T-bonds

DRV - Short Real Estate NowMortgage rates are penciling-in to be around 10% on a first mortgage note by Jan/Feb - so everyone with a couple of brain cells to rub together knows what that will do to real estate prices.

Some good things will come out of this - like the Gen Z's in the market will get a chance to become homeowners, but in trading terms, this is a very good opportunity. DRV is an easy ETF symbol to broadly short the real estate market with - I recommend sitting on the thing for several months.

Shorting bonds directly works, but will vary by your broker for availability.

AMEX:DRV

How low can bonds go?Months ago, when 10 year bond futures were still 175, this weekly head and shoulders pattern jumped out at me. It looked so big and so bad I almost didn't want to believe it could play out.

Now, as we approach 135, this massive, fully triggered pattern may be the best indication of where bonds are headed: 125.

Sure, they could bounce a few times as they have done on the way down, but ultimately June 2011 lows are the likely stopping point on this decline.

BONUS: As you can see, I didn't count the massive March 2020 wick or include it in the measured move. Better to be prepared for the UB to overshoot the 125 target by a little or a lot before staging any meaningful comeback.

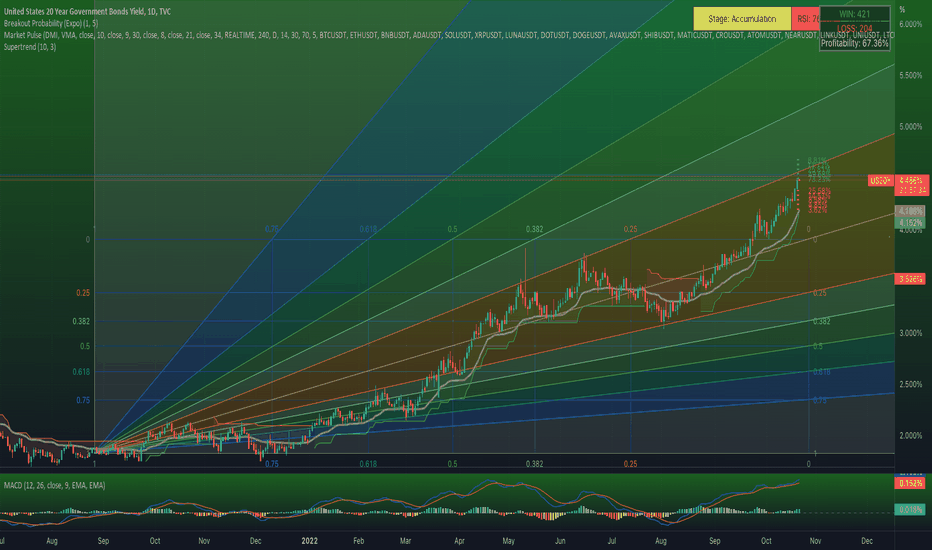

US Treasury 20 Year Bond Yield Curve - Year to DateWho would have thought we might be seeing 20 year guaranteed 10% returns on US Treasuries soon.. but it could certainly happen. Short the things on the way up, and keep your cash available to buy every one of them in sight on the way down.

Rates on a 3month Treasury are up an astounding 7,780% - Year to Date.

Actual end of an era. And it is happening fast.Western interest rates starting going back up in the end.

Looks like the whole "new paradigm" is over.

Money is not free anymore.

To sum up:

- Boomers got 110% of the wealth (other generations are in debt), they are aging and getting more conservative, covid got them even more scared and conservative (risk averse);

- Generally investor outlook on the economy which was not even positive for the last 20 years (buybacks and money printing were the bulls) is now rather negative;

- Average people are starting to notice the money printing. Memes and permabears are doing their jobs. And those that do not notice want to go far right or far socialist even thought they have no clue why they want to. So central bankers cannot continue to print to infinity;

- All the indicators clearly show people are not spending or lending their money since early 2020, they are hodling, no arguing is possible (unless the data is somehow incorrect), it is necessary to somehow entice them (with higher rates) to get that money;

- And boy does the west need the money

Bonus (technical):

- Well just look at it go

I'm going to go straight to the point and not go into a lenghty explanation about every point. i doubt many beginners are reading about the bund anyway. A shame, might be easy money...

The TA/chart reminds me of the typical textbook stairs up elevator down chart. Reminds me of AUDJPY when the "housewives" were mass buying the AUD because of high rates, and then all ran for the exits in just months. In the case of bonds people are not running for the exits but it's the same idea mirrored.

People with $$$ are not as eager to lend it anymore, and euro governments need as much magical ponzi beans as they can get to bounce back from the whole covid thing, and maintain fake prosperity and power for a few more years... or months.

