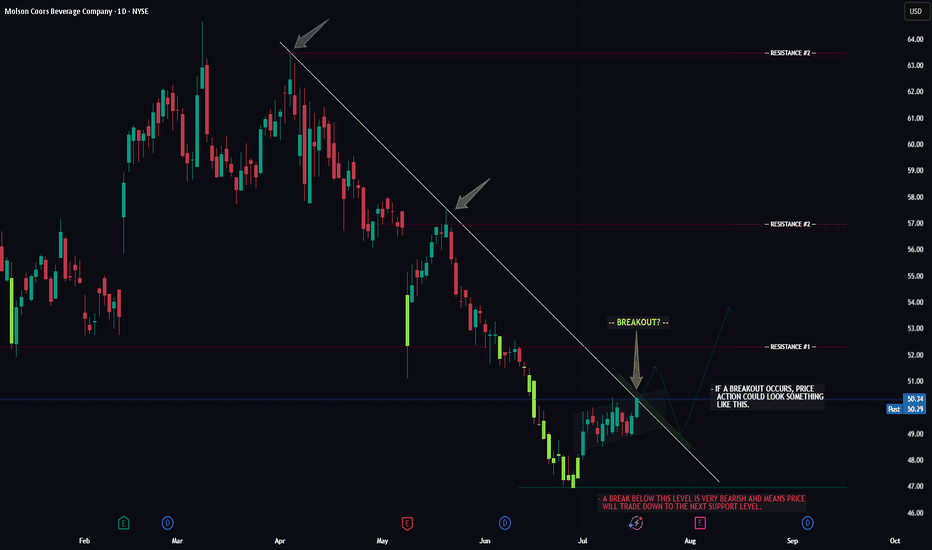

TAP -- Breakout Attempt -- Target LevelsHello Traders!

The chart of TAP (Molson Beer co.) is currently flirting with a major resistance trendline. Now whether or not price can successfully seal the deal and make it too third base remains to be seen.

If price does breakout, watch for a potential retrace to the breakout trendline first, then we could see the larger move to resistance level #1.

If price gets rejected and fails to breakout we could see a move below support before it attempts to breakout again.

Thanks everyone and best of luck with your trading journey!

TAP

TAP flushed on a good earnings beat into support LONGTAP appears to to have fallen into support on a good earnigns beat Perhaps traders were

expecting a better beat. It is now 15% below the resistance zone where shorts will take

positions and longs will sell- off. TAP has sales and consumer loyalty in its brands. It is

free of the controversies that had bogged BUD down. I see this as an opportunity to get a

decent stock at a discount. My target is 62 at the half way point has designated by the fib tool.

TAP ( Coors Molson Miller ) Ready for Bullish Continuation?On the daily chart, TAP was on a good trend up heading into earnings which were favorable.

It is consolidated since just after earnings in a " high tight bull flag pattern" Volume has been

healthy with many buyers and seller trading shares in a tight range channel. The stochastic

RSI is now at about 20% indicating TAP is in the oversold / undervalued area. The optimized

artificial intelligence moving average indicator shows parallel rises in both the short and long

MAs ( neither divergence nor convergence just consistent ). This is a minor healthy pullback

and a good entry point.

Fundamentally, the summer beer- drinking season will soon arrive. TAP may be benefitting

from the BUD backlash over the Bud Lite endorsement controversy.

My call options have been appreciated 50% in the past 2 1/2 weeks ( 4% per trading day ).

I will roll them into the call options expiring 9/15/23. I consider TAP to be a steady

consistent gainer and likely more or less recession-proof.

Craft Beer Seltzer Alcohol Barometer: Sam Adam's Boston Beer Co.Alcohol consumption

When averaged over two years, 2021-2022, 63% of U.S. adults aged 18 and older consumed alcohol. Gallup, Inc. indicates that "the drinking rate ticks up to 65% when narrowed to adults of legal drinking age" of 21. When segmented based on demographic characteristics:

Eighty percent of adults, 18 and older, living in households with annual incomes of $100,000 or more consumed alcohol in 2021/2022.

