TAO

Bittensor Breaks Descending Channel, 10X Potential Vs BitcoinAnother downtrend is reaching its end. You are about to experience something that you have never experienced before. You are about to feel something you have never felt before. You are about to become rich; buying, trading, holding, investing in Crypto. That's the experience you are about to embark on.

Another downtrend comes to an end. Here Bittensor—TAOBTC—is breaking out of a descending channel. As this breakout occurs, a downtrend is left behind. The end of a downtrend signals the start of a new trend. An uptrend.

The bottom already happened 7-April, this we already know. The action now is bullish-already and confirmed. Crypto is going up.

Potential is great, I am showing 690% on the chart. This would be profits, you need to add the 100% you put in. So total growth from current price to the main target on the chart would be 790%. Profits potential 690%. There can be more.

Bittensor can grow more than 10X vs Bitcoin.

These are true bottom prices. The best entry probable, the best timing possible... This is your chance.

Thanks a lot for your continued support.

Namaste.

Is BTC set to hit 90K before dropping?#BTC has been range-bound on the weekly , recently forming an SFP below the range low but failing to close below the Feb and Mar 10th lows. Could we see an SFP above the RH ($90K) before moving lower, potentially toward the FWB:65K -$72K target? That remains to be seen. The HTF MS remains bearish, and until it shifts, the risk to the downside is high. For a bullish shift on the weekly, we need weekly closes above $94000. Until then, downside risk persists.

On LTF/MTF: I update my analysis regularly, but for now, I’m considering a few scenarios:

👉a. BTC could bounce from an 18H HOB if the 2H HOB breaks, potentially aligning with USDT.D hitting a 23H HOB at 5.62%. This might form a DB at a 22H PHOB at 5.35%, or USDT.D could target a 12D demand or a 22H HOB at 5.15%.

👉b. BTC might bounce, breaking the current 21H OB, and reach the HTF supply at $90K, while USDT.D takes the 23H PHOB and possibly the 22H HOB before rising to 5.77%-6.01%.

Also note, the daily close below the $84600 SH shows weakness on the chart. There’s little to do until we either reach $72K or see an MS shift, which could open risky upside trades. These are risky because we haven’t taken the liquidity needed for higher prices. MT also mentioned that higher prices without key level breaks are likely a bull trap. Avoid heavy trades until direction is clear.

Until then, we focus on taking LTF scalp trades 🤝

TAO RectangleBITGET:TAOUSDT has been trading in a well-defined rectangle for the last 16 months.

Key Levels

• $195 - Support, with demand zone extending to ~$260

• $470 - Midline, S/R band extending between $460-$490

• $745 - Resistance, with supply zone extending to $640

Despite a recent fakeout to the downside, TAO recovered support and might be headed for another move to the upside.

Targets

• $1300 in case of a sustained break above $745

• $50 in case of a sustained break below $195

TAO Analysis (1D)TAO appears to be forming a new corrective pattern from the point where we placed the red arrow, with its wave C potentially completing within the green box.

We are looking for buy/long positions in the green zone.

Targets are marked on the chart.

A daily candle closing below the invalidation level will invalidate this analysis.

invalidation level = 150$

For risk management, please don't forget stop loss and capital management

Comment if you have any questions

Thank You

TAO What will happen in the future?As you can see, the price has now formed an ascending wedge , which is promising. The price could rise to $280 after breaking this wedge...

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

TAO at important levels... watch list materialTAO is revisiting previous lows and hoping to get support once again. There is a good chance that it does but a proper CHOCH would provide that evidence. Alternatively, the trend is still down and it could continue. The volume gap below could allow that to happen. This chart should be on a watch list. Time to DCA.

Full TA: Link in the BIO

Is TAOUSDT About to Dump Hard? Yello, Paradisers! Are you paying close attention to this subtle shift on TAOUSDT? Because what we’re seeing right now could easily trap late bulls before the real drop even begins…

💎TAOUSDT is currently displaying clear signs of a potential bearish reversal. We’ve observed a bearish Change of Character (CHoCH) developing from the 1H Fair Value Gap (FVG), which is a strong early indication of weakening bullish momentum. To add to this, price has also broken down below the 50 EMA, a technical signal that increases the probability of further downside movement. When both of these elements align, it’s often a precursor to a more significant pullback.

💎If TAOUSDT revisits the recent Fair Value Gap, the trade setup becomes even more attractive, offering a stronger risk-to-reward ratio. That would be the optimal level for entry. However, even from current price levels, the trade still offers a 1:1 risk-to-reward opportunity. While not ideal, it remains viable for more aggressive traders.

