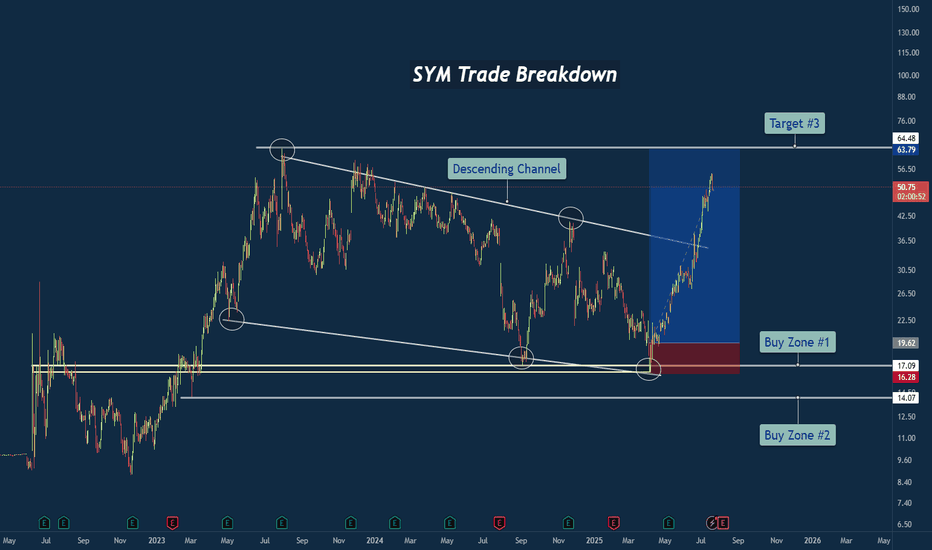

SYM Trade Breakdown – Robotics Meets Smart Technical's🧪 Company: Symbotic Inc. ( NASDAQ:SYM )

🗓️ Entry: April–May 2025

🧠 Trade Type: Swing / Breakout Reversal

🎯 Entry Zone: $16.28–$17.09

⛔ Stop Loss: Below $14.00

🎯 Target Zone: $50–$64+

📈 Status: Strong Rally in Motion

📊 Why This Trade Setup Stood Out

✅ Macro Falling Wedge Reversal

After nearly two years of compression inside a falling wedge, price finally tapped multi-year structural support and fired off with strength. This wasn’t just a bottom — it was a structural inflection point.

✅ Triple Tap at Demand Zone

Symbotic tapped the ~$17 area multiple times, signaling strong accumulation. Volume and momentum picked up with each successive test, showing institutional interest.

✅ Clean Break of Trendline

Price broke through the falling resistance trendline decisively, confirming the bullish reversal and unleashing stored energy from months of sideways structure.

🔍 Company Narrative Backdrop

Symbotic Inc. isn't just any tech stock. It’s at the forefront of automation and AI-powered supply chain solutions, with real-world robotics deployed in major retail warehouses. That kind of secular growth narrative adds rocket fuel to technical setups like this — especially during AI adoption surges.

Founded in 2020, Symbotic has quickly become a rising name in logistics and warehouse automation, serving the U.S. and Canadian markets. With robotics in demand and investors chasing future-ready tech, the price action aligned perfectly with the macro theme.

🧠 Lessons from the Trade

⚡ Compression = Expansion: Wedges like this build pressure. When they break, the moves are violent.

🧱 Structure Never Lies: The $17 zone was no accident — it was respected over and over.

🤖 Tech Narrative Boosts Confidence: Trading is easier when the fundamentals align with the technicals.

💬 What’s Next for SYM?

If price holds above the wedge and clears the $64 resistance, we could be looking at new all-time highs in the next cycle. Watching for consolidation and retests as opportunity zones.

#SYM #Symbotic #Robotics #Automation #AIStocks #BreakoutTrade #FallingWedge #SwingTrade #TechnicalAnalysis #TradingView #TradeRecap #SupplyChainTech

Swingtrading

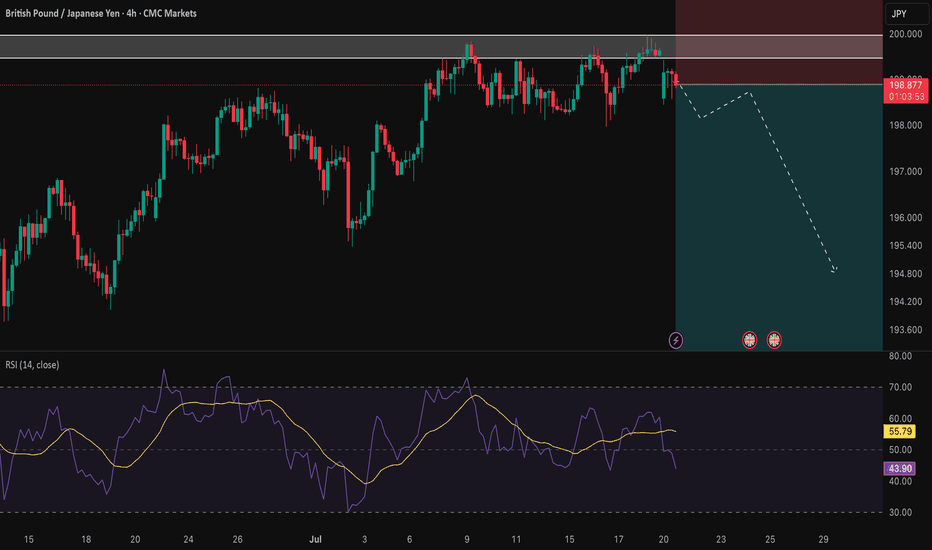

GBP/JPY: A Key Short Setup Forms as Momentum FadesHello traders,

Taking a look at GBP/JPY on the 4-hour timeframe. After a significant run, the price action has stalled, and we're seeing clear signs of fading momentum. This is creating a well-defined consolidation zone, which may present a key opportunity for a short position.