Only 49% of those living in a household with an annual income of less than $40,000 consumed the beverages.

Likewise, the higher the level of education, the greater the percentage of adults in the cohort who had consumed an alcoholic beverage, while the incidence of consumption decreased as age increased.

A nearly equal percentage of men and women consumed alcohol, 66 and 61%, respectively, when averaged over the two years.

Pertaining to race and ethnicity, 68% of non-Hispanic white adults, 59% of Hispanic adults, and 50% of non-Hispanic black adults consumed alcohol.

Another source, The 2023 Silicon Valley Bank Wine Report, states data from the Wine Market Council:

28% of consumers were "abstainer ," which "has increased 4 percentage points since the 2017 survey."

18% were "core wine drinker " who "drink wine at least once a week," which decreased from 21% in 2017.

15% were "marginal" who "prefer wine…and consume wine at least every two to three months… wine consumers who drink wine one to three times a month," which decreased from 19% in 2017.

The remaining consume "alcohol, not wine" (29%) or are "infrequent alcohol" consumers (10%).

Alcoholic beverage preferences and purchases

When asked to indicate their beverage category of choice, 30% of consumers preferred liquor, 31% wine, and 35% beer. Another source, IRI, reports that 16% of alcoholic beverage consumers drink beer exclusively, 13% drink only wine, and 11% only spirits. Consumption of more than one category is as follows:

Beer and wine, 13%,

Beer and spirits, 12%,

Wine and spirits, 9%, and

All three types, 27%.

When segmented based on consumption frequency, for consumers between ages 21 and 39 years, Wine Opinions found the following:

Half (51%) of those who drank beer consumed the beverage "weekly or more often," 24% consumed the beverage 2-3 times a month," 8% "about once a month," and the remaining 17% consumed beer "less often or never."

For wine and spirits, the percentage of consumers who drank the beverages at each reported frequency was similar: 30% of those who drank the beverages consumed them "weekly or more often," a third consumed the beverages "2-3 times a month," 16% "about once a month," and 21% of wine drinkers and 20% of those who drank spirits consumed them "less often or never."

Those who consumed beer on a weekly, or more frequent, basis were more likely to be males, weekly wine consumers were more likely to be female, and "consumption of spirits is even by gender."

BUD - Hail the King of BeerHere on a daily chart, I have plotted the ratio of the dynamic share price of BUD compared

with TAP. The thesis is that TAP ( Coors / Molson) may have had a share price rise while

BUD dropped its own as a reaction to its adverse ad campaign which resulted in a social media

disaster. BUD is global with only 25% of its market in North America while TAP is more like

North America predominantly. The ad campaign and social media backlash is only North

America over time is impact will be nil.

The thesis is that BUD will recover and that astute contrarian investors and traders can profit

from the dynamic which in the greater and longer picture has been a dip for BUD representing

a buying opportunity. As can be seen on the chart, the DUD/TAP ratio is at the bottom and

outside of the boundary of the lower Bollinger Bands and now reentering the bands.

The ratio is also in the demand/support zone where it was last October. The action

of the ratio was a double top "M" pattern which has now played out . Finally, the AI predictive

algo of Luxalgo predicts a ratio rise between now and the end of the month as the ratio

heads to the midline of the Bollinger Bands. Overall, the analysis is that either BUD will rise

or TAP will drop or some combination. Overall, I conclude that BUD could easily rise from

this dip over the next ten calendar days. I will take a position in call options with 30- 45 DTE.

BUD Uptrending despite the Bud Lite controversyBUD is a staple stock catering to beerdrinkers both in North America and Europe.

The controversy about a spokesperson for an ad campaign for Bud Lite has heightened awareness.

Bud Lite is only one product of the parent company.

Fundamentals arise, BUD is uptrending since Friday the 13th with hull moving averages converged.

In confirmation, the RSI bottomed at 25% and is now rising while the volume indicator shows

increased volume as compared with that of March.

