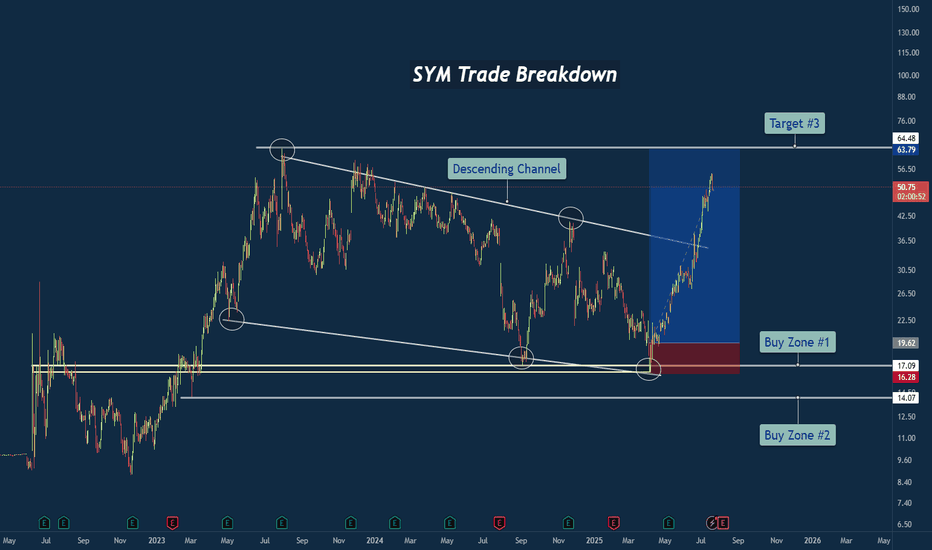

SYM Trade Breakdown – Robotics Meets Smart Technical's🧪 Company: Symbotic Inc. ( NASDAQ:SYM )

🗓️ Entry: April–May 2025

🧠 Trade Type: Swing / Breakout Reversal

🎯 Entry Zone: $16.28–$17.09

⛔ Stop Loss: Below $14.00

🎯 Target Zone: $50–$64+

📈 Status: Strong Rally in Motion

📊 Why This Trade Setup Stood Out

✅ Macro Falling Wedge Reversal

After nearly two years of compression inside a falling wedge, price finally tapped multi-year structural support and fired off with strength. This wasn’t just a bottom — it was a structural inflection point.

✅ Triple Tap at Demand Zone

Symbotic tapped the ~$17 area multiple times, signaling strong accumulation. Volume and momentum picked up with each successive test, showing institutional interest.

✅ Clean Break of Trendline

Price broke through the falling resistance trendline decisively, confirming the bullish reversal and unleashing stored energy from months of sideways structure.

🔍 Company Narrative Backdrop

Symbotic Inc. isn't just any tech stock. It’s at the forefront of automation and AI-powered supply chain solutions, with real-world robotics deployed in major retail warehouses. That kind of secular growth narrative adds rocket fuel to technical setups like this — especially during AI adoption surges.

Founded in 2020, Symbotic has quickly become a rising name in logistics and warehouse automation, serving the U.S. and Canadian markets. With robotics in demand and investors chasing future-ready tech, the price action aligned perfectly with the macro theme.

🧠 Lessons from the Trade

⚡ Compression = Expansion: Wedges like this build pressure. When they break, the moves are violent.

🧱 Structure Never Lies: The $17 zone was no accident — it was respected over and over.

🤖 Tech Narrative Boosts Confidence: Trading is easier when the fundamentals align with the technicals.

💬 What’s Next for SYM?

If price holds above the wedge and clears the $64 resistance, we could be looking at new all-time highs in the next cycle. Watching for consolidation and retests as opportunity zones.

#SYM #Symbotic #Robotics #Automation #AIStocks #BreakoutTrade #FallingWedge #SwingTrade #TechnicalAnalysis #TradingView #TradeRecap #SupplyChainTech

SYM

SYM Technical Analysis: Potential Bullish SetupSYM (Symmetry Group Ltd) is currently in an overall bullish trend and holding above a rising trendline. The price is currently at the Fib Golden Zone. The RSI is synced with price action, which supports the bullish outlook. In addition, there's a potential hidden divergence that could signal continued upward momentum. A possible gap fill towards 11.88 might also present a good buying opportunity.

Trading Recommendations:

Buy 1 (CMP): 15.05

Buy 2: 14

Stop-Loss: Closing below 9

Take Profit 1: 21

Take Profit 2: 26

Take Profit 3: Open

Happy trading!

