporary buying interest.

Target: The final target for the bearish move is near 147.000, suggesting a further downside potential.

Trading Idea:

Bias: Bearish (selling opportunity after a trendline break)

Entry: Near 149.300 (confirmed rejection)

Target: 147.000

Risk Management: Stop-loss can be placed above the resistance area.

This setup suggests that USD/JPY may continue its downward move after failing to sustain the uptrend. Traders should watch for confirmation signals before entering.

MSFT with Room to Run to UpsideI guess what I love about this one is the fact that right now MSFT isn't exactly getting all that much love, and this sleeper has room to run if it can get above it's 200 day SMA! This one has been open for a couple days and if we can get a VIX crush Friday tomorrow it may just be getting started!

The signal was created by the King Trading Momentum Strategy combines the 5 EMA crossing above the 13 EMA, RSI strength, favorable momentum as measured by ADX plus evaluating recent volume changes and even something that measures breakout momentum called Beta for some equities! MSFT and over 100 equities are built into this script with optimal backtest take profits and stop losses and can be toggled on by simply checking a box (default they are turned off). I always enable Using Bar Magnifier and On Bar Close in Properties.

Blue Star Ltd. - Long Setup (Swing Trade)Blue Star Ltd. has approached a key level, presenting a potential swing trade setup. Here’s the trade plan:

Entry Zone: 1880

Entry Price: Once a 15-minute candle breaks above 1880 , the high of that candle will confirm the entry.

Target: 2048.50

Stop Loss: 1795.80 (Triggered if a daily candle closes below this level)

The stock is currently testing the entry zone at 1880 , and if there’s a confirmed breakout, we could see momentum driving it toward the target of 2048.50 . The stop loss at 1795.80 offers a controlled risk, providing a favorable risk-reward ratio for this setup.

Disclaimer: This post is for educational purposes only and is not financial advice. Always manage your risk and trade responsibly.

Eris Lifesciences Ltd. - Swing Trade SetupWe have a potential long trade opportunity in Eris Lifesciences with a defined entry and target.

Entry Price: 1368.40 (Confirmed after the 15-minute candle broke above the entry zone at 1350)

Target: 1624

Stop Loss: 1213.05 (This stop loss is considered valid if a daily candle closes below this level)

This trade setup offers a solid risk-to-reward ratio with the target level at 1624. As always, manage risk according to your trading plan.

Disclaimer: This analysis is for educational purposes only and not financial advice. Trade responsibly and use proper risk management.

Sun Pharma - Long Setup (Swing Trade)Sun Pharma has confirmed a breakout above the entry zone, presenting a swing trade opportunity. Here’s the trade setup:

Entry Price: 1836.95 (Confirmed after the 15-minute candle broke above the entry zone at 1833)

Target: 1978.8

Stop Loss: 1760.10 (Triggered if a daily candle closes below this level)

With the entry price confirmed at 1836.95 , this setup offers a favorable risk-to-reward ratio. The target is set at 1978.8 , with a well-defined stop loss at 1760.10 to manage risk.

Disclaimer: This post is for educational purposes only and is not financial advice. Always manage your risk and trade responsibly.

Syngene International Ltd. - Long Setup (Swing Trade)Syngene International Ltd. has confirmed a breakout above the entry zone, offering a potential swing trade setup.

Here’s the trade plan:

Entry Price: 897.90 (Confirmed after the 15-minute candle broke above the entry zone at 895)

Target: 1027.90

Stop Loss: 828.65 (Stop loss will be triggered if a daily candle closes below this level)

With the entry price confirmed at 897.90 , the setup offers a favorable risk-to-reward ratio. The stock is targeting a move toward 1027.90 , with a well-defined stop loss at 828.65 to manage risk.

Disclaimer: This post is for educational purposes only and is not financial advice. Always manage your risk and trade responsibly.

IRFC - Strong Support Zone (Swing Trade Setup)Indian Railway Finance has been trading around a major support zone between ₹130 and ₹135, which has been tested multiple times in the past. The stock has shown signs of rebounding off this zone.

Support Zone: ₹130 - ₹135 (highlighted in orange)

Current Price: ₹141.99

Potential Rebound: The price is currently bouncing from this strong support area, which has held up well over several months. This indicates potential buying interest around these levels.

Entry Strategy:

I’ll be watching for further bullish confirmation. A 15-minute candle breaking above today's high or a strong daily close above ₹142.80 could be an indication to enter the trade .

Risk Management:

If the price closes below ₹130 on a daily candle , I’ll consider exiting the trade as it would indicate a breakdown of the support zone.

This setup provides a favorable risk-to-reward ratio, especially given the multiple bounces off the support zone in the past. If the support holds, the stock could be in for a significant upward move.

Disclaimer: This post is for educational purposes only and is not financial advice. Always manage your risk and trade responsibly.

Deepak Fertilizers - Breakout Setup (Swing Trade)Deepak Fertilizers has reached a critical zone, and a breakout appears to be forming. Here’s the trade plan:

Entry Zone: 1134

Entry Price: Once a 15-minute candle breaks above 1134 , the high of that 15-minute candle will confirm the entry.

