Driven Brands Holdings: Dominating North America's Auto ServicesKey arguments in support of the idea.

A potential rise in U.S. car prices may positively impact the company’s sales.

DRVN is expanding its footprint in the essential automotive services market, simultaneously reducing its car wash segment with more cyclical sales.

Investment Thesis

Driven Brands Holdings Inc. (DRVN) is the largest automotive services company in North America, operating an increasing network of approximately 5,200 franchise, independently owned businesses operated by the company across 49 U.S. states and 13 other countries. The company has a footprint in all major automotive service areas, catering to both retail and commercial customers. Its main business segments include car maintenance and repair, express car wash, bodywork and paint services.

U.S. car import tariffs, introduced in March, support the trend of an increasing average age of cars on U.S. roads and may lead to higher car prices. These factors may contribute positively to DRVN’s revenue growth. On April 3, a 25% tariff on cars imported to the U.S. will take effect, and by May 3, equivalent tariffs on automotive components will be implemented. These tariffs may disrupt automakers’ production processes due to a reconfiguration of production chains. Only half of the 16 million new cars sold annually in the U.S. are produced domestically, while other autos could be subject to these tariffs. Production disruptions may result in price increases for both new and used cars. Many consumers may delay purchasing new cars, opting instead to spend more on maintaining their current vehicles. The new factors support the general long-term trend to an increasing average age of cars on U.S. roads. In 2000, the average vehicle age in the U.S. was 8.9 years; it has now grown to 12.6 years and continues to rise annually. Despite this, the total number of vehicles on U.S. roads is also steadily increasing at an average annual rate of about 1% over the past two decades. Combined with the new tariffs, the overall growth of the automotive aftermarket is likely to boost DRVN’s revenue in the upcoming years.

Driven Brands continues successfully shifting its focus to essential automotive services. After 2023, the company began reducing its ownership of standalone car washes while expanding its Take 5 Oil Change locations. Take 5 Oil Change provides rapid oil change services within 10 minutes, allowing drivers to remain in their cars. In March, reports have indicated that Driven Brands plans to sell its Take 5 Car Wash chain. We suppose this deal will accelerate the expansion of the Take 5 Oil Change segment and enable the company to allocate some proceeds toward debt reduction, potentially decreasing debt service expenses by up to 20%.

The valuation of DRVN stock, compared to its peers, shows potential for growth. DRVN’s valuation corresponds to 14 projected earnings for 2025, aligning with the average valuation among U.S. car dealers. Nonetheless, DRVN’s potential for revenue growth in the coming years is anticipated to surpass that of its peers. In the last three quarters alone, the Take 5 segment has demonstrated a sequential revenue increase of 10%, accounting for about 60% of the company’s total sales.

We suppose that Driven Brands Holdings Inc. (DRVN) shares may exhibit positive momentum in the near term.

The target price for DRVN shares over a two-month horizon is $19.90, with a “Buy” rating. We suggest setting a stop-loss at $15.50.

Tariffs

BTC TARIFF TALKAs President Trump steps up on the stage to deliver his tariff plan BTC had a steady price rise going into the talk, a nice HH & HL LTF structure up into range high/ last weeks high, then as the speech began all of the progress made throughout the day wiped in less than 2 hours to reset BTC's price to Tuesdays low.

In the end the news event gave volatility as expected but ultimately the structure remains the same, rangebound. As the Tax year comes to an end it would be a hard ask for this choppy price action to shift bullish when institutions are going to be window dressing their portfolios for the next financial year.

In essence A continued LTF range with an overall HTF bearish trend looks to continue, this is compounded by yet another failed attempt at the 4H 200 EMA which had temporarily been broken but sent back below by the tariff announcements.

The SPX, DJI & NASDAQ Futures pre-market is looks dreadful so a revisit on the range low is probable on the cards at some stage today.

USD/JPY Stands Firm, But Volatility ExpectedVolatility has receded with less than 20-hours to go until Trump's tariffs are officially implemented, with traders now clearly in watch-and-wait mode. So while headline risks around tariffs remain in place, moves could remain limited unless traders are treated to any last-minute negotiations.

Typically, risk has benefitted when it has been expected that tariffs have been watered down. If that turns out to be the case by Trump's speech at 4pm ET Wednesday, indices could rise alongside the US dollar and the yen weaken.

Bit of course, the opposite is true. And that could weigh on USD/JPY. Rightly or wrongly, I'm feeling optimistic and now seeing a bounce on USD/JPY.

Two bullish pinbars found support and close above the 20-day SMA and monthly pivot point. The bias remains bullish while prices remain above Monday's low, and a break above 150 brings the 200-day SMA, February VPOPC and 152 handle into focus.

Matt Simpson, Market Analyst at City Index and Forex.com

Liberation Day: Fear or greed in the air? We are less than hour out from the Liberation Day tariff announcements. The U.S. is preparing to roll out reciprocal tariffs on all countries, with rates set at 10%, 15%, and 20%, according to Sky News.

