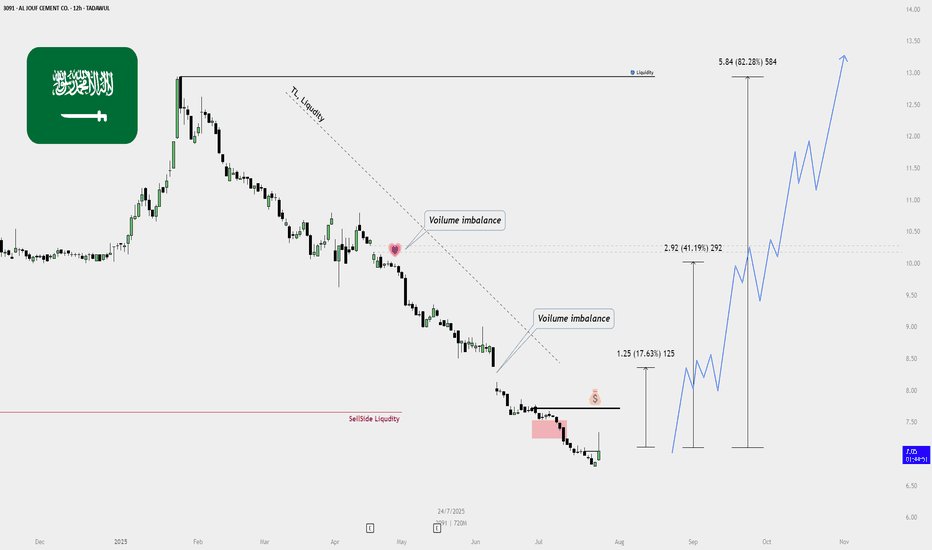

AL JOUF CEMENT – BUY PLAN (TADAWUL: 3091)📈 AL JOUF CEMENT – BUY PLAN (TADAWUL: 3091)

✅ Current Status:

Price: 7.09 SAR

Action: Initial entry taken — some shares added to My portfolio.

🔍 Technical Overview:

Sell-side Liquidity Cleared:

Previous lows taken out, triggering liquidity sweep.

Strong reversal suggests potential shift in market sentiment.

Volume Imbalances (Voids):

Bullish targets marked based on unfilled volume gaps:

📍 Target 1: 8.34 SAR (➕17.63%)

📍 Target 2: 10.01 SAR (➕41.19%)

📍 Target 3: 12.93 SAR (➕82.28%)

Trendline Liquidity Above:

Long-term descending trendline can act as a magnet for price, drawing it upward.

Bullish Confirmation:

Price has reacted from a bearish fair value gap.

Clean bullish engulfing and strong volume — suggests start of reversal.

🎯 Buy Strategy Breakdown:

Step Action

✅ Partial buy/entry completed (accumulation started)

📉 Wait for small pullback or bullish continuation to add more

🛡️ Stop Loss: Below recent swing low (around 6.50 SAR)

🚀 Targets: TP1 – 8.34, TP2 – 10.01, TP3 – 12.93

🔁 Re-evaluate plan if price closes below 6.70 with volume

Tadawulstocks

1150 IS PUSHING LOWERBack in January, I posted to buy 1150, but the market managed to take the opposite direction tp come lower and lower due to the conditions we currently have.

Now the price is pushing towards the level 24.24, we'll see how it will act around the level, but probably it will break through it and reach the next level at 21.92.

So for now don't buy anything on 1150.

Meanwhile, there's a golden opportunity for those who wants to learn how to trade Saudi Market, since it is in a level where you have all the possible configuration you'll face while running low.

Let me know if you got further questions!

2222 WILL GO LOWERAramco is one of the stocks everyone's wanting to buy, but the problem is all it does is going lower and lower.

As you can notice on the cart, we have both an FVG (highlighted in purple) and a Gap (highlighted in orange), which both the price pulled back on and started going lower.

For now don't buy it, just hold your funds till I post about buying it.

The comment section is all yours for further questions!

Follow for more!

1120 IS PREPARING AN ENTRYDear Saudi Traders,

Been a while since I last posted, and here I am now with the pdates on the market.

We're all aware of the American-Saudi Business situation and how it affected the markets last week, yet we don't know for how long it will last and how lower the markets will get.

However, TASI shows that the price will continue in its normal movement before what happened last weekend.

Now we'll just wait for the market to fill the gap I highlighted in orange to get our entry based on it.

Mots of people lost their money in the market, some lost all of their wallets, my clients too lost a large mount of their portfolio, however we'll get through that and recover.

The comment section is all yours for any questions or help!

Follow for more!

1201 IS ONE OF THE STOKS ON MY WATCHLISTEid Mubarak Said, Now since we're getting back to work sooner, I want to share with you some of the stocks I have on my watchlist.

For 1201, you can buy as soon as the price goes through 9.53 level to target 11.14, and your stop must be at 8.59.

Follow for more!

2310 ALMOST AT THE PRICE GAPCouple days ago, I posted that 2310 will continue going lower to reach 20.02 before starting to go higher again.

And here is the stock coming lower to our Price Gap to fill it before starting to raise.

Meanwhile, I'm waiting for the stocks I shared to my clients to get a bit far from the entry so they can make profits from them, then I can post them to the public.

Follow for more!

2222 WILL GO LOWER2222 is also one of the stocks that are showing no indication that it will come higher anytime sooner.

We'd expect from the price to drop to 23.90 before reversing, if you're welling to buy I advice you not to.

While waiting for other opportunities, my clients and I are holding on 3 other stocks I will post as soon as the market starts going higher.

Follow for more!

TASI IS PREPARING AN ENTRYAfter that TASI has taken the liquidity at 11,553, it just gave us an indication that it will start going bullish, no clean entry for now, but we'll keep waiting.

Meanwhile, my clients and I have taken other trades on 3 other stocks that are still in a safe zone, waiting for them to go higher so I can share them to the public.

As soon as I catch the entry and share it to my clients, I will share it to the public.

If you really care about taking clean entries, you must wait for the confirmation of the up movement then you can have a safe entry.

Follow for more!

1182 IS STILL GOING LOWER As you can notice on the chart, 1182 is still going in a bearish trend to reach at least 11.36 before it starts creating an entry to take, for now don't buy it since it will continue dropping down.

In few days I will share with you the trades I gave to my clients!

Follow for more!

Bearish Setup on United Electronics Co TADAWUL Weekly TimeframeStructure & Market Behavior:

The market made a strong bullish move from the green highlighted zone labeled as "unmitigated order flow", pushing up with a clear Break of Structure (BoS) on the left side.

A strong rally continued until it peaked (highlighted by the blue dot).

After the peak, the price dropped, creating a Lower High (LH) and Lower Low (LL) structure, suggesting a bearish shift.

Key Elements Marked:

Order Block (OB): A bearish OB is marked on the right side near the current price level (~96.4). This could act as a resistance/supply zone.

Equal Highs (EQ_H): Indicating a liquidity pool where market makers may hunt before a reversal.

Market Pattern: A minor bullish bounce is expected from current levels before a sharp drop.

Forecasted Path:

Price might grab liquidity above EQ_H (false bullish move), then reverse sharply downward.

Target area: Green zone near 40-50 SAR — previously unmitigated order flow/demand zone.

Final projected low is marked around 31.75, which might be an exaggerated worst-case scenario.

Conclusion:

Your chart suggests that the price is in a distribution phase and likely to experience a major sell-off after a liquidity grab above EQ_H. The long-term bearish bias is supported by:

Order block rejection

Equal highs as liquidity targets

Previous bullish rally needing rebalancing (Fair Value Gap / Order Flow)

RIYAD BANK - Weekly Chart (TADAWUL)RIYAD BANK - Weekly Chart (TADAWUL)

Current Price: Around 30.60

Target Price: 42.90 (marked with a heart 💗 at the top)

Plan:

Price may first drop a little (towards 27–28 zone), then move up strongly toward the target (42.90).

Important Zones:

FVG: Areas where price may bounce or react.

OB (Order Block): A strong resistance zone.

Change in Status: A possible support area where the trend might change.

Overall Idea:

The chart shows a possible move down first, then a big upward move toward the 42.90 target.

6015 IS ABOUT TO GIVE US AN ENTRY TO TAKECouple days ago, I posted that 6015 will come lower to 2.14, if you listened and followed my advice and closed your positions, congrats!

But if you don't and you kept holding, I hope you didn't lose too much of your funds.

For now there's no clear entry to take, we'll keep waiting for the price to give us a proper entry to follow, which I will post a bit late, 2/3d after I share it to my clients so you can see how it goes.

Follow for more!

Morning Star formation on Daily TF but..Morning Star formation on Daily TF.

Monthly Closing above 29 would be a Positive Sign.

However, 28 - 29 can be a Good Support Zone.

28.50 should not be broken, otherwise further

Selling Pressure can be witnessed.

On the flip side, 32 - 32.50 is an Important Resistance.

However, only Morning Star formation is not enough, because

it is currently at Strong Resistance around 32 - 32.5, so

let it sustain this level.

Sustaining this level may give 2-4 riyals gain.

NOT A GOOD TIME TO BUY 4007If you have a look at the chart, you'll see that the price started going higher and higher since Dec 2024, grabbed the liquidities we have at 41.80 and 44.35, to give us a confirmation of a reversal right on the liquidity at 44.35.

Today the price grabbed the LQ we have at 41.80, and it will keep pushing down to 37.90 before giving us an entry to take.

For now, if you still haven't bought, you just wait. And if you already holding any shares, you can tell me in the comment section your entry so I can give you some help in your situation.

Follow for more!

6015 IS STILL GOING BEARISH DONT BUYAs you can notice on the chart, the price is still pushing bearish since Sept 2023 where it gave us the ATH.

In Jan 2025, it did a quick jump towards the LQ to grab it, and now ir is coming down towards the LQ level at 2.14, the least point we'll expect the price to reach is 2.19 where we have our OB.

Anything that than is just a wish.

NB: I follow the things I have in front of me on the chart combined with the Fundamentals. So please if you have any other POV you can discuss it politely.

Follow for more!

2030 IS STILL GOING BEARISH 2030 is one of the stocks people want to buy, but to do it in the current time is a wrong decision to make, since as you can see, it kept pushng lower and lower since Sep 2023.

For now, before we can take a small trade on it, we must wait for the stock to take the LQ we have in the level 60.1. As soon as it's done, we will search to see if we have our entry point to follow it.

For any further questions don't hesitate to ask!

Follow for more!

A HIGH PROBABILITY 4003 WILL GO LOWERAs you can see on the chart, the price grabbed the ATH WK LQ, and now all it kept doing is giving us lower highs for the last 4 months since it grabbed the liquidity.

The wise thing to do is to sell if you're holding any shares, and if you haven't bought yet, just hold your funds and wait for the stock to give you a clear entry.

The comment section is all yours for further questions!

Follow for more!