Overall, I see BUD as a good investment in a recessionary environment because if anything

history shows alcohol consumption increases in a recession. If production costs can be

contained despite inflation and demand goes higher so will those earnings and the market cap

XTP TAP Global experiencing exponential growthTap global has achieved 100k users in its first year (During a bear market no less) with little to no marketing budget, and has been revealed that in the last month and a half has gained an additional 30k users. Tap global is similar to crypto.com and revolut, with additional features and side businesses such as cards as a service which Bitfinex is the first customer of. Tap has listed on a UK stock exchange, and is regulated. Tap is as trust worthy as coinbase, in an environment post FTX this is a major selling point. Being listed as a publicly traded company means that tap global is a sage place for users to trade and earn on their crypto, tap grabs the best price for its users from multiple exchanges order books. Tap currently sitting at 50 million market cap. Providing the macro environment doesnt change for the worse, onwards and upwards.

$XTP (Tap) upwards channelBeautiful upward channel for the investment of the year, too early for any other meaningful TA.

RUMOUR ALERT: Coinbase listing XTP, Coinbase wallet spotted buying up $XTP

TAP is a fully regulated company and fully meet the requirements to list on Coinbase and, with the company launching in the US in the next 2-3 months, it makes alot of sense.

Its still early to get this life changing investment, BUY ALL DIPS, HODL ALL RIPS

TAP - Molson Coors Beverage CompanyNYSE:TAP

Idea is simple:

Long position when the price breaks the downtrend ($46) (you can wait to 4h candle be closed higher than 46)

Stop - close lower than $45.6 (-0.8% risk)

Profit - 3 takes:

1st take $50 (8.8% upside)

2nd take $53.6 (15.8% upside)

3rd take $61.3 (30.3% upside)

Profit/Risk - from 9 to 31

You can split position to 3 parts, for each take

Feel free to comment / add a feedback

TAP bottomed and ready to goIts been a rough ride for tapbtc since its inception, XTP has bled from over 1000 sats to the very bottom at 2 sats.

This is the ideal buy zone for the following reasons:

1) RSI divergence having just broken below for the first time in a long time, every time this has happened it is followed by a pump, note where i point these areas out on the graph.

2) Its literally at the bottom

3) Note the significant uptick in accumulation distribution (bottom graph)

4) You will also notice that volume has also spiked (orange line)

Pretty easy buy and hodl, its at the bottom, i've loaded my bags, have you?

Let me know your thoughts and send me a like/follow if you like this idea!

Happy trading and good luck!

:)

institutional money going into TAPNot only is TAP extremely attractive fundamentally, now the technicals and external catalysts are there. Morningstar just named it one of their top stock picks of the year because of its selection by some of their most respected managers.

Morningstar is a non-bias third-party research firm that most advisors use to help keep track of their models, clients' investments, stock valuations, and fund evaluations. They are, IMO, the most reliable source for financial information that is truly material.

TAP is trading at an EV to EBITDA level of 7.8874; under 10 is considered to be that of a company that is running extremely well financially. They have been launching Seltzer products to compete with SAM's Truly. Their Coors seltzer even has an ESG side to it where every case you buy, a certain amount goes to saving rivers.

All in all, do not miss this move. Its FAIR VALUE estimate is $60. In my experience, stocks surpass what is thought to be their legitimate value based on their books/financials. That's easily a 24% return. Keep in mind that VIAC's FAIR VALUE estimate was $57, look at it now. Long story short, price targets are different than fair value estimates; price targets are where you think the stock is going, fair value estimates are where the stock should be priced based on its current financials/books.

My price target for TAP is $75, which would be a 55% return.

RAYDIUM PotentialHey again third post, enjoying positing trading ideas and opportunities, would love to hear insight from anyone reading cause I want to improve myself in this field

RAY just confirmed AcceleRaytor, a launchpad for upcoming Solana projects, and we have seen the great performance in countless launchpad projects (PAID, POLS, DUCK to name the few).