The Technical Picture 📊

1️⃣ Price Consolidation: GBP/JPY is currently trading sideways within a tight range, highlighted on the chart. This period of indecision and balance between buyers and sellers often precedes a significant directional move. The structure suggests a phase of distribution may be underway.

2️⃣ Fading Momentum: The Relative Strength Index (RSI) confirms this loss of momentum. A sustained reading below the 50 midline would signal that sellers are beginning to gain control and that the path of least resistance is shifting to the downside.

The Strategy 🧠

The core idea is to anticipate a bearish breakdown from the identified consolidation zone. A clean break and hold below this range would serve as confirmation that sellers have taken over, providing an opportunity to enter a short position targeting a continuation of the larger bearish move.

Trade Parameters 📉

👉 Entry: 198.895

⛔️ Stop Loss: 201.405

🎯 Take Profit: 192.872

Risk/Reward Ratio: approx. 2.4

This is my personal analysis and perspective, not financial advice. Always conduct your own research and manage your risk accordingly.

Good luck, and trade safe.

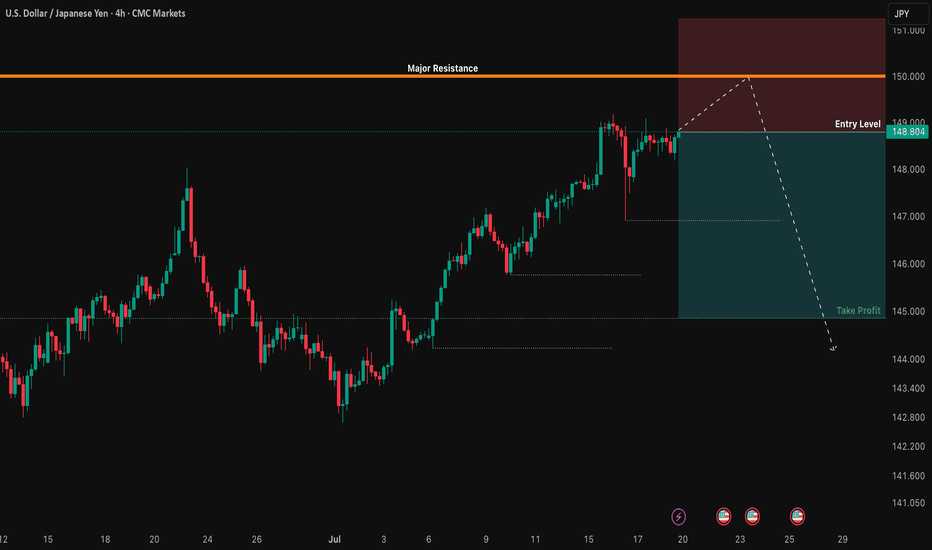

USD/JPY: The 150.00 Rejection SignalThe chart for USD/JPY looks like a simple one-way street going up. But underneath the surface, my quantitative models are in a state of conflict, and that's a high-clarity signal that something is about to change.

This isn't a signal to short right now. This is a signal to be patient and watch for a very specific setup that the "smart money" models are anticipating.

The Quant Conflict 🤖

My analysis involves several different mathematical models. Here's the situation:

One model, which is great at tracking trends, is still signaling BUY , following the obvious upward momentum.

However, two other, more complex models that analyze the relationships between economic data are now flashing a SELL signal. They are detecting underlying weakness that the price chart isn't showing yet.

When the simple trend model and the complex structural models disagree, it often means a major turning point is near. We are siding with the smarter models, but we need price action to confirm their warning.

The Game Plan 📊

We will use the 150.00 level as our "line in the sand." We are waiting for the market to fail at this level and then break down, which would confirm the bearish quant signal. This is our high-probability entry trigger.

Here is the exact setup we are waiting for:

📉 THE SETUP: A patient short position, waiting for confirmation of a breakdown.

👉 ENTRY: We enter only on a confirmed daily close below 148.00.

⛔️ STOP LOSS: Place the stop just above the psychological wall at 150.25.

🎯 TAKE PROFIT: Our primary target is the major support level at 145.00.

This is a setup where patience pays. We are letting the market do the hard work and show its hand before we commit. Let's watch this one closely.

ETH — Rally Exhaustion or More Upside?ETH has been on an absolute tear. After retesting its old 2018 all-time high, it marked a bottom at $1383 — a brutal -66% correction over 114 days from the $4109 top.

From there, ETH ripped +100% in just one month, followed by 40 days of consolidation, and now, over the past 28 days, it’s surged another +76%, currently trading around $3715 — all without any major correction.

So the big question:

What’s next? Are we near a short setup, or is it time to long?

Let’s break it down.

🧩 Key Technicals

➡️ Bounce Zone:

On June 22, ETH retested the 0.5 fib ($2131.63) of the prior 5-wave Elliott impulse, with extra confluence from:

Anchored VWAP

Speed fan 0.618

➡️ Key Highs to Watch:

$3746 → recent local high

$4109 → 2021 all-time high

➡️ Fib Retracement Levels:

ETH has smashed through all major fibs, including the golden pocket (0.618–0.65) and 0.786 fib. The 0.886 fib at $3798.27 is the last major resistance, just above the $3746 key high.