Well french president Emmanuel Macron said "abundance is over" and warned we should get ready, so at least he is honest.

Germany has been teaching its population to warm itself without electricity last year.

France relies on nuclear power but hey guess what french nuclear worker are on strike, french favorite national passtime.

People have been spending less as you can see in this chart. So it takes a bigger carrot on a stick to get them to lend it.

Reminder: velocity of money is the frequency at which it is spent. Lower value on the chart means people are holding tight on their liquidities more.

Hey, people thought the USD not going to zero with all the printing and government spending and usstock bubble getting inflated would have no downside.

Ye investors were buying us dollars because they were optimistic and just super bullish on this awesome not-a-scam currency and us economy right.

I am also short on oil price will go down but for all the bad reasons, I'm feeling like the barrel price will be low low low but price at the pump will be high high high which won't even matter since the gaz station probably won't even have gaz.

Boomers got all the money and boomers are aging, and scared to die soon, they are starting to not care about progress. Average humans stay in denial so long, but once panic starts to hit does it go fast. Any herd thing goes fast.

I mean ask anyone that studies crowds. Mindless reptilian brains (85% of the population) at a concert watch a dozen people dancing like they are martians, they think they are so weird, then a few zombies start to dance and it's like a nuclear chain reaction all the zombie-sheep dance in seconds, only a dozen people are not dancing and the zombies stare at them and think they are weird stuck-up psychopaths.

One could potentially take at least 5R, even 10-15 if it accelerates down (/up). Does it get harder and harder to find people to lend money (especially as high IR makes people/boomers scaaaared we are becoming Argentina)? Or will the increasing rates convince more and more people to lend?

No one actually holds cash do they? Apart from boomers people have between $0 and 50k in debt and I am not making that up (most experienced traders know this). A handful of people we call traders have cash and they definitely are going long the interest rate (short the bund contract) - a few hundred retail traders going countertrend is like a few hundred mosquitoes trying to stop a herd of thousands of raging elephants, ye good luck guys just #HODL.

They could continue to monetize the debt and rob poor people, but poor people even thought they have no idea what is going on are starting to get pissed, want to destroy everything and go socialist or far right. When I say poor people I really mean middle class, from low middle class to upper middle class. So every one except hobos collecting food stamps and Bezos & friends.

Plus with the democratization of trading in part because of crypto and Robinhood, as well as permabears Peter Schiff and Mike Maloney reaching millions of people on social media, people are starting to figure out what is going on.

Even the US socialists have mentionned taxing unrealized gains, I am scared, why do they know about this?

Guess what happens when old people hold all the money? Guess what happens when those were promised they would live forever with magical futuristic cyber hearts? Guess what happens when hospitals are getting more and more expensive and they might (immediately) need all the money they have to afford lifesaving intervention (or they could just stop overeating but we all know this is not going to happen).

I wonder if covid reminded them of their mortality and they are done investing for the long term, or at all. I wonder if some lost trust in the west capacity to pay back, but I do not have the answer to that it is not part of the analysis. I know "10/10 AAAA++++" France got downgraded years ago. They should all get downgraded really but will they? In 2008 junk bonds did not get downgraded... Well anyway... I don't want to predict the future or be a lifetime permabear I just want to make some money. We are traders we do not care if everything implodes do we?

ROAD MAP FOR WHAT IS AHEAD DATA 120 YRS I am posting so you get the clear picture of what is ahead and just started . remember I stated HOPE well she is a girl in the lifeboat who just used the last of the fresh drinking water to wash her hair !! I stand by my work and DATA to back it up all 120 years of it !!!!

TLT @ MMA200 support; Bond market didn’t trust today’s bounce!TLT still going down despite today’s big bounce in equities. TLT stopped exactly on the monthly mma200 red line after breaking below 100 today Monday.

TLT should hold mma200 this week or else bonds & equities have a lot more to fall.

Not trading advice.

DJI and Bonds: Get your popcorn ready. In this short video I focus on the UK and US 10 year bond markets in comparison to the DJI.

All these markets are linked up in the background - at the speed of light.

There are no predictions here - only probabilities and speculation.

High volatility is expected at the opening of the markets tonight, 16th Oct 2022.

Some are predicting a 'Black Monday' type event next week, which doesn't have to happen on a Monday. I take no sides. I'm only protecting my losses in short positions and happy to let winners run.