I believe smart money will start to move over to different blockchains such as Solana, Polkadot, Cardano, due to network congestion on ETH but this is not to say the KING will be dethroned just because of congestion and gas fees, its always great to have alternatives anyways.

Its always good to try be one step ahead of the rest if possible to get in on these opportunities, and thats why I believe RAY can be a smart play in the future, It is practically the UNI of SOL. Fees on SOL blockchain are crazy cheap and TPS is ridiculous, but like with every other blockchain, they will always end up being congested in the long run as more people jump in.

What Im hoping for RAY to do to really confirm my entry, is a retest of the trendline which has been tapped twice previously. But the more I think of RAYs launchpad, more RAY will be locked up since you need to stake for 7 days from the opening of the pool. This means a decrease in available RAYs for sale on the market, which means price goes up! Supply and demand imbalance.

Thanks for reading!

Update on TAP, kitchen sink earnings report, Double Down!TAP just had their kitchen sink earnings report. It was a dismal quarter. There are silver linings to this though.

First, they had a 1.9% rise in net sales on a brand-volume basis in the United States. Second, their sales in Europe were badly hurt by the lockdown measures as the UK was in its worst phase at the time; this is only creating a demand glut. Third, they lowered their debt by $1.1 billion dollars. And finally, they realized they spent too much on general administrative expenses and marketing expenses; this is something that is easy to fix when the CFO gets handed the scissors.

All the bad news is out, it should be all downhill from here with improvements and higher margins as they improve the bottom line. Buying stocks when they are fully beaten down but are still institutions that are household names that aren't going anywhere, can be a good entry point after they have their "kitchen sink" quarter. Boeing already had theirs, and Wells Fargo had theirs a while ago as well.

Their fair value estimate based on their current financials is $55 a share so they are fundamentally undervalued. Keep in mind most companies eventually trade up to share prices that are above what would be a considered a fair valuation. A perfect example would be Tesla.

STZ is in purple to compare TAP to a peer. STZ has mostly stayed inline with TAP in terms of performance until recently. STZ has now outperformed TAP and created a gap between the two. I believe TAP is due to play some catch up here.

Last I saw, they closed at $44.50 after-hours. Buy under $50. Hold long and collect a 2.56% dividend yield in the meantime. NYSE:TAP

Go long TAP! beer exposure for these trying timesBuy Below $50, should easily hit $60 as it is currently undervalued.

When you look at the technicals, MACD and RSI are signaling buy. The moving averages (20,50,100 day for shorter-term outlook) have all converged and the stock just bounced off the bottom of the trend line so I see a reversal leading to a steady uptrend.

Sell half at $60. That's roughly a 22% return, then I'd suggest letting the other half ride to see if you can squeeze some more juice out of it or if you have to bail you've already capped gains. Selling half and letting the other half ride is my favorite method of risk management and a way to stay disciplined.

Tap (XTP) Project Overview + Long-Term Targets @AlanMastersAbout Tap (XTP)

Tap offers one-stop services for cryptocurrency participants and aims to remove financial boundaries by supporting connections with banks and exchanges. Tap offers a Mastercard to EU and UK residents. Tap claims to hold a DLT licence from the GFSC and claims to be the only company in its sector regulated to hold fiat and crypto. After depositing fiat currency into the Tap app, users can trade various cryptocurrencies on different exchanges using one app and a single KYC process. Users can also send any crypto asset to anyone in the world through the app for free and the asset can be used by the recipient instantly.

Source: Coinmarketcap.com

Website: www.tap.global

--------------

Tap (XTPBTC) Chart Analysis

Here have a descending channel/falling wedge for Tap (XTPBTC).

We have a bullish breakout of the falling wedge as well as prices moving above EMA10, both strong bullish signals.

The MACD is showing a bullish cross with the histogram starting to turn green.

And the RSI is strong above 50.

This is the weekly timeframe so each signal is 7X stronger than what we get on the daily...

Meaning that these signals are really strong.

Tap is looking good... The next targets/resistance levels are marked on the chart.

Namaste.