Imagine not buying Tencent Best fundamental long term video game company.

It is already clear Valorant is going to be a huge game, even though it is still in Beta.

If the overall markets werent in limbo with COVID going on this stock would be much higher.

I expect when things recover this company will be a red hot stock...

Overall the chart on the weekly looks to in a great bull trend. I will ride this play out for months to come.

Will probably consider adding over time. Anything under $54 is free money in the long run..

TCEHY

Victory Royale for Tencent?Tencent just invested 150 million dollars in Reddit, and keep in mind that Tencent owns 40% of Epic games... The creator of the video game giant, Fortnite. The Megalodon is giving us a buy signal on the technical side!

The Megalodon indicator uses an artificial intelligence, combined with data from over 500 buy setups, and over 2000 indicators to produce extremely accurate buy signals on any and all asset classes! Send me a message if you would like to try it for yourself!

JD.com trading at a blatant valuation discount- LONGOne of the trends taking place in my portfolio is an increased weighting in China's technology sector.

Amid the trade-driven pessimism over China, clamp down on digital assets and increased control over online content China's economy is trading at a blatant valuation discount to the U.S.

Within the last few months the BAT stocks Baidu BIDU, Alibaba BABA and Tencent TCEHY have been among the biggest losers.

The recent arrest of JD CEO Richard Liu has caused JD stocks to tumble further relative to its e-commerce peers and is now almost 50% off its 52-week high. I view this as a risk-reward profile that is heavily tilted in favor of the bull.

All indicators explained on the graph.

The Gaming Trade - Video Game and Esports Stocks - September 2.0The Gaming Trade

The gaming trade tracks gaming & esports stocks. With a combination of technical and fundamental analysis I attempt to provide the best ways to profit off of these companies in the stock market. My style is a blend of classical charting, candlestick reading, trend trading and a bit of price action. My decisions are based on how the daily, weekly & monthly charts display the current status of the stock. I will do my best to provide insight on profit taking points and breakouts on my Twitter account: @TheBegonis - I use no leverage in this tracking account.

9/16/18

AMD: Current Price: $32.72 ( first article in September $25.17)

Earlier this month I wrote about AMD and noted the Bull Flag on the 4 hour that could take the stock to $30 -- Well it hit it. After a couple days of profit taking, the stock keeps on rolling. The Monthly and Weekly charts show no sign of slowing down either. We are in a little bit of chop on the daily but unless price closes below $25.61 on the weekly this could continue to climb.

Daily:

Weekly:

Monthly:

ATVI: Price $81.27 ( First article in September: $72.10)

Well... Last time I said we were in for some chop, until price closed "above$75.53 on the weekly and the Monthly closes above$75.40." DID WE. Price shot up 11% since then. Price met the previous green candle high around $74 and volume pushed the stock bullish again. Right now price seems to be rounding over on the daily as it hits the previous high around $81.50. Price could pull back a bit on the daily as it loads up for another attempt at the top of the channel. The weekly Stochastic RSI signals that momentum is on the side. Take profits should we reach the top of the channel around $85.

Daily:

Weekly:

Monthly:

EA: Price $114.27 (First article in September: $113.41)

Electronic Arts still looks to be in trouble. So far it seems that a descending wedge is forming on the Weekly and that means prices will continue to fall before any turn up. In the short term we may have a pop to the $118 area seen on the daily to confirm the resistance line of the wedge. But a move down is likely to follow. We may not find true support until the $92 area seen on the Weekly where a lower trend line can be theorized and the Weekly 200SMA (and Monthly 50SMA) would meet. If Price closes below $106.23 on the Monthly, EA will be trending down.

Daily:

Weekly:

Monthly:

HEAR: Price $18.91

Turtle Beach went on a tear this year starting in May (No doubt to the rise of steaming, esports and the explosion of Fortnite). Right now, the run is out of gas. Price is channeling down but we might see a short term bounce as we are at the support of the channel and testing the top of the ignition candle. Look for a possible short term bounce to the $22 area, but this would be a counter-trend move, so if you do, trade careful. If Price closes below $16.53 we will continue going down.