Investors hoping for certainty may be disappointed—this could mark the start of a longer phase of trade battles.

Mexico, once again, is reading the room. President Sheinbaum has confirmed Mexico won’t respond with tit-for-tat tariffs. They understand that the way to deal with Trump is to treat him with kid gloves.

Meanwhile, gold hit another record high, reaching $3,149.04 on Tuesday before pulling back a little. Buyers might have a better setup around the parallel pivot line to position for further upside.

Australian dollar rally continues, Trump tariffs loomThe Australian dollar has posted strong gains for a second straight day. In the European session, AUD/USD is trading at 0.6306, up 0.47% on the day.

The Reserve Bank of Australia maintained the cash rate at 4.10% on Tuesday, in a move that was widely expected by markets. Still, the Australian dollar reacted positively, gaining 0.48% on Tuesday.

The RBA statement noted that underlying inflation continued to ease in line with the Bank's forecast, but the Board "needs to be confident that this progress will continue" so that inflation remains sustainable at the midpoint of the 2%-3% target band. The statement said there was "significant" uncertainty over global trade developments, pointing to the threat of further US tariffs and possible counter-tariffs from targeted countries.

The central bank's decision was made in the midst of a hotly contested election campaign, and a rate cut would likely have been attacked by the opposition parties as political interference.

In a press conference after the meeting, Governor Michele Bullock acknowledged the uncertainty over the global outlook due to US trade policy but sought to assure the markets by saying that Australia was "well placed" to weather the potential storm of a global trade war.

US President Trump has not specifically targeted Australia with any tariffs but China is Australia's number one trading partner and a US-China trade war would inflict damage on Australia's economy.

The new US tariffs are expected to be announced later today and take effect on Thursday. The financial markets remain volatile as investors look for some clarity from Washington about the tariffs, as it remains unclear which countries will be targeted and the extent of the tariff rates.

Review and plan for 3rd April 2025 Nifty future and banknifty future analysis and intraday plan in kannada.

This video is for information/education purpose only. you are 100% responsible for any actions you take by reading/viewing this post.

please consult your financial advisor before taking any action.

----Vinaykumar hiremath, CMT

Stock Market Dives into Correction? It Happens—Here's What to DoYou wake up, check your portfolio, and see a sea of red. The market’s down, your stocks are taking a nosedive, and CNBC is running apocalyptic headlines about an impending crash. Sounds familiar?

It’s maybe because we’re in (or super close to) a correction right now — the S&P 500 SP:SPX was down 10% from its record high two weeks ago and a lot of people are unsure what to do.

The truth of the matter is, stock market corrections are routine—not as often as the meeting that should’ve been an email, but also not as rare as a winning trade in the Japanese yen ( widow maker is real, yo ).

And, most importantly, they’re usually not as catastrophic as they feel in the moment.

So, before you hit the panic button (or worse, start revenge trading to “win it all back”), let’s talk about what’s shaking the market right now and how to navigate corrections like a pro.

🤔 First Things First: What’s a Correction?

A stock market correction is a drop of 10% or more from a recent high. It’s not a crash, it’s not the end of capitalism, and it’s definitely not a sign that you should liquidate your entire portfolio and move to a remote cabin in the woods.

Corrections happen regularly, typically once every year or two. They’re a natural part of market cycles, shaking out excessive speculation and resetting valuations to more reasonable levels.

For the record, a drop of 20% is considered a bear market.

🤝 Why the Market’s Getting Jittery

Markets don’t move in straight lines, and sometimes they hit turbulence. Lately, two big themes have been dominating headlines:

Trump’s Hard-Line Tariffs Hit Hard (And Markets Are Nervous About It)

If there’s anything Trump knows how to do is say things online or on-site and move markets. And his hostile and straight up combatant approach to handling international relations has sent traders scrambling to offload risk.

With hiked tariffs on China, Europe, and Mexico and Canada, businesses are bracing for severe supply chain disruptions, higher costs, and tighter margins. When tariffs go up, corporate earnings tend to go down—and the market doesn’t like that math.

Inflation Just Won’t Quit

The Federal Reserve spent most of the last two years trying to tame inflation, and just when it seemed like things were cooling off, it’s creeping back up. The latest readout of the personal consumption expenditures (PCE) report showed prices ticked up more than expected at 2.8% in February.

Higher inflation means the Fed might keep interest rates elevated for longer than expected, making borrowing more expensive and slowing down growth. Every new inflation release has investors guessing: Will the Fed cut rates, hold steady, or—worst case—hike again?

Between trade wars and stubborn inflation, uncertainty is running high, and that dynamics breeds volatility. But a correction doesn’t mean the market is broken—it just means sentiment has shifted.

⚠️ How NOT to React (aka: Rookie Mistakes to Avoid)

When corrections hit, bad decision-making is at an all-time high. Here’s what not to do:

Panic selling – Selling at the bottom is a classic rookie move. If you weren’t planning to sell at the highs, why dump everything when it’s down?

