#ARCUSDT is showing signs of reversal📉 Short BYBIT:ARCUSDT.P from $0.06780

🛡 Stop loss $0.07117

🕒 1H Timeframe

⚡️ Overview:

➡️ The main POC (Point of Control) is at 0.05873, indicating the area with the highest trading volume.

➡️ The 0.07117 level acts as strong resistance where the price previously reversed.

➡️ The chart shows a potential topping structure followed by a decline.

➡️ Volume concentration between $0.065 and $0.06210 suggests key zones for potential profit-taking.

🎯 TP Targets:

💎 TP 1: $0.06510

💎 TP 2: $0.06210

💎 TP 3: $0.06050

📢 Watch the key levels and enter after confirmation!

📢 The price has already started to move down — downside momentum remains strong.

📢 The TP levels are near a previous consolidation zone, allowing quick target execution.

BYBIT:ARCUSDT.P is showing signs of reversal — considering shorts with clear downside targets!

Technical_analysis

#VANAUSDT is forming a confident bounce from key levels📉 LONG BYBIT:VANAUSDT.P from $8.180

🛡 Stop loss $8.000

1H timeframe

❗️Before entering the trade, closely monitor the levels. If the price consolidates above $8.180 with volume, this confirms the entry signal.

✅ Overview BYBIT:VANAUSDT.P :

➡️ On the chart, we can see that after a downward movement, the price formed a local bottom around $8.000, followed by an upward impulse.

➡️ A structure resembling a reversal pattern has appeared: the price broke through a slanted resistance (blue line) and consolidated above $8.180, indicating weakening sellers.

➡️ The price is now moving toward a resistance zone marked as POC (Point of Control) at $8.353, which could be the first target.

➡️ The entry is set at $8.180, aligning with the breakout level, supported by increasing volume and a short-term uptrend.

The volume profile on the left shows a low-liquidity zone above the current price (between $8.345 and $8.590), which may allow the price to quickly reach the TP levels.

🎯 TP Targets:

💎 TP 1: $8.345

💎 TP 2: $8.590

💎 TP 3: $8.775

⚡️ Plan:

➡️ Monitor the price reaction at TP1 ($8.345) — a pullback is possible. It’s recommended to close part of the position.

➡️ Wait for confirmation of the breakout above $8.180 (already happened, price is above).

➡️ Enter LONG after a retest (with volume) — in this case, the retest has already occurred, and the price is moving up.

➡️ Place the stop below the last low — at $8.000.

BYBIT:VANAUSDT.P is forming a confident bounce from key levels, and if it holds above the entry zone, we expect an upward movement!

#API3USDT is setting up for a breakout📉 Long BYBIT:API3USDT.P from $0,8985

🛡 Stop loss $0,8543

1h Timeframe

⚡ Plan:

➡️ POC is 0,8185

➡️ Waiting for consolidation near resistance and increased buying activity before the breakout.

➡️ Expecting an impulsive upward move as buy orders accumulate.

🎯 TP Targets:

💎 TP 1: $0,9300

💎 TP 2: $0,9630

💎 TP 2: $0,9900

🚀 BYBIT:API3USDT.P is setting up for a breakout—preparing for an upward move!