💎That said, the entire bearish setup becomes invalid if the price breaks out and closes a candle above the current resistance zone. In such a scenario, it would be wise to step back and wait for more reliable price action to develop before making any further decisions.

Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

BTC - Post Weekly Closure UpdateAgain, not an awful lot has changed since last week’s update. We’ve now closed a weekly candle yet again in no man’s land; in fact, one could argue it’s a bearish engulfing candle that closed below the previous week’s level, solidifying further bearish sentiment and likely continuation until key SH has been reclaimed.

Like I mentioned in last week’s update - for now, we’re waiting for 65K–72K, a break of ATH, or at least a reclamation of HTF 🗝️ swings (95K minimum) to jump back into HTF trades. Until then, I’m exploiting LTF/MTF moves.

Another thing to note: Everyone is so fixated on 72K being the potential bottom (if reached). It makes me wonder: will 72K happen soon (it will eventually), and if it does, will it hold? I personally think we’ll see a deeper pullback into the 2W demand at 68K, or potentially the 1W PHOB at 65K, which I’ve mentioned several times.

On LTF/MTF - I’ve been updating every trade, and they’ve been playing out quite well so far. We failed to hold the 23H HOB at 83K, thereby breaking below the MTF SL at 83130, and now the same level is acting as an obstacle to higher prices. If accepted above, I expect 84K, potentially 86K, before a possible downward continuation.

For us to see higher prices on MTF, we need to reclaim 88744, SH, to target 96K - potentially the 2D OB at 100K, which is also a psychological level and confluent with the volume drop in VRVP, as shown in the image above. If 88744 is reclaimed, followed by a pullback into newly formed liquidity or BB, I’d then look for a long to the above-mentioned levels.

As long as we’re below 88,744, downward pressure remains.

About AI's theme coin (token)...

Hello, traders.

If you "Follow", you can always get new information quickly.

Please also click "Boost".

Have a nice day today.

-------------------------------------

It seems that AI themes are currently classified into 5.

I will explain the coin (token) with the highest market capitalization in each theme.

-------------------------------------

(NEARUSDT 1D chart)

NEAR is classified as an AI & Big Data theme.

In order to turn into an uptrend, the price must be maintained above 3.756 and rise above the M-Signal indicator on the 1M chart.

Since OBV has broken through the upper line of the Price channel, the point to watch is whether it can continue to rise.

-

(FETUSDT.P 1D chart)

FET is classified as an AI Agents theme.

The key is whether it can maintain the price by rising above 0.848.

Since OBV is passing through the middle line of the Price channel, we should see whether it can be supported and rise near the M-Signal indicator on the 1D chart.

-

(VIRTUALUSDT.P 1D chart)

VIRTUAL is the No. 1 market cap ranking of the AI Agent Launchpad theme.

The key is whether it can maintain the price near the M-Signal indicator on the 1D chart and rise to around 1.1602.

-

(FARTCOINUSDT.P 1D chart)

FARTCOIN is classified as AI Memes theme.

The key is whether the price can be maintained around the Fibonacci ratio 0.236 (0.6228) and rise to around 1.4148.

If it fails to rise, it should check for support around 0.3822.

-

(TAOUSDT 1D chart)

TAO is classified as Generative AI theme.

The key is whether it can be maintained by receiving support around 271.1 and rising above 312.5.

In the meantime, it should be checked whether it can rise above the M-Signal indicator on the 1W chart.

If the M-Signal indicator of the 1W chart rises above and the price is maintained, it is expected to turn into an upward trend.

-------------------------------------------

Most coins (tokens) are showing the same flow as the coins (tokens) above.

This shows that the current section is an important turning point.

I think that in order to survive this important turning point and turn into an upward trend, an increase in trading volume must accompany it.

Therefore, I think it would be a good idea to check the current trading volume status by checking the flow of OBV of each coin (token).

There are three ways to interpret the OBV indicator.

1. If OBV is rising from the 0 point, it is an increase in buying power, and if it is falling, it is an increase in selling power.

2. If OBV is located above the EMA line of OBV, it is highly likely that buying power will increase, and if not, it is highly likely that selling power will increase.

3. Applying the formula of the Price channel to OBV, if each Price channel line breaks upward, there is a high possibility that the buying force will increase, and if it breaks downward, there is a high possibility that the selling force will increase.

In addition to the interpretation of 1, 2 and 3 can be interpreted as the possibility that the price will rise when the buying force increases, and the possibility that the price will fall when the selling force increases.

In 1, the price area around the 0 point is considered the selling area (volume profile) and is likely to play the role of support and resistance points.