At this zone, we also have:

Fair Value Gap (FVG)

Monthly Resistance

Negative Fib Extension Golden Pocket Target

➡️ Momentum Signal:

ETH is currently on its 8th consecutive bullish daily candle — historically, after 8–13 consecutive candles, price tends to cool off or correct. A sign to be cautious about longing here and consider profit-taking.

🔴 Short Trade Setup

Look for a potential SFP (swing failure pattern) at the key high $3746 to initiate a short trade.

This offers a low-risk setup with:

Entry: around $3746 (if SFP confirms)

Target (TP): ~$3300

Stop-loss: above SFP

R:R ≈ 1:4+

💡 Educational Insight: Why You Don’t Want to Long the Top

Markets often trap late longers near key highs or resistance zones — this is where smart money distributes while retail piles in emotionally.

Lesson: Look for zones of confluence (fib, VWAP, liquidity, FVG) and avoid chasing extended moves after multiple bullish candles.

Patience and confirmation at reversal points lead to higher-probability setups — you don’t need to catch every pump.

Final Thoughts

We’re approaching major highs, so this is a time for caution, not FOMO. Watch for reaction and potential reversals near $3750–$3850.

Stay sharp, manage risk — and remember, tops are where longs get trapped.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

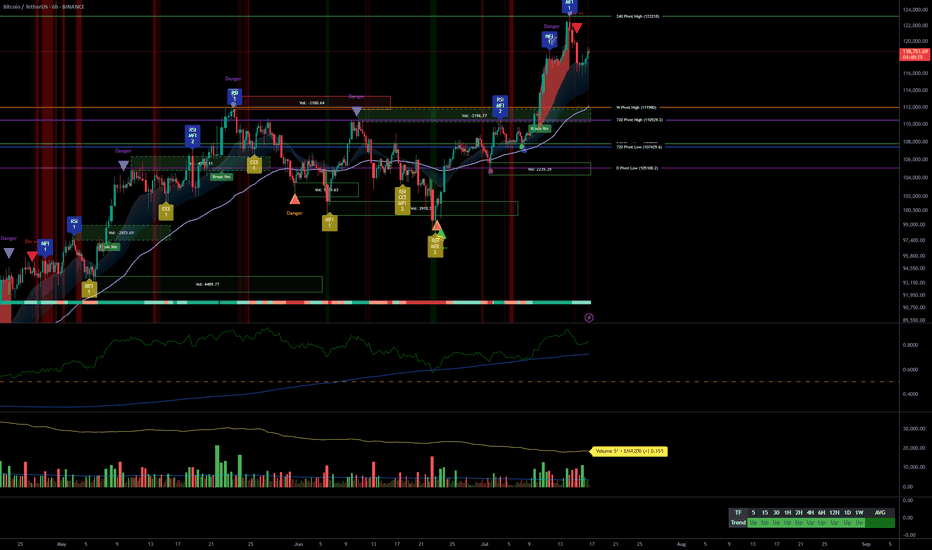

Bullish momentum holding, accumulation zones in focus__________________________________________________________________________________

Technical Overview – Summary Points

➤ Strong bullish momentum across all timeframes.

➤ Key supports: 104–110k$ and 110–115k$; pivot resistance: 124k$.

➤ Normal volumes, no panic or exhaustion phases detected.

➤ The Risk On / Risk Off Indicator consistently supports the bullish trend, with minor short-term slowing.

➤ No behavioral alerts (ISPD DIV), multi-timeframe structure fully aligned.

__________________________________________________________________________________

Strategic Summary

➤ Structurally bullish bias as long as supports above 104–110k$ hold.

➤ Tactically seek long entries on retracements to 110–115k$ (preferred swing bias).

➤ Fast profit-taking zone above 124k$ or on loss of key support clusters.

➤ Macro environment neutral to slightly positive, no urgent negative catalysts.

➤ Action: prioritize long trades on pullback, strict stops below 104k$, reduce sizing before major news releases.

__________________________________________________________________________________

Multi-Timeframe Analysis

1D:

- Strong 124k$ resistance, major supports at 104.5k$ & 108–110k$ (technical and on-chain clusters).

- Risk On / Risk Off Indicator: strong buy, balanced volumes.

- Buy zone = pullback to 108–110k$; rapid profit-taking on break of 124k$ without macro confirmation.

12H:

- Distribution below 124k$ resistance, optimal support at 110–115k$.

- Risk On / Risk Off Indicator bullish, clear bullish confluence.

- Wait for confirmed break to extend; buy dips.

6H / 4H:

- Failed breakout at 124k$, solid supports at 110–115k$.

- Momentum intact, stable volumes, healthy structure.

- Dip accumulation recommended as long as supports hold.

2H / 1H:

- Active defense of 110–115k$ support and pivots at 115–118k$.

- Risk On / Risk Off Indicator very favorable (swing pullback entries).

- Stable volumes, no exuberance.

30min / 15min:

- Moderated momentum, micro-range below 120k$.

- Treat every dip as an opportunity to join the main trend.

Cross-summary: As long as >110k$ holds, each pullback is an accumulation opportunity. Only a persistent break below 104k$ invalidates the bias.

__________________________________________________________________________________

Fundamental & On-chain Analysis

Macro: US CPI above expectations, no Fed rate cut expected, neutral to risk-on environment. No immediate negative news, volatility under control.

Calendar: increase caution before key macro releases, reduce swing exposure ahead of FOMC/high-vol days.

On-chain: major accumulation supports 104–110k$; watch for loss of STH in profit momentum.

Strong coherence between technical and on-chain clusters, but remain watchful for euphoric tops >124–130k$.