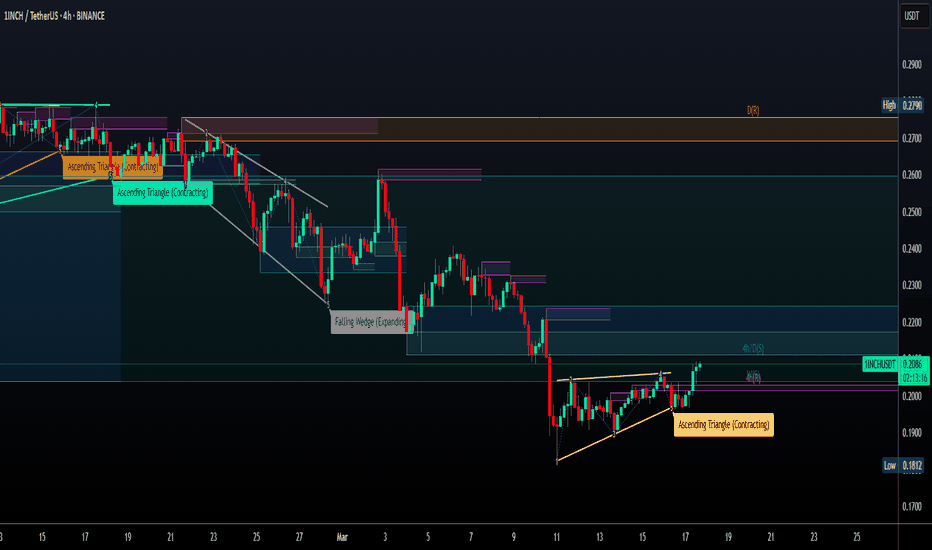

1INCHUSDT: The Invisible Forces Driving Price Right Now - 1inch◳◱ Ever seen the Bollinger Band Breakout Super Trend on a chart? It's exciting to watch! With the price hovering around 0.2093, there's potential for a breakout above 0.2203 | 0.2433 | 0.2859. Support at 0.1777 | 0.1581 | 0.1155 provides confidence for bulls.

◰◲ General Information :

▣ Name: 1inch

▣ Rank: 199

▣ Exchanges: Binance, Kucoin, Huobipro, Gateio, Mexc, Hitbtc

▣ Category / Sector: Financial - Decentralized Exchanges

▣ Overview: The 1inch Network unites three separate decentralized protocols, aggregating liquidity from a variety of decentralized exchanges to facilitate cost-efficient transactions.

Its native token, the 1inch token (1INCH) serves two primary purposes: As a governance token granting voting rights towards the 1inch DAO and as a utility token, where it is used as a connector to achieve high-efficiency routing in the 1inch Liquidity Protocol. It will also be used in the tokenomics of all future protocols developed by the 1inch Network.

◰◲ Technical Metrics :

▣ Current Price: 0.2093 ₮

▣ 24H Volume: 3,767,156.011 ₮

▣ 24H Change: 3.358%

▣ Weekly Change: 4.06%%

▣ Monthly Change: -21.88%%

▣ Quarterly Change: -56.72%%

◲◰ Pivot Points :

▣ Resistance Level: 0.2203 | 0.2433 | 0.2859

▣ Support Level: 0.1777 | 0.1581 | 0.1155

◱◳ Indicator Recommendations :

▣ Oscillators: NEUTRAL

▣ Moving Averages: BUY

◰◲ Summary of Technical Indicators : BUY

◲◰ Sharpe Ratios :

▣ Last 30 Days: -3.94

▣ Last 90 Days: -4.16

▣ Last Year: -0.69

▣ Last 3 Years: -0.39

◲◰ Volatility Analysis :

▣ Last 30 Days: 0.79

▣ Last 90 Days: 0.78

▣ Last Year: 0.93

▣ Last 3 Years: 0.87

◳◰ Market Sentiment :

▣ News Sentiment: N/A

▣ Twitter Sentiment: 0.53 - Bullish

▣ Reddit Sentiment: 0.60 - Bullish

▣ In-depth BINANCE:1INCHUSDT analysis available at TradingView TA Page

▣ Your thoughts matter! What do you think of this analysis? Share your insights in the comments below. Your like, follow, and support are greatly valued and help sustain high-quality content.

◲ Disclaimer : Disclaimer

The content provided is for informational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult a qualified professional before making any financial decisions. Use of the information is solely at your own risk.

▣ Explore the Power of Charting with TradingView

Unlock a wide range of financial analysis tools, data, and features to elevate your trading experience. Take a tour and see the possibilities. If you decide to upgrade your plan, you can receive up to $30 back. Discover more here - affiliate link -

Currently making LH LLs but..Weekly & Monthly Closing above 60.67 would be a Positive Sign.

