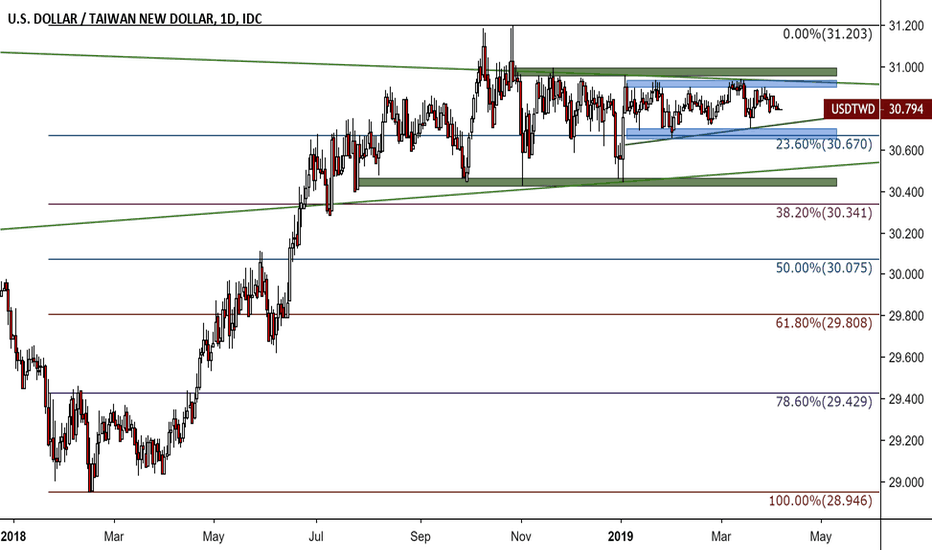

The Low Volatility Taiwan Dollar Is Now Less VolatileThe already incredible low volatility of the US dollar to the Taiwan dollar somehow over the past few weeks managed to drop volatility even lower than before. The range trading has tightened further from 30.42 to 31 by a tighter range of 30.65 to 30.94. This is truly incredible, even for the foreign exchange market which has suffered (or enjoyed given your financial position) from extremely low volatility compared to other asset classes such as commodities or equities. The question remains if this volatility can be sustained and if so for how long. Clearly, this pair suffers from low liquidity which can be seen by long tails of the candlesticks indicating short-term volatility. Less clear is the fact that this pair is still manipulated by the central bank. Either way, USDTWD is a fairly stable pair to invest in with foreign exchange risk extremely low, at least for now.

Taiwan

TWSE Off From Technical Overbought HighsWhile RSI and Bull/Bear sentiment have edged away from clear overbought signals, we are continuing to see exponential moving averages assert their authority in suggesting the uptrend will continue. This is the case for the 'ribbon' of EMAs excluding the five day EMA which price action has dropped below. In the short-term I am a bit bullish on Taiwanese equities especially since they tend to outperform other Asian equities when the majority of Asian stocks are in deep red territory. Moreover, Taiwanese equities outperform their Asian peers in differing times of entry point since the 2008 Financial Crisis. However, entry point is extremely important for this and perhaps for a buy and hold strategy prices are a bit too expensive for those types of investors.

USDTWD Continues Sideways, will do so for the immediate futureThis forex pair suffers from a number of problems including manipulation, low volume, lack of interest, etc. The technicals are not on the side of those expecting divergence from these trends. Overall, expect a continuation of this sideways move.

MITHRIL TOKEN is still on a long downtrend channel.It seems no one is interested with this coin? This Taiwanese/Korean Popstar owned coin have not gone anywhere but down since the start of the year. I would recommend a buy on this once downtrend channel is broken, either up or down.

Personally, I would buy after price goes above 99 MA.

Short the Taiwanese Index at 382-383.3 until invalidationThis could happen in unison with the Nikkei et other global markets.

All-time biggest slump of Taiwan stock market today 2018.10.11 After the government made many statements about "most consecutive trading days for the index to stay above 10,000",

Taiwan stock market had a biggest slump of all time to go down more than 6.3% (7.3% for the futures) today.

To take this 0050 ETF as an example (composed of top 50 Taiwan stocks),

it had so many potential trades to take on the train of slump!

Of course, the main purpose of this article is not about hindsight, but with a thought of "the market is made of trading plans"

there indeed had so many signs and chances to establish short positions before today!

Focus on the trading plans on your own trading system, sometimes the market will give such a big gift like today~!

It'll be quite interesting for the world's stock market to become so volatile again, that's when traders start to get exciting!

===========================================

After an 8-day vacation I'm back yo~

Luckily enough all of my stock positions got out on the trailing stop last week like COST and ATVI.

And I'm ready to trade this volatile market gogogo!!

Taiwan Dollar (TWD) maintaining its bearish strength vs the USDTaiwan Dollar is maintaining its strength versus the US Dollar since the beginning of 2017 and holds the longer term bearish trend. A head and shoulders pattern has formed on the weekly chart but is as yet complete. The 30 level could prove significant resistance and if it can break here, then 28/29 could be a potential further resistance level. Upside support may be found at 30.75 then 31.42.

INTERMARKET | USDCNH vs USDTWD DeviationWhat is a meaningful relationship between the currencies of two very interlinked and substitute export-led economies appears to have broken down - at least directionally in this case.

I think they reconverge, so my bias here is long USDTWD... So now I shall look for an entry.