Bitcoin - The Bottom Is In!Bitcoin ( CRYPTO:BTCUSD ) is reversing right now:

Click chart above to see the detailed analysis👆🏻

It was really just a matter of time until Bitcoin actually manages to create a potential short term and longer term bottom. With this monthly candle, bulls are taking over again and starting to buy cryptos quite heavily. The chart just tells us that this is not the end, but rather the continuation.

Levels to watch: $70.000, $300.000

Keep your long term vision,

Philip (BasicTrading)

Swingtrading

Nifty back to bull controllhi Traders,

Weekly the swing had a correction of 38%.

The daily time frame's Inverted H&S pattern is a confirmation of the trend change(from correction to impulse wave)

Nifty 50 will make a move from 500 to 1500 points till the previous high of the weekly swing.

The targets are mentioned in the chat.

As we have 14days to expiry, there is enough time to hit target 1. Interested traders buy ATM CALL option or FUTURES

sbull.co

ADITYA BIRLA CAPITAL LTD – Trend Reversal Breakout Trade🧠 Technical Highlights:

Downtrend Channel Breakout: Clear breakout from a falling channel pattern

Resistance Break: Strong breakout above supply zone of ₹204–₹210

Volume: Massive volume spike validates bullish strength

RSI: Above 70, indicating strong momentum but not overbought yet

🟢 Buy Setup

Buy Above: ₹219 (today's close confirms breakout)

Stoploss: ₹204 (below the previous resistance/new support)

Target 1: ₹235

Target 2: ₹248

Target 3: ₹260+ (swing/high-risk high-reward)

🔻 Sell/Short Setup (only if reversal)

Sell Below: ₹203

Stoploss: ₹210

Target: ₹190, ₹178

📅 Timeframe: Short-to-Medium Term (2–6 weeks)

📊 Risk-Reward: ~1:2.5

For Education Purposes Only

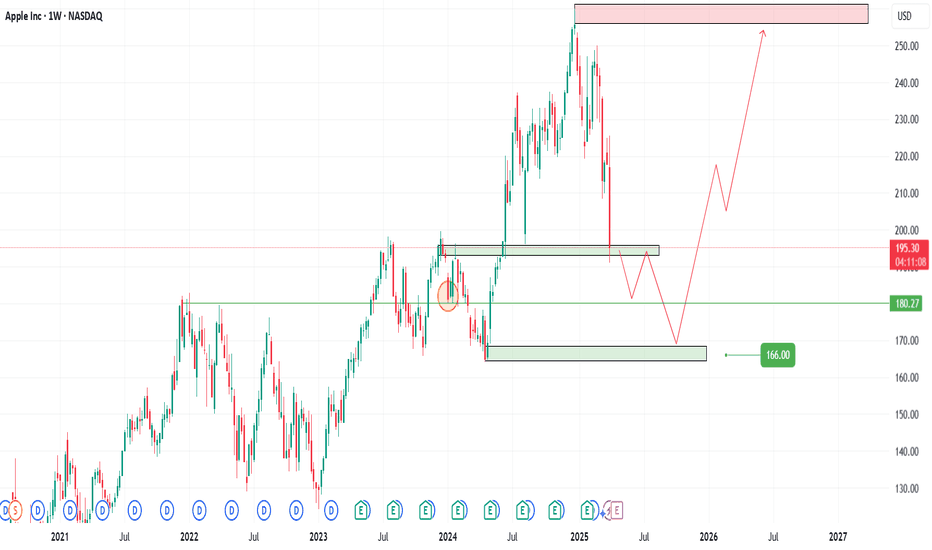

AAPL Trade Plan – 2025 Outlook📊With global markets reacting to renewed tariff talk from Trump, Apple (AAPL) NASDAQ:AAPL could face short-term volatility—but that’s also opportunity. As fears of a trade war ripple across Asia and Europe, AAPL may temporarily dip, especially with supply chain exposure in China.🍏📉📈

📌 Entry Zones (Buy the fear, not the panic):

1️⃣ 194 – Light entry as weakness sets in

2️⃣ 180 – Strong support historically

3️⃣ 166 – High-conviction zone if macro panic escalates

🎯 Profit Targets (Scale out as strength returns):

✅ 209 – Quick recovery zone

✅ 230 – Pre-fear valuation

✅ 260+ – Full macro recovery with bullish momentum

📈 Strategy: Let the news create emotion. You trade the levels.