Target: 1492.8

Stop Loss: 954.60 (Valid only if a daily candle closes below this level)

This setup offers a favorable risk-to-reward ratio. The price is testing the entry zone, and a breakout above it could lead to a potential rally towards 1492.8 . The stop loss is well-defined at 954.60 , which is only triggered if a daily candle closes below it.

Disclaimer: This post is for educational purposes only and not financial advice. Always manage your risk and trade responsibly.

Shriram Properties - Breakdown from Box Pattern (Swing Trade)Shriram Properties has experienced a rejection from all-time highs (ATH) around ₹150 and has broken down from a box pattern (highlighted in orange) between ₹110 and ₹150 , with price action showing low volume during the breakdown. The stock is now approaching a strong support zone between ₹100 and ₹105 , just above the FIB Weekly Zone .

Support Zone: The ₹100-₹105 range has been a key support level multiple times in the past (black arrows).

Box Pattern Breakdown: The stock has broken out of the consolidation phase (box pattern) with low volume, signaling potential weakness.

Rejection from ATH: The stock faced strong rejection near the ATH level of ₹150, which has led to the current downtrend.

FIB Weekly Zone: The ₹90-₹100 zone offers additional support if the price dips further, providing another potential reversal area.

Entry Strategy:

I’ll wait for a bullish candle to form near the support zone (₹100-₹105). Once confirmed, I will look for a 15-minute candle to break the high of the daily candle to confirm the entry.

This setup suggests that a potential reversal could happen near the support zone, but confirmation from price action will be key.

Disclaimer: This post is for educational purposes only and is not financial advice. Always manage your risk and trade responsibly.

L&T Finance - Strong Support Zone Swing Trade SetupL&T Finance has reached a key support zone around the 140-145 range , which has been tested several times in the past (indicated by the blue arrows). This zone has consistently held up, with strong rebounds, signaling significant buying interest.

Support Zone: 140-145 range

Current Price: 150.40

Entry Strategy: I’ll be watching for a bullish or green daily candle forming near the support zone. Once that candle is established, I’ll look for a 15-minute candle to break above the high of the daily candle. Once that happens, the entry will be confirmed.

If the support holds and we get a bullish daily candle, followed by a 15-minute breakout, this could be a strong setup for a reversal. The volume spike seen here also adds confidence that buyers may be stepping back in at these levels.

Disclaimer: This post is for educational purposes only and not financial advice. Always do your own research and manage your risk responsibly.

Zomato - Swing Long SetupZomato has already broken the entry zone on the 15-minute chart , confirming the entry price at 271 . This setup is valid only for today. Here’s the trade plan:

Entry Price: 271

Target: 320.2

Stop Loss: 240.40 (Stop loss will trigger only if a daily candle closes below this level)

With the entry confirmed at 271 , I’m aiming for a potential move toward 320.2 . The stop loss is set at 240.40 , but will only be triggered if a daily candle closes below this level.

Important: This setup is valid for today only. I'll reassess after today's close for further action.

Disclaimer: This post is for educational purposes only and is not financial advice. Always manage your risk and trade responsibly.

ICICI Lombard - Swing Long Setup with Key LevelsThis chart shows a potential long trade setup on ICICI Lombard, highlighting a possible rebound from recent lows. Here's my trade plan:

Entry Zone: Waiting for a 15-minute candle to break above 2096.50 . The high of that 15-minute candle will be my entry point.

Stop Loss: If any 1day candle closes below 2050.50 , I'll exit the trade.

Target: 2188.50

This setup offers a good risk-reward ratio. If we see a strong breakout above the entry zone with decent volume, the price could move towards the target of 2188.50. However, if the stop loss level is breached on a 1day close, I’ll exit the position to protect capital.

Note: This is not any financial advice and for education purpose only.

ICICI Securities - Swing Long SetupThe 15-minute candle has already broken the entry zone of 838.75 , confirming the entry price at 839.70 . Here's my trade plan moving forward:

Entry Price: 839.70

Stop Loss: 821.90 (Valid only if a daily candle closes below this level)

Target: 872.45

Now that the entry is confirmed, I'm looking for momentum to carry the price towards the target of 872.45 . The stop loss will only trigger if we see a daily candle close below 821.90 . Until then, I’ll hold the position and monitor how it develops.

Disclaimer: This isn’t financial advice—just sharing my thoughts for educational purposes. Manage your risk carefully and trade safe!

Swing Trade Setup for SATINDLTD & RPEL | Weekly & Daily TimeframSwing Trade Setup for SATINDLTD & RPEL | Weekly & Daily Timeframe Analysis

In this video, I provide a detailed swing trade setup for SATINDLTD and RPEL, analyzing both the weekly and daily timeframes. Using price action strategies, I identify key breakout zones, support/resistance levels, and potential trade entry and exit points. The focus is on capturing medium-term moves based on technical patterns that align with a strong risk-reward ratio.

Whether you're a seasoned trader or just getting started, this analysis offers valuable insights for your trading strategy. Make sure to watch until the end for my conclusions on the overall trend direction and targets.