Trying to time the exact bottom – Good luck. Nobody, not even Warren Buffett, can catch the bottom (not that he’s trying). If you’re waiting for the “perfect” dip, you’ll likely miss the rebound.

Going all-in on one asset – Thinking of putting everything into one stock or crypto because it’s “cheap” now? Please don’t. Diversification exists for a reason .

Getting glued to financial news – Watching every market update during a correction is like doom-scrolling Google after a mild headache—you’ll only freak yourself out more.

Now that we’ve covered what not to do, let’s focus on the smart plays.

💪 So, What Should You Do?

If you want to come out of a correction with your sanity (and portfolio) intact, here’s your game plan:

1️⃣ Zoom Out—Corrections Are Temporary

The market moves in cycles, and corrections are just part of the game. Historically, corrections last a few months, while bull markets last years. If you’re investing for the long term, a correction is a blip on the chart, not an extinction event.

2️⃣ Review Your Portfolio Like a Hedge Fund Manager

Corrections are a great excuse to audit your holdings. Ask yourself:

Is this stock/ETF/index still worth holding?

Has anything fundamentally changed, or is this just temporary market noise?

Do I have too much exposure to one sector?

Think of it as spring cleaning for your investments. It's also an opportunity to make some good use of the handy Stock Screener or Stock Heatmap to spot the best (and worst) performers. If something was a FOMO buy and doesn’t belong in your portfolio, consider trimming it.

3️⃣ Buy Selectively, Not Blindly

Corrections create opportunities, but that doesn’t mean you should just throw money at every stock that’s down. Some companies deserve their declines ( looking at you, Nikola )—others are just collateral damage in a broader selloff.

Look for quality companies with strong earnings, manageable debt, and real growth potential. If they were solid before the correction, they’ll likely recover faster than the overhyped names.

Example: Remember when Amazon stock NASDAQ:AMZN tanked 90% in 2000, the dot-com bubble? No, because you were too busy being 2 years old instead of loading up on Jeff Bezos’s dream. And look where the guy’s now.

4️⃣ Do Some Good Old DCA

Instead of dumping all your cash into the market at once, use dollar-cost averaging (DCA). Buying in small increments at regular intervals helps you avoid the stress of trying to time the bottom. If prices drop further, you can buy more at an even better price.

5️⃣ Keep Emotions in Check

Corrections test your patience and discipline. The best investors don’t let fear dictate their strategy. If you’re getting emotional about your trades, step away from the screen and take a breath. The market will be there when you come back.

👍 The Market Always Bounces Back—Eventually

Every correction feels like the worst one while it’s happening. But let’s look at history:

The S&P 500 has faced 30+ corrections since 1950. It survived them all.

The average correction lasts four months before a recovery begins.

After a correction, markets typically rally higher within a year.

Unless you believe the global economy is permanently broken (hint: not yet, at least), every major downturn has eventually turned into a new bull run.

🦸♂ Final Thought: Be the Hero, Not the Victim

Market corrections separate the professionals from the wannabes. The people who panic and sell at the bottom? They usually regret it. The ones who keep a level head, stick to their strategy, and take advantage of good opportunities? They come out stronger.

And finally, if you need to take away one thing it’s this: Corrections aren’t the enemy. They’re the price of admission for long-term gains.

👉 Let’s hear it from you!

How do you handle corrections, what’s your strategy when the market is in a downturn and what’s in your portfolio then? Share your experience in the comment section!

Trading GER30 on Tariff DayToday will be a big day for the stock market in 2025. The tariffs to be implemented promises to either make or break the market.

Last week we saw a massive sell off and on Monday and Tuesday we have seen the markets gain a decent amount. However here is what needs to be noted for all indexes:

1) The Daily downtrend is intact

2) The H4 MA is pointing down

3) On GER30,we see a bat pattern to sell

4) H1, M30, M15 is OB and has a double top

We should not follow the news, but instead focus on the charts. Based on this, we will enter a short position and expect the market to resume the downtrend.

Stop loss will be 200 pips around 25700. Good luck!

NFP + tariffs = market chaos? In addition to tariff rumors, reports, and retaliations, this week’s Nonfarm Payrolls (NFP) could add even more volatility to markets.

Gold continues to hit record-high after record-high (best quarterly performance since 1986), could be the most important asset to watch.

The market consensus expects the US economy to have added 128,000 jobs in March, down from February’s 151,000.

Danske Bank is more cautious, perhaps responding to Consumer confidence deteriorating to its lowest level since 2013, projecting just 110,000.

Trading Economics is even more bearish, forecasting an increase of only 80,000 jobs. What do they know that others don’t? If they're right, markets may not be priced for it.