⚠️ DISCLAIMER: This is not financial advice. Just sharing my personal trading plan based on current macro trends and technicals. Always do your own research and manage your risk.

RKLB Gap Down Earnings Reversal Play + Flag BreakoutTwo powerful setups are in play here, and both are primed for action:

🔹 Setup 1: Earnings Gap Down Reversal (Kicker Candle)

Post-earnings flush, buyers stepped in hard — this has been a relentless pattern in this market.

Even on earnings misses, buyers are aggressive. We saw the same setup work beautifully on NASDAQ:TEM and NYSE:HIMS recently.

This is a kicker candle setup — strong reversal signal after a gap down flush.

🔹 Setup 2: Flag Breakout at $23.50

Price is coiling into a tight flag, with a breakout level at $23.50.

Risk is defined, with stops at $22, keeping the trade tight.

🔹 My Trading Plan:

1️⃣ Initial Position: Buying May 30th $25 Calls today.

2️⃣ Risk Management: Stop at $22 for the calls and underlying stock.

3️⃣ Add Size: On a clean breakout over $23.50.

🔹 Why This Setup is Hot:

The earnings gap down reversal has been a killer setup in this market — buyers are dominating.

Dual setup means two chances to win: Reversal + Flag Breakout.

Tight risk, with a clear invalidation at $22.

⚠️ Risk Management: Tight stop at $22 — this is a LOW-risk, high-reward setup.

NBCC (India) Ltd (NSE: NBCC) – Breakout Trade Setup🧾 Equity Research Summary – NBCC (India) Ltd.

Sector: Construction & Infrastructure – Government PSU

Technical Setup: Trendline breakout + Base retest + Volume surge

Support Zone: ₹68–₹75

Breakout Zone: ₹100–₹103

Upside Potential: Strong move expected due to order book + infra push

Catalyst:

Government infrastructure spending

Order wins from CPWD, NBCC contracts, redevelopment projects

📅 Timeframe: Short-to-Medium Term (2–4 weeks)

📊 Risk-Reward: 1:2.5

🟢 Buy Setup

Buy above: ₹107 (confirmation above resistance zone)

Stoploss: ₹100 (below breakout support)

Target 1: ₹115

Target 2: ₹124

Target 3 (Swing): ₹130–₹135

🔻 Short Setup (if breakout fails)

Sell Below: ₹99

Stoploss: ₹103

Target: ₹91, ₹82

For Education Purposes Only

Vadilal Industries – Equity Trade Setup & Research View🟢 Long Trade Setup (Bullish Reversal Play)

Current Price: ₹7,346.50

Fibonacci Level Tested: 38.2% at ₹7,361 — a crucial breakout level

Trendline Breakout: Price has broken above falling trendline with volume confirmation

RSI: Near 60 – bullish momentum building

🔼 Buy Zone

Entry (Buy above): ₹7,375 (confirm above 38.2% Fib resistance)

Target 1: ₹7,825 (Fib 0.5 level)

Target 2: ₹8,291 (Fib 0.618)

Target 3: ₹8,953 (Fib 0.786 for aggressive swing)

Stop Loss: ₹6,785 (below 23.6% Fib retracement)

🔻 Short Trade Setup (if rejection happens)

Sell Below: ₹7,200

Target: ₹6,785

Stoploss: ₹7,375

📅 Timeframe: Daily (1D)

📊 Risk/Reward Ratio: 1:2.5+

🔁 Valid for: Next 2–4 weeks

For Education Purposes Only

GBPJPY: Important Breakout 🇬🇧🇯🇵

GBPJPY successfully violated and closed above a major

daily resistance cluster.

It opens a potential for more growth now.