__________________________________________________________________________________

Strategic conclusion and action plan

Trend: Bullish unless crash below 104k$.

Action: Prioritize buying pullbacks at 110–115k$, strict stops under key pivots.

Swing window possible up to 130k$ if no on-chain/macro overheating.

Increase prudence if break >124k$ occurs without macro/sector momentum.

As long as the multi-timeframe structure holds and on-chain support clusters are respected, every pullback to 110–115k$ should be seen as a buy opportunity. Key watch: breakouts above 124k$ without macro confirmation and on-chain STH/profit stress signals.

__________________________________________________________________________________

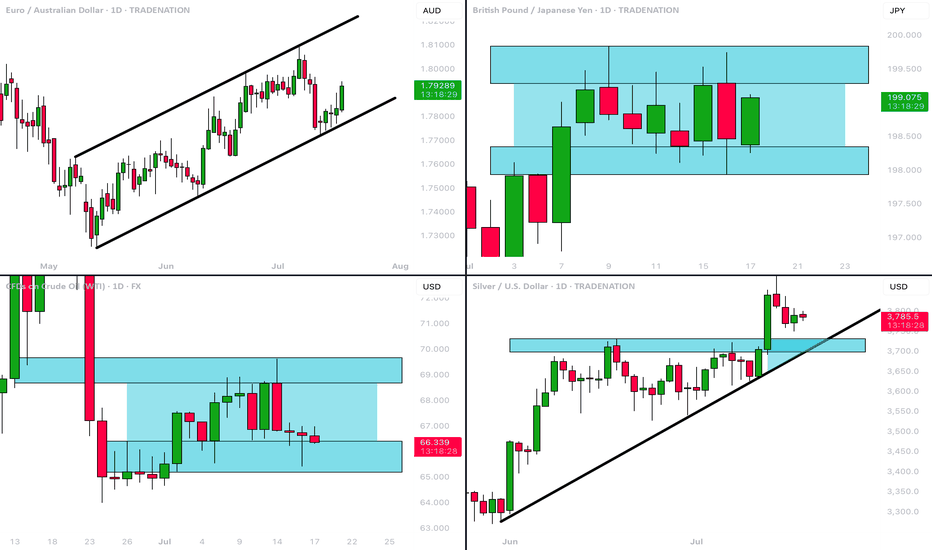

MarketBreakdown | EURAUD, GBPJPY, WTI CRUDE OIL, SILVER

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #EURAUD daily time frame 🇪🇺🇦🇺

The market is trading in a bullish trend.

The price is steadily growing within a rising parallel channel.

A recent test of its support triggered a strong bullish reaction.

I think that a rise may continue at least to a current high - 1.8035

2️⃣ #GBPJPY daily time frame 🇬🇧🇯🇵

The market is consolidating within a narrow horizontal

parallel channel.

Consider consolidation, trading within its boundaries.

The next bullish wave will be confirmed with a breakout and a

daily candle close above its resistance.

3️⃣ CRUDE OIL #WTI daily time frame 🛢️

The market remains weak and consolidation continues.

I see a wide horizontal range where the price is now stuck.

I think that we may see a pullback from its support.

4️⃣ #SILVER #XAGUSD daily time frame 🪙

The market is retracing after a formation of a new higher high.

I see a strong demand zone ahead: it is based on a rising trend line

and a recently broken horizontal resistance.

The next trend following movement will most likely initiate from there.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

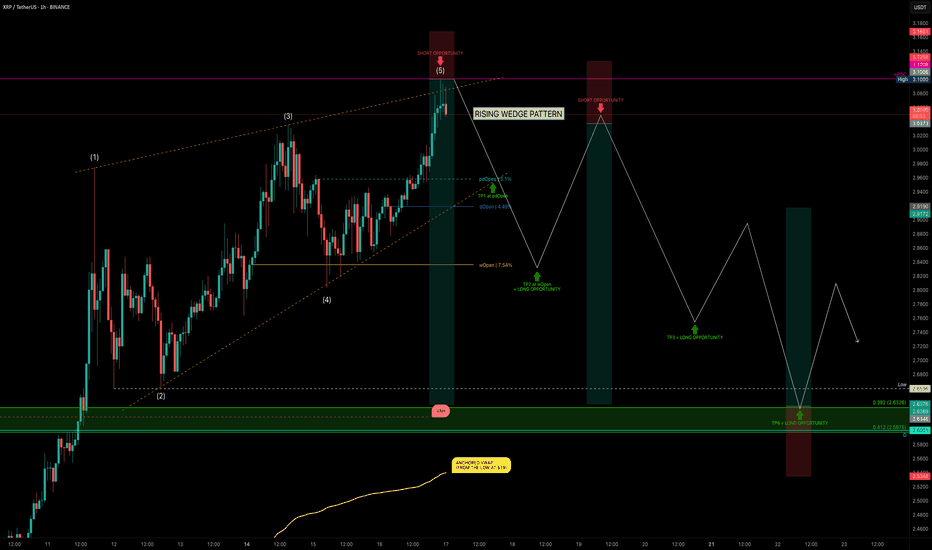

XRP Hits $3.10 — Rising Wedge or Ready to Fly?XRP has been on a strong run over the past 24 days, rallying from $1.90 → $3.10 — a +62% price increase. But after hitting key resistance, is XRP about to correct, or will it break out further? Let’s dive into the technicals.

🧩 Market Structure

Rising Wedge Pattern:

The current market structure resembles a rising wedge, with XRP likely completing wave 5.

Rejection Zone Hit:

Price tapped the nPOC at $3.10 and rejected — providing a clean short opportunity.

