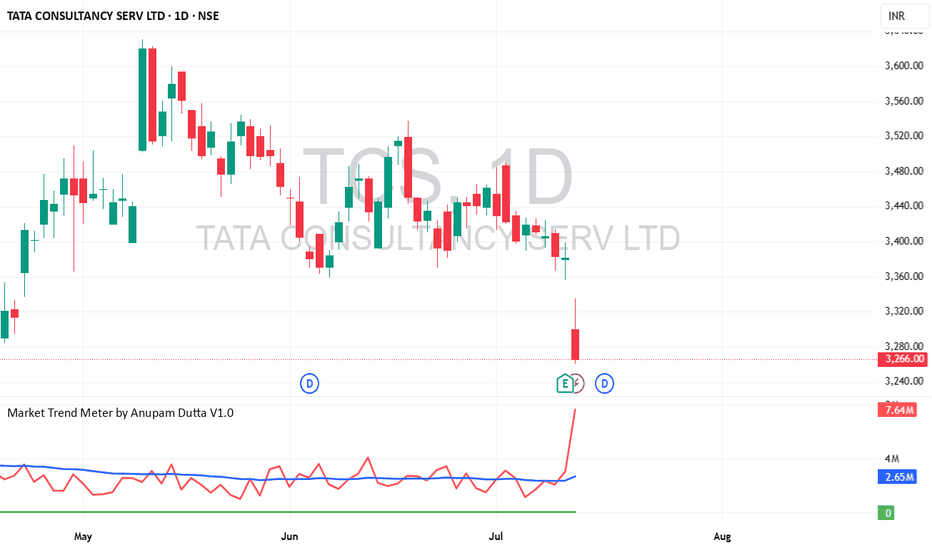

TCS - D1 - Bearish Pennant 🧾 1. 📊 Q1 FY26 Earnings Summary

i. Revenue: ₹63,437 cr (~US $7.4 bn), up just 1.3% YoY, missing expectations of ~₹64,667 cr

ii. Profit/margin held up; revenue disappointed.

📌 Key Takeaway: Profit and margin resilience, but weak revenue growth flagged caution—all aligning with cautious global client sentiment.

🔮 2. Upcoming Events & Catalysts :

Ex‑Dividend Date: Record date July 16, for interim dividend of ₹11/share.

Macro Cues: U.S. tariff developments, global IT spend trends, and sector peers (HCL, Infosys) Q2 reports. Reflation in IT services could shift sentiment.

TCS Investor Engagements: Gen‑AI STEM program (Jul 9); presence at global fintech & life‑sciences events through Sep (SIBOS, COBA) .

📆 3. Catalysts Ahead :

Global IT Budget Trends (esp. U.S. and Europe) → direction for next‑quarter bookings.

Peer Q2 Results (HCL, Infosys) → could provide broader sector cues.

New Deal Wins from BFSI/USD clients → margin & growth potential.

Macro Developments: Trade policies, Fed signals, and inflation data.

Thank you.

Tcsanalysis

TCS Long Opportunity - Medium-Term Swing Trade📈 TCS Long Opportunity – Medium-Term Swing Trade

🔹 Entry : ₹3266 (Last Close)

🔹 Target : ₹3525

🔹 Qty : Up to 25 shares

🔹 Timeframe : ~6 months

🔹 Estimated ROI : ~16.49% annualized

A moderate-risk swing setup on Tata Consultancy Services . Technically and fundamentally aligned for gradual upside, assuming market conditions stay favorable. Entry near current levels with a well-defined target.

⚠️ Trade only if you're comfortable with the risk of capital loss. Position sizing is key.

Tata Consumer Products Ltd a bearish harmonic Gartley pattern Tata Consumer Products Ltd has formed a **bearish harmonic Gartley pattern, completing at point D near the 1.395 Fibonacci extension—typically a reversal zone. RSI is near overbought, suggesting caution. Based on this technical setup, the stock may face **selling pressure**, making it a sell recommendation with a target of ₹1,040 and a stop loss at ₹1,135. If the price breaks above ₹1,135 with strong volume, trend bias can shift bullish, but currently, it's best viewed with a short-term bearish outlook.

for educational purposes only

TCS POSITIONAL LONG TRADE

Here is the valid Source and its Destination which has violated its opposite Supply;

This is the Demand & Supply Equilibrium Curve according to the Fresh Demand and Supply available.

We have further sub-divided the Curve into 5 areas; considering we as traders are supposed to buy low and sell high where is high and how low can it get; these areas give us an understanding about the Price position as per the Curve.

Price has come into the Demand making Lower Lows and then after reacting to the Weekly Demand Price has violated a previous High; which shows a possibility of Buyers upping their game vs the available sellers.

Finally we have a Demand formed in 45 mins which is the first Demand formed after Price has reacted to the Weekly Demand and we have a Buying momentum confirmation hence this is a Buy Trade favourable reward to risk ratio

TCS--@Breakout or Breakdown ??I am sharing the important levels of Support and Resistance. These levels plays a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

Take a look at these levels and trade accordingly. Recognizing and respecting these support and resistance levels can help traders make informed decisions and manage risk effectively. They serve as key reference points for technical analysis and are vital tools in successful trading strategies.

Trade safe...Thank you guys for your support

TCS TCS is currently moving in range at weekly timeframe for more than 3 years.

TCS has shown a decent performance in recent Q3 result.

TCS Q3 Results Live Updates | Key Highlights of the Quarter Ended December 31, 2023

Revenue at `60,583 crore, +4.0% YoY, +1.7% YoY in Constant Currency

Operating Margin at 25.0%*; an expansion of 0.5% YoY

Net Income at `11,735 crore*, +8.2%* YoY | Net Margin at 19.4%*

Net Cash from Operations at `11,276 crore ie 102% of Net Income

Diverse and inclusive workplace: Women in the workforce: 35.7% | 153 Nationalities

Investing in the workforce: 39.7 million learning hours YTD | 3.7 million competencies YTD

LTM IT Services attrition rate at 13.3%

Dividend per share: ` 27.00, including ₹ 18.00 as special dividend | Record date 19/01/2024 | Payment date 05/02/2024

TCS Daily timeframe analysis for long term

NSE:TCS is strong bullish after it has taken splendid bounce from golden zone and has reached first target since buying level 3534.

Next Buy Level is 3679 - 3534. We can see long term move above 3680 if it give pullback buy more near 3679 to 3534 range.

Major targets levels are highlighted in blue lines.

TCS--3200 Or 3500I am sharing the important levels of Support and Resistance. These levels play a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

They serve as key reference points for technical analysis

Look for buy side from 3200 to 3500.

TCS --Near its Demand Zones??I am sharing the important levels of Support and Resistance. These levels play a crucial role in trading decisions, as they act as reliable markers of price movements.

------>>Support levels are price points where an asset tends to find buying interest, preventing it from falling further.

---->Resistance levels, on the other hand, are points where selling pressure typically prevents the asset from rising higher.

If price breaks the resistance, we have a chance of filling the bearish gap, soo keep in buyside until it touches the zone of resistance and bearish gap.

Take a look at these levels and trade accordingly. Recognizing and respecting these support and resistance levels can help traders make informed decisions and manage risk effectively. They serve as key reference points for technical analysis and are vital tools in successful trading strategies.

Trade safe...Thank you guys for your support

TCS--@Resistance Zone?? This stock has encountered persistent resistance within the 3460 range on multiple occasions. On the flip side, the price has consistently found support along a trendline, leading to upward movements.

It's advisable to maintain a bullish perspective as long as the price remains above this trendline. However, exercise caution, as there's a possibility of a false breakdown below the trendline, which could mislead traders and necessitate a prudent approach before considering short positions.

TCS--Will break 3400 ??observations::

facing resistance multiple times from this zone...3400 range...

if this range is broken will see a strong momentum towards upside is possible...

we have a trendline support as well...now price is at important level...

if price takes the help of trendline will be on buyside...keep track this levels...

3200 and 3400.

TCS Low Risk High Reward IdeaAs per my analysis NSE:TCS is now ready to move upside for big levels. My buy level is 3189-3195 with stop loss of 3155 (-44 Points Risk). My expected upside target would be 3234 (+45), 3275 (+85) & 3435 (+246). This could be very low risk and high reward opportunity.

Note: This is my personal analysis, only to learn stock market behavior. Thanks.

TCS--3400 or 3200??Observations::

Before going to rise again, price wants to test the demand at 3200 range.

Previously strong fall is observed from this zone @3400 range,

now its showing again bearishness...if this continue to fall happens up to 3225-3200 range..

look for buy in this zone...

we have a strong demand zone previously in this level, may again push the price above 3400 range.

short Tata consultancy servicesNSE:TCS has formed a double bottom pattern. But it had not given the breakout It's still below the neckline. And the volume is also low as well as the 50 moving average is downwards direction. The 50 moving average is working as a resistance right now. So it's good time to take a short position.

target 3101

stoploss 3237