-

Thank you for reading to the end.

I hope you have a successful transaction.

--------------------------------------------------

- This is an explanation of the big picture.

I used TradingView's INDEX chart to check the entire section of BTC.

I rewrote the previous chart to update it by touching the Fibonacci ratio section of 1.902 (101875.70) ~ 2 (106275.10).

(Previous BTCUSD 12M chart)

Looking at the big picture, it seems to have been following a pattern since 2015 and has been rising.

In other words, it is a pattern that maintains a 3-year bull market and faces a 1-year bear market.

Accordingly, the bull market is expected to continue until 2025.

-

(Current BTCUSD 12M chart)

Based on the currently written Fibonacci ratio, it is displayed up to 3.618 (178910.15).

It is expected that it will not fall again below the Fibonacci ratio of 0.618 (44234.54).

(BTCUSDT 12M chart)

I think it is around 42283.58 when looking at the BTCUSDT chart.

-

I will explain it again with the BTCUSD chart.

The Fibonacci ratio ranges marked in the light green boxes, 1.902 (101875.70) ~ 2 (106275.10) and 3 (151166.97) ~ 3.14 (157451.83), are expected to be important support and resistance ranges.

In other words, it seems likely to act as a volume profile range.

Therefore, in order to break through this section upward, I think the point to watch is whether it can rise with support near the Fibonacci ratios of 1.618 (89126.41) and 2.618 (134018.28).

Therefore, the maximum rising section in 2025 is expected to be the 3 (151166.97) ~ 3.14 (157451.83) section.

To do that, we need to look at whether it can rise with support near 2.618 (134018.28).

If it falls after the bull market in 2025, we don't know how far it will fall, but considering the previous decline, we expect it to fall by about -60% to -70%.

So, if the decline starts near the Fibonacci ratio 3.14 (157451.83), it seems likely that it will fall to around Fibonacci 0.618 (44234.54).

I will explain more details when the downtrend starts.

------------------------------------------------------

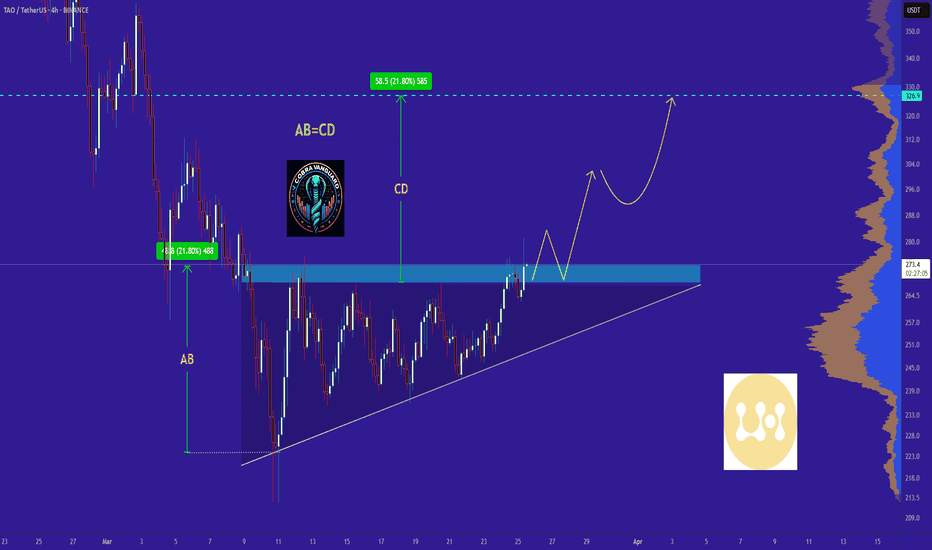

TAO in coming days ...Currently, TAO is forming an ascending triangle, indicating a potential price increase. It is anticipated that the price could rise, aligning with the projected price movement (AB=CD).

However, it is crucial to wait for the triangle to break before taking any action.

Give me some energy !!

✨We spend hours finding potential opportunities and writing useful ideas, we would be happy if you support us.

Best regards CobraVanguard.💚

_ _ _ _ __ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _

✅Thank you, and for more ideas, hit ❤️Like❤️ and 🌟Follow🌟!

⚠️Things can change...

The markets are always changing and even with all these signals, the market changes tend to be strong and fast!!