Symbotic Inc. (SYM) Bullish Opportunity – Growth & Momentum Play🔹 Current Price: $21.65

✅ TP1: $24.50 – Short-term bounce from support

✅ TP2: $30.00 – Key previous resistance level

✅ TP3: $40.00 – Next major resistance level ( long-term )

🔹Stop Loss: If trading with leverage, consider a stop below $18-$19.

🔥 Why Are We Bullish?

✅ Strong Revenue Growth

35% YoY revenue increase in Q1 FY2025, reaching $487 million.

Company forecasts $510M-$530M in Q2, signaling continued expansion.

✅ Strategic Expansion with Walmart

Acquisition of Walmart’s Advanced Systems & Robotics business enhances automation capabilities.

Strengthens Symbotic’s competitive edge in warehouse logistics.

✅ Positive Analyst Sentiment

MarketBeat Analyst Target: $38.20, indicating a +76% upside from current levels.

9 Buy, 7 Hold, 1 Sell – Moderate Buy Consensus

✅ Technical Setup

Strong support at $21.00-$22.00, with MACD & RSI signaling a bullish reversal.

A break above $24.50 could trigger a rally towards $30+.

📌 Conclusion:

Symbotic is in a strong growth phase, backed by fundamental strength & technical confluence. A push past $24.50 could fuel momentum towards $30-$40, making it a prime bullish opportunity for both traders & long-term investors. 🚀

Symbotic Hypergrowth? $850 Price TargetOverview

Symbotic Inc. is an A.I. and robotics automation company based in Wilmington, Massachusetts that is looking to increase the ability for companies to keep up with growing demand. To do this, they utilize artificial intelligence software to maintain records and warehouse organization with the assistance of SKU numbers. Autonomous robots then account for, store, and retrieve items in a fraction of the time that it would take a human being. Symbotic's mission is to increase supply capabilities through the symbiotic relationship of artificial intelligence and robots. Its origins trace back to 2007, before it was known as Symbotic, and the company went public in 2022 ( NASDAQ:SYM ).

Call it FOMO, but I think Symbotic Inc. has the potential of becoming a hypergrowth stock. I built my own fundamentals tracker to get a pulse on the tech company's vitals and, while it still is not a profitable company, it looks like it's in the early stages of becoming so. The fundamentals for Symbotic provide me the confidence to invest despite the presence of red flags which led me to performing a deep dive. My price target for Symbotic Inc. is $850 with a projected timeline before 2030.

What I Don't Like

SYM has lost nearly 60% in value since July 2023 from a high of $64.15 to its current share price of $26.87. If you look up Symbotic Inc. on a search engine then you will also see that there are numerous law firms attempting to build class action lawsuits. The headlines can't help but to sow distrust by utilizing strong statements such as "misleading investors" and "inflated revenue" within their subjects. Within the last few weeks Symbotic had to file a delayed annual report due to self-identified accounting errors within their balance sheets. Also, if you dig through their filings, you will find that Symbotic Inc. was born from a deal with SVF Investment Corp which, according to the filings, was headquartered in the Cayman Islands.

I can only assume that the business dealings with SVF Investment Corp were to facilitate equity financing and an expedited public launch for SYM. From my findings, SoftBank Group Corp ( TSE:9984 ) is an investment conglomerate and the parent company to multiple subsidiaries. You guessed it, it is affiliated with SVF Investment Corp which functions as a "blank check company" for SoftBank. In my limited knowledge, this translates as a way for SoftBank to inject a substantial investment into the company that is now known as Symbotic Inc. No matter how savvy they may have been to launch Symbotic Inc., business deals that originate in the Cayman Islands typically raise one's eyebrows.

What I Do Like

Symbotic Inc. seems to have a pretty solid vision for global expansion and has attracted some significant institutional investors such as SoftBank, Vanguard, BlackRock, and Morgan Stanley to name a few. In fact, according to the NASDAQ site, 282 institutional investors hold 82% of Symbotic Inc.'s Class A Common Stock. Symbotic Inc. was founded by Richard "Rick" Cohen who currently serves as the CEO and is a legacy to the Cohen family who founded C&S Wholesale Grocers. Symbotic's technology is used by C&S Wholesale Grocers which is one of the largest privately held companies in the United States.

Symbotic and SoftBank have partnered on a separate venture known as GreenBox which is meant to deliver automated warehouses made possible by Symbotic's hardware and software. According to the company's site, GreenBox is supplying warehouses as a service to consumers. With an increase in online shopping, I believe that Symbotic is both seeing and filling a need in an industry that its founder is very familiar with. I can also envision Symbotic spreading its reach internationally which helps fuel my massive price target. Megacap stocks need to have a global influence and extend across industries, which Symbotic appears to be preparing for.