Though currently making LH LLs, but

Bullish Divergence on Daily TF is another Positive Sign.

Upside levels can be around 65 - 67

However, in extreme pressure, it may touch around 53 - 55

& that would be an Important Support level.

#IPUSDT is gaining strength—expecting further upside!📈 LONG BYBIT:IPUSDT.P from $2.0510

🛡 Stop Loss: $2.0235

⏱ 15M Timeframe

✅ Overview:

➡️ BYBIT:IPUSDT.P is showing strong bullish momentum, trading near $2.0510, which could serve as a breakout entry point.

➡️ POC (Point of Control) at $1.8626 confirms the highest liquidity area below the current price, indicating strong buyer support.

➡️ The price is holding local support levels and is approaching $2.0510, a breakout of which could trigger further upside movement.

➡️ If the price holds above $2.0510, an upward push toward $2.0795 and $2.1155 is expected.

⚡ Plan:

➡️ Enter long on a confirmed breakout above $2.0510.

➡️ Risk management via Stop-Loss at $2.0235, limiting potential downside.

🎯 TP Targets:

💎 TP1: $2.0795

🔥 TP2: $2.1155

🚀 BYBIT:IPUSDT.P is gaining strength—expecting further upside!

📢 BYBIT:IPUSDT.P maintains bullish momentum. If the price holds above $2.0510, we expect further gains toward $2.0795 and $2.1155. However, a drop below $2.0235 may trigger a short-term pullback.

#BNXUSDT is weakening expecting a drop📉 SHORT BYBIT:BNXUSDT.P from $0.6458

🛡 Stop Loss: $0.6800

⏱ 1H Timeframe

✅ Overview:

➡️ BYBIT:BNXUSDT.P is near resistance at $0.6853, showing signs of weakness.

➡️ A pullback is expected after failing to hold above $0.6550.

➡️ Targeting support levels at $0.6060 → $0.5642.

⚡ Plan:

✅ Bearish scenario confirmation – price needs to break $0.6550 and stay below it. If confirmed, the short position remains valid.

✅ Critical resistance level – $0.6853. If the price moves above $0.6800, the trend may shift bullish, invalidating the setup.

✅ Volume analysis shows weakening buying interest, supporting the possibility of a correction.

✅ Profit-taking zones – $0.6060 → $0.5642. If price slows down around $0.6060, a bounce is possible, so partial profit-taking is recommended.

✅ Alternative scenario – if price bounces from $0.6060, a long position with a tight stop could be considered.

📍 Take Profit targets:

🎯 TP1: $0.6060 – testing the nearest support level.

💎 TP2: $0.5642 – deeper correction zone.

🚀 BYBIT:BNXUSDT.P is weakening — expecting a drop to $0.5642!

📢 A break below $0.6550 confirms the bearish scenario.

📢 Holding below this level strengthens the case for further decline.

📢 If price surges above $0.6800, the setup is invalidated.

GOLD 4H CHART ROUTE MAP ANALYSISHello Traders,

Here’s our updated 4H GOLD analysis. To fully grasp this setup, we highly recommend reviewing our previous 4H chart and carefully reading its caption for a complete context.

Key Breakdown:

Previously, we marked KEY LEVEL 2733 as a crucial support zone. Our strategy was straightforward:

If EMA5 crossed and locked below 2733, we would shift our focus to bearish targets.

If EMA5 crossed and locked above 2733, we would pivot towards bullish targets.

That’s exactly what happened! If you look at the purple circle at the center of the chart, you’ll notice how EMA5 successfully reversed from our 2733 support, triggering a strong bullish momentum.

Recent Performance & Target Updates:

✅ First Bullish Phase:

Buying at the dip allowed us to hit TP1 (2758) and TP2 (2765) twice.