📉 Key Support Levels & Confluences

Taking the full 24-day bullish move:

0.382 Fib Retracement: $2.6326 — aligns with liquidity pool below the $2.6596 swing low.

226-day Trading Range VAH: ~$2.62 (red dashed line) — adds confluence.

Daily Level: $2.60 — further support.

Anchored VWAP from $1.90 Low: ~$2.54 (rising over time).

✅ Conclusion: The $2.66–$2.60 zone is a critical support area and offers a solid long opportunity.

Trade Setups

🔴 Short Setup (After Breakdown Confirmation):

Wait for a sell-off & breakdown of the wedge.

Ideal entry: retest of the lower wedge edge, ideal short entry would be between 0.618–0.786 fib retracement.

🟢 Long Setup:

Entry Zone: $2.66–$2.60

SL: below VWAP line

Target: Fib 0.618 as TP

🧠 Educational Insight: Rising Wedges Explained

A rising wedge is a bearish pattern, often signalling weakening momentum as price climbs within narrowing highs and lows.

Key points:

➡️ Volume typically declines as the wedge matures.

➡️ Breakdown below the lower wedge edge often triggers stronger sell-offs.

➡️ Retests of the broken wedge support turn into ideal short entries.

Pro tip: Combine wedge patterns with fib retracement zones and VWAP levels for higher-confidence setups.

Watch for wedge breakdown confirmation before shorting.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

SOUTHBANK - BUY SOUTHBANK - BUY NOW

Key points :

South Indian Bank strong Fundamentals .

Stock PE - 5.47

Industry PE - 10.8

Stock Price Trade at Below Book Value ..

Company Price - Possible to Double

Technical :

Monthly - Take Support

Day - Symmetrical Triangle Pattern Breakout

Entry - 25.45 Rs

Target - 35.55 Rs

Stoploss - 21 Rs

Expected - 39 %

This is Only for My Trade Setup . Dont follow Blindly . Take Educational Purpose Only .

We not any responsiblities for Profit and loss ..

Thank You . Happy Trading ..

#DOGEUSDT: Swing Trade Targeting $0.50| Swing Trade| Setupsfx_|Hey there! Everyone

DOGEUSDT is at a turning point right now, and it looks like it might just reverse course and head towards its target price of $0.50. This is a swing trade, which means it could take a few weeks, or even months, to complete.

We’d really appreciate your support.

Thanks

Team Setupsfx_

Western Carriers (WCIL) : Breakout Candidate#WCIL #patterntrading #breakout #breakoutstock #inverseheadandshoulder #swingtrading

WCIL : Swing Trade

>> Low PE Stock

>> Inverse Head & Shoulder pattern visible

>> Breakout & Retest Done

>> Ready for New Highs

>> Low Risk High Reward Trade

Swing Traders can lock profits at 10% & Keep Trailing

Pls Comment , Boost and Follow for more such Analysis

Disc : Charts shared are for Learning Purpose and not a Trade recommendation, Consult your Financial afvisor or a SEBI Registered Advisor before taking postion in it.

SWING IDEA - NEULAND LABNeuland Lab , a niche API manufacturer with strong export presence and leadership in complex molecules, is offering a technically strong swing trade opportunity from key support levels.

Reasons are listed below :

11,500 zone acting as a crucial support area

Formation of a hammer candle on the weekly timeframe, signaling potential reversal

Reversing from the 0.618 Fibonacci retracement zone – the golden pocket

Taking support at the 50-week EMA , holding long-term trend structure

Target - 14900 // 17600

Stoploss - weekly close below 10215

DISCLAIMER -

Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Any trading in securities or other investments involves a risk of substantial losses. The practice of "Day Trading" involves particularly high risks and can cause you to lose substantial sums of money. Before undertaking any trading program, you should consult a qualified financial professional. Please consider carefully whether such trading is suitable for you in light of your financial condition and ability to bear financial risks. Under no circumstances shall we be liable for any loss or damage you or anyone else incurs as a result of any trading or investment activity that you or anyone else engages in based on any information or material you receive through TradingView or our services.

@visionary.growth.insights

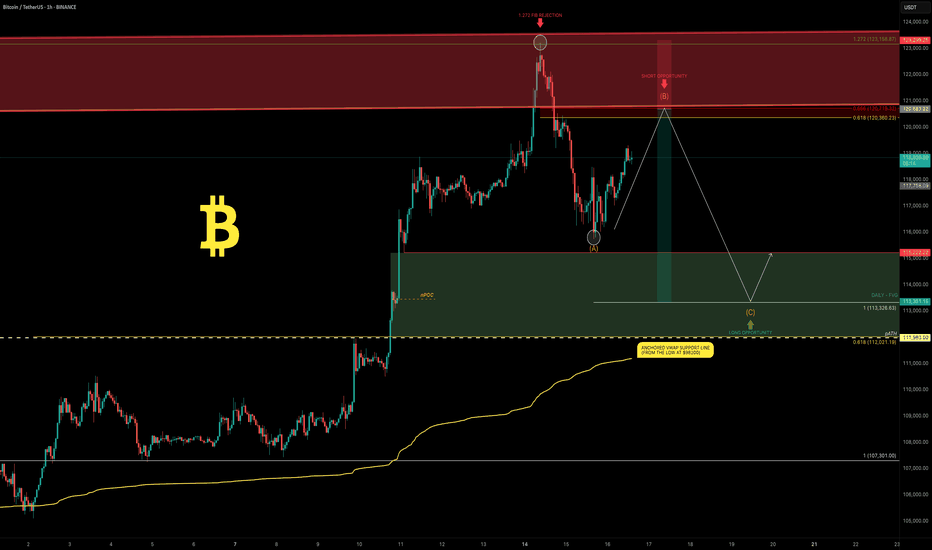

Bitcoin Full analysis: Buy the dip confirmed, 123240 key__________________________________________________________________________________

Technical Overview – Summary Points

__________________________________________________________________________________

Momentum: Very bullish across all timeframes; healthy compression above previous range.