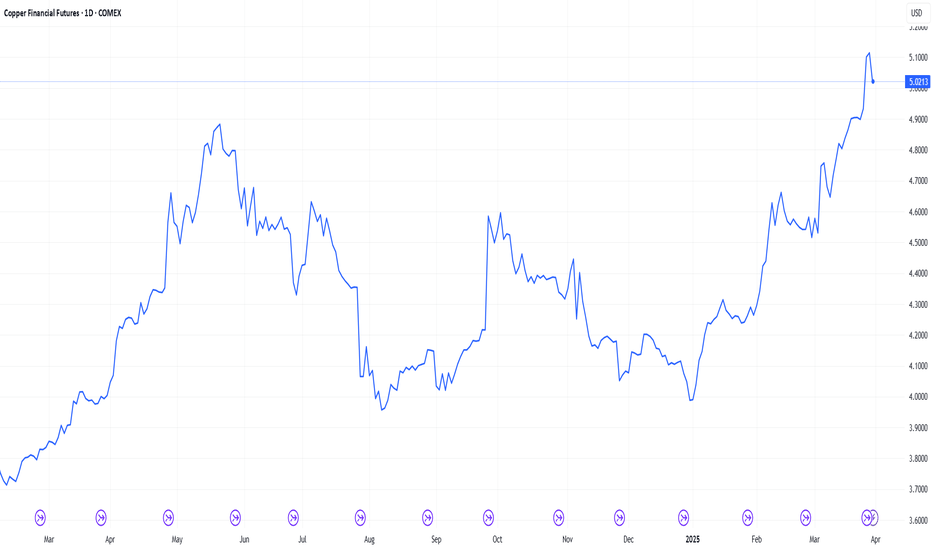

Copper is red hot right now. Here’s whyCopper’s COMEX price hit a new high on 26th March making the red metal red hot right now. The first three months of 2025 have seen industrial metals make noticeable gains with the Bloomberg Industrial Metals Subindex up 10.55% year to date1. Copper’s gains, however, stand out for numerous reasons.

Tariffs

The additional premium of COMEX prices over the London Metal Exchange (LME) prices reflects aggressive buying by US traders importing copper in anticipation of a possible 25% tariff on copper imports. This speculation has been fuelled by President Trump last month ordering a probe into the threat to national security from the imports of copper. As aluminium imports were also recently subjected to tariffs, markets are speculating that copper might be next.

This rush has triggered a shift in global flows, with metal moving out of LME warehouses and into US Comex facilities, where copper is held on a “duty paid” basis to avoid future levies. As traders front-run potential policy changes, this behaviour is tightening global supply and fuelling price gains, adding to a market already under pressure from rising demand and a looming supply squeeze.

Demand

China has given an additional boost to copper prices having announced a new action plan to boost domestic consumption by raising household incomes. The stimulus is seen as a positive signal for copper demand, especially as retail sales have already shown stronger-than-expected growth early in the year. China has also set itself a GDP growth target of 5% for 2025, and so far this year, its manufacturing Purchasing Managers' Index (PMI) has remained in expansionary territory — a sign that the economy is holding steady. With momentum building across consumption and manufacturing, copper is getting a fresh tailwind despite lingering weakness in the property sector.

Further support for industrial metals, including copper, has come from Germany’s recently unveiled €1 trillion infrastructure and defence spending plan — a move that will inevitably drive greater demand for base metals.

Supply

Supply tightness in the copper market is being driven by several structural and emerging challenges. Exceptionally low processing fees—caused by an oversupply of smelting capacity, particularly in China—have placed financial strain on global smelters, prompting companies like Glencore to halt operations at its facility in the Philippines. Looking ahead, Indonesia’s proposal to shift from a flat 5% copper mining royalty to a progressive rate of 10–17% risks discouraging future production growth. These supply-side pressures come as the International Copper Study Group reported a slight global copper deficit in January 2025. While a similar shortfall at the start of 2024 eventually turned into a surplus, this time the combination of weakening smelting economics, policy headwinds, and solid demand could make the current deficit more persistent and impactful.

Several major copper miners have recently downgraded their production estimates for 2025, adding further pressure to an already tight market. Glencore suspended output at its Altonorte smelter in Chile2, while Freeport-McMoRan delayed refined copper sales from its Manyar smelter in Indonesia due to a fire3. Anglo American expects lower output from its Chilean operations amid maintenance and water challenges, and First Quantum Minerals faces reduced grades and scheduled downtime4. These disruptions are likely to tighten global copper concentrate supply, potentially widening the market’s supply-demand imbalance just as demand continues to strengthen.

Sources:

1 Source: Bloomberg, based on total return index as of 28 March 2025.

2 Reuters, March 26, 2025

3 Reuters, October 16, 2024

4 Metal.com. February 14, 2025

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research, or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees, or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.

Japan's Business Sentiment Mixed, Yen StrengthensThe Japanese yen has gained ground on Tuesday. In the North American session, USD/JPY is trading at 149.27, down 0.47% on the day.

The yen was red-hot in the fourth quarter of 2024, gaining a massive 9.5% against the US dollar, but has reversed directions in Q1, declining 4.7%.

The Manufacturing Tankan index indicated that confidence among manufacturers eased to 12 in Q1 2025, down from 14 in the previous quarter. This was the lowest level in a year, reflective of growing concern among Japanese manufacturers over US tariff policy.

