AUD eyes yield advantage over USD UBS strategists view the Australian dollar as a compelling long opportunity at current levels, supported by expectations that the Reserve Bank of Australia will ease policy more gradually than the U.S. Federal Reserve.

The bank forecasts 75 basis points of rate cuts from the RBA through Q1 2026, compared to 100 basis points from the Fed—helping to preserve a relative yield advantage for the Aussie.

On the daily chart, AUD/USD remains within a well-defined ascending channel that began in late 2024. The pair recently bounced off the lower boundary of the channel near 0.6450, with long lower wicks potentially indicating dip-buying interest.

Immediate resistance could sit at 0.6600, followed by a major zone near 0.6670. A break above these levels could confirm bullish continuation.

TA

NQM2025 outlook for the week ahead 05/19/2025Hello World.

for the week ahead i have a bullish bias im looking to target the bearish fvg created on mon 24 feb 2025 ( daily TF) i expect the fvg formed on tue 13may2025 (Daily TF) reject the price higher, if the bullish fvg didnt hold maybe we will se a drop to the V.I bellow.

i will give updates

Apple respite before sell offApple bounced straight of major support at circa $170, with the SMI now also rising we could see a few weeks of short term respite before continuing down to test the major support line again. Also notice a backtest of the rising trend at around 21%.

Long term view is still bearish, don't think we've seen the yearly bottoms yet. Will be interesting to see how this plays out especially with bonds.

EURAUD - Long-Term Correction in the Making!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈EURAUD has been bullish trading within the rising channel in blue.

Currently, EURAUD is retesting the upper bound of the channel.

Moreover, the $1.84 - $1.87 is a strong weekly resistance zone.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper blue trendline and green resistance zone.

📚 As per my trading style:

As #EURAUD is hovering around the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

BTC - Bullish Control, Confirmed!Hello TradingView Family / Fellow Traders! This is Richard, also known as theSignalyst.

🚀 As per my last two setups (highlighted on the chart), BTC rejected the $72,000 support and pushed higher with strength.

📈 This week, BTC broke above the $90,000 structure, confirming a shift in momentum from bearish to bullish.

🟢 For the bulls to stay in control, a break above the $95,200 resistance is still needed.

📊 In the meantime, as BTC retests the $89,000–$90,000 zone, we’ll be looking for medium-term trend-following longs to catch the next impulsive move.

📚 Reminder:

Always stick to your trading plan — entry, risk management, and trade management are key.

Good luck, and happy trading!

All Strategies Are Good, If Managed Properly!

~Rich

XRP - Two Longs on the Horizon!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈 Medium-Term: XRP broke below the $2 support zone last week, shifting the momentum from bullish to bearish.

📍 As it retests the lower bound of the channel — which perfectly intersects with the orange demand zone and the $1.5 round number — I’ll be looking for short-term longs.

🚀 For the bulls to take over in the long term and kick off the next bullish phase, a breakout above the red structure at $2.15 is needed.

Which scenario do you think will happen first — and why?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

