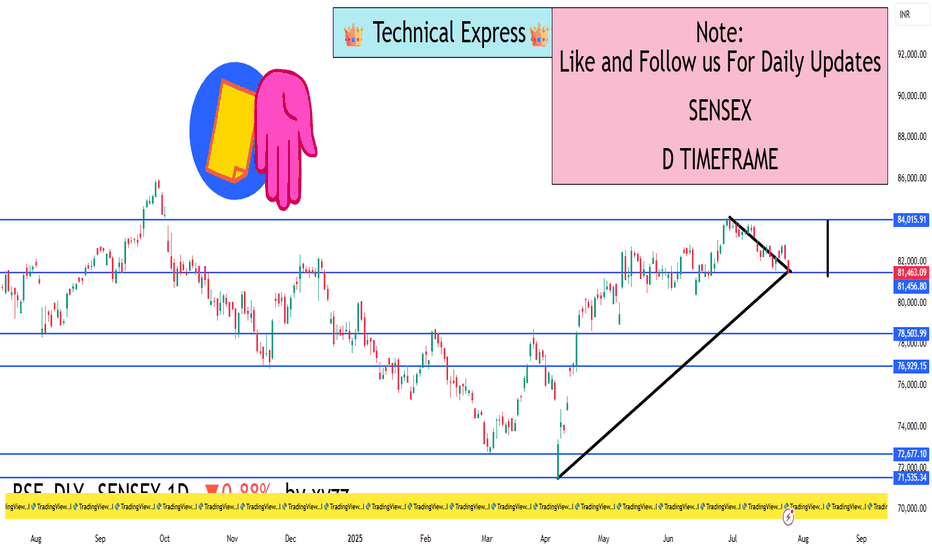

SENSEX 1D Timeframe📉 SENSEX Daily Overview (as of July 25, 2025)

Current Price: Around 81,460

Daily Change: Down by approximately 720 points (–0.9%)

Day’s High: About 82,070

Day’s Low: About 81,400

Previous Close: Around 82,184

📊 1-Day Candlestick Analysis

The candle for today is bearish, indicating strong selling pressure.

The price opened near previous levels but faced resistance at around 82,000.

Sellers dominated most of the day, pushing the index toward the 81,400 support zone.

🔍 Key Support and Resistance Levels

Level Type Price Range

Resistance 82,000 – 82,200

Support 81,400 – 81,000

If Sensex breaks below 81,400, the next target could be around 80,500 or 79,900.

If it holds above support and bounces, it could retest 82,200.

🧠 Technical Trend Analysis

Short-Term Trend: Bearish

Medium-Term Trend: Neutral to mildly bullish (as long as above 80,000)

Market Structure: Lower highs forming, suggesting pressure building on bulls

Indicators (assumed):

RSI may be approaching oversold

MACD likely showing bearish crossover

Volume increasing on red candles—indicating strong sell interest

📌 Sentiment & Market Context

Financial stocks (like banking, NBFCs) are under pressure.

Global cues (such as interest rate uncertainty and geopolitical concerns) are impacting investor confidence.

FII outflows and weak earnings in key sectors are adding to bearish momentum.

The broader trend remains range-bound, but with short-term downside bias.

✅ Strategy Suggestions (For Traders & Investors)

Swing Traders: Wait for a reversal candle (like a bullish engulfing or hammer) before considering long positions.

Breakout Traders: Watch for breakdown below 81,000 for continuation of the fall.

Positional Traders: Can wait to enter near 80,000–79,500 if the market holds that key level.

🔄 Summary

SENSEX is under pressure with a drop of 720+ points.

Technical structure suggests caution, especially if 81,000 breaks.

Support: 81,000 – 80,500

Resistance: 82,000 – 82,200

TATAPOWER

Tata Power is showing strengthTata Power's technical indicators suggest a strong buy signal based on moving averages and oscillators. Here’s a quick breakdown:

- Relative Strength Index (RSI): 65.04 (indicating bullish momentum)

- MACD: 3.38 (positive crossover, signaling upward trend)

- Moving Averages: All major SMAs and EMAs indicate a buy

- Pivot Points: Key support at ₹388.64, resistance at ₹398.69

Close Above 400 mark will be positive

- Short-Term Forecast: Technical analysis suggests support around ₹390 and resistance near ₹626, with a potential price target of ₹417.23 in the next two weeks.

Tata power, good buy for long term and short term Tata power one of the best best fundamental stock now available at good demand zone one can add in portfolio if not added yet

Can add at levels of 380-405

Sl mclbs 365

Tgt atleast:1:2 & 25% to 100% expecting a blast before a Indian budget

Ask your financial advisor and broker before buying

Only for educational purposes

TATAPOWERNSE:TATAPOWER

One Can enter now!

Or Wait for a retest of the trendline(BO)!

Or Wait for a better Risk:Reward Ratio!

Note :

1. One should go long with a StopLoss, below the Trendline or the Previous Swing Low.

2. Risk :Reward ratio should be minimum 1:2.

3. Plan your trade as per the Money Mangement and Risk Appetite.

Disclamier : You are responsible for your profits and loss.

The idea shared here is purely for Educational purpose.

Follow back, for more ideas and thier notifications on your email.

Support and Like incase the idea works for you.

TATAPOWER Trading within tested Demand Zone of ₹419.15 to ₹411.3TATAPOWER's current price is ₹417.7, positioning it within a demand zone between ₹419.15 and ₹411.3. This zone is tested, and may act as a support level. Investors should keep an eye on the stock's performance in this range, looking for signs of a potential price bounce or consolidation, which could indicate a favorable buying opportunity.