Key Supports: 115731–110481 USDT (structural, 1D to 1H).

Major Resistances: 123240 USDT (multi-frame pivot).

Volume: Normal, no climax or distribution — flows support the dominant bias.

Risk On / Risk Off Indicator: Strong bullish HLTF signal; short-term neutral intraday.

ISPD DIV: Neutral on all timeframes.

Multi-TF Behavior: Bull rally, no excess, no euphoria or capitulation; market holds above key levels.

__________________________________________________________________________________

Strategic Summary

__________________________________________________________________________________

Global Bias: Strong bullish – MT/LT “buy on dips” confirmed.

Opportunities: Progressive buying (117800, 115731 USDT), continuation on breakout >123240.

Risk Zones: Possible pullback if clear rejection below 123240, swing invalidation if close <115731-111949.

Macro Catalysts: Awaiting FOMC late July, short-term volatility limited. Watch geopolitics, extreme compression.

Action Plan: Swing entry: 118300–119000. Stop: 115500. Target: 123200 then 126000+. R/R ≥2.5. Adjust risk management before FOMC.

__________________________________________________________________________________

Multi-Timeframe Analysis

__________________________________________________________________________________

1D: Bullish momentum, supports at 105054/107939–110483. Risk On / Risk Off Indicator strong buy, healthy volume, ISPD neutral.

12H: Consolidation below 123240, aligned supports 110481/115731, healthy structure.

6H: Confirmed momentum, continuous compression, no major sell signals.

4H: Rally structure robust, corrections limited and on support.

2H: Key support band 115731–110481, volume supports rebound, possible rotation below 123240.

1H: Rally confirmed, no panic selling detected.

30min/15min: Intraday consolidation, micro-range below resistance, stable volume, Risk On / Risk Off Indicator short-term neutral.

Cross-TF summary: CLEAR momentum across all frames, no significant divergence, high-quality HTF supports. Next >123240 breakout likely fast and dynamic.

__________________________________________________________________________________

Technical & Fundamental Synthesis

__________________________________________________________________________________

Technical Synthesis: Broad bullish confirmation; buy-the-dip valid on 117800/115731, no aggressive downside signal. Swing positions above 118200 to be favored, expect acceleration after clear break of 123240.

Stops & Invalidation: Swing stops below 115731/111949. Closing below = increased risk, “off” bias.

Fundamentals: Optimal pre-FOMC swing window, US market in wait-and-see mode short term. Neutral/volatile geopolitics, no immediate shocks.

On-chain: Heavy accumulation, historic compression, ETF flows strong (but on short pause). Imminent volatility squeeze possible either way.

Recommendation: Actively monitor 123240 (breakout above), 115731 (below = increased caution). Adjust stops and sizing, remain highly responsive, especially as FOMC approaches.

__________________________________________________________________________________

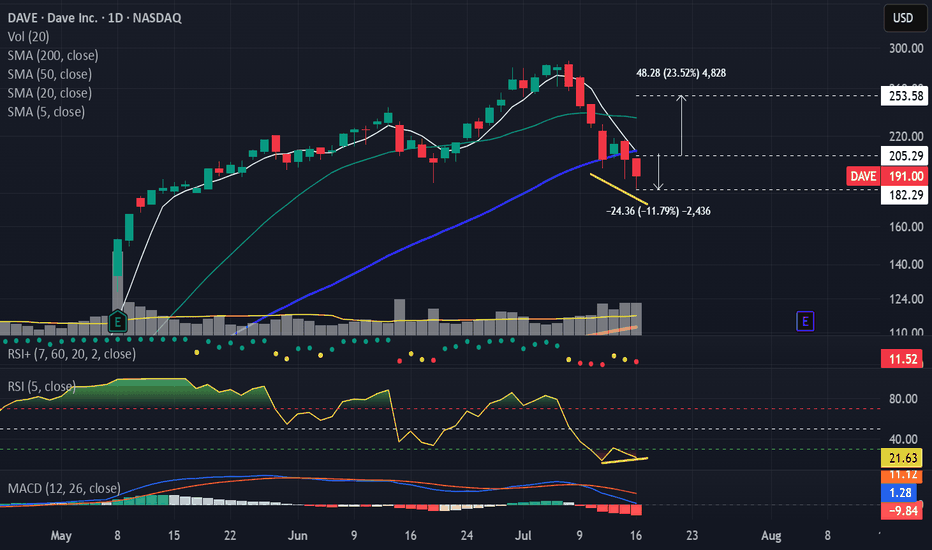

Bitcoin: New All-Time High — What’s Next?Bitcoin had an incredible run, breaking the old all-time high ($111,980) with strong bullish momentum and setting a fresh ATH at $123,218 (Binance). We just witnessed the first major corrective move of ~6% and a decent bounce so far — but the big question is:

What’s next? Will Bitcoin break higher over the summer or form a trading range here?

Let’s dive into the technicals.

