SWKS Skyworks Solutions Options Ahead of EarningsAnalyzing the options chain and the chart patterns of SWKS Skyworks Solutions prior to the earnings report this week,

I would consider purchasing the 105usd strike price at the money Calls with

an expiration date of 2024-2-2,

for a premium of approximately $2.85.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SWKS

The world no longer needs chips! LOLThis is in my opinion like buying oil stocks in the march 2020 crash. Semis to technology is like oil to transport. The world will not survive without either. So I place my long here today confidently regardless of the next few weeks or months. I will hold this until we re-reach our previous ATH which will be sooner than most anticipate. I expect by 2025 this will rereach those highs and achieve a much higher value by 2030. This is a serious chance to change your wealth status. Buy red sale green as always this is not financial advice. Do not be short-sided with this dip. Get in front of big money. Retail is gone from the markets, now all that is left is big money to choose their picks... high probability this bounces soon major.

Skyworks Solutions (SWKS) | Stormy Times-Technically In The ZoneHi,

Criteria:

1. The trendline

2. Strong multi-yearly resistance becomes support

3. Fibonaccy retracement 62%

4. Round number $100

5. 50% drop from ATH

6. Some EMA's from different TFs are in the zone

Do your own research and if it matches with my TA then you are ready to go.

Regards,

Vaido

Model Watchlist: Could it be heading to all-time highs?The Model has picked a new potential wave formation which would be completed at all-time highs. As long as the market holds up this might be a great opportunity.

Ingenuity Trading Model is an algorithm used in- Stock, Forex, Futures, and Crypto markets. The model is a Geometric Markov Model :

In probability theory, a Markov model is a stochastic model used to predict randomly changing systems. Markov Models are used in all aspects of life from Google search to daily weather forecast. The randomly changing systems we focus on are the equity, futures, and forex markets. The geometric element of the model is the fractal sine wave structure you can find on any chart you look at across any market and across all time dimensions. Our model focuses on the current sine wave formation (current state)- geometric price formation along with its volume and volatility over a given time period and using that information to predict the future state- future price movement. For questions or more information feel free to contact me in the comment section or via private chat

SWKS - strong company near good supportSkyworks Solutions, Inc. is engaged in the design, development and manufacture of proprietary semiconductor products.

Fundamental rating - 4+,

strong financial company, stable profit, revenue growth, good margins, very little debt, and assets are many times greater than liabilities.

Technically - currently in the downtrend on the h1, but good daily support zone below. I will watch the reaction at the 133.85-134.50 area. If they don't go further or if there is a bullish initiative, I will take it. If they breakdown his area , then I will consider 131.27 for long. Below 131 - cancel the scenario.

The targets are 139.65 (+4%) and 148.39 (+10%). Investment for 1-3 months.

When there is a signal to enter, I will additionally write.

Operations in financial markets can bring both large potential profits and are associated with potential risks associated, among other things, with the effect of leverage and high volatility of instruments used in trading in financial markets.

The provided forecast is a subjective analytical assessment of the situation in the financial market and in no way is it a recommendation for opening deals, investing and developing your own trading strategy.

SkyWorks Solutions IncFriday, 27 November 2020

00:39 AM (WIB)

Skyworks Solutions Inc.

NASDAQ

OUR VISION

We are empowering the wireless networking revolution, connecting people, places, and things around the world. As the demand for ubiquitous, “always-on” connectivity increasingly expands, our innovative, high-performance analog semiconductors are enabling breakthrough communication platforms from global industry leaders – changing the way we live, work, play and learn. Through our broad technology expertise and one of the most extensive product portfolios in the industry, we are Connecting Everyone and Everything, All the Time.

QUALITY

We are passionately committed to providing our customers with the highest quality products, keeping their satisfaction and success at the core of our efforts. Our quality management emphasizes sustainable, continuous improvement.

SUSTAINABILITY

We are dedicated to minimizing our environmental footprint and cultivating safe and productive workplaces. Our policies and programs drive improvements affecting the environment, health, and safety, ethics, and labor practices.

CORPORATE SOCIAL RESPONSIBILITY

Skyworks wants to Make Every Connection Count – whether through our manufacturing operations or within the communities where we operate around the globe. Our CSR program spans environmental sustainability, supply chain responsibility, inclusion and diversity, and social impacts to ensure we are doing our part to make positive changes in the world, one connection at a time.

We Create Technologies That Make 5G Work

5G will transform our world, creating an ecosystem where everyone is connected to everything, all the time ─ and changing how we live, work, play, and learn.

Skyworks is at the forefront of this sea change. Leveraging our technology leadership, broad systems expertise, and operational scale, we are creating the solutions that will launch the true potential of 5G. A world of new and unimagined applications. From our breakthrough, SKY5® unifying platform to our 5G small cell and multiple-input, multiple-output (MIMO) technology, Skyworks' comprehensive approach across both infrastructure and user equipment facilitates powerful, high-speed end-to-end 5G connectivity.

www.skyworksinc.com

Best regards,

RyodaBrainless

"Live to Ride and Ride to Live"

SWKS loosing steam Skyworks is nearing a new high and running out of steam. Heres what the indicators say.

Sell/Buy indicators: SWKS has been marked a buy since 9/25. 4 trading days while our longest buy signal in the past 4 months has lasted 20 days. This is our only indicator not yet supporting a sell but can we spot it first? Lets check out the other indicators.

Moving Average: SWKS is slowly moving closer and closer to its moving average and if history repeats itself, once it falls below the MA we should see a sharp sell off.

Volume: The volume indicator shows we are starting to loose bullish volume.

Relative Strength Indicator: Shows that SWKS is over bought, we should expect some heavy selling because of this.

Indicators are just collections of information that can help us analyze trends to make predictions about the future. SWKS price movement is not guaranteed. Even if it does receive a sell signal. Please trade at your own risk.

Buy - SWKS - weekly chartsSWKS looks great on weekly charts in a strong move. we are testing the upward momentum line that I have drawn and I think this week should give us a good buying opportunity

Buy zone / Targets are mentioned on the chart

Close below 107.95 on daily candle may require us to reevaluate are trade

Indicative time for the play : 3 to 8 weeks

SWKS BUYBuy signal at 123.10 $

Skyworks Solutions Inc . designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. This company develops 5G technology.

If you want to see more history of this strategy, I will able to show you if you request me.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

SWKS Bending TrendA commonly missed trendline pattern is the bending that occurs in a momentum trend as buyers begin to disappear. Profit-taking by professionals can create a sudden surge of selling, which can easily drive price into a retracement or correction. Speculative price action is riskier to enter at this level as the runs are shrinking. SWKS may have more speculation but this is an expert level for a trade, and is not suitable for a new or novice trader due to the risk factors.

SWKS Weekly Bull Flag WatchSWKS forming a weekly bull flag.

Bulls must break 102.87 with increasing bull volume this coming week to give confidence that we are going up.

Daily time frame is a clear equilibrium pattern. I expect low trading volume until a break.

If we do not break bullish, expect daily consolidation and a weekly higher low to form.

I would also watch for correlation with QQQ and SPY. We all know the market has been very bullish for the past weeks. If we get any pullbacks in the market, I expect the bears to take over for SWKS.