The Non-manufacturing Tankan index, meanwhile, moved in the opposite direction, climbing to 35 in Q1, up from 33 in the Q4 2024 release. This was the fastest pace of growth since August 1991, as companies are increasingly passing on costs to consumers.

The mixed Tankan report is unlikely to change the cautious stance of the Bank of Japan, which has expressed concerns about the uncertainty caused by the threat of additional US tariffs. The BoJ held rates steady in March and the next meeting is on May 1, with the markets projecting another hold.

US President Donald Trump has threatened to impose wide-ranging tariffs on April 2, leaving US trading partners and the financial markets highly anxious ahead of what Trump has declared "Liberation Day".

It is unclear which countries will be targeted or what the tariff rates will be, which has only added to financial market jitters. If Trump goes ahead with the tariffs and targeted countries retaliate with counter-tariffs, we will be one step closer to a global trade war.

USD/JPY has pushed below support at 149.65. Below, there is support at 149.02

There is resistance at 150.59 and 151.22

Using Micro Soybean Futures to Finetune Trading StrategiesCBOT: Micro Soybean Futures ( CBOT_MINI:MZS1! )

Shipping industry news recently reported that 30 U.S. soybean ships (about 2 million tons) are currently heading to China, nearly half of which will arrive after April 12th, when China's 10% retaliatory tariffs on U.S. soybeans will take effect.

How big are the tariffs? Let’s say a cargo of soybeans, or 65,000 tons, is sent to China. Assuming the trade is $10 per bushel, given 36.74 bushels per ton, total cargo value is $23.88 million. Upon arriving in China, you owe a new tax bill for $2.39 million!

According to people familiar with the matter, many cargoes are for China Grain Reserves, which may be exempted from tariffs. Soybean cargoes loaded before March 12th are eligible for a one-month grace period. Data from the U.S. Department of Agriculture on March 20th showed that the stock of unsold agricultural products in China was 1.22 million tons. Any sign of order cancellation will help us assess the real impact of tariffs.

In anticipation of the tariffs, China rushes to buy U.S. soybeans in the past two months. In January and February, China bought 9.13 million metric tons of soybeans from the U.S., up 84% year-over-year. I expect the buying will vanish by the second quarter, given new crop arriving from Brazil at much lower prices without the tariffs imposed by China.

China relies heavily on imported soybeans to crush into soybean oil for cooking use and soybean meal, a key ingredient in animal feed.

The oversupply of soybeans pushes the downstream soybean meal market to crash. According to the statistics of China Feed Industry Information, soybean meals spot market prices tumbled more than 600 yuan per ton to 3,180 since February, nearly a 20% drop.

Top feed processing companies, including New Hope, Haida, and Dabeinong, have each announced price cuts ranging from 50 to 300 yuan per ton for their chicken feed and hog feed products.

With lower overall demand, and tariffs making South American soybeans more competitive, U.S. soybeans face a shrinking export market. On my March 17th commentary “Soybeans: Déjà vu all over again”, I expressed a bearish view on CBOT Soybean Futures and discussed the possibility of $8 beans.

Trading with Micro Soybean Futures

On February 24th, CME Group launched a suite of micro-size agricultural futures contracts, including Micro Corn (MZC) futures, Micro Wheat (MZW) futures, Micro Soybean (MZS) futures, Micro Soybean Meal (MZM) futures and Micro Soybean Oil (MZL) futures.

The contract size of the micro soybean futures (MZS) is 500 bushels, or just 1/10 of the benchmark standard soybean futures (ZS). The minimum margin is $200 for the front futures month, and it gets smaller further out. For instance, the margins for May, July, August, September and November are $200, $190, $180, $170, and $165, respectively.

The smaller capital requirement makes it easier for traders to express an opinion ahead of the release of a USDA report or anticipate the impact of tariffs and retaliation.

The latest CFTC Commitments of Traders report shows that, as of March 25th, CBOT soybean futures have total open interest of 853,368 contracts, up 5% in two weeks.

• Managed Money has 89,649 in long, 123,470 in short, and 139,427 in spreading

• Compared to two weeks ago, long positions were down by 12% while shorts were increased by 12%. This shows that the “Small Money” has turned bearish on soybeans

In my opinion, micro soybean futures would be a great instrument to trade market-moving events, particularly the USDA reports. I list the big reports here for your information:

• World Agricultural Supply and Demand Estimates (WASDE), monthly, April 10th

• Prospective Plantings, annually, March 31st

• Grain Stocks, quarterly, March 31st, June 30th, September 30th

• Export Sales, weekly, every Thursday

• Crop Progress, weekly during growing season, April 7th, April 14th, April 21st

• Acreage, annually, June 30th

Hypothetically, a trader expects more soybean planting in this crop year and wants to express a bearish opinion ahead of April 7th Crop Progress. He could enter a short order for May contract MZSK5 at the current market price of 1,023. If he is correct in his view and the contract price drops to 900, the short position would gain $1.23 per bushel (= 1023-900) and the total gain is $615 given the contract size at 500 bushels.