🧩 Higher Timeframe Structure

May–June Range:

BTC was stuck between $110K–$100K, forming an ABC corrective pattern. Using trend-based Fib extension (TBFE) from A–B–C:

✅ C wave completed at $98,922 (1.0 TBFE)

✅ Upside target hit at $122,137 (-1 TBFE)

Full Bull Market TBFE:

➡️ 1.0 → $107,301 → previously rejected

➡️ 1.272 → $123,158 → recent rejection zone

Pitchfork (log scale):

➡️ Tapped the upper resistance edge before rejecting.

Previous Bear Market Fib Extension:

➡️ 2.0 extension at $122,524 hit.

2018–2022 Cycle TBFE:

➡️ 1.618 at $122,011 tapped.

Macro Fibonacci Channel:

➡️ Connecting 2018 low ($3,782), 2021 ATH ($69K), 2022 low ($15,476) →

1.618–1.666 resistance band: $121K–$123.5K.

✅ Conclusion: Multiple fib confluences mark the $122K–$123K zone as critical resistance.

Daily Timeframe

➡️ FVG / Imbalance:

Big daily Fair Value Gap between the prior ATH and $115,222 swing low.

BTC broke the prior ATH (pATH) without retest → a pullback to this zone is likely.

Lower Timeframe / Short-Term Outlook

We likely saw a completed 5-wave impulse up → now correcting.

The -6% move was probably wave A, current bounce = wave B, next leg = wave C.

➡ Wave B short zone: $120K–$121K

➡ Wave C target (1.0 TBFE projection): ~$113,326

➡ Confluence at mid-FVG + nPOC

Trade Setups

🔴 Short Setup:

Entry: $120,300–$121,000

Stop: Above current ATH (~$123,300)

Target: $113,500

R:R ≈ 1:2.3

🟢 Long Setup:

Entry: Between Prior ATH and $113,000

Stop: Below anchored VWAP (~$110,500)

Target: Higher, depending on bounce confirmation.

🧠 Educational Insight: Why Fibs Matter at Market Extremes

When markets push into new all-time highs, most classic support/resistance levels disappear — there’s simply no historical price action to lean on. That’s where Fibonacci extensions, channels, and projections become powerful tools.

Here’s why:

➡ Fibonacci extensions (like the 1.272, 1.618, 2.0) help estimate where trend exhaustion or profit-taking zones may appear. They are based on the psychology of crowd behavior, as traders anchor expectations to proportional moves from previous swings.

➡ Trend-Based Fib Extensions (TBFE) project potential reversal or continuation zones using not just price levels, but also the symmetry of prior wave moves.

➡ Fibonacci channels align trend angles across multiple market cycles, giving macro context — like how the 2018 low, 2021 ATH, and 2022 low project the current 1.618–1.666 resistance zone.

In short:

When you don’t have left-hand price history, you lean on right-hand geometry.

That’s why the $122K–123K zone wasn’t just random — it’s a convergence of multiple fib levels, cycle projections, and technical structures across timeframes.

⚡ Final Thoughts

Bitcoin faces major resistance around $122K–$123K backed by multiple fib and structural levels. A retest of the prior ATH zone (~$112K–$113K) looks probable before the next big directional move. Watch lower timeframe structure for signs of completion in this corrective phase.

_________________________________

💬 If you found this helpful, drop a like and comment!

Want breakdowns of other charts? Leave your requests below.

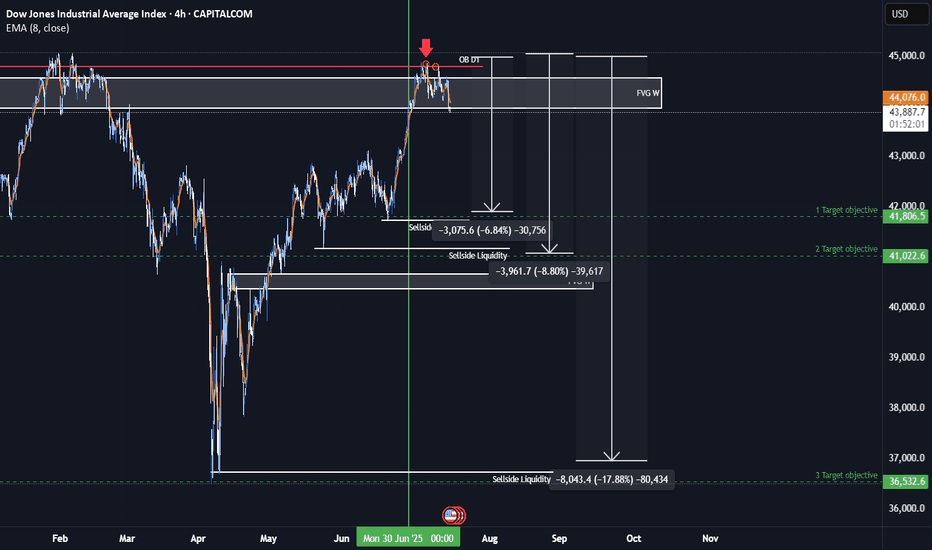

US30 Bearish IdeaAs we can see this is a anticipation of us being in a quarterly shift in the markets and having an assumption that we had a retracement up to collect more orders for smart money to go short. We have relative strength with US30 against both NASDAQ and the SP500. We have seen resistance in our premium arrays of our weekly FVG and daily order block

* Fundamental analysis:

We are are having a shift in our bond yields which could potentially effect the dollar giving it strength and you add the fact that dollar is under valued when we have a stronger dollar rate than the rest of the basket currencies we could see it negatively effect the Dow this quarter. The Dow is very over valued and we have had consistent quantitative easing from the Fed and the Fed balance sheet has been still consistently decreasing. The commercial interest have also seen a great rise of buying dollar and if dollar is being bought up then something would need to be sold.