A new Entry Level at 2762 was established.

That entry successfully achieved TP1 (2788)

🚀 Next in Line:

TP2 (2815) and TP3 (2841) is on its way—stay patient and watch price action unfold!

Why This Matters:

This is the power of structured trading. Every move is carefully mapped out, ensuring we trade with precision and patience. However, it’s crucial to read the captions thoroughly to fully understand the setups—missing key details could lead to misinterpretation of the chart.

What’s Next?

📌 We’ll be back on Sunday afternoon with the next GOLD ROUTE MAP for the upcoming week!

🔥 Support us by commenting, liking, and boosting our chart. Your engagement helps us continue providing high-quality analysis!

Looking forward to hearing your thoughts!

Trade smart, stay patient, and trust the process!

— Quantum Trading Master

BTC Dominance Breakdown = Altseason Incoming?BTC dominance (BTC.D) has broken down from key support, signaling a potential altseason ahead.

The breakdown below the 54.11% – 54.85% support zone suggests capital rotation from Bitcoin into altcoins, which could trigger major moves across the altcoin market.

If you find our work helpful, please like, comment, and follow us for more market insights—all in one place! Stay updated on Forex, Commodities, Crypto, and Global Indices with expert analysis.

USUALUSDT: What Price Action Is Telling Us Today - Usual◳◱ With Super Trend in play and the price at 0.5389, the market whispers opportunity. Breaking past 0.8931 | 1.196 | 1.6671 could spark a rally, while 0.422 | 0.2538 anchors bullish sentiment.

◰◲ General Information :

▣ Name: Usual

▣ Rank: 288

▣ Exchanges: Binance, Kucoin, Gateio, Mexc

▣ Category / Sector: N/A

▣ Overview: Usual project overview is currently unavailable. I'll try to update this in the upcoming analysis.

◰◲ Technical Metrics :

▣ Current Price: 0.5389 ₮

▣ 24H Volume: 92,622,307.521 ₮

▣ 24H Change: -3.145%

▣ Weekly Change: -13.97%%

▣ Monthly Change: -41.17%%

▣ Quarterly Change: N/A%

◲◰ Pivot Points :

▣ Resistance Level: 0.8931 | 1.196 | 1.6671

▣ Support Level: 0.422 | 0.2538

◱◳ Indicator Recommendations :

▣ Oscillators: BUY

▣ Moving Averages: STRONG_SELL

◰◲ Summary of Technical Indicators : SELL

◲◰ Sharpe Ratios :

▣ Last 30 Days: 1.10

▣ Last 90 Days: 3.20

▣ Last Year: 3.20

▣ Last 3 Years: 3.20

◲◰ Volatility Analysis :

▣ Last 30 Days: 3.18

▣ Last 90 Days: 2.94

▣ Last Year: 2.94

▣ Last 3 Years: 2.94

◳◰ Market Sentiment :

▣ News Sentiment: N/A

▣ Twitter Sentiment: N/A

▣ Reddit Sentiment: N/A

▣ In-depth BINANCE:USUALUSDT analysis available at TradingView TA Page

▣ Your thoughts matter! What do you think of this analysis? Share your insights in the comments below. Your like, follow, and support are greatly valued and help sustain high-quality content.

◲ Disclaimer : Disclaimer

The content provided is for informational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult a qualified professional before making any financial decisions. Use of the information is solely at your own risk.

▣ Explore the Power of Charting with TradingView

Unlock a wide range of financial analysis tools, data, and features to elevate your trading experience. Take a tour and see the possibilities. If you decide to upgrade your plan, you can receive up to $30 back. Discover more here - affiliate link -

The Whispered Secrets Behind CGPTUSDT’s Movements - ChainGPT◳◱ On the BINANCE:CGPTUSDT chart, the BollingerBand Breakout pattern suggests an upcoming trend shift. Traders might observe resistance around 0.4838 | 0.6085 | 0.8686 and support near 0.2237 | 0.0883. Entering trades at 0.3872 could be strategic, aiming for the next resistance level. Currently, the price is trading near 0.3872, with key support at 0.2237 | 0.0883 and resistance at 0.4838 | 0.6085 | 0.8686.