Stay safe, wash your hands, protect your positions, don't burn your accounts. 😁😂

Disclaimer : This is not advice or encouragement to trade securities or any asset class. Chart positions shown are not suggestions intended to assure you of an advantage. No predictions and no guarantees are supplied or implied. The author trades mostly trend following set ups which have a low win rate of approximately 40%. Heavy losses can be expected if trading live accounts or investing in any asset class. Any previous advantageous performance shown in other scenarios, is not indicative of future performance. If you make decisions based on speculative opinion expressed here or on my profile and you lose your money, kindly sue yourself.

Great Trades are Rarely Crowded: Long TLT and Short Twitter IQEveryone is a good trader in a bull market, but in a bear market, these good traders are reduced to hopium-fueled twitter analysts watching core CPI and interest rates. The former and latter data points serve nothing more as useless, out-of-context generalities for the single-celled Wall Street Bet retail enjoyer. But recent activity across the pond has sparked interest in the bond. These traders are now converting en-masse to self-proclaimed bond market experts with the thesis:

"The bond market is broken"

Except, the bond market is not broken. It is operating as intended, although two lines on a chart may disagree with anyone unfortunate enough to buy at the start of the year. Why is retail sentiment like this?

The simple answer is that the fed is late, but a more-elaborate explanation follows:

Bond yields rise because bond prices fall. It is the acquisition of a bond at a specific market price that determines that bond's yield, as a function of the difference between that bonds underlying rate (which is fixed) and the resale price. When interest rates rise, bond prices fall because newer bonds spawn with the higher base rate. This makes prior bonds, which have a lower fixed rate, less valuable because they output less extra cheddar. People then resell these bonds for a lower price and the yield rises according to market forces (the fed does not directly control this). Shorter duration treasuries follow interests rates very closely, whereas longer dated treasuries are difficult to influence by rate hikes. Either way these are secondary or tertiary market effects. This phenomenon is what results in an inverted yield curve: you can be paid more money to lend money for a shorter duration than a longer one.

But why would something so illogical even happen? The answer is because the treasury market is not just any pig, it's a truffle-sniffing pig. For every brain cell in the equity or corporate credit market, the treasury market has a thousand-fold more. With these one-thousand brain cells, this pig (specifically the longer-dated pig) is rewarded by looking further ahead into the future. What does this pig see when they look that far ahead? An recession that will obliterate the equity market like Exodia. The long dated treasuries have started to price in a recession (very slowly) by pricing in rate cuts. This is why stocks and bonds are still correlated, but the correlation has started showing signs of weakness. The longer tail of the curve is smarter and refuses to sell these bonds like a fire sale.

Recessions imply a fed pause and eventual rate cut, so no more high-interest treasuries. This makes bonds desirable, and this process is only starting now.

I can already feel the credit market enjoyers seething and muttering: SLR relief expired! Reverse Repo! Basil Tea! No, none of these buzzwords matter. It's true that the pandemic has modified the initial conditions of the bond market. The TLT suffered immensely as the federal reserve promised to not raise rates through forward guidance, broke those promises (as is should have), and also allowed SLR Relief exemptions to expire. This made bonds less sexy and glamorous for banks like JP Morgan because the expiry affected treasury exemptions: banks didn't need to hold additional collateral to slurp bond yields, and now they again do. It's much easier now to park money with the fed overnight and get a little more back. The RRP is a much better facility than treasuries as a result, so bond indexes have dropped even harder. SLR relief is a cherry on top, but this truffle has always tasted good without it. It's absence, and whether it is reinstated or not, should not be a determining factor in the recovery of bond prices, because:

No market has currently priced in a recession, and interest rate expectations demonstrate that without a chart, but when that happens, the bond market will get top billing. Bonds will decouple from stocks and TLT will rise from the ashes like a phoenix in the next quarters, incinerating twitter and reddit soys drawing lines on a chart and shorting the index. Nobody saw it coming, they will say, but good trades are never crowded. Smart money extracts the deep value from TLT in the pre-recessionary market by going long (DCA or otherwise). Degenerate smart money is gambling with TLT long calls. Whereas most of the market is still buying stocks, crypto, and chanting that the markets are broken and the fed will come roaring in. These pigs won't find any truffles in this market.

Interest rate expectations are unrealistic and the fed will have to pause sometime early 2023. The recession will destroy demand, taking growth, inflation, and equity market with it, rising bond prices and dropping bond yields. The stock market will crash (I don't consider this current price action a crash yet) and continue burning even as the fed pauses, and dip buyers will be buying a dip that keeps on dipping while you're selling your new truffles on ebay because you lost your job due to mass layoffs across the entire economy.