The risk of short futures is the continuous rise in soybean prices. The trader would be wise to set a stoploss at his sell order. For example, a stop loss at $11.00 would set the maximum loss to $385 (= (11.00-10.23) x 500).

To learn more about all Micro Ag futures contracts traded on CME Group platform, you can check out the following site:

www.cmegroup.com

Happy Trading.

Disclaimers

*Trade ideas cited above are for illustration only, as an integral part of a case study to demonstrate the fundamental concepts in risk management under the market scenarios being discussed. They shall not be construed as investment recommendations or advice. Nor are they used to promote any specific products, or services.

CME Real-time Market Data help identify trading set-ups and express my market views. If you have futures in your trading portfolio, you can check out on CME Group data plans available that suit your trading needs www.tradingview.com

USD/CAD breaks out of falling wedgeUSD/CAD closed higher for a fourth day on Monday, on the even of Trump's liberation day. It also accelerated away from its 50-day EMA after establishing support around its 100-day EMA last week.

This has also seen USD/CAD break trend resistance, and a falling wedge pattern now appears to be in play. This suggests an upside target near the 1.4550 cycle highs.

Bulls could seek dips towards the 50-day EMA and retain a bullish bias while prices remain above last week's low.

Matt Simpson, Market Analyst at City Index and Forex.com

Why the RBA should cut rates todayThe Reserve Bank of Australia should cut rates today, argues James Glynn in the Wall Street Journal .

Markets, however, expect the central bank to wait until May for its next move. RBA Governor Michele Bullock remains cautious, citing lingering inflation.

But Glynn contends that global uncertainty now outweighs the RBA’s desire to wait for marginal improvements in inflation data. That uncertainty is set to escalate this Wednesday, with the Trump administration announcing sweeping tariffs on U.S. trading partners—likely triggering retaliatory measures.

Andrew Boak, chief economist at Goldman Sachs Australia, appears to support Glynn’s view: “There are costs to waiting until May to cut. Waiting is not always a virtue.”

Is Glynn simply chasing a contrarian headline or is there actually a possibility the RBA could act today?

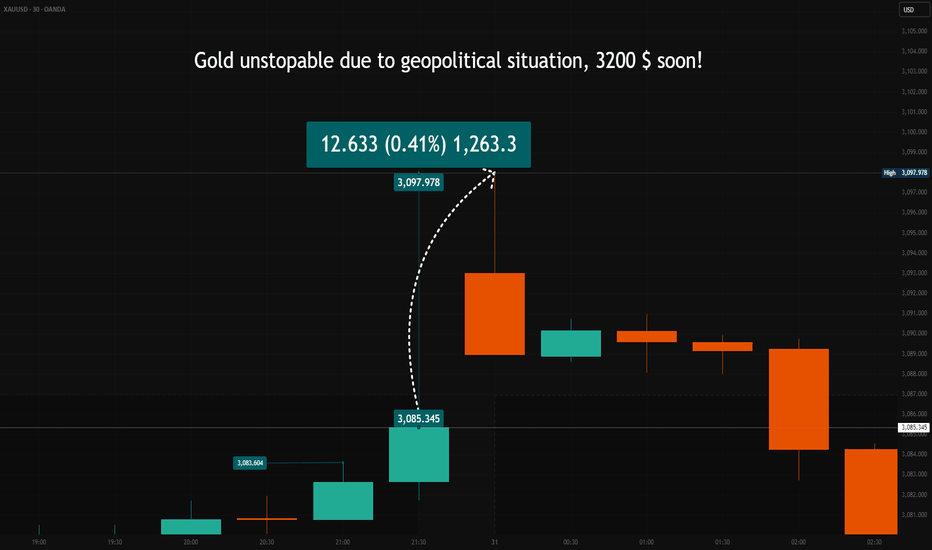

Gold Price Surges Amid Market Uncertainty – What’s Next?The late Friday session on March 28, 2025, ended with a strong rally in gold, as multiple price candles attempted to push higher. By 10 PM CET, gold had settled at $3,085.345, reflecting significant bullish momentum.

As the market reopened on Monday, the gold price gapped up by approximately +$12.5 , opening at $3,097.978 .

This type of price gap typically occurs when buyers are willing to pay more than the previous session’s close, signaling strong demand.

What’s Driving the Gold Rally?

The answer lies in a mix of tariffs, war, and recession fears. The global financial landscape remains highly unstable, and in times of uncertainty, gold historically acts as the preferred safe-haven asset. Investors are flocking to the precious metal as a hedge against economic instability.

Adding fuel to the fire, on April 2nd, additional U.S. tariffs imposed by President Donald Trump are set to take effect. This move could further disrupt markets, potentially driving even more capital into gold.

The Interest Rate Factor – A Hidden Risk?

While gold is surging, there’s a crucial factor to watch: Federal Reserve policy. So far, Fed Chair Jerome Powell has maintained a cautious stance on interest rates. However, if the situation deteriorates, the Fed might be forced to cut rates earlier than expected to stabilize the economy.