Daily:

Weekly:

Monthly:

MSFT: Price $113.37

Microsoft continues to chug along. Despite some chop of the daily chart it is at an all-time high. The chop should continue on the daily but this looks like it will continue rolling.

Daily:

Weekly:

Monthly:

NVDA: Price $276.43

Nvidia is very choppy on the weekly and daily charts but is otherwise slowly and surely trending up. Price would have to breach $239.63 before I would show any real concern for the stock. HOWEVER, price does seem to be leveling off based on the weekly, so upside may be limited.

Daily:

Weekly:

Monthly:

SNE: Price $59.44

Like so many stocks I am seeing in the market, Sony is starting to show signs of going parabolic. In other words, price may continue to rise and it may rise fast. Price gapped up and is testing a high we haven't seen since 2007. It is a bit of a ways to go before reaching the highs of '99/2000 but the next area we could see is the $84-85 area -- All three major charts are bullish.

Daily:

Weekly:

Monthly:

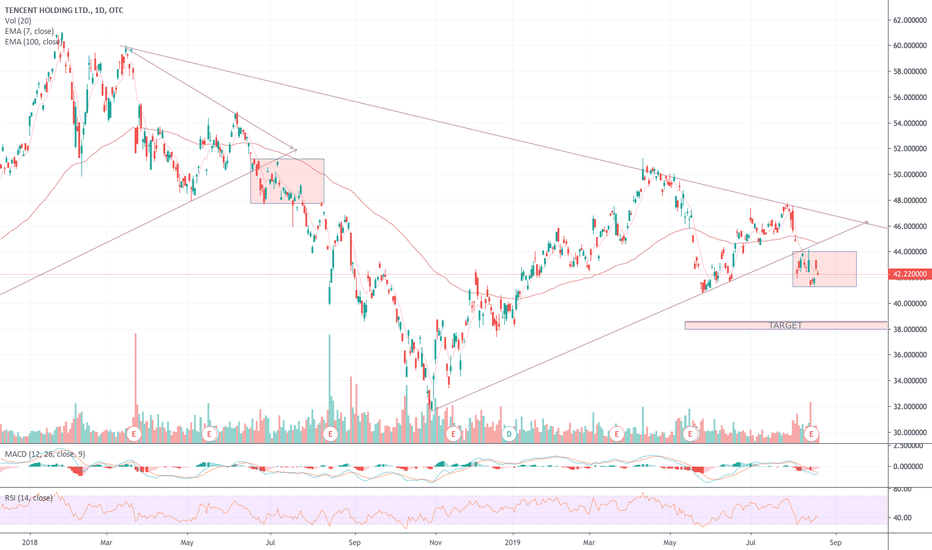

TCEHY: $Price 41.35 (First article in September Price $43.14)

I love Tencent but this is just painful. Price continues to try to break down from the descending channel. (Daily) That $36 area I mentioned last time could still be support but I think this is going to be slog down to the $30 area where the Weekly 200SMA is trending.

Daily:

Weekly:

Monthly:

TTWO: Price $134.11

TakeTwo continues to operate within the rising channel and price is chopping on the daily. At the moment there isn't a good entry and no reason to exit.

Daily:

Weekly:

Monthly:

UBI: Price $95.68

Ubisoft is in a bit of a precarious position. Price is flat. The Daily and Weekly are trading sideways with a slight downtrend. Price fought back bullish last week on the Weekly. It needs to confirm by closing past the next two targets of $97.02 & $99.52 to really resume a bullish move. Price is stagnant at the top of the monthly but it would only be in danger if it closed below $79.60.

Daily:

Weekly:

Monthly:

ZNGA: Price $4.02 (First article in September Price $4.16)

This looks like it should be covered by Ted Allen on Chopped. Two weeks ago it sabotaged all the momentum it was gaining and went choppy. Price seems to be turning back upwards but it needs to clear $4.23 on the weekly if it is going to re-gain that momentum. It doe seem that it will hit that $4.55 PT... eventually.

Daily:

Weekly:

Monthly:

Thank you!

The Gaming Trade - Video Game and Esports Stocks - September 1.0The Gaming Trade

The gaming trade tracks gaming & esports stocks. With a combination of technical and fundamental analysis I attempt to provide the best ways to profit off of these companies in the stock market. My style is a blend of classical charting, candlestick reading, trend trading and a bit of price action. My decisions are based on how the daily, weekly & monthly charts display the current status of the stock. I will do my best to provide insight on profit taking points and breakouts on my Twitter account: @TheBegonis - I use no leverage in this tracking account.