Next resistance - 197.3

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

OptionsMastery: Looking for a breakout on HOOD!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Gabriel India Ltd (GABRIEL) – Weekly Resistance Breakout Setup✅ Trade Idea:

Price has reclaimed the 0.618 retracement at ₹608.25

Breakout above the ₹612 horizontal level (weekly closing basis)

Volume is rising and RSI shows strong uptrend

💰 Buy Zone:

Entry: ₹610 – ₹613

(preferably above ₹612 on strong 15min or 1H candle close)

🎯 Targets:

T1: ₹630 (previous minor supply zone)

T2: ₹646.65 (Fib 0.786 level)

T3: ₹695.55 (Fib 1.0 extension)

T4: ₹836.85 (1.618 extension for swing positional)

🛑 Stop Loss:

Intraday SL: ₹598 (below 9 EMA on 1H)

Swing SL: ₹581 (Fib 0.5 retracement support)

🔁 Strategy:

Wait for confirmation via volume + RSI > 60

Trail SL to ₹610 once ₹630 is hit

Lock partial profit near ₹646 if market sentiment weakens

For Education Purposes Only

EDUCATION: Why I’m Still in the GBPJPY TradeWhy I’m Still in the GBPJPY Trade—Even After Hitting the Target

Most traders hit a target and run. And honestly? That’s fine.

But this time, we’re doing something different.

Our GBPJPY trade—entered at 188.813 with a target at 195.170—just did what many doubted: it hit the target. That’s over 630 pips of calculated risk, patience, and pure follow-through. But instead of closing the position and patting ourselves on the back, we’re letting it run.

Here’s why:

1. Momentum Isn’t Slowing Down

Price action is bullish. Higher highs, clean structure, and no major signs of reversal yet. When the market is walking in your favor, don’t interrupt it just to feel “right.”

2. Smart Traders Let Their Winners Run

It’s not just a quote—it’s a survival skill in trading. Letting profits develop is how you avoid the trap of small wins and big losses. This trade is still showing strength, and we’re adapting with it.

3. The Higher Timeframe Story Still Has Room

On the daily and weekly charts, GBPJPY could still reach into extended zones. With fundamentals aligning and technicals confirming, why leave early?

A Quick Recap:

Entry: 188.813

Original Target: 195.170 ✅

Current Action: Letting it ride 🚀

Lessons from This Trade:

A plan should include the possibility of more than just your first target.

Exit strategy matters just as much as entry.

Emotional discipline separates reactive traders from real ones.

Would you stay in the trade or take the money and bounce? Let me know—because this is the part where traders split into two camps: the ones who close too early... and the ones who play the full game.

Watch the full trade update and analysis now on YouTube.

Solana - This just faked out literally everybody!Solana - CRYPTO:SOLUSD - just faked out literally everybody:

(click chart above to see the in depth analysis👆🏻)

Over the course of the past 25 days, Solana dropped a significant -30% and wiped out a ton of bulls before creating a complete reversal. Especially with the current horizontal support level, bulls are taking over again, offering us another major crypto trading opportunity.

Levels to watch: $120, $250

Keep your long term vision!

Philip (BasicTrading)

COIN – Base Breakout + Earnings Gap Reversal SetupNASDAQ:COIN – Base Breakout + Earnings Gap Reversal

NASDAQ:COIN – Base Breakout + Earnings Gap Reversal Setup

Coinbase ( NASDAQ:COIN ) is setting up for a powerful move, and I’m watching two key catalysts driving this setup:

🔹 Earnings Gap Down Reversal (Primary Setup)

Despite a sharp gap down post-earnings, buyers stepped in fast, pushing price back up.

This is a classic earnings gap down reversal — a bullish signal of aggressive buying strength.

🔹 Base Breakout Pattern

NASDAQ:COIN has formed a solid base, with a breakout zone around $212 - $214.

Bitcoin ( CRYPTOCAP:BTC ) is ripping to $104,000, and NASDAQ:MSTR has been trending for a month — bullish sector sentiment could fuel NASDAQ:COIN ’s breakout.

🔹 My Trading Plan:

1️⃣ Anticipatory Entry: Looking to build a position near $212 - $214, the breakout zone.

2️⃣ Confirmation Entry: If NASDAQ:COIN breaks and holds above $214 with volume, I’ll size up.

3️⃣ Stop Loss: Placing stops just below yesterday’s low to control risk.

🔹 Why I Love This Setup:

Dual setup = Base Breakout + Earnings Gap Reversal — powerful combo.

Sector strength (BTC & MSTR) adds confidence.

Tight risk with a clear invalidation level (yesterday’s low).

A Short USDJPY Buy🌞 Good Morning, Traders! 🌞

It’s a beautiful, great morning — let’s get ready to learn and earn! 💪📊

Here’s something I want you to understand today:

📈 Price always moves from one zone to another.