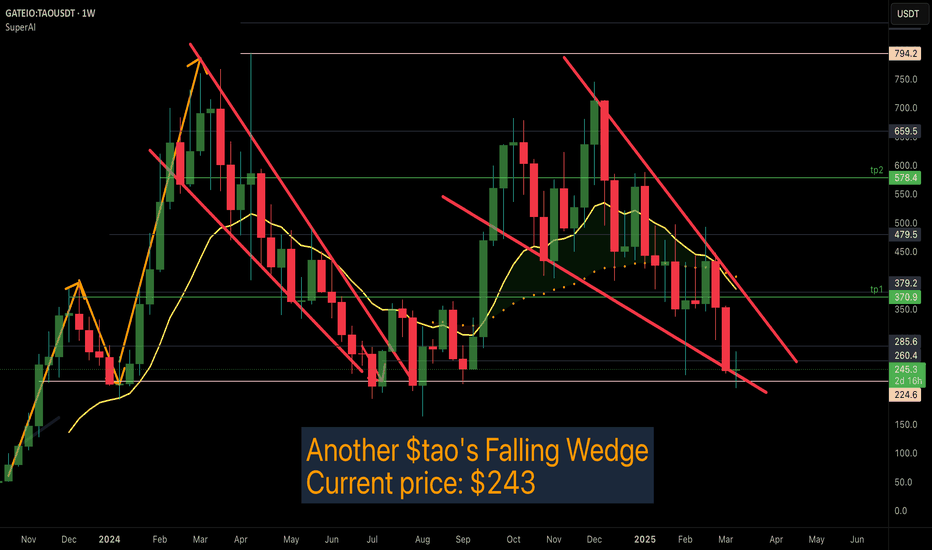

Another $TAO Bittensor tao's Falliing Wedge-Major support RetestGETTEX:TAO Tao Bittensor has formed yet another Falling Wedge

Current price: $243

For everytime #Tao has formed these falling wedges with Key support around 224, It has been accompanied by an explosive move upwards.

#Tao has also lost over 70% of it's value from an all time high of 795. So it is low risk.

Expecting retest of these supports: 370, 578

This idea Invalidation under 224!

More Extensive Analysis:

This chart is showing the price action of GETTEX:TAO (Bittensor) against USDT on a weekly timeframe, traded. Here’s a more extensive analysis based on the provided chart:

1. Falling Wedge Pattern

- The chart highlights a falling wedge pattern, characterized by converging downward-sloping trendlines.

- Falling wedges are typically bullish reversal patterns, meaning a potential breakout to the upside could occur.

- The previous falling wedge led to a strong rally, suggesting a similar scenario might unfold.

2. Current Price & Key Levels

Current Price: $243

Support Levels:

Most recent low $224

Resistance Levels:

$260 - $285** (near-term resistance)

$370 - $380 (tp1 - Take Profit 1)**

$578 - $600 (tp2 - Take Profit 2)**

$794 (long-term resistance)**

3. Key Takeaways & Trade Outlook*

- If the price breaks out above the falling wedge, a bullish move toward $370+ is possible.

- If the price breaks down further, the next major support is around $224.

- Traders might look for **confirmation** of the breakout before entering long positions.

$NEAR - Approaching key liquidity levels. #NEAR has created a BOS, followed by a drop into our POI, which has provided a nice 21% bounce. It’s a level where one can spot-buy NEAR. Personally, I’d only look for longs from the 3M HOB refined into MTF or the demand level just below it.

Other info., such as TPs and entries, is provided in the chart.

I’ve noticed that people usually miss Supply and Demand levels, and if there’s one thing I’ve learned in this recent correction, it’s that these levels, if reached, are highly respected - especially if there’s an OB/HOB at the same level. The best example of this is #ETH, which found support at the 3M Demand level, proving the significance of S&D versus just looking at individual liquidity levels.

$RENDER has entered my POI after creating a BOSThere’s a significant amount of liquidity between 2 & 2.5, specifically around the 21H HOB, which is located at 2.35–2.4. If that level is reached, it could provide a significant bounce; if it overshoots, we should look at the lower levels as shown in the image. It’s currently bouncing from the 7W HOB, but I’m particularly interested in that 21H HOB.

Let’s see what we get. :)

TAO - Extremely Bullishone of the few coins which are about to go in sub-wave 3 of macro-wave 3

haven't bought this one yet but might rotate a few weak positions to this if the structure holds

no idea what's going to happen to AI tokens (haven't looked into things yet, no time on hand) - sharing this purely based on TA

TAOUSDT LONG 1H (2Target Done! Congratulation)An excellent situation from the trading plan.

The second goal has been achieved and the stop is at breakeven.

I would like to emphasize that the $320-322 block (break block) confirmed the retention level. You can move the stop order to this level and calmly wait for new variables from the market

UPdate:

1-st target: