bitcoin weekly still has room to go down, $5500 testalthough the social media hype seems to be with the bulls the rallys upwards have looked uncertain and been generally weak.

looking on the weekly chart we can see that there is still room for bitcoin to make some drops.

we have a couple of tests coming up:

$5500 would be a double bottom off a low during last years bullrun.

$5000 would be support from a high during last years bull run

$4500 high and double bottom from last years run.

$3000 ultimate support & double bottom.

will be keeping an eye on the following indicators:

rsi, currently 43, showing there is room to drop yet.

tom de mark still seeking out that 9 low bar

200 ema (purple line) will see where that is when the time comes, at the mo it is suggesting a strong bounce at $5500 but if the weeks go on and the price comes down could seek a lower number.

basically if rsi = 30, td = 9 and ema = 200 then boom-shack-a-lacka off we go! question next will be how far as i do believe lower lows will be sought.

note: off chart also looking at bbands and ichi cloud too.

TD

BTC bearish price action coming soon?

The area of confluence ($7742-$7570) is holding up strong.

Area of confluence: combination of multiple strategies into one strategy. It is useful to find a support or resistant range for the asset's price action.

How to find: One way to find the area of confluence is finding the overlap within separately mapped Fibonacci retracements

Today's candle is currently closing under the 10 MA. If it closes under the 10 MA ($7453) it will be harder for the price to move up.

The OBV is sloping down which indicates a price drop.

BULLISH SITUATION: If today's candle prints a green 1 that will break the count which could lead to an increase in price for the next few days.

BEARISH SITUATION: If today's candle prints a red 8 the probability of bearish price action in the coming days are high.

On the lower time scale (4hr, 2hr, 1hr) the signs are pointing to a positive price gain; the OBV is bullish and the TD is looking bullish. So, on the short term we might see an increase on price since the shorter time frame is showing strength.

This is actually bearish on the long term (next few days) becuase that will print a green 8 for today (read the bearish situation above)

We shall see how today closes. Today's close is crucial in indicating the price action for the next few days.

I will keep this updated

*As I was writing this post, the price climbed $30 in 3 mins.

TD Lines on 1h GoldLooks like trading XAUUSD with a very basic Trendline-Breaking approach can be very profitable.

In this example I used TD Points Level 1 to generate Trendlines on a 1H chart - a lot of signals will be generated with this settings.

TP/ SL will be calculated based on a R:R of 1:2 according to Tom DeMarks approach. No Trailing Stops, no RSI filter.

Due to the high number of Signals, I needed to limit the backtest to only test the years 2017 and 2018.

40% profit, 5% Drawdown.

EURUSD 2H long: Bullish CCIDivergence below TD Supply LineThere is a Bullish Divergence of Price versus CCI below a TD Supply Line (based on Level 3 TD Points) on the EURUSD 2H Chart.

The Bullish Divergence indicates a possible Trend-Reversal. So chances are high, that if Price crosses the Supply Line, we will see a bigger Movement to the upside. If this Setup for for a Buy/ Long Trade will come true, TP/ SL will be calculated on a R:R Ration.

Very short term 3hour tradeIt's quite hard to draw my arrows on this one as I am posting it somewhat early hoping that a 9 count will come. The probability is that a sequential 9 will give 1-4 candles reversal (including itself). I made a good short term trade yesterday using this indicator when a 9 showed up before this rally. Note that it shows a red 1 now where I shorted but at the time I shorted it was a 9 and so many people shorted here it changed the count to a red 1. it used to be that the reversal would come following the 9 but quite often it has been happening on the 9 recently and considering we hit the bottom of the triangle and started reversing, that short was literally an active trade for only an hour or two as I bought back in with support at 6800.

Either way be very careful with this trade. The daily chart shows probability that there is around 3days left of upside so this is a trade where you'll wanna have tight stops and be in and out quick unless the reversal comes in stronger than expected.

I personally think we will correct as low as $7500-$7600 before making moves back towards 8k and beyond.

My plans if the sequential gets to a 9 on this 3hr chart: I will most likely short it at the tail end of the 8 candle if the price is high enough (at least 7800) aiming for a 2-3% gain buying back in around 7600 unless the reversal is stronger than expected.

Good luck with your trades.

How The Crypt Alpha Uses The TD Indicator To Identify A Trend Hey Guys,

This video is for educational purposes not too many people have been using the TD Numerical Indicator to help identify a trend. This is a indicator that usually signals either a continuation or a reversal that can help you make your trading decisions. The TD Numerical indicator gives us a 1-9 count to the up side then it signals a trend reversal by highlighting the 9. After this we can expect a 1-5 candle pull back. The higher time frame you use it (ex weekly) the more accurate it becomes. Sometimes on the daily or hourly you may have to do some mental tweaking to adjust the signals as it usually sends signals a one or two days early.

I hope this helps, Subscribe for more videos and information from @TheCryptAlpha

Also Be Sure To View My Previous Charts They Are Linked Below!

Ciao!

TD 9 on the daily for AMD... Short Term Bottom??AMD has created a perfect 9 buy on the daily chart and I believe this is a good time to buy short term calls or buy the stock for a bounce to the upside. Target is the mid $12's range. It should move easily through the 61% retracement since that has provided very sloppy support and resistance but I am unsure if it will have the power to be able to break the 78% retracement. It is also possible it stalls in the $11 range, since that is the prior swing low. The 11 range might be a area to take some profits and let the rest ride into the 12's. This is not a long term trade and money should be pulled quickly on further downside

Happy trading

Bullish setup for TDShares of TD appear to be pulling back to test a breakout level at ~$53.50, which coincides with a rising channel bottom. I'm a buyer at that level and will be targeting ~$66 on the upside, or +23% from here. In a rising rate environment and given the technical setup, I expect shares to outperform over the next several months.

TD Retesting Resistance?Ended the day off with a huge hammer signalling a move up, MACD is also making moves for a crossover, TD could possibly be making a move up to test the strong resistance @ $75.

Be careful though, TD is currently in a bearish state, the resistance has already been tested a total of three times, forming a triple top. However, I think a scalp here is certainly possible.

Will TD break the resistance this time around and blast through to new highs? Or will it continue its bear trend?

Let me know what you guys think!

Monthly SPX chart showing exhaustion signsEarlier sell signals on daily and weekly time frames has not triggered the expected sell signals.

This should not surprise much as we have been aware of the monthly sell setup that now is coming to completion.

In my earlier analysis I expected a short term sell off following the weekly sell signal but always emphasized that the monthly set up had to complete before we see a serious correction...

According to T. Demark based technical analysis, the SPX is now on a 13 monthly bar of a TD-sell countdown, we should still witness some euphoria into a Christmas rally in a final wave up.

Nevertheless what is manifesting in the monthly chart should not be ignored, we are few days / weeks before a sizable correction starts.

Trade wel ;o

sp500daytrader

BITCOIN (BTC) cyclesHello all,

BTC have been amazing all year long, but now I see signs of an over-extended pattern in the medium term.

All my indicators make me think it will retract soon. And this time, might be more than the usual retractions we got used to.

The TD Sequential Indicator has a peculiar moment where we are completely align in 3 of the most accurate time frames (Monthly, Weekly and Daily). All time frames will have a 'nine' candle ending after Sunday close (see charts below).

And also, the 10K touch of the value is a well known psychological barrier.

So, prepare yourself and be cautious in the next Days/Week.

If the event occur, we might be going down during 1 to 3 months or in the best scenario we might be moving sideways.

Long live Bitcoin. We are here to buy the dips.

NOTE:

This is only my opinion and don't use it as financial advisory. Always do Your own due diligence and make Your personal decisions.

Daily

Weekly

Monthly

TD Indicator will hit a Daily 9 TodayIn about 8 hours I will try to open a Shortpostion, the TD indicator will bring a Daily 9 which Potentially should lead to a 1-4 day correction (source Tone Vays). In the 4 hour timeframe it should hit the 9 in about 8 hours.

Plan is to Open the Position at 7700 with a StopLoss of 8000, Target about 6800 maybe having a close trailing if it comes to that region.

Notice: Im just a newbie and nobody should Trade based on what I post, its just my Personal oppinion how it should go according to the TD indicator.

BTC prepare to SHORT the beastAccordingly to the TD Sequential Setup Indicator we are almost there to SHORT it.

Looking at 4h chart we might have 8 more hours until a 9th candle from Daily time frame syncs with 4 hour time frame. And then I expect to go down from 1 to 4 days.

Take care and pick the sweet spot of reverse, because then we'll going up fast until hard-fork around 16h November.

NOTE: This is not financial advice and i might be wrong. So, please, do your due diligence.

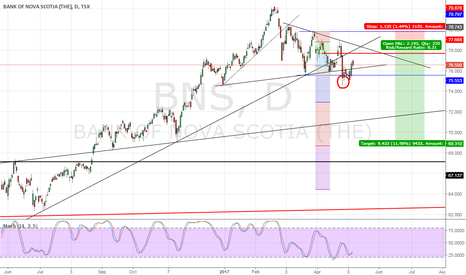

TD high probability shortShort TD

- lots of upper wicks on daily is smart money selling into strength

- bollinger bands tightening means move is coming soon

- retest of red breakout line before moving up higher (see attached chart)

Just a note - the better trade would be to try to grab some shorts once price hits the lower line of the blue channel.