When it reaches a zone, it often pauses (rests) before continuing its movement — depending on whether buyers or sellers are in control at that moment.

🧠 Here’s a key insight:

Most times, buyers are positioned around the middle of the 4H candle.

That’s exactly why we're taking this BUY trade — the price is resting and showing signs of buyer strength from that level.

So keep your eyes sharp and your mind focused. 👀

Understanding why we take trades is what separates smart traders from lucky ones.

Let’s stay patient, stay consistent, and grow together. 🚀

Is There the Best Moving Average For Swing Trading?Is There the Best Moving Average For Swing Trading?

In swing trading, moving averages are widely used to analyse market trends and identify potential turning points. In this article, we’ll dive into the most commonly used MAs, their unique characteristics, and how they can be applied in swing trading strategies.

What Are Moving Averages?

You definitely know what moving averages are. However, we need to start our article with a brief introduction to this market analysis tool.

A moving average (MA) is a fundamental tool in technical analysis that helps traders understand the direction of a market trend by smoothing out price fluctuations, often touted among the best indicators for swing trading. Instead of focusing on the volatile ups and downs, MAs calculate an average of prices over a specific period, such as 20, 50, or 200 periods. This gives traders a clearer picture of the overall trend by filtering out short-term volatility.

There are different types of moving averages, but they all work on the same principle: tracking the average price over time to highlight the market's trajectory. For example, a 20-period MA shows the average (usually closing price but a trader can choose highs, lows, and opens) over the past 20 periods, updating as new prices come in. This rolling calculation creates a line on the chart, making it easy to identify whether the market is trending upwards, downwards, or moving sideways.

Types of Moving Averages

Moving averages come in various forms, each with unique characteristics that cater to different trading styles and strategies.

Simple Moving Average (SMA)

The simple moving average (SMA) is the most straightforward type, calculated by averaging the closing prices (but a trader can choose any price type) over a set number of periods. For example, a 20-period SMA adds up the last 20 closing prices and divides by 20. It’s popular among traders who want a broader view of price trends without overreacting to short-term fluctuations, making it a contender for one of the best moving averages for swing trading. However, SMAs can lag behind price action, as they give equal weight to all prices in the calculation.

Hull Moving Average (HMA)

The hull moving average (HMA) is designed to reduce lag while maintaining a smooth line. By combining weighted averages with additional smoothing techniques, the HMA offers a balance of speed and clarity, making it an underrated moving average for swing trading.

Exponential Moving Average (EMA)

The exponential moving average (EMA) prioritises recent prices, giving them more weight in the calculation. This makes it more responsive to price changes compared to the SMA. Swing traders often use EMAs in faster-moving markets, where quick adjustments to trend shifts are crucial, with 8- and 21-period EMAs considered by some traders as two of the best EMAs for swing trading. For instance, a 20-period EMA reacts faster to sudden price movements than a 20-period SMA, helping traders spot potential reversals sooner.

Weighted Moving Average (WMA)

Similar to the EMA, the weighted moving average (WMA) also gives more importance to recent prices but does so with a linear weighting system. This means the most recent price has the greatest impact, gradually decreasing with older data. WMAs are less common but useful when traders want a more precise reflection of recent price action.

How to Use Moving Averages in Swing Analysis and Trading

Moving averages are versatile tools that can provide valuable insights for swing traders. Beyond highlighting trends, they can help identify potential turning points and dynamic support or resistance levels. Here’s how they’re commonly used in swing trading:

1. Identifying Trends

MAs are widely used to assess the direction of a trend. For instance, if the price consistently stays above a rising moving average, it suggests an upward trend. Conversely, when prices remain below a declining moving average, the market could be trending downward. Swing traders often rely on shorter moving averages, like the 20-period, for identifying trends that align with their trading horizon.

2. Spotting Reversals with Crossovers

Crossovers happen when two MAs intersect. A common example is a shorter MA crossing above a longer one, which may indicate a shift towards bullish momentum and vice versa.

3. Dynamic Support and Resistance

MAs act as floating support and resistance levels. MAs serve as a support level in an uptrend, with the price bouncing off it repeatedly. In a downtrend, the same moving average might act as resistance, limiting upward moves.