Bonds Recover After CPIBonds took a dive to break lows and hit our target of 110'05. A green triangle on the KRI confirmed support and we immediately the dip was immediately bought back, and we recovered the range between 110'27 and 111'26. We are currently hugging the upper bound of this range. The move followed yet another hotter than expected CPI print and a slump in retail sales. The Kovach OBV is slumping, so we expect the range to hold as the markets digest this data.

#TLT approaching long-term channel supportStarting to get interested in US bonds here... If you look at this chart since 2023 using fibonacci channels and uptrend support.. we could well start to see a bid in Bonds here. Also note that the weekly RSI is starting to show signs of divergence here which could be warning of a rally to come.. We could still flush down to 103 but i think i would start building a long term position here with a view to add as we move lower

The Bank of England to end gilt purchase programEUR/USD 🔼

GBP/USD 🔽

AUD/USD 🔽

USD/CAD 🔼

XAU 🔽

WTI 🔽

Amidst domestic financial turbulences, the Bank of England announced an emergency program to purchase UK government bonds - which will end on Friday. The decision was made public earlier by the central bank’s governor, a sudden spike in the Claimant Count Change readings to 25,500 was also detrimental to the British Pound, which made GBP/USD plunge below the 1.100 level to 1.0963, losing over 100 pips.

EUR/USD first closed at 0.9703 with minor gains, then climbed to a high of 0.9773, currently at 0.9684. The European continent had growing tensions after the Russian retaliation targeted Ukrainian civilians, as a mobilization in Belarus becomes more likely.

Fearing a resurgence of the pandemic in China, AUD/USD closed lower at 0.627, and briefly peaked at 0.6342. A possible stall in oil consumption also sees WTI oil futures gradually declining to $89.35 a barrel. Gold was last traded at $1,666.29 an ounce amidst a volatile session.

USD/CAD fluctuated to 1.3796, though the FOMC Meeting Minutes will be released early tomorrow morning, the market doesn’t expect new insights to swat the Federal Reserve’s determined hawkish stance.

SLR Policy Decisions the root of InflationThis idea is a primer for ideas on how the FEDs decision to suspend the Supplemental Leverage Ratio for COVID and Implement the Overnight Reverse Repo while printing QE has led to the complete collapse of the bond market and began the era of sticky inflation.

If you overlay the 10Y Breakeven Inflation rate with Year over Year then circle the dates when Jerome Powell Eased SLR for covid and when it expired and implemented changes to overnight repo.

You get a clear sense of how the policy decisions around SLR/Overnight Repo while continuing to print dollars is a clear driver for a decline in bonds and equities while also driving up inflation, DXY and Commodities.

TLT has completed a massive multi-year head and shoulders and over a half dozen daily bear flags.

TLT recently broke through 2014 lows and already flagging lower to 2008 levels.

More to come. It's a fascinating time to analyze markets.

Wish you saw this coming? Hit the like and follow.

Below are charts and ideas I created with warning signs over the past 2 years (I didn't know what some of them meant at the time) but I do now.

When USD Hits Resistance, That's When USDMXN Will Breakdown In today's video I will look into a detail analysis of USDMXN, which is doing quite well compared to the strong USD Index. So my assumption is that when USd index will hit resistance, possibly after the 10 year US notes completed the current fifht wave up, the USDMXN can easily break through the support and will be targeting Feb 2020 pandemic low.

Crude oil is also very important for the USDMNX. Price is higher for the last two weeks as the situation between Russia and Ukraine is getting worse. OPEC also decided in its first one-on-one meeting since 2020 to cut production by up to 2 million barrels per day from November. So it appears that EU will not have easy task to limit the energy prices.

If you like this video, please leave me a comment below and press like.

Thank you

Grega

#DXY - WIN or LOSS Hello my Fellow TraderZ,

Currently this is the most important chart most of the traders eyeing upon - #DXY.

#DXY - an index containing the graphical representation of the strength of $USD against major currencies of the World.

We can see the #DXY is enjoying the Parabolic Blow off phase after making DOUBLE BOTTOM in JUNE 2021.

Now , after breaking certain important levels, it is approaching towards MONTHLY level of 120 after Dotcom Bubble in 2001.

As I can see we could possibly have two scenarios to play in the coming days :

1. GREEN - here #DXY will continue its path to 120 giving more pain to Equity markets.

2. RED - here I'm assuming this one to play (anticipating FED's soft behavior towards Rates' Hike), then we could see a retracement towards the 102 allowing Equities to enjoy relief rally in 3-5 months following a major crash globally which could possibly lead to mark the Cycle BOTTOM.

NOTE : - Not a Financial Advice, just my speculation.

CHEERS!!!