Fundamentals

Right now, Symbotic Inc. is in its early stages and is bringing in a negative income which makes it a risky investment. However, the company's total revenue has increased by 200% from 2022-Q4 to 2024-Q4; the gross profit has also increased by 147% in the same timeframe. Symbotic's net income has revealed consistent losses since 2022, but the 2024 annual report had the smallest loss on record at a negative $84.7M which is a 39% improvement from 2022 and a 59% improvement from 2023. No matter which way you cut it, the company is still absorbing annual losses so it will be important to keep an eye on improvements and deficiencies to identify any consistent trends.

NASDAQ:SYM has 585,963,959 total outstanding shares according to the 2024 Annual Report published at the beginning of December. This is a far cry from the 106M outstanding shares reported on some financial websites and even here on TradingView. From my findings, around 100M of Symbotic's shares are Class A Common Stocks and the remaining 485M are Class V Common Stocks. My focus is on the market capitalization which is a tool that I like to use when establishing long-term price targets. For Symbotic, which has the potential for global reach and use across multiple industries, I think it's reasonable to achieve a market capitalization of $500B.

Price Target

With the current number of outstanding shares at a market cap of $500B, this would place Symbotic's share price at $853. This type of growth would turn a $1,000 investment today into $31,710 at the projected target price; a whopping 3,000% return. HOWEVER, a lot has to happen to make this come to fruition. One thing I would like to see, in addition to profitability, is for Symbotic to begin buying back its own stock.

It's become my investing philosophy that companies who believe they are undervalued will buyback their shares while companies that believe they are overvalued will issue new shares. Symbotic's total outstanding shares have increased by 5.8% since its annual report at the end of 2022. I think that my philosophy is best tailored to established companies so it is possible that Symbotic could be an exception. Because the company is so new, it may need to issue more shares to generate enough capital to stay afloat while its roots set.

SYM to $89Overview

Consumers of artificial intelligence have garnered my attention, specifically cybersecurity and robotics automation companies. This is a hopeful attempt to obtain early exposure to industries that may thrive during the era of artificial intelligence. Symbotic ( NASDAQ:SYM ) is one of the those companies.

What does SYM do?

Symbotic Inc. utilizes artificial intelligence and robotics to enhance warehouse production. How this translated to me is that they support online shopping (ex: Amazon) by generating environments that can keep up with the demand through the use of robotic automation and artificial intelligence. This could be used in just about every business venture as a growing company will face the challenges that come with maintaining a healthy supply chain. This is why I believe Symbotic has a bright future ahead.

As of 24 July 2023, Symbotic and SoftBank ( TSE:9984 ) jointly founded GreenBox Systems LLC which aims to provide access to Symbotic's automations and software. The goal is to reduce inventory costs while simultaneously increasing capacity and management -- organization and collection. SoftBank has also vested in Symbotic with the purchase of 17.8M shares (worth $707,550,000 today) in addition to an unspecified amount of warrants covering 2% of outstanding shares. Warrants are similar to options except they are distributed to the holder directly by the underlying company.

Key takeaway: SoftBank is significantly invested in the A.I. powered robotics company.

2025 Price Target

Symbotic has been in a yearlong symmetrical triangle that appears ready for a breakout before the end of 2024. If a breakout does occur, I believe the share price will reach around $89 USD sometime in 2025. This price target was determined by utilizing uptrend Fibonacci retracement levels from the lowest and highest values of the current trading pattern.

Short-Term Price Target

A double bottom pattern appears to be forming which may see the share price diminish back to the $32-35 price range (yellow circle) in the near future. Should these price levels experience significant support, I believe the next area of significance will be the $41-42 price range (green circle). A breakout at this level may indicate a further rally.

SYM Technology @ WorkSYM has ascended YTD at a rate of 20% monthly and compounded. It has had consistent

earnings doing its thing which is providing robots to replace human labor in factories and

servicing them. Its products are in constant demand and growing. On the chart, SYM

is above the POC of the volume profile. Buyers have pushed the price higher and sellers

overall have not kept up with opposing momentum. Price is in the upper bands of both

the intermediate and short-term anchored VWAPs putting it in the fair to overvalued

range. I see SYM as continuing to rise as companies and industries with warehouses seek

to lower labor costs as a means to maintain their margins and survive the recession and its

consequences. For me, this is an obvious long setup with high potential.

SYM.ASX_Bearish Pullback Trade_ShortENTRY: 3.31

SL: 3.80

TP1: 3.07

TP2: 2.91-2.97

- ADX<25. Would like to be higher.

- Daily RS -ve

- Daily FFI -ve

- Weekly RS -ve

- Weekly FFI -ve

- Moving averages are aligned.

- Price breakdown on 23 Sep 2022 and then pullback.

- Candle on 10 Oct 2022 shows rejection of support-turn-resistance area with head wick and high volume.

- Entry based on today from pullback and rejection of support-turn-resistance area (3.46) with engulfing candle.