This could create a paradox for gold traders. While rate cuts typically support gold in the long run, a sudden policy shift could trigger a short-term sell-off as investors adjust their positions. If that happens, gold could see a sharp correction before resuming its trend.

Final Thoughts

Gold remains in a strong uptrend, but traders should stay cautious. If the Fed pivots and announces rate cuts sooner than expected, we could see a pullback in gold before the next leg higher. The coming days will be critical – keep an eye on April 2 and any shifts in Fed policy that could shake up the market.

👉 Will gold continue its rally, or are we facing a major pullback? Share your thoughts in the comments! 🚀

-------------------------------------------------------------------------

This is just my personal market idea and not financial advice! 📢 Trading gold and other financial instruments carries risks – only invest what you can afford to lose. Always do your own analysis, use solid risk management, and trade responsibly.

Good luck and safe trading! 🚀📊

Liberation, Altercation or Doom? ES Futures weekly planCME_MINI:ES1!

Quick Update

The upcoming week is poised to be critical for financial markets as President Donald Trump's so-called "Liberation Day" on April 2 approaches. On this date, the administration plans to implement new tariffs aimed at reducing the U.S. trade deficit by imposing reciprocal duties on imports from various countries.

As April 2 looms, the full impact of these tariffs remains uncertain, leaving markets and investors in a state of heightened anticipation.

We may get clarity on the tariff situation on April 2, 2025.

Universal tariff announcement of categories of imports may clarify US administration’s maximum tariff escalation approach.

A phased out and unclear tariff approach may keep markets in limbo.

Economic Calendar

Keep an eye on the data docket, NFP and other key releases are due this week.

Tuesday, Apri 1, 2025 : ISM Manufacturing PMI, JOLTS Job Openings

Wednesday April 2, 2025 : ADP Employment Change, Factory Orders MoM

Thursday April 3, 2025 : Balance of Trade, Imports, Exports, ISM Services PMI, Initial Jobless Claims

Friday, April 4, 2025 : Non-Farm Payrolls, Unemployment rate, Average Hourly Earnings MoM,Average Hourly Earnings YoY, Fed Chair Powell Speech

Key Levels to Watch:

Yearly Open 2025 : 6001.25

Key Resistance : 5850- 5860

LVN : 5770 -5760

Neutral Zone : 5705-5720

Key LIS Mid Range 2024 : 5626.50

2024-YTD mCVAL : 5381

2022 CVAH : 5349.75

August 5th, 2024 Low : 5306.75

Scenario 1: Bold but Strategic Tariffs (Effective Use of Tariff to reduce trade deficit and raise revenue) : In this scenario, we may see relief rally in ES futures, price reclaiming 2024 mid-range with a move higher towards key resistance level.

Scenario 2: Maximum pressure, maximum tariff (All out trade war) : In this scenario, we anticipate a sell-off with major support levels, such as 2024- YTD mCVAL, 2022 CVAH and August 5th, 2024 low as immediate downside targets.

Scenario 3: Further delays in Tariff policy (A negotiating tool, with looming uncertainty) : In this scenario, sellers remain in control and uncertainty persists, while we anticipate that rallies may be sold, market price action may remain choppy and range bound.

Will the Fear Gauge Flash Red?The Cboe Volatility Index (VIX), Wall Street's closely watched "fear gauge," is poised for a potential surge due to US President Donald Trump's assertive policy agenda. This article examines the confluence of factors, primarily Trump's planned tariffs and escalating geopolitical tensions, that are likely to inject significant uncertainty into the financial markets. Historically, the VIX has proven to be a reliable indicator of investor anxiety, spiking during economic and political instability periods. The current climate, marked by a potential trade war and heightened international risks, suggests a strong likelihood of increased market volatility and a corresponding rise in the VIX.

President Trump's impending "Liberation Day" tariffs, set to target all countries with reciprocal duties, have already sparked considerable concern among economists and financial institutions. Experts at Goldman Sachs and J.P. Morgan predict that these tariffs will lead to higher inflation, slower economic growth, and an elevated risk of recession in the US. The sheer scale and breadth of these tariffs, affecting major trading partners and critical industries, create an environment of unpredictability that unsettles investors and compels them to seek protection against potential market downturns, a dynamic that typically drives the VIX upward.

Adding to the market's unease are the growing geopolitical fault lines involving the US and both China and Iran. Trade disputes and strategic rivalry with China, coupled with President Trump's confrontational stance and threats of military action against Iran over its nuclear program, contribute significantly to global instability. These high-stakes international situations, fraught with the potential for escalation, naturally trigger investor anxiety and a flight to safety, further fueling expectations of increased market volatility as measured by the VIX.

In conclusion, the combination of President Trump's aggressive trade policies and the mounting geopolitical risks presents a compelling case for a significant rise in the VIX. Market analysts have already observed this trend, and historical patterns during similar periods of uncertainty reinforce the expectation of heightened volatility. As investors grapple with the potential economic fallout from tariffs and the dangers of international conflicts, the VIX will likely serve as a crucial barometer, reflecting the increasing fear and uncertainty permeating the financial landscape.