(Note this was created on 9/4/18)

I will be publishing this bi-monthly. One short-form chart update and one long-form newsletter with chart updates.

AMD: Price $25.17

This has been on fire! After completing an 11-year cup & handle it looks like it will need to cool down a bit -- especially because of the HUGE shooting star on the weekly chart. Look to buy the upcoming pull back and consolidation. This will be rolling once again soon enough.

Based on the daily chart - look for a potential pull back to the 50SMA around $21.50 - however price is holding above the 9DEMA (not pictured). If you want to play the potential Bull Flag on the Daily - set a tight stop Just below $24 with a price target around $30

ATVI: Price $72.10

Activision-Blizzard has been in a rising channel since October '16. The stock peaked at the upper resistance line of $81.60 and pulled back to the lower support line. The stock will be in for some choppy trading for a while until the Weekly closes above$75.53 and the Monthly closes above$75.40

EA: Price $113.41

Electronic Arts is showing big weakness at the moment. The huge red candle on the monthly chart is resting on the SMA. This has been in a rising channel since November 2015 and is the first major break in either direction from it. If this doesn't bounce back the next area of support will be $105. Be careful, this has a falling knife quality to it at the moment.

TCEHY: Price $43.14

Tencent is trending south right now. It is currently resting on the SMA of the monthly chart. After a huge hammer back the week of August 13th - price continued to fall and broke below the close of that hammer just two weeks later. Price needs to close back above $49.50-$50 area to change the current down trend. At the moment, a possible area of support could be found in the $36 area.

ZNGA: Price $4.16

Zynga has been slowly moving within a rising channel since February of 2017. Price decisively closed above $3.99 on the weekly locking in the upward trend. It is probably too late to enter a trade as the target is $4.55. This is a stock worth following for the long term - I find the price movements to be reliable - for the time being.

I'll try to do better the next time.

Thank you & safe trading!

China bearish: Buy the trade war tech dip BIDU NTES IQ TCEHY On Friday the 3rd August 2018 Chinese stocks ceded their ranking as the second-largest equity market in the world amid an elevation in trade tensions after the Trump administration said it was considering increasing the initial proposed tariff.

Buying the dip: Considering Chinese markets are at almost a one year low and under a temporary trade war, a knee jerk reaction will eventually take place causing an influx of capital across the market. I cant predict when this would happen or whether stocks have reached their bottom but I consider this another buy opportunity.

TCEHY very long term outlook fib levels looking at places to add/start a position in this monster

Tencent is a massive Chinese company that owns WeChat and a sizable portion of Fortnite among many other things

Pretty confident that FB's data on Americans is nothing compared to the data WeChat has on Chinese people due to how much the "super app" is used.

YY: Good valuation and fundamentals, great chart setup$YY has a great chart here, paired with very interesting growth potential, and current valuation metrics.

We're long and averaging into a long term position as well.

Best of luck,

Ivan Labrie.

ADDING CHINA BEST OF BREEDS - BABA, BIDU, BZUN, GELYYAdded positions in China as I see strength in growing middle class/consumers.

- More attractive valuation than those in US.

- I believe there is more credibility in investing in China's blue-chips. I expect foreign institution $ to flow back to China.

- I am focusing on purchasing best companies in China in technology space.

- I like internet of things and I believe China is ahead of US in terms of utilizing mobile payment such as WeChat by Tencent. I wanted to begin adding positions prior to Tencent earning release next week on March 28, 2018.

- Only non-internet related company is GELYY. China's first global automaker.

- No in-depth technical analysis was conducted as I plan to hold these investments for longer term. However, the overall China market and tech industry's monthly chart shows upside from here.

- I will be conducting more technical analysis for swing trading in another account and compare results.

Ref only - FXI: IShare China Large Cap

Ref only - KWEB: China tech exclude hardware

BABA:

BIDU:

BZUN:

GELYY: (This is only company that is not internet of things. China's #1 public automaker. Now owns Volvo.)