Tata Consultancy Services Ltd Technical Analysis Stock Market InTata Consultancy Services Ltd Technical Analysis Stock Market India

Tata Consultancy Services its provides consulting-led integrated portfolio of information technology (IT) and IT-enabled services delivered through a network of delivery centers around the globe.

TCS

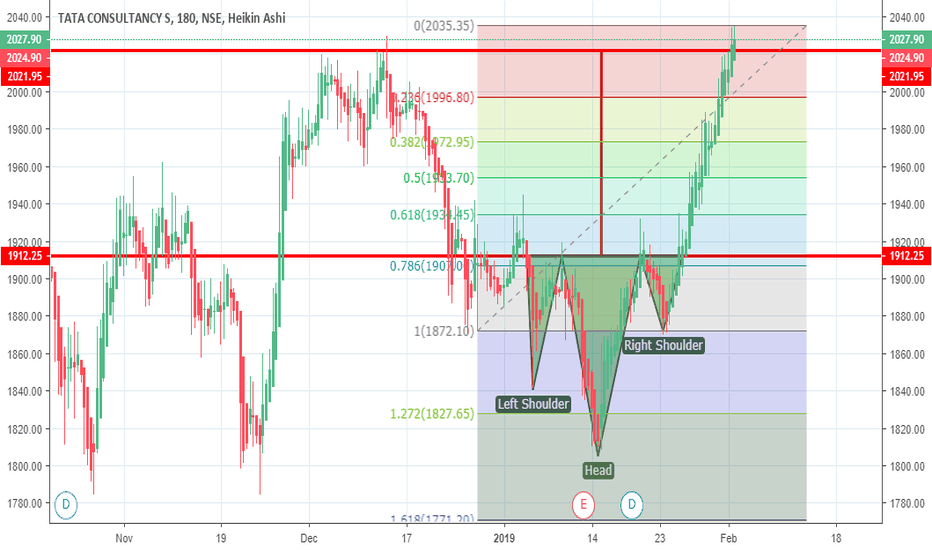

TCS looks weak. A short swing opportunity.At CMP TCS is overvalued. The weekly structure looks weak and shows a failed double bottom structure at 38.2% Fib level. This is indicative of a fall in TCS prices. Target is the 61.8% Fib level which also coincides with the weekly trend line. This is the major support level from which TCS may resume an uptrend post 31st March 2019

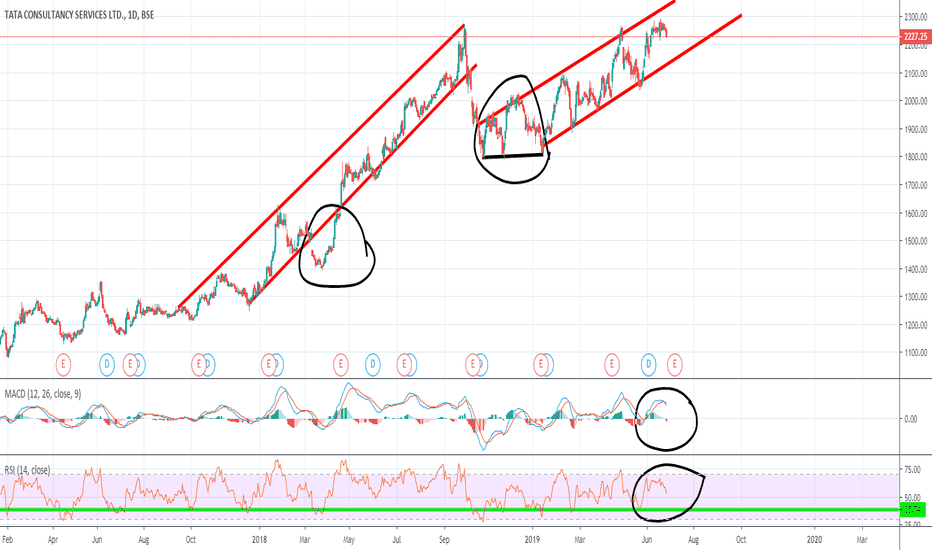

TATA CONSULTANCY SERVICES SHARE HOLDERS SHOULD KNOW THIS!the chart is self explanatory

i know many Indians with family and kids are holding their life savings in this stock

please read this and see the obvious bear in the room

DISCLAIMER - i don't have any TCS shares..... so hopefully this analysis is emotionally uncompromising

Short TCS after reversing from Upper trend lineTCS is trading in channel.

Previously, before making up move, stock had taken support at 200 SMA.

So, stock may touch 200 SMA again, before making up move.

Good shorting opportunity at upper trend line. R:R ratio is favorable.

Views invalid, if stock closes above trend line.

TCS Fib Model$TCS fib model put together on multiple time frames. If the model is accurate TCS should see some price movement tomorrow as it approaches quadrant intersections. No position.