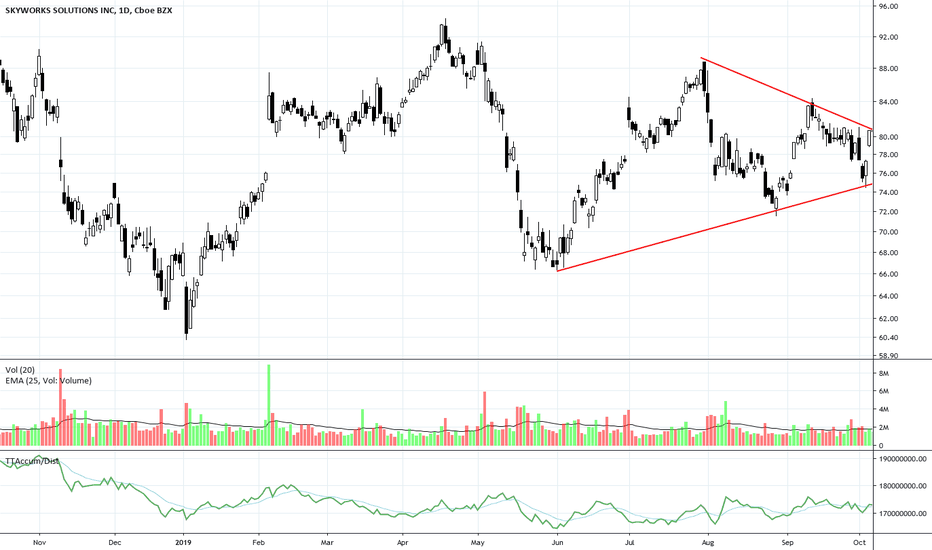

SWKS - DAILY CHART Hi, today we are going to talk about the Skyworks Solutions Inc and its current landscape.

Huawei and its suppliers received exciting news, as the U.S. Commerce Department renewed a 90-day period extension, that grants to American companies’ permission to continue to do business with the giant Chinese telecom companies. Commerce Secretary Wilbur Ross's announcement included that the need for extension was also due to the necessity of some rural communities of the Huawei 3G and 4G networks. The extension should keep the supplying chain going, principally of the Americans ones like Skyworks Solutions Inc that have its revenues highly exposed to Huawei demand (6% of its revenue) and have now another quarter of relief from the tension of loose a so significant company like Huawei. The concerning aspect it’s if this extension doesn't lift the results of its supplier on the next quarter, considering that the Chinese company might already be restructuring its supply chain, as the uncertainty created by the ongoing Trade War that ended blacklisting the company on the U.S. The Huawei CEO Ren Zhengfei also already have been clearly vocal that isn't concerned with the U.S decisions and said that Huawei could grow without the U.S markets.

Thank you for reading and leave your comments if you like.

To have access to our exclusive contents, join the Traders Heaven today! Link Below.

Disclaimer: All content of Golden Dragon has only educational and informational purposes, and never should be used or take it as financial advice.

SWKS BUY 04.09.2019BUY signal at 74.17 $

Skyworks Solutions Inc . designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. This company develops 5G technology.

If you want to see more history of this strategy, I will able to show you if you request me.

ATTENTION this strategy may has downtrend about 10-15%, so you can split your buy order, that you have not big downtrend.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

The signals rare but useful.

*I've rewrite this idea because I wrote the same idea for English (IN).

SWKS Take-ProfitSell signal at 102.10 $

Skyworks Solutions Inc . designs, develops, manufactures and markets semiconductor products, including intellectual property. The Company's analog semiconductors are connecting people, places, and things, spanning a number of new and unimagined applications within the automotive, broadband, cellular infrastructure, connected home, industrial, medical, military, smartphone, tablet and wearable markets. Its geographical segments include the United States, Other Americas, China, Taiwan, South Korea, Other Asia-Pacific, Europe, Middle East and Africa. This company develops 5G technology.

If you want to see more history of this strategy, I will able to show you if you request me.

__________________________________________________________________________

You can use the signals independently or like indicator of trends together with other indicators in your trading strategy.

Know that the success of your strategy that based on those signals depends from your money management and the additional conditions that you make in these strategies.

You use these signals inside your strategies at your own risk.

The chart shows the last trades on the product + the last signal.

I have several strategies for different products, and I want to show you proof of it works on history, and you will be able to see it, when returns to that profile.

Therefore, subscribe and watch for that profile.

The signals rare but useful.