4. Filtering Market Noise

In choppy markets, MAs can smooth out minor fluctuations, making it easier to focus on the bigger picture. Swing traders often use longer MAs, such as the 50-day or 200-day, to filter out irrelevant short-term movements.

5. Timing Entry and Exit Zones

Many traders use crossovers to time their entries and exits, though it’s worth noting their lagging nature means they can result in untimely trades. They can also provide context. For example, if the price approaches a key moving average after a strong move, it might indicate a consolidation phase or a potential reversal, allowing traders to adapt their analysis.

Common Moving Averages for Swing Trading: The 20, 50, and 200 MAs

Swing traders often turn to the 20-, 50-, and 200-period moving averages as their go-to tools for analysing market trends. Each serves a specific purpose, helping traders gauge short-, medium-, and long-term price movements. These moving averages are often used together.

20-Period Moving Average

The 20-period MA is a favourite for short-term trend analysis. It reacts quickly to price changes; therefore, traders use it to identify recent momentum or potential trend shifts. Traders frequently watch for price “bounces” off the 20-period MA as potential indications of continuation in the current trend.

50-Period Moving Average

The 50-period MA provides a medium-term perspective, offering a smoother look at price trends. It’s slower to react than the 20-period MA but avoids being overly lagging. This balance makes it useful for identifying sustained trends while filtering out minor price noise. When prices interact with the 50-period MA, it often acts as a dynamic support or resistance level.

200-Period Moving Average

The 200-period MA is the benchmark for long-term trend analysis. It’s often used to determine the overall market direction. This MA is also a widely followed indicator for institutional traders, adding weight to its significance. Interactions with the 200-period MA often mark key turning points or areas of consolidation.

Traders also monitor crossovers between the 50- and 200-period MAs, recognised by some as the best moving average crossover for swing trading. For instance:

- Golden Cross: When the 50-period MA crosses above the 200-period MA, it suggests potential bullish momentum.

- Death Cross: When the 50-period MA drops below the 200-period MA, it signals a possible bearish shift.

Using Them Together

Using the 20-, 50-, and 200-period MAs together offers a comprehensive approach to identifying the best moving average crossover setups, allowing traders to see the bigger picture while still tracking short-term shifts. For instance, when the price breaks above the 200-period MA while the 20-period MA crosses above the 50-period MA, it may signal the beginning of a broader bullish trend. Meanwhile, a price drop below all three MAs could suggest broader bearish momentum.

Other Moving Average Combinations for Swing Trading

While the 20, 50, and 200-period MAs are staples in swing trading, exploring other combinations can offer nuanced insights tailored to specific trading strategies. Some alternative moving average setups that traders often employ include:

8-Period and 21-Period Exponential Moving Averages (EMAs)

This pairing is favoured by traders seeking to capture short-term price movements with greater sensitivity. They call this the best EMA crossover strategy. The 8-period EMA responds swiftly to recent price changes, while the 21-period EMA provides a slightly broader perspective.

10-Period and 50-Period Simple Moving Averages (SMAs)

Combining the 10- and 50-period SMAs offers a balance between short-term agility and medium-term trend identification. This combination helps traders filter out minor price fluctuations and focus on more sustained movements.

28-Period and 50-Period HMAs

For traders focused on short-to-medium-term trends, the 28- and 50-period HMAs offer a balanced approach. The 28-period HMA reacts quickly to price changes, while the 50-period HMA provides a steadier view of the broader trend. Crossovers between the two can signal potential bullish or bearish momentum shifts, benefiting from the HMA’s reduced lag.

13-Period and 34-Period WMAs

Rooted in Fibonacci sequences, the 13- and 34-period WMAs are employed by traders who believe in the natural rhythm of the markets. A 55-period WMA can also be included for a longer-term perspective. Crossovers between these WMAs can highlight potential trend reversals or continuations, with the WMA adapting more quickly than other MAs due to its weighted calculation.

Implementing These Combinations

When applying these moving average combinations, it's crucial to consider the following:

- Market Conditions: These combinations often perform better in trending markets versus ranging markets. Moreover, shorter MAs might be more effective in capturing quick price movements during high volatility.

- Timeframes: Traders align MAs with their trading horizon. Shorter periods like the 5-period or 8-period MAs are usually used by traders focusing on brief swings, while longer periods like the 50-period MA cater to those looking at extended trends.

- Confirmation with Other Indicators: Relying solely on moving averages can lead to false signals. Traders corroborate these signals with other technical indicators, such as Bollinger Bands or the Relative Strength Index (RSI).

What Moving Averages Should You Use for Swing Trading?

There is no best moving average for swing trading. The choice of MAs ultimately depends on a trader's strategy and preferences. The combinations discussed provide a framework, but experimenting with different setups can help identify what aligns with individual trading styles and objectives.

The Bottom Line

Moving averages are powerful tools for swing trading, offering insights into trends and potential market turning points. Whatever your unique preference for different types and lengths, understanding their application can refine your strategy.

FAQ

Which Moving Average Is Good for Swing Trading?

The 20-period, 50-period, and 200-period moving averages are widely used in swing trading. However, different combinations, like the 8- and 21-period or 13- and 34-period MAs can offer equally valuable insights; it ultimately comes down to the trader’s preference.

What Is the Most Popular Moving Average to Use?

The most popular moving average depends on a trader’s trading style and goals. Shorter MAs, like the 20-day MA, are popular for quick trend identification, while longer ones, such as the 200-day MA, provide a bigger picture. Many traders combine MAs to cover different timeframes.

Is 200 EMA Good for Swing Trading?

The 200-period EMA is useful for swing traders seeking to understand long-term trends. It reacts faster than the 200-period SMA, making it suitable for traders looking to incorporate a responsive indicator in their analysis.

Which Indicator Is Most Popular for Swing Trading?

There isn’t a single best indicator for swing trading. Moving averages, RSI, MACD, and volume indicators are commonly used. Combining these can provide a more comprehensive analysis.

Which Volume Indicator Is Popular for Swing Trading?

The On-Balance Volume (OBV) and Volume Weighted Average Price (VWAP) are popular volume indicators for swing traders, helping assess market momentum.

Which RSI Indicator Is Popular for Swing Trading?

The standard 14-period RSI is widely used. Swing traders often adjust it to shorter periods (e.g., 7) for faster signals or longer periods (e.g., 21) for smoother trends.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Equity Research Report – CARE Ratings Ltd (CARERATING)🔹 Technical Outlook

Stock has broken out of a horizontal resistance near ₹1,237 with volume pickup.

RSI is above 60, indicating momentum strength.

Short-term EMAs are crossing over the 50-day EMA — bullish signal.

Volume confirms accumulation.

🛒 Trade Setup

✅ Short-Term View (Swing/Positional Trade):

Buy above: ₹1,240 (on closing basis)

Target 1: ₹1,320

Target 2: ₹1,375

Stop-Loss: ₹1,185

Timeframe: 2–4 weeks

🏦 Long-Term View (Investor Strategy):

Buy Range: ₹1,180–1,240

Target 1: ₹1,450

Target 2: ₹1,580

Stop-Loss: ₹1,080 (weekly close)

Timeframe: 3–6 months

for educational purpose only

OptionsMastery: Sitting at resistance on BAC!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Jubilant Ingrevia (JUBLINGREA) – Short-Term Breakout Trade LTP: ₹726.30 | Recommended Entry: ₹722.00 – ₹723.00

Type: Short-Term Swing / Intraday MTF Trade

✅ Trade Setup:

Breakout above horizontal resistance near ₹725.75

9 EMA has crossed 26 EMA (bullish momentum)

RSI at 60.84 – strong trend, room for upside

BB %B: 0.96 – price pushing upper band = momentum buying

Good volume breakout on daily TF confirms buying interest

🟢 Buy Zone: ₹722 – ₹723

🔁 On retest or 15-min candle close above ₹725.75 with volume

🎯 Targets:

T1: ₹738

T2: ₹750 (supply zone / fib level)

T3: ₹765+ (if breakout sustains in 1H)

🛑 Stop Loss:

Conservative SL: ₹707 (below support + 9EMA)

Aggressive SL: ₹712 (tight SL for intraday)

For Education Purposes Only

BIRLASOFT LTD – Bullish Reversal with Volume Surge✅ Trade Plan:

Stock gave a bullish breakout with a large green candle & volume spike

RSI crossed 60 level – bullish strength confirmed

Price broke above short-term resistance zone at ₹407 and nearing ₹425

💰 Buy Zone:

Entry Range: ₹418 – ₹422 (on 15min or 1H candle close above ₹420)

🎯 Targets:

T1: ₹425.05 (Immediate resistance)

T2: ₹444.35 (Previous swing high)

T3: ₹485.75 (Gap fill zone and 200 EMA resistance zone)

🛑 Stop Loss:

Intraday SL: ₹407.20 (below support zone and previous candle low)

Swing SL: ₹400 (for positional trade)

🔁 Strategy:

Scalp at ₹425 with 30–40% booking

Hold rest for breakout continuation toward ₹444+

Trail SL to ₹415 once above ₹425

For Education Purposes Only

Tesla - The Next 7 Days Decide Everything!Tesla ( NASDAQ:TSLA ) is sitting at a crucial structure:

Click chart above to see the detailed analysis👆🏻

Despite the -60% correction which we have been seeing over the past couple of months, Tesla still continuously validates its overall uptrend. That's exactly the reason for my strong bullish thesis and the assumption, that after we see bullish confirmation, Tesla will reject the current support area.

Levels to watch: $250, $400

Keep your long term vision,

Philip (BasicTrading)

OptionsMastery: Break and Retest on GE.🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

SUI Pullback in Motion — Here’s Where the Smart Money Loads UpSUI is showing signs of exhaustion after failing to convincingly reclaim recent highs. Today’s price action delivered a strong clue: a sweep of the key high at $4.274 followed by a sharp rejection — Swing Failure Pattern (SFP).

Momentum is fading as volume dries up, and bulls have lost control of major levels:

❌ Yearly Open at $4.1225

❌ Weekly Level at $4.0921

This suggests a deeper correction may be underway before SUI can attempt another leg higher.

📌 Liquidity & Fib Levels in Focus

There’s still significant liquidity resting below the $3.80 zone — and the market often seeks to sweep such areas before reversing. Taking the Fib retracement from the $3.12 low to the $4.2989 high, we can identify two critical zones for a potential long entry:

0.5 Fib Retracement → $3.7095

This level not only sits just below the $3.80 liquidity shelf but also provides a strong technical anchor. If SUI finds support here, it could offer a solid long opportunity.

🎯 Trade Setup from the 0.5 Fib ($3.7095)

Entry: Around $3.71

Stop-Loss: $3.612

Target 1: $3.90 → R:R ≈ 2:1

Target 2: $4.587 (0.786 Fib Retracement) → R:R ≈ 9:1

Key Note: Watch the volume on the bounce — strong reaction = continuation potential; weak reaction = deeper retrace risk

🔸 Golden Pocket (0.618–0.666) Zone → $3.57-$3.52

If the 0.5 Fib bounce fails or lacks volume confirmation, price may dig deeper into the golden pocket — a historically strong reversal area. This zone becomes your next high-probability long setup to monitor.

🧠 Summary & Strategy

SUI showed rejection via SFP at key high ($4.274)

Lacking volume for immediate continuation

Next key long opportunity: $3.71 (0.5 Fib), SL at $3.612

If weak, watch $3.57 (golden pocket) as secondary entry

R:R potential ranges from 2:1 up to 9:1 depending on bounce strength

Let price come to you. Monitor reactions at each zone and don’t trade blindly into weakness. This is where patience and precision pay off. 💡

___________________________________

If you found this helpful, leave a like and comment below! Got requests for the next technical analysis? Let me know.

$TSLA – Base Breakout Setup with Dual Entry StrategyTesla ( NASDAQ:TSLA ) is coiling up, forming a classic base breakout setup with a dual approach for traders who want precision:

🔹 Support Zone Entry (280-285)

Shaded area = the zone between the 9 EMA (blue) and 20 EMA (yellow) — a key dynamic support area.

I'm taking a starter position here with a stop just below yesterday's low for tight risk control.

🔹 Breakout Confirmation (Above 295)

Full size only if we see a clean breakout above $295, confirming momentum.

This is where I’ll add size, looking for a strong continuation.

🔹 Execution Plan

Starter position: Shares and options at support zone ($280-$285).

Full position: Add at breakout ($295) with a mix of shares and options.

Risk: Tight stop below yesterday's low for the starter position.

⚠️ Risk Management: Always respect your stops — discipline over hope.