Is Gold Forming a Double Top?Gold prices surged once again toward the record high of 3,057, driven by safe-haven demand ahead of April, which brings renewed tariff threats and unfolds amid intensifying geopolitical tensions involving Russia, Ukraine, the U.S., Yemen, Israel, and Gaza.

Should gold prices retreat below this level, we may witness the formation of a potential double top pattern, with downside targets around 3,030, the 3,000 neckline, and further support levels at 2,955, 2,920, and 2,900.

On the upside, a decisive close above 3,060 could trigger another leg higher, potentially setting a new record in alignment with the 3,080 level.

From a monthly perspective, the RSI continues to flash reversal signals similar to those seen in 2024, 2020, 2011, and 2008—raising caution around gold’s elevated levels. While safe-haven demand may continue to outweigh overbought momentum, any shift toward peace could swiftly reverse gains, creating a double-edged sword scenario for the precious metal.

Written by Razan Hilal, CMT

Copper's Grip: Stronger Than Oil's?Is the U.S. economy poised for a red metal revolution? The escalating demand for copper, fueled by the global transition to clean energy, the proliferation of electric vehicles, and the modernization of critical infrastructure, suggests a shifting economic landscape where copper's significance may soon eclipse oil. This vital metal, essential for everything from renewable power systems to advanced electronics, is becoming increasingly central to U.S. economic prosperity. Its unique properties and expanding applications in high-growth sectors position it as a linchpin for future development, potentially rendering it more crucial than traditional energy sources in the years to come. This sentiment is echoed by recent market activity, with copper prices hitting a new record high, reaching $5.3740 per lb. on the COMEX. This surge has widened the price gap between New York and London to approximately $1,700 a tonne, signaling strong U.S. demand.

However, this burgeoning importance faces a looming threat: the potential imposition of U.S. tariffs on copper imports. Framed under the guise of national security concerns, these tariffs could trigger significant economic repercussions. By increasing the cost of imported copper, a vital component for numerous domestic industries, tariffs risk inflating production costs, raising consumer prices, and straining international trade relationships. The anticipation of these tariffs has already caused market volatility, with major traders at a Financial Times commodities summit in Switzerland predicting copper could reach $12,000 a tonne this year. Kostas Bintas from Mercuria noted the current "tightness" in the copper market due to substantial imports heading to the U.S. in anticipation of tariffs, which some analysts expect sooner than previously anticipated.

Ultimately, the future trajectory of the U.S. economy will be heavily influenced by the availability and affordability of copper. Current market trends reveal surging prices driven by robust global demand and constrained supply, a situation that could be further exacerbated by trade barriers. Traders are also anticipating increased industrial demand as major economies like the U.S. and EU upgrade their electricity grids, further supporting the bullish outlook. Aline Carnizelo of Frontier Commodities is among the experts forecasting a $12,000 price target. However, Graeme Train from Trafigura cautioned that the global economy remains "a little fragile," highlighting potential risks to sustained high demand. As the world continues its march towards electrification and technological advancement, copper's role will only intensify. Whether the U.S. navigates this new era with policies that ensure a smooth and cost-effective supply of this essential metal or whether protectionist measures inadvertently hinder progress remains a critical question for the nation's economic future.

EURUSD Contracts Ahead of Key Data and Trump’s "Liberation Day"The main scenarios from our earlier post remain unchanged. The 1.0800 support has shifted slightly lower to 1.0780. Trump's so-called "Liberation Day" is approaching, and it's creating downward pressure on EURUSD, despite weak U.S. data.

Yesterday, consumer confidence fell to 92.90, marking the worst reading since the COVID shock, and the lowest since 2016 if you exclude that period. The magnitude of the drop is significant.

EURUSD price action has now contracted into a very narrow range, suggesting that a major breakout is likely imminent. Which direction it will take remains unclear. This week’s PCE data will be important, but the main price driver will likely be the April 2 tariff announcement, or any early leaks or headlines leading up to it.

1.0780 has now become the short-term support level, while the updated trendline serves as the main resistance.

SPX: Bear Flag? On the 4hr or a bounce off the 1D trendline?Market has been in a funk. Trump announces 25% tariffs on auto imports. Surprised markets didn’t tank more in AH.

Gap filled on a lot of charts today (3/26/25). Wondering now, on the daily if it bounces off this purple trend with unemployment data and PCE Friday.

Trump to unveil auto tariffs at 4 p.m.President Trump will announce new tariffs on auto imports during a press conference in the Oval Office at 4 p.m. ET, according to White House press secretary Karoline Leavitt.

The headlines have weighed heavily on EUR/USD, pushing the pair to multi-week lows (now below 1.0750). However, it is hard to find sources that indicate that the tariffs announced today will apply to autos coming from Europe.

Regardless of today’s announcement, Trump has promoted next week’s April 2 as D-Day for imposing reciprocal tariffs on all countries that maintain import duties on U.S. goods. So, the market might just be getting ahead of itself for good reason.