Tata Power Co. Ltd. - Technical OverviewTarget Price: ₹560 (As per Nomura's analysis)

Price Action: The stock is currently trading at ₹456.90 (+3.54% for the day). It has been in a steady uptrend, following a clear rising channel since early 2024, supported by both the 50-day and 200-day moving averages, which indicates long-term bullish momentum.

Key Levels:

Support: ₹435.50 (currently a strong support level near the lower trendline)

Resistance: ₹507.40 (the recent upper boundary of the trend channel)

Target Price : ₹560 (suggested by Nomura)

Trend Channels:

The stock has formed a well-defined ascending channel , where the price tends to respect both the upper and lower boundaries.

Recent pullbacks toward ₹435.50 suggest that the stock is consolidating before a potential bounce toward ₹507.40, and possibly ₹560 in the medium term.

Price Momentum:

RSI: The Relative Strength Index (RSI) suggests that the stock is not in overbought or oversold territory, signaling healthy price momentum.

Volume : Notice the spike in volume during price rallies, reflecting strong market interest and confirmation of price movements.

Outlook:

Given the current market setup, Tata Power is showing signs of continued bullish momentum within its trend channel. A move beyond ₹507.40 could trigger further buying, pushing the stock towards ₹560 in the medium term. Any price retracements to the ₹435 level can be seen as a potential buying opportunity, given the channel support.

Chart Details:

Green Lines : Support and resistance levels.

Blue Channels : The stock’s rising trend, representing medium-term bullish momentum.

Volume: Key volume spikes highlight investor activity during price jumps.

Tata Power

Tatapower :

1. Super Breakout above 363....

2. Some profit booking seen on last trading day...

3. One of my favorite stock..

4. Evey investor should have this in their portfolio...

5. I have marked price road map on the chart...

6. Every dip you can add near green lines...

7. Traders can use to plan their trades based on the levels...

Happy Trading

Like.. Share.. Follow

TATAPOWERwe are looking TATAPOWER bullish move.

Disclaimer:

Kind regards to all friends and members ,

Stock market investment is subject to 100% market risks. Our company is not a SEBI registered company. Please consult your financial advisor before investing. This is for learning and training purposes only. Market Traps administrators are not responsible for any financial gains or losses resulting from your decisions. You acknowledge that stock market investments are highly risky and that you understand the market risks involved. Hence any legal action is void.

When to sell Tata PowerNamaste!

Power stocks and the electric car maker Tesla have sky-rocketed since the Democrats took the Whitehouse in the year 2020. Tesla jumped 1300% (peak) from previous swing low of USD 29. Tata Power jumped 974% (peak) from previous swing low of INR 28.

I remember watching an analysis on YouTube, which emphasized that Democrats are more "environment conscious". If they won the election, they will do the Democrat thing i.e. make policies for the benefit of environment. So, power stocks, clean energy stocks (solar, wind) etc. will be benefited. It eventually happened, which can be seen in the prices of Tesla, Tata Power, Suzlon, Adani Power, etc.

Suzlon is an interesting case. Like Democrats and their environment policies in the US, India was also following the hype. Suzlon Energy's price increased 1300% (peak) since Nov 2020.

There is another reason, based on the shareholding pattern shared by the company on August 14, the promoters of the company held 13.3 percent stake in the company amounting to nearly 180 crore shares, of this stake, nearly 81 percent or 146 crore shares were pledged. Suzlon's promoters released pledge on 97.1 crore shares from SBICAP Trustee Company Ltd. It was another tailwind for Suzlon Energy Ltd.

Not a long time ago, we have been listening "electric" everywhere. The hype was great at that time, but soon AI (Artificial Intelligence) stolen the hype. I am not saying electrification will not happen. But, it might take a longer time than the market is realizing.

There is one more uncertainty, there is US election in Nov 2024.

So now I think it is a good time to book profits in Tata Power. It could be sold at Rs 260.

Disclaimer: This article should not be considered as an investment or trading advice. The analysis is based on my understanding and experience in the markets. You must do your own analysis and/or consult your financial advisor before investing or trading.

TRADE SETUP_TATA POWER_DIWALI SPECIALHappy Diwali to everyone. I wish for prosperity and happiness to all seeing this post.

Tata power is seen in an Elliot wave structure on hourly chart. The stock will now look to reach the 260 mark in wave v to complete what it started on Oct. 26th.

There is also a reverse head and shoulder pattern developing on the hour chart. The neckline of the pattern is yet to be broken, but chances are high the stock might do it and quickly march upwards to 260 then on.

Please note the company had reported a net profit rise of 8%(Y-O-Y) on 8th of Nov. when it announced the results.

Note*-Trading is risky and can lead to financial loses. Kindly study the charts and fundamentals of company before taking any financial positions.

Tata Power - Elliott Wave CountTata Power - Elliott Wave Count

Tata Power seems to have completed its correction and is now on an upward impulse wave with a target of 280 and beyond. However, if the market breaks below 230, this view will be invalidated.

Please note that this information is solely for educational purposes, and it is essential to exercise caution when trading.

NSE:TATAPOWER BSE:TATAPOWER NSE:TATAPOWER1!

TATAPOWERNSE:TATAPOWER

One Can Enter Now ! Or Wait for Retest of the Trendline (BO) Or wait For better R:R ratio

There can be a pause or reversal, at all time high.

Note :

1.One Can Go long with a Strict SL below the Trendline or Swing Low of Daily Candle.

2. Close, should be good and Clean.

3. R:R ratio should be 1 :2 minimum

4. Plan as per your RISK appetite

Disclaimer : You are responsible for your Profits and loss, Shared for Educational purpose