◰◲ General Information :

▣ Name: ChainGPT

▣ Rank: 267

▣ Exchanges: Binance, Kucoin, Huobipro, Gateio, Mexc, Hitbtc

▣ Category / Sector: N/A

▣ Overview: ChainGPT project overview is currently unavailable. I'll try to update this in the upcoming analysis.

◰◲ Technical Metrics :

▣ Current Price: 0.3872 ₮

▣ 24H Volume: 94,764,005.058 ₮

▣ 24H Change: 13.582%

▣ Weekly Change: 65.21%%

▣ Monthly Change: 101.73%%

▣ Quarterly Change: 170.98%%

◲◰ Pivot Points :

▣ Resistance Level: 0.4838 | 0.6085 | 0.8686

▣ Support Level: 0.2237 | 0.0883

◱◳ Indicator Recommendations :

▣ Oscillators: NEUTRAL

▣ Moving Averages: STRONG_BUY

◰◲ Summary of Technical Indicators : BUY

◲◰ Sharpe Ratios :

▣ Last 30 Days: 3.22

▣ Last 90 Days: 2.45

▣ Last Year: 1.13

▣ Last 3 Years: 0.87

◲◰ Volatility Analysis :

▣ Last 30 Days: 3.32

▣ Last 90 Days: 2.17

▣ Last Year: 1.47

▣ Last 3 Years: 1.51

◳◰ Market Sentiment :

▣ News Sentiment: N/A

▣ Twitter Sentiment: N/A

▣ Reddit Sentiment: N/A

▣ In-depth BINANCE:CGPTUSDT analysis available at TradingView TA Page

▣ Your thoughts matter! What do you think of this analysis? Share your insights in the comments below. Your like, follow, and support are greatly valued and help sustain high-quality content.

◲ Disclaimer : Disclaimer

The content provided is for informational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult a qualified professional before making any financial decisions. Use of the information is solely at your own risk.

▣ Explore the Power of Charting with TradingView

Unlock a wide range of financial analysis tools, data, and features to elevate your trading experience. Take a tour and see the possibilities. If you decide to upgrade your plan, you can receive up to $30 back. Discover more here - affiliate link -

Understanding Symmetrical Triangle Breakout and Retest XAUUSD (Gold vs. US Dollar) is currently priced at 2680, with a target price set at 2660. This indicates a bearish outlook, suggesting the price is expected to drop. The pair has recently experienced a symmetrical triangle breakout, which is a technical chart pattern signaling potential price movement. After the breakout, the price is now in a retesting phase, a common occurrence where the price revisits the breakout level to confirm the move. Traders often view this as a critical period to assess the strength of the breakout. If the retest holds, it could validate the downtrend, increasing the probability of reaching the target price. However, failure to maintain the breakout level could result in a reversal. This scenario highlights the importance of monitoring key support and resistance levels. The retest phase provides an opportunity for risk management and strategic entry.

Bulls and Bears zone for 01-08-2025Yesterday S&P 500 sold off and closed near LOD which could caution momentum traders.

Any test of ETH session High could provide direction for the day.

Level to watch: 5956 --- 5958

News to watch:

US FOMC Minutes --- 2:00PM EST

Wishing everyone Happy, Healthy and Wealthy Year !!!

ZECUSDT: What the Market Is Whispering About Today - Zcash◳◱ On the BINANCE:ZECUSDT chart, the Super Trend pattern suggests a pause in volatility, potentially gearing up for a breakout. Traders might observe resistance around 66.05 | 73.53 | 93.48 and support near 46.1 | 33.63 | 13.68. Entering trades at 59.68 could be strategic, aiming for the next resistance level.

◰◲ General Information :

▣ Name: Zcash

▣ Rank: 121

▣ Exchanges: Binance, Kucoin, Huobipro, Gateio, Mexc, Hitbtc

▣ Category / Sector: Payments - Currencies

▣ Overview: Zcash is a privacy-preserving cryptocurrency providing anonymous value transfer using zero-knowledge cryptography. The protocol provides the option for transactions to be either shielded, in which case they will be completely anonymous, or transparent, in which case they will be visible on the Zcash blockchain. Zcash pays out a portion of its block rewards, called the "Founder's Reward", to fund protocol development. It currently allocates the Founder's Reward to the Electric Coin Company and the Zcash Foundation who develop and steward the Zcash protocol respectively.

◰◲ Technical Metrics :

▣ Current Price: 59.68 ₮

▣ 24H Volume: 26,131,359.620 ₮

▣ 24H Change: 8.786%

▣ Weekly Change: 4.11%%

▣ Monthly Change: 23.08%%

▣ Quarterly Change: 106.32%%

◲◰ Pivot Points :

▣ Resistance Level: 66.05 | 73.53 | 93.48

▣ Support Level: 46.1 | 33.63 | 13.68

◱◳ Indicator Recommendations :

▣ Oscillators: SELL

▣ Moving Averages: STRONG_BUY

◰◲ Summary of Technical Indicators : BUY

◲◰ Sharpe Ratios :

▣ Last 30 Days: 2.32

▣ Last 90 Days: 2.64

▣ Last Year: 1.06

▣ Last 3 Years: 0.01

◲◰ Volatility Analysis :

▣ Last 30 Days: 1.50

▣ Last 90 Days: 1.17

▣ Last Year: 0.94

▣ Last 3 Years: 0.88

◳◰ Market Sentiment :

▣ News Sentiment: N/A

▣ Twitter Sentiment: N/A

▣ Reddit Sentiment: N/A

▣ In-depth BINANCE:ZECUSDT analysis available at TradingView TA Page

▣ Your thoughts matter! What do you think of this analysis? Share your insights in the comments below. Your like, follow, and support are greatly valued and help sustain high-quality content.

◲ Disclaimer : Disclaimer

The content provided is for informational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult a qualified professional before making any financial decisions. Use of the information is solely at your own risk.

▣ Explore the Power of Charting with TradingView

Unlock a wide range of financial analysis tools, data, and features to elevate your trading experience. Take a tour and see the possibilities. If you decide to upgrade your plan, you can receive up to $30 back. Discover more here - affiliate link -

VIDTUSDT: The Tipping Point Every Trader Is Watching - VIDT DAO◳◱ On the BINANCE:VIDTUSDT chart, the Td Sequential pattern suggests a pause in volatility, potentially gearing up for a breakout. Traders might observe resistance around 0.04192 | 0.05218 | 0.06923 and support near 0.02487 | 0.01808 | 0.00103. Entering trades at 0.03207 could be strategic, aiming for the next resistance level.

◰◲ General Information :

▣ Name: VIDT DAO

▣ Rank: 1044

▣ Exchanges: Binance, Kucoin, Mexc

▣ Category / Sector: N/A

▣ Overview: VIDT DAO project overview is currently unavailable. I'll try to update this in the upcoming analysis.

◰◲ Technical Metrics :

▣ Current Price: 0.03207 ₮

▣ 24H Volume: 2,649,650.101 ₮

▣ 24H Change: 0.564%

▣ Weekly Change: N/A%

▣ Monthly Change: N/A%

▣ Quarterly Change: N/A%

◲◰ Pivot Points :

▣ Resistance Level: 0.04192 | 0.05218 | 0.06923

▣ Support Level: 0.02487 | 0.01808 | 0.00103

◱◳ Indicator Recommendations :

▣ Oscillators: NEUTRAL

▣ Moving Averages: STRONG_SELL

◰◲ Summary of Technical Indicators : SELL

◲◰ Sharpe Ratios :

