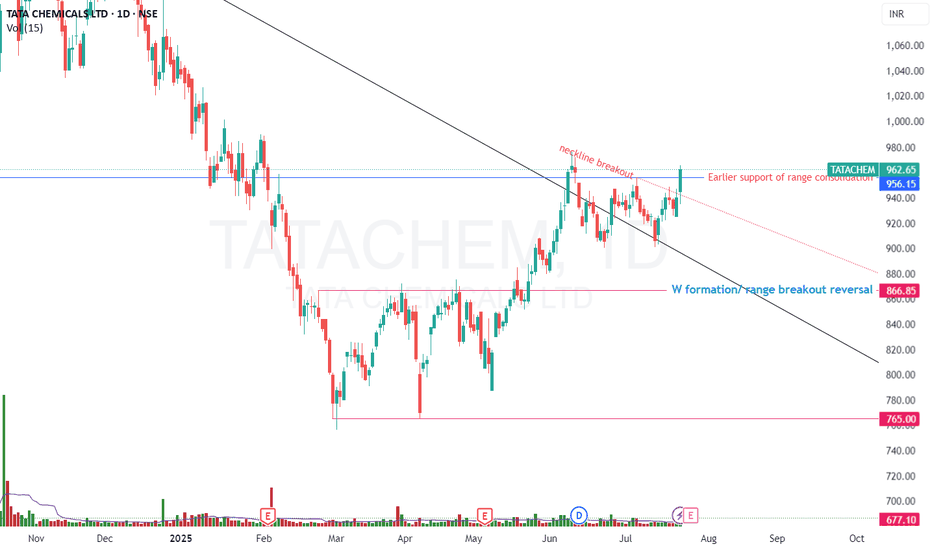

Tata Chemical, #tata chem# tata chemical📉 Trend Reversal from ₹790–₹800 Support Zone

'W' pattern formed on daily chart — trend reversal signal.

Bottom range & neckline breakout confirm bullish momentum.

Price consolidating above W base, showing strength.

📈 Bias: Bullish above neckline; potential for further upside.

🗓️ Upcoming Event: Q1 results due soon — may act as a trigger for next move.

⚠️ Risk: Breakdown below ₹890 could negate the setup CMP = 962.65 total 70 points nearly 7% SL.

Tatachemicalslong

TATA CHEMICALS Ready to FIRE ( LONG TERM IDEA ) !!!TATA CHEMICALS' weekly counts indicate a bullish wave structure.

Both appear to be optimistic, and this stock's invalidation number is 756.

Investing in declines is a smart move for long-term players.

Long-term investors prepare for strong returns over the next two to five years.

TOP PLAYER IN THE INDUSTRY OF CHEMICALS

Every graphic used to comprehend the theory of elliot waves, harmonic waves, gann theory, and time theory

Every chart is for educational purposes.

We have no accountability for profit or loss.

Tata Chemicals Set for Bullish Swing, Targeting ₹1200-₹1220 Tata Chemicals is showing strong bullish momentum on the weekly chart, making it an attractive pick for swing traders. With a target range of ₹1200 to ₹1220 in the next 1 to 2 weeks, this stock is positioned for potential short-term gains.

Key Technical Highlights:

The stock has recently closed at ₹1128.65, marking a high over the past one to two months, indicating sustained strength.

Multiple RSI indicators are showing bullish momentum, reinforcing confidence in the uptrend.

The chart pattern suggests a clear bullish bias, making Tata Chemicals an appealing candidate for swing trading.

Trade Setup:

Target: ₹1200 to ₹1220

Stop Loss: ₹1092.60

Time Frame: 1 to 2 weeks for swing traders

Reason for the Buy Call:

Bullishness on the Weekly Chart: The stock has consistently shown strength, breaking through key resistance levels.

RSI Momentum: Multiple RSI indicators suggest ongoing upward pressure, confirming that buyers are in control.

Conclusion:

Tata Chemicals offers a solid swing trade opportunity, with technical indicators pointing towards further gains. With a target of ₹1200 to ₹1220 and a stop loss of ₹1092.60, this trade setup presents an attractive risk-to-reward ratio for swing traders.

Disclaimer: This is for educational purposes only and not financial advice. Please do your own research before making any investment decisions.

TATACHEM--This stock is facing the resistance from top levels at 1150 levels...

price is trading in a channel...

now it is ready to breaks the channel, after strong break price gives us some retracement to enter short side again for targets of below demand zone...

soo keep look for short side up to the below demand zone and support levels.

TATACHEM Daily timeframe analysis for long term

NSE:TATACHEM has given strong breakout of consolidation range over year near 1040 price.

We can buy near 1043 and can see long term move above 1040 with SL of 1000 if it give pullback add more till 1033 .

Major targets levels are highlighted in blue lines.

Tata Chemicals can be slow but is looking solid.Tata Chemicals Ltd. CMP – 1011.90 (Long Term Investment Idea)

Market Capitalization Rs 25,778.8Cr

Red Flags:🟥

FIIs are decreasing stake

MFs are decreasing stake

Green Flags:🟩

No debt

Zero promoter pledge

Improving annual net profit

Improving cash from operations annual

Dividend Yield @CMP = 1.78%

Previous Happy Candles Number – 87/100

New Happy Candles Number – 79/100

Fresh Entry/ averaging / compounding after closing above 1031

Targets: 1063 and 1084.

Long term target: 1108+.

Stop loss: Closing below 935.

The above information is provided for educational purpose, analysis and paper trading only. Please don't treat this as a buy or sell recommendation for the stock. We do not guarantee any success in highly volatile market or otherwise. Stock market investment is subject to market risks which include global and regional risks. We will not be responsible for any Profit or loss that may occur due to any financial decision taken based on any data provided in this message.

Tatachem - Elliott Wave CountTatachem - Elliott Wave Count

The market appears to be in a bearish trend, and we can expect wave C to complete between 780 and 680. After that, we can expect an upward rebound.

Please exercise caution when trading as this information is for educational purposes only.

NSE:TATACHEM NSE:TATACHEM1! BSE:TATACHEM

TATACHEM : Rectangle pattern TATACHEM trading in Rectangle pattern in 15 min time frame.

If any bullish candle stick pattern formed near support line, we can see reversal of stock

If support break then its good to wait for retest and sell if find any bearish candle.

Like, Share, Comment for regular updates.

Disclaimer

I am not sebi registered analyst

My studies are Educational purpose only

Please consult with your Financial advisor before trading or investing

TATA CHEM POSSIBLE INTRADAY & SWING.Tata chemicals opened gap down due to bad earnings report and consolidated there for the rest of the day

Major support at 923 & 875 which are also fib levels 0.618 & 0.786 respectively

Buy above 924 for the upper marked targets.

Sell below 900 for the lower marked targets.

RSI levels are also in consolidating range

MACD looks bullish

Please LIKE, COMMENT and SHARE to motivate and support me. I'll keep on posting new ideas on Indices & Stocks. NSE:TATACHEM

TATACHEM ::: HIGH RISK BULLISH TRADEH I G H R I S K T R A D E.

10 MAY 2021

INSTRUMENT: TATACHEM

TREND: BUY

TIME FRAME: DAY

CMP: 683.80

BUY ABOVE: 697

STOP LOSS: 681

TGT 01: 730

DISCLAIMER:

We are not S E B I registered analysts. Please consult your personal financial advisor before investing. We are not responsible for your profits/losses whatsoever.