Swiss

GBPCHF - Short Again!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📉As per our last GBPCHF analysis (attached on the chart), it rejected the red resistance zone and has been trading lower.

Short-term, GBPCHF has been trading within the falling channel marked in orange and today, it has been rejecting the upper bound of the orange channel.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper orange trendline aligned with the previous long-term analysis/trend.

📚 As per my trading style:

As #GBPCHF is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

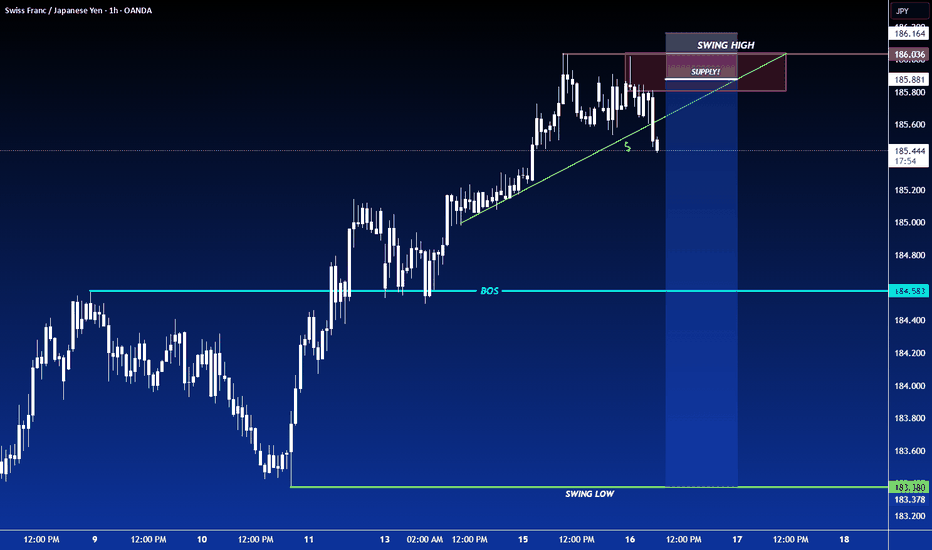

CHF Supply Demand Trade SetupSee picture for analysis.

-DXY had long-term weak fundamentals + Technicals which will be bullish for CHF and other currencies.

-Price broke downward trend line

-Price removed opposing pivto supply zones structure

-Demand created

Options:

1) possible buy back into 1hr demand

2) Wait for price to reutn the wait for lower-timeframe confirmation buy setups.

GBPCHF PoV - BUY POINT 1.07000???The GBP/CHF exchange rate has shown a significant bearish trend, especially after breaking the support at 1.110. Currently, the pair is heading towards the 1.07 area, indicating sustained selling pressure.

One possible cause of this movement could be related to tariff issues and the economic uncertainties associated with them. Trade policies, including tariffs, can significantly affect currencies as they impact expectations about economic growth and international trade. Recent news about the introduction or tightening of tariffs between the UK and other countries may have contributed to a negative sentiment toward the British pound, strengthening the Swiss franc as a safe-haven currency.

To fully understand the reasons behind the current trend of GBP/CHF, it's essential to monitor the latest economic and political news, especially those related to trade policies and the UK's international relations. A close examination of economic data and political developments can provide clearer insights into the future outlook for this currency pair.

USDCHF PoV - Long POINT 0.82$!Currently, the USD/CHF pair is going through a bearish phase, influenced by several economic and geopolitical factors.

Influence of US Trade Tariffs: Recent trade tariffs imposed by the United States have strengthened the Swiss franc, creating pressure on Switzerland's export-oriented economy. This scenario could push the Swiss National Bank (SNB) to consider introducing negative interest rates to counter the appreciation of the currency and support the economy.

Monetary Policy of the SNB: In June 2024, the SNB reduced interest rates by 25 basis points, bringing them to 1.25%. Inflation forecasts were revised downward, indicating 1.3% for 2024 and 1.1% for 2025. These adjustments reflect economic challenges and the SNB's intent to avoid deflation.