▣ Last 30 Days: N/A

▣ Last 90 Days: N/A

▣ Last Year: N/A

▣ Last 3 Years: 1.77

◲◰ Volatility Analysis :

▣ Last 30 Days: N/A

▣ Last 90 Days: N/A

▣ Last Year: N/A

▣ Last 3 Years: 2.17

◳◰ Market Sentiment :

▣ News Sentiment: N/A

▣ Twitter Sentiment: N/A

▣ Reddit Sentiment: N/A

▣ In-depth BINANCE:VIDTUSDT analysis available at TradingView TA Page

▣ Your thoughts matter! What do you think of this analysis? Share your insights in the comments below. Your like, follow, and support are greatly valued and help sustain high-quality content.

◲ Disclaimer : Disclaimer

The content provided is for informational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult a qualified professional before making any financial decisions. Use of the information is solely at your own risk.

▣ Explore the Power of Charting with TradingView

Unlock a wide range of financial analysis tools, data, and features to elevate your trading experience. Take a tour and see the possibilities. If you decide to upgrade your plan, you can receive up to $30 back. Discover more here - affiliate link -

ILVUSDT: A High-Stakes Moment for Traders - Illuvium◳◱ On the BINANCE:ILVUSDT chart, the Td Sequential pattern suggests momentum building up for a significant move. Traders might observe resistance around 53.59 | 67.39 | 90.06 and support near 30.92 | 22.05. Entering trades at 40.77 could be strategic, aiming for the next resistance level.

◰◲ General Information :

▣ Name: Illuvium

▣ Rank: 267

▣ Exchanges: Binance, Kucoin, Gateio, Mexc, Hitbtc

▣ Category / Sector: Media and Entertainment - Gaming

▣ Overview: Illuvium is a decentralised game studio that merges the worlds of gaming and cryptocurrency. The game studio is building an open-world RPG adventure game on the Ethereum blockchain that allows players to collect, exchange and battle NFT assets.

◰◲ Technical Metrics :

▣ Current Price: 40.77 ₮

▣ 24H Volume: 4,601,102.937 ₮

▣ 24H Change: -1.212%

▣ Weekly Change: -24.25%%

▣ Monthly Change: -12.83%%

▣ Quarterly Change: 7.46%%

◲◰ Pivot Points :

▣ Resistance Level: 53.59 | 67.39 | 90.06

▣ Support Level: 30.92 | 22.05

◱◳ Indicator Recommendations :

▣ Oscillators: NEUTRAL

▣ Moving Averages: STRONG_SELL

◰◲ Summary of Technical Indicators : SELL

◲◰ Sharpe Ratios :

▣ Last 30 Days: 0.36

▣ Last 90 Days: 0.73

▣ Last Year: -0.42

▣ Last 3 Years: -0.70

◲◰ Volatility Analysis :

▣ Last 30 Days: 1.37

▣ Last 90 Days: 1.19

▣ Last Year: 1.03

▣ Last 3 Years: 0.98

◳◰ Market Sentiment :

▣ News Sentiment: N/A

▣ Twitter Sentiment: N/A

▣ Reddit Sentiment: N/A

▣ In-depth BINANCE:ILVUSDT analysis available at TradingView TA Page

▣ Your thoughts matter! What do you think of this analysis? Share your insights in the comments below. Your like, follow, and support are greatly valued and help sustain high-quality content.

◲ Disclaimer : Disclaimer

The content provided is for informational purposes only and does not constitute financial, investment, or trading advice. Always conduct your own research and consult a qualified professional before making any financial decisions. Use of the information is solely at your own risk.

▣ Explore the Power of Charting with TradingView

Unlock a wide range of financial analysis tools, data, and features to elevate your trading experience. Take a tour and see the possibilities. If you decide to upgrade your plan, you can receive up to $30 back. Discover more here - affiliate link -