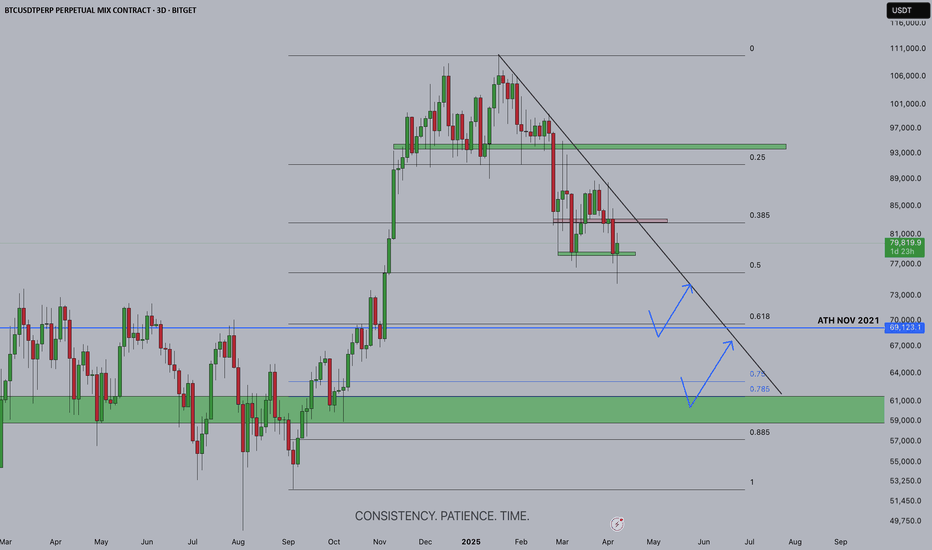

BTC 3D Market BreakdownBitcoin is currently trading around $79,200 on the 3-day chart and is sitting just above the key 0.5 Fibonacci retracement level from its most recent macro impulse. The chart shows a clear descending trendline acting as dynamic resistance, reinforcing the ongoing downward pressure on price. Until this trendline is broken and retested from above, market structure remains bearish in the mid-term.

After a strong rally to $108K, BTC was rejected near the 0.25 Fibonacci level at $93K. Since then, it’s formed a series of lower highs, confirming that bulls are losing momentum. The 0.385 retracement level, which aligns with the $85K region, has now acted as resistance multiple times, indicating a strong ceiling unless volume and price action shift.

Price is now hovering above the 0.5 retracement area (~$78K–$79K). If this zone fails to hold, Bitcoin is likely headed toward the 0.618 Fib level near $73,747. This level also aligns with the previous all-time high from November 2021, adding to its historical importance. While some buyers may attempt to defend that level for a short-term bounce, the real macro demand lies lower.

The green zone around GETTEX:64K to $61K is the highest confluence support area. It matches both the 0.75 and 0.785 Fibonacci retracement levels, and overlaps with the major accumulation and breakout structure from Q4 of 2024. If BTC trades down into that region, it would present a much higher probability bounce zone and a potential macro higher low — if bulls can defend it.

Until Bitcoin flips the descending trendline and reclaims $85K with conviction, the market structure favors downside continuation. A reclaim of $85K would be a significant signal for bullish momentum to return, especially if it comes with a breakout retest of the trendline. For now, however, the path of least resistance remains to the downside, with $69K and then GETTEX:64K –$61K as the next key support zones to watch.

In summary, Bitcoin remains in a corrective structure beneath its trendline. A move into $69K may offer a reaction, but the most meaningful support lies in the GETTEX:64K –$61K macro zone. Patience is key here, as buyers wait for either deeper value or a clear shift in trend.

BTCUSDT BinanceBTCUSDT Binance

4H hollow candlesticks

A descending parallel Channel has been formed, after the ATH (all-time high) at 110165$.

We can expect a price correction about 67338$ that is exactly the red line, as also the price drops to 62,000 and a flash a wick to 52 -53,000$.

The bar pattern (flipped fractal) has been formed from a previous movement, indicates a future price movement.

We can also see the current Support and Resistance areas.

Market Cap: $2.75T +0.42%

24h Vol: $48.68B -30.46%

Dominance: BTC: +60.5%

ETH: +8.7%

Good Luck

#CryptoHellas Team

GBPAUD - Already Over-Bought!Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

📈GBPAUD has been bullish trading within the rising channels in orange and red.

Currently, GBPAUD is retesting the upper bound of the channels.

Moreover, the $2.085 - $2.1 is a strong resistance zone.

🏹 Thus, the highlighted red circle is a strong area to look for sell setups as it is the intersection of the upper trendlines and green resistance zone.

📚 As per my trading style:

As #GBPAUD approaches the red circle zone, I will be looking for bearish reversal setups (like a double top pattern, trendline break , and so on...)

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Trump and the Market's Turmoil📉 Hey hey, here we are. It's been an eventful last week or two to say in the least for everyone. We've seen one of the worlds most followed stock-market benchmarks slide into correction territory following some of Trumps remarks and actions in the last week or two already under his administration prompting fears and a growing pessimism from Investors with Washington's whipsaw of policy changes an announcements, particularly in reference to the latest tariff's trump has been threatening other countries with and imposed.

📉 Currently CNN has the Fear and Greed Index for the market at 21 signifying Extreme Fear driving the market which for the most part is thanks to trump following all the anxiety surrounding Trump's tariff threats and actions. On top of this in Trumps' latest Fox interview on Sunday when asked if he was expecting a recession this year Trump responded in full; "I hate to predict things like that". Understandably so, this prompted a rather steep sell off and turn around for the SP:SPX leading investors to exit and jump ship rather quick.

📉 Understandably so, the markets are in turmoil right now, Investors are trying to figure out what our next move might be, as to whether or not we'll possibly slide more now that we're in correction territory or whether or not we've reverse and manage to regain and recoup some of the ground we've lost following the slew of announcements, tariffs, and threat's trump's made the last few weeks.

📉 We're basically stuck within this descending channel so for technical analysis we'll have to lookout for a clean breakout before we can anticipate or look to any upside or positive moves back up, and even so we already know that'll be much easier said than done, especially with Trump still threatening tariffs and Investors worrying about the impact all these actions will play in the near future and further out.

📉 Today's already going positively with us seeing a 600 point bounce already but we already know it'll take much more than just one green day before we can hold that outlook, especially after what the last week or two have done to us.

📉 I'll leave the idea here for now, we'll be back to keep things updated and posted but definitely keep an eye out for a breakout and we'll be looking to our 200 EMA to watch for a convergence which would be a great help if we could regain that and hopefully get out of this Extreme Fear sentiment.

📉 Till then, wishing all the best, thank you sm for all the support and till next, have a great day!

~ Rock '

Doge Showing BUY signal While Using Easy Machine Learning Method

TL:DR

Currently Analyzing DOGE because one of my clients asked me to create a customized indicator and parameter set for him, and these are the results. Long story short, a backtest shows that the custom indicator and parameter set will yield 7000%+ profit compared to buying and holding DOGE which only resulted in 400%+ profits. According to that indicator, DOGE is currently in another buy state. Let me walk you through how I did it, the details and nuances, and next steps. Please let me know if you agree or disagree with me. I have a breakdown of the script and here is the link for it:

www.tradingview.com

Here is my general process for validating whether a script will be successful:

1) Determine performance vs buy and hold

In the world of technical analysis, you must have a benchmark to compare your results to. Depending on your goals, that benchmark can vary. For my goals, I believe it makes sense to compare indicators directly to the buy and hold scenario, but in some scenarios, it makes sense to use other metrics to compare your indicator against (I'll discuss this in a future post.)

When comparing your indicator to a buy and hold, I PREFER to use a 100% order size and this is obviously UNREALISTIC because there aren't many traders who dump 100% of their equity into a single investment. However, because I am doing a comparison test, it is important to max out the indicator since we are comparing it directly to the buy and hold. Similarly, we don't add in any trade costs, which mean I am neglecting the commission, fees, and slippage, which again show this is unrealistic. Again, the reason I do this method is so that I can verify if the indicator is any good or not. A "good" indicator will have consistent results and beat the buy and hold over the course of a long duration with a large number of trades. a "bad" indicator will be inconsistent, which may refer to huge drawdown, or periods of time where it is unsuccessful/unprofitable. The difference between a 'good' indicator and a 'bad' indicator in this context is that a 'good' indicator will be able to absorb some of the trade costs (mentioned earlier) whereas the 'bad' indicator can't be fixed. Trade costs, especially commission and fees, are highly dependent on number of trades. So if a 'good' indicator performs well on a 1 minute chart against the buy and hold, but it starts to fail when trade costs are accounted for, then you can still adjust the indicator or timeframe so that you perform less trades, which will reduce the trade costs, but still maintain the profits. Again, a 'bad' indicator is dead in the water if it can't outperform buy and hold in the first place.

In this example, we have DOGE performing at +400% profits. In the same time period, this strategy would have yielded 7000%+ profits in the same time period. Therefore, these results show that the customized parameter set and indicator work well, and should be considered as a 'good' indicator to use for DOGE. The next step is to add in trade costs, and modify the timeframe IF NECESSARY. Most likely, from my experience, a strategy that yields 7000%+ profits won't suffer significantly from trade costs, and will still be SIGNIFICANTLY better than the 400% DOGE buy and hold scenario, which ultimately leaves my client and I with what he requested: a solid and profitable strategy that he can use to alert him when to buy and when to sell DOGE.

🔔If you'd like me to come up with a custom indicator and parameter set for whatever you trade, please send me a message and I'll work on it ASAP and make a post about it!

🙏Please respect each other's ideas and express them politely if you agree or disagree.🙏

🔔Be sure to follow the updated ideas.🔔

Please do not forget the ✅' like'✅ button 🙏😊 & Share it with your friends; thanks, and Trade safe.

With Major Liquidity Swept and RSI reset Bitcoin is now going UPIn the last few days, after achieving a new all-time high of $108,000, Bitcoin has experienced a massive dump, liquidating many retail traders using leverage. This market downturn was caused by several factors. First, Bitcoin was severely overbought and overdue for a correction. Second, Jerome Powell added to the market uncertainty by making strong anti-Bitcoin statements, dashing hopes of the U.S. adding BTC to its Federal Reserve reserves.

As a result, the market saw a steep fall, with major altcoins such as SOL and DOGE dropping over 30%.

The Main Question: What’s Next?

Bitcoin is unlikely to go up from here in the immediate term. Instead, it may be better to position for a short targeting the $90-91K range. The market might remain bearish over the Christmas holidays, giving “holiday discount” vibes. It’s not a good idea to buy Bitcoin with leverage at this moment. Waiting until next Monday to reevaluate might be a safer option.

Technical Analysis:

As highlighted, Bitcoin has broken out of an ascending channel and dropped significantly. One of the key technical reasons for this is the overbought RSI. Major resistance is currently around $99.7K , while key support lies between $89.5K and $87.5K . A break below these levels could indicate a strong move in either direction.

The most liquidity is around $92.2K , where Bitcoin is likely to gravitate before making an upward move. Additionally, RSI has hit a support level, which increases the possibility of a bounce from here.

Outlook:

After the holidays and once Bitcoin sweeps the lower liquidity levels, we could see an excellent buying opportunity . There is potential for BTC to reach $118K by the end of January . Moreover, Donald Trump’s inauguration could act as a catalyst to drive Bitcoin’s price higher once again.

TIA still seems to be bullishFrom where we placed the green arrow on the chart, it seems that TIA has entered a bullish diamond diametric, and is currently in the middle of wave D.

We expect wave D to complete and wave E to start from the green range.

Targets are $10, $12, and $14.

A daily candle closing below the invalidation level will invalidate this analysis.

For risk management, please don't forget stop loss and capital management

When we reach the first target, save some profit and then change the stop to entry

Comment if you have any questions

Thank You

Technical Review - EuroSports Global Ltd (SGX: 5G1)Our proprietary indicator had spotted a significant uptick in interest in SGX: 5G1 over the past few trading days, with its share price once breached the key resistance level of $0.200. Based on the fund flow indicator (as represented by the red bar), there is collection activities ongoing for 5G1 currently.

We remain positive on the upcoming price movement of 5G1 with our short term TP being set at $0.300, which is the previous high level for the company, while supported strongly by the EMA20/50 levels at the current price, $0.175.

BTC - Short-Term Bearish?Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

The BTC market structure has been very clean lately, which I find interesting.

📉Previously, after breaking below the last major lows (marked in red), BTC dipped .

📈Similarly, after breaking above the last major highs (marked in blue), BTC surged .

🔄 If history repeats itself, and the current last major low marked in red is broken to the downside, we can expect another dip in BTC.

However, as long as BTC continues trading within the rising orange channel, the overall short-term trend remains bullish.

🕝What do you think? Will BTC break below the channel for a bearish correction to start, or will it keep pushing higher within the channel to test the $70,000 round number?

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

SCA/USDT NEW INCREASE VOLUMESCA/USDT shows the low time frame possibility for new volume which can affect the price for an uptrend. ( depend all on high chance) There are no guarantees in the markets.

The new increase volume updates always start with interest if there is a confirmation to follow and if there is a building with a hold for a time.

90% of coins this time are not building coins. Some % also show a start fake trend and return to where it started. time frame confirmation + high levels building is important for a healthy coin.

EURCHF BUYSHello guys let me go over why buys were valid on EURCHF and what is my task for a price to complete. As you can see price is clearly in a downtrend. Knowing that strong move needs a recovery and then to continue to the direction of the trend, buy to sell setup made sense to me. As you can see price came all the way down, broke an important structure and created it's own independent trading range. It mitigated the blue line, while making structure shift on smaller time frames. With stop loss being put below the low, minimum RR for this trade was 1:2.5 which is not that bad at all! Let's see what price will do next.