Swiss Franc Forecast: Analysts from Bank of America have expressed doubts about the sustainability of the Swiss franc's weakness in 2025. Despite expectations of lower interest rates, the SNB may be reluctant to implement unconventional measures, given the limited effectiveness of such policies in the past.

Technical Analysis: The daily chart shows a range between a maximum of 0.82 and a minimum of 0.92, which has been respected for the past three years. Currently, the price is approaching the upper limit of the channel, suggesting a possible downward correction. However, a break above 0.92 could indicate an extension of the bullish movement.

Conclusion: The bearish trend of USD/CHF is influenced by both internal and external factors, including SNB policies, US trade tariffs, and market dynamics. Investors should closely monitor SNB decisions, international trade policies, and key economic indicators to assess potential developments in the USD/CHF exchange rate.

Why is the Swiss Franc Defying the Odds?In a global economy where central banks are leaning towards softer monetary policies, the Swiss Franc is charting its own course—strengthening against the odds. But what forces are truly at play here? Is it merely the cautious whispers of the Swiss National Bank, or is there a deeper undercurrent, tied to inflation expectations and global safe-haven flows? As we peel back the layers, we uncover a narrative that challenges conventional wisdom. Discover the intricate dynamics that could redefine how we perceive currency resilience in today's volatile market landscape.

The franc's unexpected strength has sparked a flurry of theories. Some point to the SNB's potential reluctance to cut interest rates as aggressively as its peers. Others suggest that the widening gap between Swiss and global inflation expectations could be fueling the franc's appreciation. Yet, the franc's safe-haven status and its role in carry trades add another layer of complexity to this puzzle.

The EUR/CHF currency pair, a barometer of the Eurozone and Switzerland's economic health, is particularly sensitive to the franc's strength. As the franc appreciates, it can impact trade balances, inflation, and overall economic competitiveness.

As the global economic landscape continues to evolve, the enigma of the Swiss franc's resilience persists. Is this a temporary anomaly, or a harbinger of a new era in international finance? Only time will tell.

USD/CHF: Jordan’s Final Moves as SNB Chief Switzerland's Consumer Price Index (CPI) for August is forecast to show a year-over-year increase of 1.2%, down from 1.3% in July. On a month-over-month basis, CPI is expected to rise by 0.1%, rebounding from the prior month’s 0.2% decline.

The figures, due on Tuesday, come as Swiss National Bank (SNB) President Thomas Jordan recently acknowledged the challenges posed by the strong Swiss franc on the nation’s industry.

Speculation is mounting over whether the central bank will respond with a 50-basis-point rate cut in September or intervene in the currency markets to ease pressures.

Bear in mind, Jordan, who has steered the SNB for over a decade, will step down at the end of September 2024, marking the end of an era for Swiss monetary policy.

On the daily chart, we can see that USDCHF broke the August low last week. The near-term resistance is possibly around 0.8590,

USDCHFWe are in a down trend and currently in the corrective phase of the leg.

We have not gotten a multi touch confirmation but we got a second touch which is also still valid to use. Price tested the previous high and rejected. Going down into lower time frames.

The are 3 bearish soldiers from that rejection which show further market strength. We are in a very corrective ascending channel. We formed another correction (it has been 6-8 hours).

Sell Idea also still has kinks so make sure to follow your plan and manage according to your system.

UBS GROUP (UBSG): From Accumulation to ActionUBS GROUP (UBSG): SIX:UBSG

The banking sector has experienced significant turbulence over the past years, which has not spared UBS Group from Switzerland. Please note, this analysis is presented in Swiss Francs, not dollars, as we're examining it from the Swiss stock exchange perspective. Unusually, we're delving into the monthly chart here, where it's evident that we've been in an accumulation phase since 2008, lasting about 15 years with no significant progress. This is the second time we've broken out, but the first time we're sustaining levels above this zone for an extended period.

Our analysis starts at the all-time low of 7 CHF (Swiss Francs), also coinciding with the COVID-19 low, from which we've seen a completed 5-wave cycle. If our foresight holds, we believe the peak at 26.55 CHF marks the top. Following this, we anticipate forming a Wave A, an overshooting Wave B, and then a Wave C that drops below Wave A for a Wave (2) correction. This correction is expected to retrace between 50% and 61.8%, aligning with the notion that Wave 2 often reaches the level of the subordinate Wave 4, situated right at or slightly below the 61.8% mark.

With the stop-loss set below these two potential outcomes and within the outlined blue support zone, we foresee a significant rise for Wave (3). This wave is typically the longest or at least not the shortest of the three impulse waves, leading us to anticipate a climb to at least 48 CHF. Our course of action is to wait, assess how the scenario unfolds, and potentially scale into positions earlier. This remains to be seen, and we'll continue monitoring and keep you updated on developments.

SHORT CHF/JPYPretty precarious short trade on the Swiss/Yen. The years long uptrend has been exhausted for ages, but with the Yen's across the board weakness, price has steadily climbed. I entered a short on the 28th and added a lot on the 29th. Technically, I did get a signal from my indicators, but they haven't did very well against any Yen pairing as of late. We'll see how this goes.

USDCHF D1 | Falling to overlap supportUSD/CHF is falling towards an overlap support and could potentially bounce off this level to climb higher.

Buy entry is at 0.87779 which is an overlap support that aligns close to the 100.0% Fibonacci projection level.

Stop loss is at 0.86750 which is a level that sits under an overlap support that aligns with the 78.6% Fibonacci retracement level.

Take profit is at 0.89019 which is an overlap resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd, previously FXCM EU Ltd (www.fxcm.com):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Trading Pty. Limited (www.fxcm.com):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at www.fxcm.com

Stratos Global LLC (www.fxcm.com):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of FXCM and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of FXCM or any form of personal or investment advice. FXCM neither endorses nor guarantees offerings of third party speakers, nor is FXCM responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

NZDCHF: Descending resistance linesSeeing this pair reject from either the current local resistance boundary or if not the longer term descending trendline.

I'm expecting NZD weakness in the coming week so monitoring LTF's carefully.

I believe we'll be dropping down from either 0.538 or 0.543, a break above this latter number could signify reversal.

Some of the Reasons Why We Are Selling This PairThis pair has witnessed a large amount of back-and-forth swings in the last couple of days. We witnessed price fluctuations that resulted in a direction switch over and over again. Right now, we are going to ignore all other timeframes and look at this market analysis from a 4-hour perspective.

On the 4-hour chart, we can see that the market is on a down PB from weeks ago. As of last week, we had marked out our zone in the PB from which we looked to see a reversal. Yesterday saw prices rally all the way up into our zone, and from there, as expected, the market began to show signs of bearish reversals.

In a bid to catch that bearishness, we were able to jump on that trade using the panzy pips trade system.

The trade is expected to dip all the way down to the 4-hour liquidity target below.

Now it is also important to look at the charts from multiple timeframes at the same time, so forget my earlier statement that we would only pay attention to the 4-hour chart. You all should know by now that that was a joke. So let's look at the 1-hour perspective.

On the 1-hour chart, the market is bullish, with 2 PBs to the top. The 4-hour bearish impulse has experienced a good amount of support around the 1-hour PB zone (the zone is not marked out on the chart, to keep the charts clean).

There is obviously a good deal of support around that level, and we believe it is because of the 1-hour zone. We would be expecting prices to breach that level and continue to dip all the way to our 4-hour liquidity level.

But where that fails and the zone holds, prices would be expected to rally all the way to the top to liquidate the 1-hour target, which is the 4-hour zone, while at the same time threatening the daily timeframe zone.

AUDCHF: Fakeout or Breakout?We can see we've just broken out of my channel top after a strong bullish move, but this isn't the first time and we're hitting strong resistance.

Swissie has been weak of late, unlike the Aussie, so I believe this can go either way. I'll be looking at longs around 0.589 if resistance is broken, but we may well fall back first. If we fall back below 0.578 then I'll be waiting for the triple bottom around 0.561 before looking to go long.

Obviously this could all be a fakeout and we'll be back in the channel, but I do think it's risky shorting down hear unless it's for a quick scalp as it definitely looks like a good double bottom is already in play.

Both of these currencies are gold dependent for different reasons (Aussie exporting it, Swissie holding it), and Aussie is doing well because gold is.

I'm expecting a c0ontinuation of gold strength as per my recent idea, so probably expecting this pair could keep flying?

A Little Bearishness Before We Go BullishBorrowing from our previous analysis, we saw how the market went all the way bullish to hit our liquidity target. After doing that, it gave us more bullish setups and trading opportunities, all of which played out.

Today, we are on the 1-hour chart again, and we are looking to predict market direction. The market is currently in an uptrend, with 6 PBs to the north. We have every reason to believe this market will continue to be bullish and remain so, all the way to the daily liquidity target above.

But before we look to jump on a bullish trade, we would want to see a bearish pullback into our PB. We have refined the PB for our zone, so we will wait for the price to come into that zone. When price comes to our zone, we would apply our rules to identify early reversals, following which we will use one of the trade entry methods.

The Bullish RUN ContinuesWith the previous Bullish swing completed, it is time to look on to the next.

The market has given us a new PB, an area to trade from. From the PB, we have made an attempt to refine it to get our zone within 1 hour.

With our zone clearly marked out as seen on the chart, we anticipate price dipping into the zone, and from there we will be looking to trade.

The trend is bullish in the 1-hour timeframe, and our TP target is the 1-hour liquidity target.

GBPCHF: Retest incoming, then downWe've broken out of a long-standing sideways channel to the lower side, now bouncing off support to retest the broken channel.

I'm expecting a big dump in this paid once the retest is complete, UK economy vs Swiss economy, interest yields etc, no comparison.

The Swiss has been a stand-out performer against most crosses this year, GBP has been clinging on but I think we'll drop again soon.

Bullish and Bearish... Which way to Trade?The pair is Bullish on the 1 hour. With the breach of our zone and PB of the 1 hour timeframe from yesyerday, as is clear that the 1 hour chart has reversed from a bearish perspective to a completely Bullish one.

The only trouble here is the on the larget timeframe of the 4 hour and above, the market is still bearish as the Bearish PBs are still in place.

It would therefore be more comfortable to consider the 1 hour bullish impulse as a retracement on the larget timeframe.

Be that as it may, because we are looking to trade the 1 hour chart, though in the direction of the higher timeframes, we will narrow our attention to just the 1 hour for now and monentarily forget about what the larger timeframes are saying.

We will be looking to see prices retrace Bearish into our PB and the marked zone. When market reaches our zone, we will use the Panzy Pips formula to confirm a Bullish reversal, following which we will apply one of the Panzy Pips trade entry methods to take our trade.

Bearish Again on the 1 Hour...?Yesterday, we made our analysis and found a possibility of the market dipping.

The market played out our prediction and hit the 1 and 4-hour liquidity target at 0.89016.

With that swing completed, we are setting up for the next trading opportunity.

We see prices begin to retrace Bullish after hitting our liquidity target.

We have prices back inside our Panzy Pips Block (PB) and we are setting up for a trade. Price is expected to get to our marked-out zone, and from there, it will reverse Bearish. We will look to jump on that Bearishness when the reversal begins.

Even though we are Bearish on the 1 Hour, as well as the 4 hour, it is important to notice and pay attention to the fact that the daily chart is bullish and we have seen prices very recently come into our marked-out zone. This is a sign of Bullishness on the Daily. Be that as it may, since we are trading the 1 hour time frame, we will hold on to the Bearishness sold to us by the 1 hour timeframe and only look to think otherwise where and when the 1 hour reverses adn begins to move Bullish, in the direction of and in syncrony with the Daily Chart.