MarketBreakdown | GBPAUD, WTI CRUDE OIL, US30, US100

Here are the updates & outlook for multiple instruments in my watch list.

1️⃣ #GBPAUD daily time frame 🇬🇧🇦🇺

The market is trading within a wide horizontal parallel channel.

The price is stuck on its support.

Probabilities will be high that the market will start growing from that.

Alternatively, its bearish breakout will provide a strong bearish signal.

2️⃣ #WTI CRUDE OIL daily time frame 🛢️

The price is now testing a significant rising trend line.

It is a critical decision moment for the market.

A bearish breakout of that may trigger a strong bearish continuation.

Monitor intraday price action today. If you see a strong bullish pattern,

it will provide a reliable confirmation to buy,

3️⃣ DOW JONES INDEX #US30 daily time frame

The market started a correction movement in

a bullish flag pattern.

Your next signal to buy will be a breakout of its resistance

and a daily candle close above that.

4️⃣ NASDAQ INDEX #US100 daily time frame

The market is now breaking a resistance of a horizontal parallel channel.

IF a today's daily candle closes above that, it will confirm a start of

another bullish wave.

The market will continue growing then.

Do you agree with my market breakdown?

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

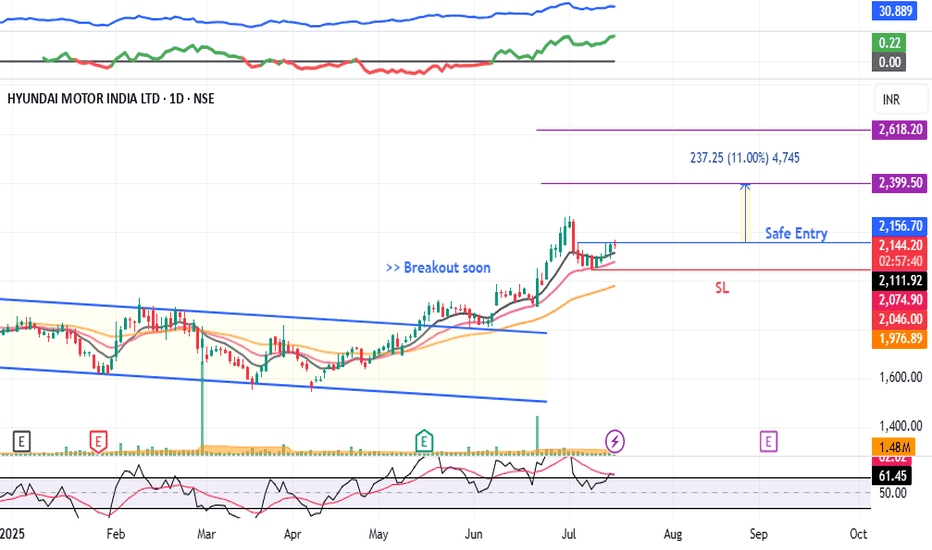

HYUNDAI - Swing Trade#HYUNDAI #swingtrade #trendingstock #momentumtrading #breakoutstock

HYUNDAI : Swing Trade

>> Breakout soon

>> Trending Stock

>> Volume Dried up

>> Good strength

>> Low Risk Trade ( RR - 1:2 or 1:3 )

Swing Traders can lock profit at 10% and keep trailing

Pls Boost, like and comment if u like the analysis

Disc: Charts shared are for Learning purpose, Take position only after consulting ur Financial Advisor or a SEBI Registered Advisor

EUR/CAD: Quant-Verified ReversalThe fundamental catalyst has been triggered. The anticipated strong Canadian CPI data was released as expected, confirming the primary driver for this trade thesis. Now, the focus shifts to the technical structure, where price is showing clear exhaustion at a generational resistance wall. 🧱

Our core thesis is that the confirmed fundamental strength of the CAD will now fuel the technically-indicated bearish reversal from this critical price ceiling.

The Data-Driven Case 📊

This trade is supported by a confluence of technical, fundamental, and quantitative data points.

Primary Technical Structure: The pair is being aggressively rejected from a multi-year resistance zone (1.6000 - 1.6100). This price action is supported by a clear bearish divergence on the 4H chart's Relative Strength Index (RSI), a classic signal that indicates buying momentum is fading despite higher prices.

Internal Momentum Models: Our internal trend and momentum models have flagged a definitive bearish shift. Specifically, the MACD indicator has crossed below its signal line into negative territory, confirming that short-term momentum is now bearish. This is layered with a crossover in our moving average module, where the short-term SMA has fallen below the long-term SMA, indicating the prevailing trend structure is now downward.

Quantitative Probability & Volatility Analysis: To quantify the potential outcome of this setup, we ran a Monte Carlo simulation projecting several thousand potential price paths. The simulation returned a 79.13% probability of the trade reaching our Take Profit target before hitting the Stop Loss. Furthermore, our GARCH volatility model forecasts that the expected price fluctuations are well-contained within our defined risk parameters, reinforcing the asymmetric risk-reward profile of this trade.

The Execution Plan ✅

Based on the synthesis of all data, here is the actionable trade plan:

📉 Trade: Sell (Short) EUR/CAD

👉 Entry: 1.6030

⛔️ Stop Loss: 1.6125

🎯 Take Profit: 1.5850

The data has spoken, and the setup is active. Trade with discipline.

NZDJPY: Another Bullish Wave Ahead?! 🇳🇿🇯🇵

NZDJPY violated a significant daily resistance cluster last week.

The broken structure and a rising trend line compose a

contracting demand zone now.

That will be the area from where I will anticipate a bullish movement.

Next resistance - 89.0

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.